Global trade prospects. Saudi Q1 trade, monetary stats, population. Oman fiscal surplus.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 2 Jun 2023: Global trade prospects remain uneven – for now, GCC oil trade & revenues provide support

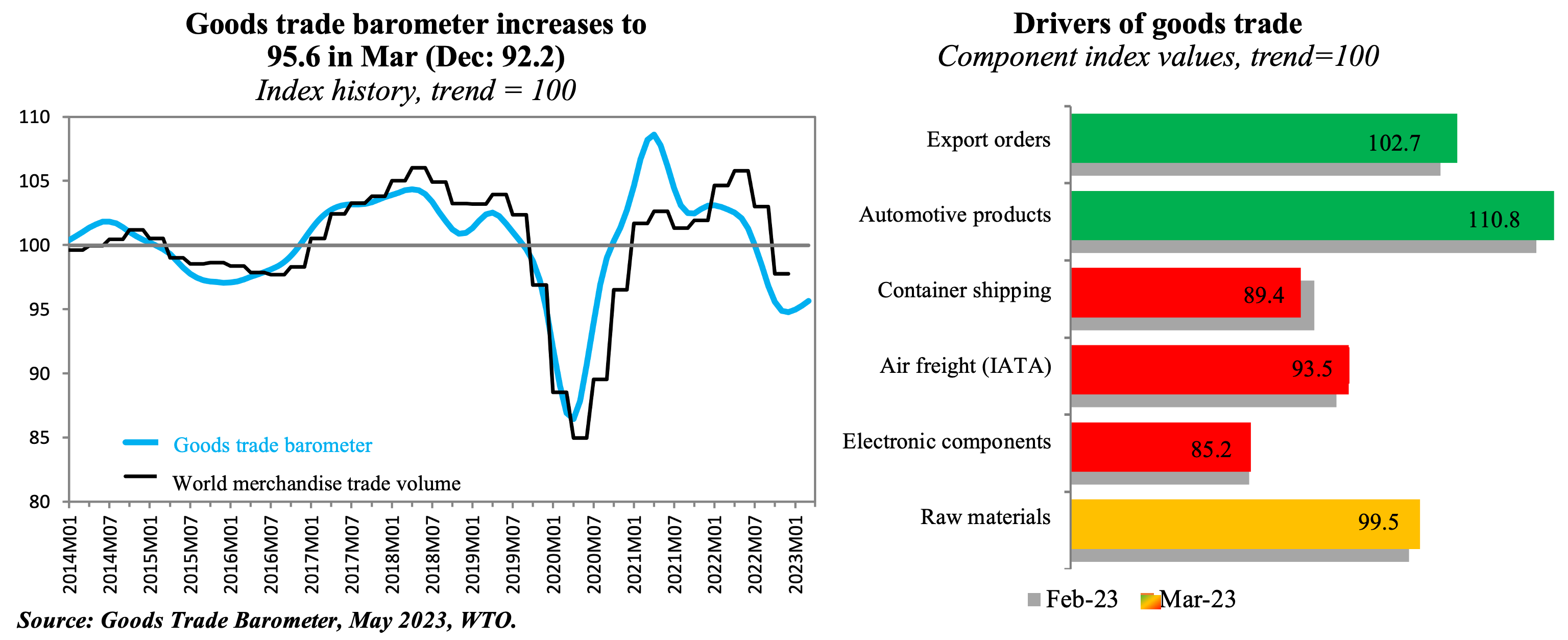

1. Choppy trade prospects ahead

- The WTO’s goods trade barometer increased to 95.6 in Mar, but remains below the baseline of 100. The WTO’s forecast for trade growth stands at 1.7% yoy in 2023.

- Increased exports orders and recovery in the automotive sector (largely in the US and Europe) suggest a better Q2 performance than in Q1. However, other indicators such as container shipping, air freight and trade of electronic components indicate ongoing weakness.

- Global manufacturing PMI indicates uneven trade prospects: (a) new export orders dropped for the fifteenth consecutive month in May, and at the fastest pace in 2023; (b) however, there is a divergence – India & China show growth, in contrast to US, EU, Japan, UK and Brazil reporting sub-50 readings; (c) the silver linings were costs (average purchase prices fell for the first time in 3 years & selling prices fell marginally – first time since mid-2020) and supply chains (average vendor lead times shortened to the most since Apr 2009).

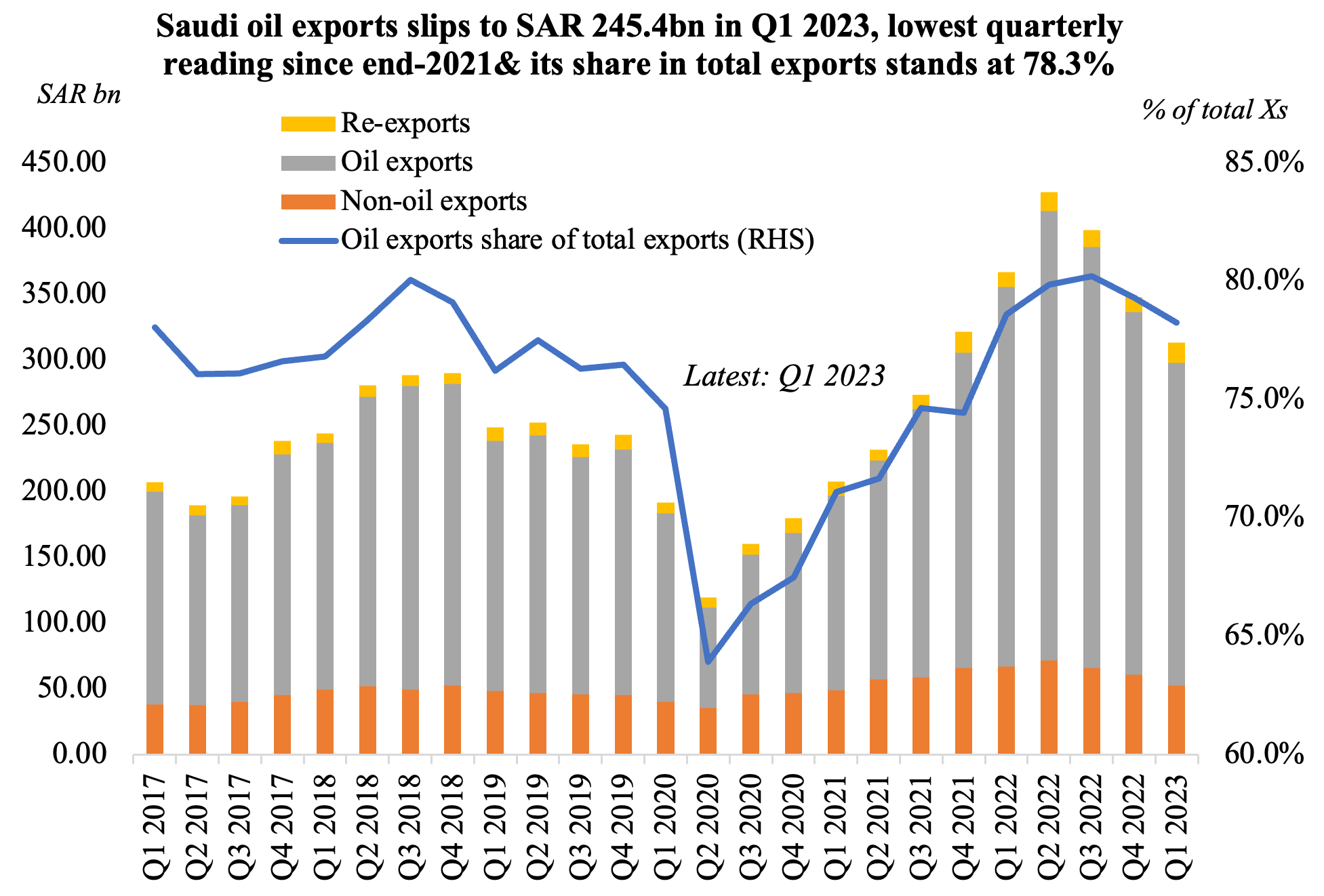

2. Saudi Arabia’s exports decline for the 4th consecutive quarter in Q1 2023

- Saudi Arabia’s overall exports fell by 14.6% yoy in Q1, as a result of declines across both oil (-14.9%) and non-oil (-21.5%) exports. Re-exports meanwhile increased by 34.1% in Q1.

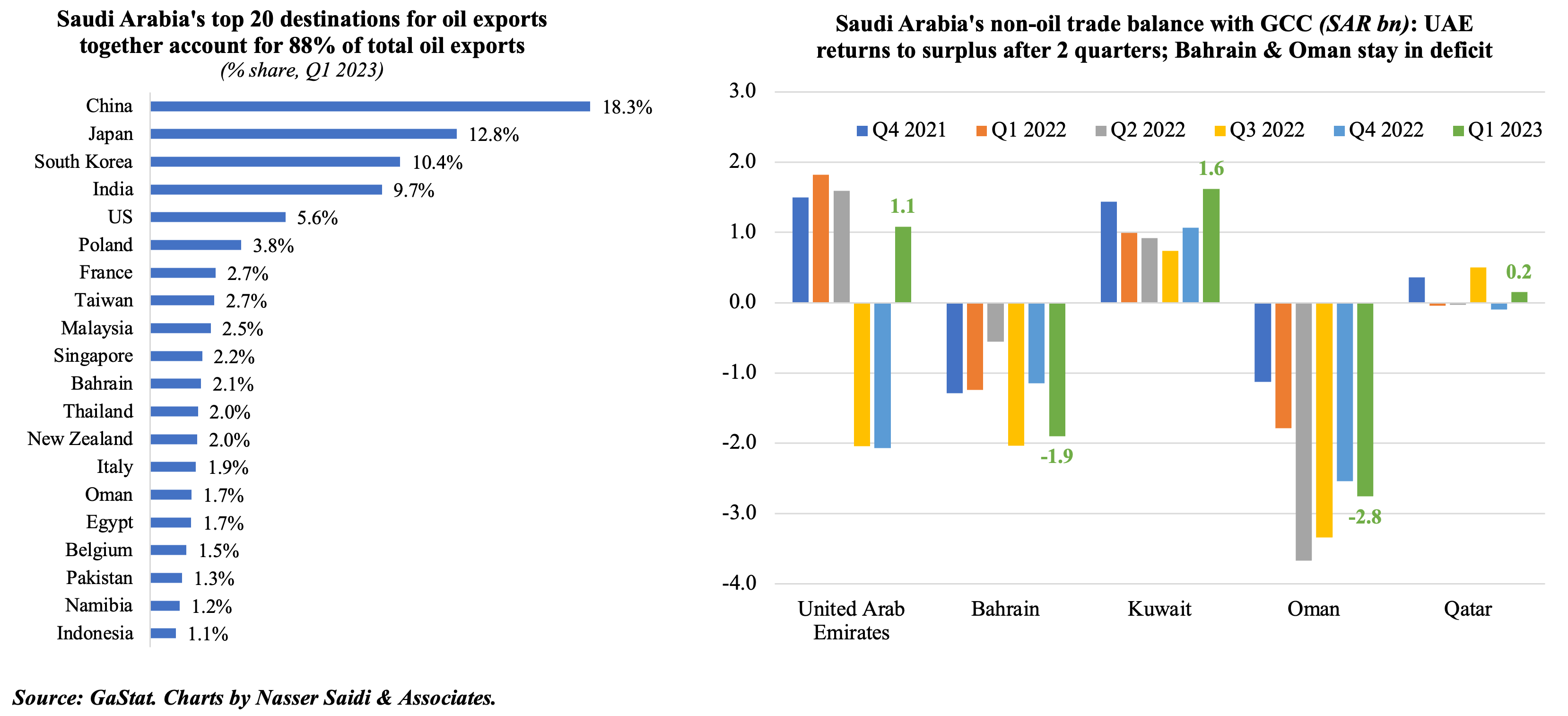

- Despite of the decline, share of oil in overall exports stands at 78.3%. The top 5 destinations for Saudi oil exports – China, Japan, Korea, India and the US – accounted for about 57% of total in Q1.

- The top destination for non-oil exports (includes re-exports) was UAE, with transport equipment and parts the largest export item.

- Saudi’s non-oil trade balance with the GCC showed a return to surplus with the UAE.

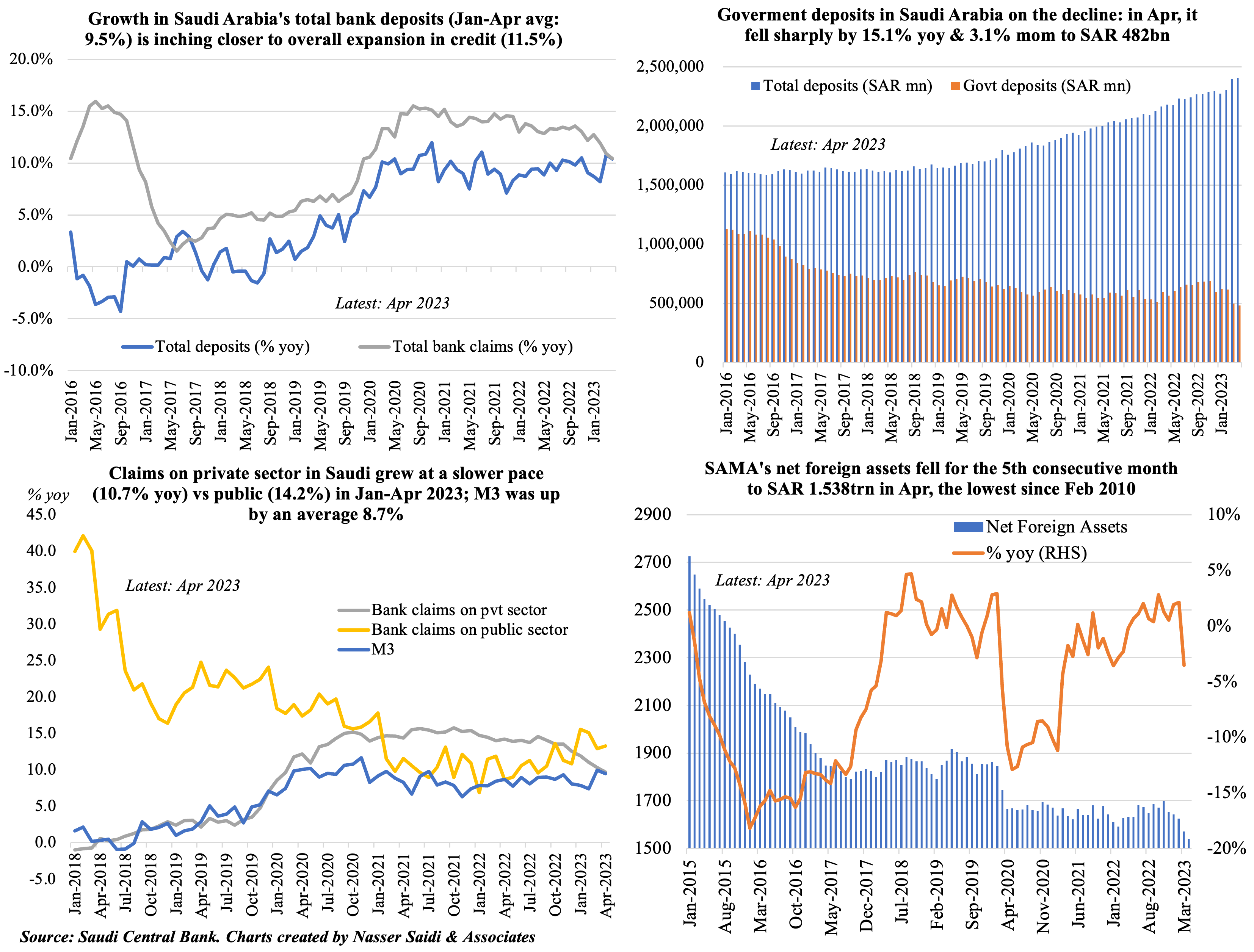

3. Saudi Arabia’s deposit growth is rising, after months of being outpaced by credit expansion; government deposits are still falling (-3% mom & -15.1% yoy in Apr); claims on the public sector continue to post double-digit increases in Jan-Apr; net foreign assets fell for the 5th straight month – lowest in more than 13 years (in spite of oil gains last year)

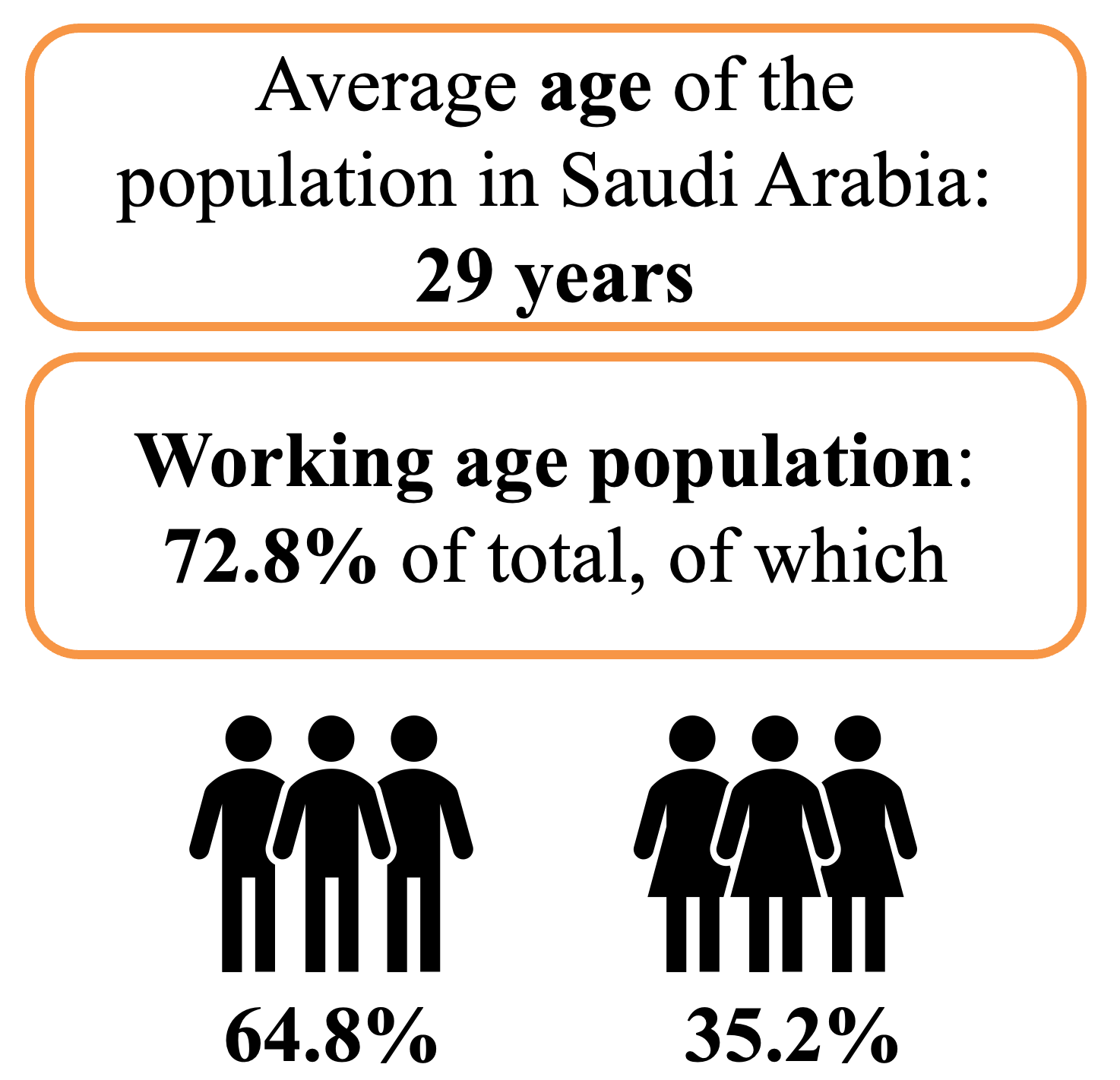

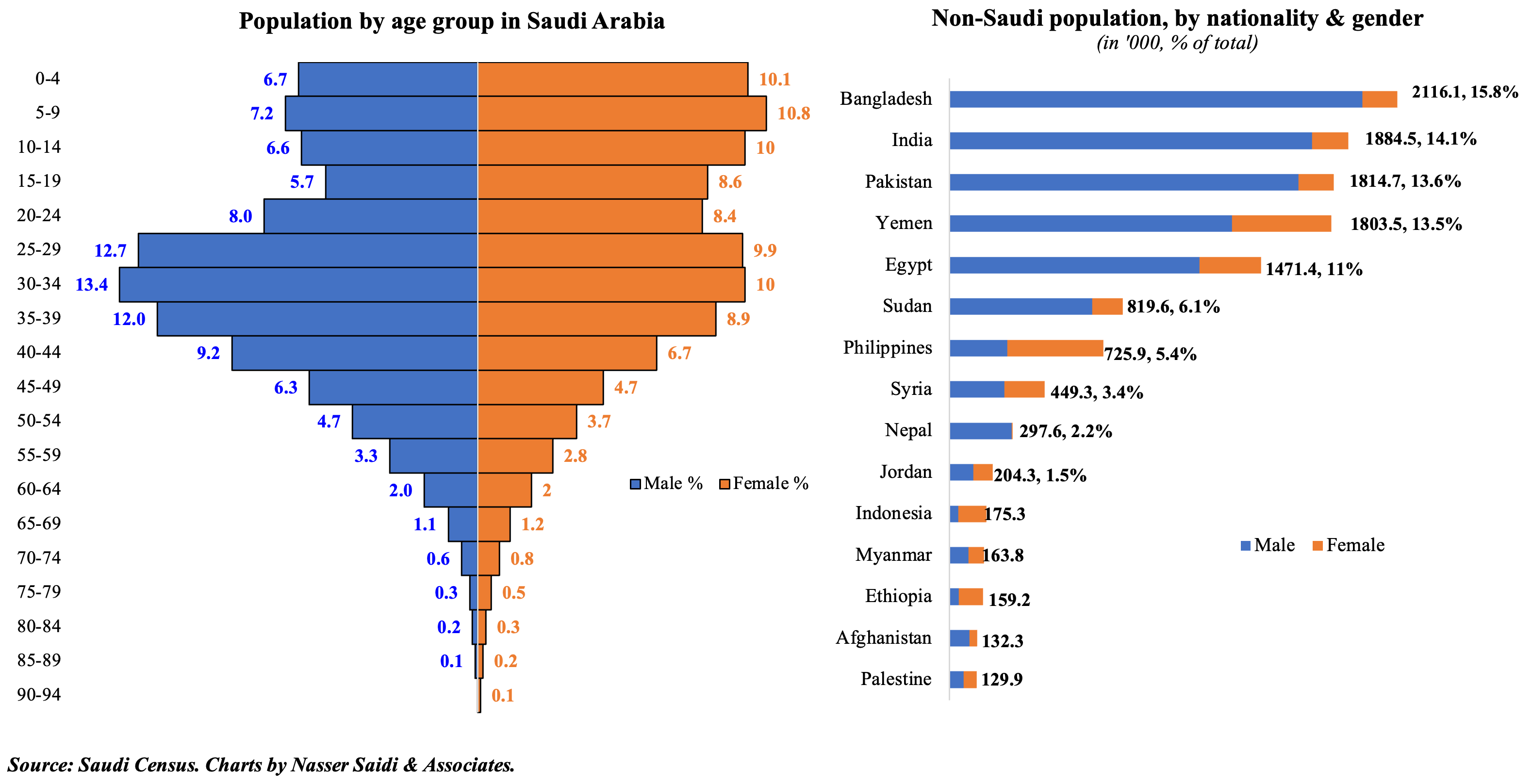

4. Saudi population crosses 32.2mn with expats at 13.4mn: Census results; 61% are male; population growth was 34.2% (2022 vs 2010) & fastest in Riyadh

- Saudi Arabia’s population jumped to 32.2mn as per the latest census, with foreigners accounting for 41.6% of the total (lower than 2016’s peak of 14.6mn). Of the non-Saudi

population, only 23.5% are female. - Since 2010, total population increased by 8.2mn (34.2%) while that of Saudis and expats grew by 4.8mn (33.8%) and 3.5mn (34.7%) respectively.

- The average age is 29 in the country, with regional variations (lowest is 25.3 in Al Jawf region), while 63% of Saudis are under the age of 30.

- The largest non-Saudi population are from Bangladesh, India and Pakistan (all three with males accounting for more than 90% of the total).

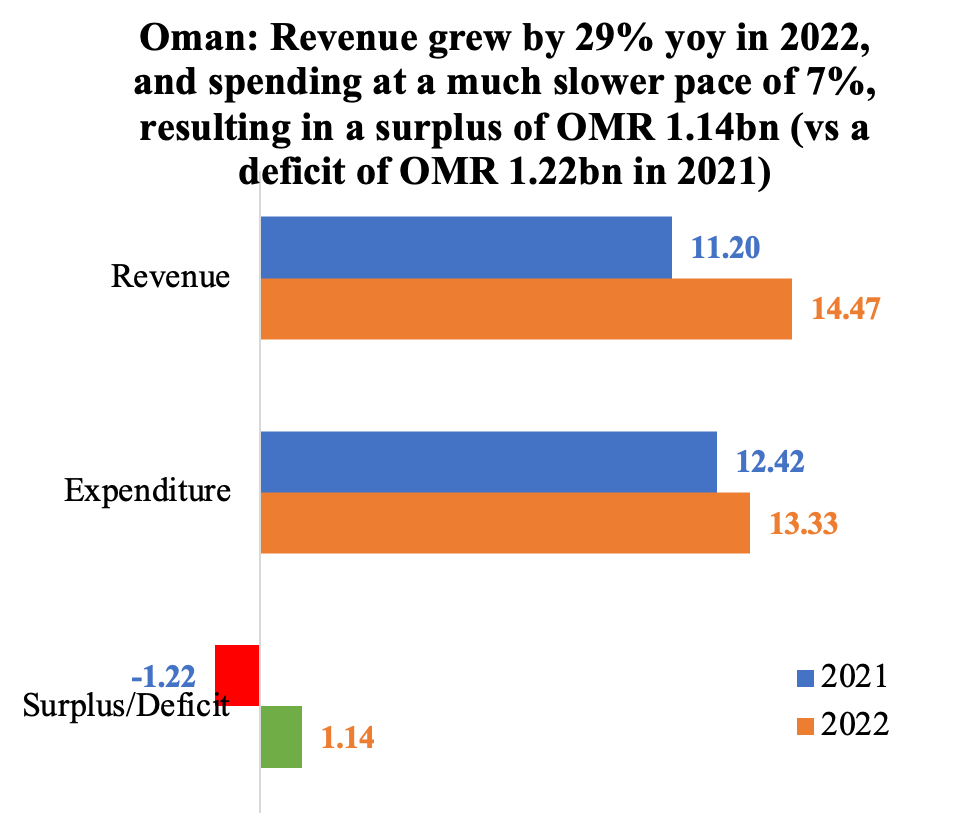

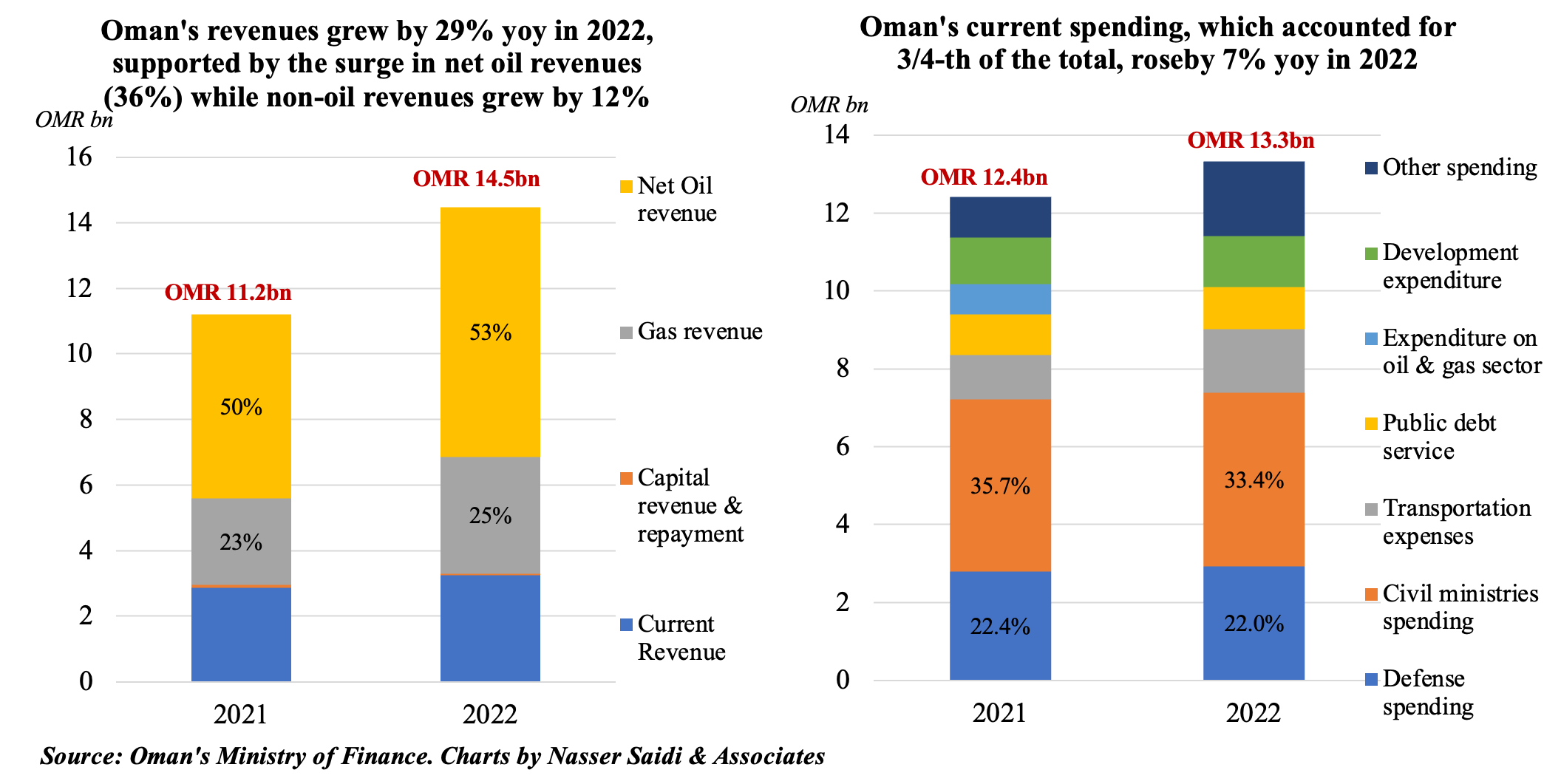

5. Oil revenues & restrained spending enable Oman to post a fiscal surplus in 2022

- Increased production (+10% yoy) and higher oil prices (+54% yoy to USD 94) alongside spending up by just 7% enabled Oman post a budget surplus of OMR 1.14bn in 2022 (2021: deficit OMR 1.22bn)

- Net oil and gas revenues, accounting for 78% of total revenue, supported the 29% uptick in revenues.

- Total expenditure was up by just 7% to OMR 13.33bn in 2022, with the largest share (75.7%) attributed to current spending (OMR 10.1bn). Development spending was up by 10% yoy to OMR 1.3bn.

- Public debt narrowed by 15% yoy to OMR 17.74bn (or 43% of GDP) in 2022; external loans at end-2022 stood at OMR 13.2bn.

Powered by: