Markets

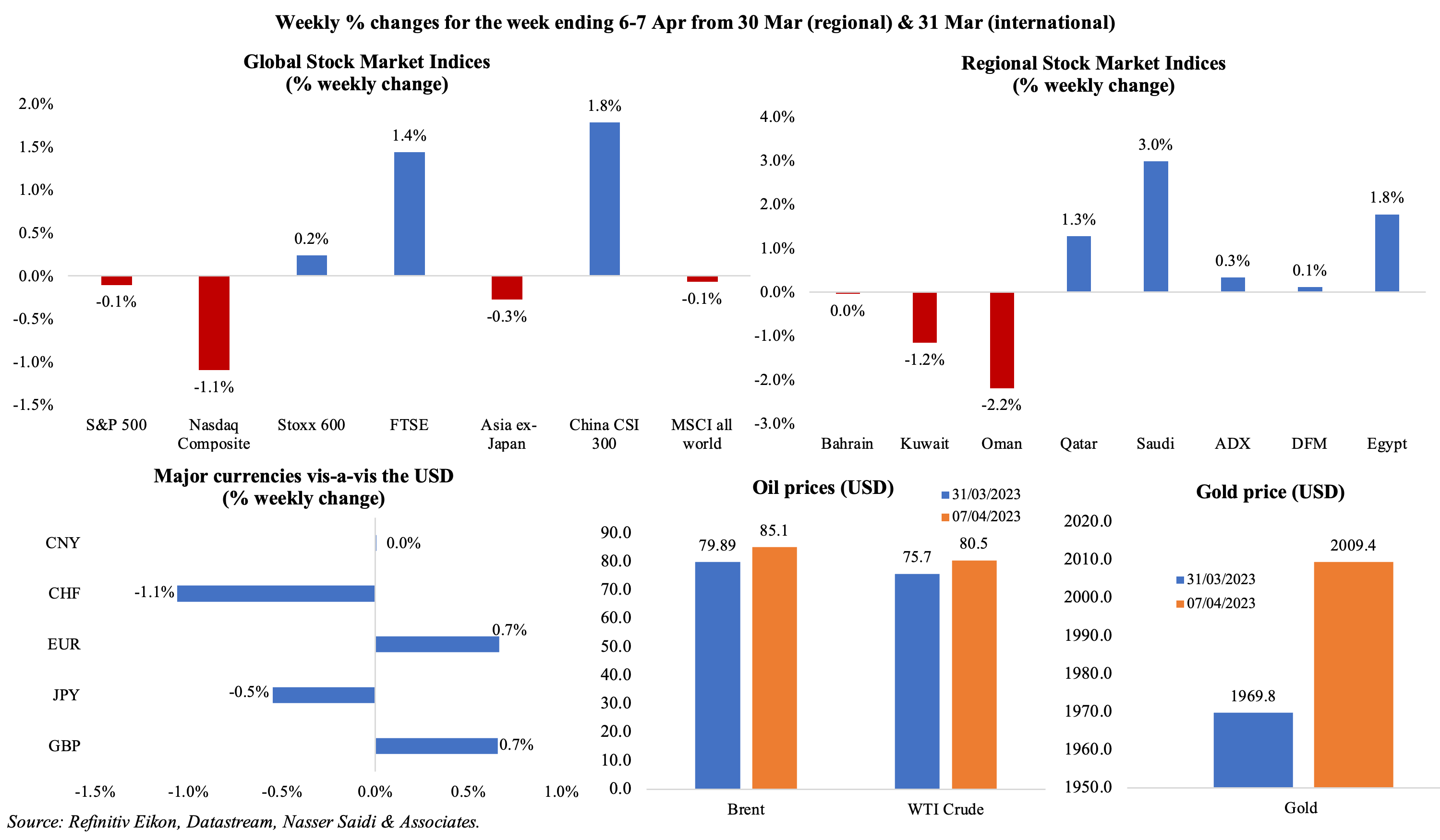

Equity markets were mixed, with the US markets under-performing compared to European counterparts (most of which were closed on Fri due to Easter holidays) and in Asia, China performed better. Regional markets saw gains including in Saudi Arabia, benefiting from the surprise OPEC+ oil production cut announcement; in the UAE, Al Ansari Financial Services surged 16.5% on their market debut day. The US dollar strengthened following the jobs report, oil prices posted a 6% weekly gain last week after OPEC+ announced production cuts and gold price rose by 2% to cross USD 2000.

Global Developments

US/Americas:

- US non-farm payrolls increased by 236k, the lowest since Dec and much lower than Feb’s 326k gain. Average hourly earnings grew by 0.3% mom and 4.2% yoy while labour force participation rate inched up to 62.6%. Unemployment rate eased to 3.5% in Mar (3.6%).

- Private sector hiring increased by only 145k in Mar (Feb: 261k), with financial activities, professional and business services and manufacturing posting losses (51k, 46k and 30k respectively). On the other hand, leisure & hospitality and trade, transport & utilities saw upticks of 98k and 56k respectively.

- JOLTS job openings dropped to 9.931mn in Feb (Jan: 10.563mn), with vacancies falling below 10mn for the first time since May 2021. Quits increased by 146k to just above 4mn.

- Initial jobless claims fell by 18k to 228k in the week ended Mar 31st with the 4-week average sliding down to 237.75k. Continuing jobless claims also moved up by 6k to 1.823mn in the week ended Mar 25th, the highest since Dec 2021.

- Goods and services trade deficit widened for a 3rd consecutive month, to USD 70.5bn in Feb (Jan: USD 68.7bn), as exports fell by 2.7% (to USD 251.2bn) while imports were down by 1.5%. Goods trade deficit meanwhile widened to USD 93bn (Jan: USD 91.6bn).

- Factory orders in the US fell by 0.7% mom in Feb (Jan: -2.1%): orders for transportation equipment dipped by 2.8% (Jan: -14%) including a 6.6% drop in civilian aircraft booking. Orders for non-defence capital goods, excluding aircraft, fell by 0.1% in Feb.

- ISM manufacturing PMI slipped further to 46.3 in Mar (Feb: 47.7), the lowest reading since May 2020, as new orders tumbled to 44.3 (from 47) and employment fell to 46.9 (Feb: 49.1) while manufacturing prices paid eased (to 49.2 from 51.3). This is the first time since 2009 that all sub-indices have clocked in sub-50 readings, signalling potential entry into recession territory.

- ISM services PMI edged lower to 51.2 in Mar (Feb: 55.1) after new orders plunged (52.2 from 62.6) alongside employment moderating to 51.3 (from 54). Services sector inflation is slowing, with prices paid for inputs fell to 59.5 from Feb’s 65.6.

- S&P’s US manufacturing PMI remained below-50 in Mar, though expanding to 49.2 (Feb: 47.3): new orders continued to fall as output rose for the first time since Oct. The services PMI rose to 52.6 (Feb: 50.6), the highest since Jun 2022, supported by domestic demand amid a decline in new export orders and an uptick in selling price inflation.

Europe:

- Factory orders in Germany accelerated by 4.8% mom in Feb (Jan: 0.5%), the biggest jump since Jun 2021, thanks to massive gains in vehicle orders (55.9%), motor vehicles and engines (3.7%) as well as capital goods orders (7.3%).

- Industrial production in Germany inched up by 2% mom and 0.6% yoy in Feb (Jan: 3.7% mom and -1.6% yoy), with a noticeable 7.6% mom gain in manufacturing of motor vehicles. Despite the recent upticks, IP is still below pre-pandemic levels.

- Germany’s exports increased by 4% mom in Feb while imports were up by a faster 4.6%, resulting in a trade surplus of EUR 16bn. Exports to the US and China were up by 9.4% and 10.2% respectively while exports to the rest of the EU ticked up by 2%.

- Producer price index in the eurozone eased to 13.2% yoy in Feb (Jan: 15.1%), falling for the 5th straight month, thanks to the decline in energy prices (-1.6% mom). Excluding energy, producer prices were up by 0.2% mom and 10.2% yoy.

- Manufacturing PMI in the eurozone slipped to a 4-month low of 47.3 in Mar (Feb: 48.5), with orders declining for the 11th straight month, employment improving modestly and input costs falling for the first time in 3 years. Services PMI improved to 55 (Feb: 52.7), the strongest expansion since May 2022.

- Germany’s manufacturing PMI fell to 44.7 in Mar, a 34-month low(Feb: 46.3) and the 9th straight month of below-50 reading, with new orders continuing to decline. Though services PMI ticked up to 53.7 (Feb: 50.9), growing wage demands and rising borrowing costs kept services price inflation high by historical standards.

- UK’s manufacturing PMI slipped to 47.9 in Mar (from Feb’s 7-month high of 49.3), as output fell to below-50, amid declining new export orders and employment falling for the 6th consecutive month. Input price inflation hit its lowest level since June 2020. Services PMI slowed to 52.9 from Feb’s 53.5, though new orders accelerated (fastest since Mar 2022) and employment levels saw an uptick.

Asia Pacific:

- China’s Caixin services PMI rose to 57.8 in Mar (Feb: 55), the highest since Nov 2020, supported by new orders (which rose the most in 28 months) and employment (which recorded the fastest pace since Nov 2020). Input cost inflation rose to a 7-month high given wage costs and price of raw materials.

- Overall household spending in Japan increased by 1.6% yoy in Feb, the first rise in 4 months and after declining by 0.3% in Jan; households with two or more people spent an average of JPY 272,214 (USD 2,065). On a nominal basis, spending increased by 5.6% yoy, up for the 11th month in a row.

- Japan’s preliminary leading economic index reading inched up to 97.7 in Feb (Jan: 96.6), the highest reading since Oct 2022; the coincident index also moved up to 99.2 (Jan: 96.4).

- The Reserve Bank of India unexpectedly left rates unchanged, leaving repo rate at 6.5% and reverse repo at 3.35%, stating that monetary policy actions taken since May 2022 were still working through the system. CPI inflation is projected to moderate to 5.2% in 2023-24.

- Singapore PMI fell into contractionary territory, clocking in at 49.9 in Mar (Feb: 50): PMI for electronics, which accounts for about a third of Singapore’s manufacturing, inched up to 49.4 in Mar (Feb: 49.3).

- Retail sales in Singapore rebounded in Feb, rising by 12.7% yoy and 3.9% mom (Jan: 0.8% yoy and -9.5% mom). In yoy terms, sales accelerated for department stores (26.1% from Jan’s 3.6%), food & alcohol (69% from 34.3%), apparel & footwear (38.1% from 23.2%).

Bottom line: The IMF-World Bank meetings are underway this week and global growth is expected to be driven by momentum from Asia. India and China are forecast to account for half of global growth this year while medium-term prospects are the weakest in more than 30 years, according to the IMF. With inflation still high in many economies (despite world food prices falling for the 12th consecutive month in Mar), the IMF is likely to call for more monetary tightening from major central banks. In this backdrop, this week’s US inflation reading is important to gauge Fed’s next move especially given last week’s jobs report. Meanwhile, indicators suggest that global private sector activity jumped to a nine-month high of 53.4 in Mar (Feb: 52.1), with activity in the service sector rising at the quickest pace since Dec 2021.

Regional Developments

- The World Bank forecasts that economic growth in the GCC will more than halve to 3.2% this year (2022: 7.3%), with Saudi Arabia registering the sharpest slowdown (to 2.9% from 8.7%) while Oman posts the fastest growth (4.3%). The wider MENA region will growth by 3%, down from 2022’s 5.8% rise. The region will also be bogged down by double-digit food price inflation, according to the World Bank – citing average food inflation at 29% for the period Mar-Dec (vs headline reading at 19.4%).

- Bahrain introduced a new “golden licence” for companies: to qualify, firms need to undertake major investment and strategic projects that either exceed USD 50mn in value or create more than 500 jobs in the country. The firms could be either local or foreign, and the benefits would include prioritised allocation of land, infrastructure and services, easier access to government services and support from government development funds.

- PMI in Egypt shrank for the 28th consecutive month in Mar, falling to 46.7 (Feb: 46.9), given dampened demand and a sharp reduction in new orders (to 44.3 from Feb’s 44.7) while output inched up (to 44.9 from 44.6). However, inflation indicators increased: input prices rose to 62.8 (Feb: 62.7) and purchase prices were up to 64.3 (from 63.9). Sentiment for future activity was the weakest since records began (in early 2012).

- Egypt’s President visited Saudi Arabia early last week, with the discussions likely centring around financial support (after Saudi signalled that conditionalities would be applied) and regional alignment (as discussions are underway with Iran, Syria and Turkey).

- Financial inclusion in Egypt improved in 2022, according to the central bank. Total ownership of transactional accounts surged by 147% (between 2016 and 2022) to reach 42.3mn citizens (or 64.8% of the total 65.4mn eligible adult population).

- Reuters reported that Red Sea Wind Energy signed a USD 680mn agreement with banks and international financing organisations for establishing a 500 MW wind farm in Egypt’s Gulf of Suez (cited as “one of the biggest wind energy projects in Egypt and Africa”).

- Iraq agreed to a 30% stake in TotalEnergies USD 27bn project, which has been delayed for a long time: it was signed in 2021 for the firm to build 4 oil, gas and renewables projects over 25 years, with an initial investment of USD 10bn.

- In a cabinet reshuffle, Kuwait’s PM appointed a new finance minister while leaving other major roles unchanged.

- Lebanon’s PMI remained in contractionary territory in Mar, but rose to a 7-month high of 49.7 (Feb: 48.8), thanks to a slight improvement in both output and new orders. However, the private sector remains weighed down by challenging domestic conditions, political vacuum and weak purchasing power.

- Oman’s domestic liquidity inched up by 2.1% yoy to OMR 20.5bn (USD 53.6bn) in Jan 2023 while total cash in circulation was lower by 5,3% to OMR 1.6bn.

- Real GDP in Qatar surged in Q4, rising by 8% yoy and 2.7% qoq to QAR 179.99bn (Q3: 4.3% yoy and 3.6% qoq), supported by the boost from the World Cup. This was the strongest yoy gain in the GDP since Q3 2011: the non-mining and quarrying sector growth jumped by 9.9% while the mining & quarrying sector was up by 4.8%. A breakdown of activity by sector shows that the biggest gains in Q4 were recorded in accommodation & food services (64.8% yoy), transport & storage (25.4%) and trade (16.1%).

- Qatar’s non-oil PMI increased to 53.8 in Mar, the highest since Jul 2022, thanks to faster growth in output and new businesses alongside an 8-month high in the employment index.

- Bilateral trade between Qatar and Italy increased by 54.4% yoy to nearly EUR 8bn in 2022, according to the Italian Chamber of Commerce chairperson.

- Saudi Arabia and Iran foreign ministers met in Beijing last week, the first formal meeting of top diplomats in around 7 years. On the cards are ways to expand bilateral cooperation via resumption of flights as well as granting of visas and official delegation visits. Later, it was disclosed that Saudi officials had arrived in Iran to discuss procedures for reopening its embassy in Tehran and that an Iranian delegation would be visiting Saudi this week to prepare for the reopening of Iran’s embassy in Riyadh.

- Saudi and Omani delegations arrived in Yemen’s capital Sanaa yesterday for peace talks: Oman-mediated negotiations are leading up to a permanent ceasefire deal with Houthi officials including full reopening of Houthi-controlled ports and Sanaa airport among others.

- A PwC report revealed that majority of Middle East M&A activities were concentrated in Saudi Arabia, UAE, and Egypt, which altogether recorded 563 deals or 89% of the region’s total volume last year.

- Abu Dhabi, Dubai and Riyadh were ranked 13th, 17th and 30th in the 2023 IMD Smart City Index. The list was topped by Zurich, Oslo and Canberra. Detailed analysis per city can be accessed via https://www.imd.org/smart-city-observatory/home/.

Saudi Arabia Focus

- Saudi Arabia’s PMI eased to 58.7 in Mar, from Feb’s almost 8-year record of 59.8, as both output (64.2 from Feb’s 65.5) and new orders (66.4 from 68.7) expanded in the backdrop of strong demand (including for exports). The rise in employment was among the quickest in five years and salaries rose to the greatest degree since Sep 2016.

- Money supply in Saudi Arabia rose by 4.72% year-to-date to SAR 2.613trn in the week ending Mar 30th.

- In the week of 26th March to 1st April, residents in Saudi Arabia spent SAR 12.7bn (USD 3.2bn) via 150.2mn points of sale transactions, according to SAMA data. Value of transactions was up 15.1% from a week ago, with the highest value spent on food and beverages (SAR 2.11bn) and clothing & footwear (up 79.8% to SAR 1.42bn) among others.

- Saudi central bank granted a license to Rasid Payments to offer fintech solutions, bringing the total number of licensed payment companies to 24, with an additional six firms granted “in-principle approvals”.

- Saudi Arabia’s National Center for Privatization revealed 140 projects open for private investment including 4 airports and 4500km of road developments; in Q1 2023, contracts were signed for projects in the transport sector including Spanish and Chinese alliances.

- Eighteen mining licenses were issued by the Saudi Ministry of Industry and Mineral Resources in Feb, down from Jan’s 46 permits. Total licenses issued in the sector amounted to 2,230 permits until Feb, including 1,327 permits for quarrying building materials. Separately, the Ministry disclosed that 80 new factories with investments totalling SAR 4.3bn (USD 1.1bn) started operations in Feb.

- Saudi Arabia issued 37,723 certificates of origin in Mar, up by 33k from the month before, indicating a boost in exports. These are used for customs clearance, payment management and import tariff concessions, making a product more cost-efficient.

- Localisation in Saudi financial market institutions and market infrastructure institutions touched 77% and 91% respectively in Q4 2022, according to the capital market authority.

- The Ministry of Commerce has issued 1.3mn commercial registers in Q1 2023, of which 40% are women-owned. Just over half of the registers are owned by youth (~51%, up 2% yoy) and Riyadh topped in the number of commercial registers (391k).

- Saudi Arabia has 160 operational vehicle factories: the Ministry of Industry and Mineral Resources provided a breakdown of these factories as 33 for parts, accessories, and engines, 21 for vehicles and structures including processing works, and 106 for trailer and semi-trailer vehicles or trucks.

- Social Development Bank in Saudi Arabia disclosed that it had financed over 30,000 small enterprises, startups and self-employed business owners with over SAR 2.9bn (USD 770mn) in Q1 2023.

- Within Saudi Arabia, unemployment rate was lowest in Riyadh (6.7%) while in Madinah it stood at 12.2%, according to data from the General Authority for Statistics.

- Air passenger traffic in Saudi Arabia surged by 82% yoy to 88mn in 2022, according to the General Authority of Statistics, with the King Abdulaziz International Airport in Jeddah the busiest airport (handling 32mn passengers).

- Saudi Tourism Development Fund has 23 projects underway with investment value totalling SAR 16bn (USD 4.26bn).

- Hotel occupancy in Makkah jumped to 80% in the holy month of Ramadan this year, the highest since 2020.

- Saudi Arabia ranked second globally for societal awareness of artificial intelligence, according to the 2023 Artificial Intelligence Index Report by Stanford University.

- Saudi Arabia has conveyed to the IMF its commitment to provide financial support to Pakistan, disclosed Pakistan’s junior finance minister. Obtaining assurances on external financing from friendly nations was one of the final conditions for an IMF deal. Separately, the Saudi Fund for Development signed a USD 240mn loan agreement to co-finance Pakistan’s hydro-power dam.

- Fitch upgraded Saudi Arabia to A+ from A previously, supported by its “strong fiscal and external balance sheets”, favourable debt-to-GDP ratio and secure sovereign net foreign assets.

- Saudi Arabia planted over 12mn trees in the past five years through the National Center for Vegetation Development, as part of the Saudi Green Initiative.

UAE Focus![]()

- Non-oil private sector PMI in the UAE ticked up to 55.9 in Mar (Feb: 54.3), thanks to higher output, a 5-month high of new orders (to 56.2) and employment (52.6) posting the fastest pace of growth since Jul 2016. While input prices rose for a 2nd consecutive month (on higher wages and supplier price hikes), there was a “marginal drop in selling charges”.

- Businesses in the UAE with revenues of AED 3mn or less can claim small business relief for corporate tax in each tax period. The AED 3mn revenue threshold will only continue to apply to subsequent tax periods that end before or on Dec 31st, 2026. Corporate tax stands at 9% on firms’ profits exceeding AED 375k.

- According to World Trade Organisation’s data, UAE merchandise trade crossed USD 1trn in 2022, with exports and imports growing by 41% and 22% respectively. Excluding intra-EU trade, UAE was the world’s 7th largest exporter and 13th as importer of goods trade last year.

- Vietnam and the UAE signed a mutual declaration of intent to begin talks for a comprehensive economic partnership agreement (CEPA). Bilateral non-oil trade stood at AED 29.4bn in 2022, with UAE the largest trade partner of Vietnam in the Arab region.

- There were 577,000 SMEs operational in the UAE as of end-2022, according to the Minister of Economy, accounting for 63.5% of non-oil GDP. The nation plans to raise the number of SMEs of 1mn by end-2030.

- The UAE Minister of Human Resources & Emiratisation disclosed that there was an 11% yoy increase in the number of private establishments in 2022 (that are registered with the Ministry) and a 38% increase in the number of work permits issued(more than 2.1mn versus 1.5mn in 2021). About 51% of work permits are for professional levels, as the overall number of employees in the private sector increased by 13%.

- UAE’s unemployment insurance scheme, which covers both federal government and private sector employees, crossed a million subscribers since being launched in Jan 2023.

- As regional relations realign, Iran announced the appointment of an ambassador to the UAE for the first time since 2016.

- The industrial sector contributes 20% to Ajman’s GDP, according to the Director General of Ajman Department of Economic Development.

- UAE’s Abu Dhabi Commercial Bank (ADCB) stated that it was not in talks with funds to sell AED 13.5bn of bad loans,in response to a Bloomberg report.

Media Review

Opec’s gamble: can the global economy cope with higher oil prices?

https://www.ft.com/content/9e1e089e-163d-43a7-9b75-15e2e2cbcfd6

Egyptian treasury bond sales plummet on currency concerns

https://www.reuters.com/article/egypt-economy-treasuries-idAFL8N36758Z

A Perilous Macroeconomic Moment by Eswar Prasad

https://www.project-syndicate.org/commentary/high-inflation-tightening-financial-conditions-limit-medium-term-growth-by-eswar-prasad-2023-04

Trade growth to slow to 1.7% in 2023: WTO

https://www.wto.org/english/news_e/news23_e/tfore_05apr23_e.htm

Geopolitics and Fragmentation Emerge as Serious Financial Stability Threats

https://www.imf.org/en/Blogs/Articles/2023/04/05/geopolitics-and-fragmentation-emerge-as-serious-financial-stability-threats

Powered by: