Egypt inflation, asset sales. Dubai inflation, PMI. Dubai & Middle East tourism indicators. MENA remittances. Saudi unemployment. Oman fiscal surplus.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 14 Jul 2023: Middle East – Divergent Inflation, Travel & Tourism, Remittances & more

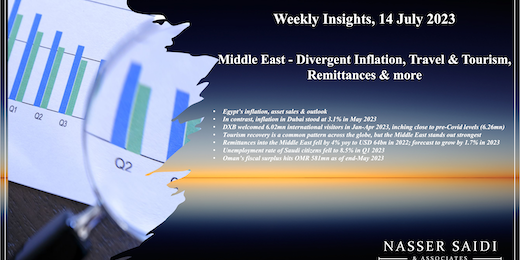

1. Egypt: Inflation, asset sales & outlook

- Urban inflation in Egypt surged to a record high 35.7% in Jun: this surpasses the previous record of 32.95% touched in Jul 2017, about 8 months after the currency was devalued by half.

- Core inflation was at a much higher 41% (May: 40.3%) and annual food inflation posted a whopping 65.9% jump (from 60%).

- Inflation is accelerating in Egypt in part due to the Egyptian Pound depreciation pass-through to consumers and partly due to a dollar shortage; EGP has lost close to half its value since last year and there have been import restrictions.

- Egypt already announced as part of the 2023-34 budget a 50% increase in social spending. But, at the current speed of price gain, this measure is unlikely to dent the impact of inflation on households.

- Furthermore, IF the authorities proceed with further devaluation, more inflationary pressure is guaranteed.

- Though the Central Bank has been holding rates steadysince March 2023: prior to that, the apex bank had raised 200bps this year and another 800bps last year. We believe that more rate hikes are in the offing, with the next one likely as soon as next month (if not, then definitely by September).

- In this backdrop, Egypt signed contracts to sell stakes in state assets worth a total of USD 1.9bn – of this USD 1.65bn will be in foreign currency. This is a start, but the nation is only 1/4th the way through its list of 32 state firms embarking on privatisation plans. The foreign currency will give some support in building up a foreign currency buffer – a condition needed prior to moving to a flexible exchange rate.

- Meanwhile, domestic demand has been weak, with high inflation and a weakening currency: non-oil sector PMI remained contractionary (below-50) for the 31st consecutive month in June & forward-looking sentiment was the second-weakest on record.

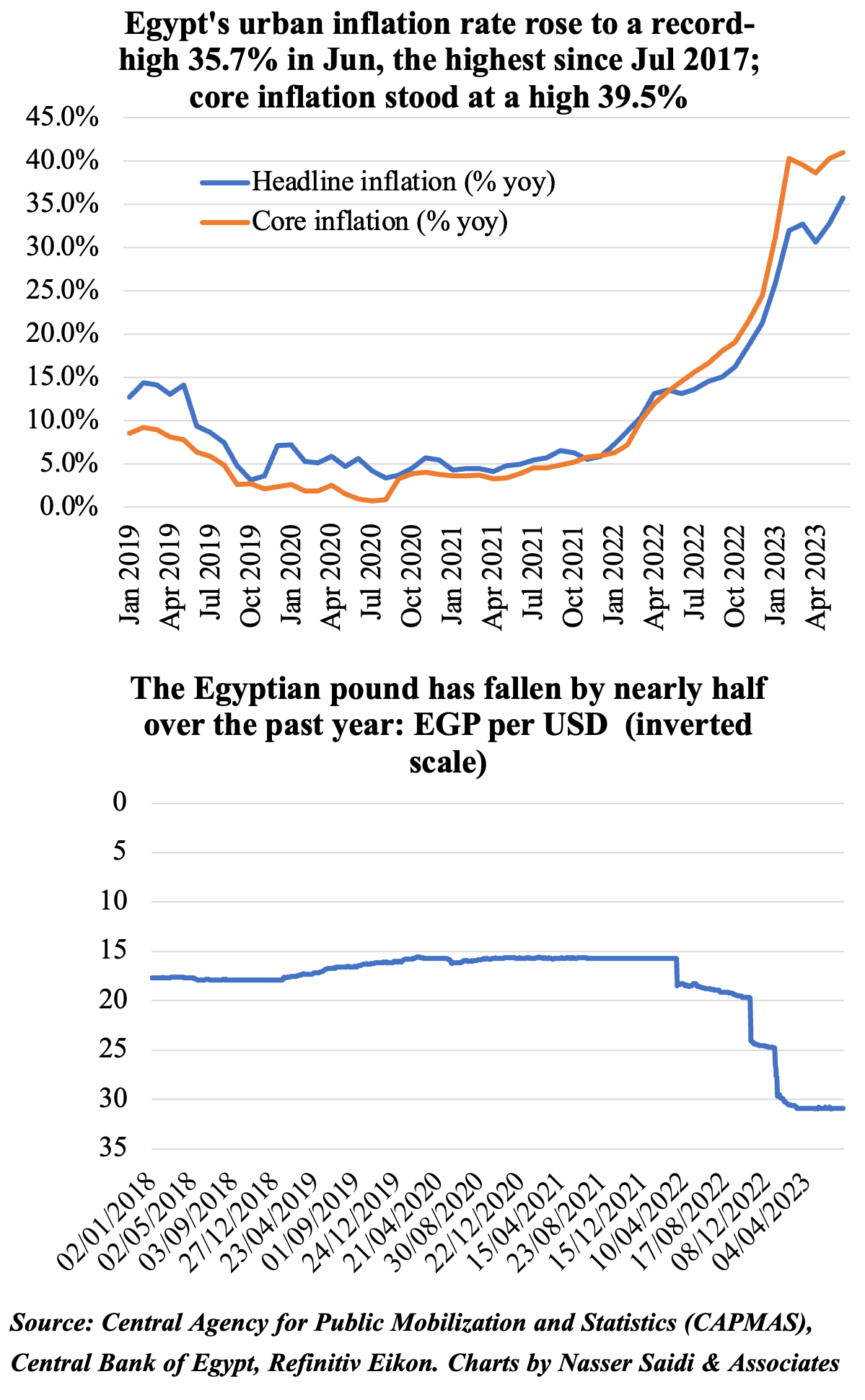

2. In contrast, inflation in Dubai stood at 3.1% in May 2023; Dubai’s non-oil sector firms continue to cut prices charged for goods & services

- In May, inflation in Dubai eased to 3.05% yoy, after easing the month before to 3.27%. The only uptick in May was seen in housing & utilities (5.74% from 5.44%) while transport prices fell the most (-1.57% average in Jan-May vs an average of 22.13% in 2022). Food inflation, though easing, is relatively high (4.8% in May vs 6.7% in 2022); recreation costs fell in May (-1.2% vs 7% in Apr) while restaurants & accommodation has been easing (4.6% in Jan-May ‘23 vs 6.5% in 2022).

- This easing of costs is showing up in the PMI for Dubai’s non-oil sector: average input prices rose, but it was weaker than the long-run series average. Though input prices ticked up at the fastest rate in 3 months in June, firms continued to reduce charges levied, with discounts being offered to support demand – such behaviour is not sustainable and will have an impact on firms’ bottom line and profits. Construction firms reported the biggest increase in costs, while travel & tourism firms led new order growth.

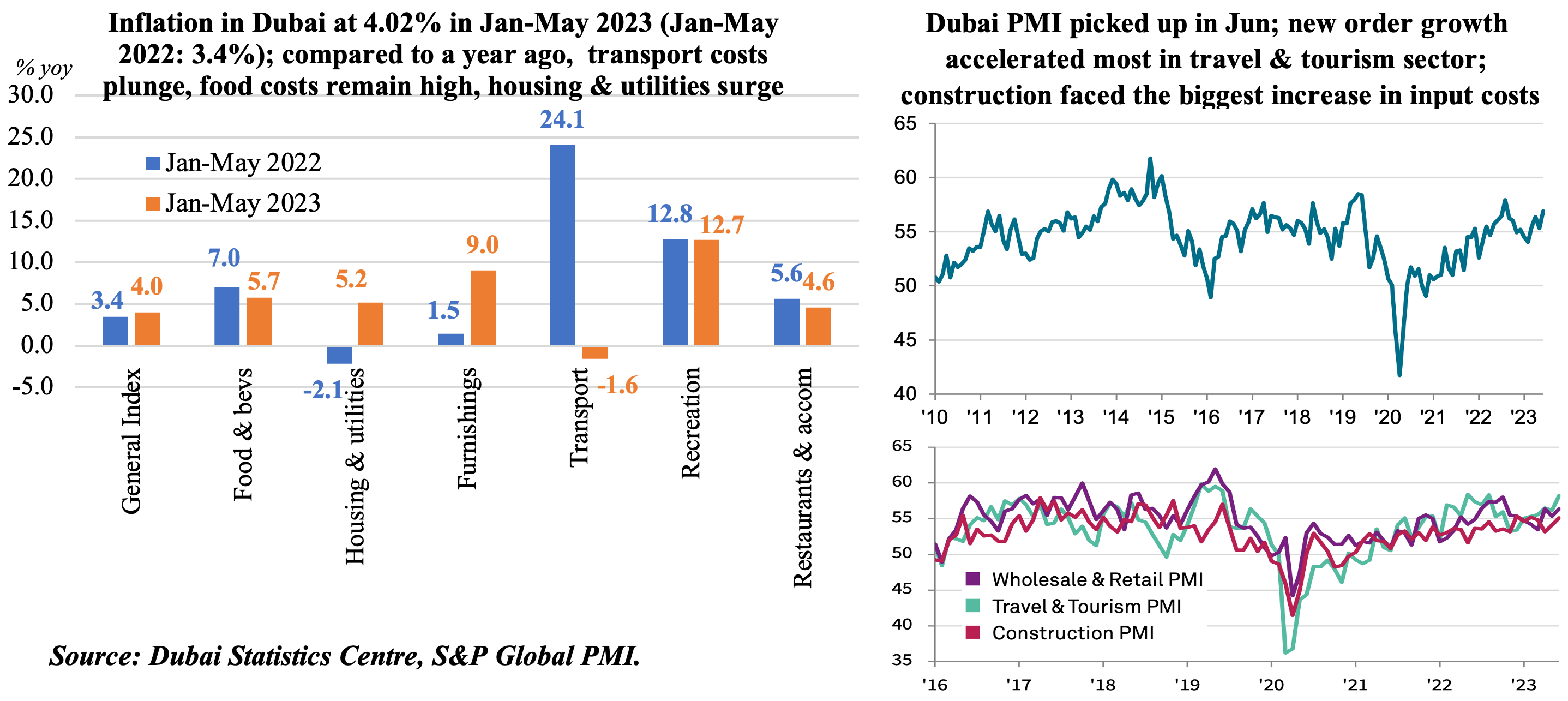

3. As seen in PMI data, Dubai tourism is gaining. DXB welcomed 6.02mn international visitors in Jan-Apr 2023, inching close to pre-Covid levels (6.26mn).Occupancy rates are higher than the past 3 years, but a tad below pre-Covid days

- Regional composition of tourists have remained the same, there are distinct differences top source nations: the major one is the re-entry of Chinese travelers into the top 10; Saudi Arabia and Oman are still among the top 5 but have dropped from top-3.

- Revenue per available room has fallen vs 2022, as has length of stay (4 from 4.4) & room rates (still-high AED 599 from AED 640)

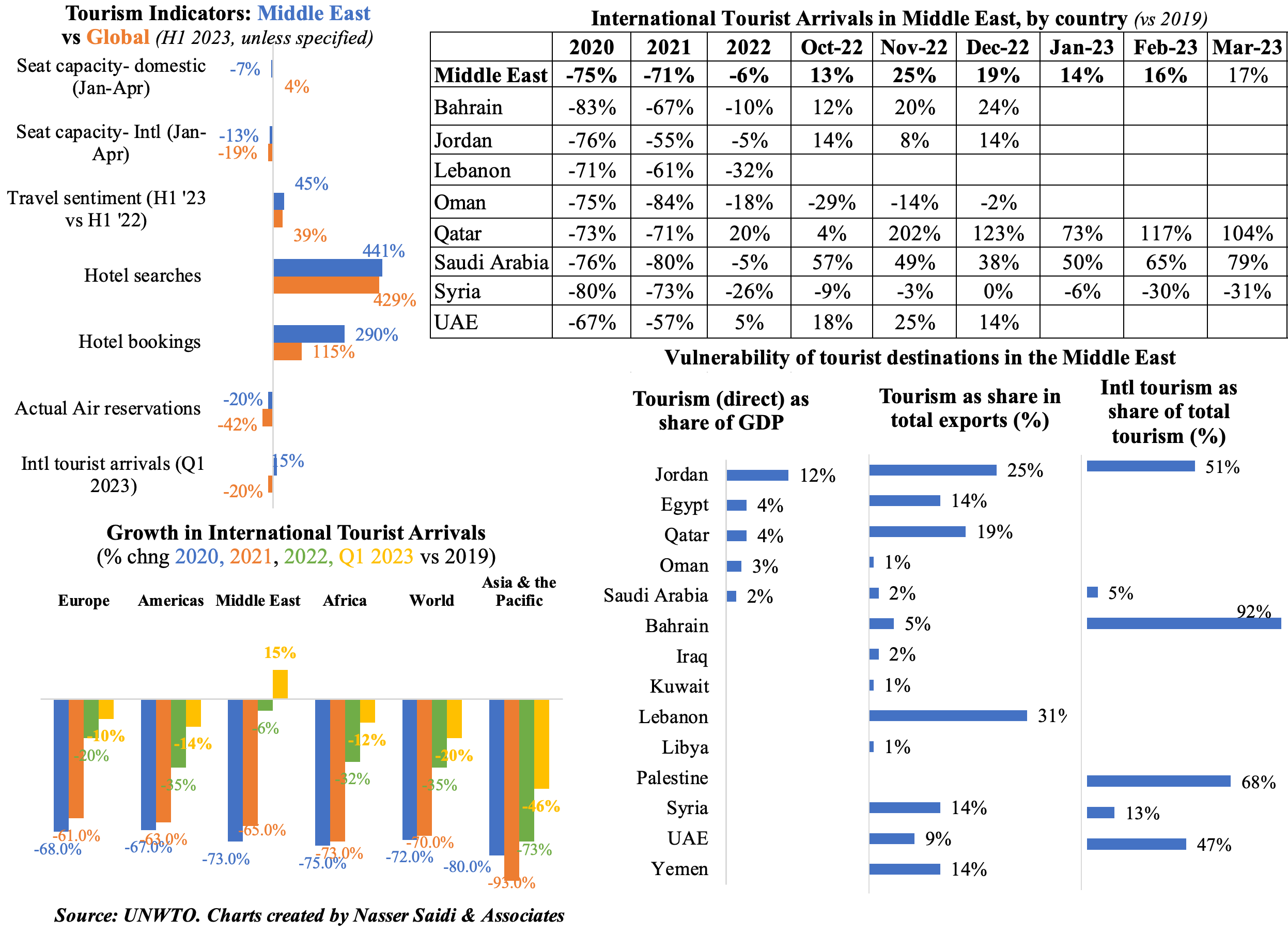

4. Tourism recovery is a common pattern across the globe, but the Middle East stands out with its strongest post-Covid recovery in international tourist arrivals (+15% in Q1 2023 vs 2019), also outpaces global average in many indicators

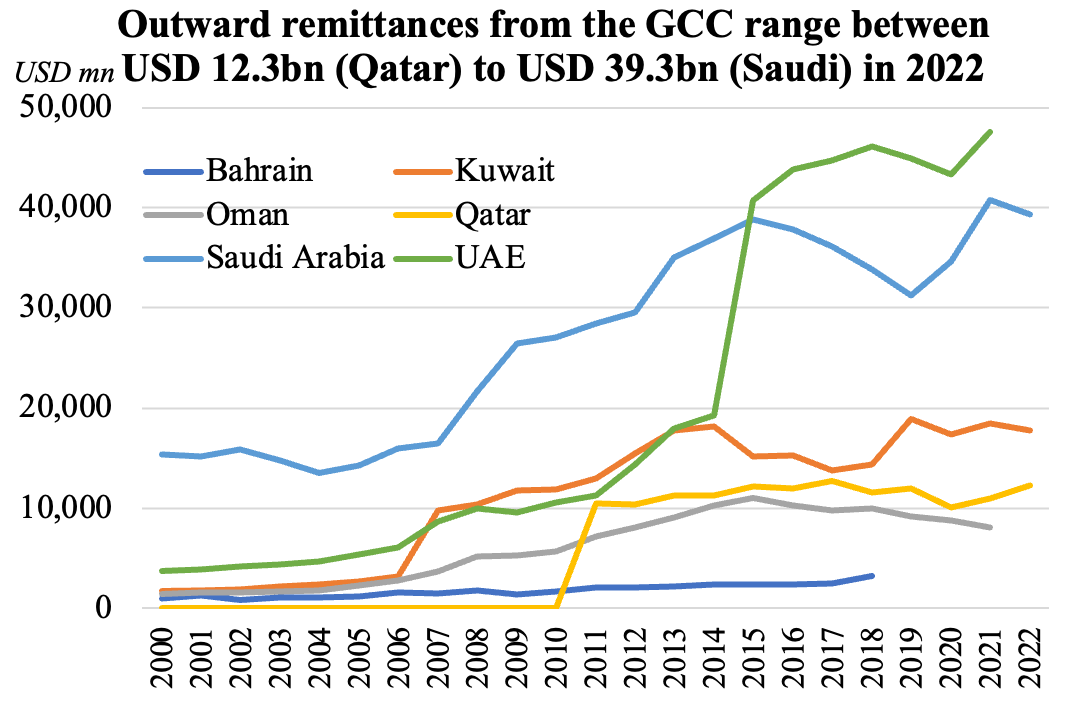

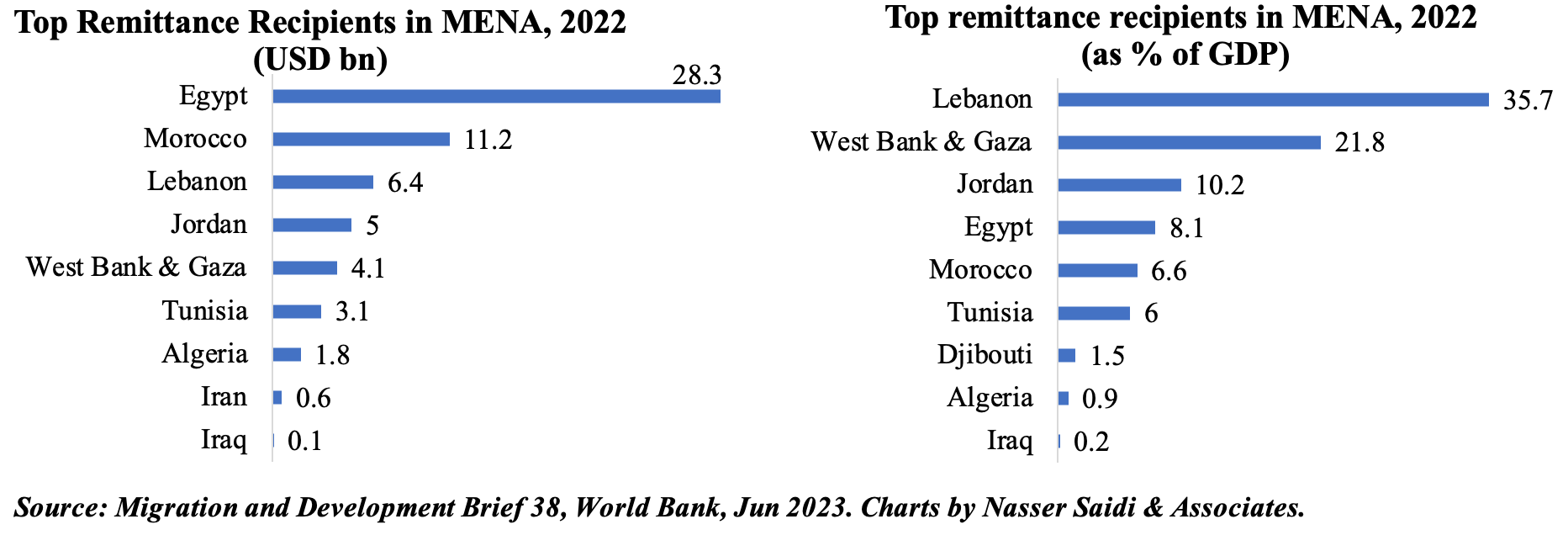

5. Remittances into the Middle East fell by 4% yoy to USD 64bn in 2022; forecast to grow by 1.7% in 2023

- Remittances inflows into MENA weakened last year, but is estimated to tick up in 2023.

- Why? Increased inflow of migrants post-Covid, resulting in an uptick in remittances; but many GCC nations’ long-term residency programs may lead to a slight decline is remittances back home. Also dependent on degree of inflation & financial volatility in host nation.

- Egypt is still the largest remittance recipient, but it declined by 10% last year: recipients are either selling foreign exchange on the parallel market (given the gap) or holding due to devaluation expectations.

- Saudi Arabia, which accounts for 1/3-rd of Egypt’s remittances, also recorded a decline in total remittance outflows in 2022.

- Lebanon and West Bank are the most dependent on remittances: 35.7% and 21.8% of GDP respectively last year.

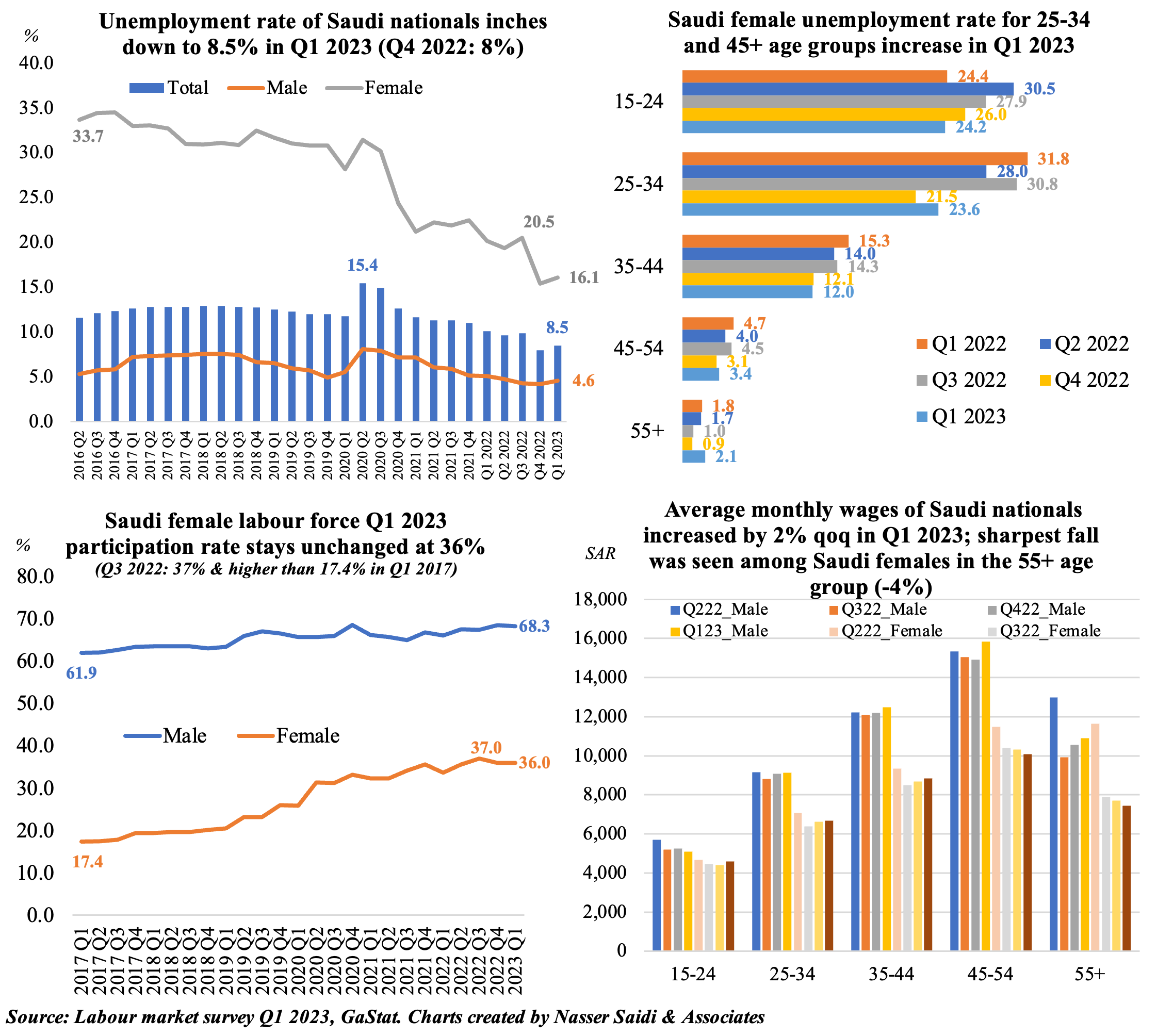

6. Unemployment rate of Saudi citizens fell to 8.5% in Q1 2023

- Unemployment in Saudi Arabia (inclusive of expats) inched up to 5.1% in Q1 2023 (Q4: 4.8%).

- Saudi citizens unemployment rate also ticked up: 8.5% in Q1 (Q4: 8%).

- Female unemployment among Saudis rose to 16.1% in Q4 (less than half of 33.7% in Q2 2016); though some age groups saw declines (the under-24 and the 35-44 age groups)

- Female labour force participation remained unchanged at 36% in Q1 while females’ wages barely moved (0.1% qoq to SAR 7,723).

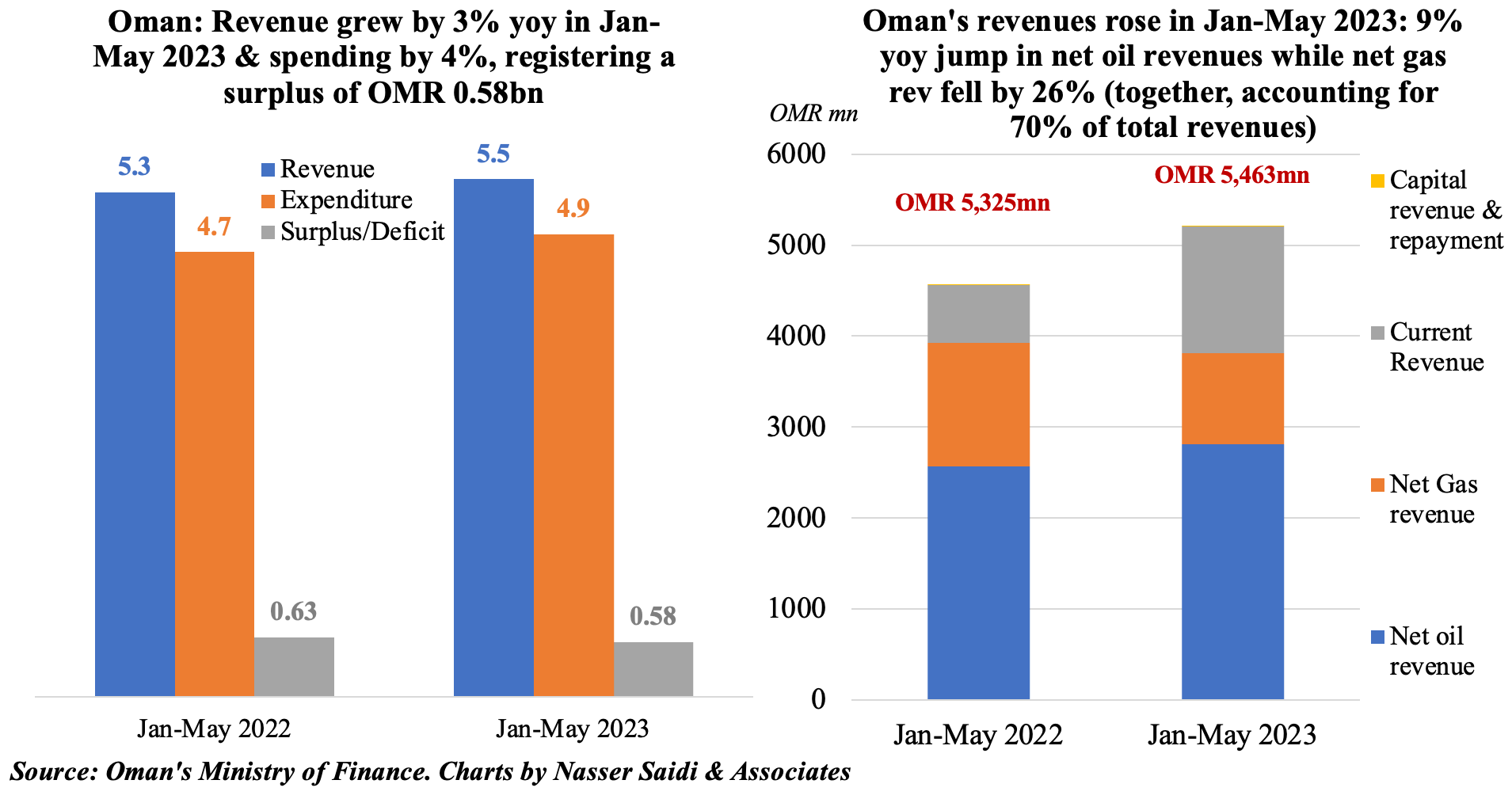

7. Oman’s fiscal surplus hits OMR 581mn as of end-May 2023

- Oman posted a budget surplus of OMR 581mn at end-May 2023: total revenue was up by 3% yoy while spending grew at a faster pace of 4%. This compares to a projected deficit of OMR 1.3bn as per the 2023 budget.

- Increased production & higher oil prices led to a 9% increase in net oil revenue to OMR 2.8bn in May 2023: prices averaged USD 84 per barrel (+2.4% yoy) and oil production increased 2.9% to 1.064mn barrels per day.

- Net gas revenues plunged by 26% to OMR 1,003mn (largely due to “due to the deduction of gas purchase and transport expenses from the total revenue” according to the ministry). But together net oil and gas revenues accounted for 70% of total public revenue, making it more vulnerable to volatility in the oil & gas markets.

- While current expenditure declined (-9% to OMR 3.4bn), there was a 31% hike in “contributions and other expenses” (to OMR 678mn); latter due to an increase in electricity and oil subsidies amounting to OMR 244mn and OMR 143mn in Jan-Apr. Furthermore, OMR 166mn was transferred to future debt obligations budget-item.

Powered by: