Markets

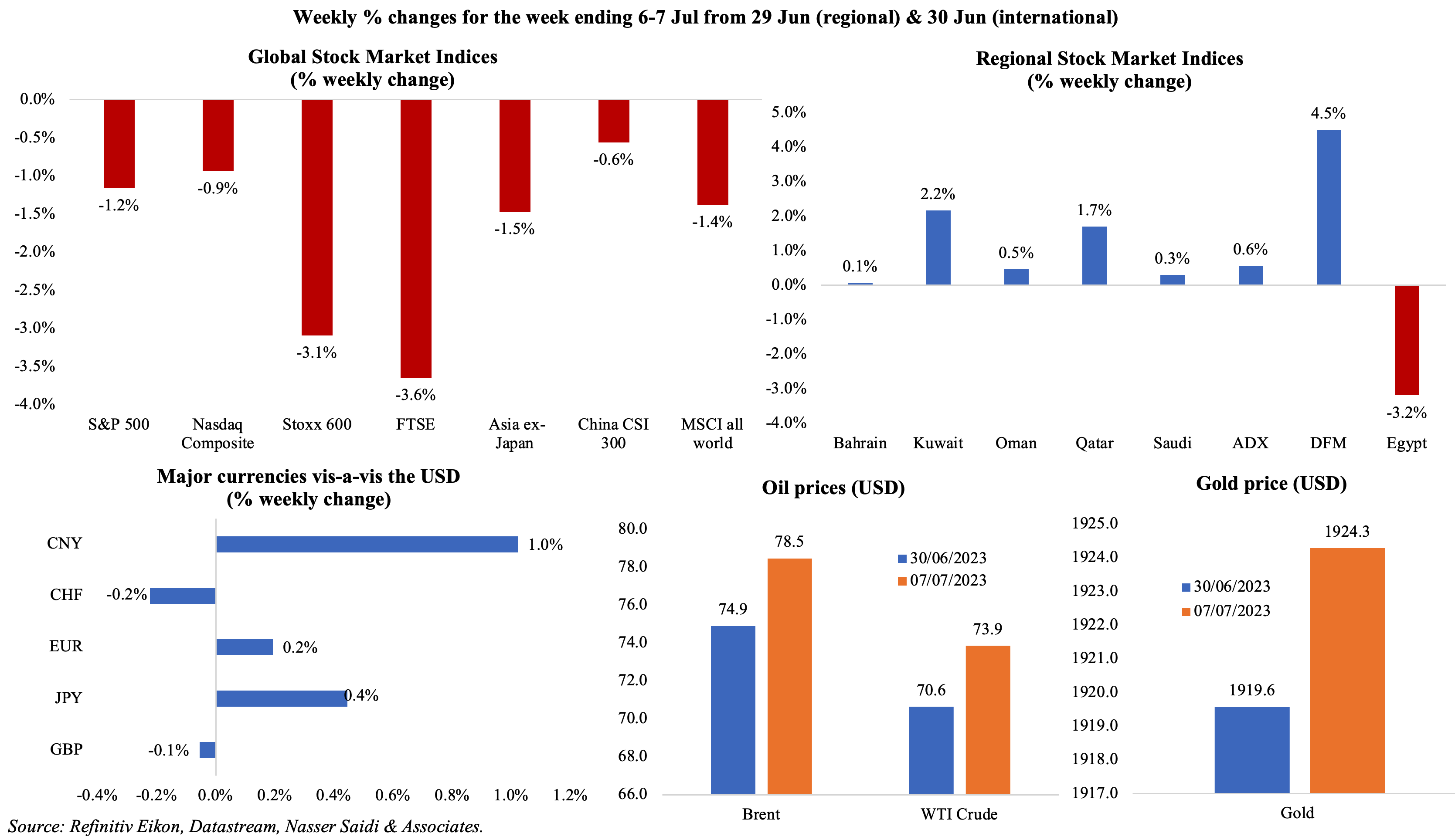

Global equities markets ended the week in the red – with relatively strong private sector jobs data resulting in an equities sell-off in the US; other markets were also affected by investors’ expectations of rate hikes for longer than expected, with US yield curve inversions deepening last week, hitting the lowest level since 1980. Regional markets saw Dubai post a strong increase – the index touched the highest since 2015 on gains in property stocks – while Egypt declined sharply (largely a reflection of ongoing economic woes). Non-farm payrolls data sent the dollar down while JPY strengthened; GBP had touched a one-year peak on Friday before closing lower. Oil prices rose to a 9-week high as supply worries (both Saudi and Russia announced fresh output cuts) outweighed concerns about lower demand (stemming from more rate hikes); gold price gained as well.

Global Developments

US/Americas:

- US factory orders inched up by 0.3% mom in May (Apr: 0.3%), with orders for transportation equipment rising by 3.8% (Apr: 4.8%) and civilian aircraft orders surging by 32.8%. Orders for non-defence capital goods excluding aircraft rose by 0.7%.

- Non-farm payrolls increased by 209k in Jun (May: 306k): this was the smallest jobs gain since Dec 2020 and job growth averaged 278k per month in H1. Unemployment rate eased to 3.6% from May’s 7-month high of 3.7%. Labour force participation rate remained unchanged at 62.6% for the 4th month in a row.

- The private sector added 497k jobs in Jun, the most since Feb 2022, with the leisure and hospitability sector adding the most jobs (+232k).

- Initial jobless claims increased by 12k to 248k in the week ended Jun 30th, and the 4-week average declined by 3.5k to 253.25k. Continuing jobless claims fell by 13k to 1.72mn in the week ended Jun 23rd, the lowest in 4 months.

- JOLTS job openings slipped to a 2-year low of 9.8mn in May (Apr: 10.3mn), it was much higher than pre-pandemic levels, with 1.6 job openings for every unemployed person.

- Goods and services trade balance narrowed to USD 69bn in May (Apr: USD 74.4bn)

- S&P manufacturing PMI in the US fell to 46.3 in Jun (May: 48.4), with output falling for the first time in 4 months and new orders down the most since Dec on subdued demand while input costs fell the most since May 2020. Services PMI eased slightly to 54.4 from 54.9: rate of job creation eased amid higher wage bills even as demand conditions remained robust.

- ISM manufacturing PMI slipped to 46 in Jun (May: 46.9), despite the uptick in new orders (45.6 from 42.6) while employment sub-index dropped to 48.1 from 51.4. Prices paid eased to 41.8 from 44.2 the month before. ISM services PMI increased to 53.9 in Jun (May: 50.3), with both new orders (55.5 from 52.9) and employment sub-indices improving (53.1 from 49.2).

Europe:

- Manufacturing PMI in the EU fell to 43.4 in Jun(May: 44.8), falling for a third consecutive month and posting the sharpest decline since May 2020, dragged down by declines in output new orders. Input costs fell the most since Jul 2009 while output costs fell at the quickest in 3 years. Services PMI slipped to 52.0 from 55.1 and composite PMI fell below-50 to 49.9 (down from the preliminary reading of 50.3 and May’s 52.8).

- Producer price index in the eurozone declined by 1.9% mom and 1.5% yoy in May: this was the first month of yoy decline since Dec 2020, as energy and intermediate goods costs dropped by 13.3% and 1.5% respectively.

- Retail sales in the eurozone fell by 2.9% yoy in May, following a similar drop in Apr. In mom terms, sales remained unchanged: food, drinks and tobacco fell by 0.5% mom while spending on non-food items edged up by 0.1%.

- Manufacturing PMI in Germany slipped to 40.6 in Jun (lower than the preliminary reading of 41 and May’s 43.2), with new orders falling at the sharpest pace in 8 months and output charges falling for the first time since Sep 2020. Services PMI fell to 54.1 (from May’s 13-month high of 57.2) amid reports of dampening demand, rising wage costs and elevated prices. Composite PMI eased to 50.6 (May: 53.9).

- Germany factory orders rebounded by 6.4% mom in May (Apr: -0.4%), posting the largest increase in orders since Jun 2020. New orders for motor vehicles and trailers grew by 8.6% and other transport equipment surged by 137.1%. Domestic orders grew by 6.2% while foreign orders jumped by 6.4%.

- Industrial production in Germany unexpectedly fell by 0.2% mom in May (Apr: 0.3%), with production of consumer goods and intermediate goods falling by 1.2% and 0.5% respectively while capital goods grew by 1.3%. In yoy terms, IP grew by 0.7%.

- Exports from Germany fell by 0.1% mom in May, and imports by 1.7%; trade surplus narrowed to EUR 14.4bn (Apr: EUR 16.5bn), the smallest surplus since Dec 2022.

- Manufacturing PMI in UK declined to a 6-month low of 46.5 in Jun (May: 47.1), driven by falling new orders alongside declining output and employment levels. Services PMI eased to 53.7 (May: 55.2), with respondents citing slower consumer spending and weaker client demand while rate of job creation accelerated.

Asia Pacific:

- China’s Caixin manufacturing index declined to 50.5 in Jun (May: 50.9): output slowed from May’s 11-month high while employment fell for the fourth month in a row; input costs fell the most since Jan 2016. Caixin services PMI also fell to 53.9 in Jun (May: 57.1), with new orders easing to a 6-month low and new export also moderating.

- Reuters reported that China’s “Big Five” state-owned lenders were capping interest rates on most dollar deposits at 2.8% (from 4.3% before) to prevent a slide in the yuan.

- Manufacturing PMI in Japan fell to 49.8 in Jun (after expanding in May to 50.6 – the first time in 7 months), with output and new orders shrinking due to weak demand conditions. Input costs rose at the softest pace since Feb 2021, while output cost inflation slowed to a 21-month low. Services PMI eased, down to 54.0 (from the flash estimate of 54.2 and May’s 55.9), with employment moderating while input costs inflation slipping to a 15-month low.

- Flash estimate of the leading economic index in Japan improved to 109.5 in May (Apr: 108.1), the highest level since Nov 2022 (with a new base year 2020). The coincident index eased to 113.8 in May (Apr: 114.2), the lowest level since Jan.

- Japan’s overall household spending fell by 4% yoy in May (Apr: -4.4%), marking a third consecutive month of decline in personal spending. Base salary in Japan grew by 1.8% yoy in May, the biggest gain since Feb 1995. Total cash earnings (or nominal wages) inched up by 2.5% yoy in May (Apr: 0.8%) while real wages fell by 1.2% (the 14th consecutive month of yoy declines).

- South Korea manufacturing PMI slipped to 47.8 in Jun (May: 48.4), staying below 50 for a record 12th month. Both output and new orders stayed contractionary on weak demand in Asia and Europe while inflationary pressures eased.

- Singapore PMI inched up to 49.7 in Jun (May: 49.5), remaining below-50 for the fourth month running, while electronics sector (Jun: 49) fell for the 11th month in a row.

- Retail sales in Singapore fell by 0.2% mom in May following three previous months of gains; in yoy terms sales eased to 1.8% (Apr: 3.7%), the lowest since Jul 2021.

Bottom line: PMI readings last week show a slump in global manufacturing output, with weaknesses reported across the US, Europe and Asia (except in India where the reading slowed, but remained at a strong 57.8), largely a result of subdued demand. This week sees the release of US inflation reading – we expect core inflation to remain relatively high amid easing of the headline number; this, along with continued labour market strength, is likely to result in an interest rate hike when the Fed meets later this month. Fears over borrowing costs are rising – US yield curve inversions deepened last week, hitting the lowest level since 1980. Earnings season also begins this week, which will give an insight into firms’ immediate worries in the second half of this year. With various optimistic mentions of the oil demand outlook (including from the CEO of Aramco), the 2024 demand outlook in the OPEC report to be issued this week is likely to be slightly upbeat (vs IEA’s forecasts).

Regional Developments

- Bahrain signed an MoU to invest GBP 1bn (USD 1.3bn) in the UK via the sovereign wealth fund Mumtalakat, Investcorp, GFH Financial Group, and Osool Asset Management. Separately, the two also signed a digital economy trade partnership including fintech, cyber and space. Bilateral trade had nearly doubled to a record high GBP 3.1bn in 2022.

- Inward FDI stock in Bahrain increased by 5.8% yoy to USD 35.44bn in 2022, according to UNCTAD data. FDI inflows into the country grew by 9.7% to USD 1.95bn.

- Egypt PMI remined below-50 in Jun, but at 49 (May: 47.8), it was the highest since Aug 2021. Amid inflationary pressures and weak economic conditions, sentiment was the 2nd weakest since the series began in 2012 while export orders fell sharply (the most in 9 months) and employment dropped for the seventh consecutive month.

- Trade deficit in Egypt widened by 23.8% yoy to USD 2.33bn in Apr: exports plunged by 44.9% yoy to USD 3.03bn while imports were down by 27.4% to USD 5.36bn.

- Egypt’s minister of trade and industry disclosed that non-oil exports jumped by 60.8% to USD 35.7bn in 2022 from 2014. From the 2013-14 period, the Export Development Fund disbursed an amount of EGP 56.5bn till end-Jun 2023 to more than 2700 firms.

- In a bid to improve the investment climate and attract new capital, Egypt approved an amendment to the Investment Law: this expands the scope of projects that can be granted a single approval or a golden license. Separately, UNCTAD data show that FDI into Egypt doubled to USD 11bn in 2022, largely due to increased M&A sales.

- Egypt’s minister of petroleum and mineral resources disclosed a USD 1.8bn offshore exploration plan to drill 35 gas wells from now till Jul 2025 across the Mediterranean Sea, the Nile Delta and the Western Desert: of these, 21 are being planned for 2023-24 and the rest in the 2024-25 fiscal year. Over the past five years, Egypt has discovered 284 new fields, comprising 217 oil wells and 67 gas wells.

- Saudi Arabia and UAE committed a total of USD 6bn to support trade and investment opportunities in Iraq, reported the Iraqi News Agency.

- Kuwait’s oil minister revealed that the nation plans to invest more than USD 300bn in the energy sector by 2040. Separately, the minister reiterated commitment to OPEC decisions, while also underscoring hopes for a higher production quota when capacity is increased.

- Lebanon PMI surged to the highest in 10 years, with new orders rising the most since May 2013, albeit from low levels. Demand strength was visible in both domestic and foreign sales while input price inflation eased to a 21-month low.

- Oman revealed plans to establish two economic free zones in the Khazaen economic city in the Al Batinah South Governorate.

- Qatar PMI eased to 53.8 in Jun (May: 55.6), though remaining above the long-run trend of 52.3, as growth rates for output and new orders remained at “solid levels”. Financial services expanded, with indices for activity and new business clocking in at 60 and 63.4 respectively.

- International reserves and foreign currency liquidity of the Qatar Central Bank grew by 14% yoy to QAR 240.7bn in Jun. Gold reserves were up by QAR 8.6bn to QAR 20.85bn.

- Reuters reported that Qatar is in negotiations with Thailand’s largest energy company PTT for a 15-year LNG supply deal. Supply is likely to range between 1 to 2mn tonnes per annum, but the deal is unlikely to happen before end of summer.

- Qatar Airways reported a record revenue of QAR 76.3bn (USD 21bn) in 2022, thanks to the rush related to the FIFA World Cup (when it operated around 14k flights ferrying more than 1.4mn fans); overall passengers surged by 71% yoy to31.7mn. Net profit for the 2022-23 fiscal year stood at QAR 4.4bn.

- Travel spending in Qatar increased by 28% yoy to QAR 13.1bn (USD 3.59bn) in Q1 2023, according to balance of payments data from the central bank. Revenues from travel and transport sectors in Q4 2022 posted the highest ever quarterly value of QAR 32.4bn, partly due to the World Cup.

- Japan’s oil imports from the GCC amounted to 97% of its total 76mn barrels reported in May. UAE and Saudi Arabia were the top crude oil suppliers to Japan with approximately 33mn and 29.36mn barrels in May, or 43.4% and 38.6% respectively of its total imports.

- MENA nations need to spend USD 500bn on urban regeneration programs, citing revamp of older parts of towns and cities as a “necessity” to achieve sustainability targets, according to a Strategy& report.

- Turkey expects GCC nations to make direct investments of about USD 10bn in the nation’s domestic assets during the President’s trip to the region during Jul 17-19, reported Reuters citing senior Turkish officials. Talks are private and deals not finalised, but expectations are high – up to USD 30bn is expected in investments over a longer period.

- A senior Bank of America executive disclosed that several Middle East firms are planning to push IPO plans to 2024 instead of this year.

Saudi Arabia Focus

- Saudi Arabia’s PMI inched up to 59.6 in Jun (May: 58.5) but was slightly lower than Feb 2023’s 8-year high of 59.8. Output, at 66.1 in Jun, posted the fastest pace of growth since Mar 2015 while new orders sub-index (at 69.5) was the strongest since Sep 2014 and employment the highest since Aug 2015 (many respondents stated higher wages needed to retain experienced staff). Government-backed construction and infrastructure projects provided support to economic activity.

- The ministry of industry and mineral resources in Saudi Arabia issued 53 new industrial licenses in Apr with an investment volume of SAR 5.8bn (Mar: 123, SAR 3.09bn); about 56 factories began operations during the month.

- Agricultural GDP in Saudi Arabia surged by 38% yoy to SAR 100bn (USD 26.6bn) in 2022, thanks to an increase in investment and measures to promote sustainable practices, disclosed the deputy minister for environment, water and agriculture.

- Saudi Arabia and France inked a Memorandum of Understanding to cooperate in the field of energy, with a focus on clean energy, enhancing energy efficiency and grid interconnection projects among others.

- Saudi Arabia’s push to increase tourism: plans are underway to increase inbound flights from India by 19% to 290 per week – about 400k Indian tourists visited in Q1 alone; Saudia plans to increase seat capacity by 10% to 7.4mn during Jul-Aug while the number of flights will be increased by 4% to over 32,400 flights.

- Spending by incoming travellers to Saudi Arabia surged by 225% yoy to USD 9.8bn in Q1 2023, according to SAMA data. Saudi citizens travelling abroad during the period spent about USD 3.7bn (+7.9% yoy).

- NEOM’s green hydrogen project formally entered the construction stage, revealed ACWA Power in a statement to Tadawul. The plant is expected to start producing green hydrogen in 2026, with production of up to 1.2mn tonnes of green ammonia annually.

- Red Sea Global installed 750k solar panels and has constructed five solar stations ahead of the first phase of its opening, supporting its renewable energy drive. It is also implementing a battery storage facility at a capacity of 1200 MW per hour, allowing it full grid independence.

UAE Focus![]()

- PMI in the UAE increased to 56.9 in Jun (May: 55.5), with strong consumer demand leading to a surge in new orders (to 61, the most since Jun 2019) and output sub-index (to 64.1 from May’s 62.3). While employment rose for the 14th month in a row, input prices ticked up to 52.1, posting the fastest pace of increase since Jul 2022.

- The UAE will set up an investment ministry, with an aim to stimulate the investment environment. Separately, it was announced that a Financial Stability Council will be set up to monitor risks and deal with financial crises.

- UAE attracted a record high USD 22.7bn in FDI last year, up 10% yoy, as per UNCTAD’s World Investment Report. Outward FDI flows also grew by 10% yoy to USD 25bn. UAE was the 4th largest recipient of greenfield projects globally (997) behind US, UK and India.

- GDP in Ajman grew by 5.7% yoy in 2022: the five highest contributors to the GDP were transformative industries (19.2%), construction (18.8%), wholesale & retail trade (17.8%), electricity and water (14.6%) and real estate (12.1%).

- Dubai’s Road and Transport Authority selected Rothschild & Co for an asset review, ahead of a potential IPO of the Dubai Taxi Corp and its public parking business, reported Reuters.

- The UAE central bank announced new guidelines related to residential mortgage loans in light of increased interest rate payments: for UAE nationals with a monthly income of AED 40k or more, banks are allowed to increase the deduction rate from the current 50% level to up to 60% to cover the increase in interest rates; but banks must pay the additional interest arising from the rate increase. Deduction from salary or income will remain at 50% for those with income less than AED 40k, though banks are permitted to extend the repayment tenor to cover the increase in interest rates, up to a maximum of 30 years.

- UAE’s re-exports contributed 6.6% to GDP, generated 1.3mn jobs (not limited to just logistics and trade-related sectors) and had a total direct and indirect economic impact of AED 48bn, according to the minister of state for foreign trade. In 2022, UAE re-exports share stood at AED 614.4bn or 27.5% of the total: it is the world’s largest re-exporter of rice, third largest re-exporter of diamonds, fifth largest re-exporter of coffee, and fifth largest re-exporter of tea.

- DMCC attracted 1456 new companies in H1 2023, a tad lower than the 1469 firms welcomed in Q1 2022. There are now more than 23k companies in the freezone, contributing over 11% to Dubai’s FDI.

- The UAE approved the updated National Energy Strategy 2050. The plan aims to triple the contribution of renewable energy to the overall energy mix by 2030 with investments worth up to AED 200bn (USD 54.4bn). The UAE Cabinet also approved the National Hydrogen Strategy and the National Electric Vehicles policy which aims to build a national network of electric vehicle chargers. The UAE government also approved a license for the company WeRide to test its self-driving cars in the country.

Media Review

Bond bull markets: lessons from the past

https://www.ft.com/content/ea867ea4-08ec-40ab-9bfb-a3dc4de3fe94

Focus on Productivity, Not Technology

https://www.project-syndicate.org/commentary/ai-technological-innovation-does-not-necessarily-raise-productivity-living-standards-by-dani-rodrik-2023-07

Saudi crude floating off Egypt’s Ain Sukhna falls to 10.5 mln bbls -Vortexa

https://www.reuters.com/business/energy/saudi-crude-floating-off-egypts-ain-sukhna-halves-105-mln-bbls-vortexa-2023-07-07/

Bitcoin miners will struggle to survive the next ‘halving’ event amid electricity costs, debt payments

https://fortune.com/2023/07/08/bitcoin-miners-will-struggle-to-survive-halving-electricity-costs-debt-payments/

Abu Dhabi and OMV in talks to form chemicals giant

https://www.reuters.com/markets/deals/abu-dhabi-omv-talks-form-30-bln-chemicals-giant-bloomberg-2023-07-04/

Powered by: