Markets

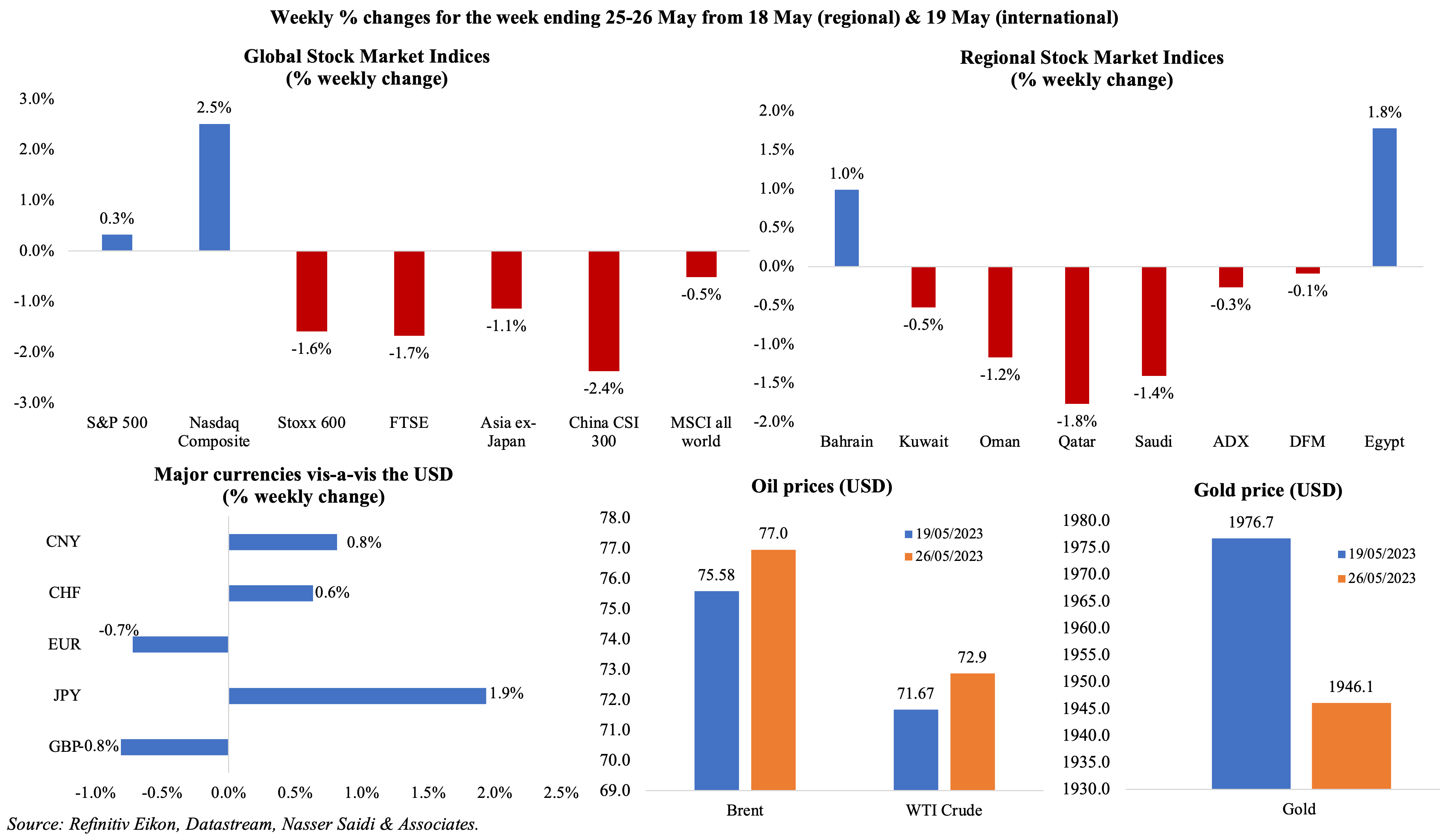

Equity markets in the US rose to a 9-month high on Fri, given strong economic data (e.g. durable goods orders, personal spending) and hopes of a deal raising the US debt ceiling. Stoxx touched an 8-week low and ended last week in the red. Chinese equities also declined, given lower-than-expected post-Covid recovery phase; Regional markets were mostly down. Among currencies, the dollar gained for the third week in a row, while Germany’s weak data (showing a technical recession) affected the euro; Turkey’s lira fell to 20 against the US dollar for the first time (with Erdogan cruising into victory during the second-round of voting). Oil prices ended the week higher compared to a week ago amid mixed messages from OPEC+ nations regarding supply while gold price edged lower.

Global Developments

US/Americas:

- The US President and the Republican House Speaker agreed in principle to a deal that would raise the US debt ceiling. Details of the deal have not yet been disclosed, but reports indicate that non-defence government spending would be kept flat for two years, and then up 1% in 2025.

- US Q1 GDP growth was revised up to a 1.3% annualised rate, from the previously reported 1.1% gain (Q4: 2.6%), thanks to upward revisions to investment, government spending as well as exports. In yoy terms, GDP was down by 6% yoy, the largest drop since Q2 2020.

- Personal income grew by 0.4% mom in Apr (Mar: 0.3%). Personal spending was up by a strong 0.8%, supported by higher wages (+0.5%) as spending on goods rebounded by 1.1% (after 2 consecutive months of declines) and services by 0.7%. Core PCE rose by 0.4% mom and 4.7% yoy in Apr (Mar: 0.3% and 4.6%).

- Fed officials are leaning towards less aggressive stance with respect to rates: the FOMC minutes record that ““Many participants focused on the need to retain optionality after this meeting”.

- Durable goods orders in the US grew by 1.1% in Apr (Mar: 3.3%), largely due to the sharp increase in orders for defence aircraft. Non-defence capital goods orders rebounded in Apr, up by 1.4% (Mar: -0.6%).

- US goods trade deficit widened to USD 96.8bn in Apr (Mar: USD 86.6bn), as imports rose by 1.8% (driven by imports of motor vehicles and consumer goods) while exports fell by 5.5%.

- S&P Global manufacturing PMI in the US eased to 48.5 in May (Apr: 50.2), as a result of weak demand and lower new orders while input prices fell for the first time since May 2020. Services PMI increased to a 13-month high of 55.1 (from 53.6), with new export orders up for the first time in a year, and the composite PMI reading up to 54.5 (Apr: 53.4).

- New home sales in the US increased by 4.1% mom to 683k in Apr, the highest since Mar 2022. Pending home sales was unchanged in Apr from the previous month and down by 20.3% in yoy terms.

- Richmond Fed manufacturing Index plunged to -15 in May (Apr: -10), given declines in both shipments (to -13 from -7) and new orders declined further (to -29 from -20). Kansas Fed manufacturing activity rose to -2 in May (Apr: -21), thanks to gains in both durable and non-durable goods. The future composite index was modestly positive, at 2.

- Michigan consumer sentiment index was revised up to 59.2 in May (preliminary estimate of 57.7 and Apr’s 63.5): it was still the lowest in 6 months. Year-ahead inflation expectations receded to 4.2% in May after increasing to 4.6% in Apr.

- Initial jobless claims increased by 4k to a seasonally adjusted 229k in the week ended May 19th, with the 4-week average remaining unchanged at 231.75k. Continuing jobless claims slipped by 5k to 1.794mn in the week ended May 12th.

Europe:

- Eurozone’s HCOB manufacturing PMI declined to 44.6 in May (Apr: 45.8), the sharpest fall in 3 years, given faster declined in output and new orders. Input prices however fell the most since Feb 2016. Services PMI also slipped, to 55.9from Mar’s 12-month high of 56.2: though new orders rose for the 5th month in a row, wages and salaries kept prices high.

- GDP in Germany was revised down to a contraction of 0.3% qoq and 0.5% yoy in Q1 (Q4: -0.1% yoy). Final consumption expenditure fell by 1.2% qoq while government spending was lower by 4.9%.

- Ifo business climate in Germany fell to 91.7 in May (Arp: 93.4). The current assessment and expectations also declined to 94.8 and 88.6 respectively (from 95.1 and 91.7).

- HCOB manufacturing PMI in Germany fell to 42.9 in May (Apr: 44.5), the sharpest drop since May 2020, as output fell below-50 and new orders declined. Services PMI increased to 57.8 from 56: job creation was the weakest in 27 months while input prices slowed to a 2-year low. Composite PMI gained due to the services sector uptick, rising to 54.3 from 54.2.

- GfK consumer confidence index in Germany inched up to -24.2 in Jun (May: -25.8), rising for the 8th consecutive time. Income expectations rose to -8.2 (May: -10.7), supporting the uptick in sentiment.

- Inflation in the UK eased to 8.7% in Apr (Mar: 10.1%), with food and drink prices cooled slightly (to 19.1% from Mar’s 19.2%). Core inflation increased to 6.8%, a new 31-year high, from 6.2% the month prior. PPI, both input and output prices, slowed to 3.9% (the lowest in more than 2 years and from Mar’s 7.3%) and 5.4% (the smallest increase since Jul 2021, from Mar’s 8.5%) respectively.

- UK’s preliminary manufacturing PMI edged down to 46.9 in May (Apr: 47.8), with output declining for a 3rd month, while new orders fell and input costs declined. Services and composite PMI slipped by 0.8 and 1.0 point to 55.1 and 53.9 respectively.

- Retail sales in the UK rebounded in Apr, rising by 0.5% mom following Mar’s 1.2% fall, thanks to upticks in both food and non-food stores sales (0.7% and 1% mom respectively). Excluding fuel, retail sales rebounded by 0.8% mom (Mar: -1.4%).

Asia Pacific:

- China’s PBoC left rates unchanged: the one-year loan prime rate (LPR) stood at 3.65% and the 5-year LPR was 4.3%. The last time both LPRs was lowered was in Aug 2022.

- Preliminary reading of the Jibun bank manufacturing PMI inched up to an 8-month high of 50.8 in May (Apr: 49.5): it was the first expansion since Oct 2022, with new orders and output posting readings of 50+ for the first time since Jun 2022.

- Inflation in Tokyo slowed to 3.2% in May (Apr: 3.5%), staying higher than the BoJ’s target for a 12th consecutive month. Excluding food and energy, prices were up to 3.9% (Apr: 3.8%), the highest since Apr 1982. Excluding fresh foods, prices eased to 3.2% (Apr: 3.5%).

- Japan’s leading economic index inched up by 0.2 point (from the preliminary reading) to 97.7 in Mar. Coincident index moved up to a 3-month high of 98.8.

- Bank of Korea left policy rates unchanged for the third consecutive time, given signs of growth slowdown amid sticky core inflation readings.

- Singapore GDP contracted by 0.4% qoq in Q1, reversing a 0.1% growth in the previous quarter; in yoy, growth was up by 0.4% in Q1. The trade ministry forecasts GDP to range between 0.5%-2.5% this year.

- Inflation in Singapore edged up slightly to 5.7% in Apr (Mar: 5.5%), with private transport and recreation costs up by 8.6% and 7.6% (Mar: 6.2% and 6.8% respectively). Core inflation was unchanged at 5%, the lowest since Jul 2022.

- Industrial production in Singapore declined by 1.9% mom and 6.9% yoy in Apr. In yoy terms, production declined for the 7th consecutive month, with the volatile biomedical manufacturing output plunging by 11.1%.

Bottom line: Preliminary PMI data for major economies point to resilience, with services sector supporting the composite PMI readings. While input prices have fallen to multi-year lows, thanks to improvements in supply chains and lower energy prices, on the services side wages and salaries are still rising leading to sticky inflation. The talk of last week however was the surge in AI chipmaker Nvidia’s shares on bullish forecasts: AI for sure is the current flavour of the month, with chip and AI stocks rallying alongside Nvidia.

Regional Developments

- Egypt will introduce new taxes next week, on items including entertainment (5% tax on cinemas airing foreign films), foreign travel (EGP 100 + charges on duty free purchases), luxury food items (10% customs tax) and leisure activities (20% tax on scuba diving) among others, after having received Parliamentary approval yesterday. The taxes are expected to add USD 5bn annually to the treasury.

- Exports from Egypt to the US fell by around 8% yoy to USD 2.3bn in 2022: ready-made clothing was the largest export item, accounting for 57.9% of the total, and it grew by 10.5% to USD 1.3bn.

- Iraq launched a USD 17bn the Development Road project to connect the Grand Faw Port (a major commodities port on its southern coast) by rail and roads to the border with Turkey. This will shorten travel time between Asia and Europe, and if completed (by 2029, if work starts early next year) could potentially transform the country post-war.

- Saudi Arabia plans to invest and develop Iraq’s Akkas gas field, revealed the Iraqi oil minister. The gas field could produce more than 400mn cubic feet of gas per day.

- An electricity grid interconnection between Jordan and Iraq will begin supplies to Iraq on July 1st: the initial capacity will be 50 megawatts.

- Kuwait’s June 6th legislative elections will go ahead, after the Constitutional Court upheld the March ruling that the Sep 2022 election was void.

- Lebanon is likely to be placed on a “grey list” of countries, following a preliminary evaluation undertaken by the MENA section of the Financial Action Task Force (FATF). Reuters reported that Lebanon was scored as only partially compliant in several categories, including anti-money laundering measures, transparency on beneficial ownership of firms and mutual legal assistance in asset freezing and confiscation. The report will be published in June.

- Inflation in Oman eased to 1.1% yoy in Apr, the lowest reading since Mar 2021, as food inflation fell to a 19-month low of 2.7% (Mar: 4.1%).

- Oman posted a budget surplus of OMR 1.144bn (USD 2.97bn) as of end-2022: revenues surged by 37% yoy to OMR 14.473bn while spending touched OMR 13.329bn.

- Oman’s Sultan is in Iran for a 2-day visit, with bilateral discussions ranging from industry to “defence and security affairs”.

- At the Qatar Economic Forum, Qatar’s PM disclosed that the non-oil sector grew by 9.9% in Q4 2022, while oil sector activity was up by a slower 4.8%.

- Budget surplus in Qatar amounted to QAR 19bn (USD 5.2bn) in Q1 2023, revealed the finance minister. Furthermore, the surplus would be used to “pay public debt, support the reserves of the Qatar Central Bank, and strengthen the assets of the Qatar Investment Authority”.

- Qatar’s trade surplus stood at QAR 22bn (USD 6bn) in Apr: this is a 3.5% mom increase but a 35.6% drop from Apr 2022. Qatar’s oil and gas exports fell by 33.2% yoy to QAR 18.6bn while imports also slipped by 6.3% yoy to an estimated QAR 8.7bn. China and South Korea accounted for 18.3% and 16.6% of the total exports.

- Qatar Investment Authority committed up to QAR 1bn (USD 275mn) towards a permanent market-making programme on the Qatar Exchange, to support liquidity and attract more foreign asset managers to invest. It will be applicable over the next 5 years and will cover 90% of the listed market cap size. Separately, the CEO committed to investing GBP 10bn (USD 12.4bn) in the UK through 2027.

Saudi Arabia Focus

- Saudi Arabia’s development goals will continue beyond 2030, according to the finance minister, while commenting on the Vision 2030 initiative. He referred to the long-term infrastructure development plans, also highlighting that the wider region (not just the GCC) would reap benefits.

- Merchandise exports from Saudi Arabia increased by 4.4% mom to SAR 106.1bn (USD 28.29bn) in Mar. In yoy terms, exports fell by 25.3%, largely due to the decline in oil exports (-26.5% to SAR 83.1bn) while non-oil exports also dipped by 21% yoy (to SAR 23bn). China (17.1% of the total), Japan and India were top export destinations while imports were from China (19% of the total), US and the UAE.

- Point of sale transactions in Saudi Arabia fell for the second week in a row (for the week ending May 20th), down by 7.3% to SAR 10.1bn. Sixteen of the 17 sectors posted weekly declines (only jewellery ticked up by 0.1%), of which food and beverage sector posted the biggest drop (-8% to SAR 136.17mn).

- Riyadh municipality has launched more than 40 investment initiatives in Q2 2023, covering various sectors including industries and sports.

- Saudi Arabia and Iraq signed multiple agreements to boost economic cooperation: deals were signed to develop a special economic zone and to increase bilateral trade (which stands at USD 1.5bn in 2022). Saudi Arabia’s investment minister disclosed that USD 1bn had been allocated for reconstruction projects in Iraq and USD 500mn to support bilateral trade. Saudi PIF created a USD 3bn investment unit for Iraq, looking for funding opportunities in infrastructure, mining, agriculture, real estate and financial services among others.

- The number of subsidized real estate financing contracts in Saudi Arabia exceeds 724,000 (worth SAR 429bn) in the period starting Q1 2017 till Q1 2023, according to the CEO of the Real Estate Development Fund.

- Saudi Arabia’s NEOM Green Hydrogen Company achieved financial closure on a green hydrogen production facility at a total investment value of USD 8.4bn. The mega plant is expected to integrate up to 4 gigawatts of solar and wind energy to produce up to 1.2 million tons of green ammonia.

- Passenger traffic into Saudi Arabia surged by 42% yoy to 35.8mn in Jan-Apr 2023, and compares to the 33.7mn recorded in Q1 2019. Domestic passengers were up by 6.7% to 16.3mn in the same period while international traffic jumped by 95.5% to 19.5mn.

- Saudi Arabia signed an agreement with Azerbaijan to increase cooperation, with focus on various fields including petroleum, petrochemicals, gas, electricity, and renewables. The agreement also aims to promote the circular carbon economy concept to reduce emissions.

- Canada and Saudi Arabia agreed to restore full diplomatic ties and appoint new ambassadors. Saudi Arabia was the biggest export market in the region for Canada, with exports standing at USD 1.65bn in 2021 (more than 80% were transport equipment) while imports from Saudi (mostly oil and petrochemicals) were USD 2.4bn.

UAE Focus![]()

- The UAE and Malaysia have initiated discussions towards a bilateral Comprehensive Economic Partnership Agreement. Currently, the UAE is Malaysia’s 17th trade partner globally and the second in the Middle East; Malaysian investments in the UAE are at USD 150mn while UAE investments in Malaysia are USD 220mn, according to UAE’s trade minister.

- UAE’s Mubadala is set to acquire majority stake in Fortress Investment from SoftBank Group: while the financial terms are not public, the Fortress management will own a 30% stake in the company and Mubadala the rest.

- Abu Dhabi based firms have identified USD 2bn in investment opportunities in South Korea, according to a joint statement from Korea Development Bank and Mubadala Investment Co. This stems from the UAE pledge to invest up to USD 30bn in South Korea, that was made during the President’s visit to Abu Dhabi in Jan 2023.

- A report from CBRE stated that UAE’s property market posted double-digit growth in sales and rental rates in Q1 2023. Average property prices in Dubai rose by 12.8% yoy in Q1, versus 1.4% in Abu Dhabi while rental rates were easing (in Dubai it rose by 26.3% in Mar from Feb’s 27.7%). However, prime office properties in both Abu Dhabi and Dubai posted higher occupancy rates, resulting in growth rates of 19.1% and 20.2% respectively.

Media Review

The stark “de-risking” choice facing economies: El-Erian

https://www.ft.com/content/8f6afed5-1e74-4bad-bec2-fb3bb4e08a41

China-GCC FTA will be a game changer: Dr. Nasser Saidi & Aathira Prasad

https://www.agbi.com/opinion/nasser-saidi-china-gcc-fta-will-be-a-game-changer/

Russian gold shipments to the UAE, China and Turkey

https://www.reuters.com/markets/commodities/russian-gold-shipments-uae-china-turkey-2023-05-25/

Interview with the CEO of NEOM Green Hydrogen Co.: Arab News

https://www.arabnews.com/node/2308136/business-economy

Powered by: