Saudi Arabia & Abu Dhabi GDP growth. Dubai PMI & tourism. Oman and Saudi fiscal balances. Surge in Middle East FDI projects.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 12 May 2023: GCC’s largest economies to benefit from non-oil sector output even as oil remains main revenue source

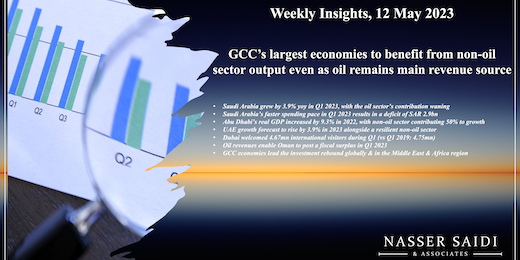

1. Saudi Arabia grew by 3.9% yoy in Q1 2023, aided by non-oil sector growth as oil sector contribution wanes

- Real GDP in Saudi Arabia grew by 3.9% in Q1 2023 according to initial estimates. Growth was significantly lower compared to the 5.4% in Q4 2022 and 10% in Q1 2022. This was largely due to the decline in oil sector growth (+1.3%) given the oil production cuts and lower oil prices. However, the non-oil sector GDP has remained resilient, rising by 5.8% in Q1 following a 6.2% uptick in Q4 2022. The strong project pipeline given mega and giga projects will support growth in the coming quarters (including via government activity, which grew by 4.9% in Q1 2023).

- Evidence of non-oil sector activity is also evident from manufacturing growth: in Q1, manufacturing grew by 15.5% though the overall industrial production index was dragged down by the dip in mining and quarrying activity (2.3% in Q1 2023 vs 21.2% in Q1 2022 and 7.3% in Q4 2022). If PMI is considered as a leading indicator, prospects are strong given that in Apr, new orders rose at the fastest rate since September 2014 supported by domestic demand.

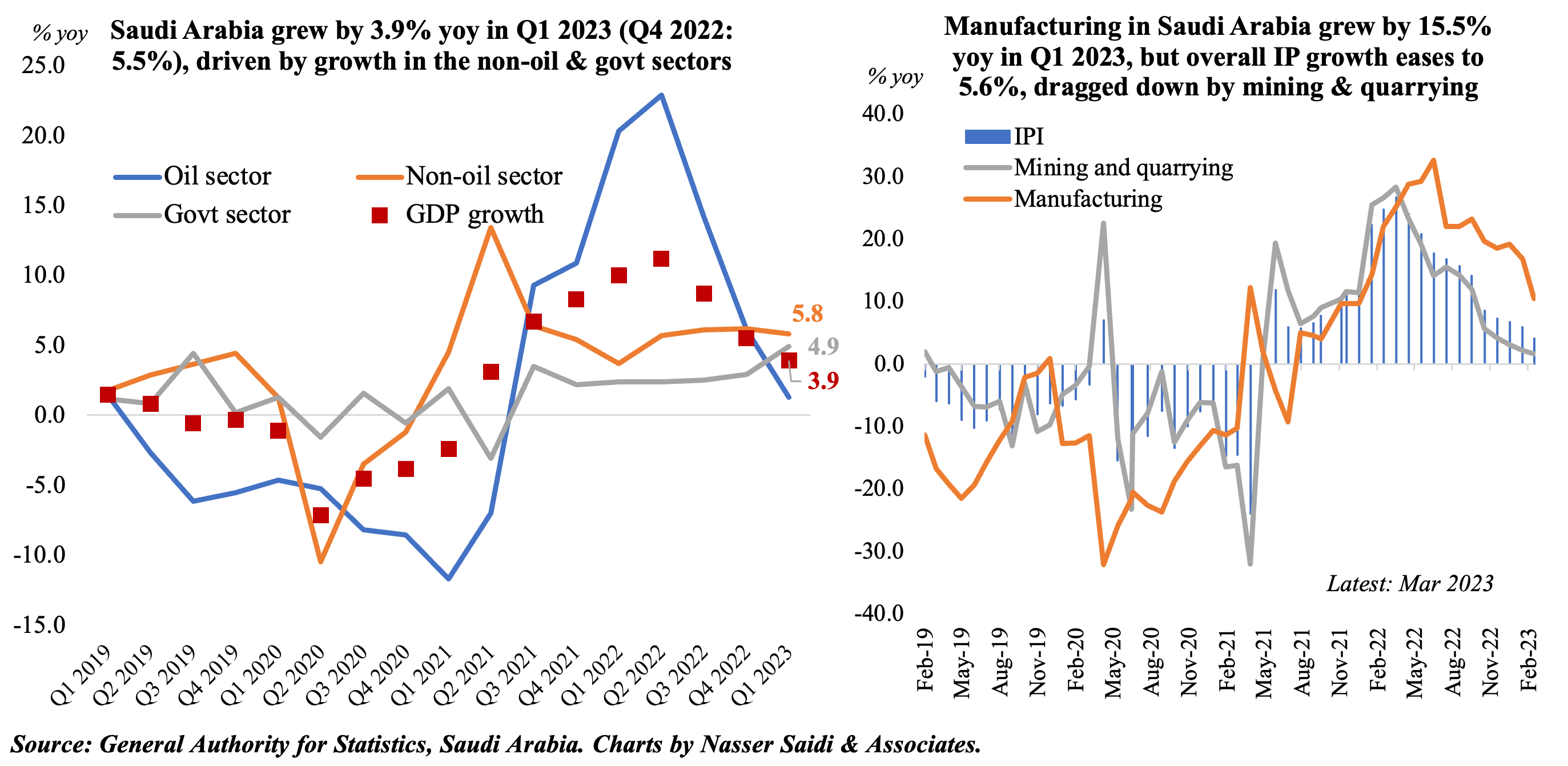

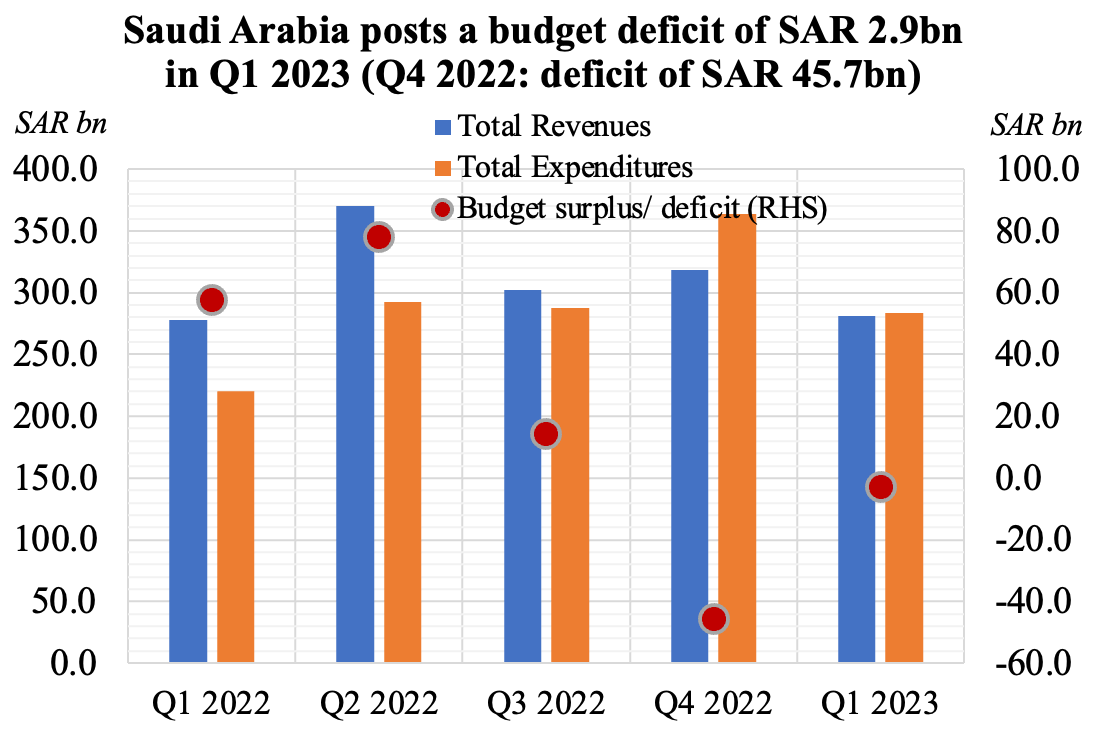

2. Saudi Arabia’s faster spending pace in Q1 2023 results in a deficit of SAR 2.9bn

- Saudi clocked in a 1% yoy uptick in total revenues (with non-oil revenues up by 9%) to SAR 280.9bn in Q1. Oil revenues fell by 3% while tax on goods & services (largest component within taxes) rose by 4% to SAR 63.1bn.

- Spending rose by a faster 29% in yoy terms, with all items other than compensation of employees reporting a double-digit increase. Compensation, which accounted for 47% of total spending, rose by 7% to SAR 134.07bn. Capex posted the largest increase, up by 75% to SAR 26bn.

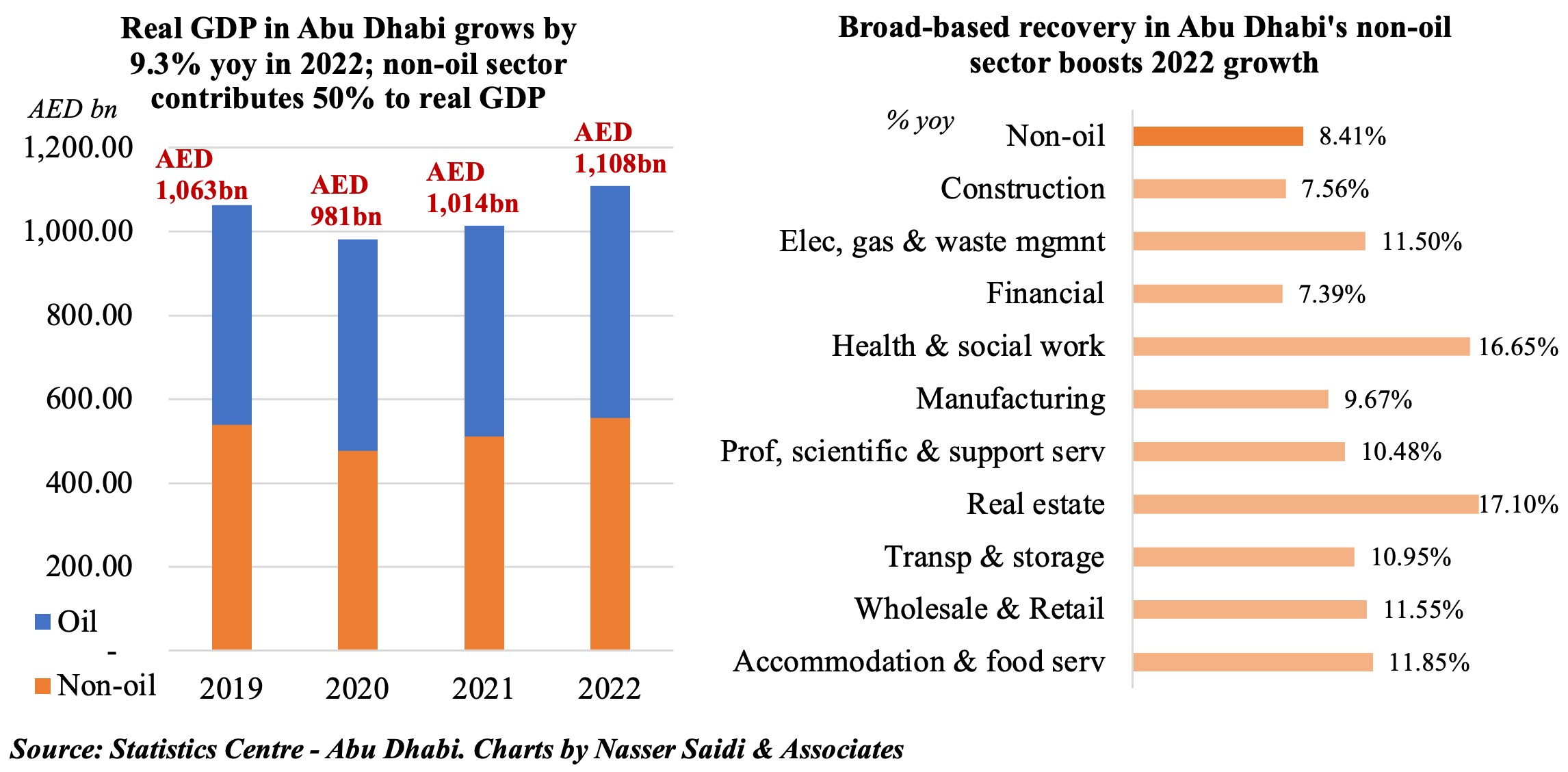

3. Abu Dhabi’s real GDP grows by 9.3% in 2022, with the non-oil sector contributing 50%

- Abu Dhabi’s economy grew by 9.3% in 2022 (2021: 7.2%), supported by growth in both oil (+10.2% vs 2021’s 0.2%drop) and non-oil sectors (8.4% vs 2021’s 7.2% uptick). The contribution of the non-oil sector highlights the success of its diversification efforts.

- Growth in manufacturing last year (+9.7% yoy) underscores the emirate’s Abu Dhabi Industrial Strategy which was launched in June last year. The sector also contributed 8.2% to overall GDP growth. Other fast-growing sectors which had a high contribution to growth included construction (7.6% yoy growth) and financial activities (7.4%). Covid-affected sectors posted double-digit growth, indicating a broad-based recovery: wholesale & retail trade (11.6%), accommodation (11.9%) and transport (10.95%) among others.

- The recent announcement of ADGM’s expansion plans, focus on new sectors (AI, clean energy etc) alongside the UAE’s plans to increase non-oil exports (given multiple trade agreements) and attract a high-skilled workforce is likely to support overall growth in the near-term.

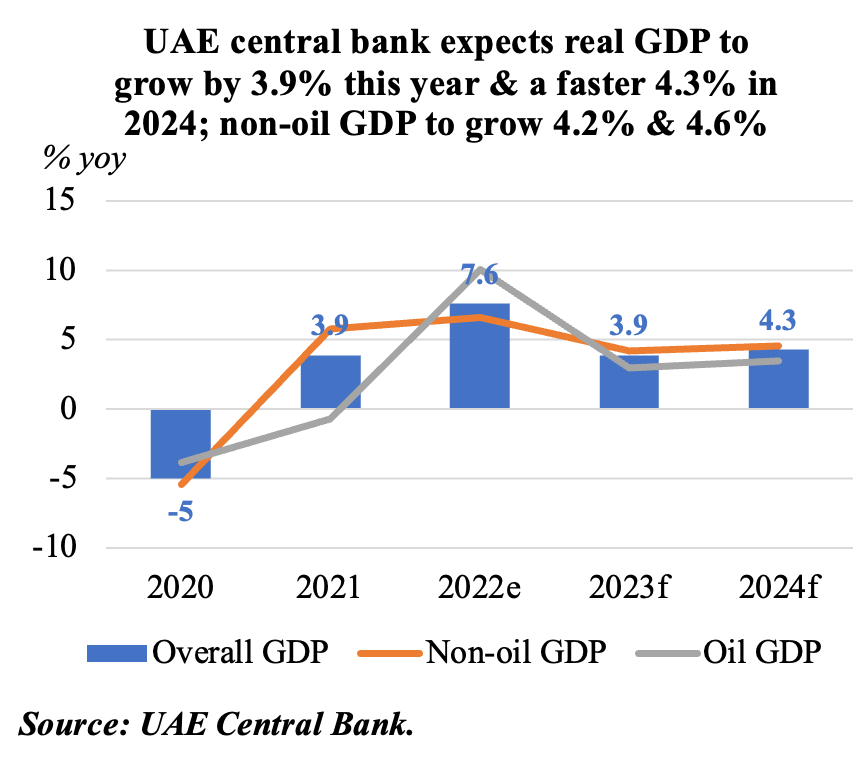

4. UAE estimated to grow by 3.9% in 2023, supported by non-oil sector

- UAE central bank, in its Annual Report 2022, forecasts GDP to grow by 3.9% and 4.3% in 2023 and 2024, slower than 2022’s 7.6% gain. OPEC+ production cuts are reflected in the sharp decline in oil GDP.

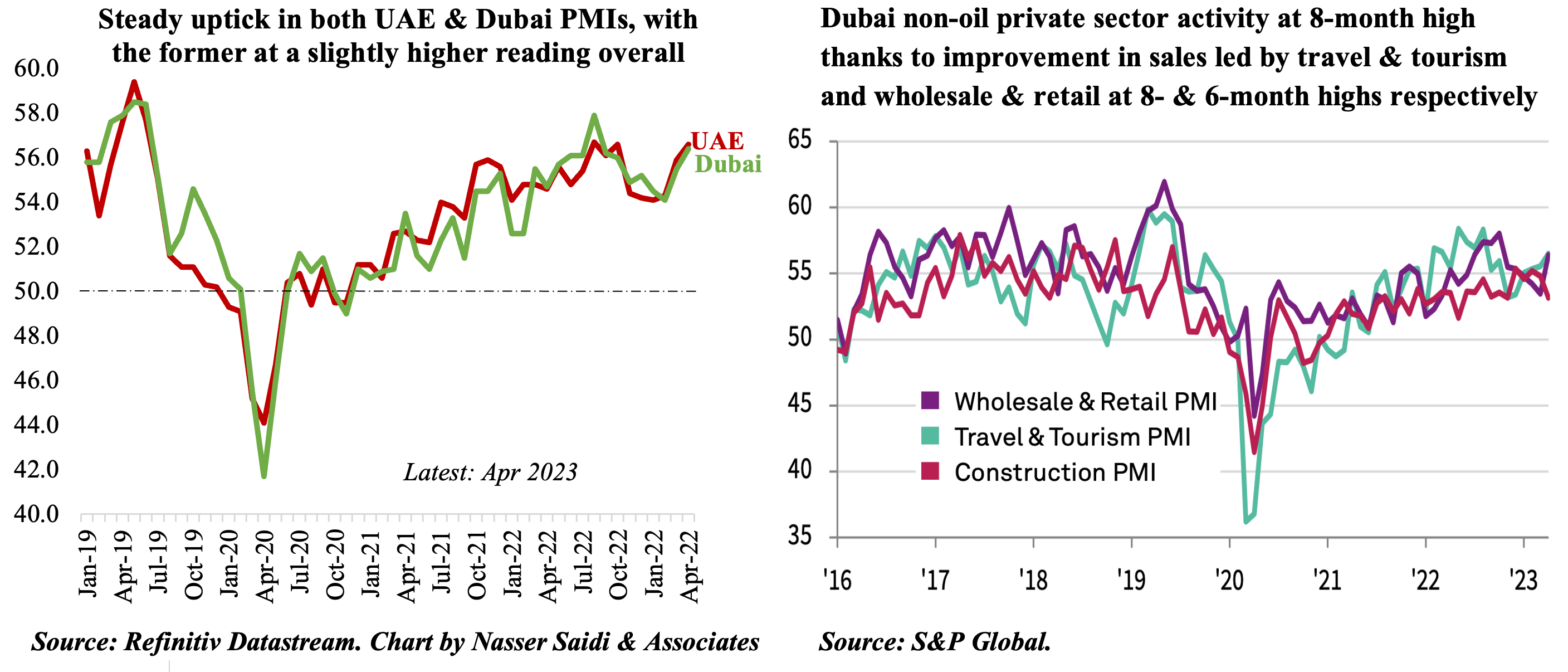

- Non-oil GDP is expected to remain resilient in 2023-24 (though lower than 2022’s estimated 6.6%): this is also evident in the PMI readings for this year. UAE and Dubai PMI averaged 55.2 and 55.1 respectively in Jan-Apr, both faster than in the same period a year ago.

- Latest Dubai PMI for Apr rose to an 8-month high, supported by new orders rising at the second-quickest rate in nearly four years. Travel & tourism sector gains rose to an 8-month high as well, with respondents also reporting a decline in costs (supporting sales in the future).

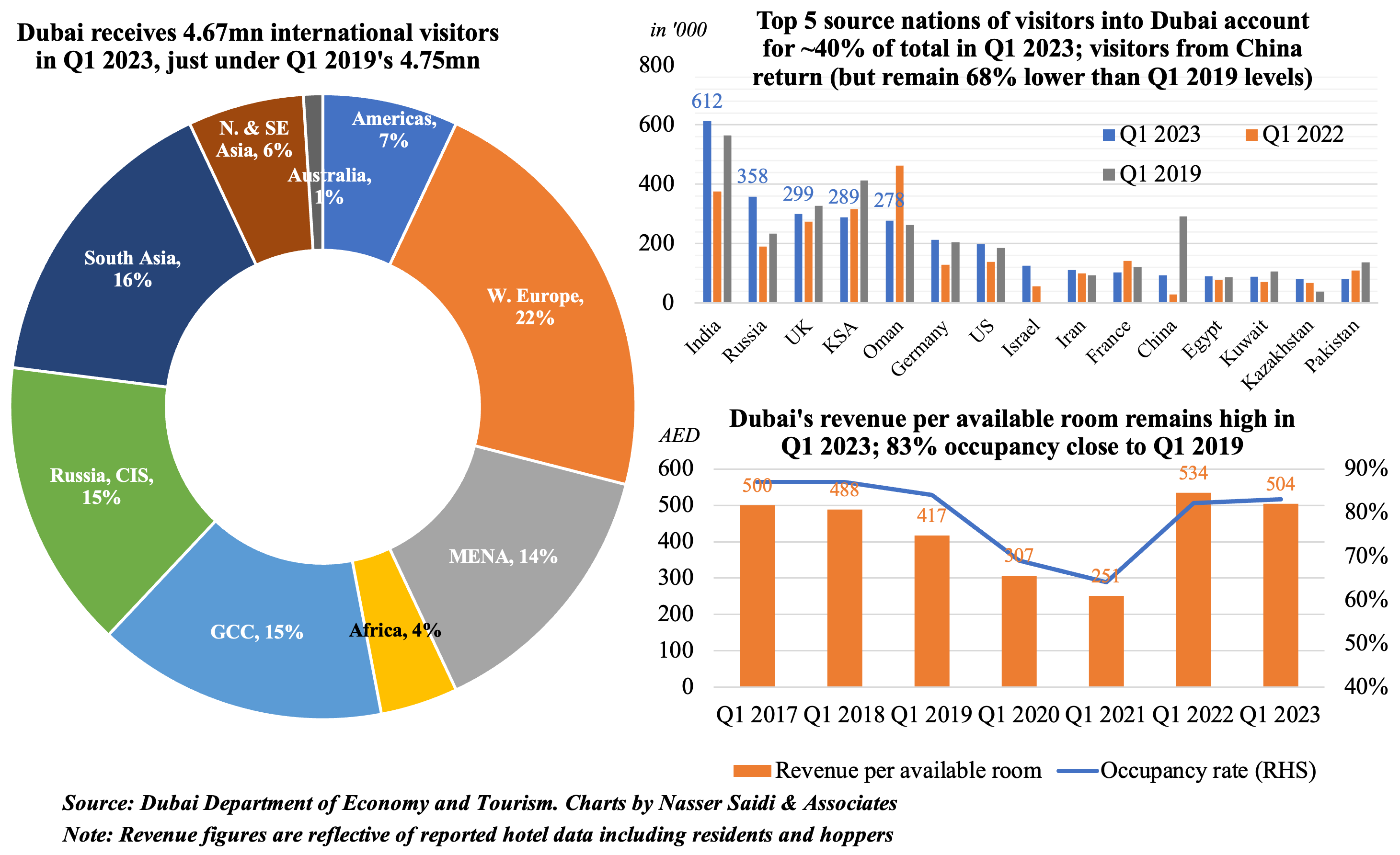

5. In Q1 2023, Dubai International Airport (which is connected to 234 destinations) welcomed ~21.3mn passengers (+55.8% yoy & 95.6% of pre-pandemic levels). Dubai welcomed 4.67mn international visitors during Q1 (vs Q1 2019: 4.75mn). In terms of source nations, India, Russia & UK topped the list while Chinese tourists jumped 239% yoy to 94k visitors.

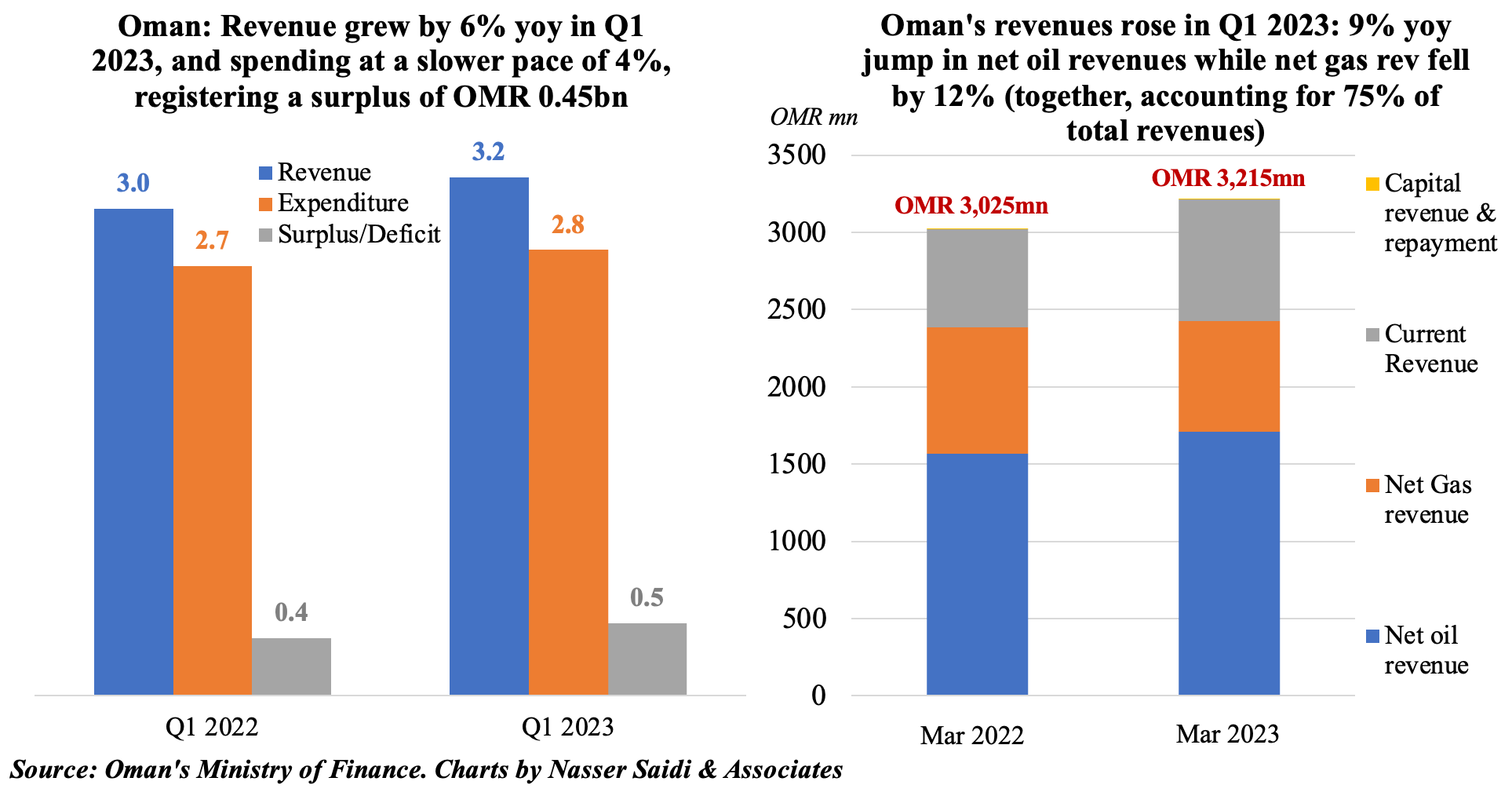

6. Oil revenues enable Oman to post a fiscal surplus in Q1 2023

- Increased production and higher oil prices supported Oman post a budget surplus of OMR 450mn at end-Q1 2023: total revenue was up by 6% yoy while spending grew by 4%.

- Net oil revenue touched OMR 1.7bn in Q1 2023, up 9% yoy, as oil prices averaged USD 85 per barrel (higher than the USD 78 in Q1 2022. In spite of net gas revenues down by 12% yoy to OMR 720mn, O&G revenues accounted for 88% of total public revenue, making it more vulnerable to volatility in the oil & gas markets.

- The IMF estimates a fiscal breakeven oil price of USD 72.2 for Oman this year. However, this does not consider the latest OPEC+ decision wherein Oman agreed to a voluntary oil output cut of 40,000 barrels per day from May.

- The Ministry of Finance disclosed that more than OMR 325mn had been paid to the private sector; a further OMR 1.1bn was repaid in loans, bringing total public debt to OMR 16.6bn (USD 43.1bn) at end-Q1 2023.

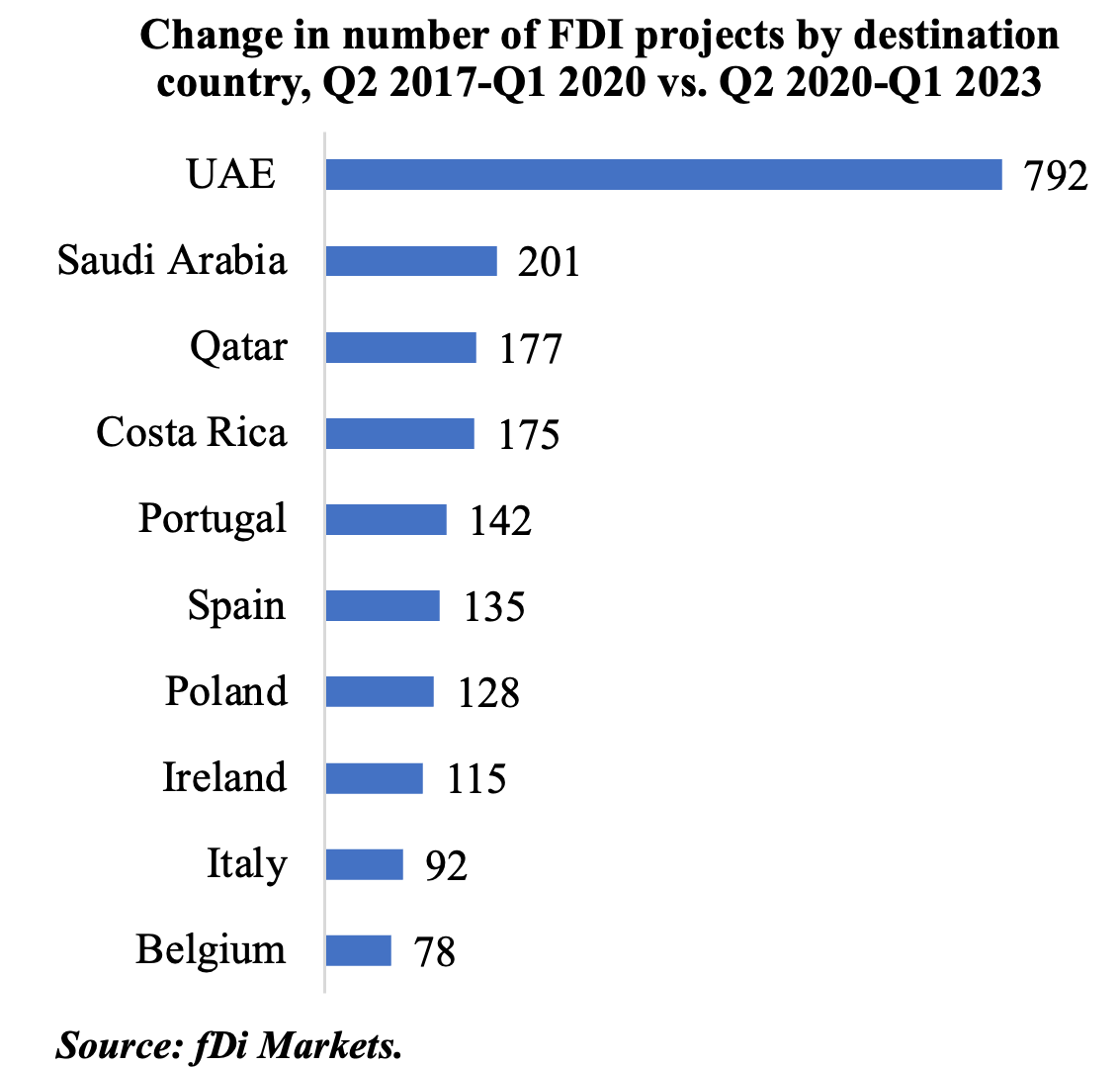

7. GCC economies lead the investment rebound globally & in the Middle East & Africa region

- According to fDi Markets, UAE, Saudi Arabia and Qatar were the top 3 nations globally with the largest increase in the number of FDI projects for the period since the outbreak of Covid (compared to 3 years prior to that). Dubai and Abu Dhabi attracted 1469 & 273 projects respectively in the 3 years starting Q2 2020.

- Interestingly, as opposed to funds flowing largely into the real estate/ construction sectors, 62.5% of Dubai’s foreign investments were in tech, business and financial services.

- A separate report issued during the Annual Investment Summit in the UAE found that Saudi Arabia, UAE, South Africa, Egypt and Qatar were the top five countries attracting FDI into the Middle East and Africa in 2022. Saudi attracted funds into tourism, Egypt to its renewable energy programs and Dubai into software and IT services, business and professional services (BPS) and financial services.

- US accounted for ~25% of FDI into the Middle East with investments primarily in software, tourism and BPS projects. UAE was the 5th largest investor into the Middle East and Africa region (and only regional investor within the top 10 source markets), accounting for 5.4% of proportion of FDI.

- By project value, top FDI projects in the Middle East were US H2 Industries USD 1.4bn waste-to-hydrogen plant in Oman and UK’s J. O. Steel Holdings USD 865mn manufacturing plant in Saudi Arabia.

Powered by: