Call for climate action. Slowing trade growth. US-China trade decoupling. UAE federal fiscal surplus. Dubai inflation.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 25 Mar 2023: Climate Cautions & Slowing Global Trade Growth

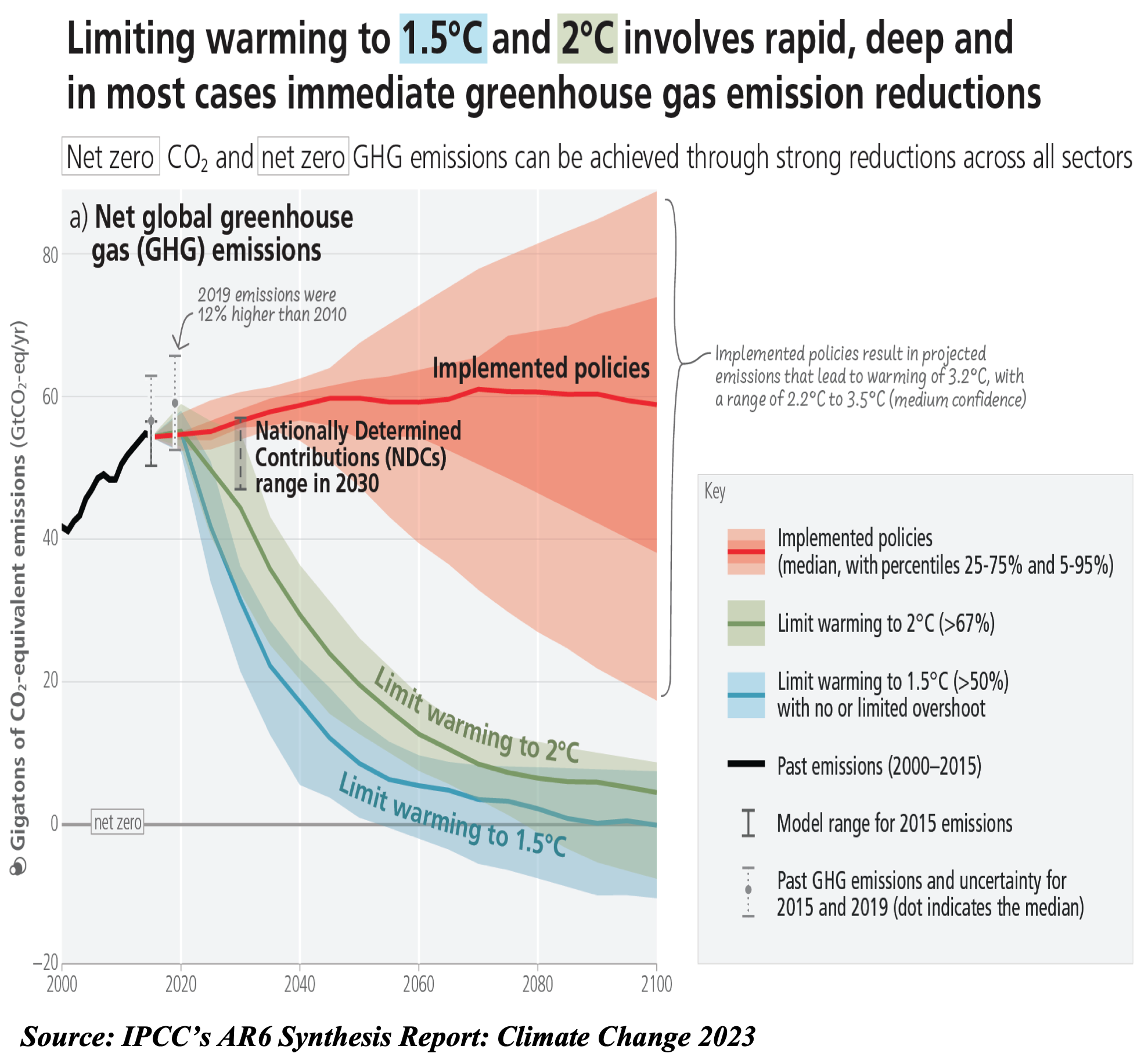

1. The Urgent Call for Climate Action

The IPCC released its 6th Assessment Report, with its key findings underscoring the need for immediate climate action:

- There is a more than 50% chance that global temperature rise will reach or surpass 1.5°C between 2021 and 2040

- GHG emissions have climbed steadily over the past decade: at 59 gigatonnes of carbon dioxide equivalent (GtCO2e) in 2019, it was ~12% higher vs 2010 & 54% higher vs 1990.

- A clear warning was associated with fossil fuels: CO2 emissions from existing & planned fossil fuel infrastructure was putting 1.5 °C out of reach.

- Carbon removal was seen as essential to limit the rise to 1.5°C in global temperature (examples include afforestation, direct air capture, seaweed cultivation etc).

- Though climate policies are in place in at least 170 countries, it needs to progress from planning to actual implementation

- Developing countries alone will need USD 127bn per year by 2030 and USD 295bn per year by 2050 to adapt to climate change. This compares to funds for adaptation at just USD 23-46bn from 2017 to 2018! Details of funding arrangements are critical.

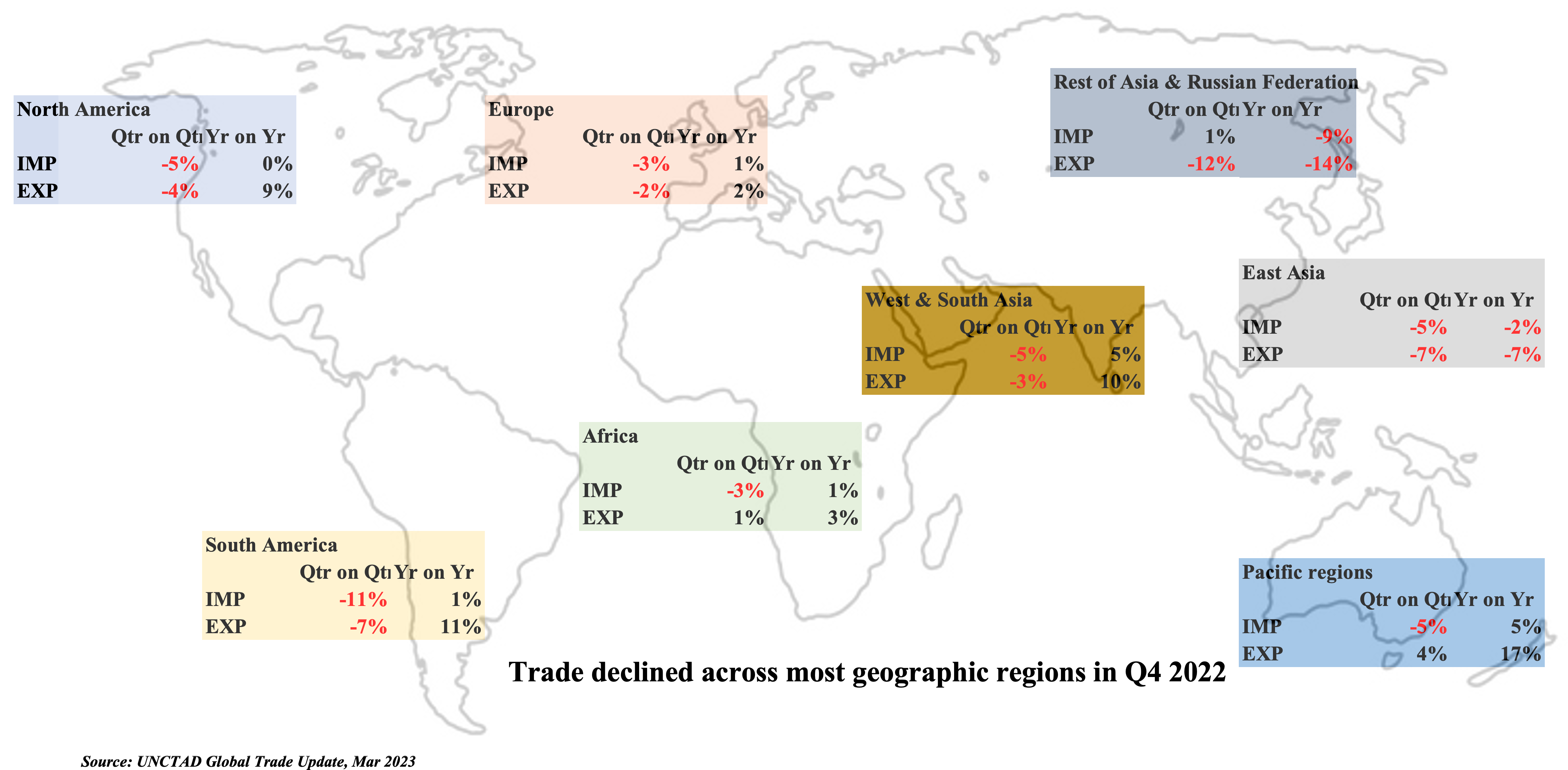

2. Global trade growth turned negative in Q4 2022: UNCTAD; positive outlook for 2023

- UNCTAD estimates global trade to have touched a record high of USD 32trn in 2022, largely owing to substantial growth in H1 2022, followed by a “subpar” H2 (trade in goods fell by USD 250bn in Q4 vs. Q3 while services trade remained constant).

- Volume of trade has been rising (even though value of goods trade has declined), indicating a “resilient global demand” for imports.

- What factors are likely to support trade growth? Falling shipping costs, less concerns about supply chain disruptions & improvements in delivery times (from PMI data), weaker dollar (i.e. increased demand for traded goods) & more demand for services.

- Risk factors that could derail trade growth: geopolitics (including Russia-Ukraine conflict), higher commodity prices & persistent inflation, high interest rates.

- Regional trade trends shows trade declined across most regions in Q4 2022: East Asia & the region including Russian Federation witnessed the sharpest year-on-year drops. In qoq terms, imports dropped the most in South America while exports increased only in Africa & the Pacific regions.

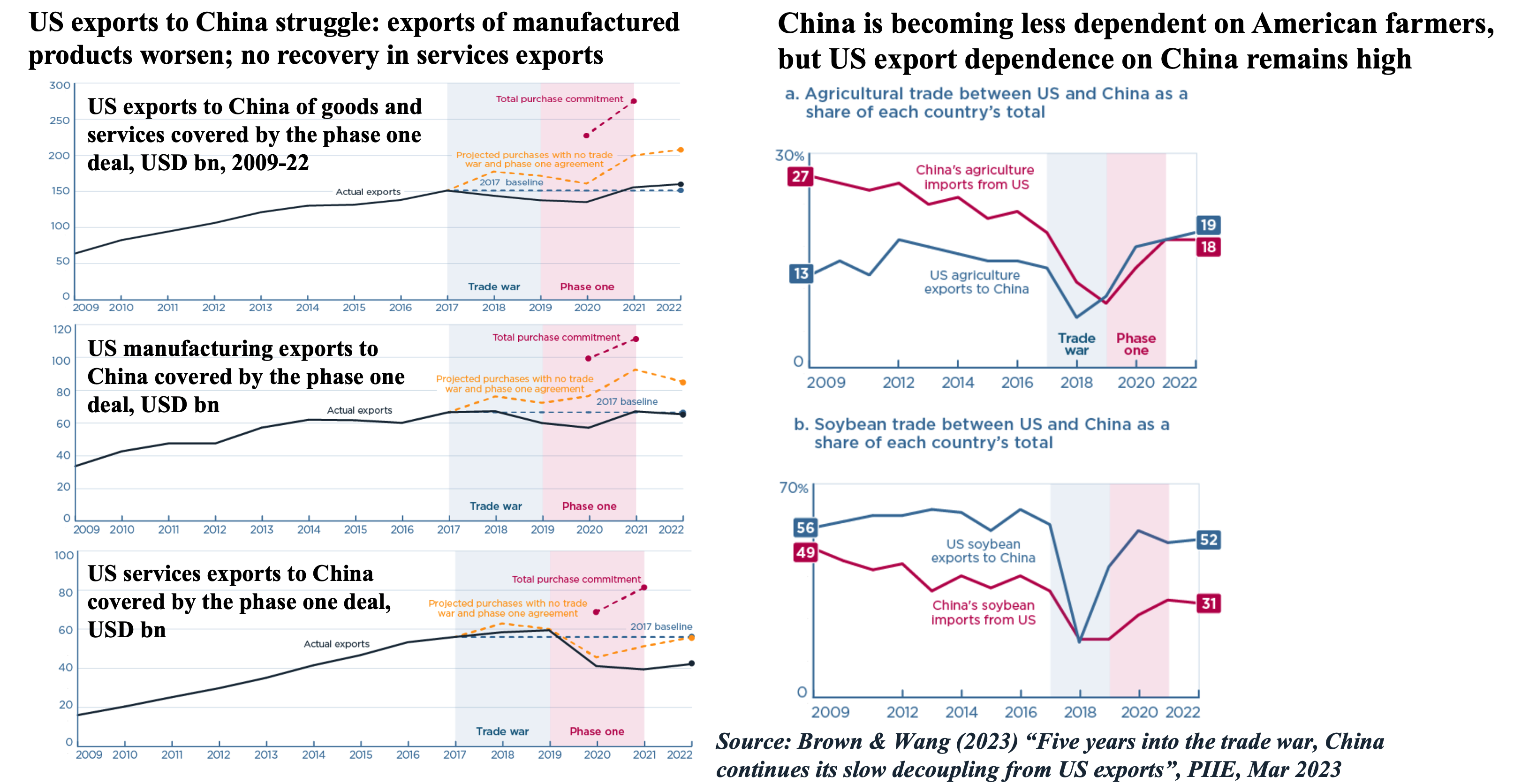

3. In the backdrop of slowing trade growth, evidence of China’s slow decoupling from US exports (Source: PIIE)

- A recent article from the PIIE examines US-China bilateral trade relation in the backdrop of rising geopolitical tensions and 5 years since the trade/ tariff wars began in 2018.

- Bilateral trade between US and China hit a record high of USD 960.9bn in 2022, in spite of deteriorating diplomatic relations. China-US trade, which was once mutually dependent & beneficial, has started showing evidence of decoupling.

- US exports to China, which started to decline during President Trump’s trade war phase, is now showing signs of distress even in agriculture trade (a bright spot before). Meanwhile, Chinese importers are diversifying their sourcing to become less reliant on the US.

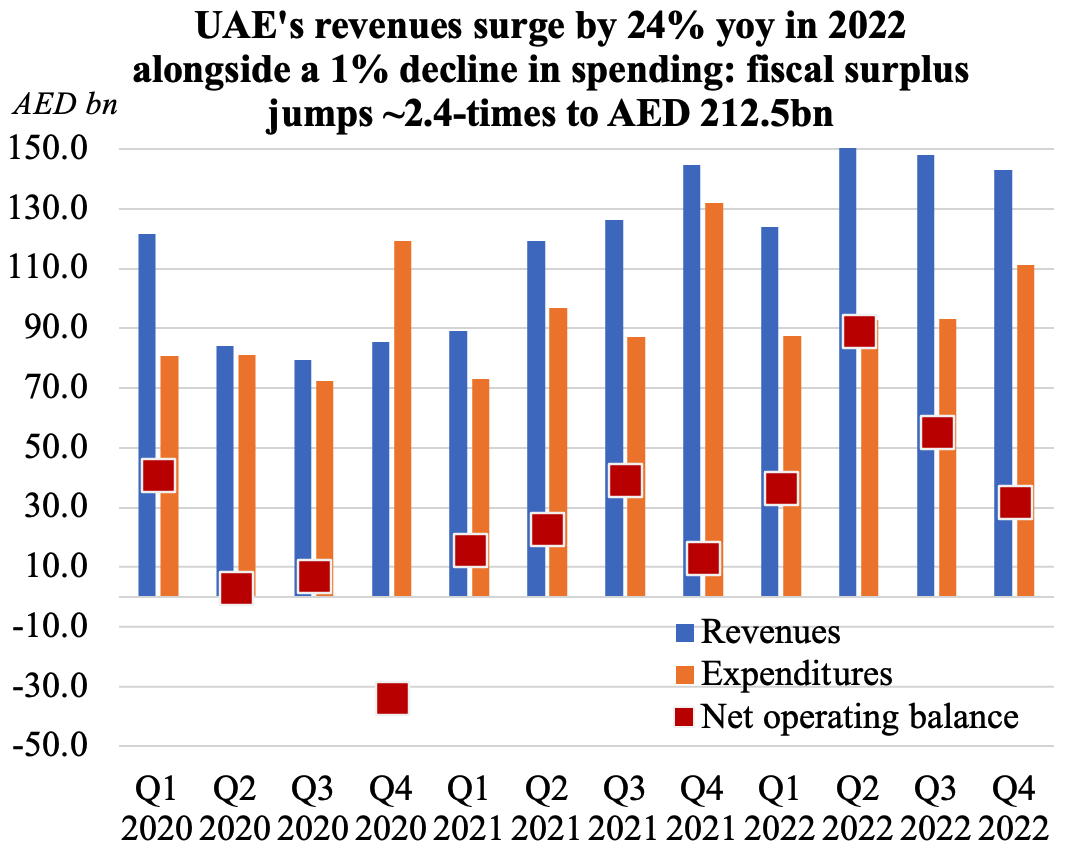

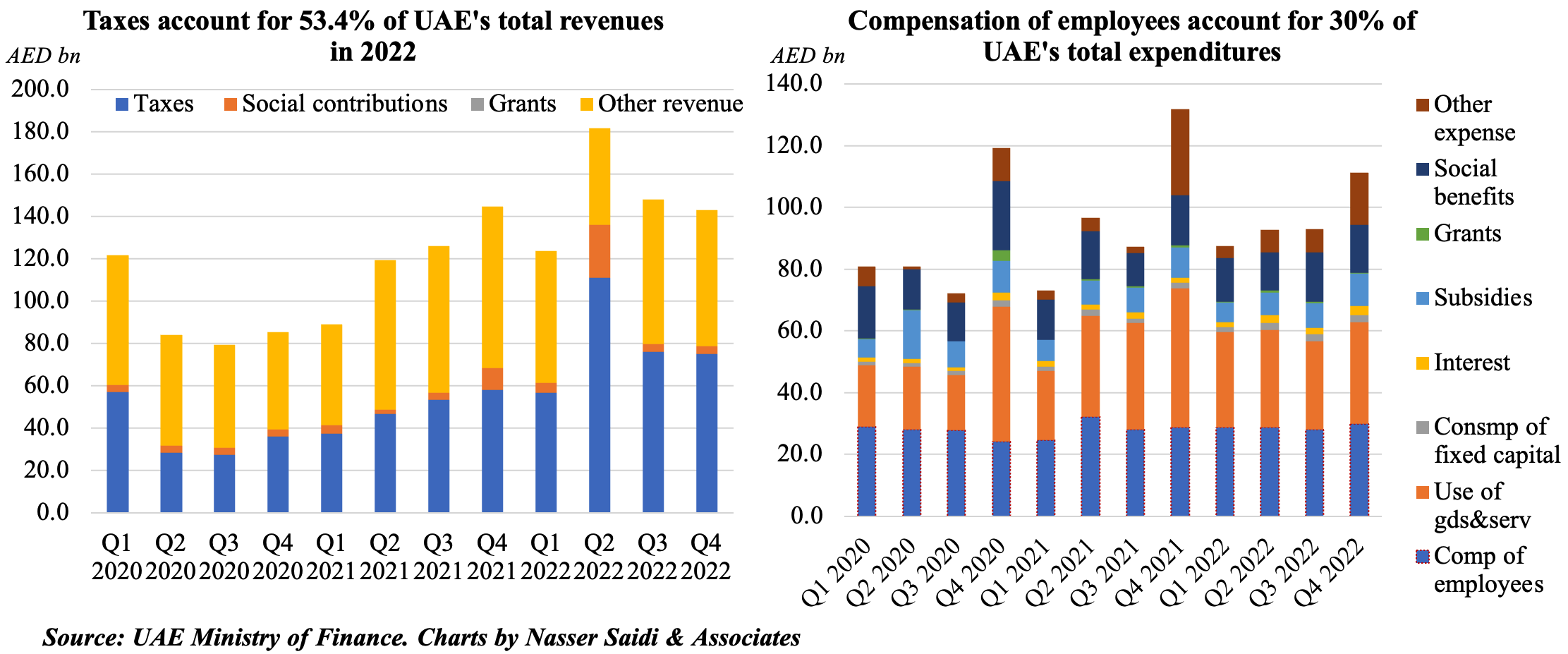

4. UAE’s net fiscal operating surplus more than doubles to AED 212.5bn in 2022

- UAE’s federal revenues grew by 24% yoy to AED 596.8bn in 2022, with taxes accounting for more than half of total revenues.

- Tax revenues surged by 63% yoy to AED 318.8bn in 2022; this is likely to tick up, oncecorporate tax is rolled out

- Spending, on the other hand, fell by 1% to AED 384.3bn in 2022, resulting in a 2.4-fold increase in net operating balance to AED 212.5bn.

- Both subsidies and grants inched lower in 2022, as did the “use of goods and services”.Compensation of employees (30% of overall expenditure) edged up by 2% to AED 115.4bn while social benefits posted a 5% increase to AED 58.1bn.

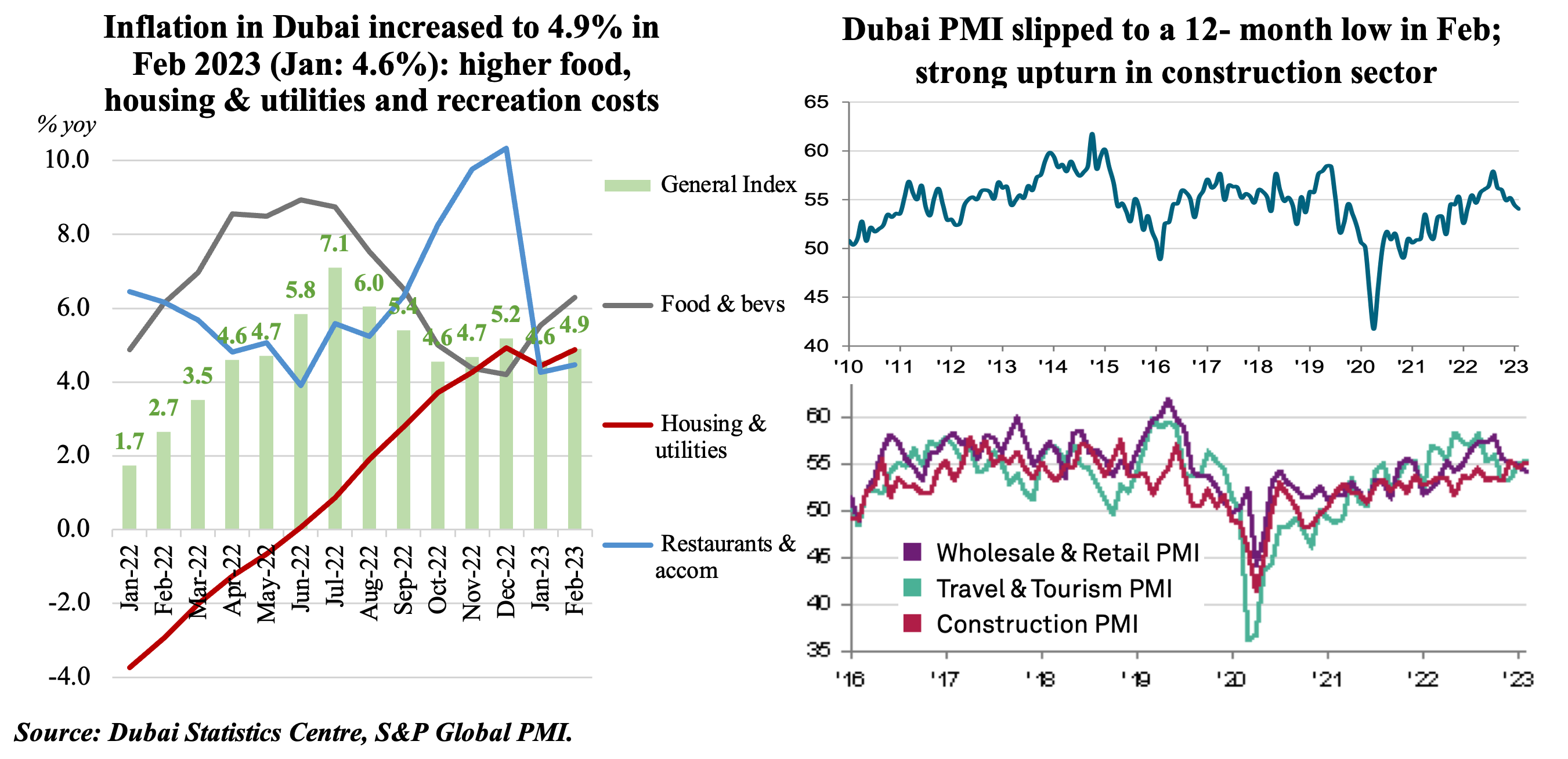

5. Inflation in Dubai inches up in Feb 2023; Dubai’s non-oil sector firms have been absorbing most of the rising costs

- In Feb, inflation in Dubai increased to 4.9% yoy, after easing the month before to 4.6%. The uptick in Feb was largely due to higher costs of food (6.3% in Feb from 5.5% in Jan) and housing & utilities (4.9% from 4.4%) while transport prices eased significantly (4.4% in Jan-Feb vs an average of 22.13% in 2022). Recreation (22.63% in Jan-Feb vs 23.4% in 2022) and restaurants & hotels (4.4% from 6.5%) costs have also eased this year compared to 2022.

- This uptick in Feb was also mentioned in the PMI for Dubai’s non-oil sector, wherein respondents highlighted a “fresh increase in input prices”, the fastest since Jul 2022, which could be traced back to material prices and shipping costs. Though input prices ticked up in Feb after two months of stable costs environment, firms continued to absorb most of the costs, with output charges falling for the 7th consecutive month in Feb.

Powered by: