Global trade. Air cargo & passenger movements. Middle East within top exporters and importers globally. Middle East PMIs. Qatar GDP. UAE firms & labour.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 7 Apr 2023: Middle East Nations were top Importers & Exporters in 2022

1. WTO: Global trade slowing to 1.7% in 2023 (2022: 2.7%)

- Global trade volume inched up by 2.7% yoy in 2022, slower than previously expected and lower than the average trade growth for the past 12 years, given a decline in Q4 due to higher inflation & commodity prices, monetary policy tightening and China’s Covid19 outbreaks that led to production disruptions. Merchandise trade volume growth is forecast to grow by 1.7% in 2023 before rising to 3.2% in 2024.

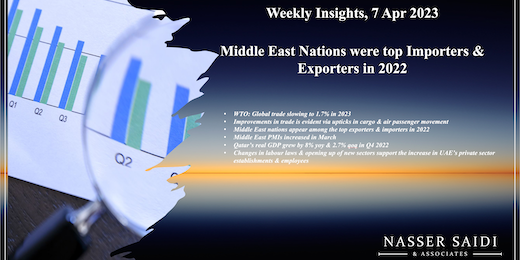

- Trade volumes by region (chart below) shows data till Q4 2022 and estimates till end-2023: export volumes across all regions slipped in the last quarter of 2022; weaker domestic demand led to a dip in import volumes across all regions in Q4 2022. A slight recovery is estimated in Q1 2023 as seen from global manufacturing PMI readings: export orders sub-index has been inching up in recent month (though still below-50 in major economies vs. expansion in China ), supplier delivery times have shortened (suggesting almost-resolved supply chain issues) amid falling input and output prices.

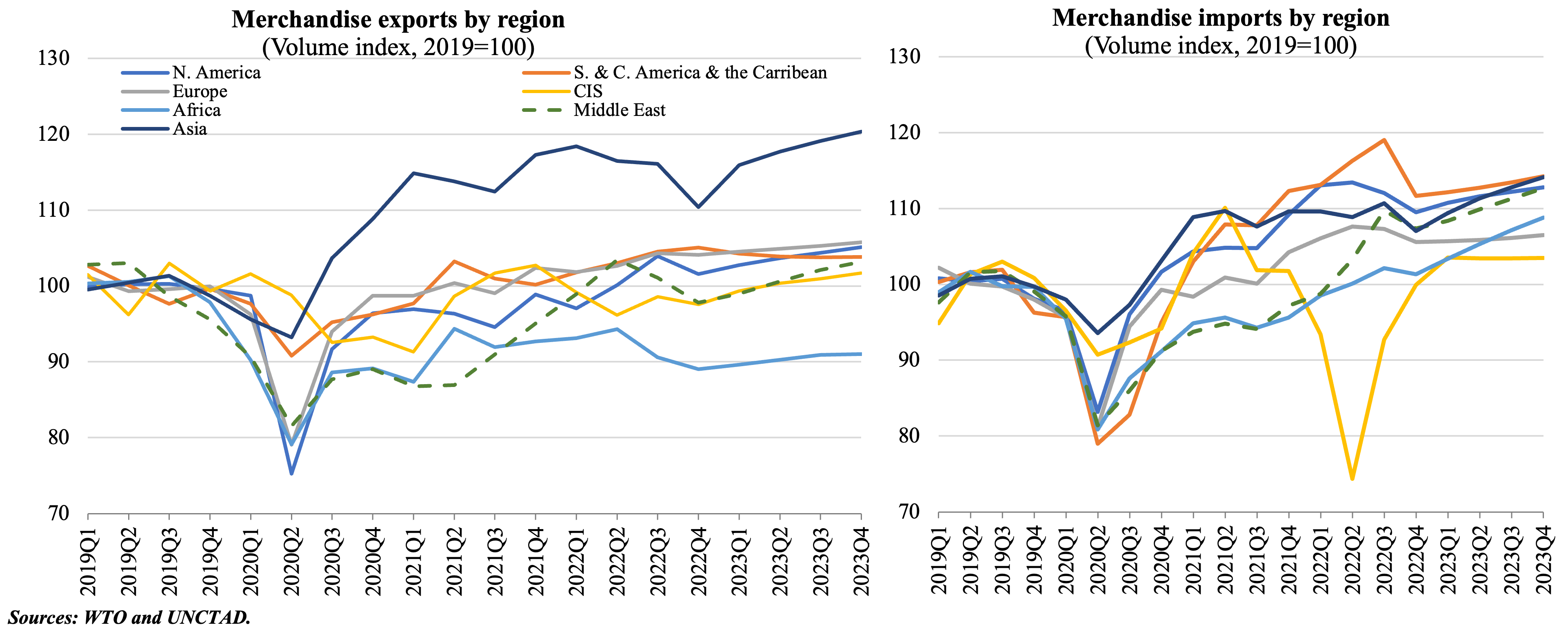

2. Improvements in trade is evident via cargo movement upticks; commercial services trade will benefit from air transport / travel & tourism recovery

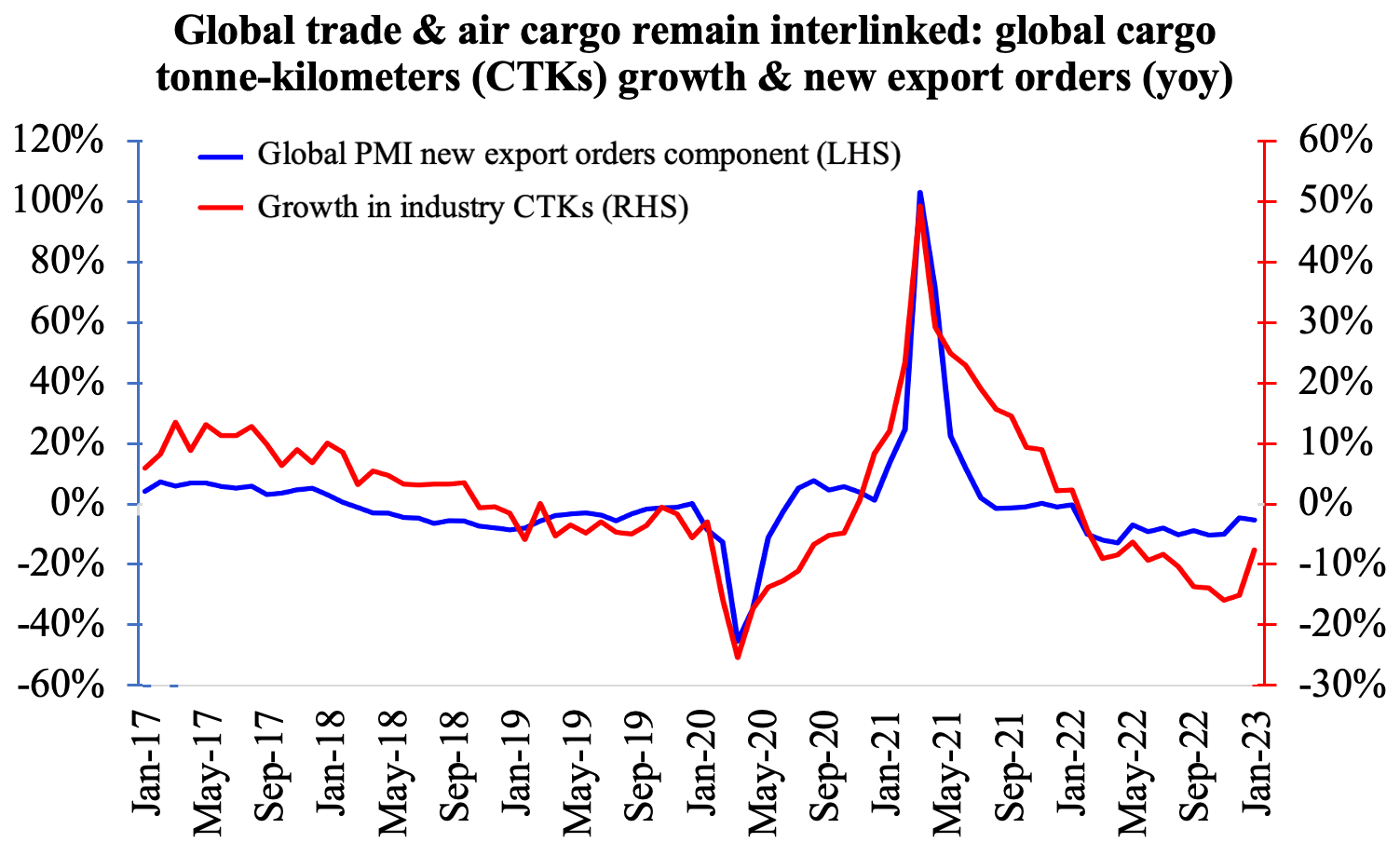

- Cargo demand has been resilient: Air cargo traffic surpassed pre-pandemic CTKs for the first time in eight months, growing 2.9% over Feb 2019 levels (led by Africa & N. America). Global trade and cargo recovery go hand in hand (as can be seen with new export orders).

- On the other hand, passenger traffic has been supported by Asia Pacific travel flows coming back onboard. Middle Eastern airlines grew their international revenue passenger-kilometers (RPKs) by 75.0% yoy in Feb, reaching 93.7% of pre-pandemic levels.

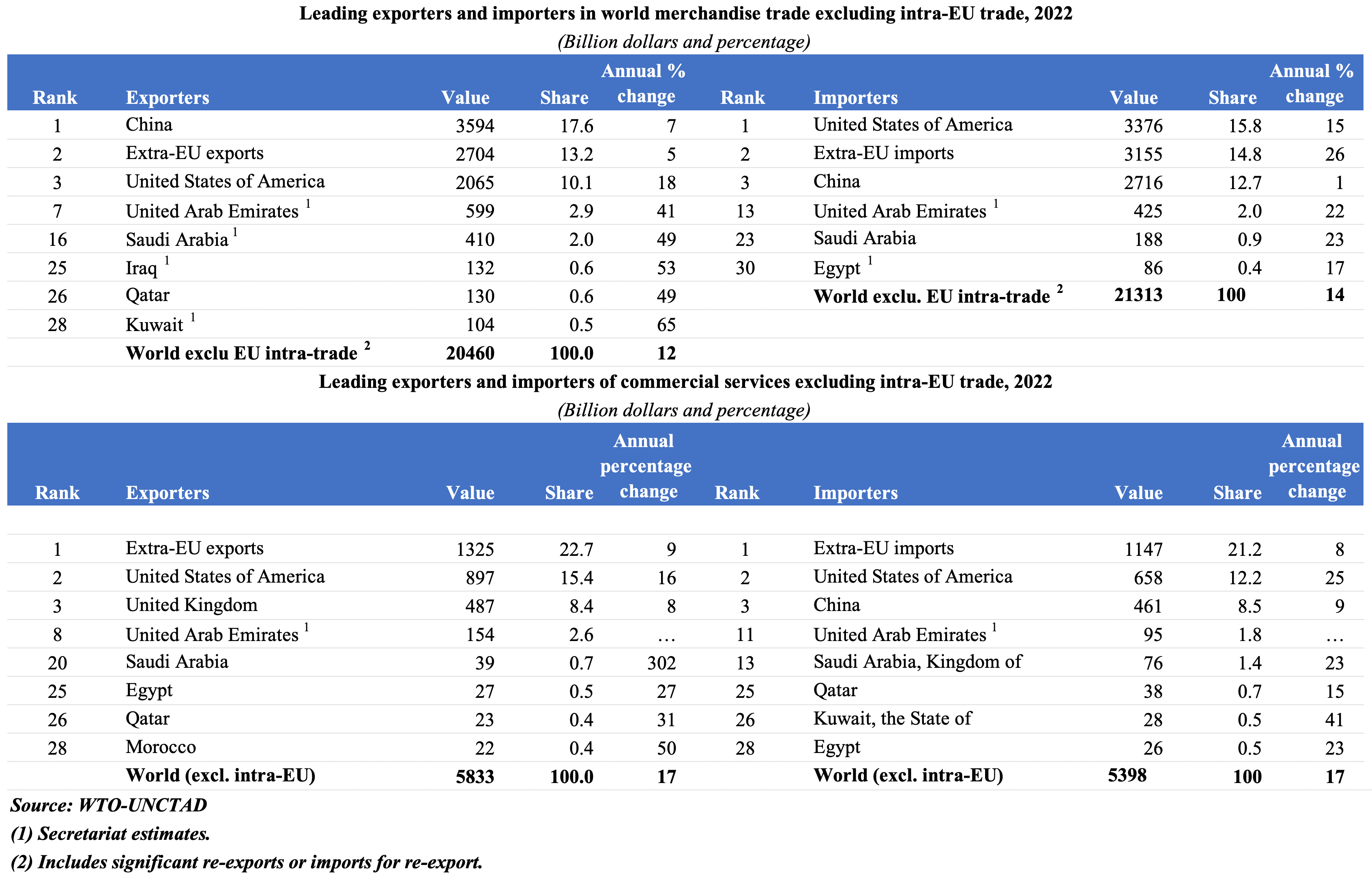

3. Middle East nations appear among the top exporters & importers in 2022

- The value of merchandise trade grew by 12% yoy to USD 25.3trn in 2022, partly given higher global commodity prices. Global commercial services trade meanwhile jumped by 15% to USD 6.8trn.

- Oil exporters UAE and Saudi Arabia are among the leading exporters & importers, even in commercial services trade; excluding intra-EU trade, their rankings are higher & includes more nations from the Middle East

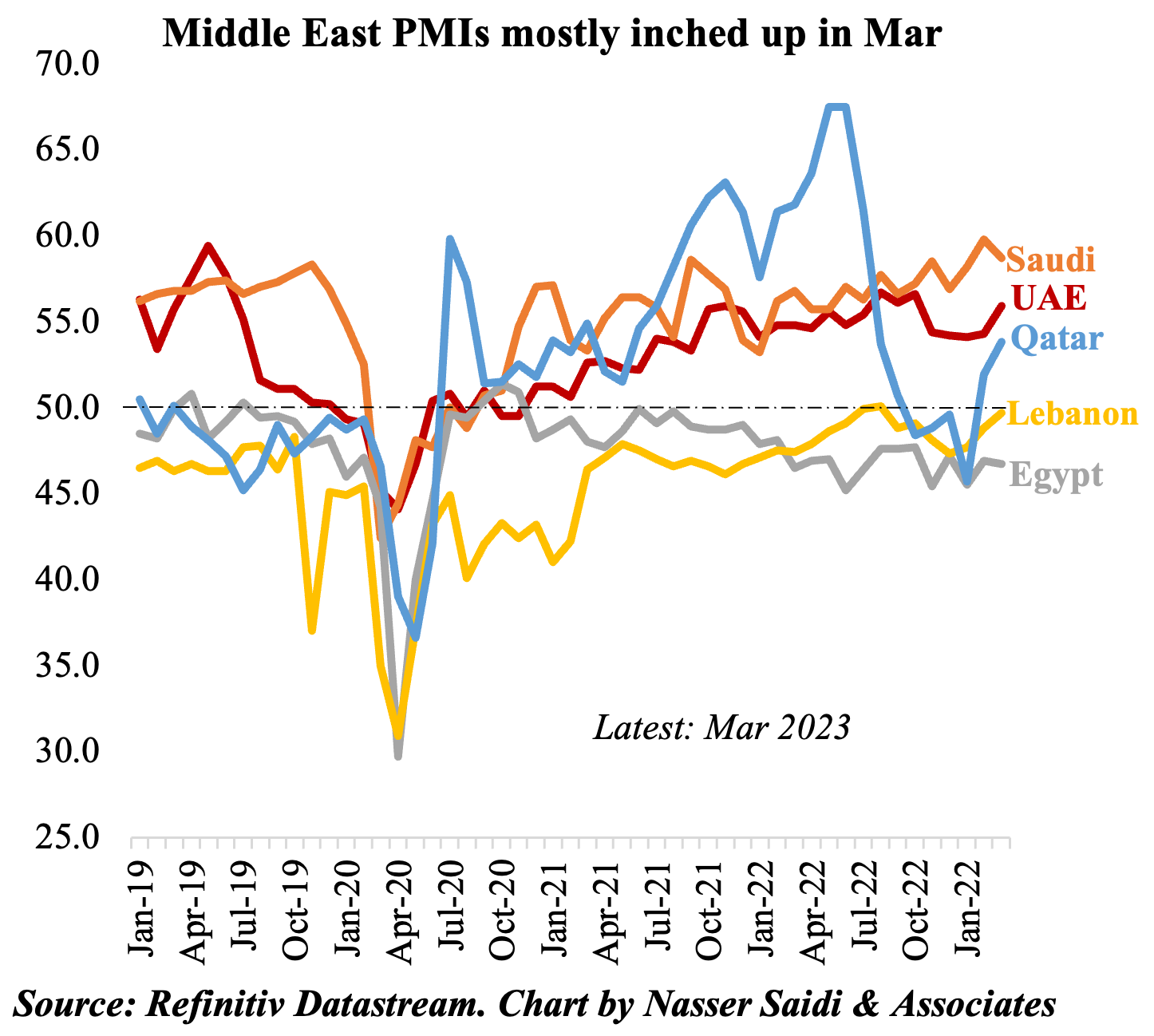

4. Middle East PMIs increased in March while Egypt & Lebanon continue to be riddled by exchange rate woes

- Most Middle East PMI readings increased in Mar.

- Employment surged the most in 5 and 7 years in Saudi and UAE respectively.

- Both Saudi and UAE reported an increase in input costs given raw materials prices & wages (rising to the greatest degree since Sep 2016 in Saudi Arabia) ; output prices inched up at a slower pace in Saudi while it dropped in the UAE as firms preferred to remain competitive amid strong domestic demand. Supportive government policies have led to improvements in sentiment.

- Qatar’s PMI increased to 53.8 in Mar, the highest since Jul 2022, thanks to faster growth in output and new businesses alongside an 8-month high in the employment index.

- Egypt and Lebanon PMIs remained below-50 in Mar though the latter inched up to a 7-month high. Inflationary pressures remain high in both nations, and exchange rate volatility pushed up operating costs.

- Egypt’s import controls and exchange rate restrictions continue to weigh in on sentiment while Lebanon is bogged down by domestic conditions, political vacuum and weak purchasing power. Outlook for future activity remains bleak for both nations.

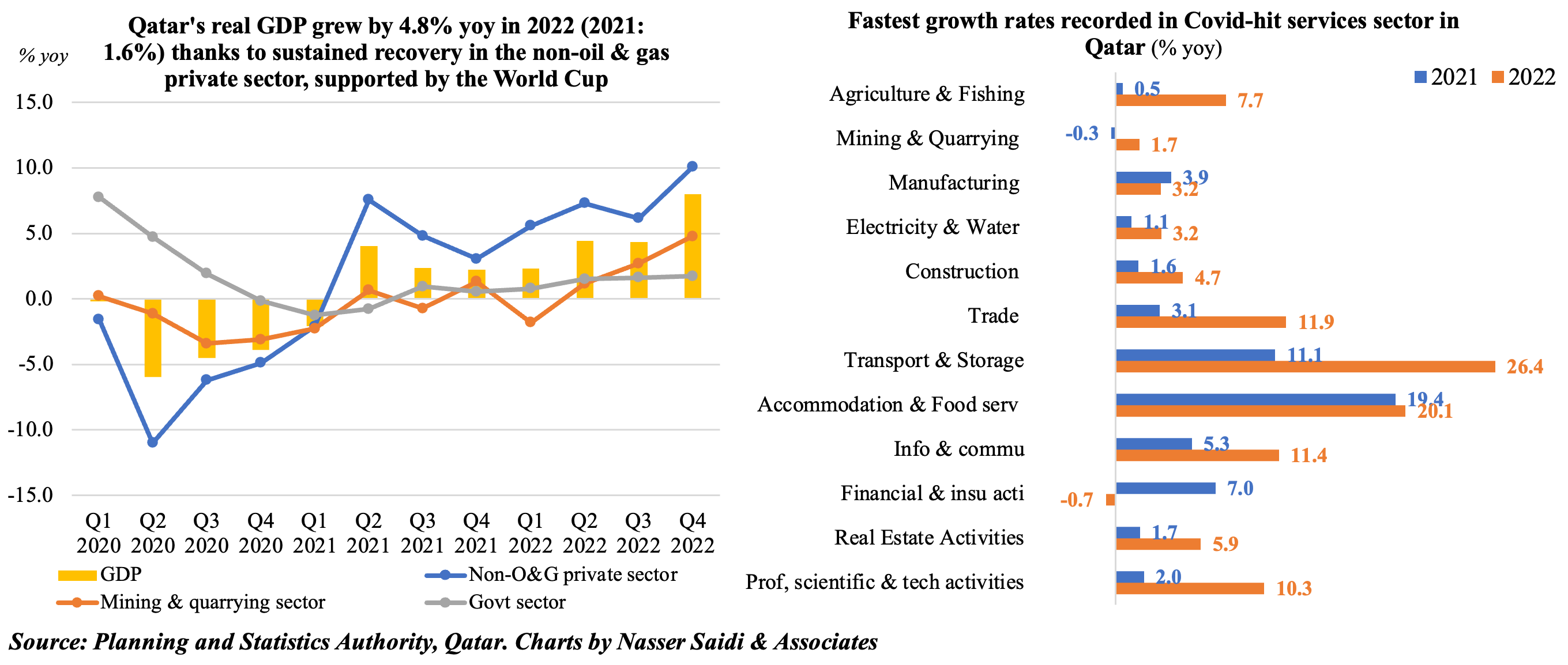

5. Qatar’s real GDP grew by 8% yoy & 2.7% qoq in Q4 2022

- Real GDP in Qatar surged in Q4, rising by 8% yoy and 2.7% qoq to QAR 179.99bn (Q3: 4.3% yoy and 3.6% qoq), supported by the boost from the World Cup. This was the strongest year-on-year gain in the GDP since Q3 2011: the non-mining and quarrying sector growth jumped by 9.9% while the mining & quarrying sector was up by 4.8%.

- A breakdown of activity by sector shows that the biggest gains in Q4 were recorded in accommodation & food services (64.8% yoy), transport & storage (25.4%) and trade (16.1%).

- The acceleration in Q4 growth led to a 4.8% yoy increase in overall real GDP in 2022 (2021: 1.6%); the significant uptick in oil and gas sector (from Q2 2022) has been accompanied also by the non-oil & gas private sector performance. The government sector’s growth has come off highs seen in 2019-2020 to average 1.4% in 2022.

- Economic activity has grown the fastest in sectors that were most affected by Covid19: transportation, accommodation as well as trade. This momentum has continued into 2023, as seen from Mar PMI: at 53.8, it was above the long-run trend of 52.2, and with the wholesale & retail and services sectors registering the strongest growth rates for activity and new orders.

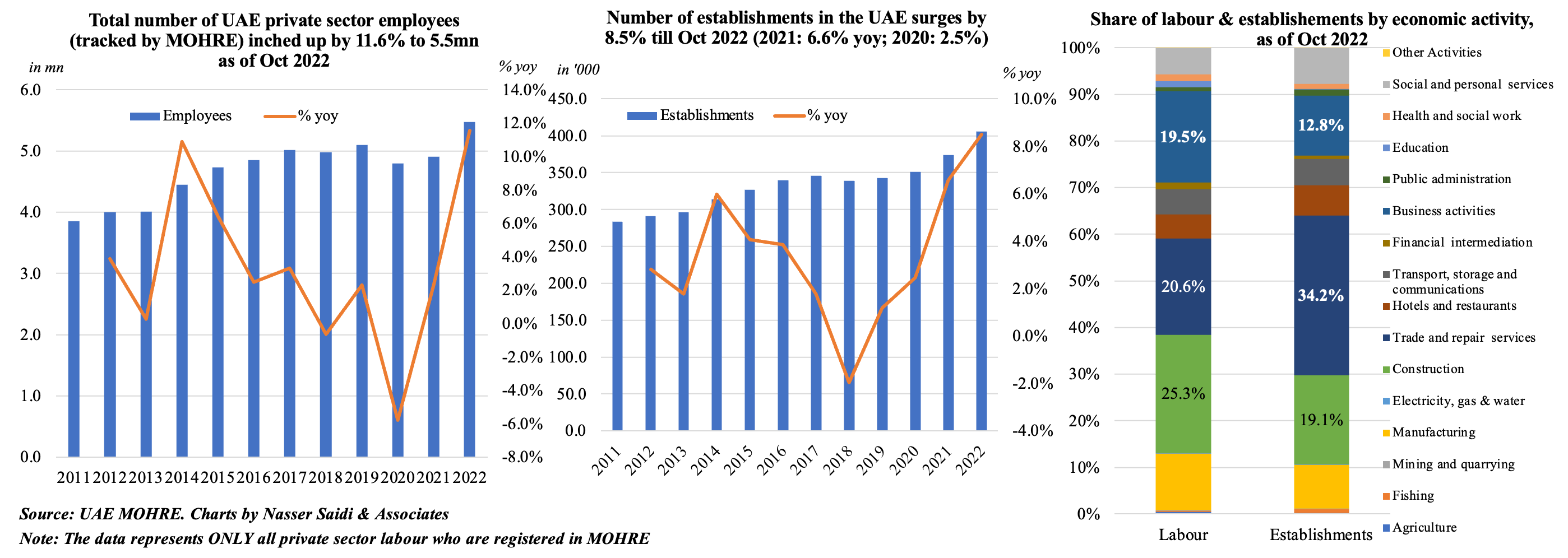

6. Changes in labour laws & opening up of new sectors support the increase in UAE’s private sector establishments & employees

- The UAE Minister of Human Resources & Emiratisation disclosed that there was an 11% increase in the number of private establishments in 2022 (that are registered with the Ministry) and a 38% increase in the number of work permits issued (more than 2.1mn vs 1.5mn in 2021). This is confirmed by the recent surge in employment in UAE’s PMI and is supported by the changes in labour laws (e.g. long-term visas) as well as the new up-and-coming sectors attracting interest (e.g. fintech, AI/ Blockchain, crypto firms)

- The MOHRE’s website has data on the number of firms and employees in the private sector till Oct 2022. The number of employees registered with the MOHRE surged by 11.6% to 5.48mn as of Oct 2022 (2021: 2.2% yoy to 4.9mn). Furthermore, new firms grew to a record high 406k as of Oct 2022, following 2021’s 6.6% yoy gain. Both these numbers likely excludes all free zone firms/ employees.

- Employees were concentrated mostly in construction and trade & repair services (together ~45.9% of total last year) trade & repair firms accounted for just more than 1/3-rd of the total firms (34.2%), followed by construction (19.1%). The highest number of employees per firm were in education (84.1 per firm) and mining & quarrying (37.7).

Powered by: