Supply chain pressures & food prices. GCC inflation. Middle East airlines performance & strong tourism recovery. UAE bank loans resurgence.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 19 May 2023: Will inflation play spoilsport to recovery in travel & tourism?

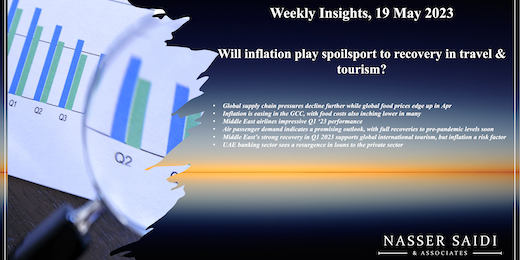

1. Global supply chain pressures decline further while global food prices edge up in Apr

- The Fed’s Global Supply Chain Pressures Index (GSCPI) readings slipped into negative from Feb 2023 onwards, and continued declining further (i.e. standard deviations are below index’s historical average) – implies global supply chain conditions have returned to “normal”. This April’s decline is largely due to the improvements in delivery times (especially in Europe), according to the Fed.

- Freight rates for oil tankers collapsed this month after the announcement of OPEC+ production cut: vessels carrying crude from the Middle East to China are earning just above USD 14k in early-May, down from USD 97k+ on Mar 20th. Short-term shipping costs have also fallen to pre-pandemic levels; shipping firms are also likely to face over capacity soon, as new vessels are delivered, leading to further decline in freight rates.

- If the Index remains below the historical average over a few months, it could lead to a decline in CPI; however, the pace will depend on the other drivers of inflation e.g. increases due to services costs or housing would be unaffected by supply chains.

- Meanwhile, UN’s food price index inched up in Apr, after declining for the last 12 months, driven by prices of sugar (+17.6% mom to the highest level since Oct 2011), meat and rice: however, it is still 21.7% lower compared to the March 2022 peak.

- From the recent earnings calls, many companies are more concerned about labour shortages and pressure on wages and prices than supply chain pressures; as mentioned earlier, ongoing hike in wages will contribute to stickier inflation & a rise in core inflation.

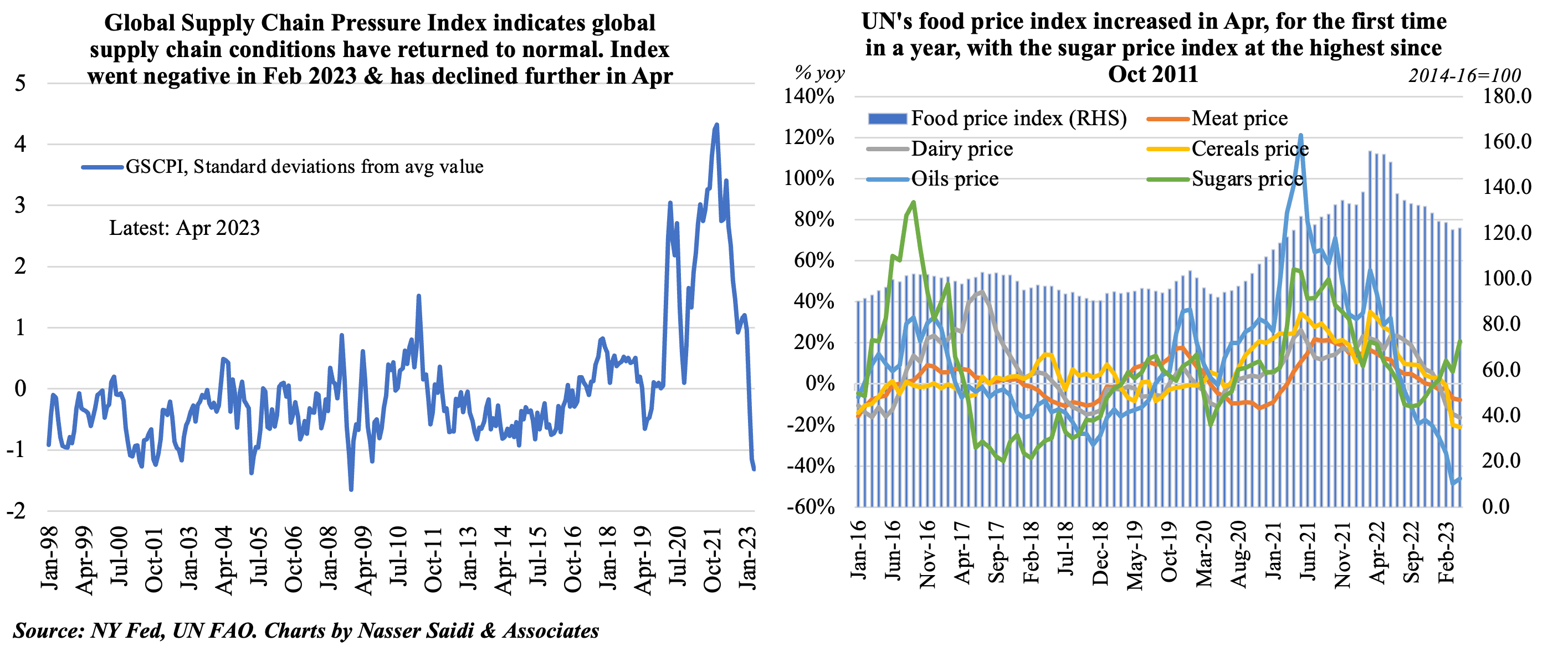

2. Inflation is easing in the GCC, with food costs also inching lower in many. Lebanon saw inflation hit 264% yoy in Mar, the highest on record. In many nations, services & housing costs are still on the rise

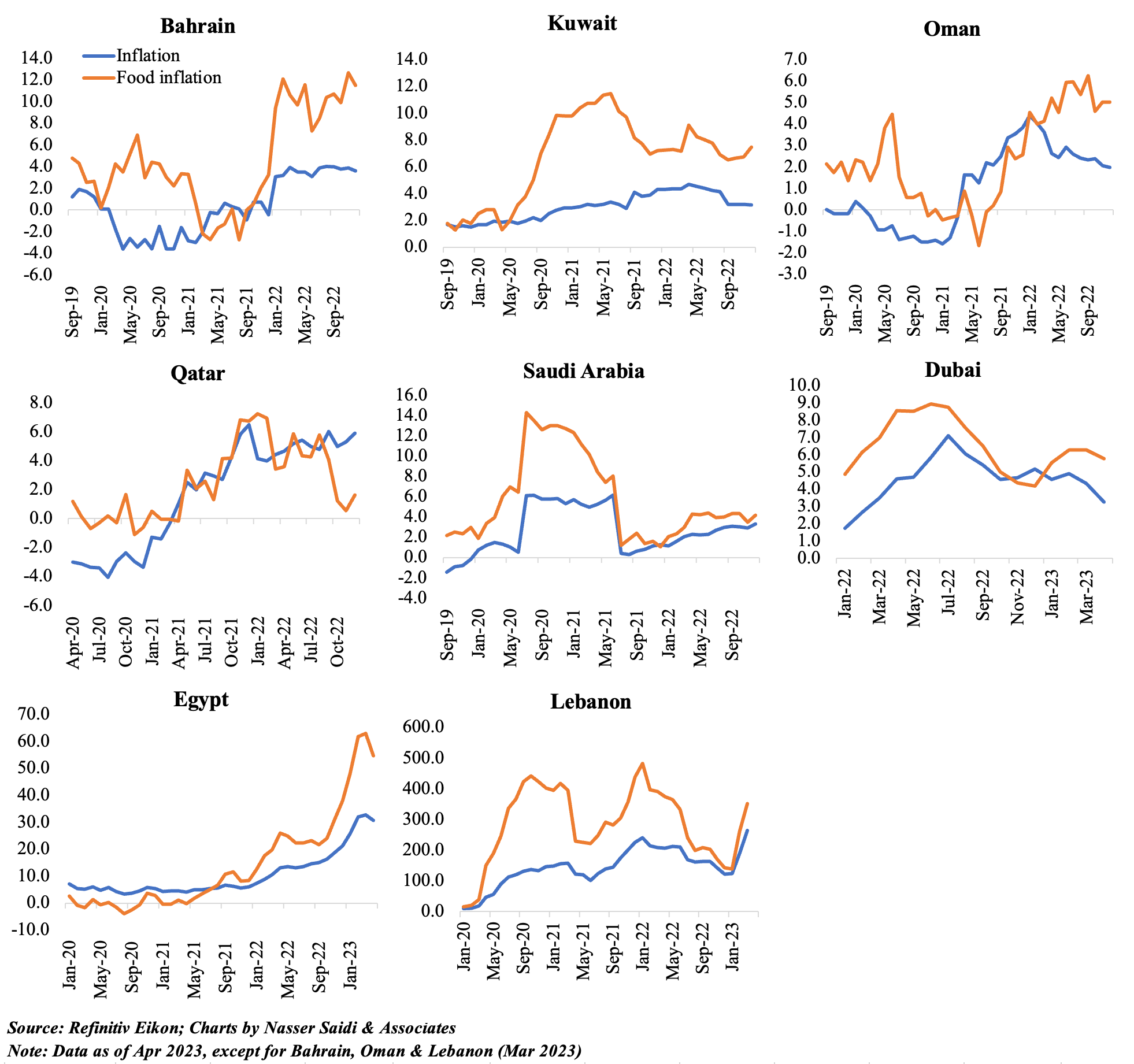

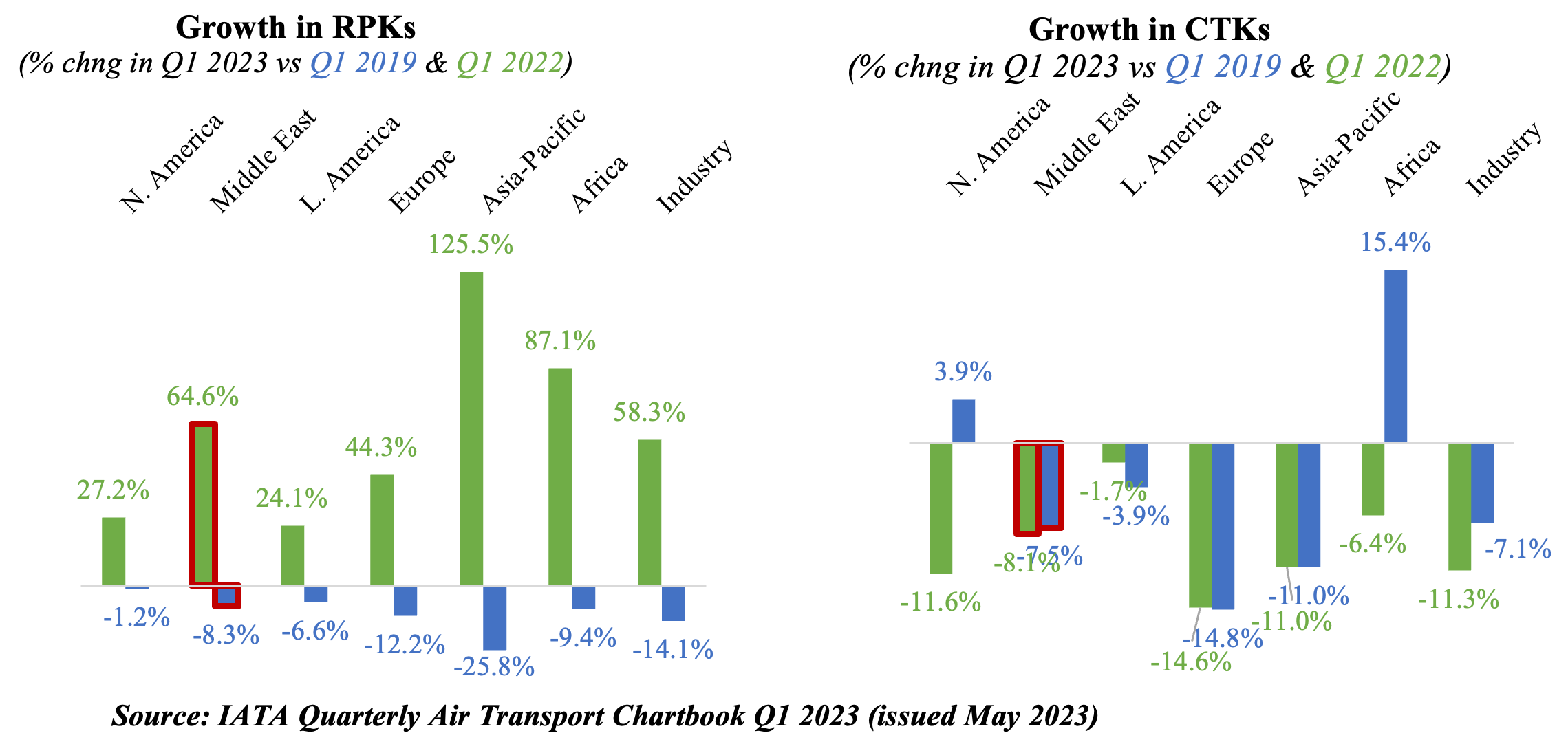

3. Middle East airlines post impressive Q1 ‘23 performance

- Passenger traffic in the Middle East grew by 64.6% yoy in Q1 & revenue passenger kilometres (RPKs) were within 8.3% of Q1 2019 levels.

- Most countries in the Middle East region rebounded: while Jordan, Qatar, Saudi Arabia, and UAE posted positive numbers (vs Q1 2019), Iran and Kuwait were lower (the former due to domestic conditions)

- The decline in cargo activity meanwhile is reflective of the global slowdown (as a result of weaker demand for goods). The region had seen volumes higher than pre-pandemic in 2021 but has since then declined.

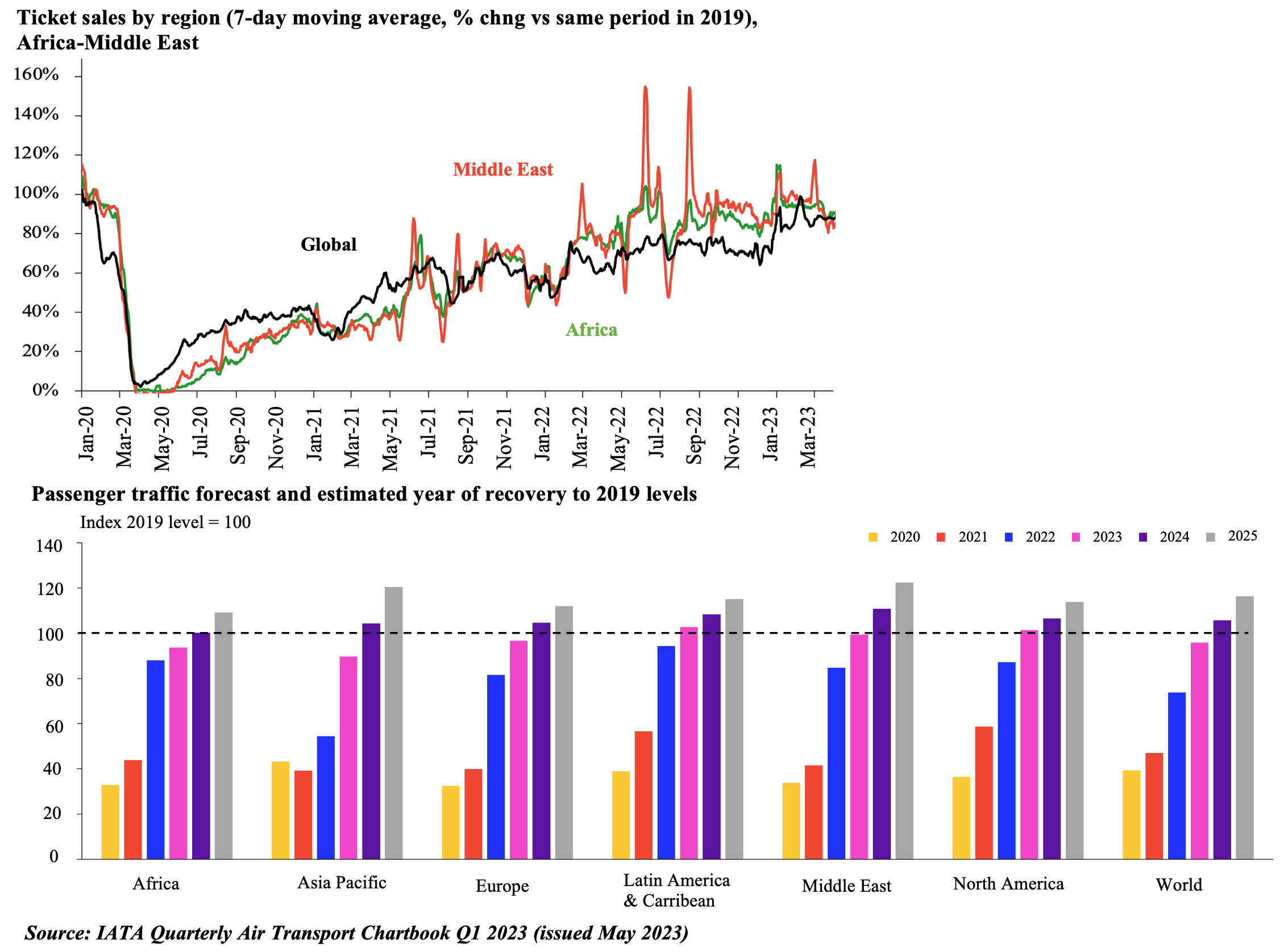

4. Air passenger demand indicates a promising outlook, with full recoveries to pre-pandemic levels soon

- Ticket sales in the Middle East has been consistently higher compared to the global average (which was above 80% of 2019 levels). Though the gap has been narrowing recently, the positive trend will work in the region’s favour ensuring sustained demand.

- This is also reflected in the passenger traffic forecast, wherein it is estimated that the Middle East will reach its 2019 levels by 2024 (in line with global forecasts).

- IATA estimates global air passenger traffic to grow at an average annual growth rate of 3.2% till 2040.

- There however are multiple risks to this outlook including higher energy prices (especially jet fuel), overall prices (that might deter international travel) and supply-side constraints in the air industry in addition to slowing growth globally.

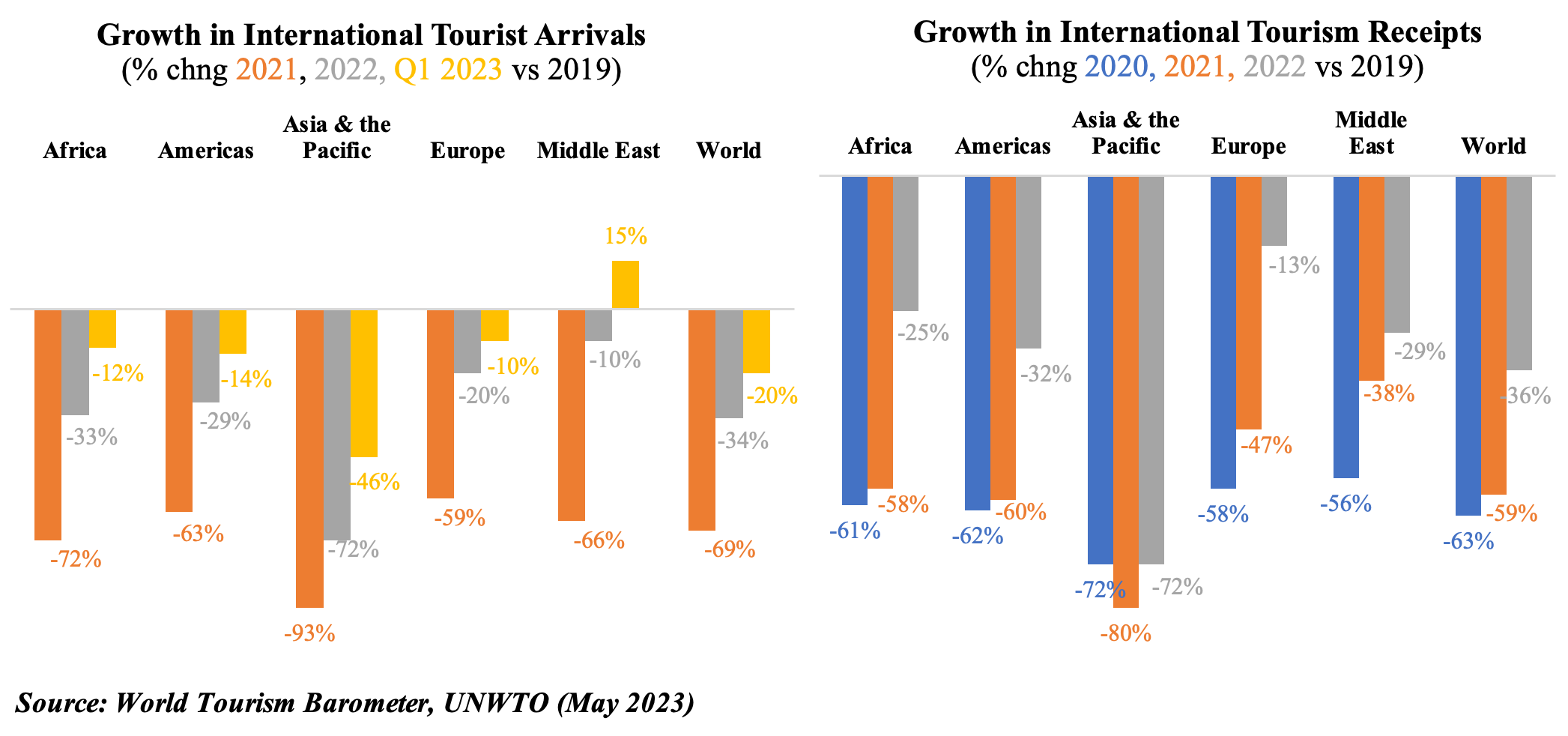

5. Middle East’s strong recovery in Q1 2023 supports global international tourism, but inflation is a risk factor

- The UNWTO reported in its latest World Tourism Barometer that an estimated 235mn tourists travelled internationally in Q1 2023. The Middle East stands out, being the only region to recover pre-pandemic levels in a full quarter; Europe and Africa are close behind, having reached 90% & 88% of pre-pandemic levels.

- Among the best performing destinations in Q1 2023 in terms of international tourist arrivals were Qatar (top, +98% vs 2019), Saudi Arabia (2nd, +64%) and Morocco (13th highest, +17%).

- International tourism receipts also recovered, up 50% yoy to over USD 1trn in 2022, and 64% of pre-pandemic levels. The opening up of China and anecdotal evidence of ticket sales during the May Day holiday suggests a sustained recovery.

- According to UNWTO panel of experts survey, the main factors weighing on recovery were economic environment (71% of experts mentioned this), higher transport & accommodation costs (62%) and Russia-Ukraine uncertainty (31%).

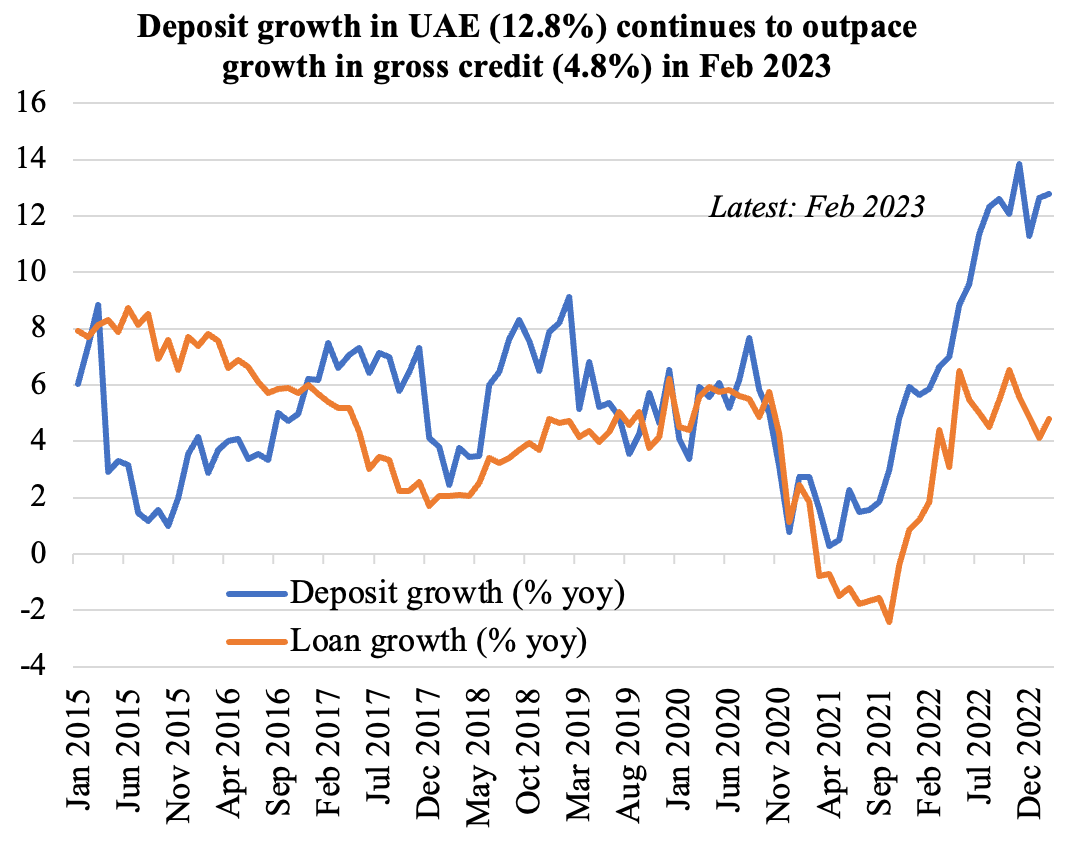

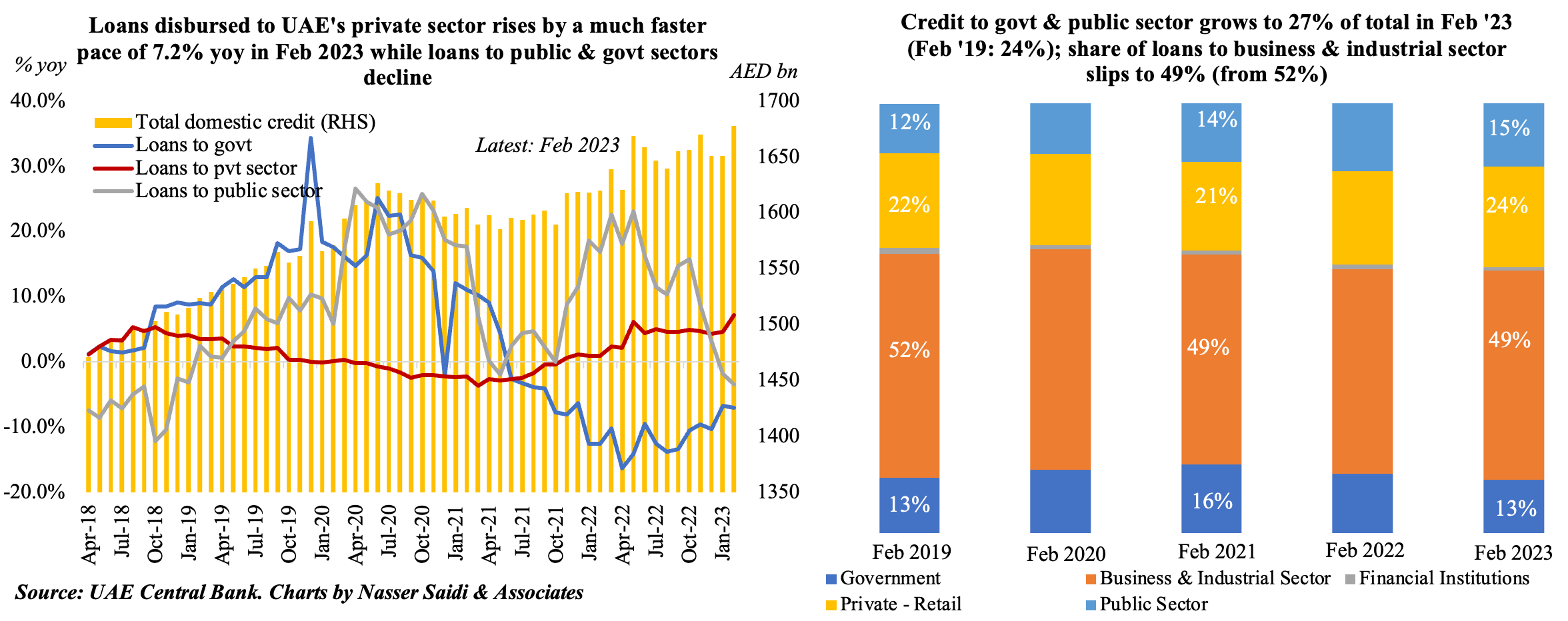

6. UAE banking sector sees a resurgence in loans to the private sector

- Bank deposits in the UAE surged by 0.4% mom and 12.8% yoy to over AED 2.24trn in Feb, driven by the increase in non-resident deposits (+2% mom). Meanwhile, gross credit grew by 1.2% mom and 4.8% yoy to AED 1.9trn in Feb 2023, driven by the increase in domestic credit.

- In Feb, there was an increase in the pace of loans to the private sector: it rose by 2.8% mom and 7.2% yoy (faster than Jan’s 4.6% yoy & 2022’s average of 3.8% yoy). Credit to both the public sector (GREs) and governments fell by 3.4% yoy and 7% respectively.

- Loans disbursed to UAE’s business & industrial sector accounts for just under 50% of total domestic credit in Feb 2023 (Feb 2019: 52%). Share of loans to GREs have edged up to 15% of the total (Feb 2019: 12%).

Powered by: