Saudi & Egypt inflation. Cost vs quality of life in MENA. Saudi manufacturing & SAIBOR. Oman’s Apr budget surplus.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 16 Jun 2023: Moderating Inflation in Saudi. GCC offering high quality of living but at a high cost of living

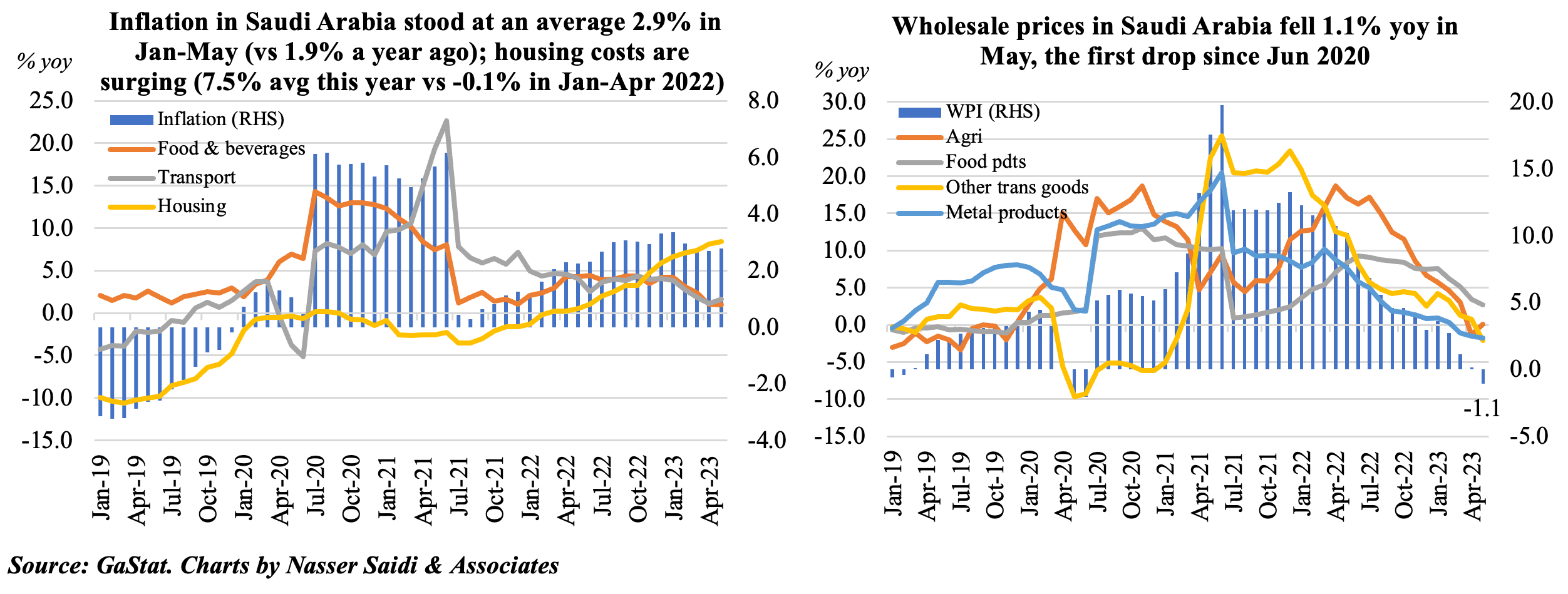

1. Wholesale prices fall in Saudi Arabia in May while consumer price inflation is driven by housing costs

- Consumer price inflation in Saudi Arabia inched up to 2.8% yoy in May (Apr: 2.7%), thanks to higher housing costs (8.4%). Overall housing rents surged (9.9% yoy) alongside apartments rents (23.7%), given higher demand for expatriate accommodation versus limited supply. Inflation is Saudi Arabia remains one of the lowest in the GCC/ MENA region.

- In the period Jan-May 2023, consumer inflation had inched up to 2.9% versus 1.9% in the same period a year ago. Housing & utilities costs have climbed by 7.5% (from -0.1%) and restaurants & hotels costs are up by 6.1% (from 3.0%) with easing food prices (2.3% versus 3.2%) and transport costs (2.2% from 4.5%).

- Wholesale prices in Saudi Arabia dropped in May, declining 1.1% yoy, for the first time since Jun 2020, with declines seen in 3 of the five categories. WPI plunged to 1.1% during the period Jan-May 2023 from a double-digit 11.4% surge a year ago. The sharpest declines during the Jan-May period were in agriculture (2.4% from 15.4%), other transportable goods (1.5% from 15.8%) and metal products (-0.6% from 8.6%).

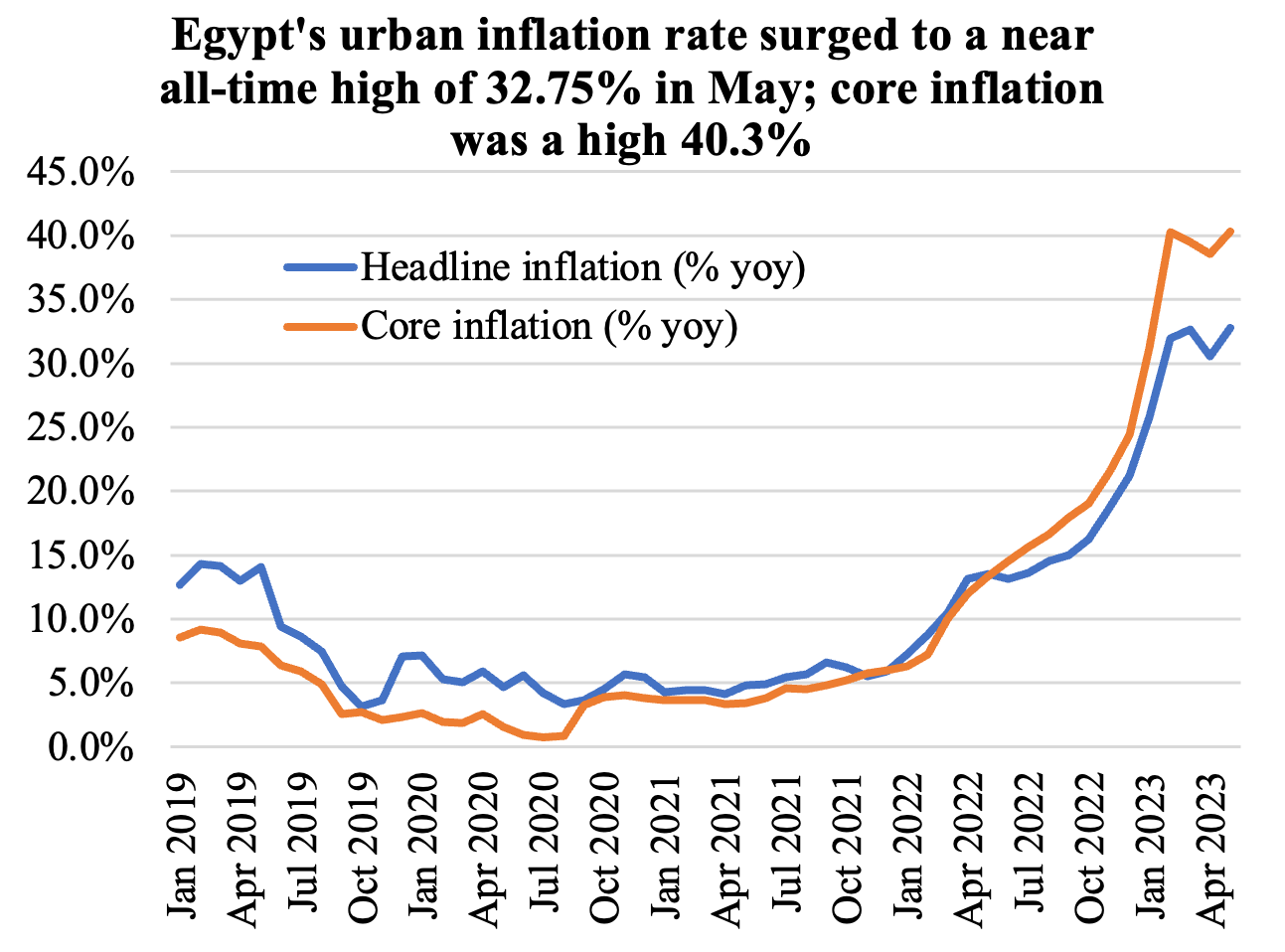

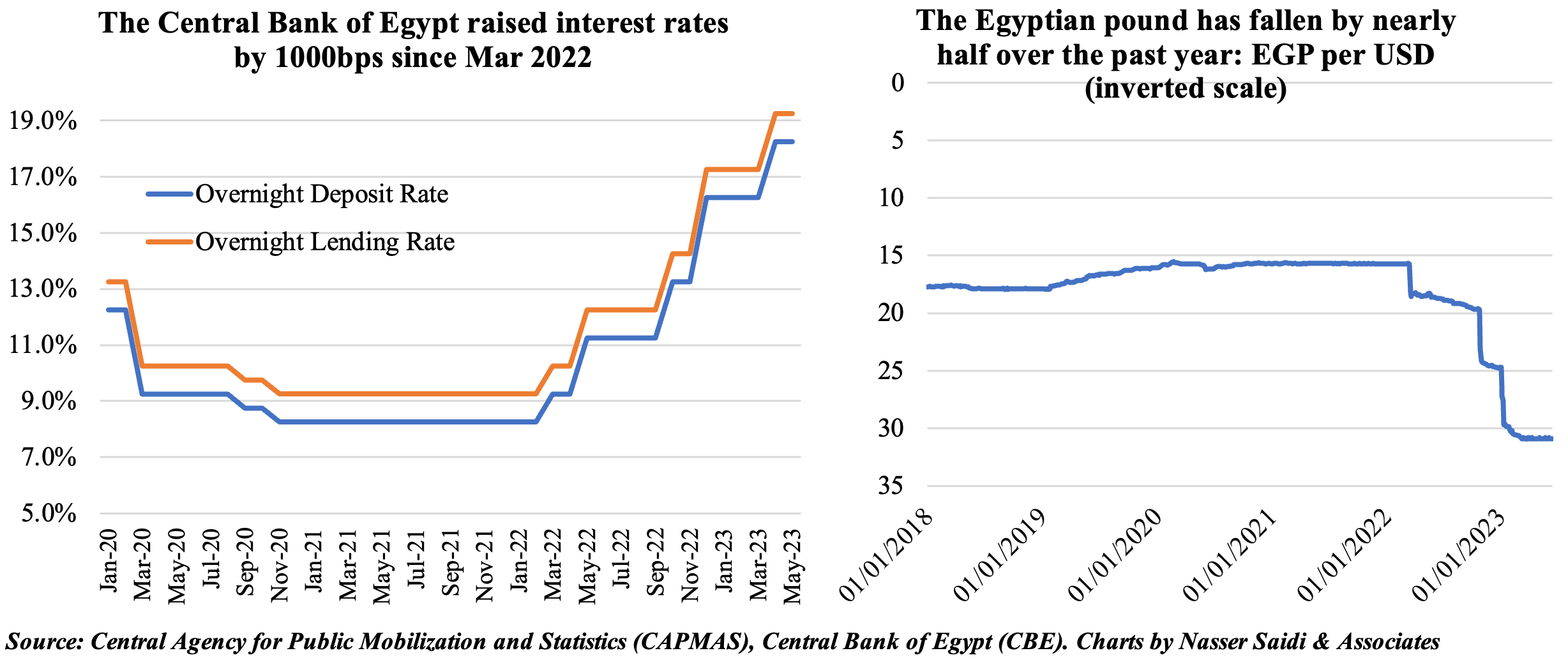

2. In contrast to Saudi Arabia, Egypt inflation stands relatively high

- Urban inflation in Egypt touched 32.7% in May (Apr: 30.6%), a near 6-year high. Core inflation was at a much higher 40.3% and annual food inflation posted a record high 60%.

- Inflation is accelerating in Egypt in part due to the Egyptian Pound depreciation pass-through to consumers. Egypt is struggling with a dollar shortage; EGP has lost close to half its value since last year and there have been import restrictions.

- However, the Central Bank held rates steady at the meeting in May stating that the most preliminary indicators point to a slowdown in overall growth in Q1 2023 and given lower commodity prices globally. It will most likely hold rates again next week.

- Domestic demand has been weak, in the backdrop of high inflation, a weakening currency and import controls: non-oil sector PMI remained contractionary (below-50) for the 30th consecutive month in May & forward-looking sentiment was still among the lowest on record.

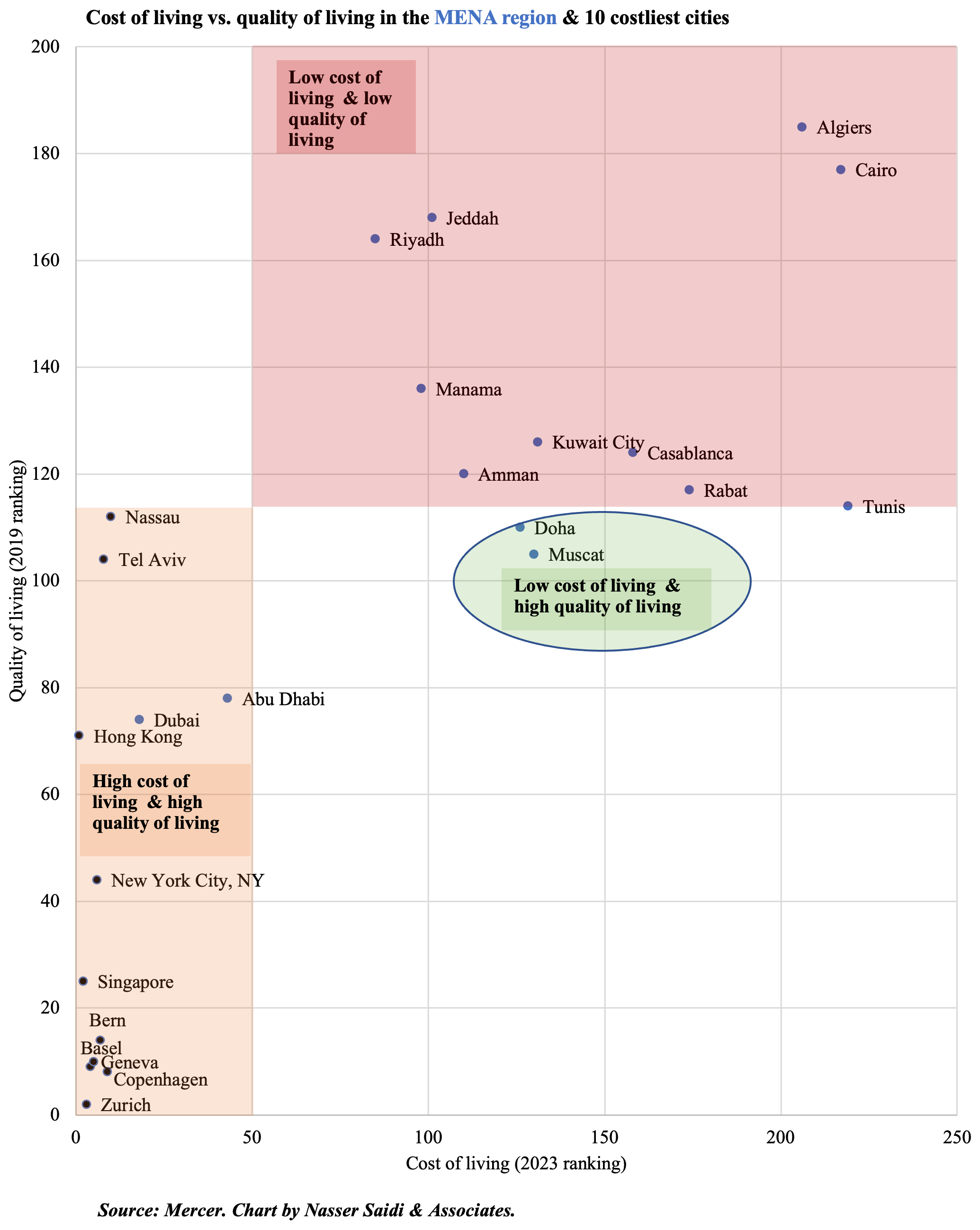

3. GCC are booming amid rising costs of living; a few other MENA cities also offer good quality of life

- Mercer’s 2023 Cost of Living by city ranks Dubai 18th globally, up 13 places from the previous edition. The list was topped by Hong Kong, Singapore, Zurich, Geneva and Basel. Abu Dhabi and Riyadh also jumped by 18 places to 43rd and 85th respectively. This has an impact on purchasing power and also standard of living.

- To be an attractive destination for expats, the quality of living needs to be ranked high (irrespective of cost of living). Mercer’s publicly available Quality of Living rankings are from 2019, and is topped by Vienna, Zurich, Vancouver, Munich and Auckland, with other Swiss cities in the top 10. Safety, sustainability and infrastructure are other factors influencing a decision to move (especially in the context of digital nomads & remote/ globally mobile persons).

- The chart on the left tracks cost of living ranking (X-axis) versus quality of life (Y-axis). The bottom left corner indicates those cities that are both high in terms of cost and quality of living: from the MENA region, it includes both Dubai & Abu Dhabi.

- While cost of living is relatively low in both Riyadh and Jeddah (ranked 85 & 101 respectively), they rank low on the quality of living (164 & 168 respectively). On the bottom end of the rankings spectrum for both indicators are Algiers and Cairo.

- Tunis (& to a certain extent Rabat) are close to the cusp of the low cost of living and relatively high quality of living – where Doha & Muscat are currently placed.

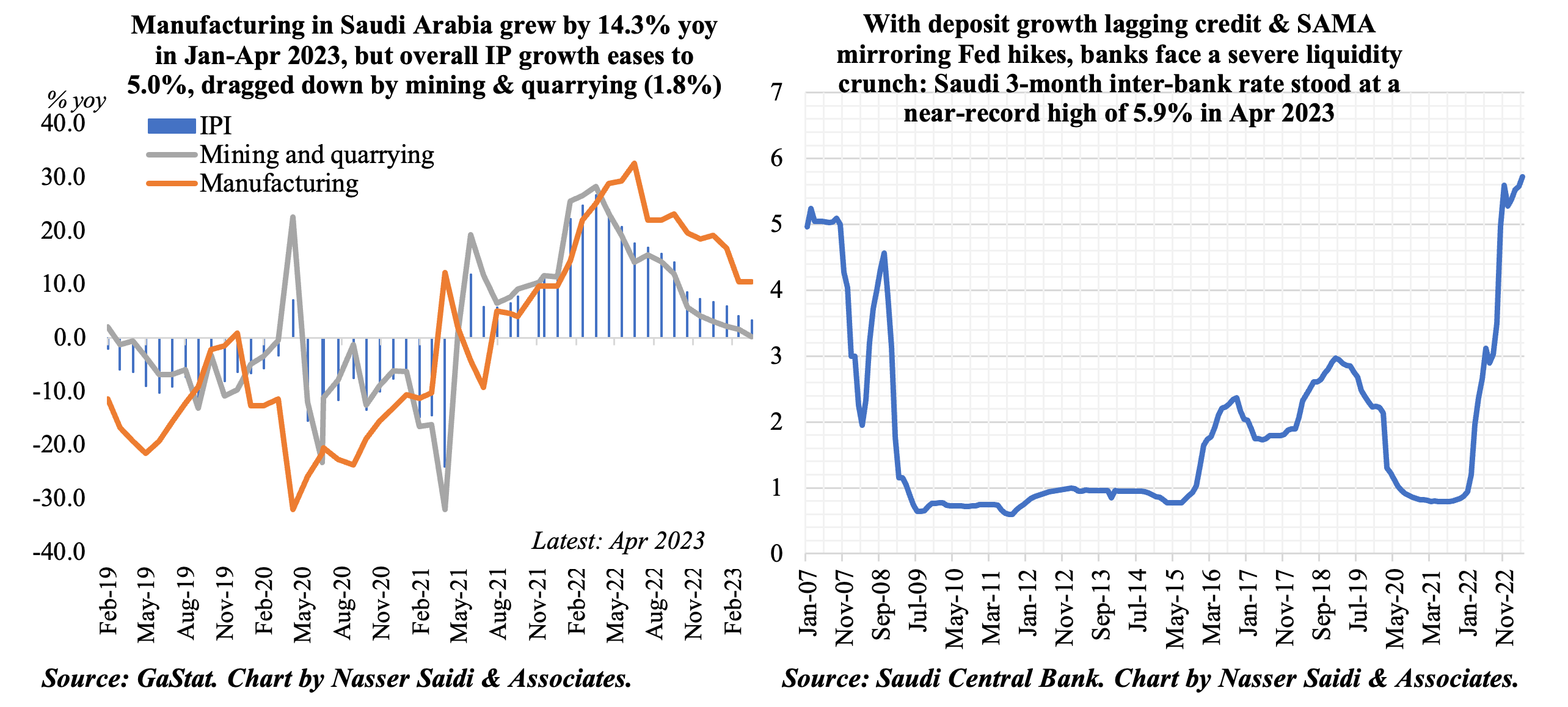

4. Updates from Saudi Arabia: industrial production eases in Apr 2023; inter-bank rates rise to new decades highs

- Industrial production (IP) in Saudi Arabia grew by 3.2% yoy (Mar: 4.1%) – the 24th month in a row with gains.

- Mining and quarrying sector growth has been declining and is poised for further slowdown (given oil production cuts). It grew by 1.8% in Jan-Apr 2023, dropping from a 22.9% jump in Jan-Apr 2022.

- Manufacturing has been the mainstay: it rose by 10.5% in Apr, averaged 14.3% in Jan-Apr 2023 (vs 17.8% in Jan-Apr 2022).

- Overall expansion in credit in Saudi Arabia (11.5%) has outpaced growth in bank deposits (Jan-Apr: 9.5%).

- Interest rate increases following the Fed’s hikes indicate that lending growth could decline without liquidity support from SAMA. Private sector credit grew by 9.7% in Apr, slowest since Feb 2020.

- Oil prices have not increased despite the OPEC+ production cuts as demand has been weaker-than-expected (among other factors) => lower than expected oil revenues. The 3m-SAIBOR is inching closer to 6%.

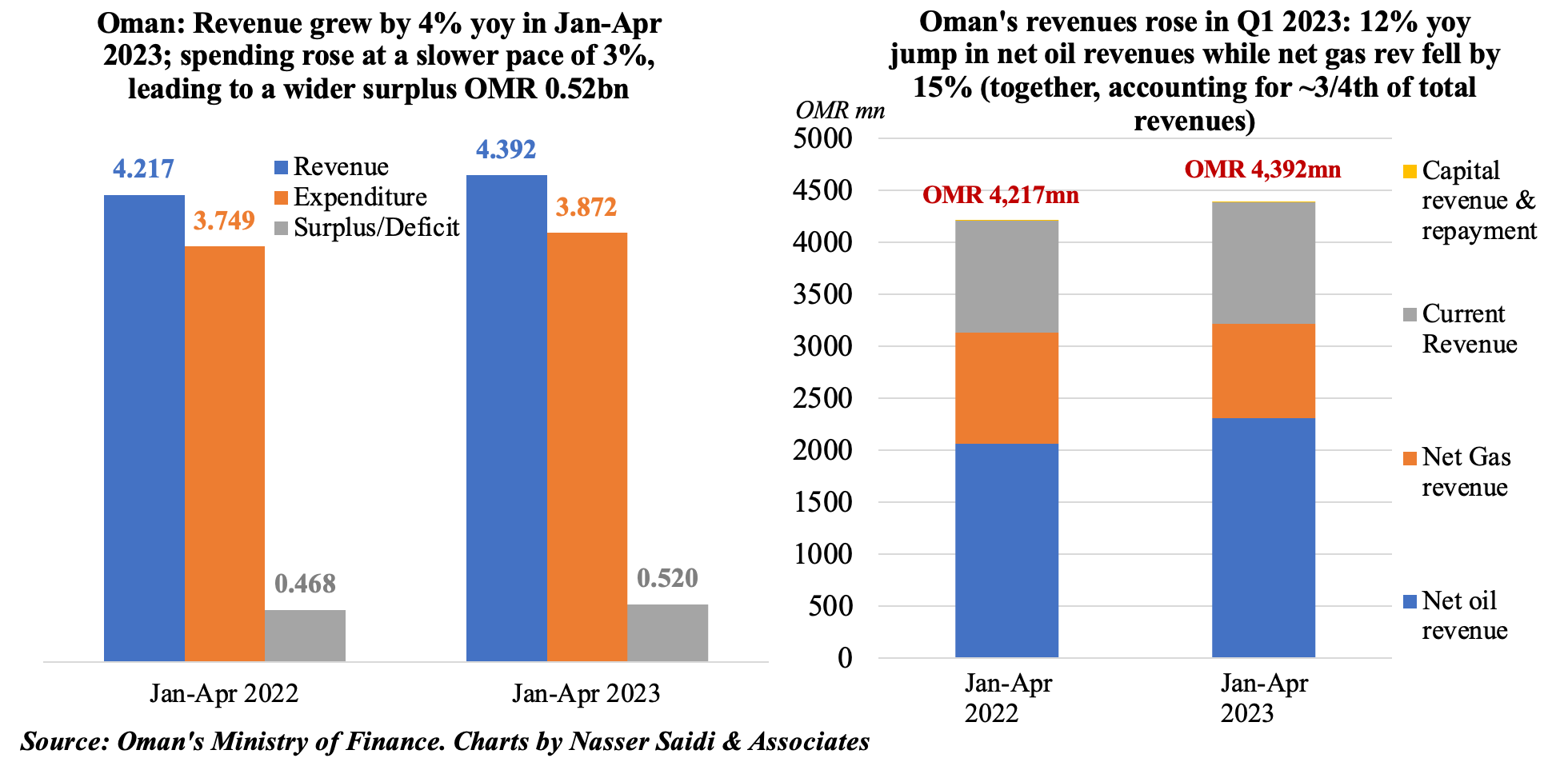

5. Oman’s fiscal surplus hits OMR 520mn as of end-Apr 2023

- Oman posted a budget surplus of OMR 520mn at end-Apr 2023: total revenue was up by 4% yoy while spending grew a tad lower by 4%. This compares to a projected deficit of OMR 1.3bn as per the 2023 budget.

- Increased production & higher oil prices led to a 12% increase in net oil revenue to OMR 2.3bn in Apr 2023: prices averaged USD 84 per barrel (vs USD 80 in Apr 2022) and oil production increased 3.2% to 1.064mn barrels per day.

- Net gas revenues tumbled by 15.2% to OMR 908mn (largely due to “due to the deduction of gas purchase and transport expenses from the total revenue” according to the ministry). But together net oil and gas revenues accounted for 73% of total public revenue, making it more vulnerable to volatility in the oil & gas markets.

- Spending inched up due to an increase in current expenditure of ministries while oil subsidies amounted to OMR 111mn in Jan-Apr 2023.

- Separately, Oman established a new investment fund on May 30th.The “Oman Future Fund”, with a capital of OMR 2bn, plans to support economic activity including financing of existing projects, supporting SME projects and others.

Powered by: