Markets

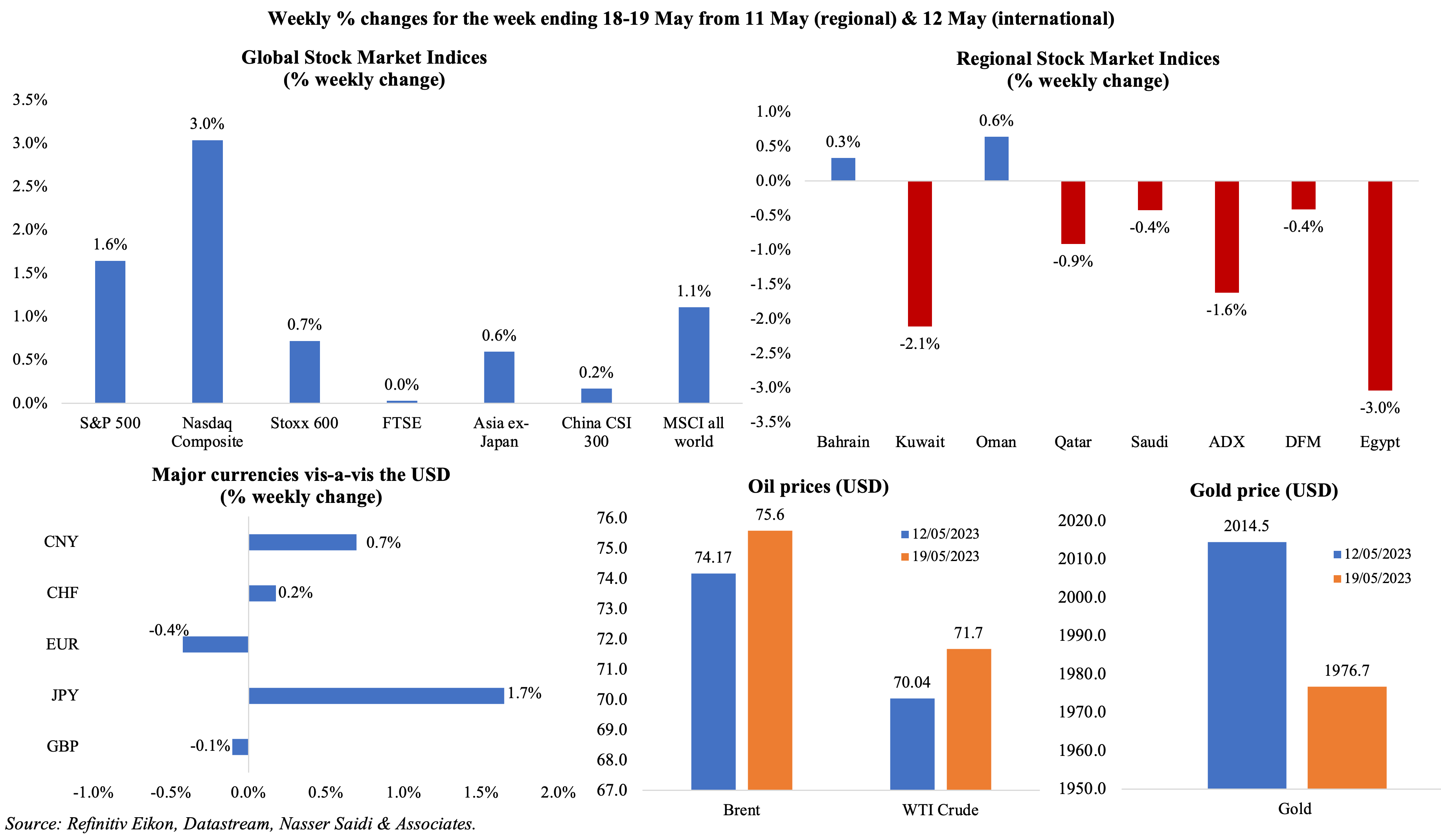

Equity markets were mostly up, thanks to strong data releases amidst a standstill in US debt ceiling negotiations; European shares also posted a weekly gain with the German DAX at a record high thanks to strong corporate earnings (markets had closed before reports of stalled debt ceiling discussions); Japan’s Topix index touched its highest point since Aug 1990. US regional banking worries might result in market jitters, given news that banks CEOs had been advised by Yellen that more mergers may be necessary. Regional markets were mostly down, given the volatile energy market. Among currencies, the JPY strengthened while the CNY went past 7.00 for the first time this year as the latest spate of macro data failed to show ongoing recovery pace. Oil prices ended higher compared to a week ago; gold price dropped below USD 2000 an ounce.

Global Developments

US/Americas:

- Industrial production in the US grew by 0.5% mom in Apr (Mar: 0%), with rebounds in manufacturing (+1% mom following 0.8% drop in Mar) and mining output (+0.6% from -1.3%). The jump in manufacturing was supported by the increase in motor vehicles and parts (+9.3% following a 1.9% dip). Capacity utilisation inched up to 79.7% from 79.4%.

- Retail sales in the US rebounded in Apr, rising 0.4% mom following Mar’s 0.7% drop, with sales at auto dealers up by 0.4% alongside sales at food services places and online sales up by 0.6% and 1.2% respectively. Core retail sales rebounded by 0.7% mom (Mar: -0.4%).

- The New York Empire State manufacturing index plunged to -31.8 in May (Apr: 10.8), dragged down by new orders and shipments both recording negative readings after surging in Apr. Capital spending also slowed, with the reading at 0.9, the lowest in 3 years.

- Philadelphia Fed manufacturing survey improved to -10.4 in May (Apr: -31.3), with new orders and shipments rising from Apr (though remaining negative). Firms’ future outlook remained bleak (-10.3 from Apr’s -1.5), with ~37% expecting a decline in activity in 6 months.

- Building permits in the US declined by 1.5% mom to 1.416mn in Apr though permits for single-family building permits jumped to a 7-month high (+3.1% to 855k units). Housing starts grew by 2.2% mom to 1.401mn in Apr, supported by both single- and multi-family homebuilding. The number of houses approved for construction that are yet to be started fell 1.0% to 290k units, the lowest level since Jun 2022.

- Existing home sales fell by 3.4% mom to 4.28mn in Apr, with buyers affected by high prices and fluctuating mortgage rates. The median existing-home price for all housing types declined by 1.7% yoy to USD 388,800.

- Initial jobless claims dropped by 22k to a seasonally adjusted 242k in the week ended May 12th, the largest drop since late Nov 2021, and the 4-week average inched lower by 1k to 244.25k. Continuing jobless claims slipped by 8k to 1.799mn in the week ended May 5th, the lowest since early Mar.

Europe:

- Inflation in the eurozone was confirmed at 7% in Apr (Mar: 6.9%) amid higher services and energy costs; in mom terms, the reading was revised lower to 0.6%.

- Industrial production in the eurozone weakened in Mar, dragged down by capital goods production (-15.4% mom and -2.1% yoy) and volatile numbers from Ireland (-26.3% mom and -26.1% yoy). IP declined by 4.1% mom and 1.4% yoy in Mar, with only durable consumer goods posting growth (+2.8% mom).

- Unadjusted trade surplus in the eurozone stood at EUR 25.6bn in Mar (vs EUR 20bn deficit in Q1 2022), given higher exports of machinery, vehicles and chemicals as energy imports fell. Imports from Russia fell by 72.1% yoy in Q1 2023, while trade deficit with China narrowed to EUR 74.7bn last quarter (Q1 2022: EUR 92bn).

- The ZEW indicator of economic sentiment for Germany worsened in May, posting the first negative reading since Dec 2022 (-10.7 from 4.1 in Apr) while the current situation reading also fell (-34.8 from -32.5). In the eurozone, economic sentiment indicator fell to -9.4 from 6.4 in Apr while the situation indicator rose 2.7 points to -27.5.

- Germany’s wholesale price index dropped by 0.5% yoy in Apr, the first decline since Dec 2020. In mom terms, prices were down by 0.4%, reversing the 0.2% gain registered in Mar. Separately, producer price index eased to a 25-month low of 4.1% in Apr (Mar: 6.7%).

- Unemployment rate in the UK inched up to 3.9% in the 3 months to Mar; average earnings excluding bonus ticked up by 6.7% (3 months to Feb: 6.6%) while including bonus it was unchanged at 5.8%. The claimant count in the UK rose by 46.7k in Apr (Mar: 26.5k).

Asia Pacific:

- China’s industrial production grew by 5.6% yoy in Apr (Mar: 3.9%), posting the fastest rise since Sep 2022. Fixed asset investment increased 4.7% year-to-date (Q1: 5.1%) while retail sales rose by 18.4% (Mar: 10.6%), the fastest pace since Mar 2021.

- Japan’s Q1 GDP grew by 0.4% qoq (Q4: 0% qoq) and 1.6% on an annualised basis and. Personal consumption increased by 0.6% qoq, staying positive for the 4th consecutive quarter, while capital and public investment were up by 0.9% and 2.4% respectively. Exports fell by 4.2% (the first quarterly drop in 18 months) as did imports (-2.3%).

- Exports from Japan increased by 2.6% yoy, the weakest growth since Feb 2021, with exports to China and Asia down by 2.9% and 7.7% respectively. Imports fell by 2.3% in Apr, the first annual decline in 27 months, hence narrowing trade deficit to JPY 432.4bn.

- Inflation in Japan climbed in Apr: the headline inflation rose to 3.5% in Apr (Mar: 3.2%) while core inflation (excluding fresh food) moved up to 3.4% (Mar: 3.1%). Services inflation ticked up to 1.7% (Mar: 1.5%) while food prices were up 9.0% (Mar: 8.2%). Excluding both fresh food and energy, prices rose to 4.1% (Mar: 3.8%) – the fastest pace since Sep 1981. Separately, producer price index eased to 5.8% in Apr (Mar: 7.4%), lowest since Aug 2021.

- Industrial production in Japan gained by 1.1% in Mar following the preliminary reading of 0.8% (Feb: +4.6%), supported by increases in production of motor vehicles (+5.2%) and production machinery (5.8%) among others.

- Wholesale price inflation in India declined by 0.92% yoy in Apr (Mar: +1.34%), falling for the first time in almost 3 years. Food and fuel & power indices were up by a marginal 0.17% and 0.93% respectively.

- India’s trade deficit narrowed to a 20-month low of USD 15.24bn in Apr (Mar: USD 19.73bn): exports fell for the 3rd consecutive month (-12.7% to USD 34.66bn) given weaker demand and imports were down by 14% (largely given fall in commodity prices).

Bottom line: With the debt-ceiling negotiations in the limelight once again, it puts the US on the brink of a sovereign default (on its USD 31.4trn debt as soon as June 1). Alongside these discussions, investors are also watching for signs of a potential Fed pause in June – last week, Powell sounded more dovish stating that the Fed would now make decisions “meeting by meeting”, and that officials “can afford to look at the data and the evolving outlook to make careful assessments” after a year of rate hikes. Separately, the IIF disclosed that global debt rose by USD 8.3trn in Q1 2023 to USD 304.9trn (the highest since Q1 2022, and USD 45trn higher than pre-pandemic levels). In emerging markets, total debt hit a record high USD 100.7trn or 250% of GDP (2019: USD 75trn). Any pause in rates would be a welcome relief to the emerging markets given the rising cost of servicing debt and liquidity worries.

Regional Developments

- The World Bank forecasts GCC GDP to grow by 2.5% and 3.2% in 2023 and 2024 (2022: 7.3%). While hydrocarbon GDP is estimated to contract by 1.3% in 2023, non-oil sector will grow by 4.6%, thanks to private consumption, fixed investments, and looser fiscal policy. Read the Gulf Economic Update report.

- Bahrain and Saudi Arabia reviewed cooperation efforts, discussing 13 initiatives of mutual interest across categories such as investment, environment, and infrastructure. The Saudi Minister of Investment revealed that the nation would allocate a specialised investment fund (of about USD 5bn) for Bahrain. Bilateral trade stood at USD 3.9bn in 2022: Saudi Arabia was the biggest destination for exports from Bahrain and the 7th largest source for imports. Saudi Arabia’s FDI stock in Bahrain touched USD 9.1bn last year, accounting for 26% of total FDI.

- Online government transactions in Bahrain surged by 16% to more than 940k in Q1 2023.

- Egypt’s central bank left interest rates unchanged: overnight lending rate at 19.25% and deposit rate at 18.25%. The apex bank expects real GDP to slow in 2022-23 and ease in international commodity prices.

- Unemployment rate in Egypt declined to 7.1% in Jan-Mar 2023, down by 0.1% from the previous quarter.

- fDi Insights 2023 report on global greenfield investment trends showed that the number of FDI projects in Egypt surged by over 150% to 148 in 2022, with an estimated capital investment of USD 107bn. There were 19 mega projects in green hydrogen, accounting for 97% of total inbound capital investment.

- The IMF lauded Jordan on “consistently” implementing sound macro, fiscal and monetary policy, but called for the acceleration of structural economic reforms to support job creation. Unemployment currently stands at a high 22.9% and the 2.6% growth forecast for this year is insufficient to improve standards of living.

- Kuwait’s trade surplus with Japan narrowed by 2.6% to JPY 79.9bn (USD 581mn) in Apr.

- Inflation in Kuwait inched lower to 3.69% in Apr (Mar: 3.7%), with costs of housing & utilities, transport and restaurants & hotels standing at 2.6%, 3.1% and 3.5% respectively. In mom terms, prices were up by 0.2%, slower than Mar’s 0.7% gain.

- Lebanon’s economy continued to contract in 2022, albeit at a slower pace, according to the World Bank. Real GDP is estimated to contract by 0.5% in 2023, after declining by 2.6% last year and a cumulative contraction of 37.2% during 2018-2021. Inflation this year is estimated to stand at 165%. The LBP has lost more than 98% of its pre-crisis value and along with the banking system crisis, this has resulted in a large, dollarized cash-based economy, worth an estimated USD 9.86bn or 45.7% of GDP in 2022. Read the full report here.

- Lebanon agreed with Iraq to secure more fuel supplies: the volume of heavy fuel oil supplied under an existing deal will be increased by 50% to 1.5mn metric tonnes this year. Furthermore, a commercial deal to provide 2 million metric tonnes of crude per year has also been agreed and includes a deferred payment mechanism for 6 months from the date of receipt.

- Following an Interpol notice issued for Lebanon’s central bank governor, the government is expected to discuss the issue at Monday’s cabinet meeting. The Deputy PM had called on the governor to step down from his post, and the interior minister stated that the notice would be implemented if the judiciary so instructed.

- Moody’s upgraded Oman’s issuer and long-term senior unsecured ratings to Ba2 from Ba3 with a positive outlook. The upgrade is largely due to the fiscal improvement, and the government using surpluses to pay down more than 15% of its outstanding debt.

- Inflation in Qatar eased to 3.68% in Apr (Mar: 4%), the lowest reading since Sep 2021 as prices eased in housing & utilities (7.7% from Mar’s 8.6%), clothing & footwear (2.5% from 4.9%) and education (1.6% from 2.6%) among others. Prices fell by 0.03% mom (Mar: 0.2%).

- Bloomberg reported that Qatar was considering a plan to boost stock market float i.e. increase trading in local stock, in a bid to attract investors and deepen markets.

- The Investment Promotion Agency Qatar, in its annual report, disclosed that the FDI ecosystem saw USD 29.78bn in capital expenditure, 135 FDI projects and creation of 13,972 new jobs in 2022. The value of projects has surged almost 25 times and jobs doubled.

- Reuters reported that a royal decree had been issued to reorganise the Qatar Investment Authority (QIA) though no further details were provided.

- UAE topped the 2023 Index of Economic Freedom in the MENA region, with a score of 70.6 (out of 100), up 0.7 from the previous year. The nation is 24th highest of 184 nations, followed by Qatar and Bahrain ranked 36th and 68th respectively.

- Ultra-rich individuals in UAE grew by 18.1% yoy in 2022, the fastest growth globally, according to Knight Frank’s The Wealth Report. Saudi Arabia posted a 10.4% annual growth, and the Middle East saw an overall 16.9% surge, supported by investor-friendly reforms.

- A USD 5bn undersea liquefied natural gas (LNG) pipeline from the Gulf to India is being planned by the consortium South Asia Gas Enterprise. The project’s technical and feasibility studies have already been carried out and help is being sought from India’s Petroleum Ministry to develop the pipeline.

- The Arab Summit was held in Jeddah: the main highlight was Syria’s welcome back into the group following years of war, with the Saudi Crown Prince stating that the nation would “not allow our region to turn into a field of conflicts”.

Saudi Arabia Focus

- Inflation in Saudi Arabia remained unchanged at 2.7% yoy in Apr: food and beverage costs were up by only 1% while the largest increases were recorded in housing & utilities (+8.1%) and restaurants & hotels (6.2%). Overall rents were up by 9.6% and apartment rents surged by 22.2%.

- Bloomberg reported that Saudi Arabia is planning another Aramco stock offering on the Riyadh exchange. In late 2019, the company raised USD 25.6bn in the IPO.

- Saudi Arabia issued 27 new mining licenses in Mar (Feb: 18), bringing the total licenses issued to 2314.

- Total industrial factories in Saudi Arabia reached 10,910 in May, with investments of more than SAR 1.45trn and employment close to 700k, reported the Saudi Press Agency. Foreign and joint investments in Saudi Arabia’s industrial sector totalled more than SAR 542bn (or 37% of total investment in the sector) as of May 2023.

- The Ministry of Industry and Mineral Resources disclosed that in Q4 2022, Saudi Arabia had issued licenses to 248 industrial units and 150 factories with an investment volume of SAR 2.2bn (USD 59mn) had become operational.

- Saudi Arabia’s M3 money supply increased by 4.74% year-to-date to SAR 2.61bn (USD 696bn) in the week ending May 11th.

- A report issued by the Saudi Capital Market Authority (CMA) disclosed that more than 24 IPOs are lined up for the year 2023. By end-2023, the CMA plans to increase foreign investors’ ownership as percentage of total market value of free float shares to 16.5%, raise the size of debt instruments as a percentage of GDP to 20.1% and grow the percentage of assets under management to GDP to 27.4%.

- Total written premium in Saudi Arabia’s insurance sector grew by 26.9% yoy to SAR 53bn (USD 14.1bn) in 2022, reported SAMA. Net profit in the insurance sector after zakat and tax stood at SAR 689mn in 2022, versus a net loss of SAR 47mn in 2021.

- Saudi Arabia’s holdings of US Treasuries increased by USD 4.5bn to USD 116.2bn in Mar, staying the 17th largest holder of US debt. From the region, UAE and Kuwait holdings stood at USD 61.5bn (down by 3bn from Feb) and USD 39.3bn (+0.2bn) respectively. Foreign buying of US Treasuries rose to its highest level in more than two years in Mar, with the list topped by Japan (USD 1.087trn) and China (USD 869.3trn).

- Crude oil exports from Saudi Arabia increased by 68k barrels per day to 7.52mn bpd in Mar, according to a JODI report. Crude oil production was up 14k bpd to 10.46mn bpd.

- According to UN World Tourism Organisation, Saudi Arabia welcomed 16.6mn tourists in 2022 (2021: 3.5mn) while it was ranked 11th globally in international tourism receipts in 2022 (up 16 places since 2019). It was placed second globally in growth of passenger arrivals in Q1 2023: it was up 64% compared to Q1 2019.

- Duba Port, the primary seaport of entry to the northwest of Saudi Arabia, has been renamed as Port of NEOM. NEOM’s CEO disclosed that about SAR 7.5bn (USD 2bn) had been invested in the port till now, and its first advanced terminal would be opened in 2025.

UAE Focus![]()

- UAE money supply (M2) grew by 1.7% mom to AED 1.75trn in Feb while M3 edged up by 0.3% to AED 2.13trn. Gross bank assets rose by 2.2% to AED 3.75trn.

- Bank deposits in the UAE surged by 0.4% mom and 12.8% yoy to over AED 2.24trn in Feb, driven by the increase in non-resident deposits (+2% mom). Meanwhile, gross credit grew by 1.2% mom and 4.8% yoy to AED 1.9trn in Feb 2023, driven by the increase in domestic credit. In Feb, there was an increase in the pace of loans to the private sector: it rose by 2.8% mom and 7.2% yoy (faster than Jan’s 4.6% yoy & 2022’s average of 3.8% yoy).

- Inflation in Dubai eased to a 13-month low of 3.27% yoy in Apr (Mar: 4.32%), supported by easing of food costs (5.78% from 6.28%) as transport costs fell sharply (-8.53% from -1.2%). However, housing and utilities costs increased for the 11th straight month, rising to a record high of 5.44% (Mar: 5.27%).

- ADNOC aims to raise up to USD 607mn from the IPO of its logistics unit. About 1.1bn shares is being offered, equivalent to 15% of its issued share capital.

- Abu Dhabi’s Mubadala’s 2022 financial results show it having more than AED 1trn (USD 276bn) in assets under management while proceeds stood at AED 106bn. Its portfolio mix was revealed as 36% in direct and indirect private equity, 27% in public markets and 15% in real estate and infrastructure.

- Dubai Centre for Family Businesses has been set up by Dubai Chambers, to support the growth of family firms (especially transitions across generations). Plans are also underway to start a family business dispute centre to settle such case outside of the courts.

- UAE’s travel and tourism sector added more than 89k jobs in 2022 to reach a total of more than 751k, surpassing 2019 levels by an additional 6,000 jobs, according to the World Travel and Tourism Council’s report.International visitors spent AED 117.6bn (65.3% yoy but 19% below 2019 levels) while domestic spending was AED 46.9bn (10.6% higher than 2019). An estimated 7k more jobs will be created this year and visitors spending is forecast to rise by 56.8% yoy to AED 258bn.

- The Minister of Human Resources and Emiratisation disclosed that over 2mn persons had signed up for unemployment insurance in the country; this includes 40k Emiratis. He also disclosed that Emiratis working in the private sector grew by 11% to over 66k in Q1 2023.

- UAE announced a new support scheme for Emirati farm owners with limited income who are registered in a federal or local social welfare programme (to be rolled out in Jul): an annual electricity subsidy of AED 8400 will be allocated to each beneficiary and will be directly deducted from the electricity bill of the farm.

Media Review

Saudi minister: energy cooperation with Arab, OPEC+ countries integral to global oil markets

https://www.arabnews.com/node/2306211/business-economy

Henry Kissinger explains how to avoid world war three

https://www.economist.com/briefing/2023/05/17/henry-kissinger-explains-how-to-avoid-world-war-three

Europe, And the World, Should Use Green Subsidies Cooperatively

https://www.imf.org/en/Blogs/Articles/2023/05/11/europe-and-the-world-should-use-green-subsidies-cooperatively

Who wins from US debt default? China.

https://www.piie.com/blogs/realtime-economics/who-wins-us-debt-default-china

Arab League Summit 2023

https://www.ft.com/content/cab11131-824f-41ab-a20d-87db015c6b35

https://www.reuters.com/world/middle-east/then-now-how-arab-states-changed-course-syria-2023-05-19/

https://www.arabnews.com/node/2306821/middle-east

Powered by: