Markets

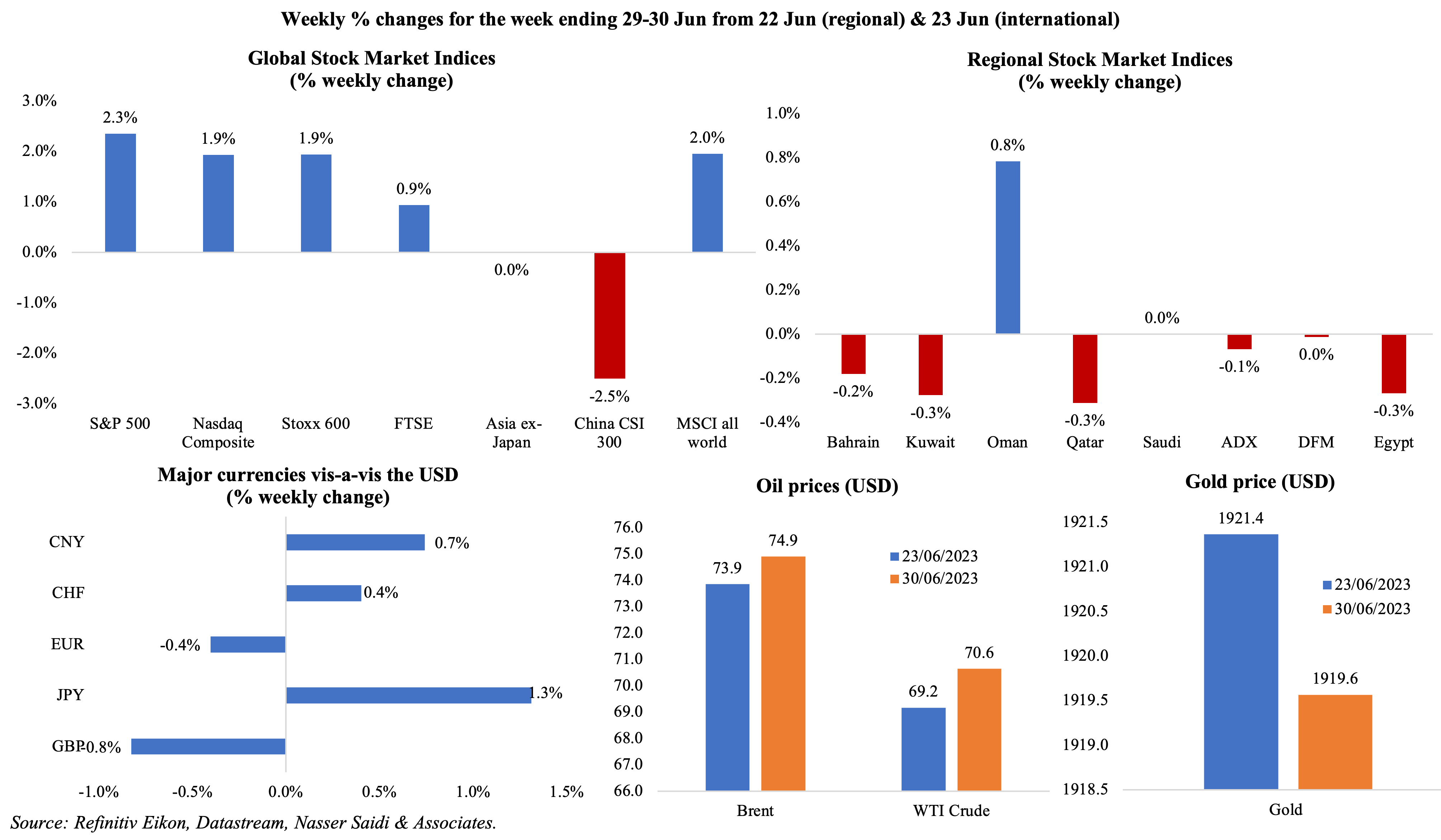

Global equities markets closed mostly higher, other than in Asia where signs of weakness in growth (especially in China) affected sentiment. US markets posted a strong H1 result, with the S&P 500 and Nasdaq Composite up by 15.9% and 31.8% respectively. Regional markets were closed for most of last week, with many falling slightly as investors cashed in ahead of the Eid break. Among currencies, the JPY touched a more than 7-month low versus the dollar, raising speculation about a possible intervention from the BoJ; Sterling declined sharply (as investors grappled with impact on growth of larger than expected hike in interest rates). Oil prices inched up from the week before but posted a quarterly decline for the fourth time in a row; gold price also posted a quarterly decline (first time since Sep 2022).

Global Developments

US/Americas:

- US GDP grew at a 2% annualised rate in Q1 (Q4: 2.6%), revised up from the previous estimate of 1.3%, thanks to upticks in consumer spending and exports. Consumer spending grew by 4.2% in Q1, the highest quarterly gain since Q2 2021, while exports rebounded by 7.8% (Q4: -3.7%) Core PCE prices (excluding food and energy) grew by 4.9% in Q1.

- Personal income increased by 0.4% mom in May, with wages rising by 0.5%. Personal spending grew at a slower pace of 0.1% (Apr: 0.6%), with spending on motor vehicles and gasoline & other energy goods down by 23.3% and 23.4% respectively. The saving rate increased to 4.6% (Apr: 4.3%).

- Core PCE index rose 4.6% yoy in May (Apr: 4.7%); overall PCE price index eased to 3.8% (Apr: 4.3%), the smallest yoy increase since Apr 2021.

- Durable goods orders in the US inched up by 1.7% mom in May (Apr: 1.2%). Non-defence capital goods orders excluding aircrafts ticked up by 0.7% after the previous month’s 0.6% gain.

- Preliminary goods trade deficit in the US narrowed to USD 91.1bn in May (Apr: USD 96.1bn). This largely stemmed from a decline in imports by 2.7% (to USD 254bn), with consumer goods imports down by 7.3%. Exports were down by 0.6% to USD 162.8bn.

- Dallas Fed manufacturing business index improved in Jun, though staying negative for the 14th consecutive month: rising to -23.2 from -29.1 the month before. New orders have remained negative for over a year (Jun: -16.6) while the production index fell 3 points to -4.2. Richmond Fed manufacturing index also improved, rising to -7 in Jun from -15. Chicago PMI increased to 41.5 in Jun (May: 40.4) – the 10th month of contraction in business activity.

- S&P Case Shiller home price index fell by 1.7% yoy in Apr (Mar: -1.1%) but posted a monthly gain of 0.9% (rising for the third straight month).

- New home sales increased by 12.2% mom to 763k in May, the highest reading since Feb 2022. The median house price dropped by 7.6% yoy to USD 416,300 in May. Pending home sales fell by 2.7% mom and 22.2% yoy to a 5-month low in May.

- Michigan consumer sentiment index rose to 64.4 in Jun (May: 59.2), with improvements in both current conditions and consumer expectations. The one-year ahead inflation expectation fell to 3.3% in Jun – the lowest since Mar 2021 and down from May’s 4.2% – while the 5-year expectation stayed unchanged at 3%.

- Initial jobless claims fell by 26k to 239k in the week ended Jun 23rd, the largest decline since Oct 2021, and the 4-week average ticked up by 1.75k to 257.5k. Continuing jobless claims fell by 19k to 1.742mn in the week ended Jun 16th, the lowest level since Feb. Labour market indicators remain strong.

Europe:

- Inflation in the eurozone eased to 5.5% in Jun (May: 6.1%), with energy costs a major contributor to the decline (-5.6%) while food, beverages & tobacco prices remained in the double digits (11.7% from May’s 12.5%). Though headline inflation was the lowest since Jan 2022, core inflation remains stubbornly high as it inched up to 5.4% (May: 5.3%). Inflation fell in all eurozone nations except Germany (where it ticked up) and Croatia (stayed flat); it fell below the ECB’s 2% target in Spain, Belgium and Luxembourg.

- Inflation (HICP) in Germany surged to 6.8% yoy in Jun (May: 6.3%): services prices increased at a record rate of 5.3% while energy and food inflation slowed (to 3% and 13.7% respectively). Core inflation also increased, up to 5.8% in Jun from May’s 5.4%.

- Economic sentiment indicator in the EU slipped to 95.3 in Jun (May: 96.5), the lowest reading since Nov 2022. Consumer confidence slipped to -16.1 (May: -17.4) while business climate fell to 0.06 from 0.19.

- The German Ifo business climate indicator slipped to 88.5 in Jun (May: 91.5), the lowest since Dec 2022. Pessimism was evident with current assessment and expectations also declining to 93.7 and 83.6 respectively (from 94.8 and 88.3).

- GfK consumer confidence index in Germany plunged to –25.4 heading into Jul (prev month: -24.4), the first decline after 8 consecutive months of improvements. The propensity to buy inched up amid declines in both economic and income expectations.

- German retail sales grew by 0.4% mom in May (Apr: 0.7%) as sales of non-food rose by 0.5%; in yoy terms, sales fell by 3.6% (Apr: -4.3%).

- Unemployment rate in Germany inched up to 5.7% in Jun (May: 5.6%), with the number of unemployed up by 28k to a seasonally adjusted 2.61mn persons. Unemployment rate in the eurozone remained unchanged at 6.5% in May, with the jobless numbers down by 57k from the previous month to 11.014mn (lowest level since comparable records began in 1995).

- UK GDP grew by 0.1% qoq and 0.2% yoy in Q1, unrevised from previous estimates; output is 0.5% smaller than in pre-Covid Q4 2019. Households’ real disposable income was down by 0.8% qoq (the biggest drop since Q2 2022) and 0.5% yoy. Business investment however increased by 3.3%, the biggest uptick in a year (largely as companies invested ahead of the expiry of the “super-deduction” tax break on capital projects).

Asia Pacific:

- NBS manufacturing PMI in China shrank for the third month in a row in Jun, though inching up to 49 (May: 48.8). NBS separate services index dropped to 52.8 (May: 53.8), the lowest since Dec 2022. Non-manufacturing PMI moved lower to 53.2, the weakest reading this year, from 54.5 in May. With new orders and new export orders falling, the pace of growth seems to be weakening.

- Headline inflation in Tokyo eased to 3.1% yoy in Jun (May: 3.2%) though excluding food, inflation ticked up to 3.2% (May: 3.1%). Core inflation has exceeded the BoJ’s 2% target for the 13th straight month. Excluding both food and energy, prices eased (3.8% from 3.9%). The BoJ has continued to stress that interest rates will remain ultra-low.

- Industrial production in Japan declined by 1.6% mom in May (Apr: 0.7%), the first drop since Jan, dragged down by lower motor vehicles production (-8.9% from Apr’s 2.45 growth). In yoy terms, IP grew by 4.7% (Apr: -0.7%), the first uptick in 7 months.

- Japanese business sentiment improved in Q2: BoJ’s Tankan for big manufacturers clocked in +5 in Jun, the highest since Dec 2022 and up from Mar’s 2-year low of +1. The sentiment index for big non-manufacturers improved to +23 (Mar: +22), the highest level since Jun 2019.

- Retail trade in Japan increased by 5.7% yoy in May (Apr: 5.1%), growing for the 15th consecutive month: motor vehicle sales jumped by 19.1% (Apr: 14.9%) and non-store retail rebounded (4.4% from Apr’s 0.1% dip).

- Current account balance in India narrowed to a deficit of USD 1.3bn in Jan-Mar or 0.2% of GDP (Oct-Dec: USD 16.8bn deficit or 2% of GDP). This was largely a result of the narrowing trade deficit (to USD 52.6bn from USD 71.3bn) alongside strong services exports and remittances (+20.8% yoy to USD 28.6bn).

- Fiscal deficit in India widened to INR 2102.9bn (USD 25.63bn) in May, nearly 12% of annual estimates, from Apr’s INR 1335.95bn.

- South Korea’s exports fell by 6% yoy to USD 54.24bn in Jun, with semiconductors exports down by 28% (the smallest decline in 8 months) while auto exports surged by 58.3%. Imports fell by 11.7% to USD 53.11bn (slower than May’s 14% drop), resulting in a trade surplus of USD 1.13bn, the first after 15 months of deficits.

- Industrial production in Singapore shrank by 3.9% mom and 10.8% yoy in May (Apr: -6.5% yoy): it was the largest yoy decline since Nov 2019, largely a result of sharp declines in electronics (-23% from Apr’s 8.7% drop).

Bottom line: At the central bankers’ conference in Portugal last week, chiefs from the Fed, ECB and BoE warned that interest rates may need to rise further to curb inflation. Latest inflation readings from Europe had a common thread of rising core inflation (even as overall inflation eased in most economies). This week sees the release of GDP in the eurozone, with a backdrop of higher inflation and borrowing costs alongside rising wages and falling energy costs. Germany has seen some downbeat numbers from surveys, so it seems likely that a further contraction is on the cards. In China, evidence of weakness is likely to be countered by moves of lower rates and increased investment spending among others. More specific announcements may come during the Politburo meeting in July.

Regional Developments

- Bahrain plans to increase the share of its renewable energy to 5% of its total electricity generation by 2025. This will enable the nation to achieve a renewable resource share of 20% by 2035.

- Egypt’s foreign trade touched USD 58.5bn in H1 of the 2022-23 financial year. Imports stood at USD 37.054bn while exports totalled USD 21.505bn. UAE was Egypt’s top trading partner with bilateral trade standing at USD4.873bn, followed by China (USD 4.114bn) and the US (USD 4.04bn).

- Bilateral trade between Egypt and India grew by 13.7% yoy to USD 6bn in 2022. Exports to India fell by 6.5% yoy to USD 1.9bn while imports jumped by 26.4% to USD 4.1bn.

- Indian companies invested nearly USD 170mn into Egypt during the past six months, disclosed Egypt’s PM. Overall Indian investments in Egypt is estimated at around USD 3.5bn.

- Egypt accelerated its climate commitments: it has moved up the target of generating 42% of its energy through renewable sources to 2030 from 2035. Egypt needs grants and soft financing worth EUR 500mn (USD 548mn) to achieve the revised targets.

- Kuwait Petroleum International (known as Q8) will build the first hydrogen refuelling station in Rome, in collaboration with Maire Group. The refuelling station’s capacity is estimated to be up to about 700 kg of hydrogen per day for light and heavy vehicles.

- Lebanon’s Article IV report from the IMF highlights triple-digit inflation, a 98% plunge in value of the currency, 40% drop in GDP as well as a decline in foreign currency reserves by 2/3-rds. The IMF estimates that without reforms, public debt could reach 547% of GDP by 2027, from the current “unsustainable” levels of above 280% of GDP.

- Oman’s real GDP grew by 4.7% yoy to OMR 8.7bn at end of Q1 2023, with the hydrocarbon and non-hydrocarbon sectors growing by 3.5% and 4.6% respectively. Services sector grew by 4.5% and compares to industrial growth of 4.4% and construction of 3.1%.

- Qatar’s production price index rose by 4% qoq and 49.8% yoy in Q3 2022, according to the Planning and Statistics Authority. The increase was driven largely by the prices of crude oil and natural gas (+7.4% qoq and 58.3% yoy).

- Middle East’s assets under management grew by USD 100bn to USD 1.3trn in 2022, as per a BCG report, reflecting a compound annual growth rate of 7%. Global AuM fell by USD 10trn, or 10%, to USD 98trn, near 2020 levels.

- OPEC oil output clocked in at 28.18mn barrels per day in Jun, down by 50k bpd from May, found a Reuters survey. The biggest declines were seen in Iran and Saudi Arabia, which lowered outputs by 50k and 40k bpd respectively.

Saudi Arabia Focus

- Saudi Arabia’s GDP growth will slow to 2.4% in 2023 from 8.9% last year, according to the IIF, though non-oil GDP will remain strong at 4.7%. The IIF estimates fiscal break-even oil price to be USD 83 this year.

- Unemployment rate for Saudi citizens rose to 8.5% in Q1 2023 (Q4 2022: 8%) while the overall rate stood at 5.1%. Labour force participation among Saudi females rose 2.4% yoy to 36% in Q1 2023 (unchanged in qoq terms) while their unemployment rate inched up to 16.1%.

- King Fahd International Airport posted an 11% jump in passenger numbers to 250k through the seven days of the Eid Al-Adha holidays compared to the same period a year ago.

- Aston Martin will give EV company Lucid Group a 3.7% stake in the company in exchange for access to “high performance” technology allowing the former to meet its plans for its first EV in 2025. Both firms have PIF as a common shareholder.

- The PIF ranks first in the Middle East region and seventh globally in governance, sustainability and resilience (GSR) practices, according to an evaluation by the Global Sovereign Wealth Fund. Regionally, the Middle East posted the largest jump in the GSR scoreboard – to 52% in 2023 from 32% in 2020.

UAE Focus![]()

- The IMF forecasts UAE growth at 3.6% yoy in 2023, supported by a 3.8% increase in non-oil sector GDP, buoyed by strong tourism activity and higher capital expenditure.

- Abu Dhabi GDP increased by 3.9% yoy in Q1 2023, with the non-oil sector growing by 6.1% to AED 146bn (the highest quarterly value in 9-years). Among the non-oil sector activities, accommodation & food services, construction and wholesale & retail trade grew the fastest – by 14.5%, 14.4% and 13.9% respectively.

- Population in Dubai jumped by 1.43% year-to-date (as of Jun 26th) to over 3.6mn.

- The Dubai Financial Market (DFM) added 26,953 investor accounts in H1 2023, up 48% yoy. Separately, UAE stocks touched AED 220bn (USD 59.9bn) in market value in H1 2023, with 2 new listings each in the Abu Dhabi Securities Exchange and the DFM.

- India and the UAE have signed a mutual recognition arrangement to allow for faster customs clearances by recognising each other’s authorised economic operators (AEOs).

- UAE’s ADNOC Distribution signed a deal with India’s Hindustan Petroleum Corp. Ltd allowing the expansion of its lubricant and allied products business in India. The agreement gives ADNOC access to over 28k retail stations in India.

- The Abu Dhabi Department of Culture and Tourism plans to increase the number of visitors to more than 24mn in 2023 from 18mn last year. In 2022, overnight guests increased by 24% yoy to 4.1mn, with average length of stay per visitor at 3 nights and posting an 18% uptick in revenue per available room.

Media Review

Can China’s charm offensive with business ease US tensions?

https://www.ft.com/content/8a4c09b6-8b34-47f9-a68f-13d1ed765689

To understand Xi Jinping, it helps to be steeped in the classics

https://www.economist.com/china/2023/06/29/to-understand-xi-jinping-it-helps-to-be-steeped-in-the-classics

The New-Old Middle East

https://www.project-syndicate.org/onpoint/middle-easts-geopolitical-evolution-by-aaron-david-miller-2023-06

After years of talks, indebted Arab states and the IMF are at an impasse

https://www.economist.com/middle-east-and-africa/2023/06/27/after-years-of-talks-indebted-arab-states-and-the-imf-are-at-an-impasse

What’s next on the road from Paris to Dubai for climate finance

https://www.ft.com/content/c2f2ffba-c2f8-4e80-a19b-44672cb53b2c

The IMF-World Bank Climate Policy Assessment Tool (CPAT): A Model to Help Countries Mitigate Climate Change

https://www.imf.org/en/Publications/WP/Issues/2023/06/22/The-IMF-World-Bank-Climate-Policy-Assessment-Tool-CPAT-A-Model-to-Help-Countries-Mitigate-535096

Powered by: