Markets

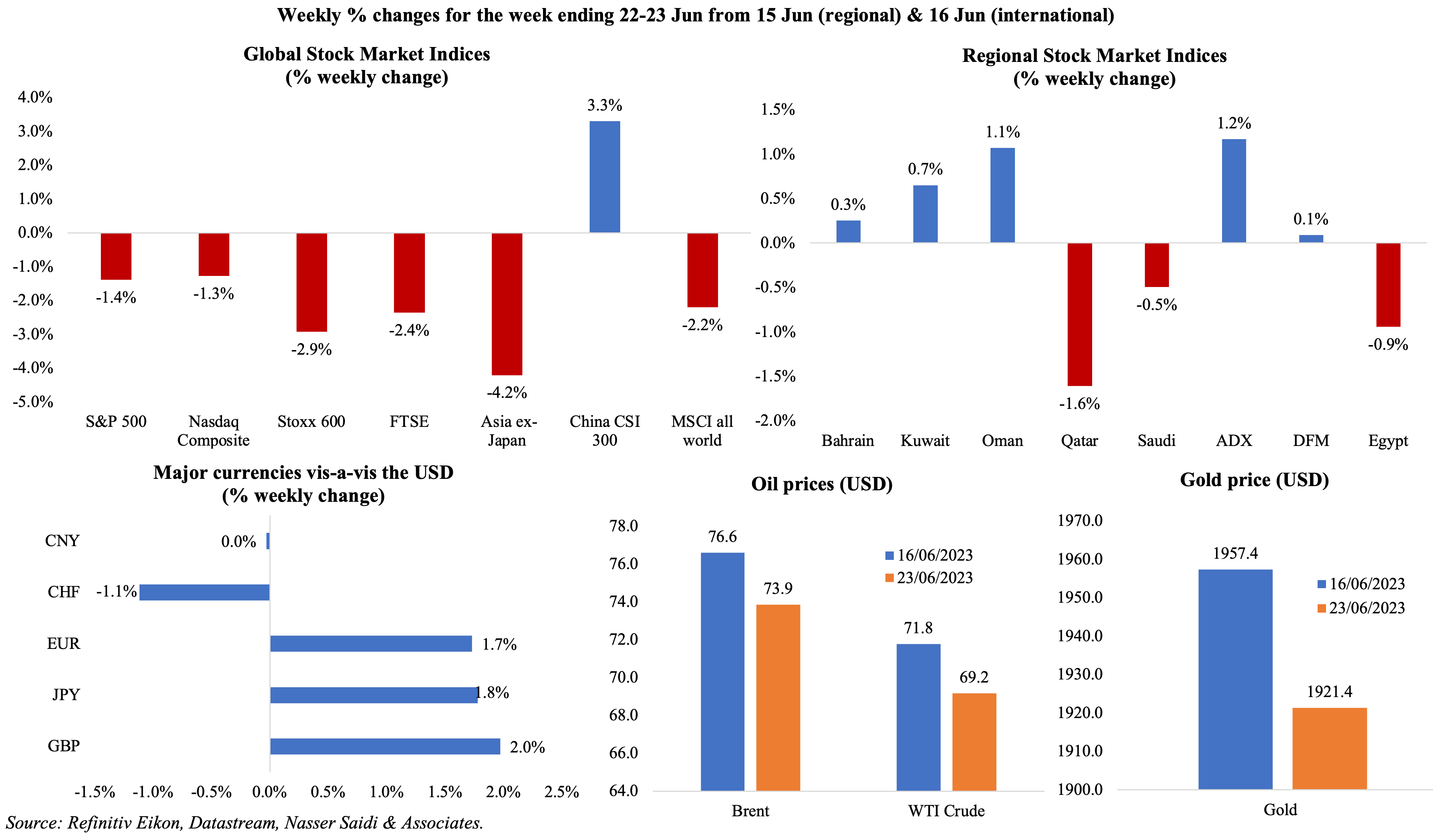

Global equities markets were mostly down last week with a spate of negative news: Powell’s testimony that two more rate hikes were a “very reasonable” projection and hawkish signals from Europe, worries about growth and an impending slowdown abounded; disappointing flash PMI numbers all did little to support investor sentiment; the MSCI all-world index fell by 2.2% from a week before. Regional markets were mixed, but mostly subdued given weaker oil prices and potential rate hikes. Among currencies, the rouble opened this morning at a 15-month low vis-à-vis the dollar, after the aborted Russian coup/ mutiny over the weekend. Oil prices declined over the week on demand worries while gold price fell on a stronger dollar.

Global Developments

US/Americas:

- In Fed Chair Powell’s testimony to the Congress, he justified the need for further tightening given inflationary pressures and stated that two rate hikes (as signalled by the dot plot) were “a pretty good guess of what will happen”.

- Current account deficit in the US widened slightly to USD 219.3bn in Q1 (Q4: USD 216.2bn). In Q4, the current account deficit stood at 3.3% of GDP.

- Housing starts surged by 21.7% mom to 1.631mn in May: this was the largest mom gain since Oct 2016 and the 291k unit increase in starts was the most since Jan 1990. Building permits in the US increased by 5.2% mom to 1.491mn (the most since Oct) in May, with permits for single- and multi-family projects up by 4.8% and 7.8% respectively. Mortgage rates have been on the decline this year, with rate on a 30-year fixed-rate home loan at 6.73% the week before last.

- Existing home sales inched up by 0.2% to 4.3mn in May. However, the median sales price dropped by 3.1% yoy to USD 396,100, recording the largest drop since 2011.

- Chicago Fed national activity index slipped to -0.15 in May (Apr: 0.14), with three of the four categories making negative contributions (namely, production, employment and sales, orders & inventories).

- Kansas Fed manufacturing index plunged to -10 in Jun (May: -2), posting the third month in a row of negative readings. The number of employees index fell to the lowest in 3 years (-12 from May’s 7) while a 6-month outlook showed pessimism, for the first time since Apr 2020.

- Manufacturing PMI in the US fell to 46.3 in Jun (May: 48.4), with output falling for the first time in 4 months and new orders down the most since Dec on subdued demand while input costs fell the most since May 2020. Services PMI eased slightly to 54.1 from 54.9: rate of job creation eased amid higher wage bills even as demand conditions remained robust.

- Initial jobless claims remained unchanged at 264k in the week ended Jun 16th, at a 20-month high, and the 4-week average ticking up by 8.5k to 255.75k. Continuing jobless claims fell by 13k to 1.759mn in the week ended Jun 9th.

Europe:

- Manufacturing PMI in the EU fell to 43.6 in Jun (May: 44.8), falling for a third consecutive month and at the fastest rate since Oct, dragged down by a sharp decline in new orders. Services PMI slipped to 52.4 from 55.1 and composite PMI moved lower to 50.3 (May: 52.8). Input costs across both sectors slowed to its lowest since Dec 2020 and average selling prices rose at the weakest rate since Mar 2021.

- Manufacturing PMI in Germany slipped to a 37-month low of 41 in Jun (May: 43.2), with orders falling at the sharpest pace in 8 months and output charges falling for the first time since Sep 2020. Services PMI fell to 54.1 (May: 57.2) amid reports of dampening demand and firms rising prices. Composite PMI eased to 50.8 (May: 53.9).

- The euro zone posted a current account surplus of EUR 4.2bn in Apr compared to a deficit EUR 17.7bn in Apr 2022. In Jan-Apr, surplus totalled EUR 69.5bn, reversing a EUR 26.1bn deficit in Jan-Apr 2022.

- Consumer confidence in the euro area improved to -16.1 in Jun (Apr: -17.4), the highest reading since Feb 2022.

- Another sign of easing inflation as German producer price index fell by 1.4% mom in May; in yoy terms, prices were up by 1%, the smallest increase since Jan 2021.

- The Bank of England raised rates by 50bps to 5%, the highest since 2008.

- Inflation in the UK remained unchanged at 8.7% in May even as core inflation increased to 7.1% – the highest since 1992 – from Apr’s 6.8% rise. Producer price input and output prices eased to 0.5% and 2.9% respectively in May (Apr: 4.2% and 5.2%).

- Manufacturing PMI in UK declined to 46.2 in Jun (May: 47.1), driven by falling new orders and declining output levels. Services PMI eased to 53.7 (May: 55.2), with respondents citing slower consumer spending and weaker client demand (especially in the construction and real estate sectors).

- Retail sales in the UK fell by 2.1% yoy in May (Apr: -3.4%), the 14th consecutive month of decline, while excluding fuel sales were down by 1.7% yoy (Apr: -3%). Value of spending was 17% higher compares to Feb 2020 while volumes were down by 0.8%. In mom terms, sales unexpectedly rose by 0.3% (Apr: +0.5%), with non-store retail sales increasing by 2.7%.

- UK consumer confidence index rose for the fifth month in a row to -24 in Jun (May: -27), the highest level since Jan 2022. The 12-month ahead outlook for consumers personal finances rose by 7 points to -1.

Asia Pacific:

- The People’s Bank of China cut the one and 5-year loan prime rates by 10bps to 3.55% and 2% respectively – the first time since Aug. The smaller than expected rate cut seems to indicate more rate cuts to come later this year given data showing weak domestic demand.

- Inflation in Japan eased to 3.2% in May (Apr: 3.5%): food inflation increased (9.2% From Apr’s 9%) and so did hotel charges (9.2% from 8.1% in Apr) while energy costs fell 8.2%. However, excluding food and energy, prices were up 4.3% (Apr: 4.1%), the biggest increase since Jun 1981. Core inflation (i.e. excluding fresh food) eased to 3.2% (Apr: 3.4%).

- Industrial production in Japan inched up by 0.7% mom in Apr (Mar: 0.3%), rising for the 3rd consecutive month, based on the new base year 2020. Flash data (using the old 2015 base year) indicated a decline (0.4% mom vs Mar’s +1.1% rise). In yoy terms, IP fell by 0.7% (using the 2020 base year), following the 0.8% drop in Mar.

- Manufacturing PMI in Japan fell to 49.8 in Jun (May: 50.6), with declines in output and new business, affected by weak demand conditions. Input costs rose at the softest pace since Feb 2021, while selling price inflation stood to a 21-month low. Services PMI eased, down to 54.2 (May: 55.9), with new business and new export orders moderating from May’s all-time highs.

- South Korea recorded its first current account deficit with China since 2001 last year: current account turned a deficit USD 7.78bn in 2022 from a surplus of USD 23.41bn in 2021. Korea’s services balance with China (mostly travel and transportation) also slipped to a deficit of USD 590mn (2021: surplus USD 2.88bn) – the first deficit in five years since 2017.

- Inflation and core inflation in Singapore eased to 5.1% yoy and 4.7% in May respectively (Apr: 5.7% and 5%), thanks to a decline in both food and services costs. Food prices eased to 6.8% (from Apr’s 7%), services costs fell to 3.9% (Apr: 4.3%) and private transport inflation slipped to 7.2% (from 10.4%).

Bottom line: Flash PMIs indicate an intensifying decline in manufacturing alongside slower services sector activity (with businesses also burdened by higher wage costs) – weakening demand is evident, not surprising, given the high costs of living and rising interest rates. In the backdrop of flash PMI’s cooling prices, markets are looking to see if the eurozone inflation & US core PCE out this week will move in a similar direction suggesting greater synchronicity. Meanwhile, despite signs of a slowdown, central banks have been sending hawkish signals underscoring their priority to lowering inflation – Switzerland, Norway and the UK raised rates last week. China, with its wavering recovery, is showing no hurry of pushing through massive stimulus measures – even the rate cuts so far have been less-than-expected.

Regional Developments

- Bahrain-based Investcorp Holding is seeking to raise up to USD 600mn this year from a listing of its Abu Dhabi registered Investcorp Capital. The discussions are in early stages and the firm is also considering other listing venues (other than Abu Dhabi) and other options for growth.

- Bahrain’s state investment fund Mumtalakat is buying preference shares and warrants in carmaker McLaren from the Saudi PIF and Ares Management, thereby expanding its majority stake in the McLaren Group. No new money is being injected into the company.

- Egypt left its policy rates unchanged at the meeting last week: deposit rate at 18.25% and lending rate at 19.25%. The central bank cited leading indicators for Q1 pointing to a slowdown in real GDP growth and with a decline in global commodity prices.

- The International Finance Corporation (IFC) disclosed that it would advise on the Egypt government’s plans for asset monetisation including structuring and preparing assets for sale.

- Egypt’s cabinet passed a law to eliminate tax exemptions for state entities in a bid to attract private investment. The law still needs approval from the parliament and the President.

- The minimum wage for private sector workers in Egypt will be increased by EGP 300 to EGP 3000 a month as of Jul, according to the Ministry of Planning and Economic Development. In Apr, the minimum monthly wages for state workers was raised to EGP 3500.

- Egypt’s Suez Canal Authority disclosed that annual revenues grew to a record high USD 9.4bn in the current financial year ending June 30th (2021-22: USD 7bn).

- Kuwait inflation increased to 3.69% in May 2023, largely because of hikes in food and beverages (6.85%), clothing & footwear (6.8%) as well as housing (2.55%). Separately, money supply in the country grew by 0.3% to KWD 39.6bn in May wile private sector bank deposits were up by 0.6% to KWD 36.2bn.

- Lebanon’s inflation touched 260% yoy in May (up by 5.4% mom) staying in hyperinflation territory for the 35th consecutive month. Inflation was up due to rising costs of communication (599.67%), alcoholic beverages & tobacco (464.2%) and restaurant & hotels (375.52%) while food price inflation eased to a 3-month low of 304.25% (Apr: 350%).

- Lebanon was not included in the FATF “grey list” of countries in the modified list announced on Friday, even though an earlier preliminary assessment had raised concerns that it might be. (UAE still remains on the new FATF grey list).

- The IMF, at the conclusion of their Staff visit to Oman, disclosed that growth is projected to slow to 1.3% this year before rebounding to 2.7% in 2024, supported by an increase in non-oil sector growth (of 2% and 2.5% respectively). It stated that the “near- to medium-term outlook is favourable” supported by strong fiscal and external positions while pressures to spend the oil windfall represents a key risk to the outlook.

- Oman signed a new long-term gas supply deal with Bangladesh – to supply an additional 0.5mn to 1.5mn metric tonnes of LNG per annum for 10 years from 2026.

- Oman’s Hydrom signed green hydrogen agreements worth USD 10bn: two new green hydrogen production projects will be developed with a consortium of South Korea’s Posco and French firm Engie, and Hyport Duqm initiative. This brings the total number of large-scale hydrogen projects awarded so far to 5, with a total investment of more than USD 30bn.

- Qatar signed a second large gas supply deal with China: China National Petroleum Corporation and QatarEnergy signed a 27-year agreement, with the former purchasing 4mn metric tons of liquefied natural gas a year. China’s CNPC will also take an equity stake in the expansion of Qatar’s North Field LNG project.

- The World Economic Forum’s Global Gender Gap 2023 report places MENA at the bottom of the regional groupings: not only has the region received a low 62.6% parity score, it also posted a decline from the previous edition of the report. At the rate of progress since 2006, it will take MENA 152 years to achieve gender parity.

- Saudi Arabia’s ranking in the IMD World competitiveness Index 2023 rose 7 places to 17th. Denmark, Ireland and Switzerland occupied the top rankings. From the region, UAE, Qatar and Bahrain stood at 10, 12 and 25 respectively.

Saudi Arabia Focus

- Saudi Arabia has allocated USD 7.8bn worth of investments for Expo 2030, disclosed the investment minister, as Riyadh made its bid for the upcoming event in 2030.

- Saudi Arabia’s exports fell by 25.2% yoy and 4.2% mom to SAR 103bn in Apr. The fall in exports stemmed from oil and non-oil exports, which were down by 24% and 32% respectively. The share of oil exports to overall exports increased to 81.3% in Apr, a range not seen in the previous 6 months. Imports declined by 16.1% mom to SAR 57.9bn in Apr though it nudged up by 1% in yoy terms.

- At the French-Saudi Investment Forum last week, 24 investment accords were signed, with the value of deals and initial pacts touching USD 2.9bn. Bilateral trade volumes grew by 80% yoy to USD 11.5bn in 2022 while France’s FDI into Saudi was close to USD 6bn. Speaking at the Forum, Saudi Arabia’s tourism minister disclosed that the nation’s travel and tourism industry has grown 12% over its pre-pandemic market size and aims to grow to 130% of the current level by 2032. Separately, Saudi budget airline Flynas signed a SAR 14bn (USD 3.73bn) agreement with Airbus to buy 30 aircraft.

- Bloomberg reported that Saudi PIF is in advanced discussions (emerging as the leading bidder) to acquire a roughly 10% (or USD 2.5bn) stake in nickel and copper operations of Brazilian mining firm Vale.

- Crude oil exports from Saudi Arabia slipped by 3% mom to 7.316mn barrels per day in Apr, a five-month low, according to data from the Joint Organizations Data Initiative. Crude output held steady at 10.46mn bpd while inventories ticked up by 1.98mn barrels to 149.4mn.

- Saudi Arabia’s Ministry of Industry and Mineral Resources granted Ceer an industrial license to establish an EV manufacturing facility. The factory is expected to attract over SAR 562mn in FDI and create up to 30k jobs.

- The King Abdulaziz Port in Dammam set a new container throughput record of handling 206,145 twenty-foot equivalent units (TEUs) in May 2023, breaking its Aug 2022 record.

- Saudi Arabia improved its standing in the EIU’s Global Liveability Index 2023, with Riyadh and Jeddah advancing to 103rd and 107th (up 3 and 4 places respectively from 2022).

UAE Focus![]()

- UAE GDP grew by 7.9% yoy to AED 1.62trn in 2022, according to preliminary estimates from the FCSA, with non-oil GDP at AED 1.174trn.

- The UAE central bank, in its quarterly economic review report, forecasts GDP to grow by 3.3% and 4.3% in 2023 and 2024 respectively (2022: 7.9%). Non-oil sector growth was revised upwards to 4.5% this year and by 4.6% in 2024 (2022: 7.2%). The report also stated that domestic consumption remained robust in Q1: “the 3-month moving average of people employed in the UAE and wages paid in the private sector recorded a double- digit increase yoy in Q1 2023, with levels and growth higher than their pre-COVID levels” (though the data is limited to the Wage Protection System).

- Foreign assets of the UAE Central Bank grew by 27% yoy and 6.85% mom to AED 574.18bn (USD 156.2bn) in Apr for the first time in its history. The central bank balance sheet grew by 6.3% mom to AED 631.63bn at end-Apr. Gold reserves at the central bank grew by 41% yoy to AED 17.505bn, with the year-to-date growth at 9.1%.

- ADNOC and Abu Dhabi AI firm G42 are planning an IPO of their joint venture technology firm AIQ, reported Reuters. The firm uses AI and machine learning to optimise processes and raise profits for ADNOC and wider oil and gas industry.

- ADNOC’s initial bid of roughly EUR 13bn to take over German plastics and chemicals maker Coversto was rejected, but the FT reported that the latter did not rule out further engagement. The move comes as ADNOC pursues its diversification strategy – both in terms of diversifying beyond fossil fuels and in terms of revenues.

- The DIFC announced plans to establish a Dubai AI& Web 3.0 Campus with a goal of attracting more than 500 high-tech companies, bringing in USD 300mn in funds and create more than 3,000 jobs by 2028.

- In a bid to boost competitiveness, attract investors and support the business environment, UAE reduced the fee (to AED 500) for companies registered in the National Programme for Small and Medium Enterprises to obtain a national in-country value certificate.

- Abu Dhabi plans to increase the contribution of its tourism sector to GDP to 12% by 2030 (from 5% this year). It is already on track to meet its target of 24mn visits this year, from 18mn last year.

- The “Dubai’s Venture Capital Ecosystem” report revealed that the number of scale-ups (i.e. a start-up that has grown and become a profitable product or service) in Dubai surged by 26% in 2022 and these firms have raised over USD 11.7bn in the last decade. The report states that about 306 fast-growing companies in the region are in Dubai.

Media Review

Monetary and fiscal policy: safeguarding stability and trust, BIS Annual report

https://www.bis.org/publ/arpdf/ar2023e2.htm

Electrical transmission line connecting Afar in Saudi Arabia to Yusufiya in Iraq inaugurated (with comments from Dr. Nasser Saidi)

https://www.arabnews.com/node/2327481/business-economy

India’s Russian oil buying scales new highs in May

https://www.reuters.com/business/energy/indias-russian-oil-buying-scales-new-highs-may-trade-2023-06-21/

Lebanon: The Bank Robbers who are Stealing Their Own Money

https://www.bloomberg.com/news/features/2023-06-26/lebanon-financial-crisis-leads-people-to-steal-their-own-money

The promise of AI & how corporate America is deploying AI

https://www.economist.com/business/2023/06/25/our-early-adopters-index-examines-how-corporate-america-is-deploying-ai

Prigozhin’s Wagner mutiny is over. What now?

https://www.politico.eu/article/yevgeny-prigozhin-wagner-mutiny-over-what-happens-now/

https://www.nytimes.com/interactive/2023/06/24/world/europe/prigozhin-putin-russia.html

Powered by: