Markets

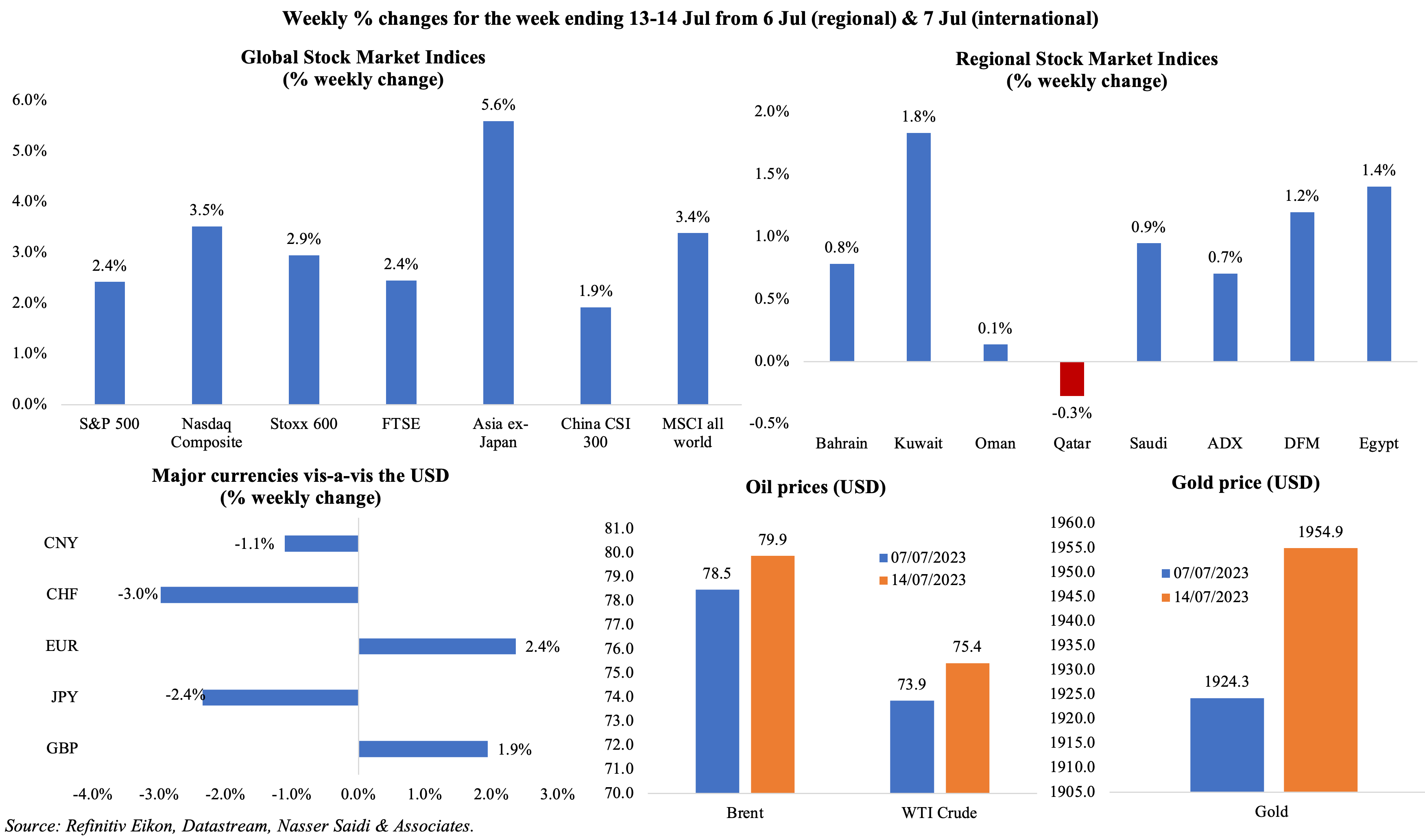

Global equities markets mostly gained last week: easing inflation in the US raised expectations that the Fed was near-close to its rate hiking cycle; stocks in China and Hong Kong ticked up after 6 months; MSCI World equity was at its highest level since early-2022. Regional markets were mostly up and the Dubai’s DFMGI closed at its highest since Aug 2015. The dollar weakened last week allowing the EUR and GBP touch the highest near 16-month highs while the Swiss franc on Friday reached the highest-level vs the dollar last seen in Jan 2015. Oil prices fell by about 2% on Friday, but clocked in a weekly gain for the third week running while gold price posted the biggest weekly gain since Apr.

Global Developments

US/Americas:

- US inflation eased to 3% yoy in Jun (May: 4%), the slowest pace since Mar 2021, partly due to the high base effect. Energy costs fell by 16.7% while food and shelter costs slowed to 5.7% and 7.8% respectively (from 6.7% and 8%). Core inflation inched lower to 4.8% yoy, the lowest since Oct 2021, but only a modest drop from May’s 5.3% reading.

- US export and import prices also dropped in Jun, another indication that inflationary pressures are easing – import prices fell by 6.1% yoy, the biggest decline since May 2020; export prices plunged 12% yoy, the biggest drop on the record (May: -10.2%).

- Producer price index inched up to 0.1% yoy in Jun (May: 0.9%), posting the lowest rise since Aug 2020; in mom terms, it rebounded by 0.1% following a 0.4% drop in May. Core PPI stood at 2.6% yoy in Jun compared to May’s 2.8% gain.

- US budget deficit narrowed to USD 228bn in Jun (May: USD 240bn). However, deficit nearly tripled to USD 1.39trn in Oct 2022-Jun 2023, up from USD 515bn in the same period a year ago, given a decline in receipts (-11%) while spending rose (+10%). This deficit adds to the large federal debt: interest payments during the 9 months rose by 25% yoy to USD 652bn.

- Beige book pointed towards a slight increase in economic activity alongside easing of inflationary pressures and “modestly” increasing employment. The report showed five districts reporting some growth, 5 with no change, and two with modest declines.

- Michigan consumer sentiment index in the US improved to 72.6 in Jul (Jun: 64.4), the highest reading since Sep 2021; sentiment increased across all groups except among the lower-income consumers. Inflation expectation for 5-years ahead inched up to 3.1% from 3% in the previous month while the 1-year expectation inched up to 3.4% (from 3.3% in Jun).

- Initial jobless claims fell by 12k to 237k in the week ended Jul 7th, and the 4-week average declined by 6.75k to 246.75k. Continuing jobless claims increased by 11k to 1.729mn in the week ended Jun 30th. Wages and tight labour market are key considerations for the Fed: more than 90% of traders expect another hike at the meeting this month (Source: CME FedWatch Tool).

Europe:

- Industrial production in the EU inched up by 0.2% mom in May (Apr: 1%), the second consecutive monthly increase. In yoy terms, IP fell by 2.2% (Apr: 0.2%). A breakdown by country showed that IP fell the most in Germany (-0.2%) while it grew by 1.3% and 1.6% in France and in Italy.

- Germany’s ZEW survey showed a deterioration in economic sentiment in Jul, plunging to -14.7 from Jun’s -8.5 reading while the current situation also weakened (-59.5 from -56.5). In the eurozone, economic sentiment worsened to -12.2 in Jul (Jun: -10) and the situation indicator dropped 2.5 points to -44.4.

- Current account surplus in Germany narrowed to EUR 8.9bn in May (Apr: EUR 22.3bn); for the period Jan-May, surplus widened to EUR 101.2bn from EUR 74.6bn a year ago.

- Wholesale price index in Germany declined by 2.9% yoy in Jun (May: -2.6%), the sharpest fall in since Jul 2020.

- GDP in the UK contracted by 0.1% mom in May (Apr: 0.2%); May’s output was only 0.2% above the pre-pandemic level. Industrial production fell by 0.6% mom following a 0.2% drop – and the largest contributor to the decline in GDP – while manufacturing fell by 0.2% mom (prev: -0.1%). Construction declined by 0.2% in May, the 3rd consecutive drop.

- Unemployment rate in the UK unexpectedly inched up to 4% in the 3 months to May (prev: 3.8%), for the first time since the start of 2022. Average earning including bonus increased by 6.9% (prev: 6.7%), the fastest on record, while the average basic pay remained unchanged at 7.3%.

- UK like-for-like retail sales grew by 4.2% yoy in Jun (May: 3.7%): this is largely driven by the increase in prices as sales volumes dropped. Apart from a slight decline in May, overall retail sales growth has remained steady at around 5% every month in H1 2023.

Asia Pacific:

- China’s GDP grew by 6.3% yoy and 0.8% qoq in Q2 (Q1: 4.5% yoy. And 2.2% qoq); this brings growth in H1 to 5.5% (there is a low base effect). More stimulus measures will be required through the year for China to reach the 5% 2023 growth target set by the government.

- Inflation in China remained flat in yoy terms in Jun (May: 0.2%), on the brink of deflation, resulting in additional calls for stimulus. The easing in prices were largely due to a drop in food prices. Producer price index fell by 5.4% yoy in Jun (May: -4.6%), the 9th consecutive month of decline and the largest since Dec 2015.

- Exports from China fell by 12.4% yoy in Jun (May: -7.5%) while imports were down by 6.8% (May: -4.5%). Trade surplus widened to USD 70.62bn (prev: USD 65.81bn). However, bilateral trade between Russia and China grew to USD 20.83bn, the most since the start of the Ukraine war.

- Urban unemployment rate in China was stable at 5.2% in Jun while it touched a new high of 21.3% for those aged 16 to 24.

- Money supply in China grew by 11.3% yoy in Jun (May: 11.6%). New loans jumped to CNY 3050bn in Jun, more than double May’s CNY 1360bn. Altogether banks disbursed CNY 15.73trn in new loans in H1 2023, the highest on record for the period. Outstanding yuan loans grew by 11.3% yoy in Jun (May: 11.4%), the lowest in five months.

- Japan current account surplus narrowed to JPY 1.86 trn in May: this was the fourth month of surplus in a row. Trade deficit widened to JPY 1.19trn in May (Apr: USD 113.1bn).

- Industrial production in Japan rebounded by 4.2% yoy in May (Apr: -0.7%), the first rise in 7 months; it however fell by 2.2% in mom terms – the first fall since Jan – dragged down by motor vehicles production (-8.9% vs Apr’s 2.4% gain).

- Inflation in India inched up to 4.81% in Jun (May: 4.31%), rising for the first time in 5 months. Food inflation rose by 4.99% (May: 2.9%), housing costs were up 4.6% and clothing & footwear rose by 6.2%. WPI inflation in Jun fell by 4.12% yoy in Jun (May: -3.48%), the third month of deflation and the steepest since Oct 2015.

- India’s industrial output grew by 5.2% yoy in May (Apr: 4.2%), with manufacturing output rising by 5.7% (following Apr’s 5.2% gain) and mining activities surging 6.4% (Apr: 5.1%).

- Preliminary estimate for GDP in Singapore grew by 0.7% yoy and 0.3% qoq in Q1, escaping a technical recession, after Q4’s 0.4% qoq decline (Q4: 0.4% yoy). The government has forecast growth to range between 0.5%-2.5% this year.

Bottom line: The positive news of easing US inflation was balanced by the Chinese data dump which highlighted lower growth momentum, deflationary pressures, a sharp decline in trade flows and record-high youth unemployment thereby raising expectations of a stimulus package soon (the Politburo meeting is later this month). This slow economic recovery in China contrasts with an upbeat oil demand outlook for 2023 from the OPEC last week (driven by China and India). The UK’s inflation data will be published this week – an easing is expected but given high wage growth, the BoE is expected to press ahead with rate hike at the next meeting.

Regional Developments

- Bahrain was ranked the 9th best destination for expatriates, according to a report by InterNations, with the list topped by Mexico, Spain, Panama, Malaysia and Taiwan. UAE, Oman and Saudi Arabia were ranked 11th, 12th and 28th respectively.

- Urban inflation in Egypt surged to a record high 35.7% in Jun: this surpasses the previous record of 32.95% touched in Jul 2017, about 8 months after the currency was devalued by half. Core inflation was at a much higher 41%(May: 40.3%) and annual food inflation posted a whopping 65.9% jump (from 60%).

- Egypt signed contracts to sell stakes in state assets worth a total of USD 1.9bn – of this USD 1.65bn will be in foreign currency (including the sale of minority stakes in three oil and petrochemical sector companies to Abu Dhabi sovereign wealth fund ADQ for USD 800mn). The foreign currency will give some support in building up a foreign currency buffer – a condition needed prior to moving to a flexible exchange rate.

- Primary surplus in Egypt stood at EGP 164.3bn or 1.7% of GDP in 2022-23, according to the minister of finance. Expenditure growth was up by 16.3% alongside a 11.5% uptick in public revenues, hence raising the total deficit to 6.2% (up from 2021-22’s 6.1%).

- Egypt’s government plans to increase remittances into the country by 10% annually to USD 45bn in 2026. It is also planned to raise foreign exchange resources by about USD 70bn annually to nearly USD 191bn in 2026.

- The Minister of Tourism and Antiquities of Egypt disclosed that the nation had received almost 7mn tourists in H1 2023, with April recording a record 1.35mn tourists. A national strategy aims to raise total tourist numbers to 30mn by 2028 from an expected 15mn this year.

- Iraq plans to trade crude oil for Iranian gas, stated the Iraqi PM, to end payment delays as a result of failing to get US approval for fund disbursement. Iraq imports electricity and gas from Iran – between a third and 40% of its power supply. Paying for the imports has been difficult due to US sanctions, hence Iraq owes around EUR 11bn in outstanding debts to Iran.

- Iraq and TotalEnergies signed a USD 27bn energy deal last week: four oil, gas and renewables projects will increase oil production and capacity boost to produce energy.

- Kuwait’s 2023-24 budget projects a deficit of KWD 6.8bn (USD 22.2bn), reported Al-Dustor, citing an MP. Oil revenues are estimated to drop by 19.5% to KWD 17bn alongside an increase in non-oil revenue (+10% to KWD 2.2bn) and higher spending (+11.7% to KWD 26.2bn). The budget is based on an oil price of USD 70 per barrel.

- Inflation in Kuwait stood at 3.69% yoy in May, unchanged from the previous month. Food inflation eased to 6.85% (Apr: 7.68%) while clothing and restaurants & hotels costs were up by 6.8% and 3.49% respectively. Excluding food and beverages, inflation ticked up by 2.92%.

- Lebanon’s PM stated that the term of the central bank governor will not be extended when it ends on Jul 31st. Governors are usually appointed by the President – a post not filled yet.

- Oman posted a budget surplus of OMR 581mn at end-May 2023: total revenue was up by 3% yoy while spending grew at a faster pace of 4%. Increased production & higher oil prices led to a 9% increase in net oil revenue to OMR 2.8bn in May 2023: prices averaged USD 84 per barrel (+2.4% yoy) and oil production increased 2.9% to 1.064mn barrels per day. Though net gas revenues plunged by 26% to OMR 1.003bn, together net oil and gas revenues accounted for 70% of total public revenue.

- At a conference, Qatar’s energy minister disclosed that about 40% of new global LNG output will come from Qatar by 2029. Expansion projects approved in 2022 is expected to boost LNG output to 126mn per year by 2027 (+64%). The nation is expected to sign record volumes of long-term LNG offtake contracts this year.

- Qatar inflation eased to 2.5% in Jun, the lowest print since Jun 2021 and lower than the 2.6% clocked in May.

- Pakistan received monetary support from Saudi Arabia and the UAE, disclosed Pakistan’s finance minister. The two nations deposited USD 2bn and USD 1bn respectively with the central bank, thereby boosting forex reserves. The support follows IMF’s approval of the USD 3bn bailout package – of which USD 1.1bn will be released upfront and the rest disbursed in a staggered manner.

- India’s ministry of external affairs official disclosed that India and the GCC have resumed FTA discussions.

- Generative AI will add USD 23.5bn to annual GCC growth by 2030, with Saudi and UAE gaining a combined USD 17.5bn, according to Strategy&. The report states that the GCC could realize approximately USD 9.9 of economic growth for every USD 1 invested in GenAI. Source: https://www.strategyand.pwc.com/m1/en/strategic-foresight/sector-strategies/technology/reshaping.html

Saudi Arabia Focus

- Saudi Arabia’s inflation eased to 2.7% in Jun (May: 2.8%): price increases were highest among housing & utilities (9.1%), restaurants & hotel costs (4.3%) and education (3%) while clothing & footwear posted the largest decline (-2.9%).

- Wholesale price index in Saudi Arabia fell by 1.3% yoy in Jun (May: -1.1%), as prices declined across most categories. Agriculture & fishery products were down by 2% (May: 0.1%) while other transportable goods and metal products, machinery & equipment were down by 1.9% and 1.8% respectively.

- Saudi Arabia’s industrial production declined by 1.2% yoy in May (Apr: 3.2%), the first negative reading since Apr 2021, dragged down by the slowdown in mining & quarrying output (-5.5% yoy following Apr’s 0.2% gain) while manufacturing grew by 10%. In mom terms, IP fell by 3.1%, following the previous month’s 0.3% drop.

- Money supply (M3) in Saudi Arabia grew by 6.94% year-to-date to SAR 2.67bn in the week ending July 6, according to SAMA data.

- Total number of industrial facilities in Saudi Arabia rose to 10,819 by end-Mar, up by 2.9% year-to-date, with the factories’ estimated capital amounting to over SAR 1.43trn. The Ministry of Industry and Mineral Resources disclosed that chemical product manufacturing plants attracted the most investment during Q1 while the factories employed 725k+ workers.

- Saudi Arabia saw more than 88k new SME businesses being established in Q1 2023, up 4.8% qoq, taking the total registered SMEs to 1.2mn. Riyadh, Makkah and the Eastern Province accounted for 41.4%, 18.9% and 11.1% respectively, according to Monsha’at’s SME monitor report.

- Saudi Arabia and Japan approved 26 economic agreements across healthcare, clean energy, mining and digital innovation sectors. The 2 nations are expected to also agree on joint investment to develop rare earth resources, reported Nikkei. Saudi Arabia had become the largest oil supplier to Japan in 2021, supplying about 40% of its needs.

- ACWA Power and Power China were awarded the construction contract for a SAR 2.54bn desalination plant project on the Red Sea coast.

- The Ministry of Commerce disclosed that the number of cybersecurity firms registered in Saudi Arabia grew by 52% to reach 2,229 in Q2, with Riyadh topping the list – with 1,424 registrations. The number of robotics firms surged by 52% to 2344 in Q2 while the number of firms getting registration to offer artificial intelligence solutions rose by 49% to 4,229.

- The PIF and Engie signed an MoU focusing on integrated utilities management; they will also explore the joint development of green hydrogen projects and derivatives in Saudi Arabia.

- Saudi Arabia imported a record 910,000 metric tons (193k barrels per day) of fuel oil from Russia in June, revealed Kpler data. Russian fuel oil imports touched 2.86mn metric tons in H1 2023, exceeding the 1.63mn metric tons recorded in the full year 2022.

- The Saudi Fund for Development provided a soft loan of USD 20mn to fund an electricity project in Rwanda, with over 60k people expected to benefit from the provision of electricity.

- Saudi Arabia’s Saline Water Conversion Corp. increased its water production capacity to 11.5mn cubic meters a day, making it the world’s largest producer of desalinated water. This is in line with SWCC’s goal of reducing carbon emissions by 37mn tons by end-2025.

UAE Focus![]()

- UAE is forecast to grow by 3.9% in 2023 (2022: 7.9%), with oil and non-oil sector rising by 3.0% and 4.2% respectively, according to the central bank. The bank’s Financial Stability Report also disclosed that Islamic banking sector assets continued to grow in 2022 (+8.3% to AED 845.2bn) accounting for 23% of total banking sector assets. ESG finance is gaining prominence: green debt issuances rose to AED 23.4bn in 2022, accounting for 18.2% of total bond issuances last year.

- Dubai PMI increased to 56.9 in Jun (May: 55.3), the strongest improvement since Aug 2022, with the key sectors construction, wholesale & retail and travel & tourism registering faster increases in new work. Employment rose for the 14th consecutive month, posting the longest run of increases in over 6 years. Construction firms reported the biggest increase in costs and robust recruitment levels while travel & tourism firms led new order growth.

- India signed an agreement with the UAE to settle trade in rupees instead of dollars, thereby lowering transactions costs. Furthermore, it was agreed to set up a real-time payment link to ease cross-border money transfers.

- Bilateral trade between India and UAE grew by 18.2% in the last decade to AED 188.8bn in 2022, with total trade touching AED 1.41trn during 2013-2022. In the period Apr 2022-Mar 2023, trade between the two nations stood at USD 84.5bn.

- ADIA is in talks to bid for Telecom Italia SpA’s landline network, along with US investor KKR & Co, reported Bloomberg. ADIA’s participation in the EUR 23bn bid could be either a direct investment in the network or a stake in the KKR fund.

- Austria’s OMV confirmed that it would enter talks with ADNOC to create a global polyolefin company – a merger of petrochemicals groups Borealis and Borouge.

- Hydrogen dominates UAE’s updated energy strategy: the nation plans to produce 1.4mn tonnes of hydrogen annually by 2031, eventually rising to 15mn by 2050. Renewable energy capacity is expected to triple to 14 gigawatts by 2030 (from 3.2 gigawatts now) and this will lower total energy generation costs by AED 100-150bn.

- The UAE updated its national climate pledge to cut emissions by 40% by 2030 – from its previous target of 31%.

- According to CBRE, Dubai residential property prices grew by 16.9% in the year to end-Jun, the fastest since 2014, with off-plan sales surged by 44.9% in June. Meanwhile average rents rose by 22.8% in the year to end-Jun though slowing from May’s 24.2% uptick.

- UAE nationals working in the private sector increased to around 79k, a 57% increase compared to end-2022, as companies (with 50+ employees) comply with the 1% Emiratisation growth target.

- The Financial Action Task Force (FATF) follow-up report on the UAE indicated that the nation is compliant with most of the 40 recommendations: it was rated compliant in 15 recommendations, largely compliant in 24 and partially compliant in one.

Media Review

Weak Global Economy, High Inflation, and Rising Fragmentation Demand Strong G20 Action: IMF

https://www.imf.org/en/Blogs/Articles/2023/07/13/weak-global-economy-high-inflation-and-rising-fragmentation-demand-strong-g20-action

Does Xi Jinping need a plan B for China’s economy?

https://www.ft.com/content/00636375-7d47-40ec-9a18-598e3d7faae9

Lebanon’s State spending and the 2017 salary law, with Dr. Nasser Saidi’s comments

https://today.lorientlejour.com/article/1343005/state-spending-and-the-2017-salary-law.html

Why the Paris Financing Summit Failed

https://www.project-syndicate.org/commentary/paris-climate-financing-summit-disappointing-outcomes-by-jayati-ghosh-et-al-2023-07

Powered by: