Global growth and inflation. Global government debt. MENA’s growth, inflation & regional cooperation. Inflation in Saudi Arabia & Egypt. UAE deposit growth outpaces loans growth. Saudi industrial production.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 14 Apr 2023: How will MENA hold up in the backdrop of slowing global growth & steady inflation in 2023?

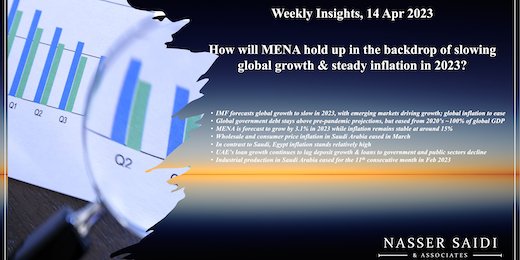

1.IMF forecasts slower global growth in 2023; Emerging Markets driving growth; Global Inflation easing

- Main highlights from the IMF’s latest World Economic Outlook report are that Growth will slow to 2.8% yoy this year before inching up in 2024; China is rebounding strongly, supporting growth in Asia & the Pacific (at 4.6%, it is one of the fastest growing regions this year, contributing more than 70% to global growth) 2. Inflation will fall to 7% in 2023 (2022: 8.7%), reflecting the decline in global food and energy prices; however, core inflation remains high in many parts of the world (including in Egypt in the region, see slide #6) given strong labour markets (in US, Europe) and effect of currency depreciation (in many emerging Asian nations). 3. More monetary policy tightening is needed to bring inflation down further; tighter fiscal policy can effectively support to bring real interest rates down faster.

- Risks to the outlook, skewed to the downside, stem from: tightening global financial conditions (impact on credit, public finances, decline in economic activity), greater geo-economic fragmentation and fiscal consolidation amid high debt & rising interest rates among others

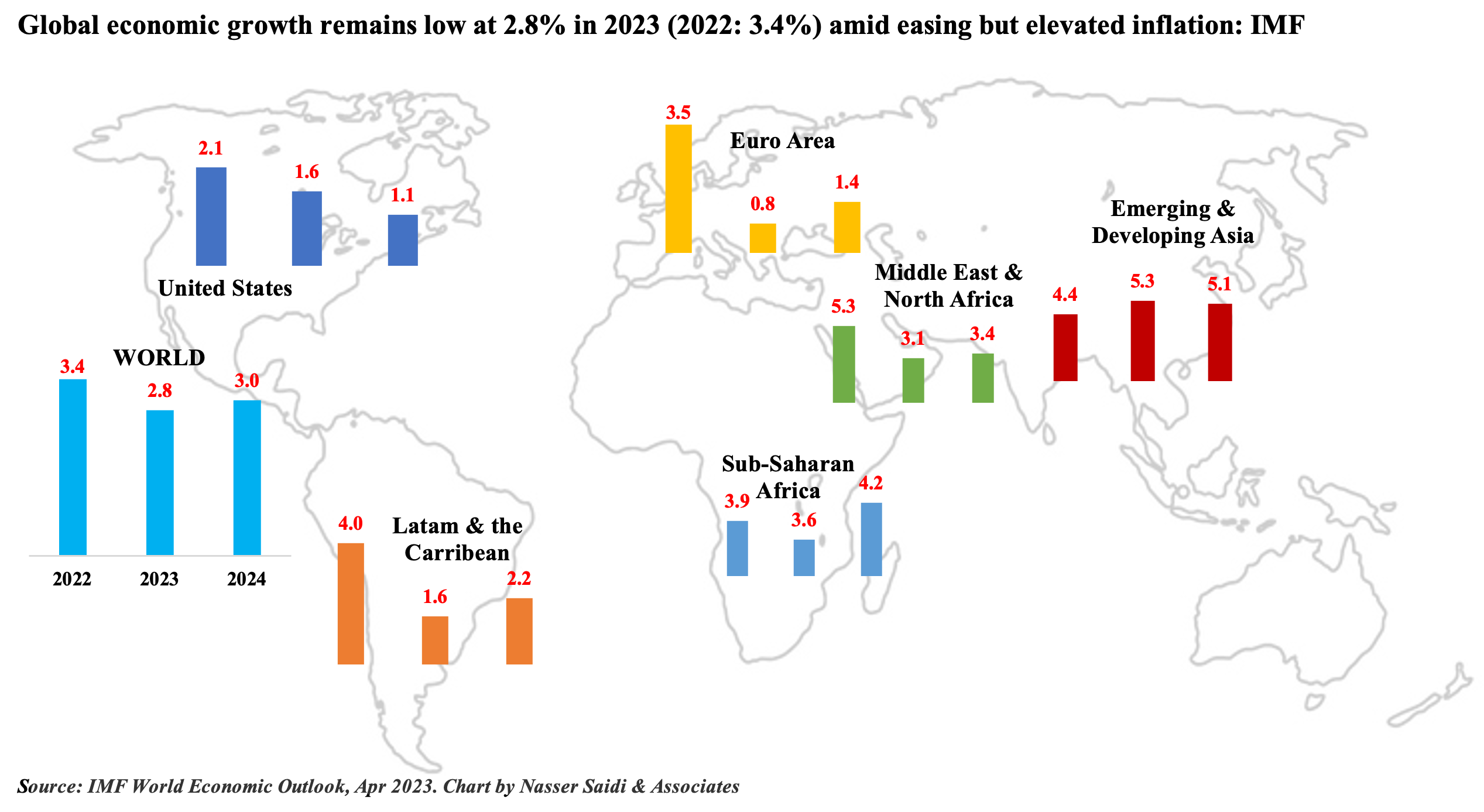

2. Global government debt stays above pre-pandemic projections, but lower from 2020’s nearly 100% of global GDP

- IMF: Nearly three-quarters of countries tightened both fiscal & monetary policies in 2022.

- This led to a decline in global government debt to 92% of GDP at end-2022. Primary deficits are also falling, returning to pre-pandemic levels.

- However, debt is estimated to deteriorate in the medium-term: global gross debt is forecast to rise to 93.3% in 2023.

- Oil producers’ fiscal balances moved into a surplus in 2022 (2.0% of GDP) but is expected to return to a deficit of 0.3% in 2023; this is mirrored also in Saudi Arabia. UAE meanwhile is expected post fiscal surpluses all through the period 2023-2028

- Government debt slipped to 115% last year in advanced economies (vs 2021’s 117.4%); in Saudi, it declined to 22.6% (28.8%)

- With the ongoing monetary policy tightening to contain inflation, higher borrowing costs are weighing on public finances: 39 nations are already in or near debt distress.

- Fiscal policy needs to complement monetary policy. Nations need to practice consolidation (including in oil producers) via introducing new taxes / raising tax revenues, improve spending efficiency, or introducing structural fiscal reforms (like pension and subsidy overhauls.

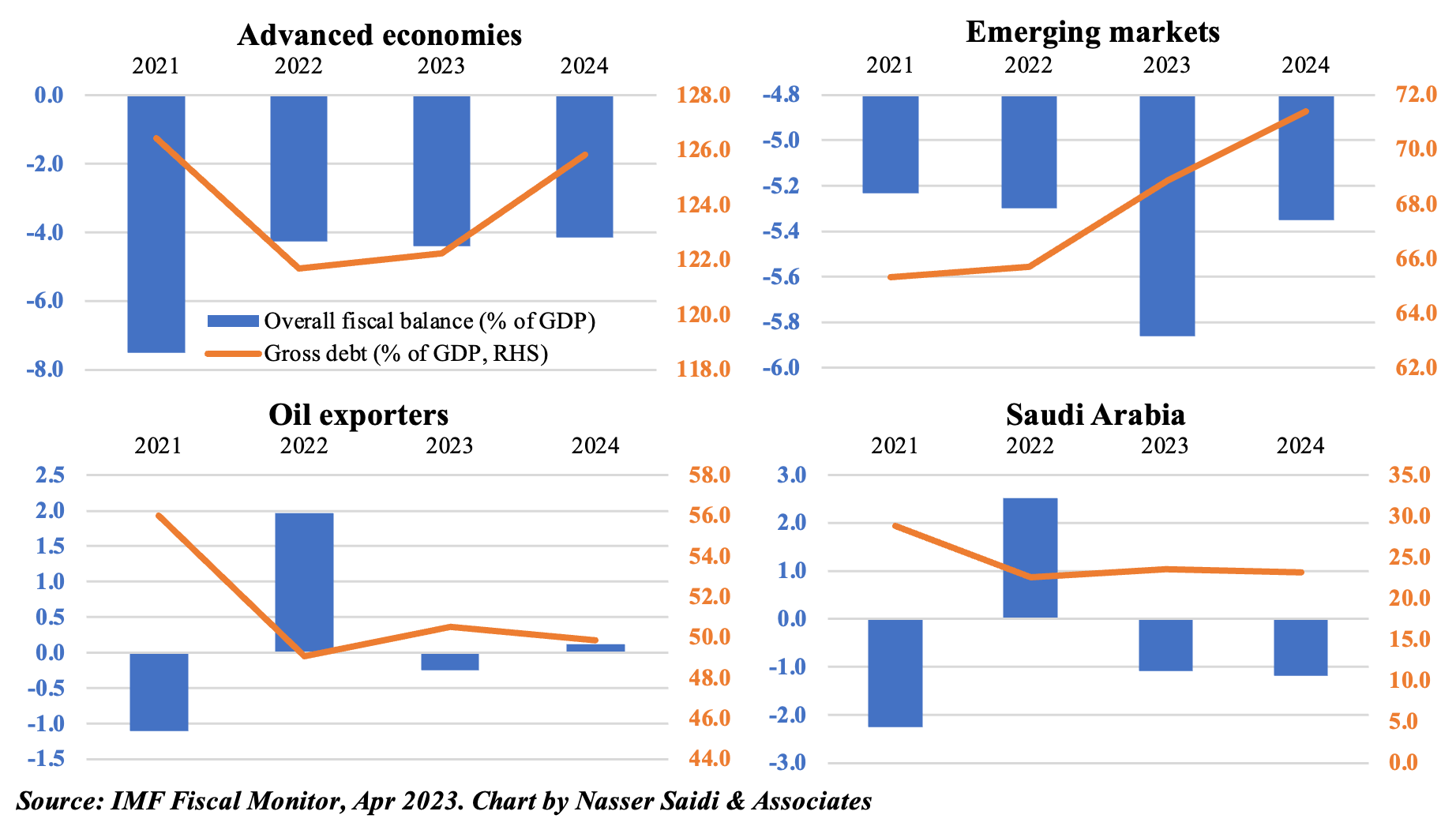

3. MENA is forecast to grow by 3.1% in 2023, while inflation remains stable at around 15%

- The IMF disclosed the growth is to slow in 2023 as a result of the OPEC+ oil production cuts (affecting oil exporters’ growth which will fall to 3.1% this year from 2022’s 5.7%) as well as tighter monetary policy (to contain inflationary pressures, which will lower demand). GCC growth will slow (but will likely be supported by its non-oil sectors and projects pipeline) and its spillover effects will be reflected in the region’s labour-exporting nations (already growing at a slower pace, seen from PMI data).

- The rise in interest rates will affect nations that have relatively high debt levels (e.g. Egypt, where government net debt is estimated at 88.3% of GDP in 2023) amid rising cost of financing and difficulties to get additional financing.

- Inflation is forecast to remain around 15% in 2023, but the divergence is likely to persist from relatively low levels in the GCC to double and triple digits in Egypt and Lebanon respectively (both reeling from sharp currency devaluations).

- However, a major change that has been seen in recent months is increased regional cooperation: from Saudi Arabia and the UAE restoring ties with Iran, Egypt’s discussions with Turkey, Saudi and Oman’s peace talks with Yemen, and a potential return of Syria into the Arab League (come May?).

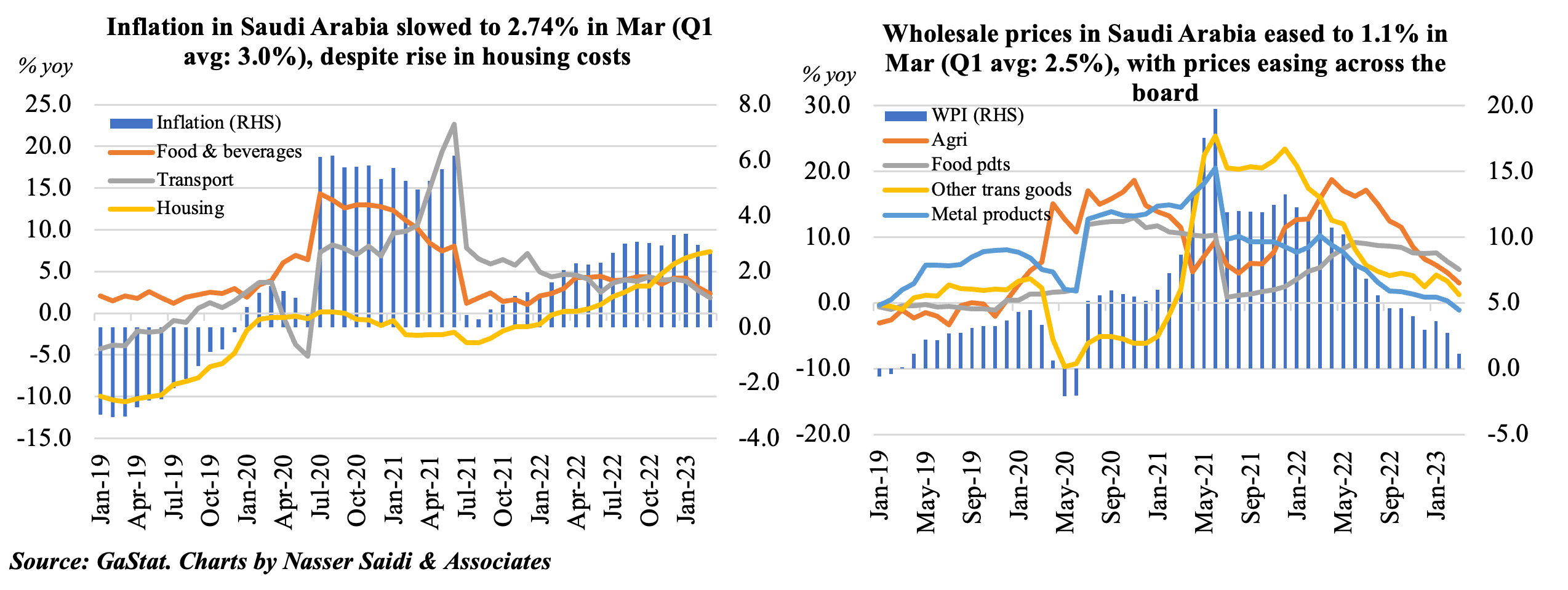

4. Wholesale and consumer price inflation in Saudi Arabia eased in March

- Overall consumer price inflation in Saudi Arabia inched lower to 2.7% yoy in Mar (Feb: 2.96%), even though housing and utilities costs jumped (7.37% yoy in Mar). Overall housing rents is surging (8.7% yoy) as is rents for apartments (22%), given that demand for expatriate accommodation is increasing (e.g. as a result of companies moving regional HQs) vis-a-vis limited supply.

- In Q1 2023, consumer inflation had inched up to 3.0% versus 1.6% in Q1 2022. Compared to a year ago, housing & utilities (7.0% from -0.4%), restaurants & hotels (2.5% to 6.4%) and food prices (2.5% to 3.2%) posted the highest upticks.

- Wholesale prices in Saudi Arabia softened to 1.1% yoy in Mar, from Feb’s 2.7% gain, with declines seen across all categories. WPI stood at 2.5% in Q1 2023 from a double-digit surge of 12% in Q1 2022. Among the various sections, only food products, beverages and tobacco and textiles showed an increase in Q1 2023 (6.32%) vs Q1 2022 (4.58%).

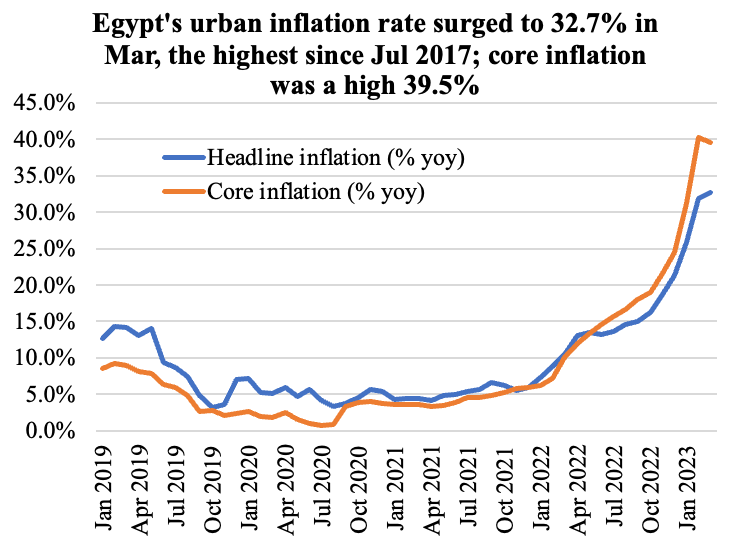

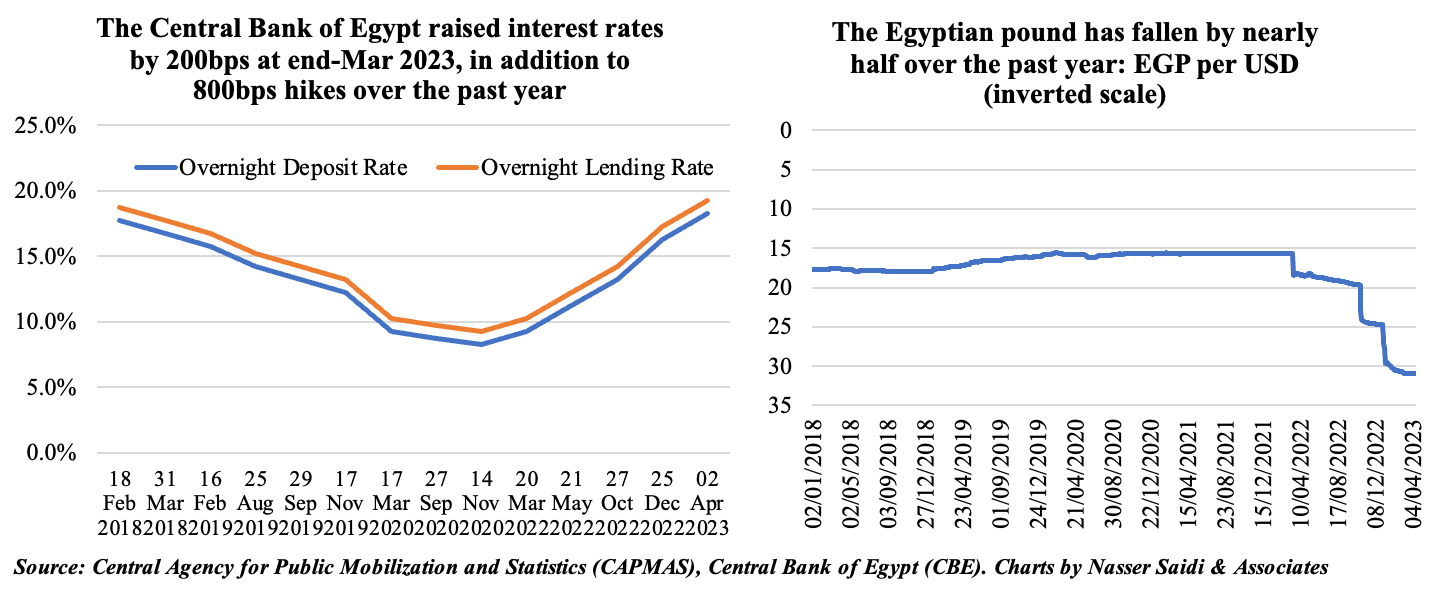

5. In contrast to Saudi, Egypt inflation stands relatively high

- Urban inflation in Egypt touched 32.7% in Mar, the highest since Jul 2017. Core inflation was at a much higher 39.5% (though slower than Feb’s record-high 40.3%).

- Despite the 800bps hike in interest rates last year, and the further 200bps hike at the latest meeting, inflation has not subsided.

- Egypt devalued the EGP in Jan for the 3rd time in less than 12 months. Domestic demand has been weak and forex liquidity needs to be improved: Egypt is struggling with a dollar shortage; EGP has lost close to half its value since last year and there have been import restrictions.

- For now, the way out seems more structural reforms (like privatisation of SOEs, social safety nets) and other commitments (like removal of subsidies, fiscal consolidation) to get further funding from its richer neighbours (e.g. GCC) in addition to support from the IMF.

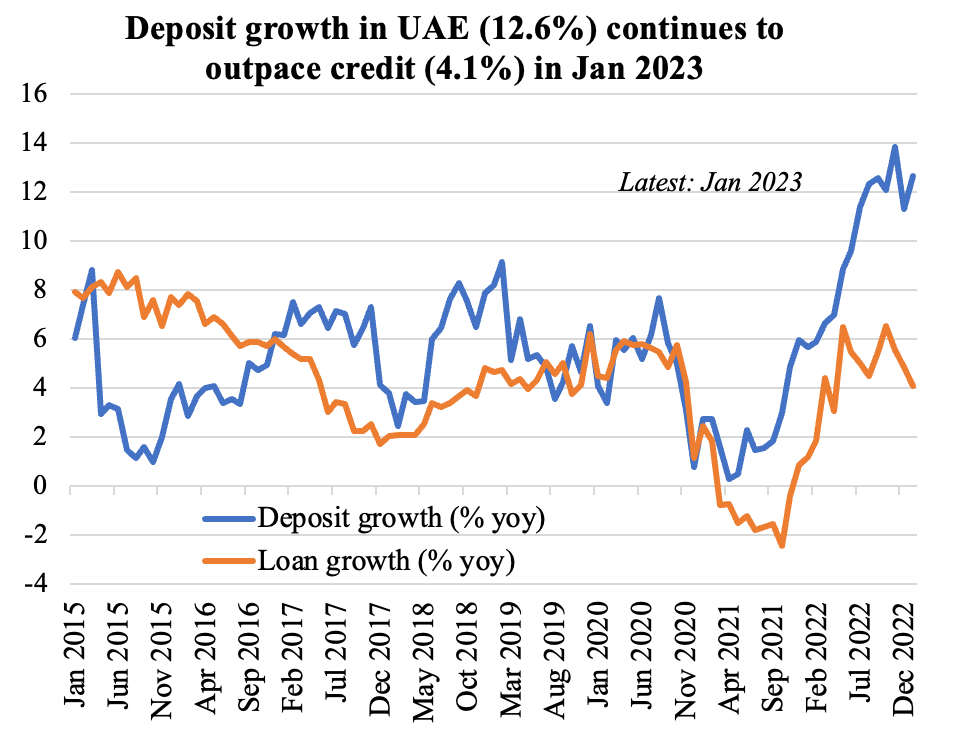

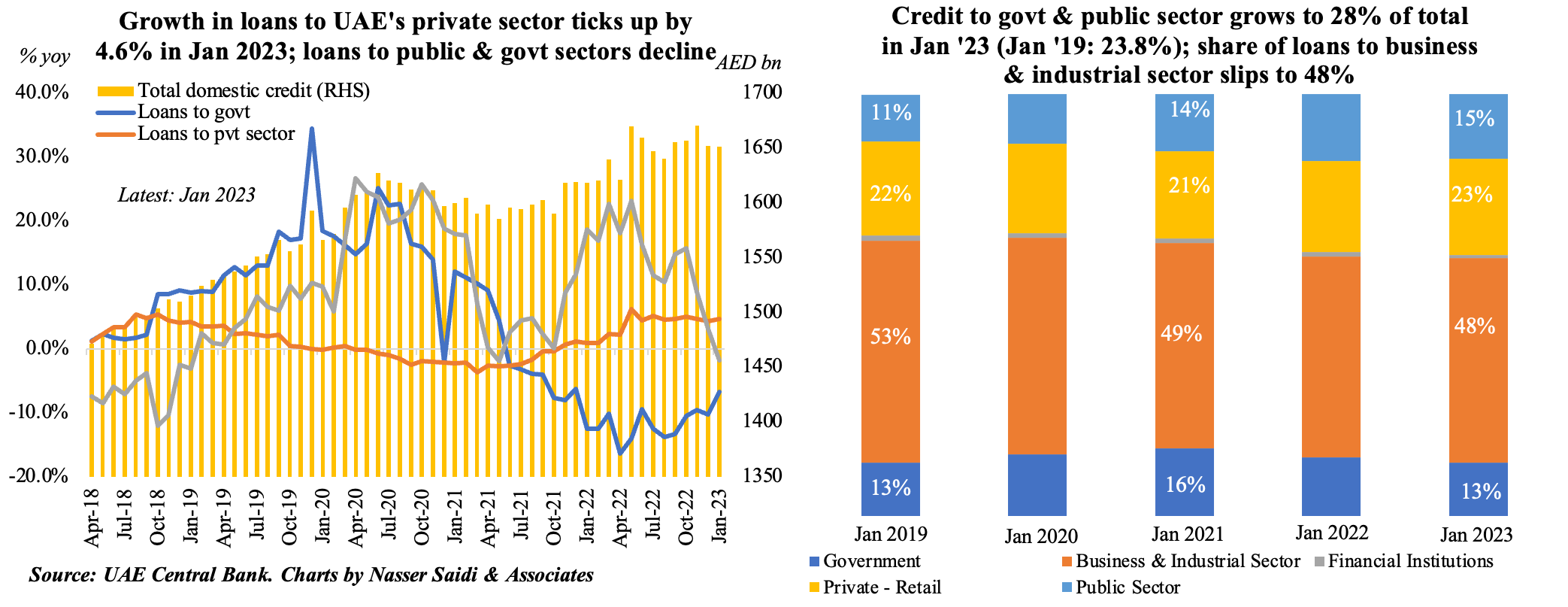

6. UAE’s latest monetary statistics shows that overall deposit growth continues to outpace loan growth & loans to government and public sectors decline

- UAE banks’ deposit growth in Jan (0.5% mom and 12.6% yoy) was the result of a surge in government (40.7% yoy to AED 286.9bn) and corporate deposits (17.4% to AED 673.7bn)

- Loan growth also shows a divergent pattern: loans to the private sector grew by 4.6% yoy in Jan 2023, largely due to the 8.2% surge in loans to retail customers; loans to the public sector fell by 1.8% yoy in Jan, after 19 consecutive months of growth (and 11 of those months clocking in double-digit increases); loans to the government declined by 6.8% yoy, the 20th straight month of negative readings.

- The lion’s share of loans disbursed are to the business and industrial sector (48% of total), but the share of credit to government and public sector has increased to 28% in Jan 2023 (vs 23.8% in Q1 2019).

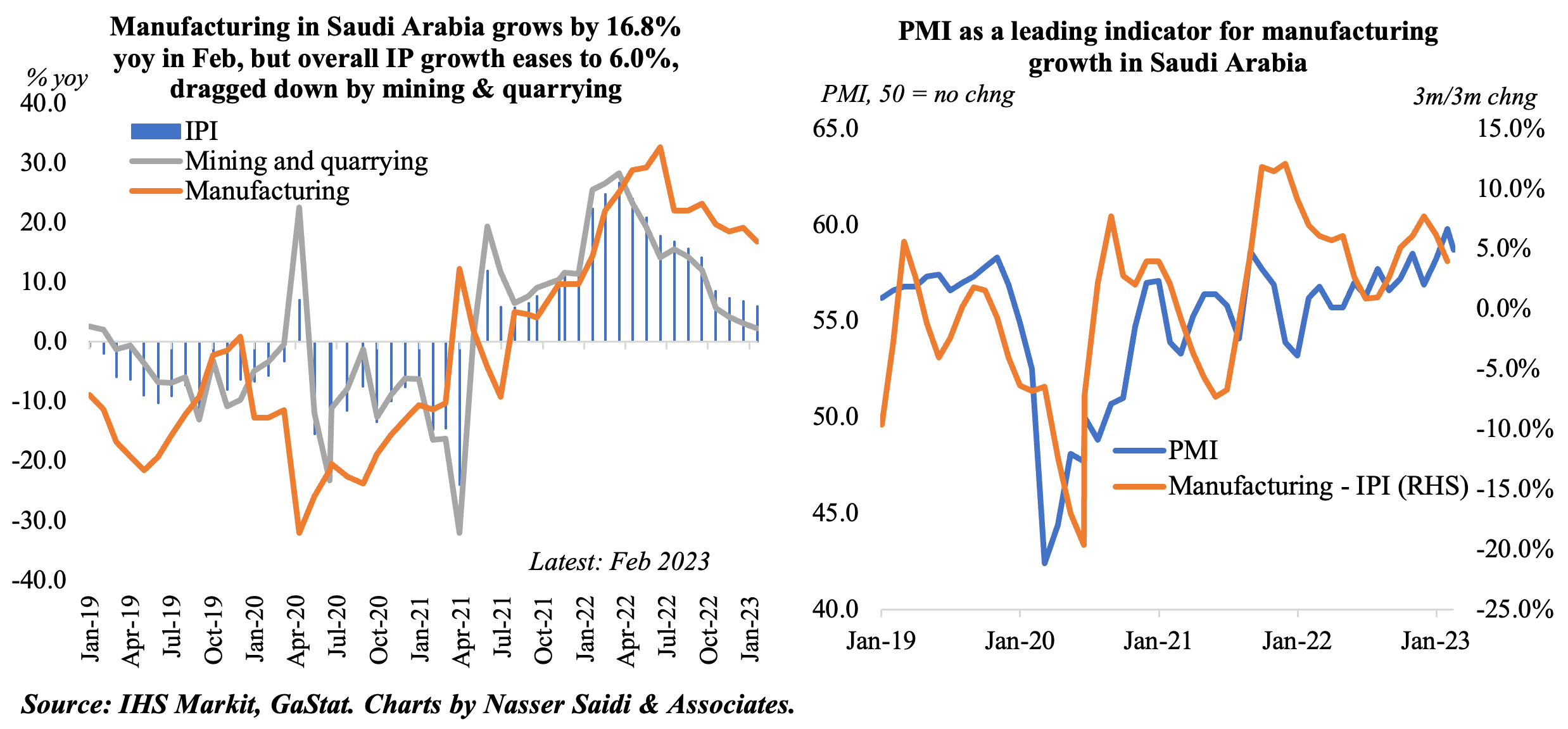

7. Industrial production in Saudi Arabia eased for the 11th consecutive month in Feb 2023

- Industrial production (IP) growth in Saudi Arabia has been easing in 2023, recording 6% yoy growth in Feb (Jan: 6.8% yoy), and following 2022’s full-year gain of 17.5%. Mining and quarrying has been the main drag on overall IP, given the oil production cuts as a result of the OPEC+ agreement. Manufacturing grew by 16.8% in Feb (Jan: 19.2%, 2022: 22.3%).

- Saudi Arabia’s non-oil sector PMI has been in expansionary territory for 31 straight months: though the increase in both output and new orders slowed, foreign orders grew (“improvement in industrial landscape has created positive grounds for producers to diversify their production lines and compete in foreign markets, enlarging their market share”).

- Both the robust PMI reading and the announcement of 85 new industrial licenses being issued in Feb (including 18 for manufacturing of metal products, 14 for food products) is likely to increase production further in the coming months.

Powered by: