Bahrain GDP. UAE inflation. Saudi Arabia’s monetary, labour market and trade statistics.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 31 Mar 2023: Strong growth in Bahrain; Inflation remains relatively low in UAE; Macro indicators show promise in Saudi Arabia

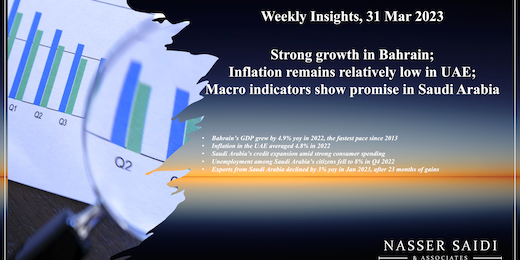

1. Bahrain’s GDP grew by 4.9% yoy in 2022, the fastest pace since 2013

- GDP in Bahrain grew by 4.9% yoy in 2022, faster than 2021’s 2.7% growth pace, largely driven by an expansion of the non-oil sector (+6.2%) while the oil sector posted a decline (-1.4%). GDP growth was the fastest since 2013 and the non-oil sector posted the highest growth in more than a decade.

- Bahrain’s Ministry of Finance and National Economy forecasts growth at 2.9% and 3.1% in 2023 and 2024.

- Sector-wise, acceleration in growth was evident in most sectors affected during Covid: hotels and restaurants (+13.9%), real estate (5.5%), trade (5.4%) and transport and communication (4.5%). Government services grew by 6.7% in 2022, up from 2021’s 1.3% rise.

- While the financial sector grew by 4.1% for the full year 2022, it recorded an uptick of 8.3% in Q4 2022. Domestic deposits were up by 3.5% in 2022, alongside a 3.6% rise in value of outstanding loans and 3% increase in banks’ balance sheet.

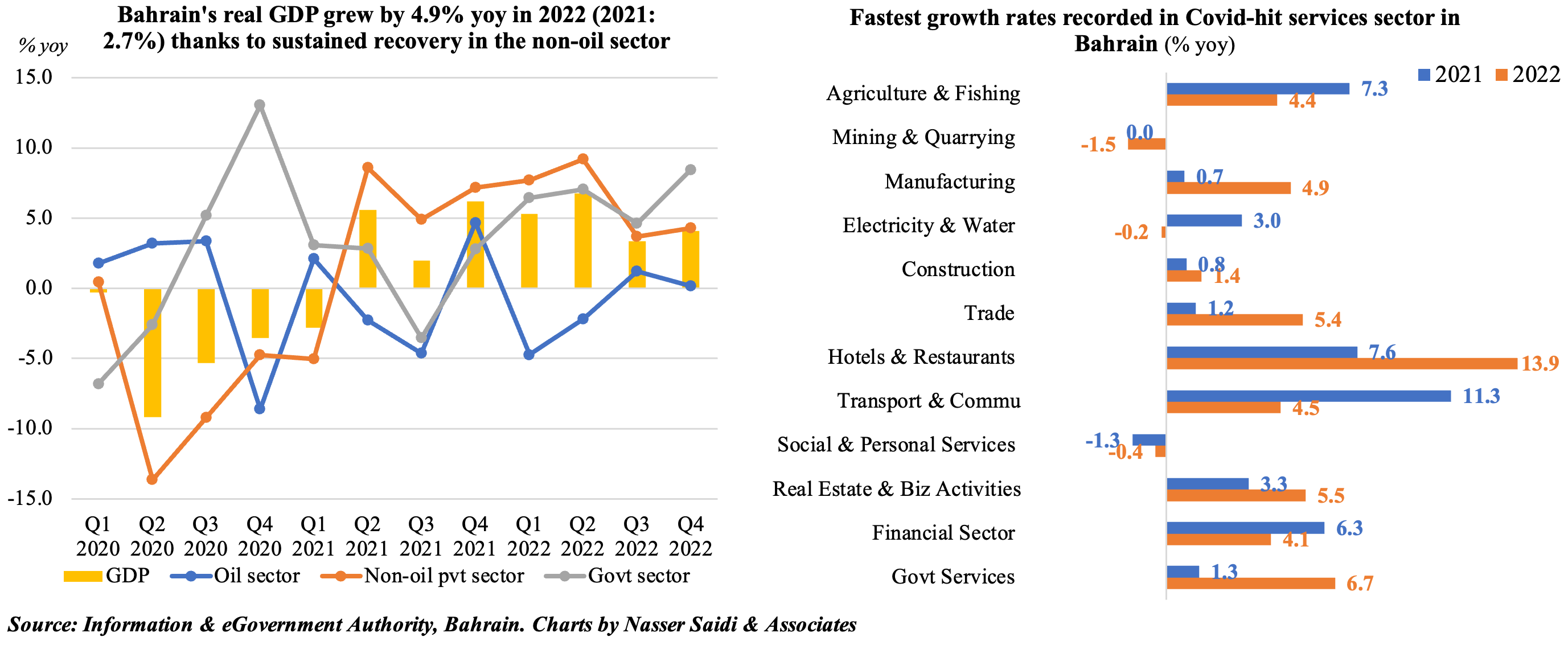

2. Inflation in the UAE averaged 4.8% in 2022

- The UAE Central Bank’s latest Quarterly Economic Review report outlined UAE’s inflation readings. Inflation in the UAE averaged 4.8% in 2022, with quarterly reading the highest in Q3 2022 (6.5%). The uptick in prices were driven by the tradeable category – costs rose 6.3%, 9.6%, 10.2% and 6% in each quarter. Last year, GCC inflation ranged between 2.5% in Saudi Arabia to Qatar’s 4.99%.

- Housing & utilities accounted for the largest weight in UAE’s CPI basket (35.1%): prices in this category declined in H1 2022, before ticking up by 0.1% and 1.6% in Q3 and Q4 respectively – driven by the surge in rents in Dubai.

- Transportation, which has a weight of 12.7%, was a major contributor to the rise in prices. UAE petrol prices touched an all-time high in Jul 2022 and has gradually eased since then (except for a hike in Nov): transport costs were hence up by 23.2% in 2022.

- Food and beverages has a weight of 12% and recorded an increase in prices last year (2%); prices eased in Q4, largely reflecting the easing globally. Furthermore, services costs – especially recreation & culture and restaurants & hotels – posted significant increases in 2022: 13.8% and 7.2% respectively.

- The UAE central bank forecasts inflation to ease to 3.2% and 2.8% in 2023 and 2024 respectively.

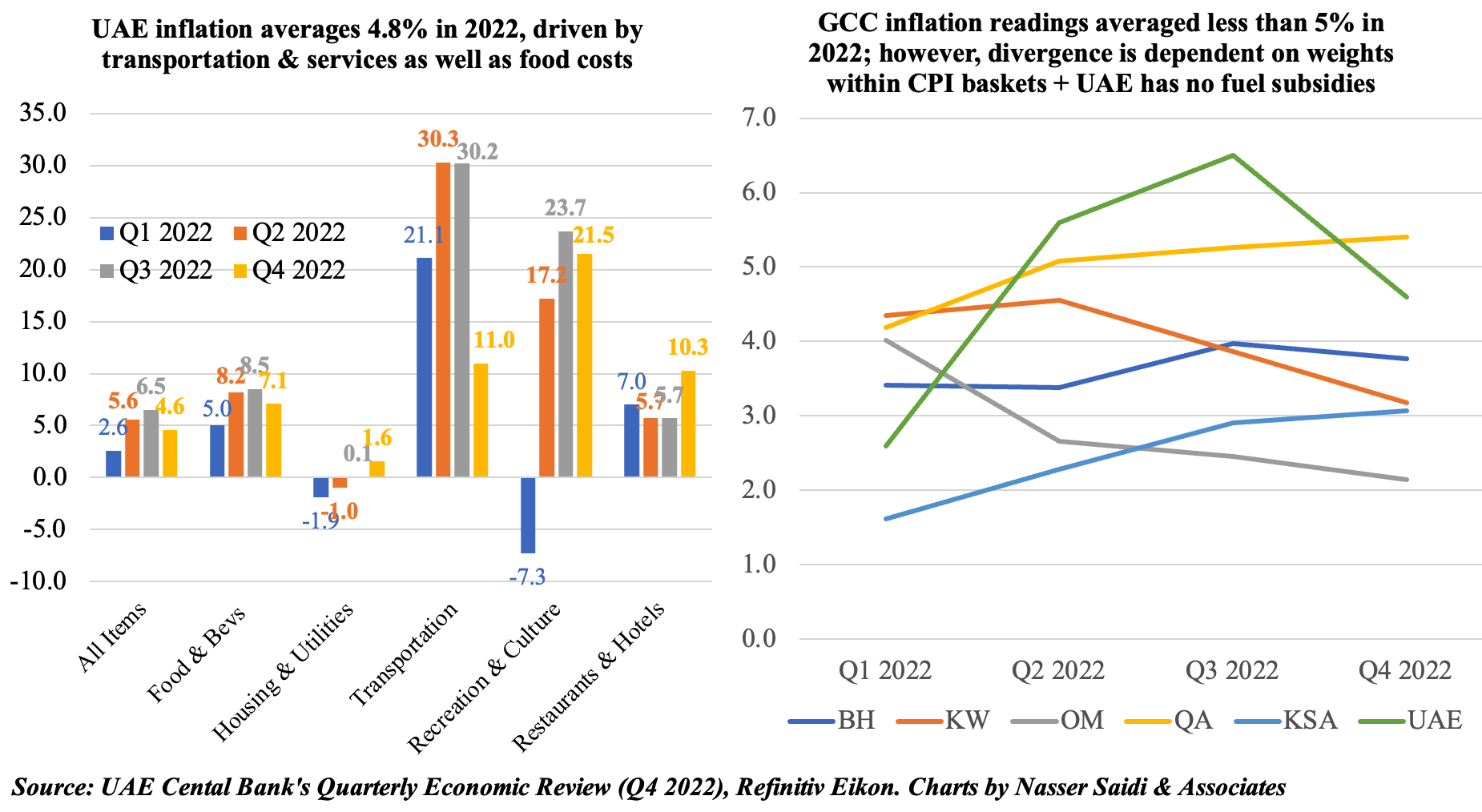

3. Saudi Arabia private sector deposit growth lags amid credit expansion (many projects underway); 3m SAIBOR high at 5.38% in Jan; consumer spending supported by rise in PoS

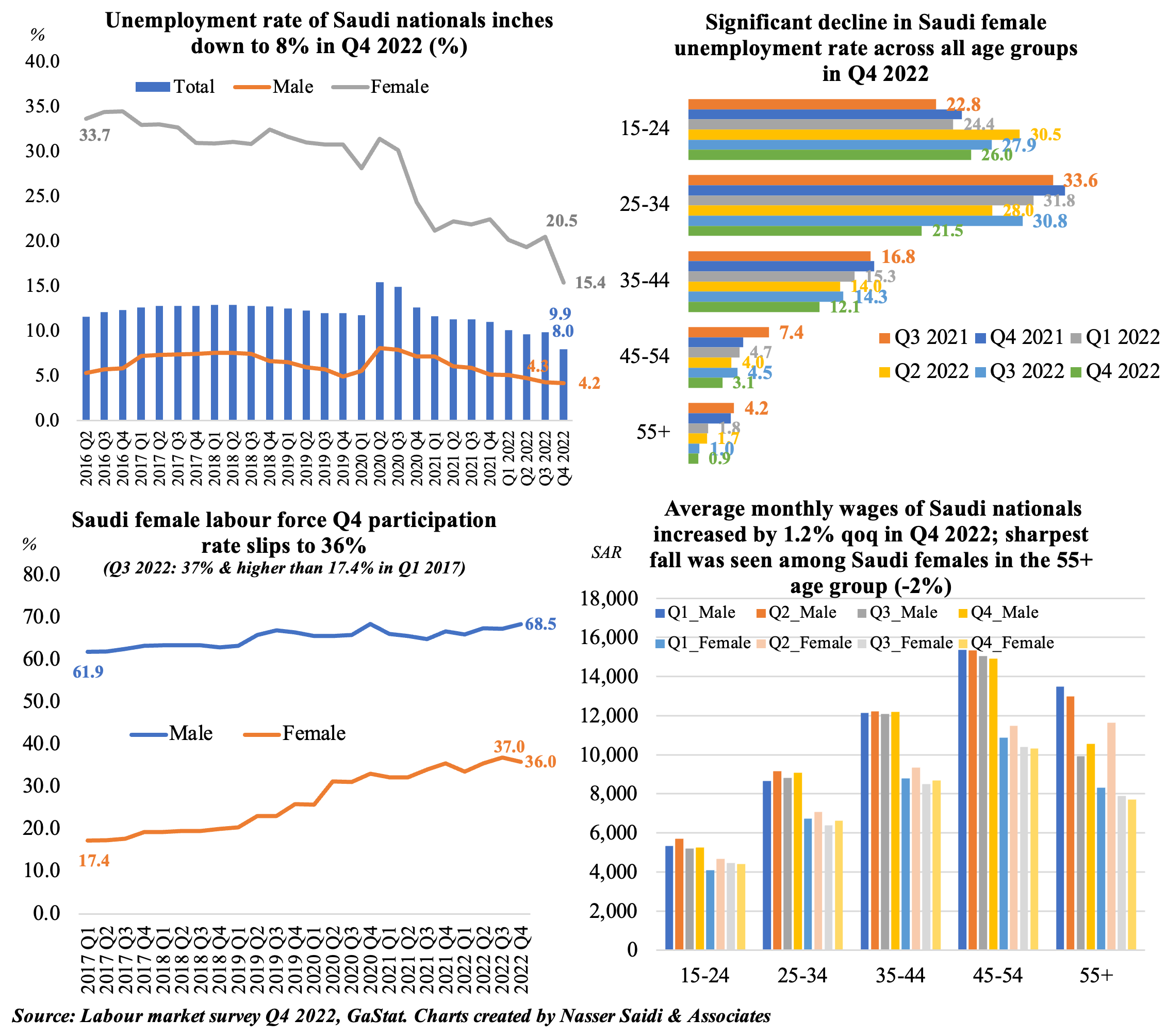

4. Unemployment rate of Saudi Arabia’s citizens fell to 8% in Q4 2022

- Unemployment in Saudi Arabia (inclusive of expats) slipped to 4.8% in Q4 (Q3: 5.8%)

- Female unemployment among Saudis fell to 15.4% in Q4 (less than half of 33.7% in Q2 2016); the decline was seen across all age groups

- Female labour force participation slips slightly to 36% in Q4 (Q3: 37%) while wages for females rise by 2% qoq in Q4.

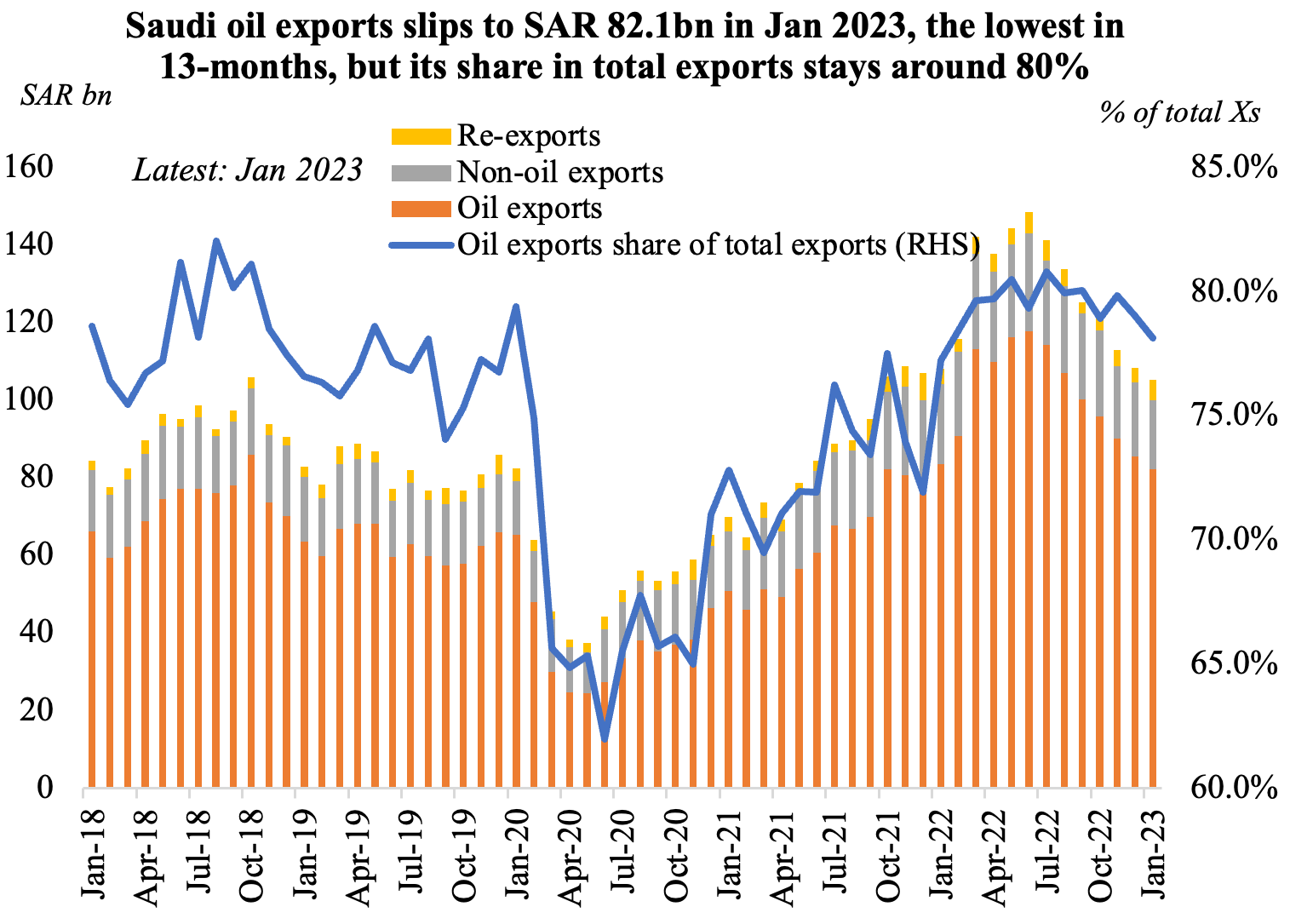

5. Saudi exports slipped by 3% yoy in Jan 2023, after 23 months of gains

- Merchandise exports slipped in Jan as a result of the 2% yoy drop in oil exports (to SAR 82.1bn) alongside the 3rd consecutive month of fall in non-oil exports (-13% to SAR 17.8bn). The share of oil exports meanwhile remained around 80% of total exports.

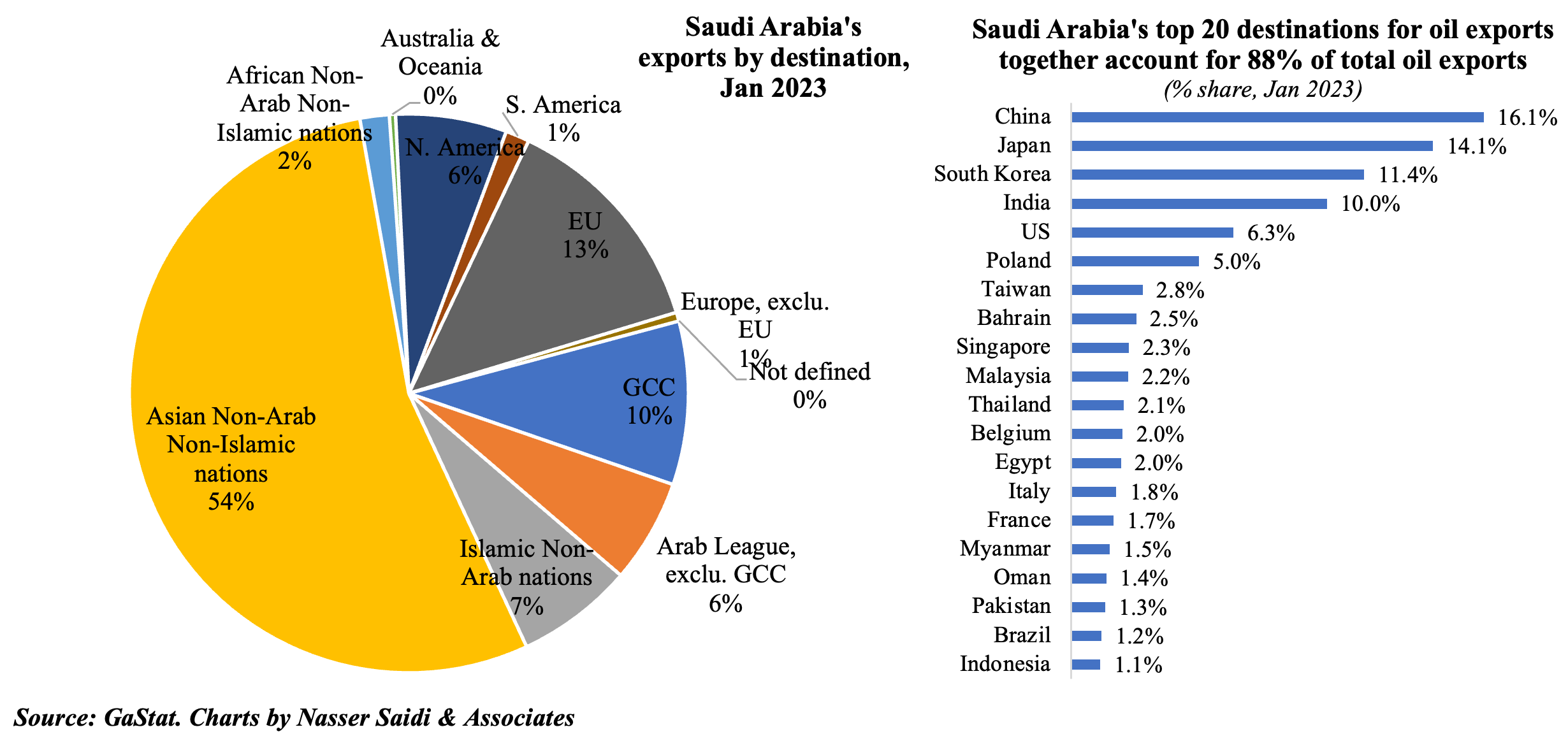

- Asian non-Arab non-Islamic nations accounted for more than 50% of overall Saudi exports, with many also featuring in the list of top destination of oil exports.

- China, Japan, Korea and India together accounted for 51.6% of Saudi’s oil exports in Jan 2023. From the region, Bahrain, Egypt and Oman had shares of 2.5%, 2% and 1.4% respectively.

Powered by: