Markets

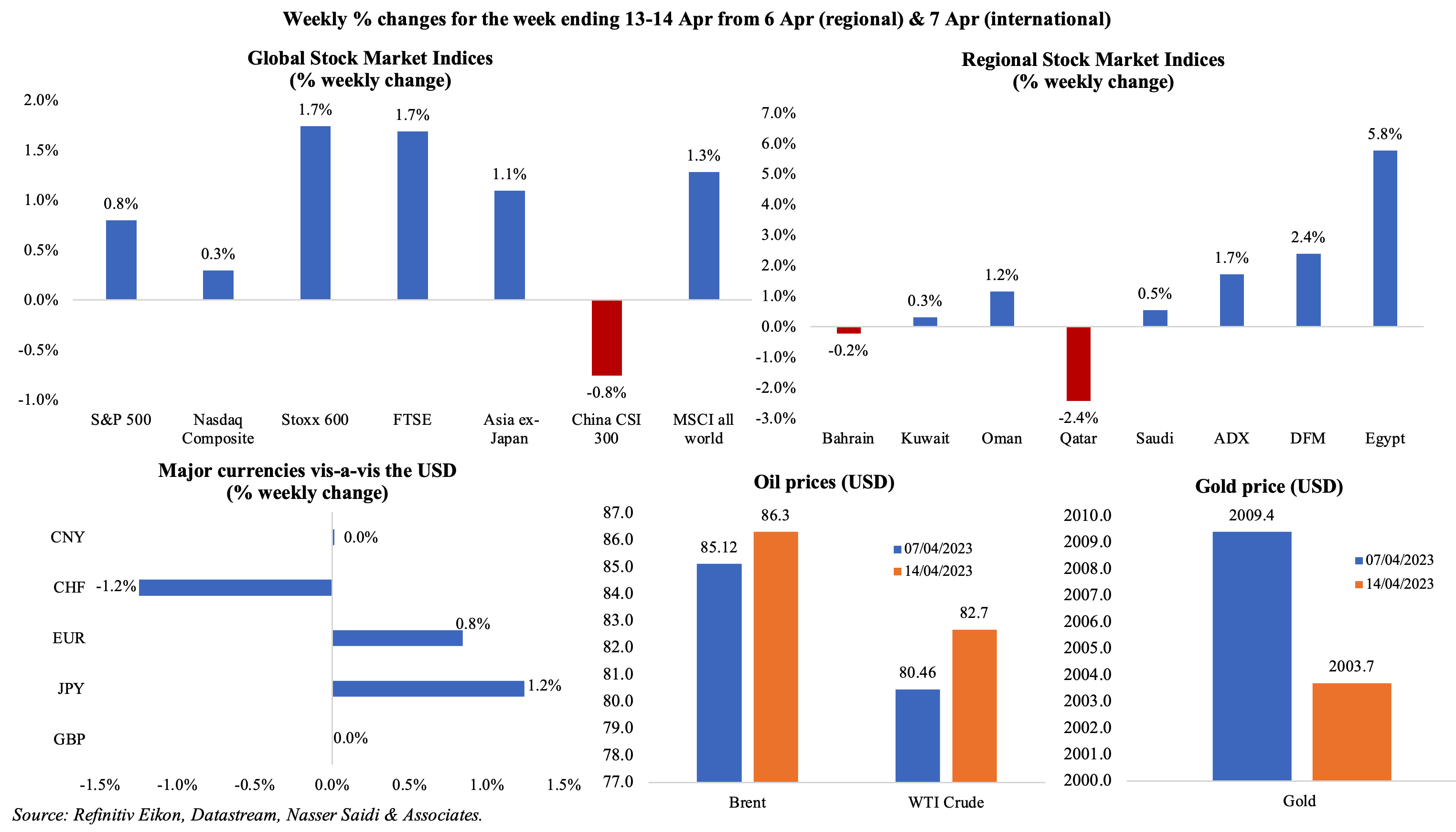

Equity markets in the US were up during last week as the markets anticipate a softening of the Fed’s monetary stance, amid a cooling of headline inflation and hints of a weakening economy; in Europe, Stoxx600 touched its highest level since Feb 2022; Asian shares also gained though China ended in the red. Regional markets were mostly up: Dubai touched a 2023 peak and ended posting the biggest weekly gain since Sep (2.4%). The euro rose to its highest in a year before closing lower while the GBP was close to a 10-month high vis-à-vis the dollar. Oil prices increased after the IEA forecast record global demand (+2mn bpd to 101.9mn bpd, given higher Chinese demand) while gold price retreated towards the end of the week in a volatile market.

Global Developments

US/Americas:

- US inflation eased to 5% yoy in Mar (Feb: 6%), the lowest level since May 2021 thanks to a decline in energy prices (-6.4%). Core inflation inched up slightly to 5.6% (Feb: 5.5%), ending the five consecutive months of slower yoy increases; core inflation rose thanks to higher shelter (8.2%), transportation (13.9%) and food costs (8.5%) among others.

- Producer price index slipped to 3.4% yoy in Mar (Feb: 4.8%) as gasoline prices plunged, recording the smallest yoy increase since Jan 2021. Core PPI increased by 3.6% in Mar, slower than Feb’s 4.5% increase.

- FOMC minutes showed that the banking turmoil unleashed by the failure of SVB was a key concern among many Fed officials, but eventually it was decided that the persistently high inflation took priority with respect to the rate hike. The committee stated that “some additional policy firming may be appropriate” to bring inflation back to the Fed’s 2% target.

- US budget deficit widened to USD 378bn in Mar (Feb: USD 262bn), taking the year-to-date fiscal deficit to USD 1.1trn (up 65% yoy). Deficit has been driven by the higher individual tax refunds (due to a backlog of unprocessed returns) and lower Federal Reserve earnings.

- Retail sales in the US fell by 1% mom in Mar (Feb: -0.2%), as auto sales fell by 1.6%, furniture and electronics & appliance sales dropped by 1.2% and 2.1% respectively. Excluding autos, retail sales fell by 0.8% mom.

- Michigan consumer sentiment index rose to 63.5 in Apr (Mar: 62) though sentiment declined among those with higher incomes; the 5-year consumer inflation expectation remained unchanged at 2.9% while the 1-year expectation rose to 4.6% from 3.6% in Mar.

- Initial jobless claims increased by 11k to 239k in the week ended Apr 7th, the first increase in 3 weeks, with the 4-week average sliding up by 2,250 to 240k (the most since Nov 2021). Continuing jobless claims moved lower by 13k to 1.81mn in the week ended Mar 31st, very close to pre-pandemic levels.

Europe:

- Industrial production in the eurozone rose by 1.5% mom in Feb (Jan: 1%), with capital goods production rising by 2.2% mom and non-durable consumer goods up by 1.9%.

- Retail sales in eurozone fell by 0.8% mom in Mar (Jan: +0.8%), with both food and non-food sales down (by -0.6% and -0.7% respectively), reflecting weak domestic demand amidst higher prices and interest rates. Sales were down by 3% yoy in Mar (Feb: -1.8%), posting the 5th consecutive month of contraction.

- Eurozone’s Sentix investor confidence improved to -8.7 in Apr (Mar: -11.1), thanks to the sixth consecutive month of increase in the current situation index (to -4.3 from -9.3) while the expectations index remained unchanged at -13.

- GDP growth in the UK was flat in Feb (Jan: 0.4%), partially given the impact of strikes in the services sector. With this reading, UK has finally risen above pre-pandemic 2019 levels, 0.3% bigger than in Feb 2020. Industrial production fell by 0.2%, resulting partly from a flat manufacturing reading while the services posted a 0.4% expansion.

- UK like-for-like retail sales increased by 4.9% yoy in Mar while total retail sales rose by 5.1% (Q1: average 4.8%), according to data from the British Retail Consortium.

Asia Pacific:

- Inflation in China unexpectedly eased to 0.7% in Mar (Feb: 1%), the lowest since Sep 2021, as food prices fell to a 10-month low. Core inflation inched up to 0.7% from Feb’s 0.6% uptick. China’s producer price index fell further in Mar, down -2.5% from the previous month’s 1.4% drop: this was the fastest decline since Jun 2020.

- New bank loans in China surged to a record-high in Mar, rising to CNY 3.89trn (more than double Feb’s reading of CNY 1.81trn). Money supply (M2) grew by 12.7% yoy while outstanding loans were up by 11.8%, the highest in 17 months.

- Exports from China surged by 14.8% yoy in Mar (Feb: -6.8%, rising for the first time since Sep 2022) alongside a 6.9% growth in imports, resulting in a narrower trade surplus of USD 88.19bn (Feb: USD 116.8bn). Exports were supported by shipments to Russia and south-east Asia, with gains in new exports including electric vehicles, lithium and solar batteries.

- Japan’s current account moved into a surplus of JPY 2.197trn in Feb (Jan: record deficit of JPY 1.989trn) as the trade deficit narrowed and was offset by a primary income surplus.

- Core machinery orders in Japan fell by 4.5% mom in Feb, following Jan’s 9.5% gain, as non-manufacturing orders dipped (-14.7%). In yoy terms, it grew by 9.8%.

- Consumer price inflation in India increased by 5.66% yoy in Mar (Feb: 6.44%), the lowest since Dec 2021. It now lies within the RBI’s upper limit of 6%, thanks to decline in costs of food, fuels and clothing while housing costs inched up (4.96% from 4.83%).

- India’s industrial output grew by 5.6% yoy in Feb (Jan: 5.5%), with manufacturing output growing by 5.3%.

- India’s trade deficit widened to USD 19.73bn in Mar (Feb: USD 17.43bn), with exports down by 13.9% yoy to USD 38.38bn (a 9-month high) and imports down by 7.9%. For the full financial year (Apr 2022-Mar 2023), exports rose to the highest on record (USD 447.5bn) and trade deficit rose to USD 122bn from USD 83.5bn a year ago.

- The Bank of Korea left interest rates unchanged at 3.5% for the second meeting in a row, as inflation slows (4.2% in Mar from a 24-year high of 6.3% in Jul 2022). However, the governor warned against expectations for a rate cut (5 of the 6 members want to keep the door open for one more hike) as inflation was still high, a riskier proposition than lower growth.

- Advance estimate for Singapore’s Q1 GDP growth stood at 0.1% yoy (Q4: 2.1%), dragged down by manufacturing sector (-6% yoy and 5.2% qoq). In qoq terms, growth fell by 0.7%, the first contraction since Q2 2022. Separately, the Monetary Authority of Singapore announced that it would maintain its current monetary policy stance, pausing after tightening the past 5 times since Oct 2021.

Bottom line: The IMF forecast slower global growth in 2023 (2.4% yoy before inching up to 3% in 2024), with Asia & the Pacific contributing more than 70% to global growth. Evidence of this was seen partly in the encouraging data from China last week: e.g. surge in exports and credit. The IMF also warned that the sharp monetary policy tightening could lead to a potential recession while its impact on the banking sector (specifically) could lead to further financial instability. For the time being, effects of the recent banking turmoil on economic activity should be evident in the flash PMIs being released this week.

Regional Developments

- The IMF forecasts growth in the MENA region to slow in 2023 (3.1% from 5.3% in 2022) while inflation remains stable at around 15%. The widening gap between nations with good credit and ability to access markets with those struggling highlights growing risks, according to the IMF. High interest rates, volatile oil prices, continuing geopolitical tensions and double-digit inflation are top concerns, and could lead to risks of social unrest, high debt levels and potential debt distress among others. GCC growth will slow as well but will likely be supported by its non-oil sectors and projects pipeline) while its spill-over effects will be reflected in the region’s labour-exporting nations (already growing at a slower pace, seen from PMI data).

- Debt issuances in the MENA region nearly tripled to USD 26.9bn in Q1 2023, according to Refinitiv data. Saudi accounted for 67% of total bond proceeds followed by the UAE (17%), Morocco (9%) and Egypt (6%). Sukuk accounted for 23% of total bond proceed, and raised USD 6.3bn, a 3-year high and up 57% yoy.

- Foreign ministers from the GCC, Egypt, Iraq and Jordan discussed a potential return of Syria into the Arab League at the meeting held in Saudi Arabia. Jordan had proposed a “step-for-step” approach which includes the return of refugees who fled Syria. The meeting did not result in an agreement: Qatar’s PM stated that the original basis of Syria’s suspension still stands. The Arab League summit is to be held on May 19th in Riyadh.

- The foreign ministers of Saudi Arabia and Syria met in Jeddah last week, agreeing to resume consular services and flights while also discussing steps needed towards a potential normalisation of links. Separately, Tunisia also disclosed an agreement with Syria to reopen embassies.

- Bahrain and Qatar will resume diplomatic ties, it was announced last week, two years after the boycott of Qatar was lifted.

- FDI inflows into Bahrain grew by 9.7% yoy to BHD 733.6bn in 2022, according to the Information and eGovernment Authority. FDI inflows by sector were dominated mostly by electricity, gas steam & air conditioning supply (BHD 226.8mn), manufacturing (BHD 187.1bn) and financial & insurance activities (BHD 95.5mn) sectors. Kuwait, UAE and Guernsey were the top three source nations, with Kuwait accounting for 66.3% of the total.

- Urban inflation in Egypt touched 32.7% in Mar (Feb: 31.9%), the highest since Jul 2017, with food and beverages up by 62.7% yoy and 5.3% mom.Core inflation was at a much higher 39.5% though slower than Feb’s record-high 40.3%. The central bank targets inflation at 7% ± 2% in Q4 2024 and lower to 5% ± 2% in Q4 2026.

- A KPMG report highlighted Kuwait’s infrastructure project pipeline with an estimated value of USD 27.6bn in the bidding stage currently.

- Oman’s budget surplus stood at OMR 372mn at end-Feb 2023 versus a surplus of OMR 210mn in Feb 2022. Revenues grew by 12% yoy to OMR 2.15bn while spending inched up by 4%. The government also repaid loans worth OMR 1.1bn (USD 2.9bn) thereby reducing total public debt to OMR 16.6bn at end-Feb.

- Bank lending in Oman increased by 6.8% yoy to OMR 29.8bn as of Feb 2023 (2022: 5%) while deposits grew by a slower 2.9%. Total assets of Islamic banks and windows in Oman increased by 8.8% yoy to OMR 6.5bn at end-Feb 2023.

- Oman’s Ahli Bank disclosed in a bourse filing that its board decided not to accept a non-binding merger offer from the nation’s 2nd largest lender Bank Dhofar. A merger would have created a lender with just under USD 20bn in assets.

- Fitch revised Oman’s outlook to positive (from stable), given its successful reduction in debt and external liquidity risks, and affirmed its rating at BB.

- Inflation in Qatar rose to 4.01% yoy in Mar 2023, with recreation & culturerising the most (13.63%), followed by housing & utilities (8.65%). The least gains were recorded health (1.62%) and food & beverages (1.06%).

- Qatar’s PMI disclosed that GDP touched QAR 864bn at end-2022, growing at a rate of 38 times in 30 years. He also revealed that the there is “no government decision on income tax” while the issue of when VAT would be applied “has not been studied”.

- Qatar’s foreign reserves surged by 11.8% yoy to QAR 235.25bn in Mar, according to the central bank.

- Wamda’s report revealed that start-ups in MENA raised USD 247mn across 67 deals in Mar 2023, with Saudi’s share more than half the total deal value. Saudi topped the regional list, raising USD 175mn from 20 deals, followed by UAE (USD 59mn across 18 deals) and Bahrain (USD 6mn).

Saudi Arabia Focus

- Saudi Arabia’s consumer price inflation inched lower to 2.7% yoy in Mar(Feb: 2.96%), even though housing and utilities costs jumped (7.37% yoy in Mar). Overall housing rents is surging (8.7% yoy) as is rents for apartments (22%), given that demand for expatriate accommodation is increasing (e.g. as a result of companies moving regional HQs) vis-a-vis limited supply.

- Wholesale prices in Saudi Arabia softened to 1.1% yoy in Mar, from Feb’s 2.7% gain, with declines seen across all categories. WPI stood at 2.5% in Q1 2023 from a double-digit surge of 12% in Q1 2022. Among the various sections, only food products, beverages and tobacco and textiles showed an increase in Q1 2023 (6.32%) vs Q1 2022 (4.58%).

- Industrial production (IP) growth in Saudi Arabia has been easing in 2023, recording 6% yoy growth in Feb (Jan: 6.8% yoy), and following 2022’s full-year gain of 17.5%. Mining and quarrying have been the main drag on overall IP, given the oil production cuts because of the OPEC+ agreement. Manufacturing grew by 16.8% in Feb (Jan: 19.2%, 2022: 22.3%).

- According to SAMA data, foreign investments in Saudi Arabia grew by 2% yoy to SAR 2.4trn (USD 640bn) in 2022, with FDI accounting for 42% of overall foreign inflow and portfolio investments at SAR 822.8bn.

- Saudi Arabia will establish four new special economic zones for international investors, located in Riyadh, Jazan, Ras Al-Khair and King Abdullah Economic City. Among the benefits of being in the SEZs are competitive corporate tax rates, exemption from customs duties on imports, production inputs, machinery and raw materials as well as 100% foreign ownership of companies among others.

- A 4% stake in Saudi Aramco has been transferred to the PIF’s Sanabil Investments, with the state still the biggest shareholder (at 90.18%). This move, which makes the PIF an 8% stakeholder, will support PIF’s financial position and credit rating.

- Saudi Arabia’s new Companies Law, which allowed the formation of a new Simplified Joint Stock Company, supported 2,011 institutes to transition to companies in Q1 2023.

- Real estate prices in Saudi Arabia inched up by 1% yoy in Q1 2023, thanks to an increase in prices of both residential (+1.6%) and commercial (0.1%) real estate properties. Prices of apartments ticked up by 2.1% while residential buildings and villas were down by 0.9% and 0.3% respectively.

- The Sakani program, launched to increase the proportion of Saudi home ownership, saw 28,000 families benefiting from housing options and financing solutions in Q1 2023.

- Jeddah international airport handled more than 2mn passengers since the beginning of Ramadan (Mar 23rd) via 13k incoming and outgoing flights. The airport was the busiest in Saudi Arabia last year, handling 32mn passengers.

- Ports in Saudi Arabia posted a 21.14% uptick in container volumes to 693,523 TEUs in Mar, supported by an expansion in imports (37.5%) and exports (17.74%).

- In spite of the announced OPEC+ cuts, Saudi Arabia will supply full crude contract volumes loading in May to Asian refiners, reported Reuters.

- Saudi Arabia’s Authority for Intellectual Property received 5,837 patent applications and 40,287 trademark applications at the domestic level and from abroad last year.

UAE Focus![]()

- UAE’s Vice President and Ruler of Dubai, looking back at 17 years since he took charge of the Cabinet and Federal Government, disclosed that during the 17-year period GDP doubled, government budget expanded by 140%, foreign trade jumped 5 times, over 4200 legislations were passed across all sectors and the government moved from a traditional one to offering over 1500 smart services among other achievements.

- Dubai PMI inched up to 55.5 in Mar (Feb: 54.1), supported by growth in output, employment (fastest pace since Jan 2018) and stocks of purchases while new orders rose to the least since Jan 2022. However, wholesale and retail sector stood at a 14-month low in Mar while travel and tourism also lost momentum. The construction sector saw strong output growth (best since Sep 2022) alongside rising new orders and employment.

- UAE banks’ deposit growth in Jan (0.5% mom and 12.6% yoy) was the result of a surge in government (40.7% yoy to AED 286.9bn) and corporate deposits (17.4% to AED 673.7bn). While loans to the private sector grew by 4.6% yoy in Jan 2023, largely due to the 8.2% surge in loans to retail customers, loans to the public sector fell by 1.8% yoy in Jan (after 19 consecutive months of growth and 11 of those months clocking in double-digit increases), loans to the government declined by 6.8% yoy (posting the 20th straight month of negative readings). UAE banks’ assets grew by 11.5% to AED 3.66trn in Jan.

- UAE has pledged financial support of USD 1bn to Pakistan, allowing the latter to get closer to an IMF deal. The country has also received commitments from Saudi Arabia and China.

- Exports from the UAE to Egypt rose by 1.9% yoy to USD 2.8bn in Jan-Nov 2022 while imports increased by 14.4% to USD 1.8bn. Remittances from the UAE grew by 1.4% to USD 3.5bn in financial year 2020-21.

- UAE’s investments in Brazil stands at an estimated USD 5bn, according to the Minister of Economy, while non-oil trade between the two nations exceeded USD 4bn (+32% yoy).

- Dubai will start accepting applications from legacy virtual asset operators under the Department of Economy and Tourism and the Dubai Free Zone Council to become fully regulated under the Virtual Assets Regulatory Authority (Vara). Towards this end, the operators are required to complete and submit initial disclosure questionnaires (to the DET or any other FZ authority) by end of this month. If the entity receives initial approval, they can submit a full market product license application to Vara.

- India’s trade data for the financial year 2022-23 (ended Mar 2023) shows that UAE is the second largest export destination (following the US and ahead of the Netherlands) and the third largest source of imports (after China and Russia).

Media Review

IMF: Global Economic Recovery Endures but the Road Is Getting Rocky

Report: https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023

A Bank Murder Mystery: Barry Eichengreen

China hit by surge in Belt and Road bad loans

https://www.ft.com/content/da01c562-ad29-4c34-ae5e-a0aafddd377c

Qatar eyes lion’s share of global halal economy

https://www.arabnews.com/node/2284416/business-economy

Powered by: