Global FDI inflow & UAE’s performance. MENA PMIs. Abu Dhabi & Oman Q1 2023 GDPs. Saudi monetary stats.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 7 Jul 2023: Record-high FDI inflow into the UAE; non-oil sector drives growth in the GCC amid oil output cuts

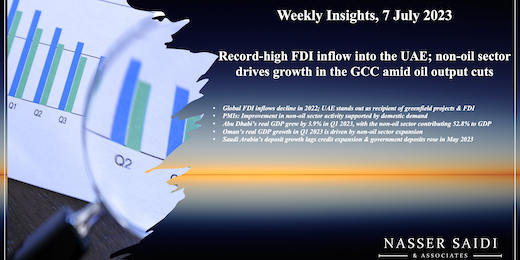

1. Global FDI inflows decline in 2022; UAE stands out as recipient of greenfield projects & FDI

- UNCTAD’s World Investment Report highlighted that global FDI declined by 12% yoy in 2022, to USD 1.3trn, given “lower volumes of financial flows and transactions in developed countries” (-37% to USD 378bn) while flows to developing nations rose by 4% to USD 916bn. The war in Ukraine, higher food and fuel prices as well as interest rate hikes (and debt pressures) negatively affected FDI flows.

- Flows to developing Asia remained unchanged at USD 662bn in 2022, accounting for more than half of global FDI. However, the increase was limited to a few large EMEs: China, Singapore, Hong Kong, India and the UAE together accounted for 80% of FDI to the region.

- Though FDI in West Asia region declined (-14% to USD 48bn), the number of project announcements increased by two thirds (to 1,854). UAE was the fourth largest recipient of greenfield projects globally (997, following the US, UK and India) and FDI flows to UAE jumped by 10% to a record-high USD 22.7bn.

- A negative outlook for global FDI flows in 2023: UNCTAD reported a decline in the number of international project finance deals and cross-border M&A activity in Q1 2023; investors seem to be risk-averse given ongoing geopolitical and economic risks.

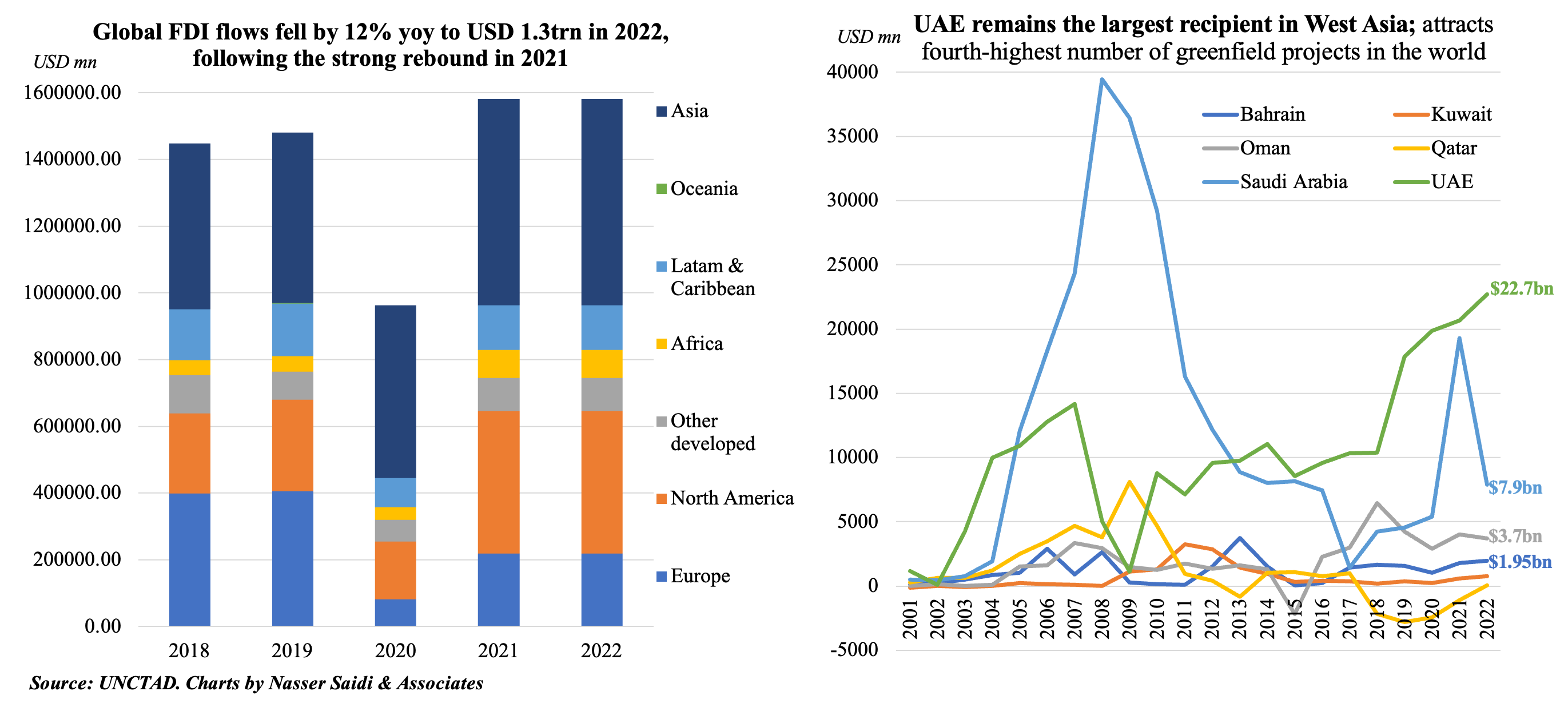

2. PMIs: Improvement in non-oil sector activity supported by domestic demand

- Non-oil sector PMI in Saudi Arabia surged to 59.6 in Jun (lower than Feb 2023’s 8-year high of 59.8), thanks to output (highest since Mar 2015), new orders (strongest since Sep 2014) & employment (most since Aug 2015). Government-backed construction & infrastructure projects provide support.

- UAE PMI ticked up to 56.9 in Jun, with new orders surging to 61 (most since Jun 2019) and employment rose for the 14th month in a row.

- Qatar PMI eased to 53.8 in Jun, but remains above the long-run trend of 52.3, as growth rates for output and new orders remained at “solid levels”.

- Lebanon PMI surged to the highest in 10 years, with new orders rising the most since May 2013. PMI has been below-50 for the longest time (with the exception of Aug 2022, coinciding with the tourist season).

- Egypt was the only one in contractionary territory, though PMI was highest since Aug 2021. Amid rising inflationary pressures and weak economic conditions, sentiment was the 2nd weakest since the series began in 2012 while export orders fell sharply (the most in 9 months).

- Domestic demand drove the expansions: in Saudi, tourism and construction sectors reported acceleration in new business; UAE demand was nudged by “promotional offers to help secure sales”. Export orders also supported: in Lebanon, new exports grew for the 3rd month in a row – “longest uninterrupted sequence of export demand growth since the survey began in 2013” while in Saudi it accelerated to 63.4.

- GCC employment increased, and so did salaries, with Saudi respondents stating higher wages needed to retain experienced staff. Despite input prices uptick, competitive pressures saw declines in prices charged in GCC: 16-month low in Saudi & 4th time in 6 months in Qatar. In contrast, input prices dipped in Lebanon and Egypt to a 21 and 16-month low respectively; considering the economic situation in the 2 nations, it is unsurprising that business sentiment remains low.

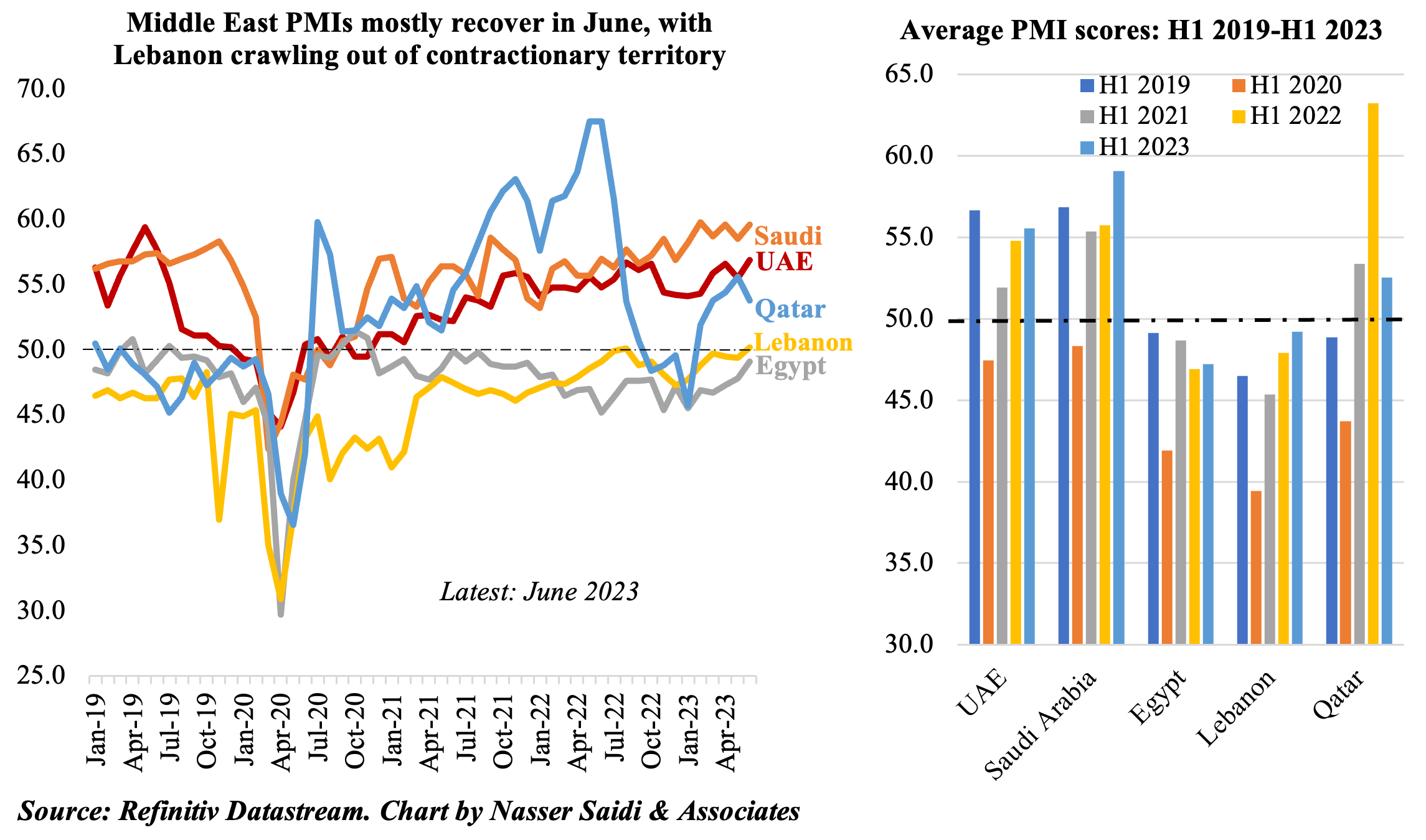

3. Abu Dhabi’s real GDP grew by 3.9% in Q1 2023, with the non-oil sector contributing 52.8% to GDP

- Abu Dhabi’s economy grew by 3.9% in Q1 2023 (Q4 2022: 5.9%), supported by growth in the non-oil sector (6.1% vs Q4 2023’s 4.8% gain) amid a sharp easing in oil sector growth (1.6% vs Q4’s 7.1%).

- Non-oil sector climbed to a 9-year high of AED 146bn, and its contribution to GDP, at 52.8%, was the highest in 8 years.

- The fastest-growing sector, also with a high contribution to growth, was construction: it grew by 14.36% in Q1 2023, following Q4’s 14.5% surge) – both the highest quarterly growth rates in nine years.

- Covid-affected sectors posted highest double-digit growth, indicating a broad-based recovery: accommodation & food services (14.49%), wholesale & retail trade (13.86%), and transport (13.58%) among others. Manufacturing contributed 8.0% to overall GDP growth but posted a 2.3% decline in Q1 2023 (slower than Q4’s 2.7% drop).

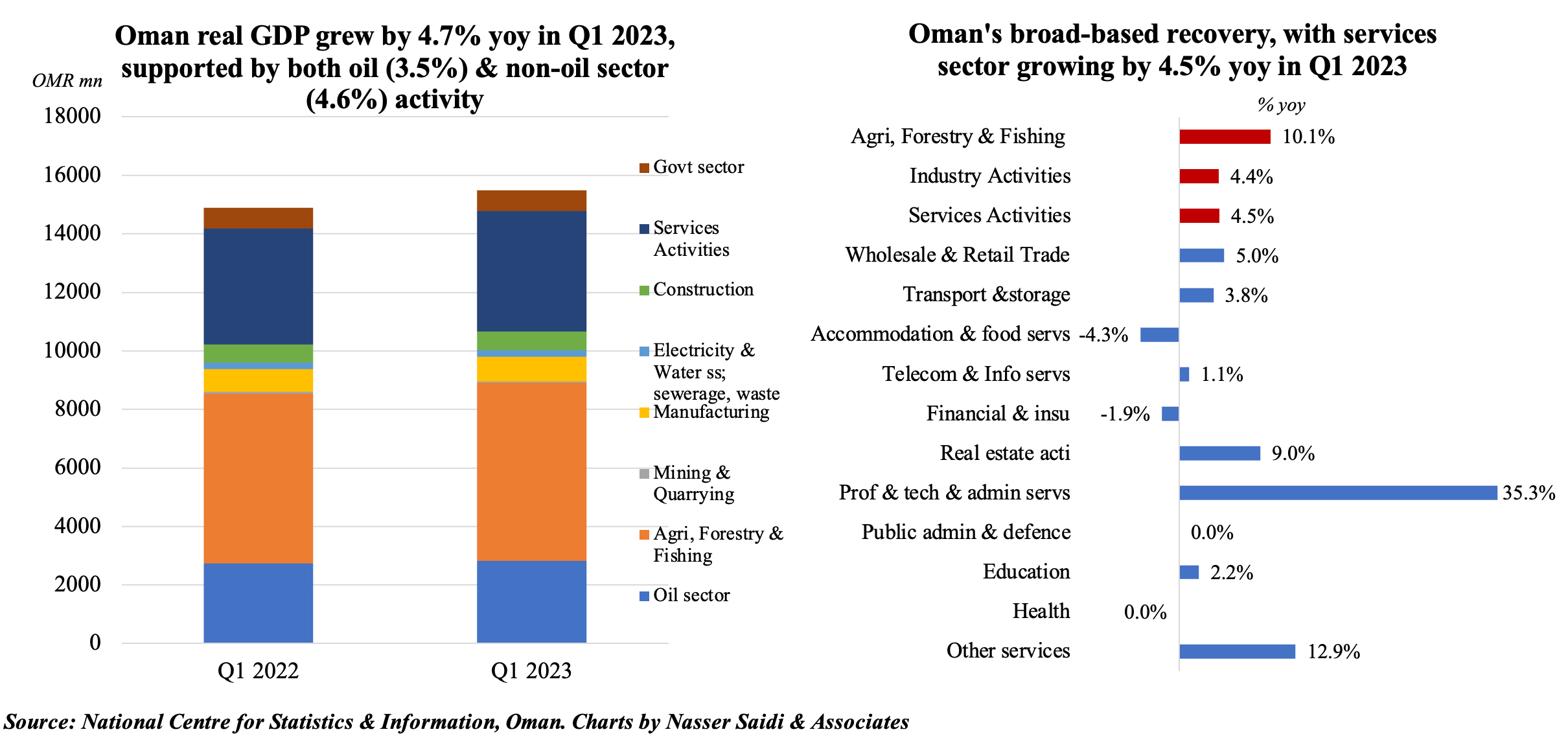

4. Oman’s real GDP growth in Q1 2023 is driven by non-oil sector expansion

- Oman grew by 4.7% yoy in Q1 2023, with non-oil sector growing at a faster pace than oil sector (4.6% and 3.5% respectively). This follows last year’s strong expansion in the hydrocarbon sector. The IMF estimates growth in Oman to touch 1.3% this year before expanding to 2.7% in 2024.

- Oil sector accounted for almost one-third of GDP while the share of construction and government sectors stood at 7% and 8% respectively. Services sector grew by 4.5%, with real estate and wholesale & retail trade sectors posting gains of 9% & 5% respectively.

- Government finances are still closely linked to the oil and gas sector, with net oil and gas revenues accounting for over 73% of total revenue in Jan-Apr 2023. The country undertaking fiscal consolidation plans (and repaying government debt) while also investing heavily in the renewables sector including in hydrogen as well as solar and wind projects.

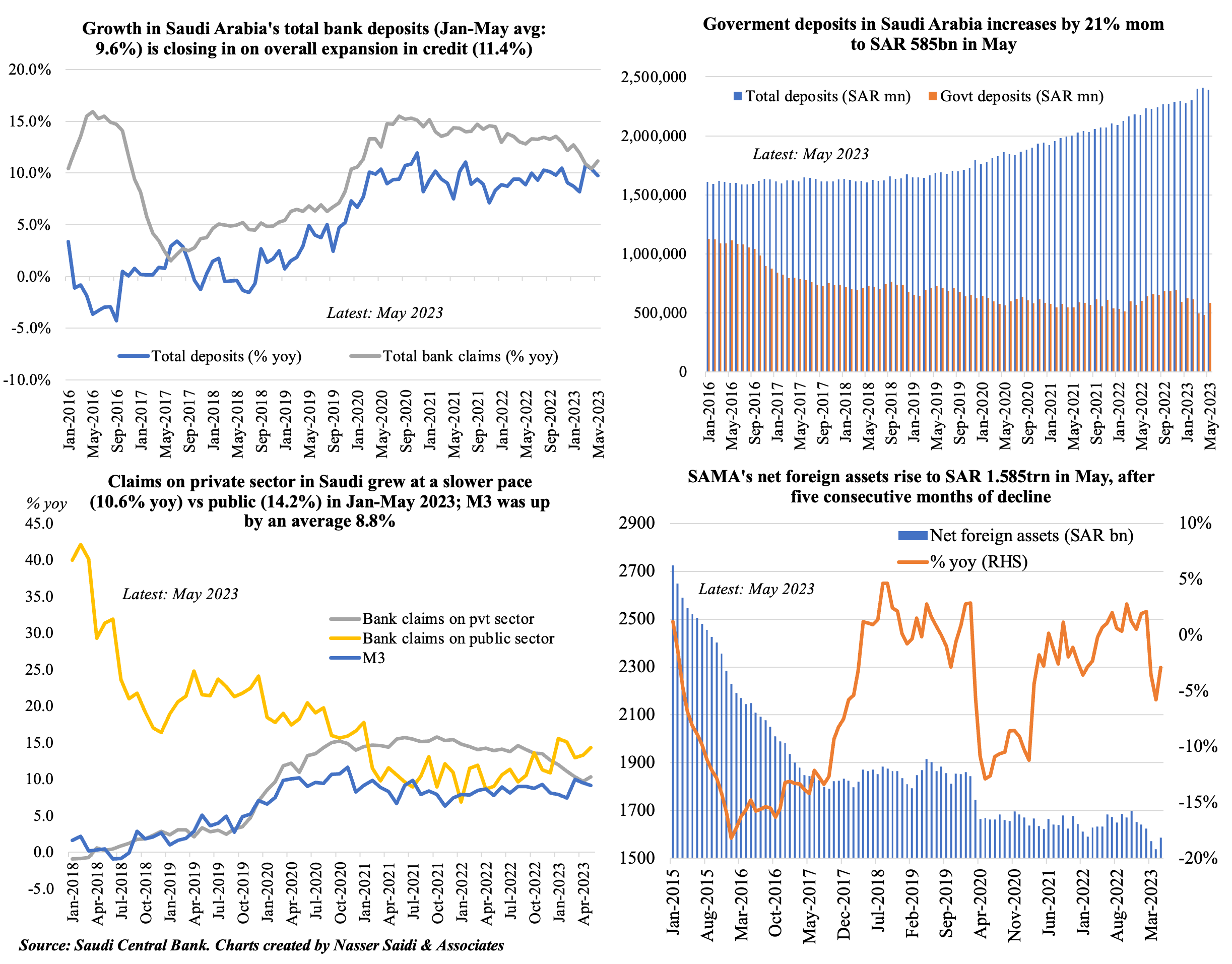

5. Saudi Arabia’s deposit growth lagged credit expansion in May & government deposits rose; claims on the public sector continues to post double-digit increases in Jan-May; net foreign assets ticked up after 5 consecutive months of declines; liquidity conditions as measured by SAIBOR are tight (5.82% in May 2023 from about 2.7% a year ago)

Powered by: