Markets

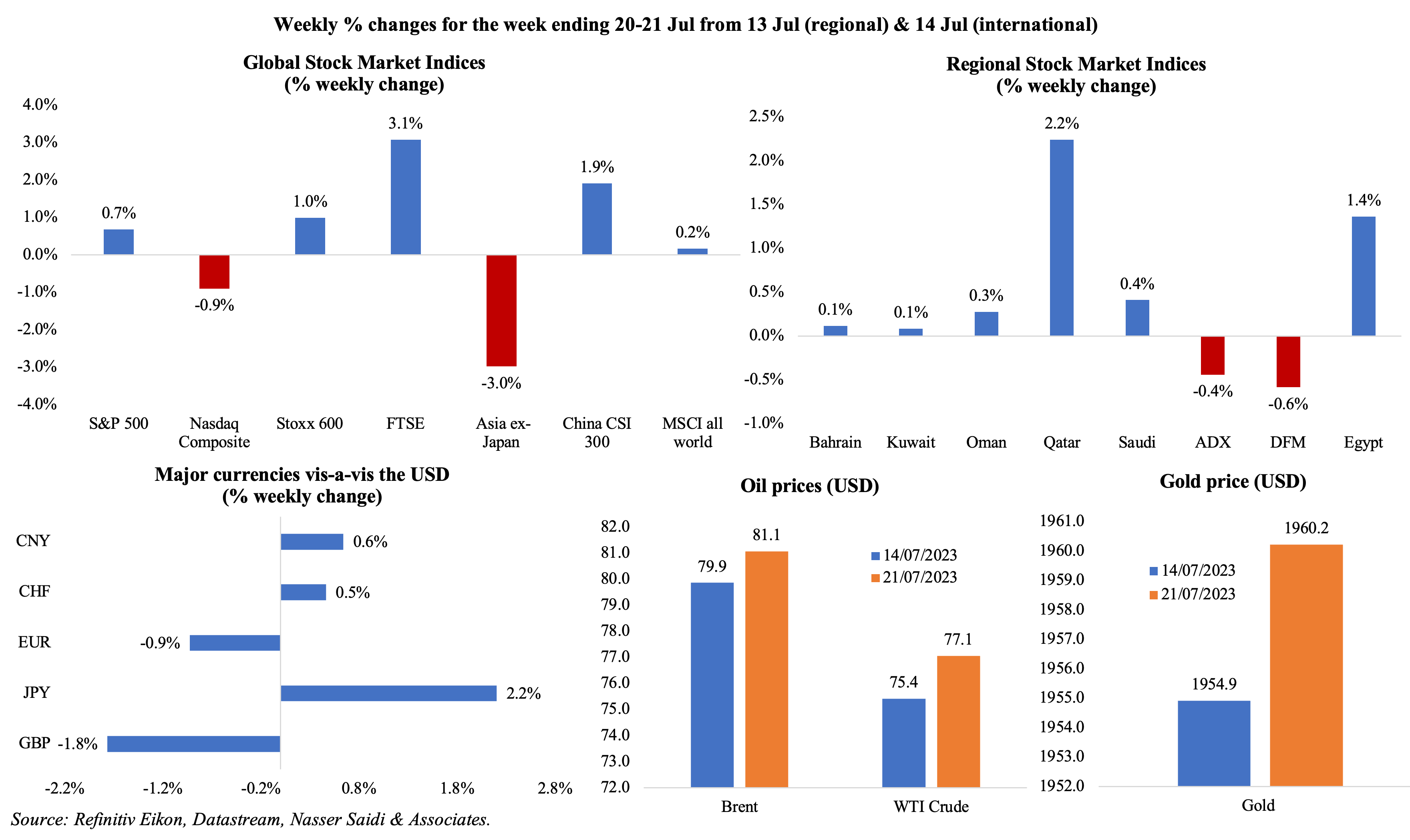

Global equities painted a mixed picture: even within the US, tech stocks slipped (on earnings and warnings about a deepening semiconductor slump from TSMC) while the S&P posted a slight gain; UK stocks posted the biggest rally since Jan, after inflation readings eased; various measures to support the Chinese economy (automobiles, electronics etc – see Media Review) led to gains in the equity market. Regionally, the UAE equity markets declined alongside gains across all other markets; Qatar’s robust banking sector supported gains while the Tadawul touched a 9-month high earlier in the week. The dollar posted its best weekly % gain (2.2%) vis-à-vis the JPY since Oct (given reports of unchanged yield control policy) while the GBP fell by 1.8%, the largest weekly drop since early-Feb, on lower reported inflation rates. Oil and gold prices rose: oil, thanks to tighter supplies.

Global Developments

US/Americas:

- Industrial production in the US fell by 0.5% mom in Jun (May: -0.5%), with durable and non-durable manufacturing decreasing by 0.1% and 0.6% respectively. Industrial activity rose by 0.7% in both Q1 and Q2. Capacity utilisation slowed to 78.9 in Jun (May: 79.4).

- NY state manufacturing index slipped to 1.1 in Jul (Jun: 6.6), despite expansions in new orders and shipments. Philadelphia Fed manufacturing survey index was in contractionary territory at -13.5 in Jul (Jun: -13.7): new orders were negative (-15.9 from -11 in Jun) though the 6-month ahead view was more optimistic (29.1 from 12.7 in Jun).

- Retail sales in the US inched up by 0.2% mom in Jun (May: 0.5%), with auto sales rising by 0.3% (May: 1.5%) and online sales up by 1.9% – the highest in 6 months. Excluding autos, sales were up by 0.2% following a 0.3% gain.

- Building permits in the US fell by 3.7% mom to 1.44mn in Jun though permits for single-family homes rose by 2.2% to the highest since Jun 2022 (at 922k). Housing starts declined by 8% mom to 1.434mn, with declines in both single and multi-family housing.

- Existing home sales slipped by 3.3% mom to 4.16mn in Jun, the lowest level since Jan. At this pace,it would take 3.1 months to exhaust the current inventory of existing homes. The median house price are up 3.5% mom to USD 410,200 – the second highest price on the books.

- Initial jobless claims dropped by 9k to a two-month low of 228k in the week ended Jul 14th, and the 4-week average fell by 8.25k to 235.5k. Continuing jobless claims increased by 33k to 1.754mn in the week ended Jul 7th. Labour market remains tight and wages are growing, while laid-off workers are easily finding work, reflecting sustained labour demand growth.

Europe:

- Germany’s producer price index fell by 0.3% mom in Jun, slower than May’s 1.4% drop. Producer inflation slowed to 0.1% yoy, the lowest since Dec 2020, dragged down by energy prices (-5%) and metals (-10.6%) among others. Excluding energy, prices grew by 2.8% yoy.

- Consumer confidence in the euro area improved in Jul: moved up by one point to -15.1, the highest since Feb 2022. In the EU, consumer sentiment rose by 1.1 points to -16.1.

- Inflation in the UK slid to 7.9% yoy in Jun (May: 8.7%), the lowest reading since Mar 2022, with food prices and services easing to 17.3% and 7.2% respectively (May: 18.3% and 7.4%). Core inflation also slowed to 6.9%, falling from May’s 31-year high of 7.1%. Producer price index for output fell by 0.3% mom in Jun (May: -0.5%) while retail price index moved lower to 10.7% (May: 11.3%).

- GfK consumer confidence in the UK plunged to -30 in Jul (Jun: -24), the first fall since Jan and the largest drop since Apr 2022. An indicator of spending intentions fell 7 points to -32.

- Retail sales in the UK increased for the 3rd consecutive month, rising by 0.7% mom in Jun (May: 0.1%). Food sales rebounded (+0.7% from -0.4% in May) while non-food trade was up by 0.1%. In yoy terms, sales fell by 0.1%, declining for the 15th straight month.

Asia Pacific:

- The People’s Bank of China left lending benchmarks unchanged: the one-year loan prime rate at 3.55% and the 5-year LPR at 4.20%, after leaving the borrowing costs unchanged at 1.9% earlier in the week. The apex bank intends to use quantitative measures, the reserve requirement ratio and medium-term lending facility (MLF) to manage the economic growth. Earlier in the week, the PBoC adjusted some rules thereby allowing companies to borrow more from overseas, in a bid to attract more foreign capital inflows.

- China’s industrial production grew by 4.4% in Jun (May: 3.5%) and rose by 3.8% in H1 2023. Retail sales growth slowed in Jun, up by 3.1%, the weakest since Dec 2022 and compared to the May’s 12.7% increase. Fixed asset investment grew by 3.8% yoy in H1 2023 (Jan-May: 4.0%), with real estate investment plunging by 7.9%.

- FDI into China fell by 2.7% yoy to CNY 703.65bn in H1 2023, but with FDI into the high-tech manufacturing surging by 28.8%.

- Inflation in Japan increased to 3.3% yoy in Jun (May: 3.2%), largely due to higher utility bills. Excluding food and energy prices eased to 4.2% (May: 4.3%).

- Japan’s exports ticked up by 1.5% yoy in Jun while imports fell by 12.9% (faster than May’s 9.8% decline), hence moving the trade balance into a surplus JPY 43bn (the first time since Jul 2021). Exports to China and Japan fell by 11% yoy and 11.7% respectively.

- India has banned exports of non-basmati white rice, in a bid to contain domestic inflation, raising fears of global food inflation. India is the largest rice exporter, accounting for 40% of global exports.

- India’s foreign exchange reserves rose to USD 609.02bn as of July 14th, the highest in almost 15 months, partly a result of the dollar weakness.

Bottom line: The Fed, ECB and the BoJ are holding meetings this week – the former two expected to hike rates, albeit by smaller amounts, and the latter likely to maintain loose policy. Inflation readings remain above central bank targets, but its easing from recent highs is seen as a precursor to central banks nearing the peak of the current tightening cycle. However, there are some indications of potentially higher food costs on the horizon – in addition to India’s ban on rice exports, Russia pulling out of the Black Sea Grain Initiative is likely to raise food prices: wheat and corn prices rose over 11% and 9% respectively towards the latter half of last week. The flash PMIs this week should also provide some insights from businesses’ point of view.

Regional Developments

- The World Bank’s Gulf Economic Report forecasts growth to reach 2.5% in the GCC this year (2022: 7.3%), due to a contraction in hydrocarbon GDP (-1.3%) while non-oil sector grows by a robust 4.6%. Among the GCC nations, growth is expected to range between 3.3% in Qatar to Kuwait’s slow pace of 1.3%.

- Bahrain’s GDP grew by 2% yoy in Q1, supported by the non-oil sector rising by 3.5%, according to the Ministry of Finance and National Economy. Transportation and communications grew at the fastest pace (11.2%), with many other sectors like real estate and business to hotels & restaurants ranging between 4.2% and 5.3%. Growth is projected to touch 2.9% in 2023, with the non-oil sector rising by 3.5% alongside a stable oil sector.

- Egypt aims to clock in USD 9bn in digital services exports by 2026, almost doubling the revenue of tech-enabled offshoring services compared to USD 4.9bn in 2022. ICT is the fastest-growing state sector in Egypt, up 16% yoy in 2022 and contributing some 5% to GDP.

- Egypt is planning to sign a USD 100mn renewable loan facility with the UAE’s Abu Dhabi Fund for Development to fund its grains purchases. The nation has 5.2 months-worth of wheat reserves.

- The Sovereign Fund of Egypt, with holdings worth USD 12bn, ranked 47th in the top 100 largest sovereign funds by total assets and 12th in the Middle East, according to the SWF Institute.

- US issued a 120-day waiver to allow Iraq to pay Iran for electricity via non-Iraqi banks, reported Reuters. Separately, US banned 14 Iraqi banks from making dollar transactions, in a bid to stem the flow of dollars into neighbouring Iran, reported the Wall Street Journal.

- Inflation in Kuwait inched up to 3.83% yoy in Jun (May: 3.69%), with food and clothing costs surging by 6.25% and 6.76% respectively. Excluding food and beverages, CPI ticked up by 2.24% yoy.

- Kuwait’s trade surplus with Japan narrowed by 33.4% yoy to JPY 67.9bn (USD 487mn) in Jun given weak exports (-22.7% to JPY 93bn). Middle East trade surplus with Japan narrowed 47.8% to JPY 606.9bn, with energy exports from the region declining by 35.5%.

- Lebanon’s central bank will decommission the Sayrafa exchange platform by end-Jul given its lack of transparency, and it will be replaced by an “exchange rate determination electronic platform” set up through international providers (either Refinitiv or Bloomberg).

- Oman’s banking sector recorded a 17.5% yoy increase in net profits to a record-high of OMR 235.3mn (USD 103mn) in H1 2023. Assets of the eight listed-banks (on the Muscat Stock Exchange) grew by 4.6% to OMR 39.9bn.

- Bilateral trade between Oman and Turkey touched nearly USD 2bn in 2022, with Oman’s imports from Turkey rising to USD 1.58bn. Turkey’s Ambassador to Turkey also disclosed that around 35 Turkish firms in the Oman’s contracting and engineering sector have implemented projects worth USD 7bn.

- Saudi holdings of US treasury bonds declined by 1.76% mom to USD 111.3bn in May, becoming the 18th largest holder of US Treasuries. UAE’s holdings fell by 1.7% mom to USD 69bn, lowering the nation to 23rd place globally.

- Following the Japan PM’s visit to Saudi Arabia, UAE and Qatar, it was announced that the Japan-GCC free trade talks will be resumed in 2024. The previous talks were suspended in 2009.

- GCC project awards jumped by 86% yoy to USD 49.7bn in Q2 2022, the highest quarterly project awards in 5 years, according to Kamco Invest report. Saudi Arabia, with projects value at USD 24.4bn (+33.7%), was the largest market followed by UAE (+127% to USD 12.2bn).

Saudi Arabia Focus

- Saudi Arabia’s e-commerce registrations grew by 21% yoy to 35,314 in Q2 2023, according to the Ministry of Commerce. Saudi Arabia is one of the top 10 developing nations in the e-commerce sector with growth rate exceeding 32%.

- Saudi Arabia issued 99 new industrial licenses and 34 new mining licenses in May. The new industrial licensees are committed to make investments to the tune of SAR 20.1bn (UDF 5.35bn). Permits in the mining industry stands at 2,365, led by 1,475 licenses for building materials quarries and 644 for exploration.

- Saudi Arabia will provide USD 400mn as a soft loan and USD 100mn as a grant to Tunisia, while pledging more financing support in the future.

- Saudi Arabia signed the biggest defence and aviation export contract in Turkey’s history, by buying Turkish drones during Turkey’s President visit. The value of the deal was not revealed. The two nations also signed other MoUs covering sectors including energy (covering also renewable energy and electricity), real estate and direct investments. Bilateral trade between the two nations touched USD 6.5bn in 2022 and USD 3.4bn in H1 2023.

- Saudia airline posted a 52% yoy surge in international passengers in H1 2023, transporting 7.4mn travellers also operating 37,600 flights (+30%).

- Indian startup Pravaig Dynamics, partnering with Saudi India Venture Studio plans to set up a left-hand-drive EV manufacturing unit in Saudi Arabia. The facility is expected to have a production capacity of up to 1mn units.

UAE Focus![]()

- UAE’s Minister of Economy disclosed that the country is targeting a 7% growth rate and plans to double the economy to over USD 800bn by end-2030.

- Abu Dhabi plans to double the contribution of its industrial sector to AED 172bn (USD 46.8bn) by 2031. Last year, the sector grew by 9.7% yoy to AED 90.8bn, accounting for 16.4% of Abu Dhabi’s non-oil GDP and just over 8% of overall GDP. About 27 new manufacturing operations began in Q1, more than the internal target of 18.

- Reuters reported that Dubai’s Road and Transport Authority (RTA) has invited banks to pitch for its planned IPOs: one, for the Dubai Taxi Corporation and another the Nol card used to pay for public transport.

- Abu Dhabi’s ADNOC and Indian Oil Corp have agreed to a USD 7-9bn 14-year LNG deal: this will see ADNOC supply 1.2mn metric tonnes of LNG per year, and the trade treaty will enable India to import LNG without paying a 2.5% import tax.

- Bloomberg reported that ADNOC increased its buyout offer for Covestro to EUR 11bn (USD 12.3bn) after the previous offer was rejected for being too low. Covestro is an insulation foam specialist that could help ADNOC diversify and expand its chemicals business.

- The region’s first high-speed hydrogen refuelling station, which will make “clean hydrogen” from water, is expected to be completed this year. The project is headed by ADNOC, and will be tested in partnership with Toyota and Al-Futtaim Motors.

- The UAE and Turkey signed USD 50.7bn in deals during the Turkish PM’s visit to the UAE: this includes ADQ’s MoU to finance up to USD 8.5bn of Turkey earthquake relief bonds, an MoU with Turkey’s Export Credit Bank to finance up to USD 3bn in credit facilities. Other agreements signed covered an extradition accord, energy & natural resources development and space & defence cooperation among others.

- UAE Masdar plans to use the proceeds from its first green bond issuance of USD 750mn to fund renewable projects in developing and climate-vulnerable countries. The bond, which was 5.6 times oversubscribed, saw about 87.5% allocated to international investors and the rest disbursed in the MENA region.

- UAE plans to double the number of electric vehicles charging stations in 2023 as part of the nation’s EV policy.

- The UAE pledged USD 100mn to support development projects in countries affected by irregular immigration.

Media Review

Here’s How China Is Supporting Its Economy as Stimulus Awaited

https://www.bloomberg.com/news/articles/2023-07-21/here-s-how-china-is-supporting-economy-as-stimulus-awaited

IMF’s External Sector Report

https://www.imf.org/en/Publications/ESR/Issues/2023/07/19/2023-external-sector-report

Finding Growth in a Fractured World

https://www.project-syndicate.org/commentary/fixing-the-fractured-global-economy-by-mohamed-a-el-erian-2023-07

Central banks must not be blind to the threats posed by CBDCs

https://www.ft.com/content/53b48346-1802-4164-bbdc-ccdc034fa9ec

Powered by: