Markets

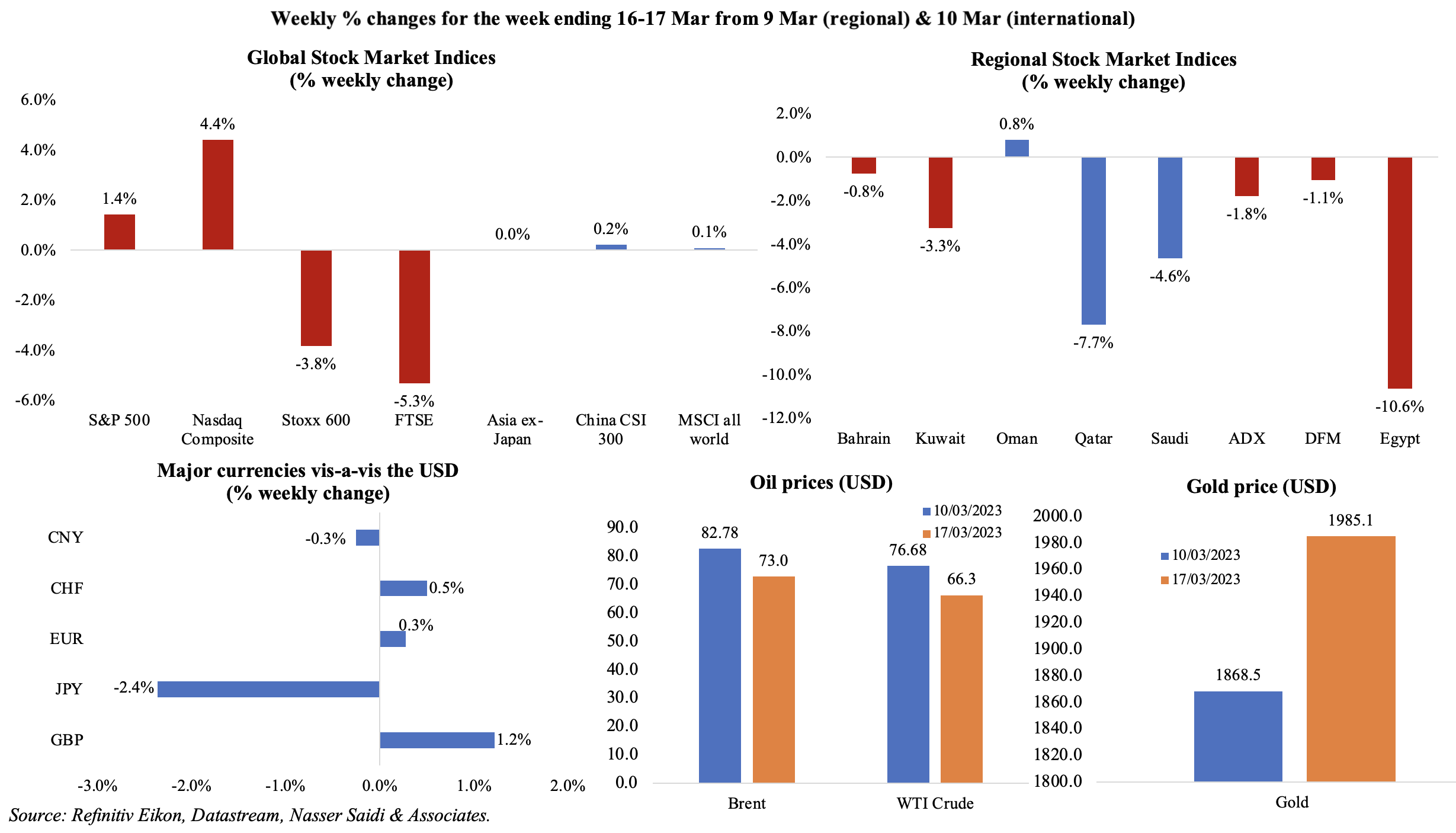

The upheaval in the banking sector, contagion and spill-over effects were the main reason for dismal equities performance last week: FT reported that banks in the US, Europe and Japan together lost USD 459bn in market value till end of last week (the sharpest decline since Mar 2020). Over the weekend, Credit Suisse was bought over by UBS (more in the Europe section) and major central banks joined together to enhance dollar liquidity to ease the banking crisis (with the ECB promising loans support to euro zone banks if needed). Regional markets were mostly down along with the global rout; Abu Dhabi and Dubai, both open on Fri, saw some respite given easing concerns of a banking crisis globally. Oil prices fell between 12-13% from the previous week, with Brent and WTI posting the biggest weekly losses since Dec and Apr respectively. Gold price gained last week, rising to the highest since last Apr, while Bitcoin also rose to a 9-month high.

Global Developments

US/Americas:

- Inflation in the US softened to 6% yoy in Feb (Jan: 6.4%), the lowest reading since Sep 2021 as food prices rose at a slower pace (9.5% vs Jan’s 10.1%) and costs slowed for energy (5.2% from 8.7% in Jan). Core inflation eased in yoy terms (slipping to 5.5% from Jan’s 5.6%) though it edged slightly higher in mom terms (0.5% from 0.4% mom in Jan). Separately, producer price index unexpectedly eased in Feb to 4.6% yoy (Jan: 5.7%) – the smallest yoy increase in almost 2 years – while core PPI stood at 4.4%.

- Industrial production in the US remained flat in Feb – manufacturing inched up by 0.1% (Jan: +1%) while motor vehicles and parts output fell by 0.3% (Jan: 0.6%). Capacity utilisation held steady at 78% (vs. Apr 2022’s high of 80.2%).

- Retail sales in the US fell by 0.4% mom in Feb (Jan: 3.2%), with receipts at food services and drinking places falling by 2.2% and auto purchases down by 1.8% (Jan: +7.1%); excluding autos, sales declined by 0.1% mom.

- NY Empire State manufacturing index plunged to -24.6 in Mar (Feb: -5.8), with readings for both new orders and shipments declining sharply while input and selling price increased eased.

- Philadelphia Fed manufacturing index edged up to -23.2 in Mar (Feb: -24.3), staying negative for the 7th month running. Both shipments and new orders clocked in the lowest readings since May 2020.

- Building permits in the US surged by 13.8% mom to 1.524mn in Feb, with permits for single family housing up (by 7.6% to 777k) after 11 consecutive months of declines. Housing starts rebounded by 9.8% mom to 1.45mn, the highest level since Sep, thanks to starts for projects with 5 units or more rising by 24.1% to 608k units (highest level since Apr).

- Michigan consumer sentiment index slipped to 63.4 in Mar (Feb: 67): about 85% of interviews were finished prior to the onset of the current banking contagion fears. The one-year inflation expectations fell to 3.8%, the lowest since Apr 2021 (Feb: 4.1%).

- Initial jobless claims fell below the 200k mark in the week ended Mar 11th – down by 20k to 192k, the largest drop since Jul while the 4-week average eased by just 750 to 196.5k. Continuing jobless claims slipped by 29k to 1.684mn in the week ended Mar 4th.

Europe:

- UBS bought Credit Suisse in a deal backed by the Swiss government over the weekend. The last-minute deal valued Credit Suisse at USD 3.2bn, a fraction of its USD 8bn+ value last Friday. Credit Suisse disclosed that CHF 16bn (USD 17.24bn) of its Additional Tier 1 debt would be written down to (an unprecedented)zero on the orders of the Swiss regulator as part of its UBS rescue merger.

- The ECB hiked interest rates by the planned 50bps to 3% despite the banking sector upheaval. The ECB emphasised that banks in the eurozone were “resilient, with strong capital and liquidity positions”, while also stating that it had the tools to “provide liquidity support” should the need arise.

- Labour costs in the eurozone jumped by 5.7% in Q4 (Q3: 3.7%), with wages up by 5.1% and non-wage labour costs higher by 7.7%. Wages grew the fastest in construction and services (at 6.5% and 5.7% respectively). However, this remains below the UK, where the average earnings excluding bonus stood at 6.7% in Q4 and edged down to 6.5% in the 3 months to Jan.

- Industrial production in the euro area grew by 0.7% mom (and 0.9% yoy) in Jan, following the 1.3% mom drop (and -2% yoy) recorded in Dec.

- Germany’s current account surplus narrowed to EUR 16.2bn in Jan (Dec: EUR 25.6bn), with the services account posting a EUR 1.4bn deficit in Jan (Jan 2022: surplus EUR 1.7bn).

- UK budget included a corporate spending tax break, increased defence spending and extra childcare support alongside plans to extend energy bill subsidies for households and the launch of 12 new low-tax zones among others.

- UK’s unemployment rate held steady at a near-record lows of 3.7% in Jan. In the 3 months to Jan, average total pay including bonuses was up 5.7% (Dec: 6%) while the proportion of working age population classified as economically inactive fell by 0.2 ppts to 21.3%.

Asia Pacific:

- Industrial production in China grew by 2.4% in Feb (Jan: 1.3%), thanks to the uptick in manufacturing output. Retail sales rebounded by 3.5% in Feb (Jan: -1.8%), though autos and home appliances sales declined. Fixed asset investment rose by 5.5% in Jan-Feb (Jan: 5.1%) while investment in real estate fell by 5.7% in Jan-Feb. FDI into China increased by 6.1% yoy to CNY 268.44bn in Jan-Feb (Jan: 14.5%): FDI flows into high-tech manufacturing surged by 68.9%.

- Exports from Japan increased by 6.5% yoy in Feb and imports were up by 8.3%, resulting in a narrower trade deficit of JPY 897.7bn (USD 6.75bn). This is the 19th consecutive month of trade deficit.

- Core machinery orders in Japan jumped by 9.5% mom in Jan (Dec: 0.3%) – this was the biggest monthly hike in mor than 2 years. Non-manufacturing orders increased by 19.3% while manufacturing orders declined.

- Japan’s BSI large manufacturing conditions index plunged to -10.5 in Q1 (Q4: -3.6) while the large all industry reading dropped to -3.0 from the previous quarter’s +0.7.

- Inflation in India inched lower to 6.44% in Feb (Jan: 6.52%): while food prices were relatively unchanged at 5.95%, costs of fuel slowed (9.9% from Feb’s 10.84%). Wholesale price inflation also fell, down to 3.85% from 4.73% in Jan, with slowing food (2.76% from Jan’s 2.95%) and fuel (14.47% from 23.79%).

- Singapore unemployment rate was unchanged at 2% in Dec, bringing the full year average to 2.1% (2021: 2.7%). Meanwhile, youth unemployment rate fell to a 24-year low of 5.9% in 2022 (2021: 7.3%).

Bottom line: Banking and financial contagion worries dominated news last week and today. Neither the deal over the weekend to rescue Credit Suisse (UBS buying it for USD 3.2bn) nor the support pledged by major central banks (increasing the frequency of their supply operations) seem to have resulted in substantial relief to investors. The focus is also on the Fed and BoE’s policy meetings this week. Banking concerns have been added alongside (easing) inflation readings for the Fed policymakers: expectations are for a 25bps hike (or none) as an aggressive hike could lead to more worries at banks (and financial market jitters). The Bank of England’s policy decision meanwhile is likely to be heavily influenced by the inflation data out a day before the meeting (it stood at 10.1% in Jan).

Regional Developments

- Bahrain’s Business Confidence Index increased by 1.81% qoq to 103.84 points in Q1 2023, with more than 94% of investors expecting business and economic stability and 44.66% expecting improvements in business performance.

- Egypt grew by 3.9% in Oct-Dec 2022 (Jul-Sep: 4.4% and 8.3% a year ago) and unemployment rate fell to 7.2% (prev: 7.4%), according to a cabinet statement. Economic growth is forecast at 4.2% in the current fiscal year (ending in Jun).

- Trade deficit in Egypt narrowed to USD 1.93bn in Dec 2022, down by 54% yoy. Exports in Dec were down by 2.7% yoy to USD 4.18bn while imports plunged by 28% to USD 6.11bn.

- Egypt plans to offer at least a 10% stake in two military-owned companies – National Company for Producing and Bottling Natural Water (Safi) and the National Petroleum Company (known as Wataniya) – to a strategic investor within a month, reported Asharq Business. CI Capital, the financial advisor to the government, opened talks with prospective investors last week in a roadshow. Will a minority stake be attractive?

- Egypt is aiming to attract USD 10bn in net FDI during the current fiscal year 2022-23, up from last year’s USD 8.6bn, disclosed the finance ministry.

- About 11.7mn tourists visited Egypt in 2022, according to the tourism minister. This year, expectations are for a 28% rise in tourists – to up to 15mn, benefiting from a decline in the EGP.

- Suez Canal reported its highest-ever daily transit rate on March 13th: 107 ships, with a total net tonnage of 6.3mn tons, crossed in both directions (without wait times). The canal had recorded revenues of EGP 18.2bn (USD 594mn) in Dec 2022.

- Abu Dhabi’s AD Ports Group signed a 30-year concession agreement worth USD 200mn to develop, manage and operate Egypt’s Safaga port: the investments will cover “superstructure and equipment, buildings, and other real estate facilities and utilities’ network inside the concession area”, according to the statement.

- It was revealed by the Iraq PM’s media adviser that oil revenues from the Kurdistan region would be transferred to a bank account under federal government supervision for the first time since 2002.

- Iraq’s oil minister reiterated the nation’s commitment to OPEC’s production cut. The minister also stated that talks with Total Energies regarding the delayed USD 27bn energy deal was in “advanced stages”. The deal was signed in 2021 for the firm to build 4 oil, gas, and renewable projects with an initial investment of USD 10bn over 25 years in southern Iraq.

- Kuwait’s constitutional court annulled the 2022 parliament, reinstating the previous (2020) parliament. The 2022 parliament had opposition in the majority, with 28 of 50 seats.

- The World Bank’s regional vice president revealed that Lebanon has to audit its state electricity company, activate its newly announced regulatory authority and recover provision costs through collection, before it is considered it for access to electricity funding.

- Oman posted a surplus of OMR 145mn at end-Jan 2023 (Jan 2022: OMR 18mn surplus), as revenues surged by 22% to OMR 982mn (oil and gas accounted for 88% of total revenues). With the repayment of loans amounting to OMR 511mn in Jan, the government debt was reduced to OMR 17.2bn at end-Jan.

- The UAE, Saudi Arabia and Egypt accounted for 89% of the 632 merger and acquisition deals in the Middle East last year, according to a PwC report. It was found that technology, energy, food processing, healthcare and education sectors were the top IPO deals drivers.

- Growing reconciliation measures: The Iran Supreme National Security Council secretary visited the UAE last week in response to an official invitation from his UAE counterpart – close on the heels of the Saudi-Iran agreement to restore ties. Separately, the Saudi finance minister disclosed that investments into Iran could happen “very quickly”. Saudi has also invited President Ebrahim Raisi to visit.

Saudi Arabia Focus

- Overall inflation in Saudi Arabia eased to 2.96% yoy in Feb(Jan: 3.4%): both food and beverage prices and transport costs rose at a slower pace in Feb (fell by 0.7% mom and 0.5% respectively), with the latter due to a fall in motor car prices. Meanwhile, housing and utilities category continued to increase (+8.3% yoy in Feb): this was a result of the surge in apartment rental prices (21.4%).

- Wholesale prices in Saudi Arabia softened to an increase of 2.7% yoy in Feb, after inching up to 3.6% in Jan, with pace of increase declining across most broad groups. Only metal products, machinery and equipment showed a mom increase: 0.49% vs -0.06% mom in overall WPI.

- Saudi Arabia’s finance minister stated that a decision about the distribution of last year’s budget surplus (SAR 103.9bn) would be finalised in “another one or two weeks”. When specifically asked if the funds could be transferred to the PIF, he answered in the negative.

- Saudi PIF launched 3 new initiatives to support the private sector: one, the local content growth initiative (to increase share of local content spend in PIF’s domestic portfolio to 60% by 2025); two, suppliers development program to support upskilling; three was the private sector hub to share supplier and investment opportunities.

- In Jan 2023, Saudi ministry of industry and mineral resources issued licenses to 124 industrial units with a total investment value of SAR 2.4bn (USD 639mn). Separately, the volume of investment in Saudi Arabia’s industrial sector jumped to SAR 1428trn in Dec 2022, with a total of 10,518 factories in operation.

- JODI data disclosed that crude oil production in Saudi Arabia increased by 18k barrels per day (bpd) to 10.45mn in Jan while crude oil exports jumped by 221k to 7.66mn.

- The value of Saudi Arabia’s financial market surged by 476% over the past 5 years to SAR 9.9trn (USD 2.6trn), according to a senior Capital Market Authority official. Listed companies jumped to 269 by end-2022 from just 188 firms at end-2017.

- S&P Global raised its rating for Saudi Arabia to “A/A-1”, citing reform and diversification plans. Moody’s reaffirmed Saudi’s “A1” rating, reflecting fiscal policy effectiveness as well as regulatory and economic reforms, upgrading the outlook to “positive” from “stable”.

- Boeing and Saudi Arabia inked a USD 37bn deal for 121 aircrafts, with 72 of these for the newly announced Riyadh Air. Timeline of the deliveries were not disclosed, but the US Commerce Secretary stated that the deal would support “more than 140k jobs [in the US] at over 300 Boeing suppliers”.

- ROSHN, the PIF-owned real estate developer, signed 8 giga contracts worth SAR 8bn (USD 2.1bn) to develop infrastructure and facilities across its projects.

- Hotel occupancy in Riyadh increased to 75.5% in Feb, the highest since 2008, according to STR. Compared to pre-pandemic 2019, occupancy rate surged by 23.4%, the average daily rate rose 34% to SAR 801.46 (USD 213.46), and revenue per available room jumped by 65.3% to SAR 605.06.

- The Royal Commission of Riyadh City (RCRC) launched the first phase of the Riyadh bus service network. Once completed by end-2024, the network will have more than 800 buses, over 2900 stations and cover 1900kms, while also being integrated with metro trains.

- Lucid Motors will launch its first fully Saudi-assembled electric car in Sep, according to the firm’s MD in the Middle East. The production factory in Jeddah is expected to produce 155k EVs annually according to the deal signed in May 2022.

- Saudi Arabia Railways signed a MoU with Italy’s Arsenale Group to launch the region’s first luxury train.

- Saudi Arabia’s Cultural Development Fund’s USD 234mn Film Sector Financing Program aims to support the growing film sector by offering financial packages to local and foreign firms to boost local content.

UAE Focus![]()

- Georgia signed a Comprehensive Economic Partnership Agreement (Cepa) with the UAE, after only 3 rounds of negotiations, hence becoming the fifth such nation following UAE’s agreements with India, Indonesia, Israel and Turkey. In 2022, bilateral trade between the two nations surged by 110% to USD 468mn. UAE now accounts for more than 63% of the total volume of Georgia’s trade with Arab countries and the UAE is Georgia’s 6th largest global investor.

- The UAE ministry of finance revealed an increase in state-level fiscal balance in Q4 2022 to the tune of AED 22.8bn (from a deficit of AED 2.2bn in Q4 2021). Revenues at the state level increased by 6.9% yoy to AED 143.1bn in Q4, with tax revenues up 29.3% to AED 75bn. Spending declined by 11.7% to AED 120.3bn in the last quarter.

- The UAE raised AED 1.1bn (USD 300mn) from the 2nd auction of a conventional AED-denominated treasury bond issuance, which was five times oversubscribed, according to the ministry of finance.

- Abu Dhabi’s IHC disclosed having invested 15% in the upcoming IPO of Presight AI (a G42 Group subsidiary). IHC has currently crossed AED 2.1bn (USD 572mn) in tech investment. Separately, Bloomberg reported that the AI firm G42 acquired a USD 100mn stake in ByteDance (Tiktok-parent firm).

- Bilateral trade between UAE and Japan surged by 57.5% yoy to over AED 200bn in 2022, making UAE the 7th largest trade partner of Japan. Non-oil merchandise trade also increased, rising by 48% yoy in Jan-Sep 2022. The value of Japanese investments in the UAE exceeded AED 51.4bn by end-Oct.

- UAE plans to introduce a flexible work permit for “all skill levels” by Q3 2023 allowing freelancers to work for themselves or with others.

- Syria’s President arrived in the UAE for an official visit (following last year’s previous trip): the trip featured “constructive talks” including exploring “ways of enhancing cooperation to accelerate stability and progress in Syria and the region”, according to the UAE leader’s tweet.

- The ministry of economy allowed for a temporary hike in the prices of eggs and poultry products in the UAE (up to a maximum of 13%).

Media Review

How Silicon Valley learnt to love the government

https://www.ft.com/content/49f848f7-187f-422f-a4b6-eaa02b46734b

Saudi energy minister: Kingdom will not sell oil to any country that imposes a price cap

https://www.arabnews.com/node/2268696/saudi-arabia

Egypt asset sales face obstacles as state maintains grip

https://www.reuters.com/world/middle-east/egypt-asset-sales-face-obstacles-state-maintains-grip-2023-03-16/

Monetary Policy Under Test

https://www.imf.org/en/Publications/fandd/issues/2023/03/POV-monetary-policy-under-test-claudio-borio

Cities of Choice: Are People Happy Where They Live? BCG report

https://www.bcg.com/publications/2023/cities-of-choice-are-people-happy-where-they-live

Powered by: