Download a PDF copy of this week’s insight piece here.

Weekly Insights 4 Mar 2023: Inflation, Monetary developments and thoughts ahead of International Women’s Day

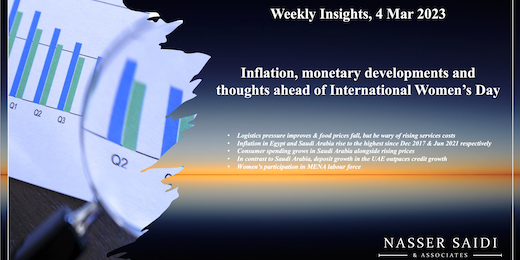

1. Logistics pressure improves & food prices fall globally, but be wary of rising services costs

- The Fed’s GSCPI readings have eased significantly over the past months, amid falling freight rates.

- A reduction in demand for goods has meant high inventory levels implying lower demand for imports, and hence for containers (leading to a further plunge in the cost of shipping).

- However, even as the cost of container ships fall, oil tanker shipping rates are surging: the reason is that Russian tankers previously going to Europe are now shipping longer routes to India and China (almost 5 times previous distance); this ties up the vessels for longer and creates a shortage of such vessels.

- Meanwhile, the UN’s food price index has been falling: it has dropped 18.7% from its peak in Mar 2022. Only sugar prices increased (to the highest level in 6 years), but it was more than offset by decline in other indices.

- Even amidst the decline in shipping costs and food prices, the limited supply of people and their skills are putting pressure on wages and prices, resulting in high costs of services and the rise in core inflation.

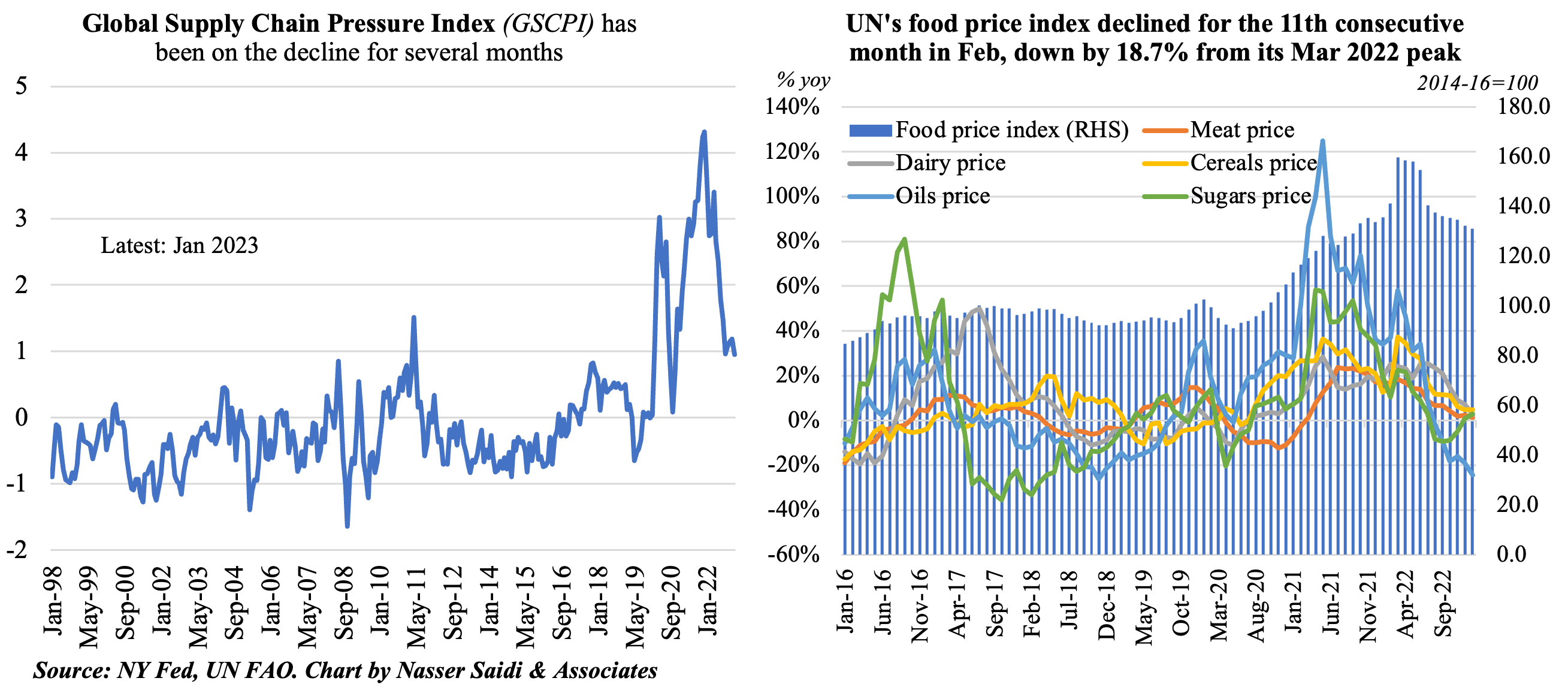

2. Inflation in Egypt and Saudi Arabia rises to the highest since Dec 2017 & Jun 2021 respectively; non-food costs are also inching up

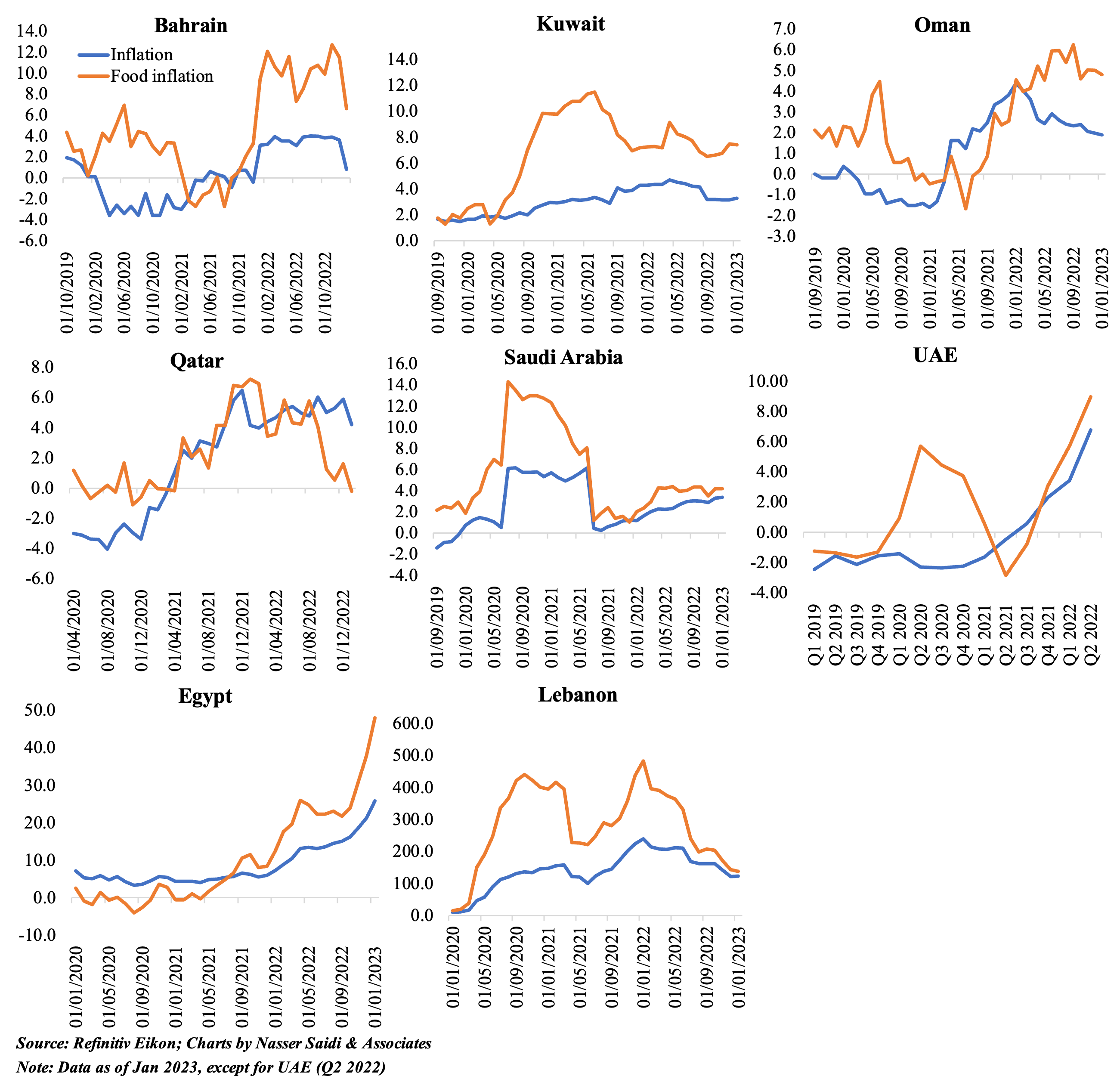

3. Higher consumer spending in Saudi Arabia alongside rising prices

- Consumer spending has been rising, supported by PoS transactions (+10.9% yoy) while cash withdrawals decline (-1.5%)

- PoS transactions by sector show “hotels” and “public utilities” report the highest increases(38.6% & 24% respectively)

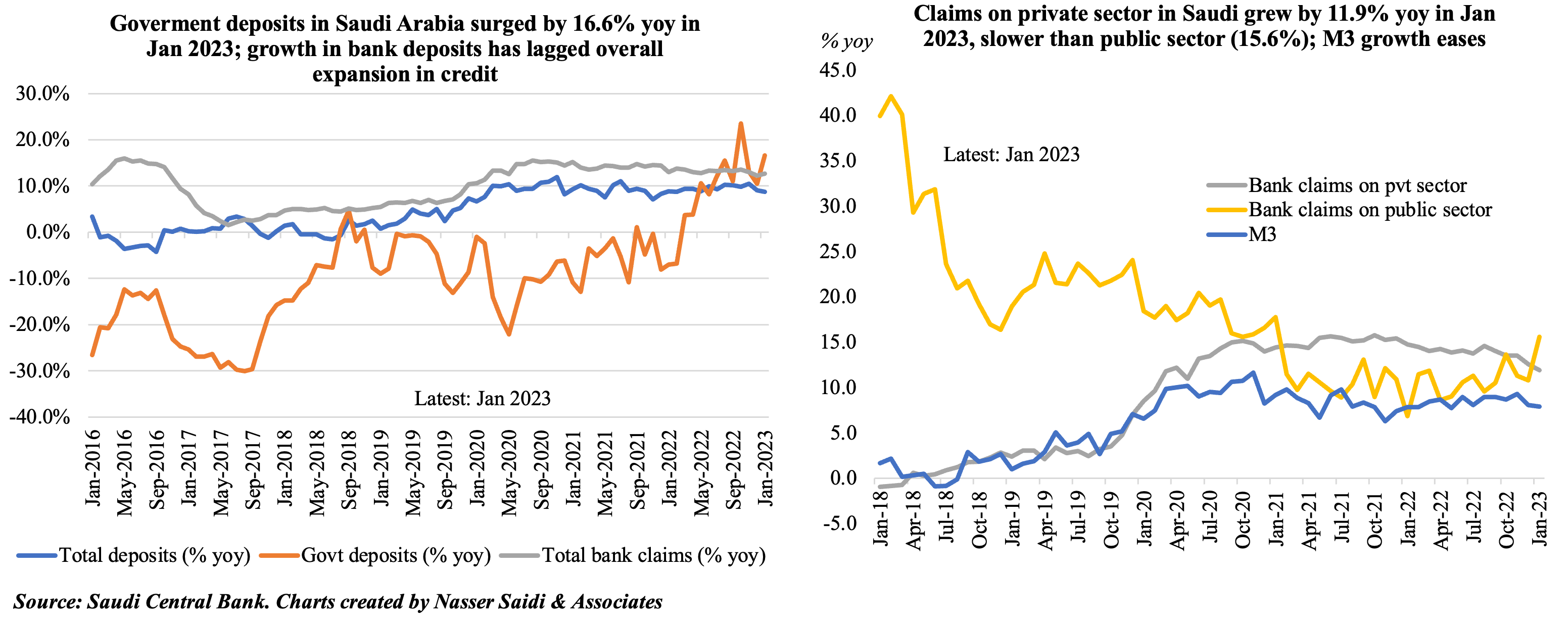

- The broad measure of money supply (M3) grew by 7.9% yoy in Jan 2023 (though down by 1% compared to the previous month)

- Total bank deposits grew by 8.7% yoy, despite a fall in demand deposits (-3.4%) while government deposits jumped (16.6%)

- Bank claims continued rising with claims on the private and public sector were up by 11.9% and 15.6% respectively in Jan

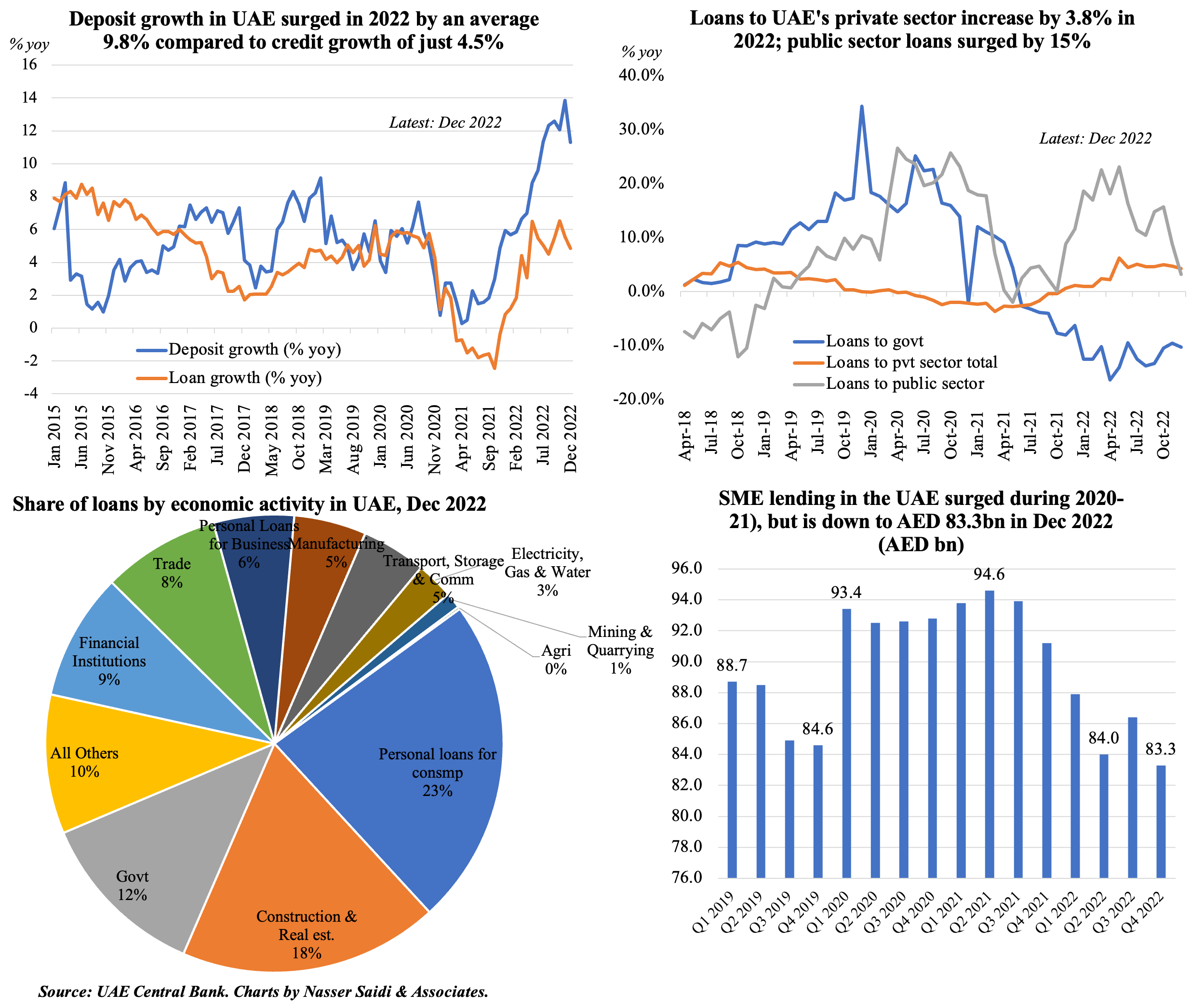

4. In contrast to Saudi Arabia, deposit growth in the UAE outpaces credit growth. Loans to the private sector are inching up; personal loans for consumption comprise ~1/4th of total loans. SME lending has come off pandemic-highs, down to AED 83.3bn disbursed as of Dec 2022

5. Women’s participation in MENA labour force

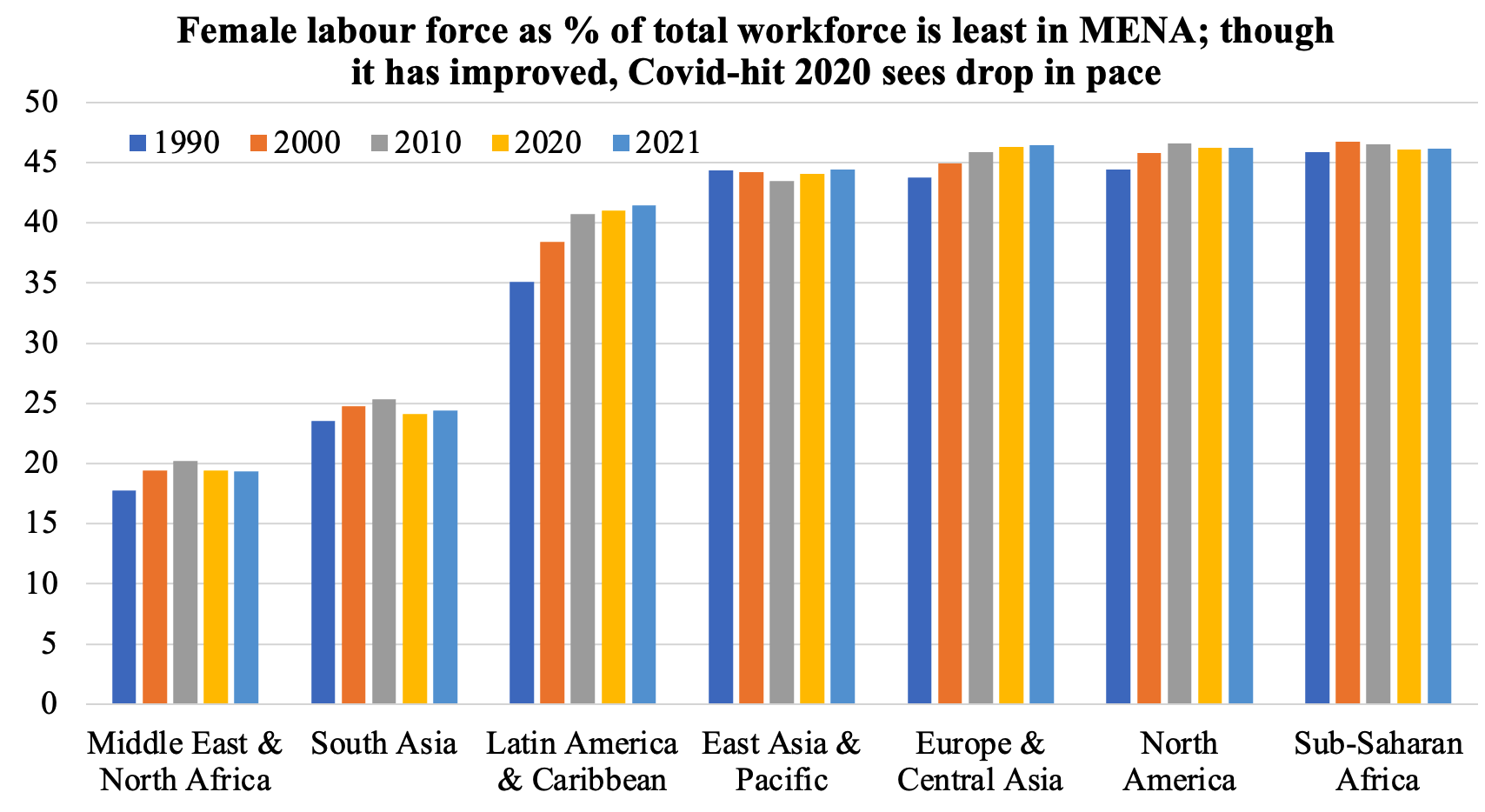

- MENA region lags all other regions in the share of women in the labour force

- Only about one-fifth of all women (aged 15-64) participate in the labour market in MENA: it had been inching up, but Covid19 reversed recent gains

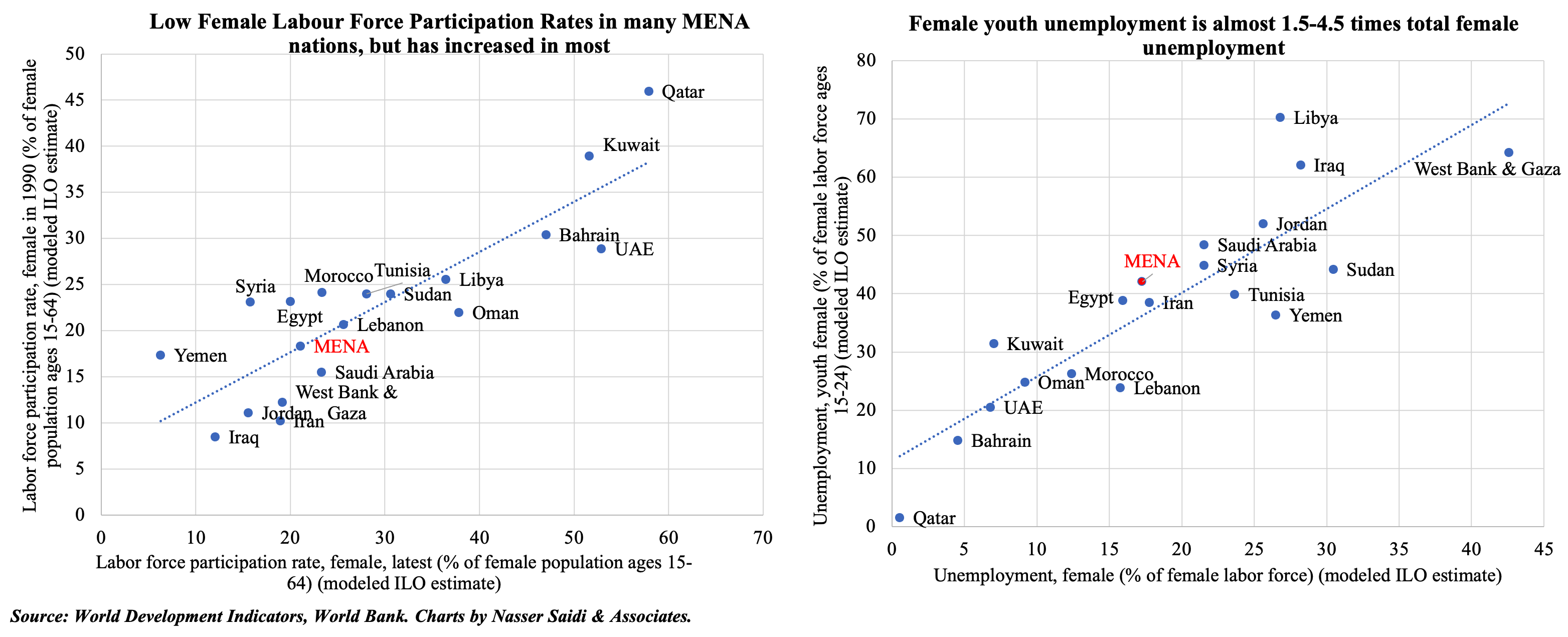

- Regional disparity exists in MENA’s female labour force participation rates (FLFPR), with it relatively higher in the GCC. A comparison with rates in 1990 (vertical axis, LHS chart) show that most nations have improved FLFPRs (x-axis). However, nations that lie above the dotted line indicate a decline compared to rates in 1990 (e.g. Egypt, Yemen, Syria)

- Low FLFPR also coincides with average female unemployment rates of 17% & 42% for young women in 2021!

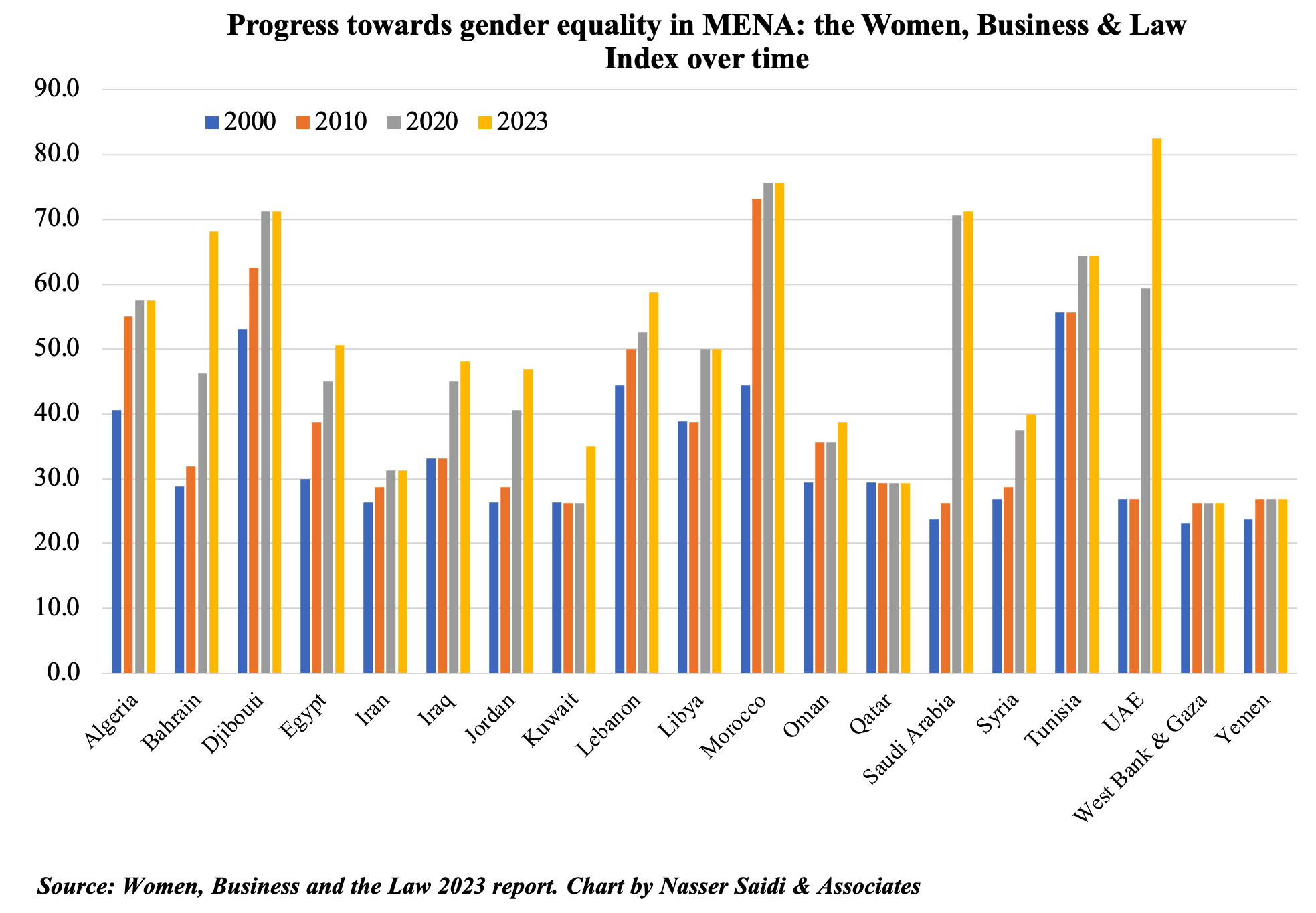

6. Gender-related reforms in MENA have a long way to catch up!

- The global Women, Business and the Law index average is 77.1 out of 100. Only 14 countries, all OECD, score 100 (i.e. equal legal standing)

- The MENA region has a long way to catch up: its score is currently the lowest among all regions, 53.2 points

- The region also has the largest variations in scores within the group. In 2023, UAE scored the most in the region (82.5), and the lowest, West Bank & Gaza, was a long way down at 26.3.

- Economies with historically larger legal gender gaps have been catching up faster, especially since 2000, including many of the GCC nations (Bahrain, Saudi Arabia, UAE)

- Reform momentum seems to have slowed: in 2022, only 34 gender-related legal reforms were recorded across 18 economies globally, the lowest number since 2001. From the region, Bahrain introduced reforms in pension & Iraq related to entrepreneurship.

Powered by: