Markets

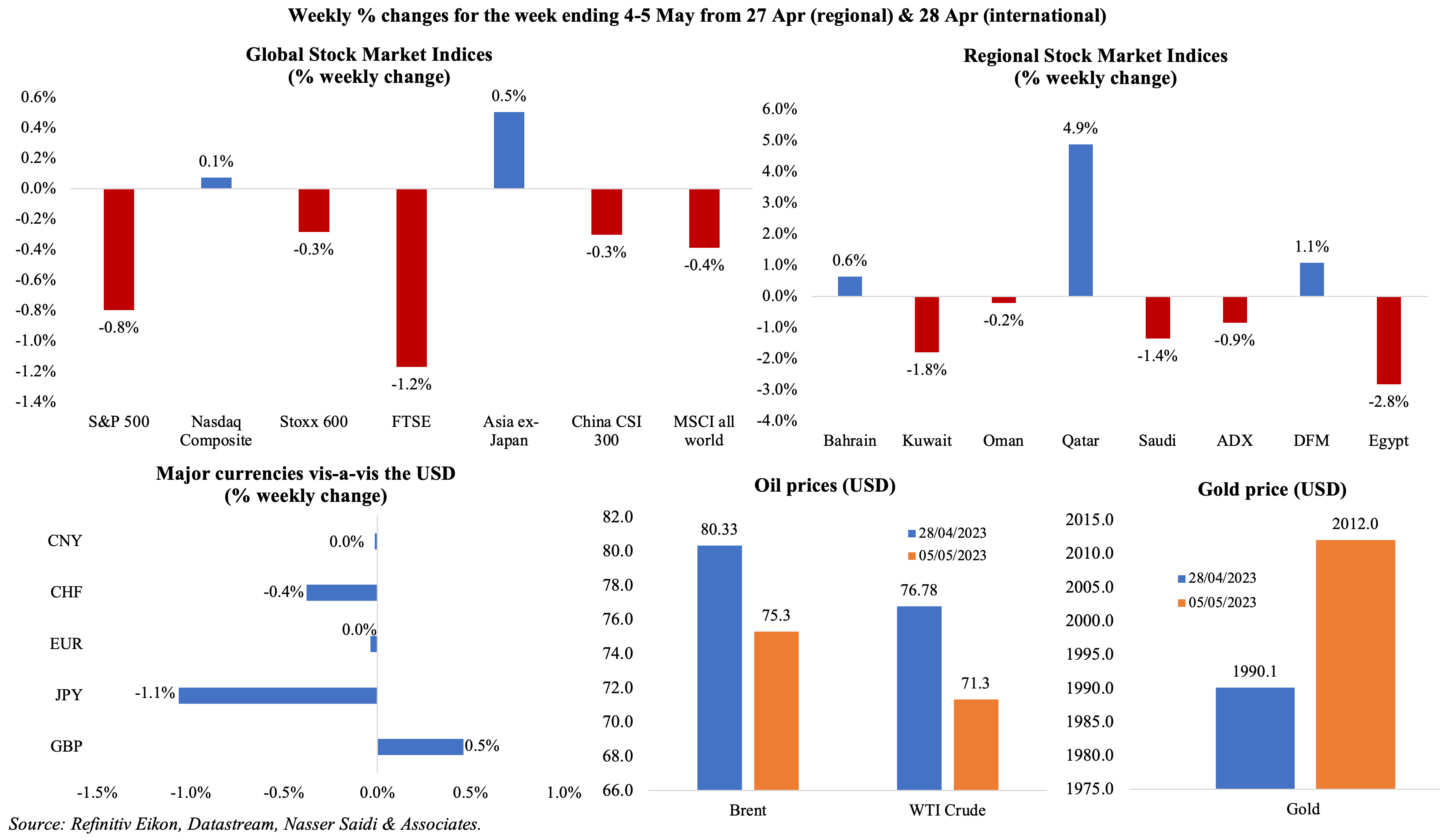

Many major equity markets ended in the red last week, with the US markets affected by fears of a regional banking crisis, while FTSE closed the week down by 1.2%. The volatility index, VIX, rose roughly 9% this week after falling for six consecutive weeks. Regional markets were mostly down, with Qatar gaining the most during the week given strong corporate earnings. The USD index fell for a second consecutive week, while GBP rose to an 11-month high versus the greenback ahead of the BoE meeting this week. Oil prices fell for the 3rd week in a row on fears of a weaker US economy and slowing demand from China, while gold price rose to near an all-time high as demand increased (including from central banks).

Global Developments

US/Americas:

- The Fed hiked rates by 25bps, its 10th consecutive increase in just over a year, taking the Fed’s benchmark policy rate to a new target range of 5 to 5.25% and its highest level since mid-2007.

- Non-farm payrolls in the US increased 253k in Apr (Mar: 165k), with job growth averaging 290k jobs per month over the past 6 months. Unemployment rate eased to a 53-year low of 3.4% in Apr (Mar: 3.5%). Average hourly earnings were up by 0.5% mom and 4.4% yoy. All indicators consistent with a continuing tight labour market.

- Non-farm productivity fell by 2.7% in Q1 (Q4: 1.6%), with output increasing 0.2% and hours worked higher by 3.0%. Unit labour costs increased by 6.3%, surging from the 3.3% gain in Q4.

- US private sector added 296k jobs in Apr (Mar: 142k), with leisure and hospitality leading gains (+154k) while financial and manufacturing sectors lost 28k and 38k jobs respectively.

- JOLTS job openings stood at 9.59mn in Mar, the lowest total since Apr 2021 and lower than Feb’s reading of 9.974mn, while layoffs and discharges leapt by 248k to over 1.8mn.

- Initial jobless claims increased by 13k to a seasonally adjusted 242k in the week ended Apr 28th, with the 4-week average up by 3.5k to 239.25k. Continuing jobless claims slipped to 1.805mn in the week ended Apr 21st, from a revised 1.843mn a week ago.

- Factory orders in the US rebounded by 0.9% mom in Mar (Feb: -1.1%), thanks to civilian aircraft bookings rising by 78.3%. Motor vehicle orders fell by 0.6% while orders for non-defence capital goods, excluding aircraft, fell by 0.6%.

- Overall trade deficit in the US narrowed to USD 64.2bn in Mar (Feb: USD 70.6bn), as imports fell slightly to a 3-month low of USD 320.4bn.

- US ISM manufacturing PMI edged up to 47.1 in Apr (Mar: 46.3) as new orders increased (45.7 from 44.3) and employment rose (50.2 from 46.9) while manufacturing prices paid jumped (to 53.2 from 49.2). ISM services PMI moved up to 51.9 in Apr (Mar: 51.2), thanks to a jump in new orders (56.1 from 52.2) and a slip in the employment index (50.8 from 51.3).

- S&P manufacturing PMI in the US moved up to 50.2 in Apr (Mar: 49.2) though lower than the preliminary estimate of 50.4, thanks to an expansion in new orders (though export orders contracted) while production ticked up (at the fastest pace since May 2022). Services PMI was higher at 53.6 in Apr, the most in a year, resulting in a higher composite PMI at 53.4.

Europe:

- The ECB raised benchmark interest rates for the 7th time in a row, this time by 25bps – the smallest increase since last Jul. ECB President Lagarde clearly stated that “we are not pausing” reiterating that inflation is not down to the ECB’s 2% target. The ECB will also stop reinvesting cash from maturing debt in its EUR 3.2trn Asset Purchase Programme from Jul, tightening market liquidity.

- Inflation in the eurozone rose to 7% in Apr (Mar: 6.9%) after months of decline, thanks to a rebound in energy prices (+2.5%) and higher costs of services (+5.2%). Though core inflation inched lower to 5.6%, it remains very close to Mar’s all-time high of 5.7%.

- Manufacturing PMI in the eurozone stood at 45.8 in Apr (down from the preliminary estimate of 45.5 and Mar’s 47.3), the worst reading since May 2020. This was the 10th straight month of sub-50 readings, as production volumes and export orders fell; the one silver lining was that input costs declined the most in almost 3 years. Services PMI increased to 56, the strongest in a year, resulting in an uptick in the composite PMI (to 54.2 from 53.9). Within the composite PMI, Spain was the fastest-growing nation again, though expansion eased from Mar’s 16-month high.

- Retail sales in the eurozone fell by 1.2% mom and 3.8% yoy in Mar, dampened by the impact from high inflation and interest rates. Food sales fell by 1.4% mom while car fuel sales were up by 1.6%; Latvia posted the biggest decline among all the nations (-2.7%).

- Germany’s manufacturing PMI remained below-50 in Apr, standing at 44.5 – this was higher than the initial estimate of 44, but the worst reading since May 2020. Though output inched up, “downward pressure on new orders continued” and factory gate inflation was at a 27-month low.

- Exports from Germany tumbled by 5.2% mom in Mar, with exports declining across many major partners: US (-10.9%), China (-9.3%) and the EU (-6.2%). Imports also declined but at a sharper pace of 6.4%, helping the trade surplus widen to EUR 16.7bn.

- German factory orders plunged by 10.7% mom in Mar (Feb: 4.5%), the largest drop since Apr 2020, as foreign and domestic orders fell by 13.3% and 6.8% respectively. In yoy terms, orders fell by 11%.

- Retail sales in Germany contracted by 2.4% mom in Mar, with sales of food and non-food dropping by 1.1% and 2.3% respectively. Sales were down by 8.6% yoy in Mar, with food sales plummeting by 10.3% – the largest drop since 1994.

- Unemployment rate in eurozone edged down to a record-low of 6.5% in Mar (Feb: 6.6%). The number of unemployed fell by 121k from a month ago to 11.01mn: this was the lowest level on record (since 1995). The largest jobless rates were in Spain (12.8%) and Italy (7.8%).

- UK’s manufacturing PMI eased to a 3-month low of 47.8 in Apr (Mar: 47.9, but higher than the flash estimate of 46.6) as output and new orders stayed below-50. Composite PMI rose to 54.9, thanks to the increase in services PMI (55.9 from 52.9 in Mar). New services orders grew at the strongest pace since Mar 2022 and total new work increased at the strongest rate for 13 months.

Asia Pacific:

- China’s Caixin manufacturing PMI unexpectedly slipped to below-50 in Apr, clocking in at 49.5 (Mar: 50). New orders shrank though foreign orders were stable as employment fell the most in 3 months. While input prices declined for the first time in 7 months, selling prices fell at the steepest pace since Dec 2015 as firms sought to attract business.

- Caixin services PMI in China eased to 56.4 in Apr (Mar: 57.8), the second-highest reading since Nov 2020, with new exports expanding for the 4th straight month. However, operating costs increased to a 1-year high on higher staff costs and raw materials prices.

- Forex reserves in China rose by USD 21bn to USD 3.205trn in Apr while the value of China’s gold reserves rose to USD 132.35bn at end-Apr (end-Mar: USD 131.65bn).

- Japan’s manufacturing PMI stood below-50 for the 6th month in a row in Apr, clocking in 49.5 (Mar: 49.2): the reduction in new orders was the slowest since Jul 2022. Inflationary pressures were “historically elevated” though rising at the softest pace since Aug 2021.

- Consumer confidence in Japan improved to 35.4 in Apr (Mar: 33.9), the highest reading since Jan 2022. All components improved including income growth (+0.7 to 38.1) and employment (+0.7 to 42) among others.

- Inflation in South Korea eased to a 14-month low of 3.7% in Apr (Mar: 4.2%) while core inflation held steady at 4%. The Bank of Korea’s inflation target is around 2%.

- Singapore’s manufacturing PMI slipped to 49.7 in Apr (Mar: 49.9), with the electronics sector remaining below-50 for the 9th consecutive month given weak global demand.

- Retail sales in Singapore grew by 4.5% yoy in Mar (Feb: 12.6%) supported by the rise in wages. Online retail sales accounted for an estimated 13% while sales of motor vehicles grew by 7.2%. Excluding motor vehicles, sales were up by 4.1%.

Bottom line: The latest PMI data releases indicate the strength in services sector activity as global manufacturing PMI remains weak – standing unchanged at 49.6 in Apr; expansions in the China and the US were contrasted with declines in Japan and Europe. In Asia, China’s unexpected sub-50 PMI readings offer some cautiousness related to the strength of post-Covid recovery. Inflation in Europe inched up in Apr, meaning this week’s US reading will be closely watched (especially in the context of whether Fed is done with its tightening moves). The US debt ceiling negotiations will add to financial market uncertainty and to growth concerns – no agreement on raising the debt ceiling would lead to delays in payments (including social security, Medicare etc), government layoffs and defaults on payments on US government debt.

Regional Developments

- The IMF’s latest Regional Economic Outlook report forecasts real GDP in the MENA region to grow by 3.1% vs 5.3% in 2022. Oil production cuts will lower GDP growth in the GCC (2.9% in 2023 vs 7.7% in 2022), but non-oil GDP is expected to remain strong (4.2% in 2023) given government’s diversification efforts, related reforms, and project spending. Inflation remains one of the most challenging issues for the region (14.8% in 2023): it is elevated in many emerging and middle-income nations within the MENA, especially in those that experienced currency depreciations; services inflation leading to rise in core inflation as well.

- GCC central banks (except for Kuwait) followed the Fed’s 25bps rate hike with a similar one at home, given the peg to the dollar.

- Egypt’s PMI inched up to 47.3 in Apr (Mar: 46.7), supported by output and new orders rising to six and four-month highs. Activity is however still burdened by weak domestic and foreign demand amid high levels of inflation and remains in contractionary territory.

- Current account deficit in Egypt narrowed by 77.2% yoy to USD 1.8bn in Jul-Dec 2022, thanks to the USD 1.41bn surplus recorded in the Oct-Dec quarter.

- Egypt signed its largest ever investment deal with Japan, worth JPY 100bn, to support transport development (more specifically the expansion of Cairo’s metro). According to the Cabinet, total Japanese investments in the country has amounted to USD 3bn across more than 18 projects supporting the nation’s SDG goals.

- Iraq’s crude oil production fell by 6%+ mom to 3.938mn barrel per day in Apr: this is almost 500k bpd below its April quota as agreed with OPEC+, a result of outages from the Iraq-Turkey pipeline dispute.

- Kuwait announced June 6th as the date for legislative elections – the move came after the parliament (that was reinstated by a Constitutional Court ruling) was dissolved by royal decree.

- Lebanon’s PMI in Apr edged down to 49.5 (Mar: 49.7), the eighth consecutive month of sub-50 readings. There were some signs of relief: new orders from abroad increased and selling charges declined for the first time since Dec 2019 as input prices eased while business confidence increased to a 37-month high.

- Loans and financing by Oman’s banks grew by 6.8% yoy to OMR 29.8bn in Feb, according to central bank fata. Deposits by the private sector inched up by 0.5% to OMR 17.5bn while broad money supply grew by 1.8% to OMR 20.7bn.

- Qatar PMI rose to 54.4 in Apr (Mar: 53.8), rising at the fastest pace since Jul 2022, with the financial services sector growing at a faster pace (both total activity and new work). New business increased at the fastest pace in 9 months (thanks to the rollout of new projects) and the employment index rose to a 9-month high.

- International reserves at the Qatar central bank grew by 12.51% yoy to QAR 237.095bn in Mar. Gold stocks rapidly increased by about QAR 9.6bn to QAR 21.4bn by end-Apr.

- Private sector exports from Qatar surged by 17.5% yoy to QAR 9.1bn in Q1 3023. Asian nations (excluding GCC and Arab region) were the top destination region receiving 68.15% of the total, followed by the GCC (16.8%) and EU nations (12.05%).

- Total population in Qatar increased by 3.5% qoq to 2,934,840 persons in Q4 2022. Economically active population in Qatar increased by 3% yoy and 0.4% qoq to 87.7% of the total population during the quarter. Male and female participation rates stood at 95.4% ad 63.4% respectively while the average monthly wages were QAR 11,724-11,486 (males) and QAR 12,390 (females).

- Qatar Airways CEO disclosed that the airways could increase its destinations to more than 255 routes (from 170 now) but it is dependent on aircraft deliveries. The airline expects to receive delivery of 73 aircraft from Airbus in the “not too distant future”.

- The Arab League readmitted Syria into the fold, after more than a decade since its suspension in 2011. Some nations have expressed concerns, demanding conditions be set in place for Syria (including progress in resolving the conflict). The readmission follows a peace plan /roadmap from Jordan addressing issues of refugees and drug smuggling among others.

- Syria and Iran signed a long-term strategic cooperation agreement, including for the oil industry. This happened during a visit by the Iranian President to Syria (the first such visit since 2011).

- The Middle East is the fastest growing real-time payments market globally, according to a ACI Worldwide-GlobalData report: transactions are expected to grow to USD 2.6bn in 2027, from USD 675mn last year. Within the region, Saudi Arabia is expected to lead the shift – real time payments transactions are expected to rise to 1.2bn in 2027 (annual growth of 26%+) from 352mn in 2022.

- A study by the flight search and booking app Wego, Saudi Arabia, Egypt and India were the top global destinations for MENA travellers in Q1 2023. Asian nations with stricter Covid19 policies saw a decline with Japan and Vietnam falling 9 spots and Singapore by four.

- The WEF’s Chief Economists Outlook report indicated a mixed outlook for the MENA region: 36% of respondents expect weak growth, with 32% each expecting strong and moderate growth levels. About 52% expected inflation to run high in the region while 39% anticipate moderate rates.

Saudi Arabia Focus

- Saudi Arabia grew by 3.9% yoy in Q1 2023 (Q4: 5.4%), with the non-oil sector expanding by 5.8% while the oil sector was up by 1.3%. However, in qoq terms, growth fell by 1.3% – a direct result of the 4.8% drop in oil sector activity.

- PMI in Saudi Arabia rose to 59.6 in Apr (Mar: 58.7), slightly lower than the 8-year peak of 59.8 recorded in Feb 2023. The uptick was supported by a surge in new orders (to 69.1, the highest since Sep 2014, and from 66.4 in Mar) and output (64.4 from 64.2) while “the rate of job creations [was] slightly stronger than seen on average in Q1 2023”.

- Saudi Arabia’s government revenues increased by 1% yoy to SAR 280.94bn in Q1, supported by a 9% increase in non-oil revenues to SAR 102.34bn amid a 3% drop in oil revenues (to SAR 178bn). Expenditures jumped by 29% to SAR 283.86bn, resulting in a deficit of SAR 2.91bn in Q1.

- Saudi-US bilateral trade and investment volume more than doubled to USD 55bn in 2022 (2021: USD 24.7bn), as per the US embassy in Riyadh.

- Bank claims on the private sector in Saudi Arabia grew by 10.3% yoy in Mar, the fastest pace since Feb 2020 while M3 money supply was up by 10%. Deposits grew at a faster pace than credit, but government deposits plunged by 16.8% yoy and 19.2% mom to SAR 497bn in Mar. Net foreign assets at SAMA fell to SAR 1.52trn in Mar, the lowest since Sep 2010.

- Aggregate profits of banks in Saudi Arabia accelerated by 23.2% yoy to SAR 7.43bn in Mar, with its assets rising by 11.17% to SAR 3.74trn. Banks are set to benefit from the higher interest rate environment.

- Saudi Arabia’s Minister of Industry and Mineral Resources disclosed that 50 investment opportunities worth over USD 25bn will be offered in the machinery and equipment sector. The minister also revealed that 3 projects for casting and forging alone saw an investment of more than USD 1bn over the last 2 years.

- Saudi Arabia’s NEOM awarded a USD 2bn contract for the construction of the 75km Connector South rail line to link its industrial city OXAGON with The Line development.

UAE Focus![]()

- The UAE PMI jumped to a 6-month high of 56.6 in Apr (Mar: 55.9), led by the rise in new orders (59.5, the most since Nov 2021) and output (62.7, the highest since Oct 2022) as a result of higher domestic demand while employment eased from Mar’s nearly 7-year high. While input prices inched up (least in 3 months), selling prices fell at their quickest pace since Sep 2020.

- UAE and Morocco plan to double volume of trade and investment over the next 7 years: at the first UAE-Morocco Joint Economic Committee meeting, it was also agreed to increase cooperation in priority sectors including food security and renewable energy among others. UAE is the largest Arab investor in Morocco (USD 14bn+ by end-2021) and the second largest globally, disclosed UAE’s minister of economy.

- Abu Dhabi’s financial centre (ADGM) plans to expand to a space of 1438 hectares, more than 10 times its current size, as decided by UAE Cabinet Resolution 41 for 2023. In comparison, the DIFC is around 44 hectares in area. The ADGM’s jurisdiction will expand to include Reem Island, close to the current location at Al Maryah Island, to accommodate increased demand from international firms to locate there, according to the official statement.

- ADNOC will move its planned LNG project to Al Ruwais Industrial City in Abu Dhabi from the Fujairah emirate (as per previous announcement). The decision was based on factors like proximity to ADNOC’s current operations as well as its local supplier base among others.

- BitOasis was given the first broker-dealer minimum viable product operational license from Dubai’s VARA, allowing the firm to provide broker-dealer services to qualified retail and institutional investors. The firm had received the provisional approval to start the licensing process in Mar 2022.

- Tourism spending in the UAE surged by 70% yoy to AED 121bn (USD 33bn) in 2022, according to a tweet from the PM of UAE. UAE aims to attract 40mn tourists within 7 years.

- Dubai welcomed 4.67mn visitors in Q1 2023, up 17% yoy, and just 2ppts below Q1 2019’s reading. India, Russia and UK were the top 3 source markets for visitors while regional peers Saudi Arabia and Oman rounded up the top 5. Occupancy rates touched 83.1% vs 83.7% in Q1 2019.

- About 31.8mn passengers travellers passed through UAE’s airports in Q1 2023, up 56.3% yoy, according to the Director-General of the General Civil Aviation Authority. He also stated that the number of destinations covered by the national airlines reached about 536.

- UAE’s airlines Emirates and Etihad announced the expansion of their interline agreement, permitting customers to buy a single ticket and opt to return from either airport, thereby giving a boost to overall tourism.

- The latest IMD Smart City Index ranks Abu Dhabi 13th globally (out of 141 nations) and top in the MENA region. Dubai and Riyadh are ranked at 17 and 30 respectively.

- Sharjah reported a 3% increase in licenses to 17,555 in Q1 2023: of these, 1979 licenses were new and the rest renewals.

Media Review

Saudi Arabia’s journey from troublemaker to diplomat

https://www.ft.com/content/a619d07c-70e3-453c-83b3-3ce2ff903a78

UAE’s new gaming resort

https://www.reuters.com/business/gaming-make-up-4-wynns-planned-uae-resort-tourism-executive-2023-05-05/

https://www.bloomberg.com/news/articles/2023-05-05/will-the-uae-legalize-gambling-wynn-s-ambitions-reflect-growing-optimism

What America’s tiny banks do that big ones don’t

https://www.economist.com/united-states/2023/05/07/what-americas-tiny-banks-do-that-big-ones-dont

Washington’s New Narrative for the Global Economy

https://www.project-syndicate.org/commentary/biden-administration-international-economic-agenda-must-not-undermine-global-economy-by-dani-rodrik-2023-05

Inflation and rising prices shape a new hybrid Middle East consumer: PwC

https://www.pwc.com/m1/en/publications/global-consumer-insights-survey-2023-pulse-5-middle-east-findings.html

Powered by: