Logistic Performance Index 2023. Supply chain indicators. Dubai’s tourism & inflation. Lebanon’s inflation amid currency depreciation. GCC holdings of US Treasuries.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 28 Apr 2023: Logistics, Tourism, Inflation in GCC & MENA

1. Logistics Performance

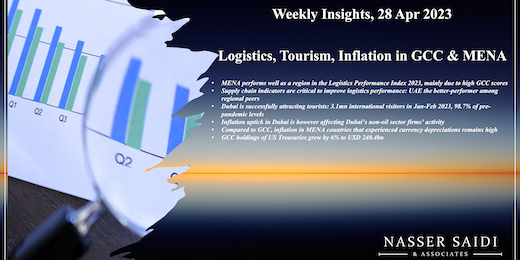

- Overall score in the 2023 Logistics Performance Index (LPI) has remained broadly same as the pre-Covid, 2018 edition, with categories unaffected by the crisis (like Customs, Infrastructure quality, Track & Trace). Also, the LPI survey was undertaken in late 2022 when disruptions were off previous peaks.

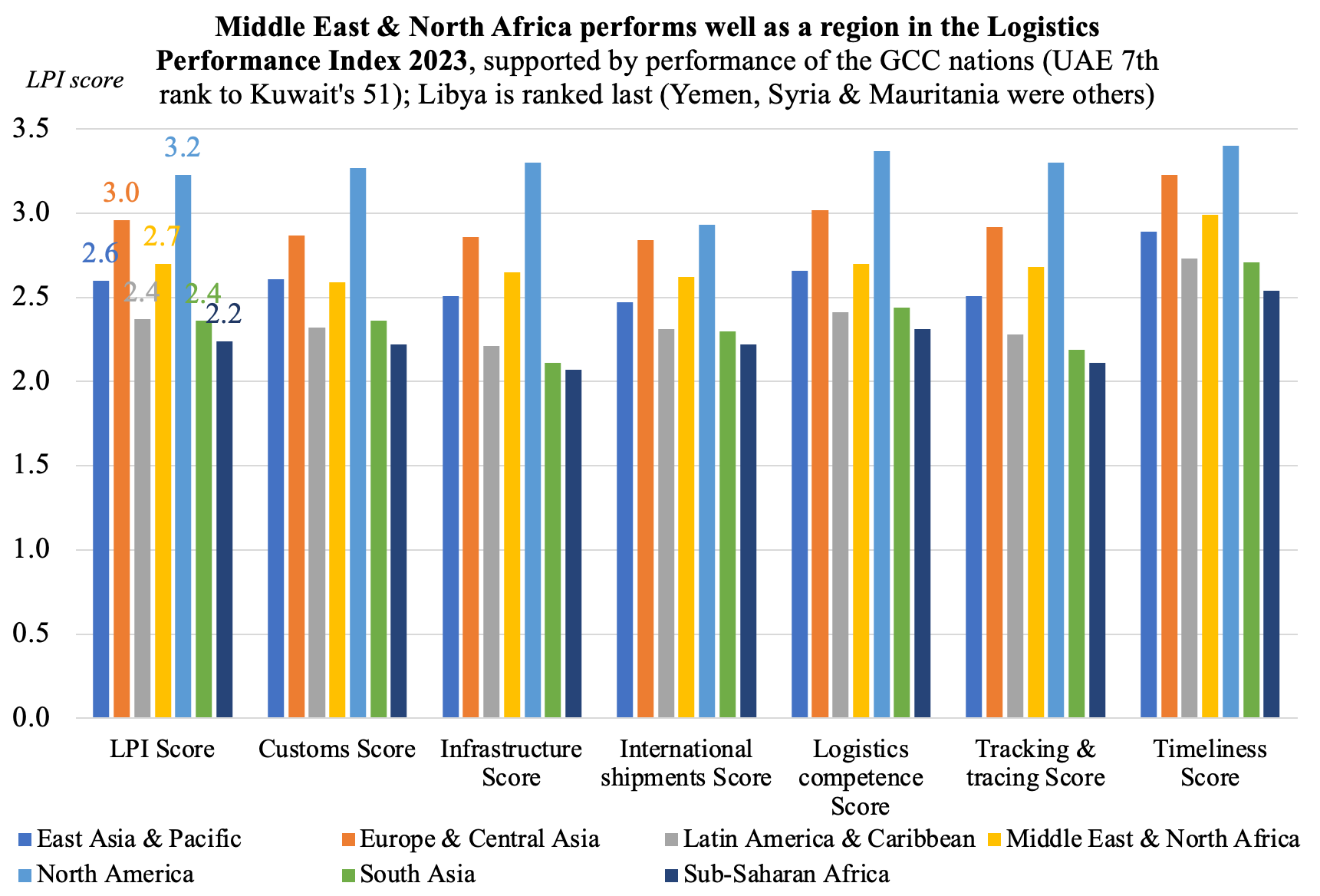

- Middle East & North Africa (MENA) clocked in an average score of 2.7, just behind North America and Europe & Central Asia, due to the high GCC rankings. Many MENA countries in the MENA region are among the lowest scorers (including Libya with an LPI score of 1.9). In many MENA nations (excluding GCC), infrastructure is the main drag on overall LPI score, alongside customs and logistics competence.

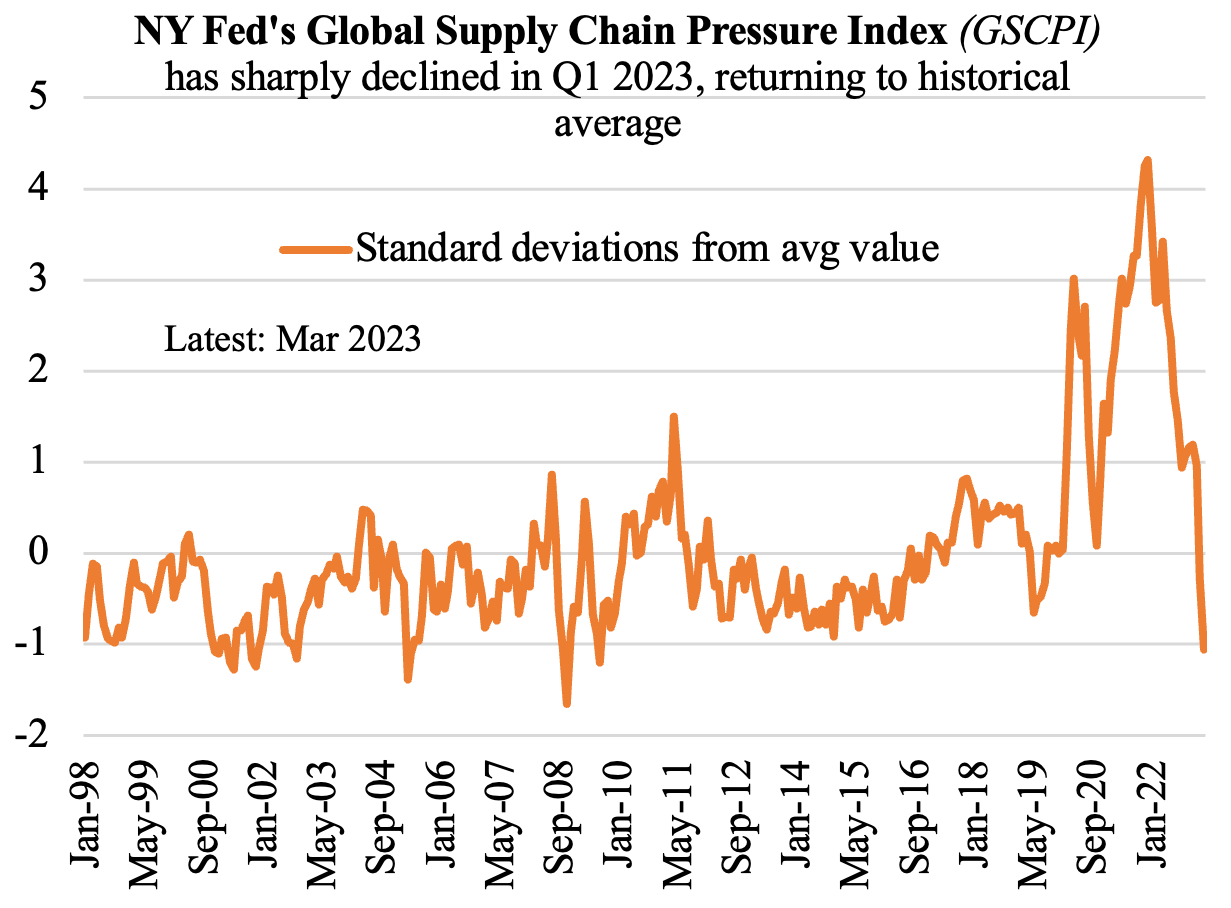

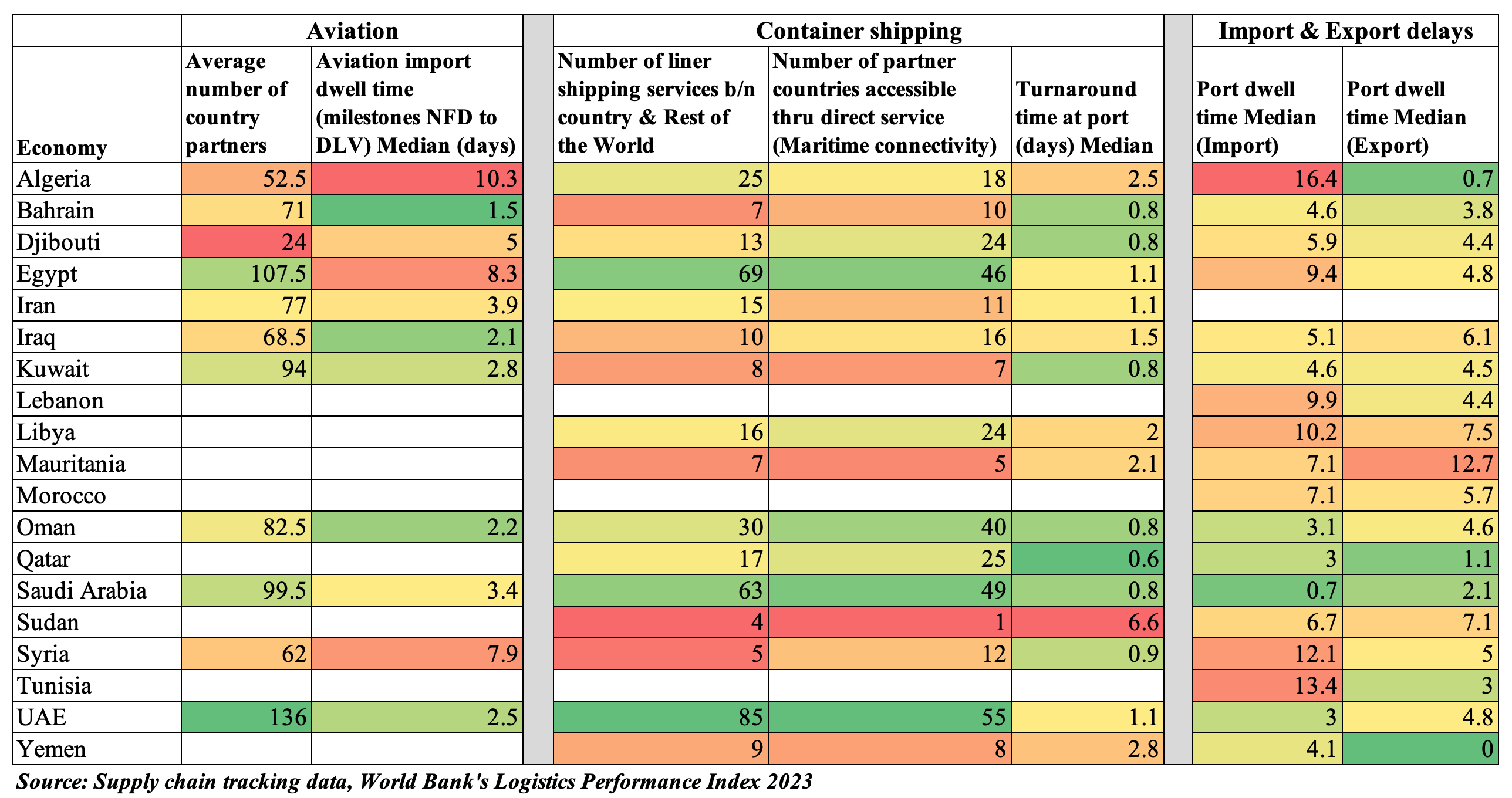

2. Supply chain indicators are critical to improve logistics performance

- As seen during the Covid19 phase, the delays at origin or destination ports can lead to significant pressures. The LPI report recommends “investing in port productivity, modernizing customs, and new technologies” to improve reliability.

- Delays at ports and airports are negatively correlated with overall LPI scoresthough nations score better the larger the number of country partners and shipping services available.

- Many MENA nations are characterised by excessive dwell time: in Algeria, import delays (i.e. time spent at the same port location from container arrival to departure during importing phase) is around 16.4 days and aviation import dwell time is 10.3 days; in contrast, it is 3 and 2.5 in best regional performer UAE. It is important to study the reasons for such delays – could range from low productivity, high congestion, slow preparation of trade documents – and introduce corrective measures.

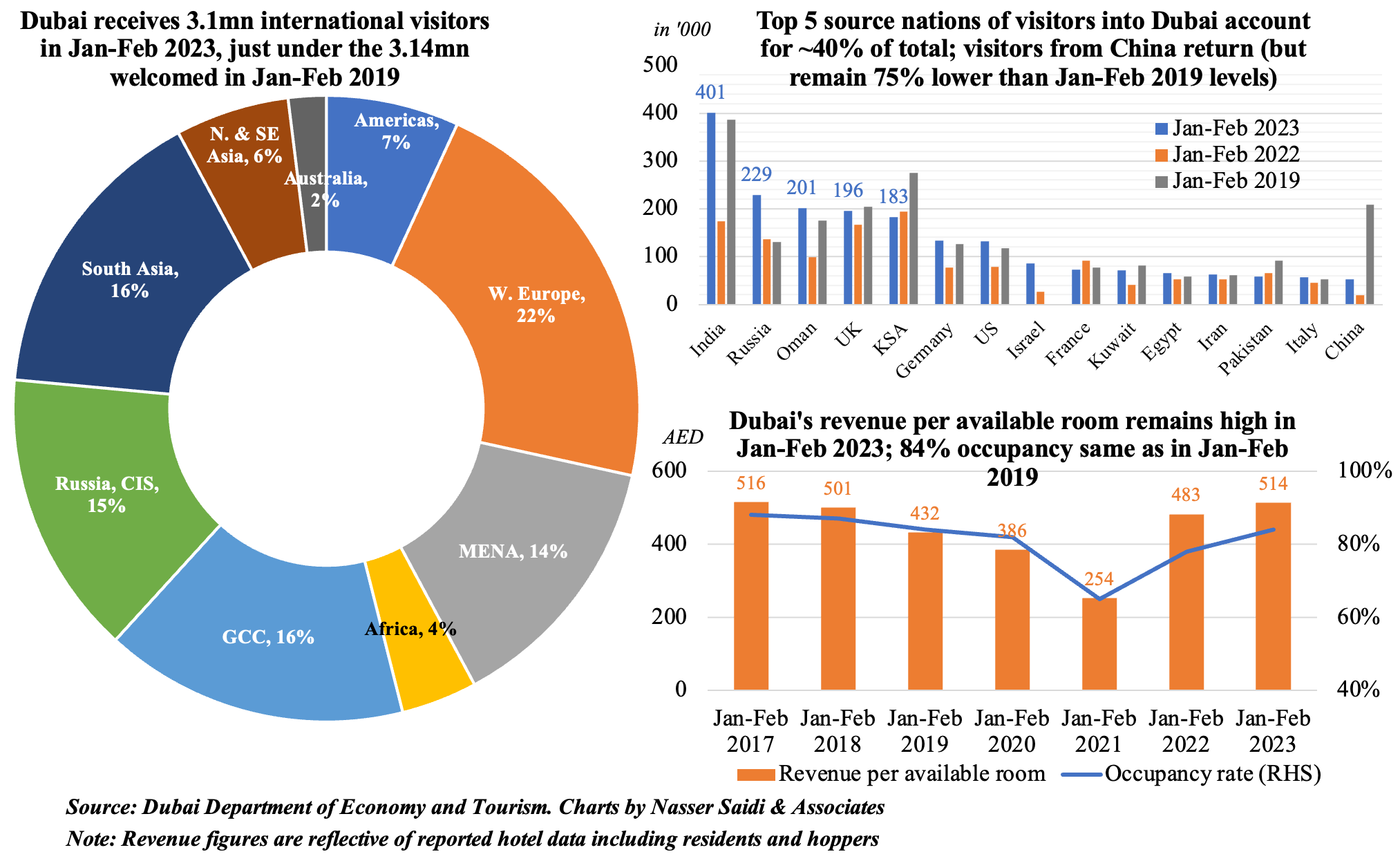

3. Dubai is also performing well in attracting tourists: emirate received 3.1mn international visitors in Jan-Feb 2023, 98.7% of pre-pandemic levels

- The composition of tourists remains familiar: India tops the list (exceeding Jan-Feb 2019 levels) with Russia 2nd (+67% yoy) but other top source nations have fallen short of pre-pandemic levels (including UK, Saudi Arabia, France, Kuwait, Pakistan & China). Regional tourism is on the rise: GCC & MENA nations accounted for 30% of total tourists and 6 were in the top 20 source nations.

- With tourism recovery underway, occupancy rates are on the rise as is revenue per available rooms. Average daily room rates are high: AED 609 in Jan-Feb 2023 (vs 623 in Jan-Feb 2022 and 390 in Jan-Feb 2021), which is getting reflected in a dip in guests’ length of stay to 4 nights in Jan-Feb 2023 (from 4.3 and 5.3 in the same period last year and in 2021 respectively).

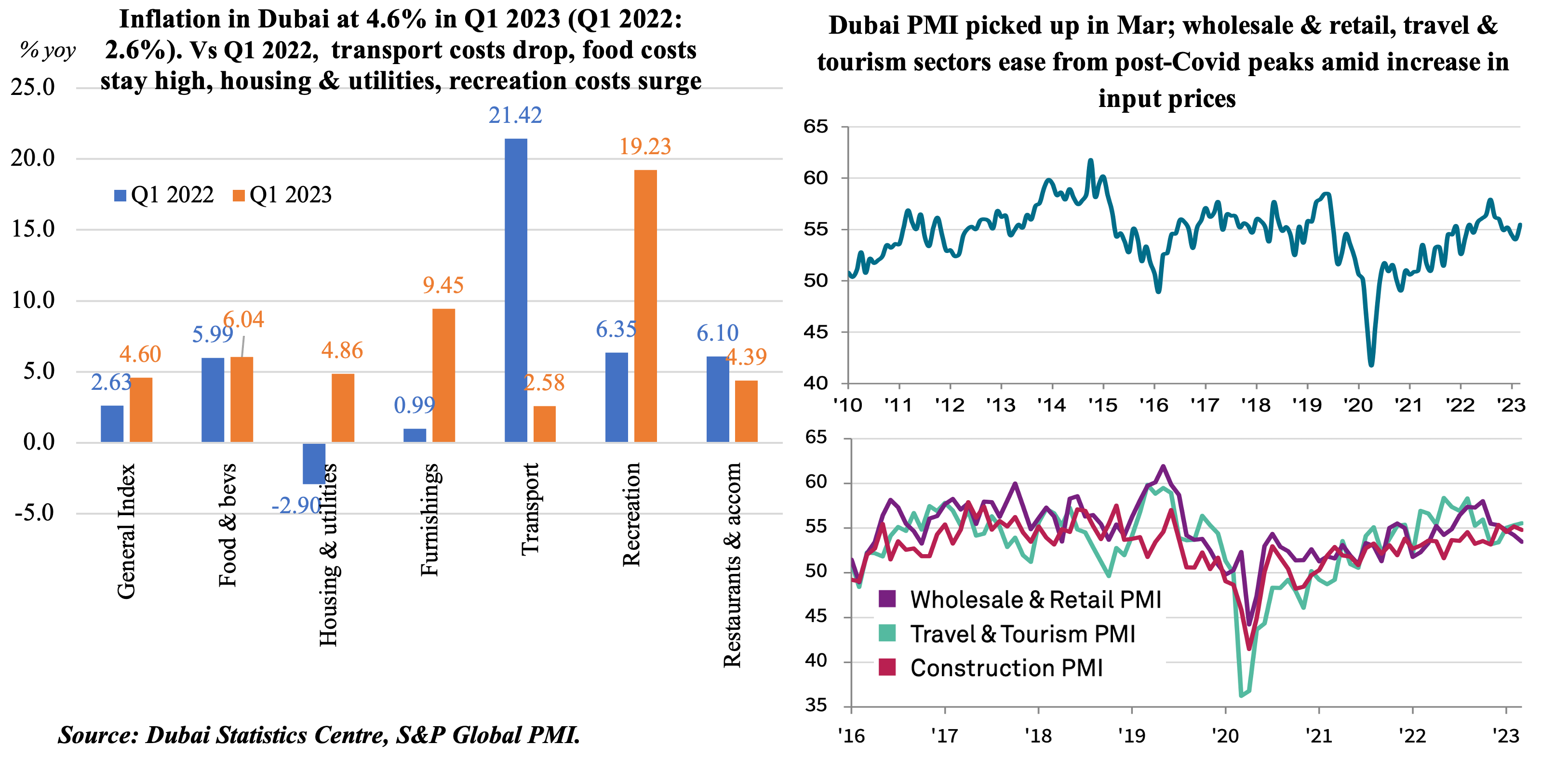

4. Inflation in Dubai is higher in Q1 2023 vs 2022; rising costs are affecting Dubai’s non-oil sector firms

- In Q1, inflation in Dubai rose to 4.6% yoy: it stood at 4.6% in Jan, rose to 4.9% in Feb before easing to 4.3% in Mar. The biggest upticks in Q1 2023 was in recreation (19.2%), furnishings and household equipment (9.5%) as well as food and beverages (which remained high at 6.1%).

- The largest surge vis-à-vis Q1 2022 was in housing & utilities (4.9% from -2.9%) while transport prices dropped significantly (2.5% in Q1 vs 21.4% in Q1 2022). Some of the services-related categories like recreation and restaurants & hotels have eased though remaining high (19.2% and 4.4% in Q1 respectively).

- The PMI for Dubai’s non-oil sector picked up in Mar: employment levels were at 5-year highs as companies catered to the increase in client demand; construction firms reported a “strong increase in employment”. Input prices are rising including staff wages though firms continued to absorb most of the rising costs, with output charges falling for the 8th consecutive month in Mar. This has seen a loss in momentum, especially in the wholesale & retail where sales growth reached a 14-month low.

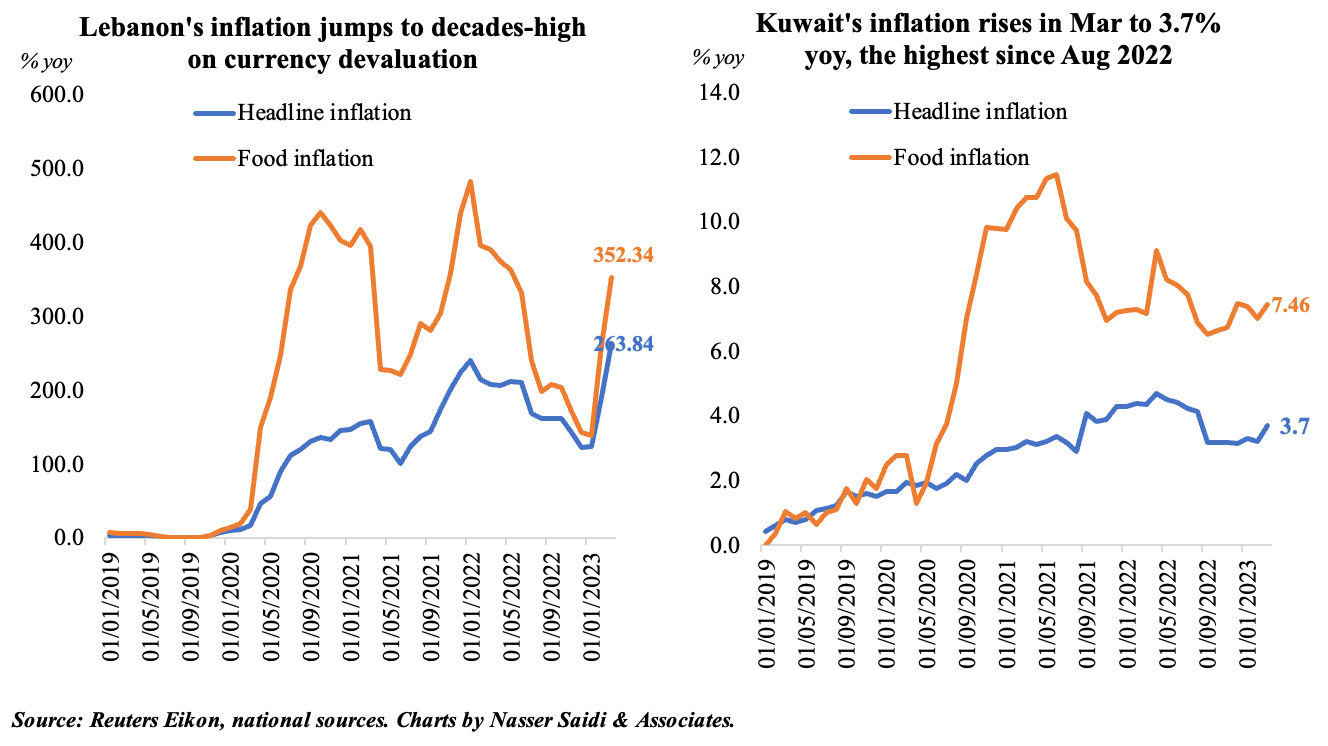

5. A tale of divergence: Inflation in MENA remains high especially in countries that experienced currency depreciations

- Inflation surged to 264% yoy in Lebanon last month, more than doubling since end-2022 (122%) while it rose to 3.7% in Kuwait (highest since Aug 2022). In both nations, food inflation was rising at a much faster pace: 352% in Lebanon and 7.5% in Kuwait.

- Lebanon has seen costs rise across all categories: monetary financing of government deficits, the recent devaluation of the pound in Feb and FOREX shortages have led to the 33rd consecutive month of hyperinflation. Absent reforms across economic-socio and political lines, the situation is likely to worsen: expect a currency meltdown with LBP falling to new lows, imports becoming more expensive and inflation accelerating further.

- In contrast, inflation is likely to subside this year in the GCC, given higher interest rates and slowing growth globally. Non-tradeable inflation will remain – relatively high costs of housing & utilities, recreation and hospitality.

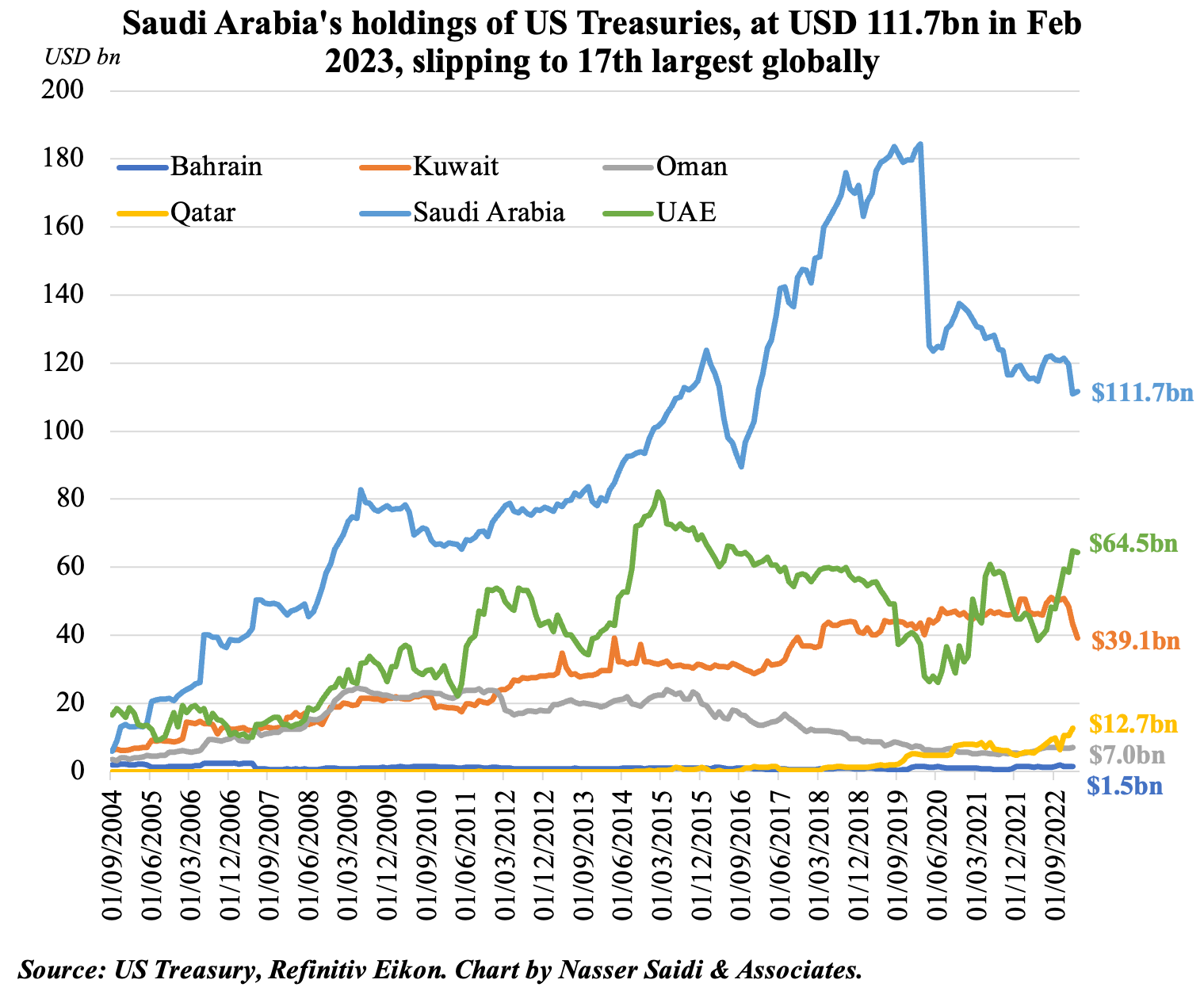

6. Saudi Arabia reduces its holdings of US Treasuries to USD 111.7bn in Feb 2023, remains the 17th largest investor globally; UAE raises share to USD 64.5bn

- Saudi Arabia is currently the 17th largest investor in US Treasury bonds globally as of Feb 2023 (USD 111.7bn)

- This pales in comparison to the top of the list Japan (USD 1.082trn) and China (USD 849bn), but it is stillhighest among the GCC

- GCC nations, excluding Kuwait and Saudi Arabia, have increased their holdingscompared to end-2021. Max increase was from Qatar, which increased holding by 2.6 times to 12.7bn (as of Jan 2023). Overall, GCC holdings of US Treasuries grew by 6% to USD 240.4bn as of Jan 2023

- Recent global central banks’ decisions to aggressively raise rates to combat inflation contributed to selling of Treasuries. Increasing chatter of over-reliance on the dollar has seen a diversification in forex reserves into gold of many nations including China and states in the Middle East and Central Asia, according to the World Gold Council.

Powered by: