Markets

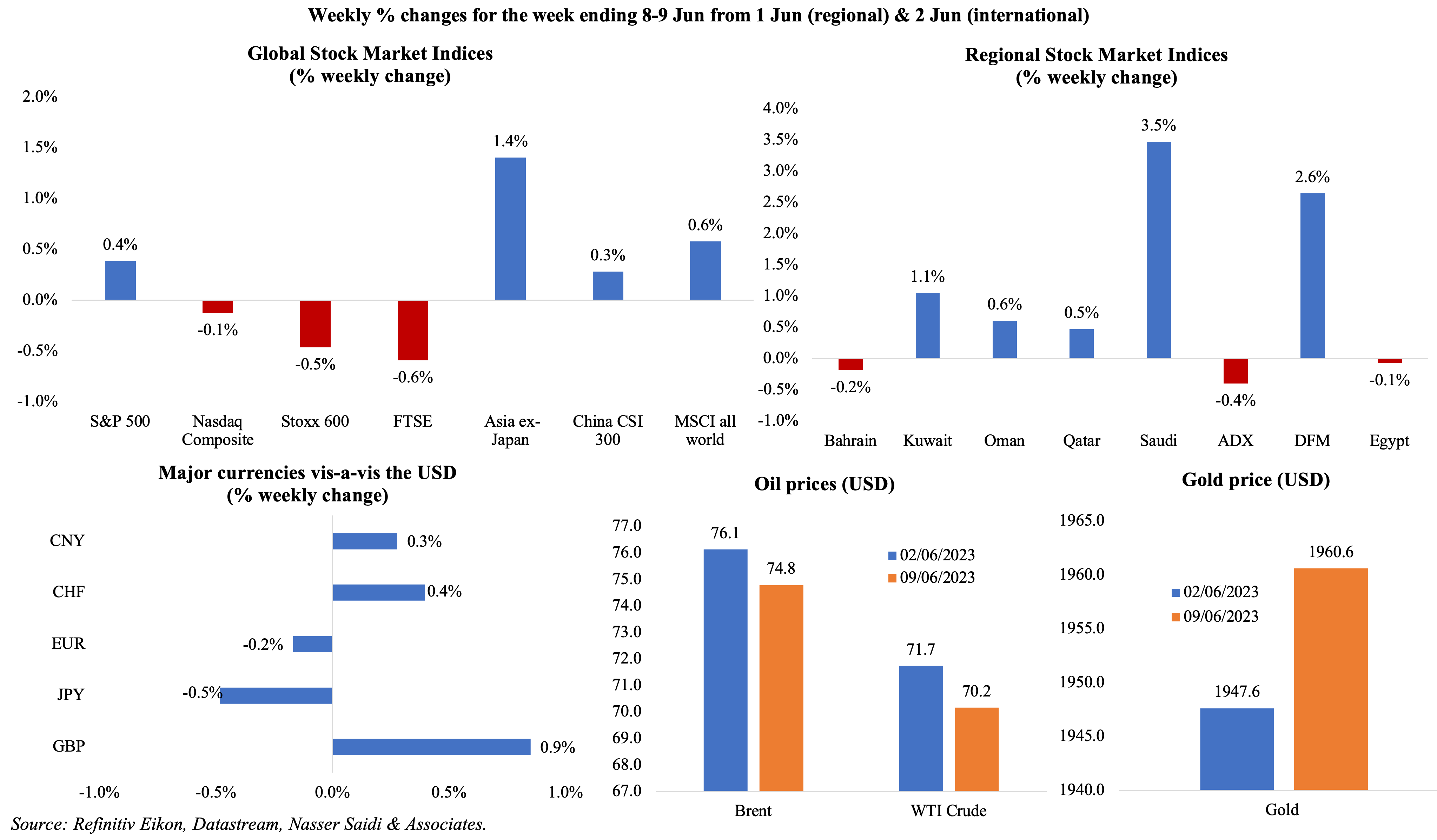

Many major equity markets were on an upbeat mode on expectations that the Fed is likely to avoid a rate hike this week: S&P 500 touched new-highs for the year, Asian markets performed well and the MSCI index of world stocks touched a 13-month high, closing 0.6% higher than the previous week. The relative calm in markets resulted in VIX falling to 13, the lowest since the pandemic hit in 2020. Regional markets were mostly up, with Saudi and Dubai the biggest gainers while Abu Dhabi posted its 6th consecutive weekly loss. Among currencies, the pound gained 0.9% week-on-week while the Turkish lira weakened to a new record low of 23.77 per dollar earlier today (with investors waiting for the first signs of policy reversals). Oil prices fell from a week ago on a weakened demand outlook from China; even though the Saudi production cut led to prices edging up earlier in the week, talks about a potential Iran-US nuclear deal nudged hopes for additional supply in the market. Gold price gained last week.

Global Developments

US/Americas:

- US factory orders grew by 0.4% mom in Apr (Mar: 0.6%), largely due to a surge in defence capital goods (+36%). Orders for non-defence capital goods excluding aircraft gained by 1.3%.

- ISM services PMI in the US eased to 50.3 in May (Apr: 51.9), as new orders slipped to 52.9 (from 56.1) and employment fell below-50 (to 49.2 from 50.8). Services inflation slowed as demand cooled: prices paid eased to 56.2, the lowest since May 2020, from Apr’s 59.6.

- Goods and services trade deficit in the US widened to USD 74.6bn in Apr (Mar: USD 60.6bn), the highest level in 6 months. Thanks to a rebound in goods imports (+2% to USD 263.2bn) while exports of goods plunged by 5.3% (the most in 3 years) to USD 167.1bn, goods trade deficit narrowed to USD 96.1bn.

- Initial jobless claims rose by 28k to a seasonally adjusted 261k in the week ended Jun 2nd, the highest level since Oct 2021, and the 4-week average ticked up by 7.5k to 237.25k. Continuing jobless claims fell by 37k to 1.757mn in the week ended May 26th (lowest since Feb).

Europe:

- GDP in the eurozone decreased by 0.1% qoq in Q1 (Q4: -0.1%): GDP volume was more than 2% higher than the level recorded in the pre-pandemic Q4 2019. Eight EU nations contracted in Q1, with Ireland declining the most (-4.6%).

- Eurozone services PMI slipped to 55.1 in May, lower than the preliminary reading of 55.9 and Apr’s 56.2: new business rose for the fifth consecutive month while new export sales rose at the sharpest rate on record. Services PMI in Germany increased to 57.2 in May from Apr’s 56, but lower than the preliminary reading of 57.8. Composite PMI in both Eurozone and Germany slipped to 52.8 and 53.9 respectively (Apr: 54.1 and 54.2).

- Producer price index in the eurozone fell by 3.2% mom in Apr, the largest decline on record. In yoy terms, it slowed to 1%, the lowest since Jan 2021 and from May’s 5.5% gain.

- Sentix investor confidence in the eurozone dropped to -17 in Jun (May: -13.1), with the current situation index plunging to -15.8 from -7.0. By country, Germany’s investor confidence tumbled to -21.1.

- Retail sales in the eurozone was flat in Apr (Mar: -0.4%): non-food sales grew by 0.5% while food and fuel trade fell by 0.5% and 2.3% respectively. In yoy terms, sales declined for the 7th month in a row (-2.6% from Mar’s -3.3%).

- Exports from Germany increased by 1.2% mom in Apr, largely due to a 10.1% and 4.7% rise in exports to China and US. Imports fell by 1.7%, widening trade surplus to EUR 18.4bn.

- Industrial production in Germany rebounded by 0.3% mom in Apr (Mar: -2.1%), led by a rebound in construction (+2%) and manufacture of pharmaceuticals (+6.4%) while capital goods production declined by 0.3%.

- German factory orders unexpectedly fell by 0.4% mom and 9.9% yoy in Apr, dragged down by large orders (34% plunge in construction of ships, aircraft, space craft and army vehicles).

- Composite PMI in the UK was lower at 54 in May, from Apr’s 1-year high of 54.9, as the divergence continued between manufacturing and services. Services PMI rose to 55.2 in May (Apr: 55.9), with consumer demand remaining resilient resulting in higher spending.

Asia Pacific:

- China’s inflation inched up to 0.2% yoy in May (from Apr’s 26-month low of 0.1%), with food price inflation ticking up to 1.4% (from Apr’s 13-month low) while non-food inflation was flat (0.1%). In mom terms, inflation dropped by 0.2%, falling for the 4th straight month. Producer price index fell by 4.6% in May (Apr: -3.6%), the steepest fall in 7 years, with the mining and raw material industries leading the decline.

- Exports from China contracted by 7.5% yoy and imports also declined by 4.5%, resulting in a narrower trade surplus of USD 65.81bn from USD 90.21bn. While exports to the US & EU declined by 15.1% and 4.9% in Jan-May, exports to ASEAN grew by 8.1%.

- China’s Caixin services PMI increased to 57.1 in May (Apr: 56.4), the fifth consecutive month of expansion, as new orders and export orders grew given robust demand. Output cost inflation accelerated to the fastest since Feb 2022.

- GDP in Japan grew by an 2.7% annualised rate in Q1, much higher than the prior estimate of 1.6%; in yoy terms, GDP grew by 0.7% (Q4: 0.4%). Capital spending and private demand were up by 1.4% and 1.2% respectively while exports and imports both fell by 4.2% and 2.3%.

- Japan’s current account surplus narrowed to JPY 1.895trn in Apr (Mar: JPY 2.28trn), the 3rd month of surplus, thanks to the widening primary income surplus (to JPY 1.664trn).

- The preliminary reading of Japan’s leading economic index was 97.6 in Apr, the highest reading since Nov 2022 and following Mar’s downwardly revised 96.9. The coincident index inched up to 99.4, the most since Sep 2022 and upfrom Mar’s 99.2.

- Overall household spending in Japan declined by 4.4% yoy in Apr, falling faster than the previous month’s 1.9% drop. Households of two or more people spent an average of JPY 303,076 (USD 2,170).

- The Reserve Bank of India held rates unchanged for the second consecutive policy meeting: repo rate and reverse repo rates stood at 6.5% and 3.3% respectively. The governor explicitly mentioned that this is not a (policy) pivot, and that the RBI maintained its policy stance of “withdrawal of accommodation” to lower inflation to within its target range.

- Singapore retail sales inched up by 3.6% yoy (and by 0.3% mom) in Apr, rising for the third month in a row, supported by higher demand for food & alcohol (+30.5%) and cosmetics, toiletries & medical goods (16.8%). Excluding motor vehicles, sales grew by 4.2%.

Bottom line: A central-bank-meetings heavy week – one to watch, especially following surprise hikes from Canada and Australia last week (to combat inflation) indicating that rates could stay higher for longer. US also releases inflation data this week (ahead of the Fed meeting), but the Fed is expected to keep rates unchanged given data on jobs and claims. With core inflation still high in the eurozone despite easing headline inflation, this week’s anticipated 25bps ECB hike may not be the last. It is widely expected that the BoJ will hold its interest rates. Last week’s weak Chinese data meanwhile has increased expectations for additional stimulus measures (including on property).

Regional Developments

- Bahrain’s finance ministry expects budget deficit to narrow to BHD 161.4mn (USD 428.16mn) in 2024 from a deficit of BHD 520mn this year. With spending remaining unchanged at BHD 3.6bn in 2024, the narrowing of deficit stems from the jump in oil revenues (to BHD 2.15bn from an estimated BHD 1.92bn in 2023).

- Inflation in Egypt jumped to 32.7% yoy in May (Apr: 30.6%), driven by food & beverage costs (58.9%), furniture, home equipment & maintenance costs (38.8%) and clothing & footwear (22.2%) among others. Core inflation jumped to 40.3% (Apr: 38.6%). Inflation in May was only marginally lower than the record high of 32.95% seen in Jul 2017.

- Egypt’s foreign reserves increased by USD 110mn to USD 34.66bn in May. According to the central bank, international reserves include about USD 26.7bn in foreign currencies, USD 7.95bn in gold and USD 27mn in special drawing rights.

- Egypt and Saudi Arabia’s Export Development Authorities have signed an MoU to boost bilateral trade, especially the non-oil export sector.

- The consortium led by UAE’s Masdar signed a deal to secure land for Egypt’s USD 10bn wind energy project. The onshore wind farms are expected to produce 47,790 GWh of clean energy per year while displacing 23.8mn tons of carbon dioxide.

- Iraq and Saudi Arabia ink a contract to build a commercial project worth USD 1bn near the Baghdad International Airport in Baghdad.

- Reuters, citing a senior Iraqi foreign ministry official, reported that Iraq agreed to pay USD 2.76bn in gas and electricity debt to Iran after receiving a sanctions waiver from the US.

- Kuwait’s non-oil sector growth is expected to rise to 3.8% in 2023 while overall growth drops to 0.1%, according to the IMF. Overall fiscal surplus is projected to decline to 6.9% of GDP in 2023, and to fall steadily thereafter into deficit over the medium term. The IMF underscored the need to pass the Debt Law soon while also stressing the risk of “political gridlock” to the progress of reforms.

- Bilateral trade between Kuwait and Vietnam stands at around USD 5.5bn, according to the Vietnamese ambassador to Kuwait. He disclosed that the Kuwait government’s investments in Vietnam is about USD 3bn and that of the private sector stands at USD 200mn.

- Following parliamentary elections in Kuwait, 12 new members have joined the 50-seat National Assembly. Only one woman was elected, down from 2 in the earlier parliament.

- PMI in Lebanon slipped to 49.4 in May (Apr: 49.5), staying below 50 for the 9th month in a row. Though employment continued to decline, new export orders rose at their fastest rate since Jun 2015 and the future expectations reading was the 2nd highest for over 3 years.

- The IMF, following the conclusion of an Article IV consultation with the authorities, called for “urgent action” to implement a “comprehensive economic reform program” in Lebanon to avoid “irreversible consequences”.

- Oman’s net oil revenues increased by 12% yoy to OMR 2.3bn at end-Apr, thanks to the average oil price of USD 84 a barrel and an increase in average oil production to 1.064mn barrels per day. Spending meanwhile ticked up by 3% to OMR 3.8bn, leading to an overall surplus of OMR 520mn at end-Apr.

- Oman and Saudi Arabia agreed to launch joint tourism initiatives, including a unified tourism visa and facilitation of seasonal trips among others.

- Russia and Oman signed an agreement to avoid double taxation, according to the former’s finance ministry.

- PMI in Qatar increased to 55.6 in May (Apr: 54.4), supported by the rise in output and new orders. Overall input price inflation rose to an 11-month high while prices charged remained “broadly unchanged”. Financial services outperformed the wider economy, with activity and new business sub-indices at 61.4 and 61.8 respectively.

- Qatar posted a budget surplus of QAR 19.7bn in Q1 2023, already 68% of the surplus budgeted total for the year (QAR 29bn). Oil and gas revenues stood at QAR 63.4bn during the quarter, accounting for 92.4% of total revenues. Total expenditures touched QAR 48.9bn in Q1, of which 32% was wages and salaries while another 31% went towards major projects.

- FDI projects in Qatar jumped by 70% during the period 2019-2022, according to the Minister of Municipality. He disclosed that the real estate sector attracted investments exceeding QAR 82bn (USD 23bn) and it was the fastest growing after the energy sector. In 2022 alone, 135 real estate projects were launched.

- Mercer’s Cost of Living City ranking for 2023 ranks Dubai as the most expensive city in the MENA region (ranked 18th globally, up 13 places from last year). Abu Dhabi and Riyadh also jumped by 18 places to 43rd and 85th respectively.

Saudi Arabia Focus

- Saudi Arabia’s GDP grew by 3.8% yoy in Q1, in line with initial estimates. Growth was driven by non-oil sector(+5.4%) and government (4.9%) while oil sector posted an increase of just 1.4% (given muted oil prices and decline in production).

- In its Article IV concluding statement, the IMF forecast Saudi growth at 2.1% in 2023, given Apr’s production cuts announcement. Non-oil sector growth is expected to remain a strong 5% in 2023 while inflation remains unchanged at 2.8%. Fiscal balance will move into a deficit in 2023 given lower oil revenues.

- Industrial production in Saudi Arabia increased by 3.2% yoy in Apr, with manufacturing activity up by 10.5% alongside a 25.5% rise in electricity and gas supplies. Oil production at more than 10mn barrels per day meant that mining & quarrying sector grew by 0.2% in Apr.

- Saudi Arabia launched a new business visa for investors, to support the drive to attract foreign funding. FDI, at SAR 1.01trn, constituted 42% of total inflow of foreign funds into the country last year.

- The Arab-China Business Forum is being hosted in Riyadh this week (on 11-12 June) on the theme of “collaborating for prosperity”. Energy transition and climate change are key themes of discussion during the forum. While Saudi Arabia’s investment minister spoke about a revival of the Silk Route with Saudi as a gateway to the Arab world, Saudi’s energy minster highlighted synergies and was quoted saying “more announcements soon on Saudi-Chinese investment”.

- Bilateral trade between the UK and Saudi Arabia touched SAR 80.7bn in 2022, according to the latter’s minister of commerce. British investment in Saudi Arabia amounted to SAR 26.5bn in two years.

- Money supply (M3) in Saudi Arabia grew by 4.7% year-to-date to SAR 2.61bn in the week ending June 1st.

- NEOM in Saudi Arabia secured SAR 21bn (USD 5.6bn) in financing for expanding housing for its workforce. NEOM is eventually supposed to house 9mn persons by 2045 from about 450k in 2026 and about 2mn by 2030.

- Iran officially reopened its embassy in Saudi Arabia last week, following the deal agreed in March (brokered by China) to re-establish relations.

UAE Focus![]()

- UAE M3 money supply increased by 16.5% yoy in Mar (Feb: 14.1%). Deposit growth grew by 3.8% year-to-date while credit disbursed to the private sector is slowly catching up (2.3% ytd). Loans to construction, real estate & government together accounted for nearly 1/3-rd of all loans in Mar while SME lending slowed.

- Dubai PMI slipped to 55.3 in May, from Apr’s 8-month high of 56.4, given “softer rise in new business inflows and a greater shortening of delivery times”. Input prices rose marginally while output charges continued to fall and job creation was the fastest since the start of 2018 (mostly in sales and marketing). Business confidence was the highest since Mar 2020.

- UAE and Cambodia signed a Comprehensive Economic Partnership Agreement, with an aim to raise non-oil trade to USD 1bn+ within the next 5 years from about USD 407mn in 2022. This is the UAE’s fifth CEPA, following those with India, Indonesia, Israel and Turkey and another 10+ are reportedly in the pipeline.

- UAE-Turkey non-oil trade increased to over AED 378bn during the decade 2013-2022: imports were at AED 204.3bn, exports at AED 127.5bn and re-exports AED 46bn.

- Dubai International Chamber disclosed that it had attracted 5 MNCs and 20 SMEs in Q1 2023, higher than the 2022 total. The Dubai Chamber of Digital Economy announced that it had attracted 30 tech startups to Dubai during the quarter. The Dubai Chamber of Commerce disclosed a 48.7% yoy growth in number of new companies to 15,366 in Q1.

- Dubai Electricity and Water Authority (DEWA) received the lowest bid from Masdar for building the 6th phase of the Mohammed Bin Rashid Al Maktoum Solar Park. The bid was 1.62154 cents per kilowatt-hour for the 1800MW solar-power plant.

- On the sidelines of the UN climate talks in Bonn, the UAE’s COP 28 president stated that the phase down of fossil fuels is inevitable, also stating that its pace depends on “how quickly we can phase up zero carbon alternatives, while ensuring energy security, accessibility and affordability”.

- Dubai attracted a record-high 451 FDI projects in the cultural and creative industries last year (+107.7%), resulting in the emirate being ranked first globally in attracting FDI projects in that sector. Dubai’s total FDI capital flows in the cultural and creative industries surged to AED 7.357bn in 2022, ranking the city 1st in the MENA region and 12th globally (up from 14th in 2021), as per fDi Markets data.

Media Review

When will China’s GDP overtake America’s?

https://www.economist.com/graphic-detail/2023/06/07/when-will-chinas-gdp-overtake-americas

FT’s climate graphic of the week: the fast-shrinking carbon budget

https://www.ft.com/content/5ef31328-2855-4637-9045-318267cc999c

IMF: MENA Vulnerable to Rising Fiscal Risks

https://www.imf.org/en/Blogs/Articles/2023/06/11/middle-east-north-africa-vulnerable-to-rising-fiscal-risks

Inside OPEC+, Saudi ‘lollipop’ oil cut was a surprise too

https://www.reuters.com/business/energy/inside-opec-saudi-lollipop-oil-cut-was-surprise-too-2023-06-09/

Qatar Offers Looser LNG Contract Terms to Entice Asian Buyers

https://www.bloomberg.com/news/articles/2023-06-06/qatar-offers-looser-lng-contract-terms-to-entice-asian-buyers

Tokens delisted, exchange closed following SEC crypto lawsuits

https://mashable.com/article/binance-robinhood-crypto-com-cryptocurrency-sec-fallout

Powered by: