Saudi inflation. Fiscal surpluses in Saudi Arabia, Oman and Qatar.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 17 Mar 2023: GCC posted spectacular fiscal surpluses in 2022, but likely to taper in 2023

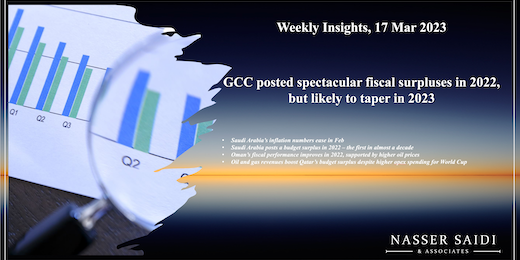

1. Saudi Arabia’s inflation numbers ease in Feb

- Overall inflation in Saudi Arabia eased to 2.96% yoy in Feb (Jan: 3.4%): both food and beverage prices and transport costs rose at a slower pace in Feb (fell by 0.7% mom and 0.5% respectively), with the latter due to a fall in motor car prices. Meanwhile, housing and utilities category continued to increase (+8.3% yoy in Feb): this was a result of the surge in apartment rental prices (21.4%).

- Wholesale prices in Saudi Arabia softened to 2.7% yoy in Feb, after inching up to 3.6% in Jan, with pace of increase declining across most broad groups. Only metal products, machinery and equipment showed a mom increase of 0.49% (vs -0.06% mom in overall WPI).

- Last week’s PMI reading in Saudi Arabia showed that input price had increased (highest since Nov 2022) as a result of increase in staff wages. (Usually, wages tend to lag inflation increases.)

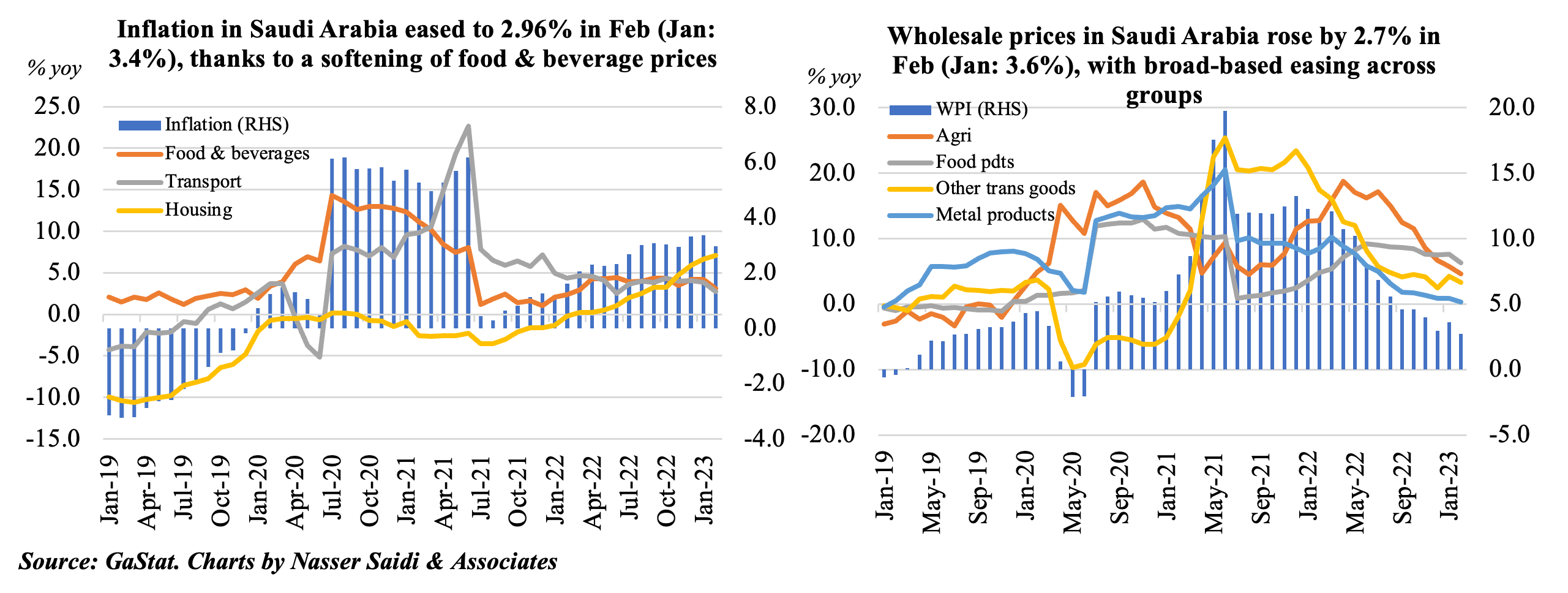

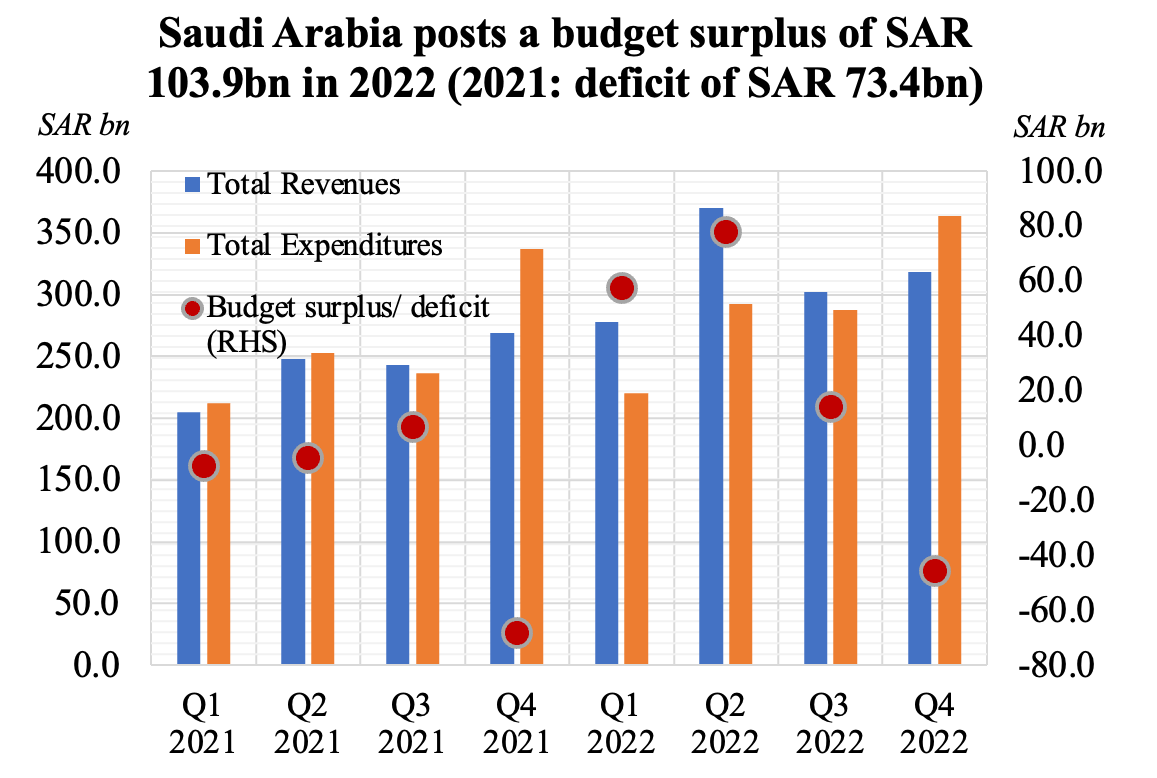

2. Saudi Arabia posts a budget surplus in 2022 – the first in almost a decade

- Saudi Arabia posted a budget surplus of almost USD 28bn in 2022, from a deficit of USD 19.54bn in 2021, thanks to the surge in oil revenues (52.5% yoy to SAR 1,268.2bn in 2022) and only a 3.5% rise in spending).

- Q4 2022 posted a deficit of SAR 45.7bn following 3 quarters of surpluses, after OPEC+ oil production cuts were implemented. But, oil revenues still accounted for more than 2/3-rds of total revenues in 2022.

- The bulk of the 2022 surplus is expected to boost reserves: an announcement is expected soon from the finance ministry.

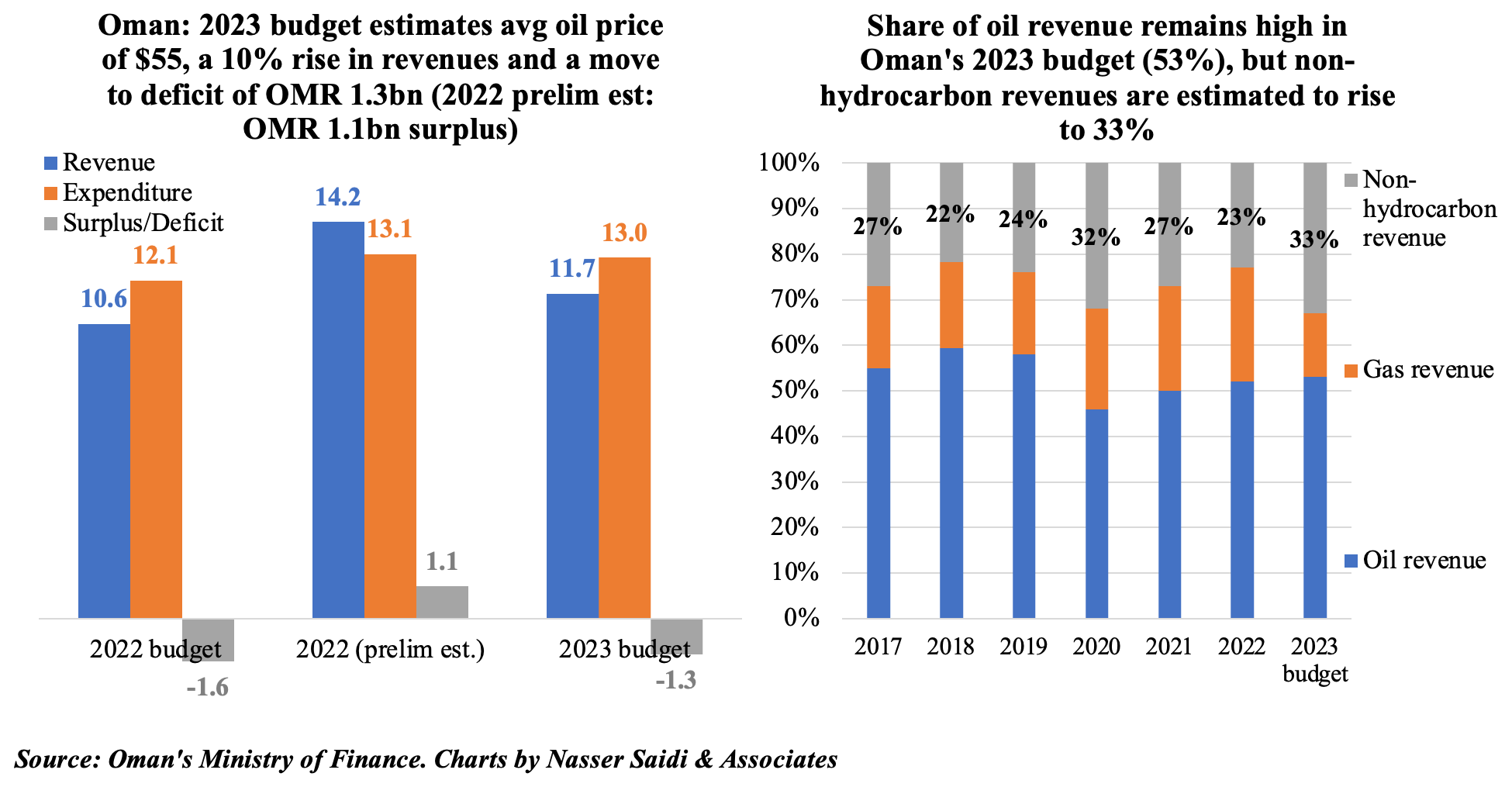

3. Oman’s fiscal performance improves in 2022, supported by higher oil prices

- Oman moved to a budget surplus of OMR 1.15bn in 2022 compared to a deficit of OMR 1.55bn in the 2022 budget, thanks to the increase in oil prices (to an average of USD 94 in 2022 from USD 50 in the 2022 budget) and revenues (+34.5% higher than budgeted).

- Oil and gas revenues continue to be the main source of overall revenue, but the share of non-hydrocarbon revenue is expected at 33% in the 2023 budget (2022 actual: 23%). Spending in 2022 was 7.9% higher than budgeted.

- Additional revenue was used towards repayment of the public debt: public debt fell to OMR 17.7bn at end-2022 from OMR 20.8bn at end-2021.

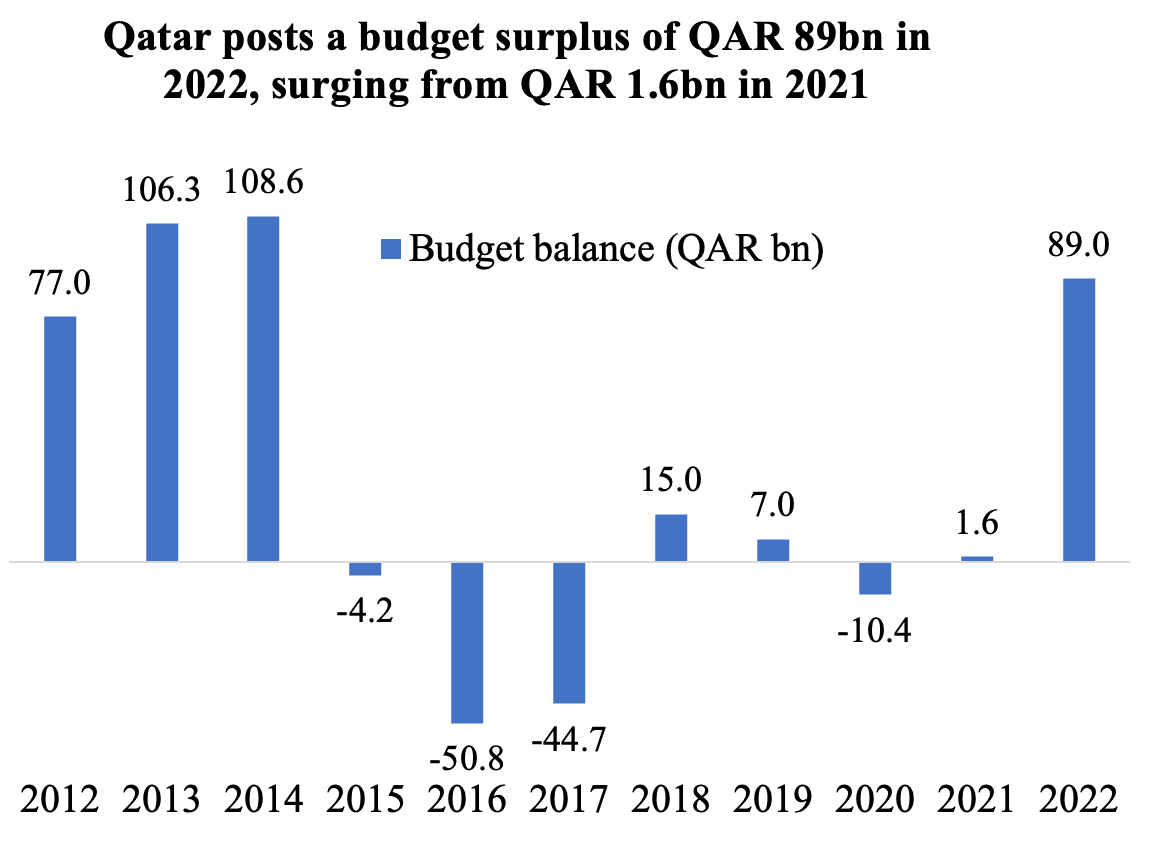

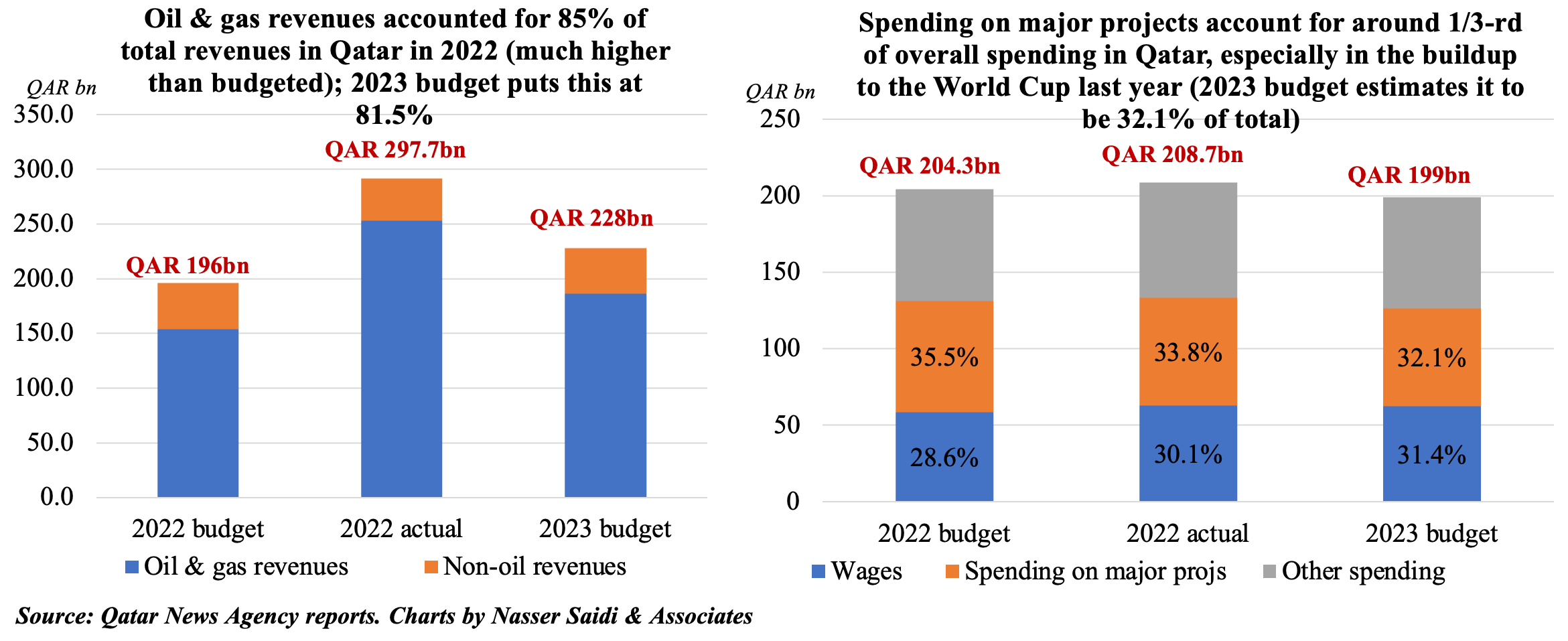

4. O&G revenues boost Qatar’s budget surplus despite higher opex spending for World Cup

- Qatar posted a budget surplus of QAR 89bn in 2022, much higher than 2021’s QAR 1.6bn and closer to the large surpluses in 2012-2014.

- As per the 2023 budget, surplus is estimated to fall by about one-third to QAR 29bn. This budget surplus is to be directed to paying public debt, supporting central bank reserves and raising capital of the Qatar Investment Authority.

- Non-oil revenues remained unchanged at QAR 42bn in the 2023 budget (2022 actual: QAT 38.6bn). The finance minister stated that studies are underway to raise non-oil revenues (via expanding list of goods covered by the selective tax and reviewing government fees).

Powered by: