Markets

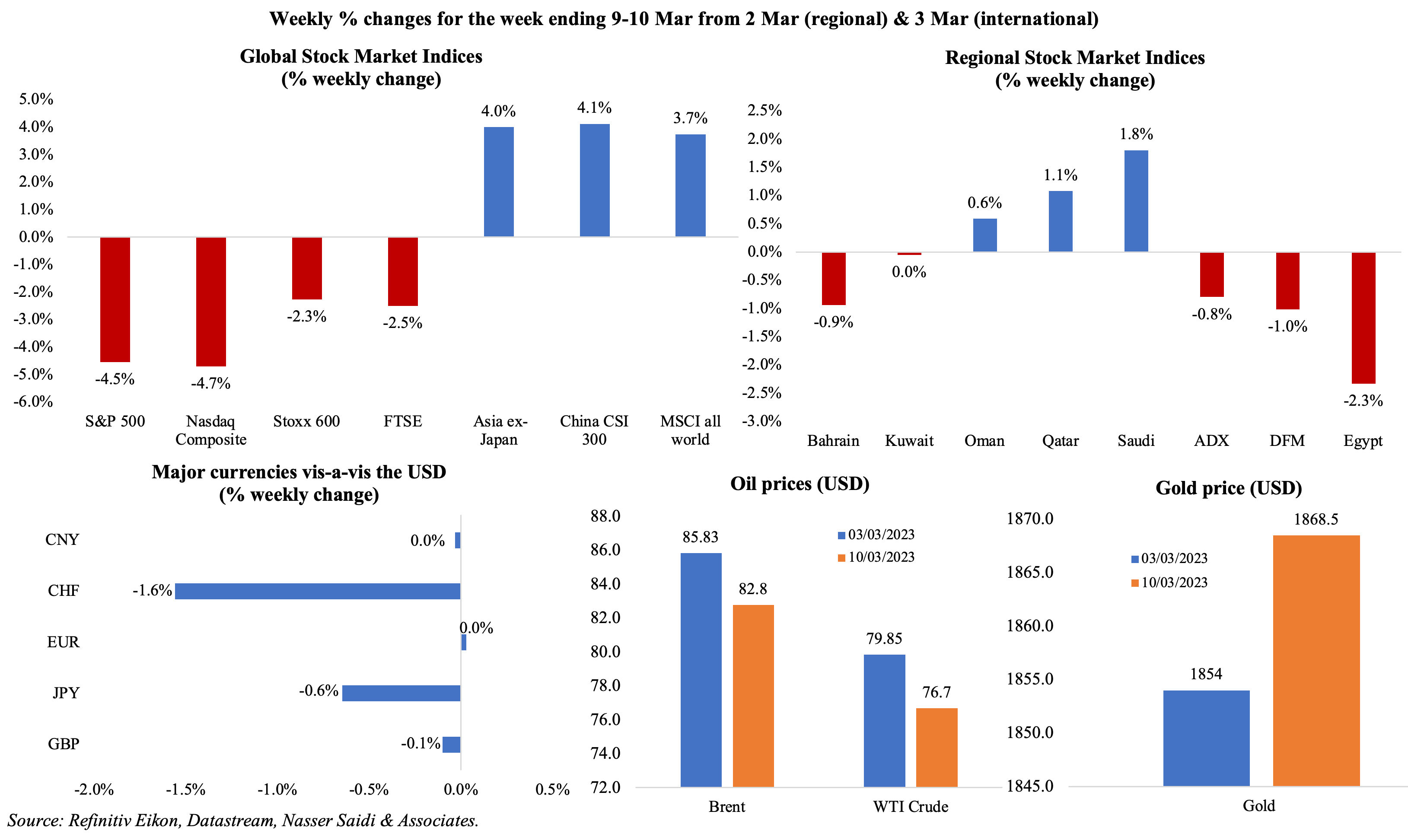

Last week ended with the failure of start-up focused lender SVB Financial Group, the largest bank to fail since the 2008 financial crisis. Equity markets in the US closed in the red (S&P was down by 4.5%) with fears of financial sector contagion and market volatility. Some spill over effect was also seen in European markets, where interest rate uncertainty was also affecting market sentiment. The Cboe Volatility Index or Vix, touched its highest level since late-Oct. Regionally, markets were mixed after Powell’s hawkish comments and strong labour market payrolls (most GCC nations are pegged to the dollar), while markets that were open yesterday (Mon, 12 Mar) closed lower also on fears of SVB contagion. Safe haven assets (CHF, JPY and gold) gained on fears of a potential crisis in the banking sector. Oil prices fell by close to 4% on interest rate worries.

Global Developments

US/Americas:

- Powell, in his testimony to the Congress, stated that inflation was showing an uptick again and should that continue, rates could be increased to a much higher level than anticipated. He also highlighted the “extremely tight” labour market as a case in point for why rates would stay elevated. The comment pre-date the SVB collapse.

- Non-farm payrolls increased by 311k in Feb (Jan: 504k), a sign of a tight labour market. Unemployment rate inched up to 3.6% (Jan: 3.4%) and labour force participation rate rose to 62.5% (Jan: 62.4%) –the highest since Mar 2020. Average hourly earnings grew by 4.6% yoy, indicating an easing of wage pressures.

- Private sector jobs grew by 242k in Feb (Jan: 119k), while pay increase showed a modest slowdown (7.2% yoy, down 0.1 ppt from Jan).

- Initial jobless claims inched up by 21k to 211k in the week ended Mar 4th, the largest rise since Oct, and the 4-week average inched up by 4k to 197k. Continuing jobless claims increased by 69k to 1.718mn in the week ended Feb 25th.

- JOLTS job openings slipped to 10.824mn in Jan (Dec: 11.234mn) while layoffs jumped 241k to 1.7mn, the highest level since Dec 2020. Overall, there were still 1.9 job openings for every unemployed person in Jan.

- Factory orders in the US declined by 1.6% mom in Jan (Feb: 1.7%), dragged down by a sharp decline in orders for civilian aircraft (-54.5%). Orders grew by 4.3% yoy in Jan.

- Trade deficit in the US widened to USD 68.3bn in Jan (Dec: USD 67.2bn), with overall imports rising by 3% to USD 325.8bn (and imports of motor vehicles, parts and engines the highest on record).

- Monthly budget deficit in the US surged to USD 262bn in Feb (Jan: USD 39bn), touching USD 723bn in the five months till Feb. Spending rose by 4% yoy to USD 525bn while receipts fell by 11% to USD 262bn.

Europe:

- GDP in the Eurozone grew by 1.8% yoy in Q4, a tad lower than the preliminary reading of 1.9%. Growth in qoq terms was lowered to zero compared with the flash estimate of 0.1%. Strong employment growth was also reported: total number of people with jobs rose to 165mn, 3.6mn higher than at end-2019, pre-pandemic.

- German factory orders unexpectedly increased by 1% mom in Jan (Dec: 3.4%), with foreign orders up by 5.5% and orders outside the euro area accelerating by 11.2% while domestic orders sank by 5.3%.

- Industrial production in Germany rebounded by 3.5% mom in Jan (Dec: 2.4%), the sharpest growth since Jun 2020, thanks to an increase in intermediate goods production (6.9%) amidst a decline in consumer and capital goods production (-1.8% and -0.6% respectively).

- German retail sales unexpectedly fell by 0.3% mom in Jan (Dec: -5.3%), with sales of food grew by 3.1% alongside a drop in non-food sales (-0.8%). Sales declined for a 9th consecutive month in Jan, by 6.9% yoy.

- EU Sentix investor confidence worsened in Mar, falling to -11.1 from -8 the month before – this was the first decline since Oct. The current situation sub-index stayed below zero, but rose for the 5th month in a row.

- Retail sales in the eurozone increased by 0.3% mom in Feb (Jan: -1.7%), with online sales declining for the 4th straight month (-2.9%); in yoy terms, sales dropped by 2.3% yoy.

- GDP in the UK increased by 0.3% mom in Jan (prev: -0.5%), with the services sector driving growth (+0.5%). Industrial production fell by 0.3% mom and 4.3% yoy in Jan (manufacturing fell by 0.4% mom and 5.2% yoy) while construction sector fell by 1.7% mom.

- Like-for-like retail sales in the UK jumped by 4.9% yoy in Feb (Jan: 3.9%).

Asia Pacific:

- Inflation in China eased to 1% yoy in Feb (Jan: 2.1%), the lowest reading in a year, while core inflation stood at 0.6% (Jan: 1%). Both food and non-food inflation fell by 2.6% and 0.6% respectively. Producer price index declined further to 1.4% in Feb (Jan: -0.8%), largely due to lower commodity costs.

- China’s exports and imports fell by 6.8% yoy and 10.2% respectively in Feb (Jan: -9.9% and -7.5% respectively), resulting in a record high trade surplus of USD 116.8bn.

- China money supply increased by 12.9% yoy in Feb (Jan: 12.6%), the fastest pace since Mar 2016. New bank loans stood at CNY 1.8trn (down from the record CNY 4.9trn in Jan) and outstanding yuan loans grew by 11.6% yoy (Jan: 11.3%), the highest since Dec 2021.

- GDP in Japan grew by an annualised 0.1% in Q4 (preliminary estimate of 0.6% and Q3’s 1.1% contraction) and remained flat in qoq terms: private consumption grew by 0.3% and capital spending fell 0.5% while exports increased by 1.5%.

- The Bank of Japan left interest rates unchanged at -0.1% and maintained its bond-buying policy. This was Governor Kuroda’s last policy board meeting before Ueda takes over on Apr 9th. Ueda’s appointment was confirmed last week by the parliament, and his comments so far seem to indicate no change to the negative interest rates policy.

- Overall household spending in Japan declined by 0.3% yoy in Jan (Dec: -1.3%), recording the 3rd straight month of declines, in the backdrop of rising inflation and declining real wages. Spending increased the most for culture and recreation (+18.6%) while it fell the most for housing (-12.1%) and education (-9.6%).

- Current account balance in Japan slipped to a record-high deficit of JPY 1.98trn (USD 4.43bn) in Jan from the previous month’s surplus of JPY 33.4bn, largely a result of the largest trade deficit (JPY 3.18trn) while primary income balance rose to a JPY 2.29trn surplus.

- Leading economic index in Japan fell to 96.5 in Jan (Dec: 96.9), the lowest reading since Nov 2020. The coincident index eased to 96.1, the lowest since May 2022, from Dec’s 99.1.

- South Korea’s GDP fell by 0.4% qoq in Q4 (Q3: +0.3%), the first quarterly decline since Q2 2020: private consumption fell by 0.6% while facilities and construction investments were both up by 2.7% and 0.8% respectively. In yoy terms, GDP expanded by 1.3% in Q4, revised down from 1.4% previously.

- Inflation in South Korea eased to 4.8% in Feb (Jan: 5.2%), the slowest since Apr 2022. Core inflation also edged down to 4.0% (Jan: 4.1%), the lowest since Aug.

- India’s industrial output increased by 5.2% in Jan (Dec: 4.3%), with manufacturing output up by 3.7% (Dec: 2.6%). Capital goods production was up by 11% yoy while consumer durables production contracted by 7.5% yoy indicating a slowdown in demand.

Bottom line: The Federal Reserve announced an emergency lending facility, the Bank Term Funding Program, to mitigate the risk of the SVB collapse developing into a banking and financial crisis and into the wider economy. While this is likely to calm markets for the time being, the next question would be whether the Fed will pause interest rate hikes at the next meeting. From Powell’s comments last week, a 50bps hike was being priced in though the inflation numbers this week will provide more hints. The ECB meets this week, likely to raise rates by another 50bps, especially given the sudden uptick in inflation readings – investors will scout for clues about future decisions.

Regional Developments

- Iran and Saudi Arabia re-established relations in a deal brokered by China. Diplomatic relations will be resumed and embassies re-opened within two months, according to a joint statement by all three parties.

- Inflation in Egypt increased to 31.9% yoy in Feb, the highest since Aug 2017, given the sharp rise in food prices (+14.4% mom and 61.8% yoy). Core inflation surged to a record-high 40.26%.

- Reuters reported that Egypt is planning to sell a 10% stake in the state-controlled Telecom Egypt. The government owns 80% of its shares with 20% already trading on the exchange.

- Foreign reserves in Egypt stood at USD 34.35 in Feb, higher than USD 34.22bn at end-Jan but lower than USD 40.99bn a year ago.

- The head of Sovereign Fund of Egypt disclosed that the volume of current investment within the UAE-Egyptian platform amounted to USD 5bn out of a total of USD 20bn.

- Bilateral trade between Egypt and China increased by 2.6% yoy to USD 14.9bn in Jan-Nov 2022; exports to China grew by 20.8% to USD 1.7bn in the period. Separately, Chinese investments in Egypt surged by 16.1% yoy to USD 563.4mn in the fiscal year 2021-22.

- Female unemployment rate in Egypt stood at 19.3% in Q4 2022, according to the cabinet media centre. It also highlighted the increase in women who have financial accounts – to 17.2mn women in Jun 2022 vs 5.9mn in Jun 2016.

- Oil exports from Iran increased to the highest level in the past 4 years (when sanctions were reimposed): the oil minister stated that it increased by 190mn more barrels in the current year (started 21st March 2022) compared to two years ago.

- In the Association of the Banks of Lebanon’s latest monthly report, it was disclosed that commercial banks had approximately USD 86.6bn deposited at the central bank (as of mid-Feb) and a net negative position with correspondent banks (USD 204mn as of end-Jan). Stating it as his “opinion and personal analysis”, the ABL’s secretary general wrote that commercial banks “have no liquidity” to pay back depositors.

- Lebanon’s foreign ministry disclosed that the nation regained its UN voting rights after paying dues (a minimum of around USD 1.8mn was needed).

- Oman’s Abraj Energy Services is selling 49%, equivalent to 377.4mn shares, at a price of 249 baizas (USD 0.65) per share. This puts the company valuation at USD 498mn. Total demand for IPO shares topped OMR 790mn, making it 870% oversubscribed.

- Solar energy projects worth OMR 300mn (USD 77mn) are set to be awarded by the Oman Power and Water Procurement Company, with work to initiate in Q3 2023 and projects being operational by mid-2025. The projects will jointly produce a total of 1,000MW.

- Qatar Central Bank’s international reserves and foreign currency liquidity rose by 0.51% mom to QAR 235bn (USD 64.56bn) in Feb.

- Qatar’s Emir named the central bank governor as chairman of the Qatar Investment Authority; this followed the appointment of the previous chairman as PM.

- Qatar Airways plans to cash in on the travel demand rebound: it is planning to add 7 destinations, restore eleven and boost flight frequency (to 35 markets) and increase flights by 21% by Jul 2023.

- The Saudi foreign minister stated that Syria could “eventually” return to the Arab League: there is increased engagement but “for now,… it’s too early to discuss”.

- The GDP of GCC nations could surpass USD 13trn by 2050 if the green growth strategies are implemented properly, according to the World Bank, versus USD 6trn in the absence of such a strategy.

- Saudi Arabi and the UAE accounted for 64.5% and 21.6% of the total value of real estate projects planned or underway in the GCC (of USD 1.36trn), according to CBRE. The firm also revealed that Dubai’s residential rents reached their highest level on record in 2022: average apartment and villa rents surged by 27.1% and 24.9% respectively.

- Mergers and acquisitions in the MENA rose by 13% yoy to 754 transactions in 2022, according to EY. The UAE recorded three of the largest deals (valued at USD 5bn, USD 4.4bn and USD 4.1bn) while the US had the highest MENA deal numbers (35, out of which 19 were in technology sector). There were 137 deals involving GREs (the highest number since 2018) and these deals accounted for almost half of the total disclosed deal value at USD 40.3bn.

- Excluding UAE, Saudi Arabia and Egypt, start up financing in the MENA region grew by 37% yoy to USD 468mn in 2022. Algeria attracted the highest funding (USD 151mn, more than a fivefold annual increase), followed by Bahrain (USD 133mn) while Jordan and Tunisia had USD 34mn each.

- UAE withdrew its bid to host the 2026 IMF-World Bank meeting and announced its intention to support Qatar as a potential host.

Saudi Arabia Focus

- Saudi Arabia grew by 5.5% in Q4 2022, taking the full year growth to 8.7%, the fastest in over 10 years and highest among G20 nations. While both oil and non-oil sectors supported economic growth in 2022 (growing by 15.4% and 5.4% respectively), easing oil production growth will leave an impact in 2023. The government’s ambitious project pipeline will support non-oil sector growth. Mining & quarrying accounts for the lion’s share of activity by sector (43.7%), but it is important to note theprominent role of manufacturing (14.4% in 2022).

- Saudi Arabia posted a budget surplus of SAR 103.9bn (USD 27.68bn) in 2022, as total revenues surged by 31% yoy to SAR 1.27trn, largely driven by oil revenues (+52% to SAR 857.3bn). Spending rose by 12% to SAR 1.16trn while total public debt stood at just over SAR 990bn at end of 2022.

- Industrial production in Saudi Arabia eased for the 10th straight month, growing by 6.8% yoy in Jan, following Dec’s 7.3% uptick and a full year gain of 17.5% in 2022. Manufacturing has been the main driver of gains, up by 19.2% (Dec: 18.5%, 2022: 22.3%), ever since OPEC+ decision to undertake production cuts, though its weightage is just 22.6%.

- The Saudi Crown Prince launched a new national airline Riyadh Air, fully owned by the PIF, with the airline expected to serve more than 100 destinations by 2030, add USD 20bn to non-oil GDP and more than 200k jobs. Earlier, the Wall Street Journal reported that PIF was close to a deal, valued at USD 35bn, to order Boeing commercial jets for the new airline.

- MNCs that move their headquarters to Saudi Arabia this year could get tax exemptions, according to the minister of investment. He stated that the incentives would be disclosed soon to clarify the regulations. The FT reported that around 80 companies, including Unilever and Siemens, have already been granted licenses to move their regional headquarters to the country, and many are expected to be based in Riyadh’s King Abdullah Financial District.

- The General Authority for Competition in Saudi Arabia approved 13 acquisition and merger requests in Feb. Acquisitions, joint ventures and mergers represented 75%, 20% and 5% respectively, of the total issued non-objection certificates.

- Privatisation program in Saudi Arabia has seen investments exceeding USD 50bn, according to the minister of finance. Investments were seen in 200 projects over 17 sectors, and about 300 projects were currently under evaluation.

- Investments in Saudi Arabia’s communication and technology market touched SAR 93bn (USD 24.7bn) over the last 6 years. It was also disclosed that the 5G coverage has increased to 53% in Saudi Arabia, while in Riyadh it exceeded 94%.

- Saudi Arabia’s SMEs grew by 6% qoq to 1.14mn by end of Q4 2022, with about 40% located in Riyadh, according to a report by the Small and Medium Enterprises General Authority (Monsha’at); the entity also offered financing solutions worth SAR 228bn (USD 60.7bn) to the SMEs sector last year.

- Saudi Arabia’s Small and Medium Enterprises Bank will allocate SAR 10.5bn (USD 2.79bn) to finance SME sector programs in the next three years.

- An average of 30 firms entered Saudi Arabia market daily, with a total of 7395 commercial registers issued from Jan till Sep 7th last year.

- Saudi Arabia signed an agreement to deposit USD 5bn in Turkey’s central bank through the Saudi Fund for Development.

- A statement by the ministry of economy and planning revealed that Saudi Arabia would allocate USD 800mn through the Saudi Fund for Development to finance development projects for least developed countries in regions including Africa and Asia.

- Red Sea Global plans to increase the net conservation value of its tourism destinations by 30% by 2030, according to the CEO.

- GCC residents and their first-degree relatives are now eligible to apply for an electronic tourist visa to Saudi Arabia irrespective of their profession.

UAE Focus![]()

- Dubai PMI dropped to a 12-month low of 54.1 in Feb (Jan: 54.5), with new orders slipping to a 13-month low while the construction sector registered its strongest upturn since June 2019. Input costs increased at the fastest pace since Jul while output charges were lowered for the 7th consecutive month.

- The UAE president appointed his brothers as chairmen at the state sovereign wealth funds instead of chairing himself: Sheikh Tahnoun bin Zayed Al Nahyan, who also heads the emirate’s third biggest investment fund ADQ, will chair the Abu Dhabi Investment Authority (ADIA), while Mubadala will be headed by Sheikh Mansour bin Zayed Al Nahyan.

- Abu Dhabi AI firm G42 plans to float its big data analytics unit Presight.ai via an AED 1.82bn (USD 495.6mn) IPO. The firm will offer 1.36bn new shares (or 32% of the company).

- UAE’s Al Ansari Financial Services, the money and exchange company, plans to float 10% on the Dubai Financial Market through an IPO. The firm will offer 750mn shares between Mar 16-24, and expects to list around Apr 6th. As of end-2022, the company had 231 physical branches and employed 4,123 people while net profits rose by 21.2% yoy to AED 595mn.

- In 2022, the total number of trips made through Dubai’s Salik toll gates rose by 12% yoy to 539mn, as traffic levels “broadly” recovered to pre-pandemic levels in Q4 2022. Salik disclosed a 12% increase in full-year revenue to AED 1.89bn in 2022, with the Q4 value up by 2% to AED 502mn.

- Dubai’s Knowledge and Human Development Authority announced that private schools would be eligible for a 3% increase in tuition fees in 2023-24 academic year, depending on their ratings.

- Dubai’s Jebel Ali Free Zone reported a 30% yoy growth in customer registrations to more than 9500 (a 10-year high) in 2022. The freezone also disclosed that the number of Chinese firms jumped by 4-times while Indian companies were up by 30%.

- Dubai’s Department of Economy and Tourism relaunched the Dubai Carbon Calculator, enabling the measurement of carbon footprint within the hospitality sector. The tool can track real-time data for emission sources, enabling effective management of energy consumption.

- Abu Dhabi plans to develop its rural and urban transport systems, including rail, through a new government company.

Media Review

The Silicon Valley Bank: collapse, policy proposals

https://www.reuters.com/business/finance/global-markets-banks-wrapup-1-2023-03-10/

https://www.ft.com/content/5a723f25-0dd3-4cff-b511-b01d7467a4ba

The Iran-Saudi deal and China

https://www.reuters.com/world/china-role-saudi-iran-deal-tricky-test-us-2023-03-10/

https://www.reuters.com/world/middle-east/middle-east-flashpoints-that-could-be-affected-by-saudi-iran-deal-2023-03-12/

How Saudi Arabia’s investments are driving electric vehicle adoption in the Middle East

https://www.arabnews.com/node/2266876/business-economy

Lessons from finance’s experience with artificial intelligence

https://www.economist.com/finance-and-economics/2023/03/09/lessons-from-finances-experience-with-artificial-intelligence

Powered by: