Middle East PMIs. Saudi Q1 GDP. UAE CEPA with Cambodia. UAE monetary stats. Qatar Q1 budget surplus.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 9 Jun 2023: Optimism in the GCC fueled by non-oil sector activity

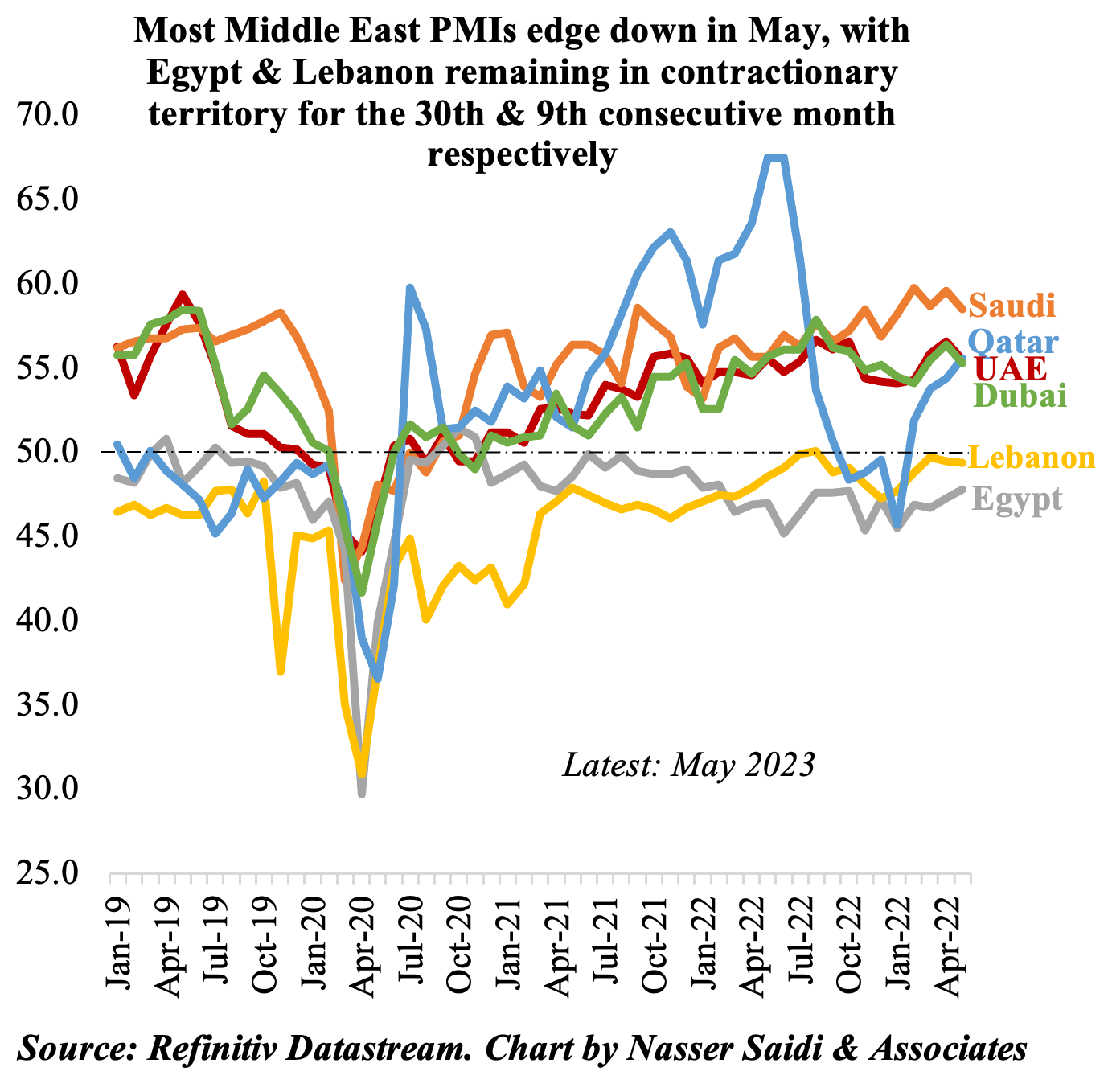

1.PMIs: GCC firms emerge more confident after pandemic-hit

- Saudi Arabia, UAE and Dubai non-oil sector PMIs edged down in May. In contrast, Qatar posted an increase in PMI to 55.6 in May (Apr: 54.4), supported by the increase in output and new orders. Overall input price inflation rose to an 11-month high while prices charged remained “broadly unchanged”.

- Saudi Arabia’s PMI showed domestic demand supporting activity (firms cited “greater travel and tourism and increased business investment”) while exports moved above-50. Joint-fastest rate of job creation since 2018 and wage hikes saw output price inflation rise to the highest since Aug 2020.

- Both UAE and Dubai firms’ selling prices continue to decline, with firms citing either strong competition or shifting of excess stocks. Output and hiring activity stayed strong, firms reported improvements in supply chain performance; there was also increased optimism for the next 12 months: UAE & Dubai readings were the highest since Oct 2021 and Mar 2020 respectively.

- Lebanon PMI stayed below the 50-mark, given weak domestic demand in the backdrop of the economic-financial-social turmoil. However, new export orders rose at quickest pace since Jun 2015 (from a very low base) and the future expectations reading was the 2nd highest for over 3 years.

- PMI in Egypt remained in contractionary territory, but the output and new orders sub-indices rose to the highest levels in 17 and 7 months respectively. However, the outlook for the next 12 months remains dismal, with only 6% of firms anticipating an expansion in output levels in the next 12 months.

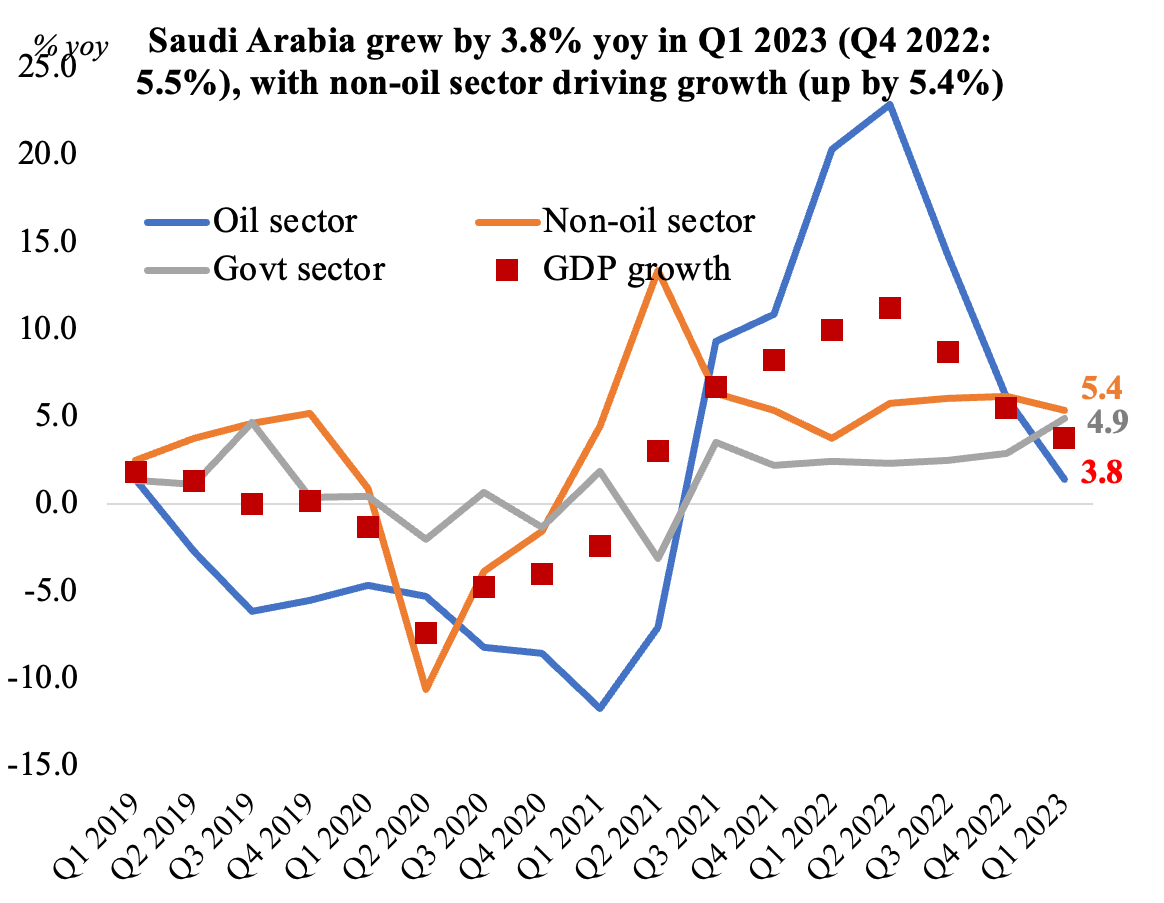

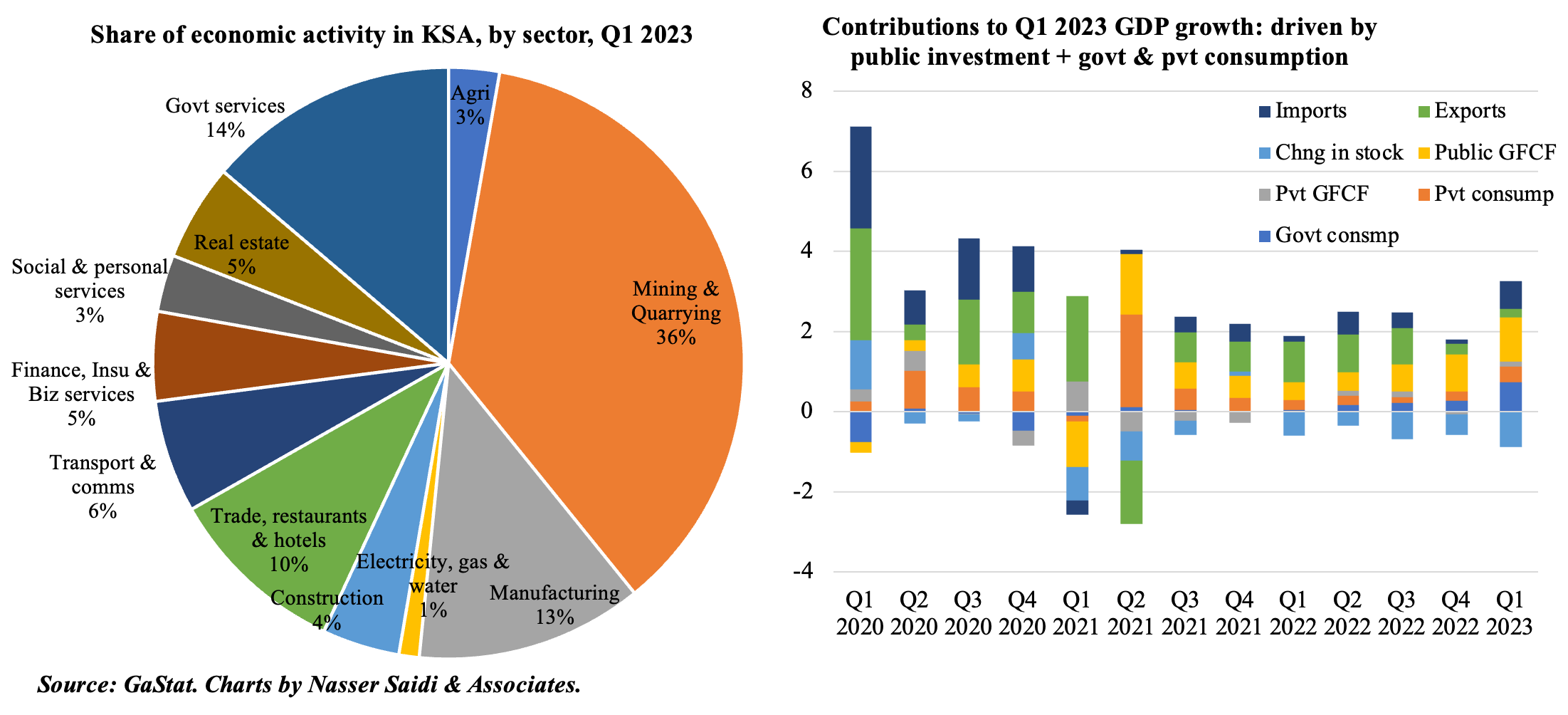

2. Saudi Arabia’s Q1 2023 GDP grew thanks to Non-Oil sector activity

- GDP in Saudi Arabia grew by 3.8% yoy in Q1 2023, in line with initial estimates.

- Growth was driven by non-oil sector (+5.4%) and government (4.9%) while oil sector posted an increase of just 1.4% (given muted oil prices and decline in production).

- Unsurprisingly, mining & quarrying activity dominates the share of gross value added in Q1, followed by government services (14%), manufacturing (13%) and trade & hospitality (10%)

- By expenditure, public investment & government consumption are the largest contributors to the increase in GDP, followed by imports & private consumption

- IMF: the recently announced oil production cut will lower GDP growth to 2.1% this year (alongside robust non-oil sector growth).

3. UAE signs its 5th CEPA with Cambodia

- UAE and Cambodia signed a Comprehensive Economic Partnership Agreement this week: the fifth one, following those with India, Indonesia, Israel and Turkey. (Another 10+ CEPAs are in the pipeline).

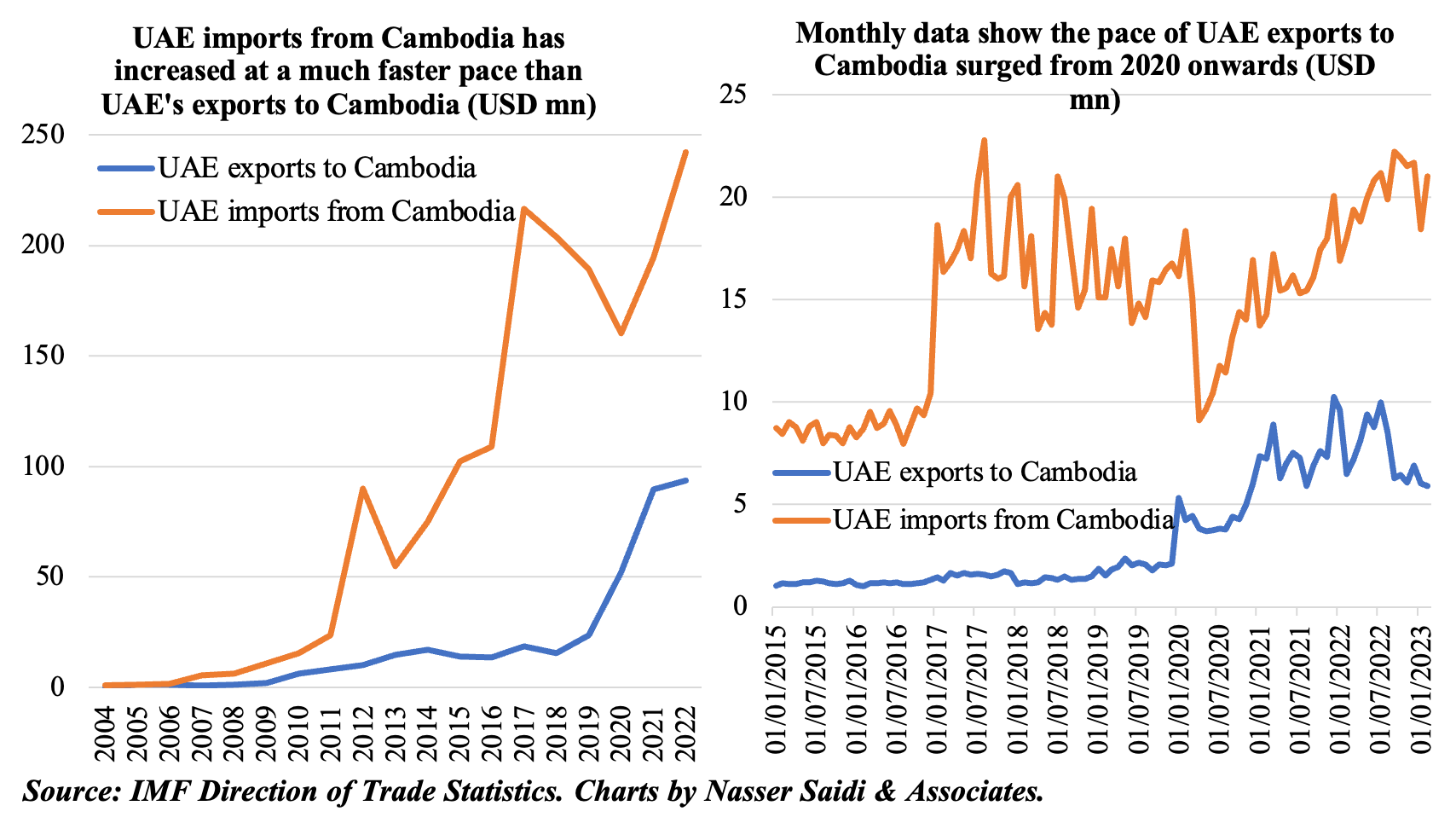

- Trade deal is expected to eliminate “barriers to trade”. Aim is to raise non-oil trade to USD 1bn+ within the next 5 years from ~USD 407mn in 2022.

- UAE imports from Cambodia are much higher (and rising at a much faster pace) than UAE exports to Cambodia. Trade flows have been on the rise from 2020 onwards.

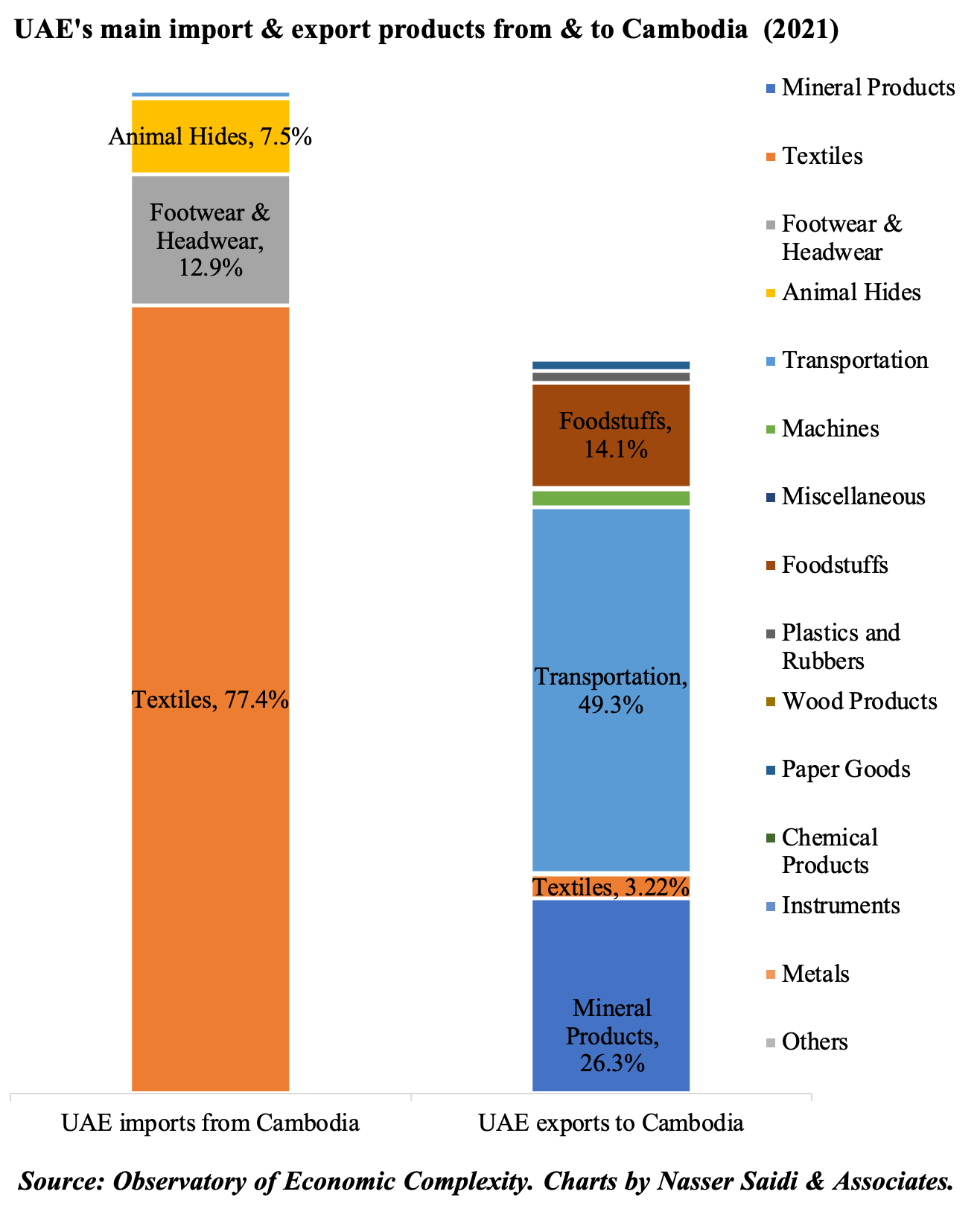

- In 2021, UAE’s imports from Cambodia account for less than 0.1% of UAE’s total imports (for comparison, China’s share is around 18%). What are the top imports? Textiles formed the majority (77.4% of total in 2021), followed by footwear & headwear (12.9%) and animal hides (7.5%, mostly trunks & cases).

- UAE’s exports to Cambodia were at an even smaller share, standing at under 0.05% of total exports in 2021; these were largely re-exports. Transportation accounted for the largest share of exports (close to 50%, of which cars formed the bulk); this was followed by mineral products, at 26.3% (share of petroleum coke and bitumen & asphalt was 15.4% and 7.5% respectively).

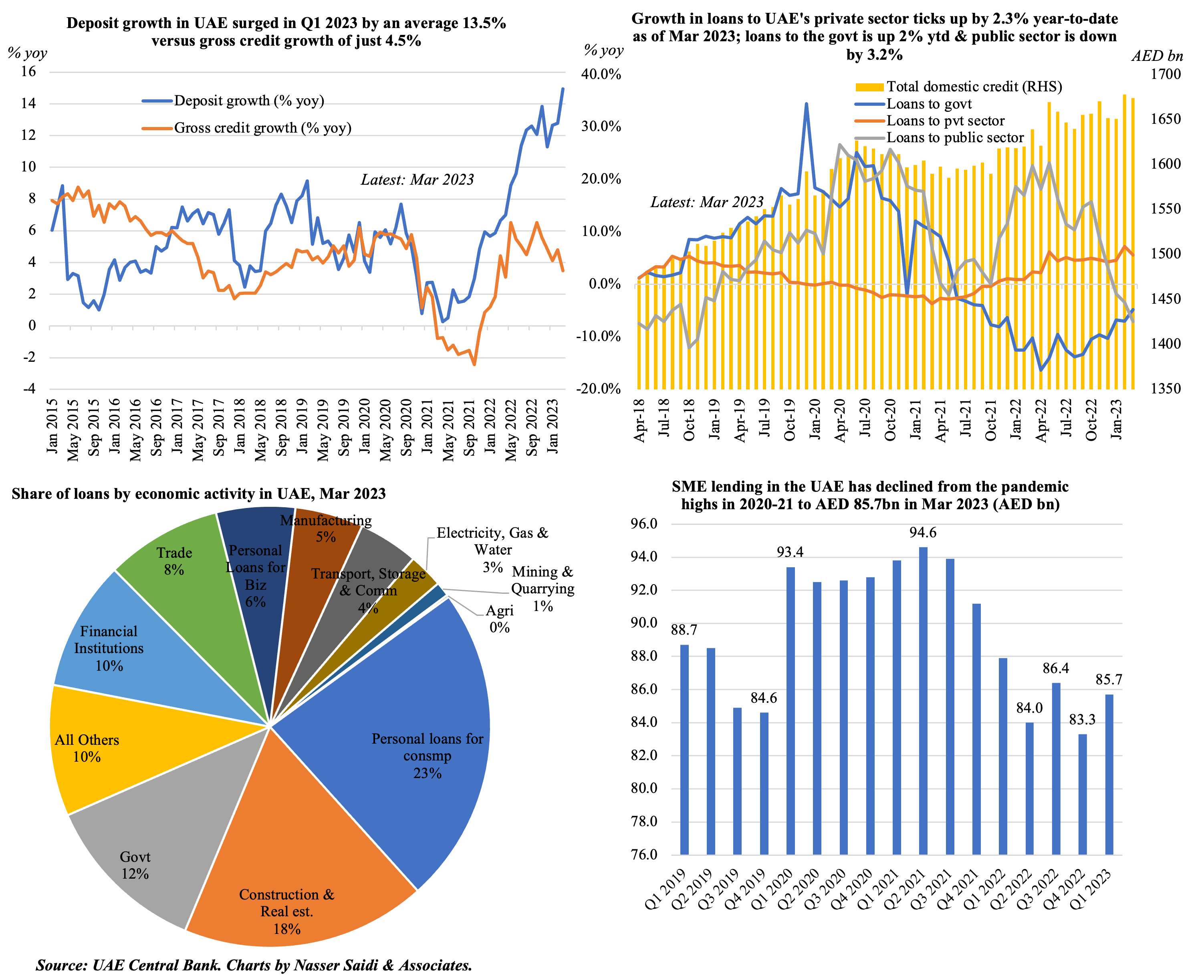

4. UAE’s deposit growth grew by 3.8% year-to-date; credit disbursed to the private sector is slowly catching up (2.3% ytd); loans to construction, real estate & government together accounted for nearly 1/3-rd of all loans in Mar while SME lending slowed

5. Qatar budget surplus clocked in at QAR 19.7bn in Q1 2023

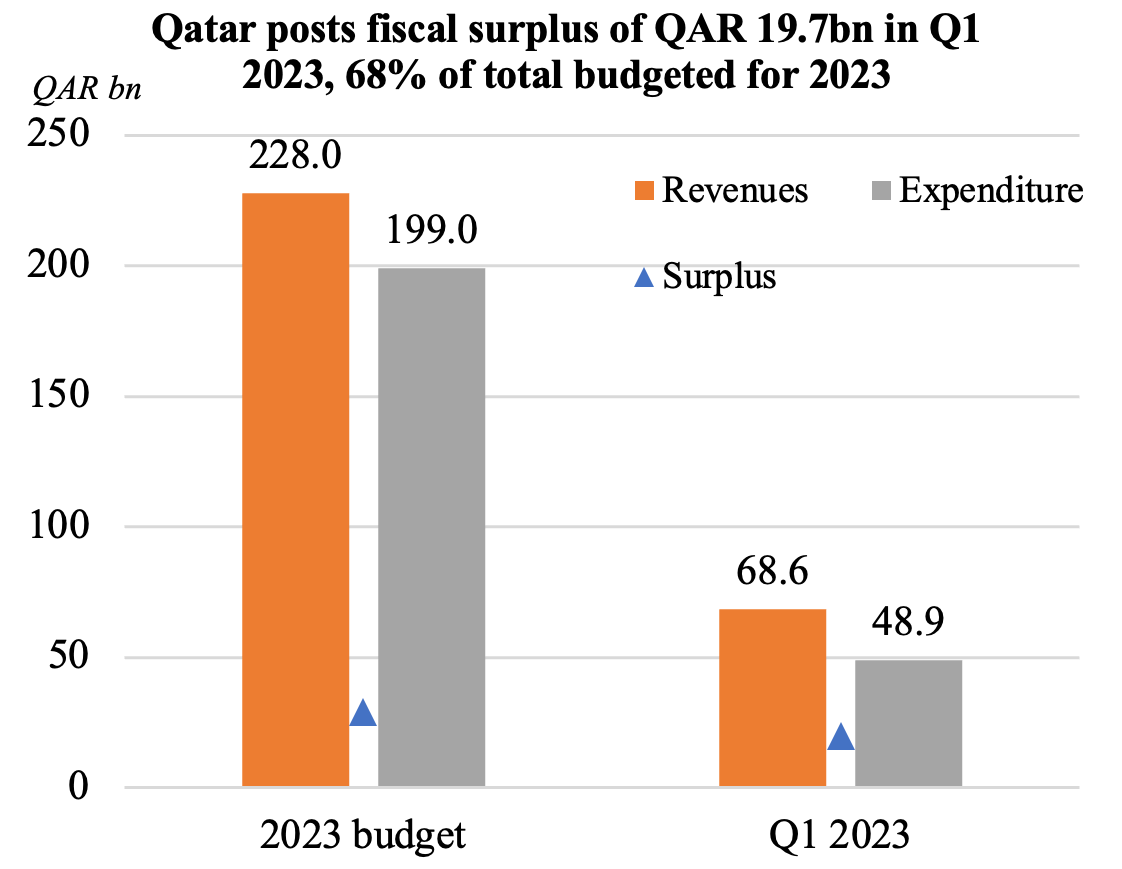

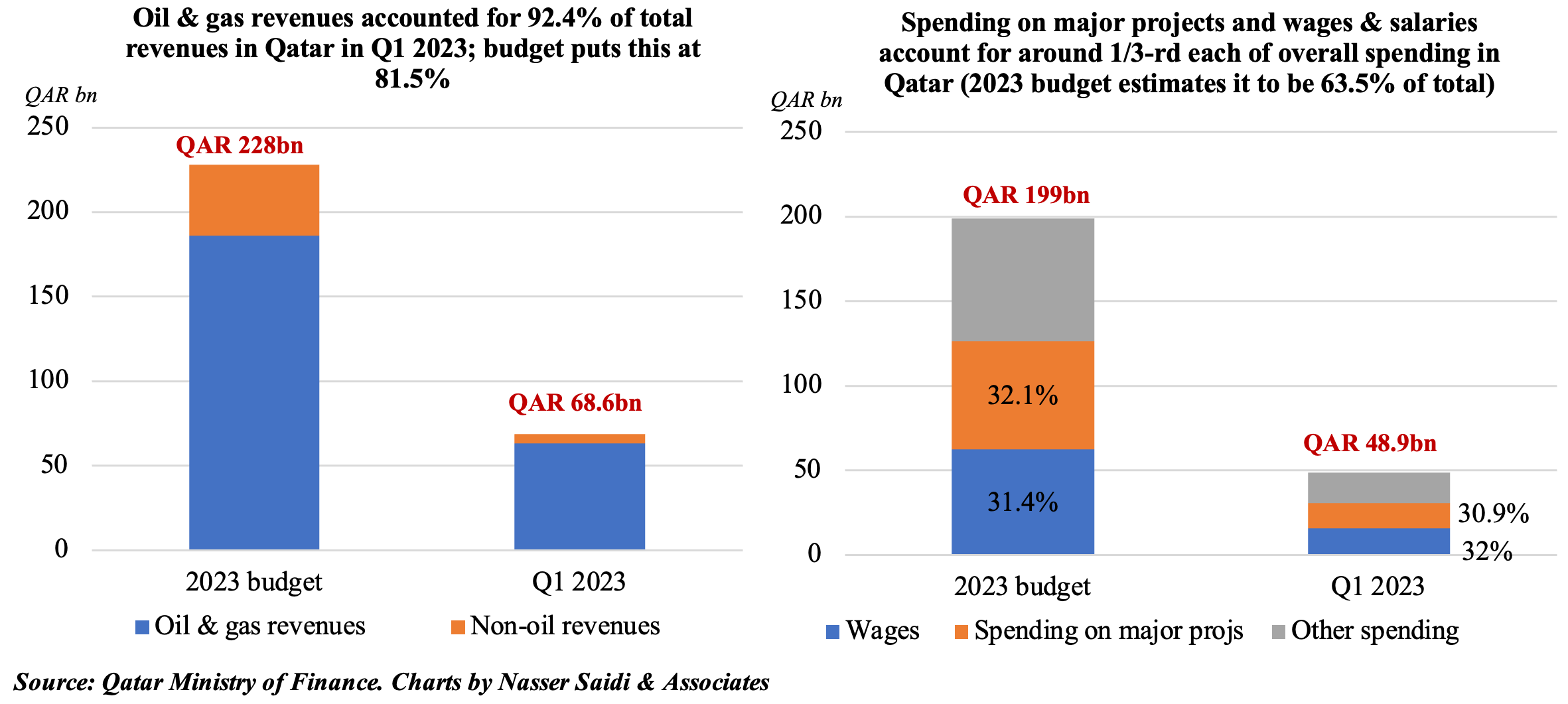

- Qatar clocked in revenues to the tune of QAR 68.6bn and spending of QAR 48.9bn in Q1 2023, resulting in a budget surplus of QAR 19.7bn

- Q1 surplus is already 68% of the budgeted total for the year (QAR 29bn).

- The average oil price was USD 82.2 per barrel in Q1 (vs budgeted price of USD 65), resulting in oil and gas revenues at QAR 63.4bn during the quarter (a share of 92.4% of total revenues).

- Gas revenues have been rising, with Qatar filling the gap of Russian gas; Asian nations are signing long-term contracts to secure gas (e.g. China, Bangladesh while buyers from India, Taiwan and Pakistan are in talks according to Bloomberg)

- Total expenditures touched QAR 48.9bn in Q1, of which 32% was wages and salaries while another 31% went towards major projects.

Powered by: