Markets

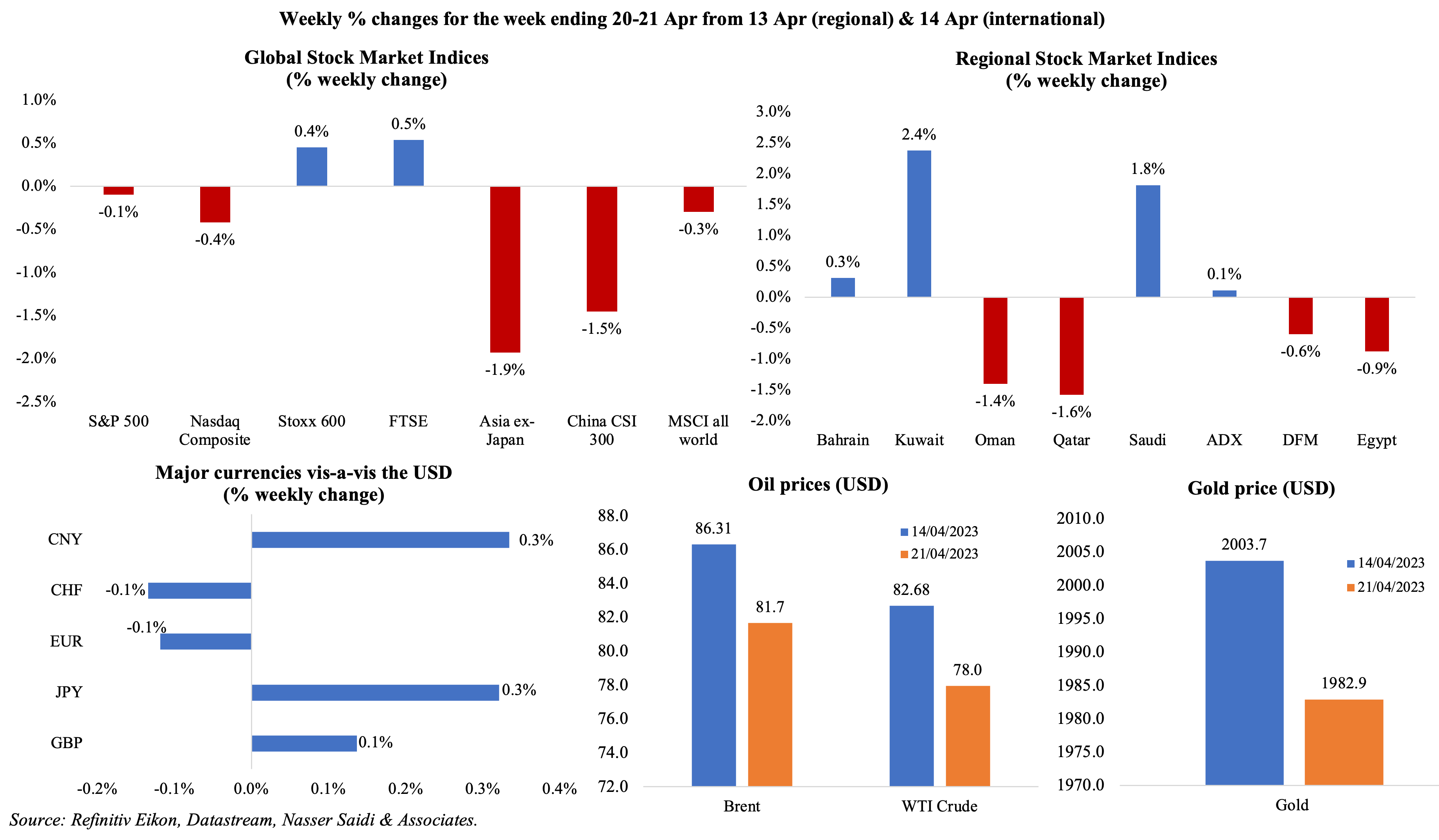

Most major equity markets ended in the red last week, including China which had posted stronger-than-expected Q1 growth figures, while stocks in Europe and the UK gained on news of expansion in business activity. Regional markets were mixed, with Kuwait and Saudi Arabia posting the largest gains; most markets were closed towards end of last week for Eid holidays. The dollar had a good week, reversing five weeks of declines. Oil prices slipped for the week (down by more than 5%) on concerns about rate hikes, as did gold price (fell by more than 1%).

Global Developments

US/Americas:

- The Fed’s Beige Book disclosed that “expectations for future growth were mostly unchanged”, job gains “moderated somewhat” in Apr, while several districts stated banks had tightened lending. Most regions also reported “steady to increasing demand” for non-financial services.

- Flash manufacturing PMI in the US inched up to a 6-month high of 50.4 in Apr (Mar: 49.2), supported by an 11-month high in the output index (52.8 from 50.2). Services PMI also rose, to 53.7 from 52.6, thanks to improved new orders though export orders declined marginally. Composite PMI rose to 53.5 in Apr (Mar: 52.3), the quickest uptick since May 2022, while both input cost and output charge inflation rose after 2 months of declines.

- NY Empire State manufacturing index unexpectedly increased to 10.8 in Apr (Mar: -24.6), the strongest reading since Jul 2022, as new orders rebounded (25.1 from -21.7).

- Building permits in the US fell by 8.8% mom to 1.413mn in Mar: single-family permits rose by 4.1% to a 5-month high of 818k units, while permits for housing with 5 units or more plunged by 24.3%. Housing starts edged down by 0.8% to 1.42mn though single-family starts increased by 2.7% to 861k units. Mortgage rates have declined from highs seen in 2022: the 30-year fixed mortgage rate stood at 6.27% 2 weeks back (from 7.08% in Nov 2022).

- Existing home sales dropped by 2.4% mom to 4.44mn in Mar, and median existing house price fell by 0.9% yoy to USD 375,700 (the largest decline since Jan 2012).

- Initial jobless claims increased by 5k to 245k in the week ended Apr 14th, with the 4-week average fell by 500 to 239.75k. Continuing jobless claims increased by 61k to 1.865mn in the week ended Apr 7th, the highest since Nov 2021.

Europe:

- ZEW survey’s Economic Sentiment index in Germany declined to 4.1 in Apr (Mar: 13) while the current economic sentiment situation improved to -32.5 (Mar: -46.5) though remaining below average. In the eurozone, economic sentiment worsened to 6.4, from 10 the month before while the situation indicator improved significantly, up 14.4 points to -30.2, and below average.

- German producer price index declined for a 6th consecutive month, down by 2.6% mom in Mar (Feb: -0.3%). In yoy terms, prices rose by 7.5%, the smallest yoy increase since Jun 2021, with energy prices up by 6.8%.

- Flash manufacturing PMI in the eurozone slipped to a 35-month low of 45.5 in Apr (Mar: 47.3). Thanks to an improvement in services PMI to a 12-month high (by 1.6 points to 56.6), composite PMI inched up to 54.4 (Mar: 53.7). Overall input costs and output prices are high by historical standards, especially in the service sector, according to the report.

- Preliminary estimate of consumer confidence in the euro area improved slightly to -17.5 in Apr (Mar: -19.2), the highest reading since Feb 2022 but well below the long-term average.

- Germany’s flash manufacturing PMI fell by 0.7 point to 44 in Apr, a 35-month low, with factory new orders falling alongside a record improvement in supplier delivery times. Services PMI moved up 2 points to 55.7, supporting the gain in composite PMI (to 53.9 from 52.6), both at 12-month highs. Rate of input cost inflation was the lowest since Dec 2020, but higher than pre-pandemic average.

- UK inflation edged lower to 10.1% in Mar (Feb: 10.4%) while core inflation remained unchanged at 6.2%. Food and non-alcoholic beverages prices rose by 19.2% yoy, the sharpest annual increase for more than 45 years. Producer price index eased on both the input (7.6% in Mar from 12.8%) and output (8.7% from 11.9%) side.

- Flash manufacturing PMI in the UK fell to a 4-month low of 46.6 in Apr (Mar: 47.9). Services PMI gained 2 points to 54.9 and composite PMI was up 1.7 points to 53.9. There was a clear divergent pattern in performance: new order growth hit a 13-month high in the services sector while amid manufacturers it fell, given subdued demand and high energy costs; exports sales rose in the services sector but declined for the 15th month for manufacturers.

- Retail sales in the UK fell by 0.9% mom and 3.1% yoy in Mar, putting the brakes on 2 straight months of rising sales. Sales at department and clothing stores fell by 3.2% and 1.7% respectively while excluding fuel, retail sales slipped by 1% mom and 3.2% yoy.

- Unemployment rate in the UK inched up to 3.8% in the 3 months to Feb (prev: 3.7%), the highest since Q2 2022. The number of unemployed increased by 49k to 1.29mn. Average earnings with (without) bonus remained unchanged at 5.9% (6.6%) in the same period while in real terms wages dropped by 3% (the largest decline since the Feb-Apr 2009 period).

- GfK consumer confidence in the UK rose for the 3rd consecutive month, easing to -30 in Apr (Mar: -36) which was the highest reading since Feb 2022. Expectations for the economy in the next 12 month also rose to a 15-month high.

Asia Pacific:

- China’s GDP grew by 2.2% qoq and 4.5% yoy in Q1: this was the highest yoy growth since Q1 2022 (when it grew by 4.8%) and ahead of expectations.

- Industrial production in China grew by 3.9% yoy in Mar (Feb: 2.4%), the fastest rise since Oct 2022. Retail sales surged by 10.6% yoy (Feb: 3.5%), hitting near 2-year highs, supported by an increase in online sales of physical goods. Fixed asset investment was up by 5.1% in Q1: infrastructure investment rose by a faster 8.5% while property investment fell by 5.8%.

- Foreign direct investment into China grew by 4.9% yoy to CNY 408.45bn in Q1 (Jan-Feb: 6.1%). More than 10k new foreign-investor firms were established in Q1, up by 25.5% yoy.

- Jobless rate in China fell to 5.3% in Mar (Feb: 5.6%) though the rate for those aged 16-24 years rebounded to a near-record high of 19.6% (Feb: 18%).

- Inflation in Japan inched lower to 3.2% in Mar (Feb: 3.3%), given ongoing electricity subsidies. Excluding fresh food, inflation was unchanged at 3.1%, though remaining higher than the BoJ’s target range. Excluding food and energy, prices rose by 3.8% (Feb: 3.5%).

- Industrial production in Japan rose by 4.6% mom in Feb, higher than the flash reading of 4.5% and Jan’s 5.3% drop. IP fell by 0.5% in yoy terms, slower than Jan’s 3.1% drop. Capacity utilization jumped declined to 86.2 in Feb (Jan: 89.7).

- Japan’s flash manufacturing PMI inched up to 49.5 in Apr (Mar: 49.2), the highest reading since Oct 2022. New orders fell at a slower pace while output declined faster amid unchanged employment.

- Exports from Japan increased by 4.3% yoy in Mar (Feb: 6.5%) and imports into the country jumped by 7.3% (Feb: 8.3%), resulting in a narrower trade deficit of JPY 754.5bn. This brought the annual trade deficit to a record JPY 21.7trn, much higher than the previous record of JPY 13.7trn (in fiscal year 2013).

- WPI-based inflation in India eased to a 29-month low of 1.34% in Mar (Feb:3.85%), the 10th consecutive month of moderation in prices. Wholesale inflation eased to an average 9.4% in the 2022-23 period, from a 30-year high of 13% a year ago.

Bottom line: Of the many events to watch this week are GDP for the US and eurozone as well as monetary policy meetings in Japan and Korea. The BoJ is unlikely to make a u-turn in terms of policy this meeting (the first under Governor Ueda), though it would be prudent to focus on hints about forward guidance for policy. Last week’s flash PMI readings offered one major finding across the board: strong start to Q2 thanks to revival in services sector activity amid depressed manufacturing readings. Furthermore, in the US, concerns about a debt ceiling standoff led to the one-year US credit default swaps rising to its highest level since at least 2008. Lastly, an ongoing change in investment strategy of central banks was highlighted in the HSBC Reserve Management Trends Survey: with rising geopolitical risks, central banks have substantially increased and are increasing their gold reserves – more than two-thirds of survey respondents (total of 83 central banks) intend to increase holdings further this year; last year, purchases rose by 152% yoy to 1136 tonnes: this was the highest since 1967, according to the World Gold Council.

Regional Developments

- Bahrain’s national origin exports declined by 20% yoy to BHD 1.004bn in Q1 2023, while re-exports grew by 17% to BHD 186mn. Saudi Arabia, UAE and the US were the top 3 destinations for Bahrain’s national origin products while re-exports were sent to UAE, Saudi Arabia and Singapore (with the top re-export being airplane parts).

- Egypt’s finance minister revealed a 48.8% yoy increase in budget for social protection programs to EGP 529.7bn in 2023-24, with an aim “to ease the burden on citizens during the global inflation wave”.

- Saudi’s ACWA Power plans to build a 1000 MW solar power plant in Iraq’s Najaf city (160km south of Baghdad).

- Jordan signed two loan agreements with the World Bank: one USD 400mn loan is to support climate-responsive investments and job creation (including opportunities for women); the other USD 250mn loans is to improve electricity sector efficiency.

- Tourism income in Jordan rose by 88.4% yoy to USD 1.671bn in Q1 2923m thanks to the more than 1.47mn tourists visiting (+90.7% yoy). This also surpassed the Q1 2019 figure of 1.146 mn visitors and 966k+ overnight tourists.

- Kuwait’s trade surplus with Japan widened by 98.5% yoy to JPY 121.4bn (USD 902mn) in Mar, thanks to strong export growth (+91.4% to JPY 149.7bn).

- Value of contracts awarded in Kuwait surged by 332% yoy and 78.3% qoq to KWD 527mn in Q1 2023, thanks to activity in the power sector. The sector saw contracts worth KWD 236mn awarded, the highest level in almost 6 years, and accounting for 45% of total project awards.

- Kuwait’s crown prince disclosed that new legislative elections would be called for in the coming months as the reinstated parliament (as per the Constitutional Court’s ruling) would be dissolved.

- Lebanon delayed municipal elections by a year (obtaining a “technical extension” until May 31st 2024) purportedly because of the lack of financing, voting to extend the terms of municipal council and other local officials.

- Oman’s latest royal decree allows Omani citizens to marry a foreign national with no requirement of prior state permission. A 1993 law had empowered the interior ministry to approve each marriage to a foreigner prior to the new decree.

- Bilateral trade between Qatar and Jordan grew by 6.5% to USD 58.5mn in Q1 2023, supported by Qatar’s imports of goods of Jordan origin.

- The World Bank’s latest Logistics Performance Index ranks UAE 7th (up 4 ranks from 2018), Qatar 34th (down by 4) and Saudi Arabia 38th (up 17) among 159 nations: a list topped by Singapore, Finland and Denmark. More: https://lpi.worldbank.org/international/global

- According to STR data, Middle East and Africa is the only region globally to post an increase in total rooms under contract (+6.4% yoy to 249,150 in Mar). Saudi Arabia and UAE account for 35.1% and 18.6% of total rooms under construction in the region.

- A report by Henley & Partners disclosed that Dubai is the Middle East’s most popular city for millionaires (68,400 as per the report). During 2022, over 3500 high net-worth individuals relocated to the emirate. Other fastest growing cities attracting millionaires in the region are Marrakech in Morocco and Kigali in Rwanda.

Saudi Arabia Focus

- US Treasuries held by Saudi Arabia inched up to USD 111.7bn in Feb (Jan: USD 111bn), though lower by 4.47% in yoy terms. It is now the 17th largest holder of US debt, a list topped by Japan, China and the UK.

- Credit to micro, small and medium enterprises in Saudi Arabia increased by 13% yoy to SAR 229.3bn (USD 61.4bn) in 2022, according to SAMA data. Banks accounted for 93% of total financing and the rest from financial institutions.

- According to the Saudi Authority for Industrial Cities and Technology Zones (MODON), private sector investments in the Saudi industrial sector surged by 77% yoy to SAR 3.34bn (USD 890mn) in Q1 2023 across various projects.

- Saudi Industrial Development Fund approved 24 loans worth SAR 875mn (USD 233.3mn) in Q1 2023, with a total disbursement of SAR 440.9mn by end-Mar, with SMEs the biggest beneficiaries (62.5% of the number of approved payments).

- Saudi Arabia issued 65,400 commercial registers in Q1 this year, with Riyadh accounting for the most (at 18,800 or 29% of the total) followed by Makkah (14,400). By sector, wholesale and retail industry led the list (21,200 or 32.4% of total) followed by construction (10,000) and accommodation/ catering (8,000).

- Japan received its first low-carbon ammonia shipment from Saudi Arabia, to be used in co-fired power generation. Japan plans to increase its fuel ammonia demand to 3mn tonnes annually by 2030 from nearly zero currently.

- Seven tourist activities in Saudi Arabia require licenses including tourist accommodation facilities and their management, tour guides, private tourism consultancy firms and experimental activities among others.

UAE Focus![]()

- The UAE central bank reported a record increase in foreign assets: up by 1.34% mom and 7.8% yoy, foreign assets rose to a record-high USD 136.2bn as of end-Jan. Aggregate capital and reserves of banks in the UAE grew by 8.5% yoy to AED 438.6bn as of end-Jan, with national banks accounting for the lion’s share (86.5% of the total). Deposits surged by 19.2% yoy and 0.5% mom to AED 2.23trn, with government and private sector deposits up by 1.7% and 1.3% mom respectively.

- Islamic banks’ gross assets in the UAE increased by 5.6% yoy to AED 620.9bn (USD 169bn) at end-Jan 2023. Its deposits grew by 3.1% yoy while total investments in Islamic banks jumped by 20.1% to AED 106bn.

- Inflation in the UAE is estimated to drop to 3.2% by end-2023 from 4.8% last year, thanks to price stabilisation measures and the receding impacts of imported inflation, disclosed the minister for financial affairs.

- The UAE Ministry of Human Resources and Emiratisation revealed that the number of UAE citizens working in the private sector grew by 11% yoy to over 66,000 as of Q1 2023, with over 10,500 persons joining since the beginning of the year. The five sectors attracting Emiratis include construction (+14% yoy), commerce & repair services (13%), manufacturing (10%) business services (10%) and financial brokerage (4%).

- The number of tourists visiting Dubai clocked in at 3.1mn in Jan-Feb 2023, with India (401k visitors), Russia (229k) and Oman (201k) topping the list. Average occupancy during the period stood at 84.4% versus 77.7% a year ago.

- The value of real estate transactions in Dubai surged by 80% yoy to AED 157bn (USD 42.7bn) in Q1 2023, with the number of transactions up by 49% to 38,700. Non-resident investors accounted for 45% of total acquisitions.

- ADNOC signed two agreements with Japan to strengthen the low-carbon hydrogen value chain between the two nations. One agreement aims to explore the production, liquefaction, and transportation of hydrogen to key global markets.

- UAE-based firms are expected to spend USD 6.8bn on outsourcing services in 2023, up from over USD 4.8bn in 2018, according to a report by BCG. The top growth-contributing industries include financial services, public sector, telecommunications, hospitality and leisure. UAE is also a major supplier of outsourcing services (in 2018, an estimated USD 1.3bn), especially customer support, finance and accounting, human resources and knowledge process outsourcing.

Media Review

Will Apple take a big bite out of the banks?

https://www.ft.com/content/fda76c42-0540-48a1-b1d9-259e1c2d6c3a

Is China better at monetary policy than America?

https://www.economist.com/finance-and-economics/2023/04/20/is-china-better-at-monetary-policy-than-america

Russia’s higher energy sales to China & India in late 2022 did not make up for falling exports to Europe

https://www.piie.com/research/piie-charts/russias-higher-energy-sales-china-and-india-late-2022-did-not-make-falling

Powered by: