Markets

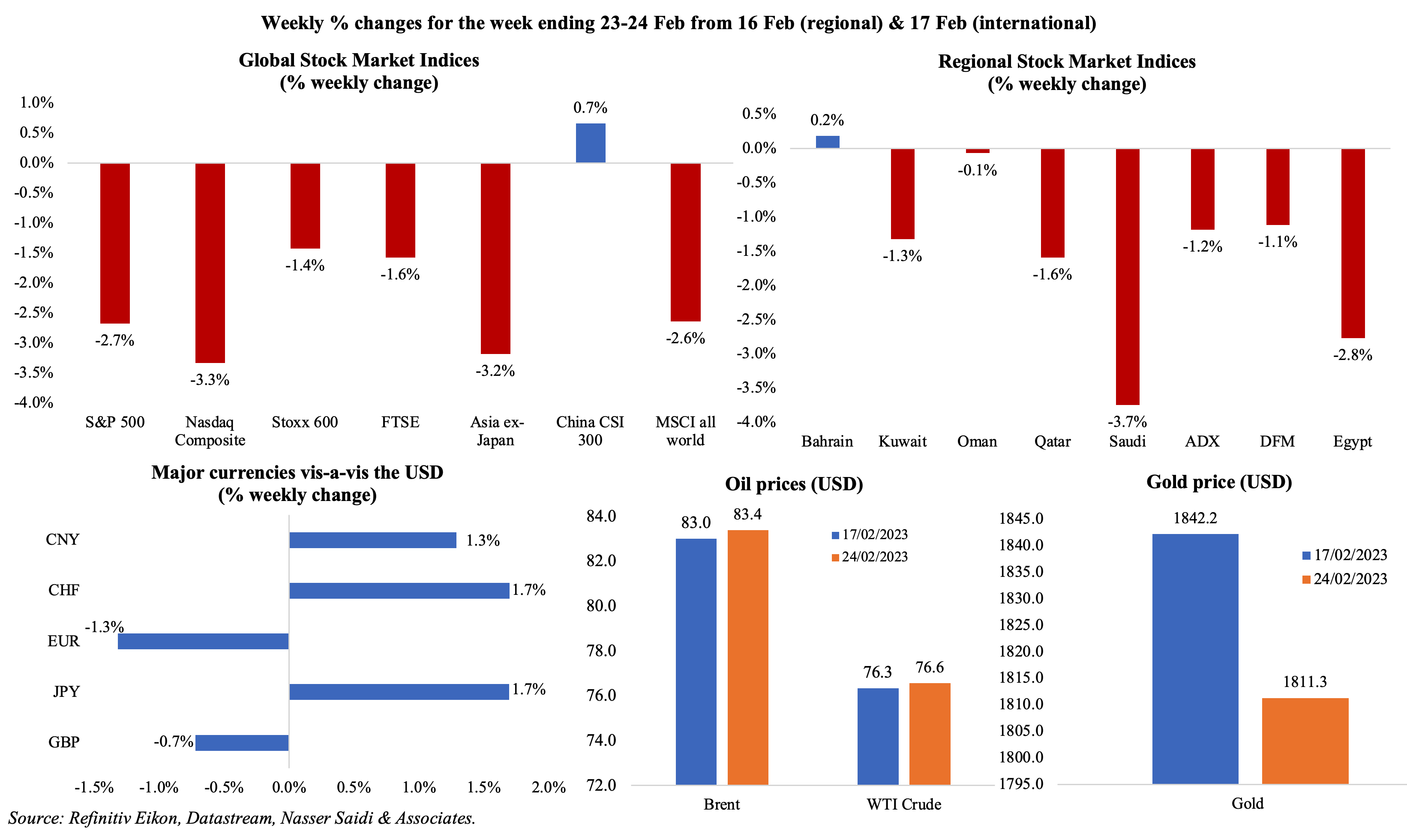

Global equity markets declined across major markets last week, with US markets posting the largest weekly decline this year, after a hawkish tone in the FOMC minutes, with a “restrictive policy stance” to be maintained; regional equity markets also reflected the global moves. The dollar index strengthened to a 7-week high, on expectations that the rate hikes would continue for longer, and it also rose to a 2-month high vis-à-vis the yen and a 7-week high against the Swiss franc. Oil prices edged slightly higher last week while gold price inched lower to the lowest in 8 weeks (in the backdrop of stronger dollar and higher bond yields).

Global Developments

US/Americas:

- FOMC minutes showed that majority of the policy makers were supportive of the 25bps hike, though “a few” preferred a 50bps rise. The minutes showed an agreement that a “restrictive policy stance” has to be maintained till “data provided confidence that inflation was on a sustained downward path to 2%”.

- Annualised GDP in the US was revised lower to 2.7% in Q4 (Q3: 2.9%), on the back of weaker consumer spending (an annualised 1.4% in Q4 vs the previous estimate of 2.1%). Core PCE jumped to an upwardly revised 4.3% qoq in Q4(Q3: 3.9%).

- Personal income increased by 0.6% mom in Jan, the most in almost 2 years, alongside a 0.9% uptick in wages. Spending grew at a faster pace of 1.8% (largest rise since Mar 2021).

- The Chicago Fed national activity index rose to 0.23 in Jan (Dec: -0.46), after 3 straight months of negative readings and the highest since Jul 2022. The Kansas Fed manufacturing activity slipped to -9 in Feb (Jan: -4), dragged down by nondurable goods plants.

- The Michigan consumer sentiment index was revised up to 67 in Feb (prelim: 66.4), the highest since Jan 2022, thanks an increase in expectations gauge (to 64.7 from 62.3).

- US S&P preliminary composite PMI rebounded to an 8-month high of 50.2 in Feb (Jan: 46.8), thanks to an increase in manufacturing PMI (still weak at 47.8, as new orders remained subdued, but higher than Jan’s 46.9) while services PMI crossed the 50-mark to 50.5 (after contracting for 7 straight months).

- Existing home sales fell for the 12th straight month, down by 0.7% mom to 4mn in Jan, the lowest level since Oct 2010. New home sales increased by 7.2% mom to a 10-month high of 670k in Jan. The 30-year fixed mortgage rate has been rising for 3 consecutive weeks now, with last week seeing an average of 6.5%.

- Initial jobless claims declined by 3k to 192k in the week ended Feb 18th, the lowest in 4 weeks, and the 4-week average inched up by 1.5k to 191.25k. Continuing jobless claims slipped by 37k to 1.654mn in the week ended Feb 11th, still below levels seen pre-pandemic.

Europe:

- Inflation in the eurozone inched up to 8.6% in Jan, slightly higher than the previous estimate of 8.5%, but lower than Jan’s 9.2%. Core inflation also accelerated to 5.3% from the initial estimate of 5.2%, as services inflation was revised up to 4.4% (prev: 4.2%). Inflation (HICP) in Germany was left unchanged (from initial estimate) at 9.2% in Jan.

- GDP growth in Germany shrank by 0.4% qoq in Q4 (prelim: -0.2%), revised down given the decline in consumer spending and investment in construction and equipment (-2.5%). In yoy terms, GDP growth was lowered to 0.9% in Q4. In qoq terms, GDP slipped by 0.4%.

- German composite PMI climbed to 51.1 in Feb (Jan: 49.9) after 7 months of sub-50 readings. Manufacturing PMI unexpectedly edged lower to 46.5 in Feb (Jan: 47.3) on declines in new orders and export sales, but production levels rose for the first time in 9 months. Services PMI increased by 0.6 point to 51.3 in Feb. Input costs fell to a 2-year low and output prices slipped to a 21-month low.

- Composite PMI in the eurozone increased by 2 points to 52.3 in Feb, the strongest reading since May 2022, as overall new orders rose for the first time in 9 months. Manufacturing stayed under the 50-mark, clocking in 48.5 in Feb, lower than Jan’s 48.8 while services PMI jumped by 2.2 points to 53, an 8-month high. Both France and Germany expanded for the first time since last Oct and Jun, respectively.

- The Ifo business climate in Germany inched up by 1 point to 91.1 in Feb. While current assessment slipped to 93.9 from 94.1 the month before, expectations rose to 88.5 (Jan: 86.4). By sector, the manufacturing index picked up to the highest level since May 2022 while in services it improved for the 5th month running.

- Germany’s ZEW economic sentiment index rose for the 5th consecutive month to 28.1 in Feb (Jan: 16.9). Current situation also improved to -45.1 in Feb (Jan: -58.6). In the eurozone, economic sentiment climbed to 29.7 in Feb, up 13 points from the month before.

- Consumer confidence in the euro area inched up to -19 in Feb (Jan: -20.9), the highest reading in a year, and was supported by easing inflation readings.

- GfK consumer confidence in Germany eased to -30.5 in Mar (Feb: -33.8).

- Manufacturing PMI in the UK rose to a 7-month high of 49.2 in Feb (Jan: 47), as production volumes increased amid reductions in new orders and export sales. Services PMI rebounded to 53.3 in Feb (48.7).

- GfK consumer confidence in the UK rebounded to -38 in Feb (Jan: -45), the highest level since Apr 2022.

Asia Pacific:

- China’s FDI inflows surged by 14.5% yoy to CNY 127.69bn in Jan, with hi-tech industries reporting a 62.8% surge, according to the ministry of commerce.

- Inflation in Japan increased to 4.3% in Jan (Dec: 4%). Excluding fresh food, inflation rose to a 41-year high of 4.2% in Jan (Dec: 4%) while excluding both food and energy prices increased to 3.2% from 3% the month before. Core CPI has exceeded the BoJ’s target rate of 2% for nine consecutive months. The BoJ’s incoming governor stated in a confirmation hearing that “trend inflation is likely to rise gradually” while calling for the apex bank to maintain ultra-low rates.

- The Jibun Bank flash manufacturing PMI in Japan declined to 47.4 in Feb (Jan: 48.9), as both output and new orders slipped the most since Jul 2020; while input costs eased, output prices increased. Services PMI improved to 53.6 from 51.1 in Jan, recording the 6th straight month of expansion supported by new order growth and new business from abroad.

- The Bank of Korea left interest rates unchanged at 3.5%: the governor disclosed that if inflation continued to moderate towards a forecast 3% by end-2023, there would be no further hikes. The central bank revised its forecasts for growth (to 1.6% yoy in 2023 from its Nov estimate of 1.7%) and inflation (to 3.5% yoy vs a 3.6% rise previously).

- Singapore inflation inched up to 6.6% in Jan (Dec: 6.5%) while core inflation (excluding private road transport and accommodation costs) rose by 5.5%, the fastest since Nov 2008.

- Industrial production in Singapore unexpectedly slipped by 2.7% yoy and 1.1% mom in Jan. This was the 4th consecutive month of contraction in yoy terms, owing to declines in electronics (-2.9%), chemicals (-13%) and general manufacturing (-18.3%) among others.

Bottom line: The flash PMIs released last week offer a glimmer of hope for a soft landing (opposed to a recession), supported by an improvement in services sector amid contractionary readings in manufacturing. The forward-looking business sentiment indicators suggest better times ahead, but that could change if central banks continue to tighten interest rates for longer. This week sees inflation data releasing in Europe (we believe that core inflation will likely stay higher) and PMIs (China’s readings will provide a glimpse to whether the reopening has indeed boosted activity after an initial boost in Jan).

Regional Developments

- Oil revenue in Bahrain was higher than budget estimates by 58% in 2022, while fiscal deficit narrowed to BHD 178mn (vs the budget estimate of a BHD 1.185bn deficit).

- Egypt FDI jumped by 94% yoy to USD 3.3bn in Jul-Sep, the highest event amount recorded in a quarter, according to the PM. Separately, the IMF estimates that Egypt will face an external financing gap of USD 16bn in the next 46 months.

- The assessment process is underway to determine the value of Egypt’s state-owned hotels prior to a sale of stakes and listing on the stock exchange, given the large devaluation of the EGP.

- Saudi PIF’s talks with Egypt to buy United Bank was put on hold, reported Reuters, after a disagreement on valuation.

- Egypt’s Suez Canal revenue touched a record monthly high of EGP 18.2bn (USD 594mn) in Dec 2022. This took the 2022 revenues to a record high of USD 8bn in transit fees (25% higher than 2021’s USD 6.3bn net).

- With inflation at multi-year highs, Egyptians are increasing their use of instalment payment services: Sympl, a Cairo-based BNPL service, disclosed that in Jan new client acquisitions had increased by 50% mom and repeat customer accounted for 40% of monthly transactions (vs 5% in Jan 2022).

- Bilateral trade between Egypt and Saudi Arabia increased by 19.1% yoy to USD 9.5bn in Jan-Nov 2022; Egypt’s imports from Saudi rose by 23.2% to USD 7.3bn. Saudi investments into Egypt jumped by 51.1% yoy to USD 491.6mn in fiscal year 2021-2022.

- Iran’s currency fell a record low of 601,500 rials against the USD on the unofficial market yesterday (Sun 26th Feb) versus 575,000 and 540,000 on Saturday and Friday respectively.

- For the first time, Iraq’s central bank plans to allow imports from China to be settled in yuan directly. The apex bank will either need to boost balance of Iraqi banks that have accounts with Chinese banks in yuan or use the bank’s USD reserves at JP Morgan and DBS.

- Iraq signed deals with UAE-based Crescent Petroleum and two Chinese companies for the development of six oil and gas fields. The new deals are expected to produce more than 800mn standard cubic feet per day of natural gas.

- Bilateral trade between Kuwait and the UAE surged by 87% to AED 43bn at end-2022 from AED 23.3bn in 2013.

- The Oman-UAE rail network received an investment if USD 3bn: the 303km railway network linking the two nations will see a 47-min journey time between Sohar to Al Ain.

- Oman’s Abraj Energy signed a partnership agreement with Kuwait’s Gulf Oil Company and Saudi-based chemical plant Saudi Chevron Co to extract and explore oil in Kuwait. Reuters reported that Abraj Energy would build three rigs for drilling and services at the Wafra field project in Kuwait.

- Oman opened its airspace allowing all airlines to fly over its territories.

- Qatar posted a budget surplus of QAR 89bn in 2022 (2021: QAR 1.59bn), thanks to a 16.3% surge in total revenues and a 67% jump in oil and gas revenues.

- Saudi Arabia’s state news agency disclosed that the country plans to make USD 1bn deposit in Yemen’s central bank. It is unclear whether this is part of a previously announced USD 3bn support package.

- Ministers of UAE, Egypt, Jordan, and Bahrain met on Sunday, signing more joint industrial projects.

- Non-oil foreign trade between UAE and Saudi Arabia grew by 70% to AED 136bn at end-2022 from 10- years ago. Non-oil imports from Saudi to UAE touched AED 34bn in 2022.

Saudi Arabia Focus

- Saudi Arabia’s non-oil exports fell by 17% yoy to SAR 19.12bn in Dec while oil exports grew by 11% to SAR 85.5bn. China, Japan, India and South Korea were the largest export partners. For non-oil exports, UAE was the top partner in Dec 2022, followed by India, China and Turkey.

- The Saudi Ministry of Industry and Mineral Resources disclosed that a total of964 industrial licenses were issued in 2022, with the highest and lowest numbers issued in Aug and Jul respectively (115 and 30). Industrial investments in Saudi Arabia totalled SAR 32bn in 2022 and 51,723 job opportunities were created during the year (of which ~43% were citizens).

- Saudi Arabia announced 27 development projects to develop the drinking water system in the Asir region: worth SAR 4bn, the projects are expected to benefit about 160k persons.

- Saudi Industrial Development Fund approved 111 loans totalling SAR 14bn (USD 3.7bn) in 2022, with SMEs accounting for 79% of loans while 40 loans were provided to factories.

- Saudi ministry of tourism is planning to raise accommodation capacity: 9000 additional hotel rooms are expected to be operational in Madinah before Ramadan. In 2022, Saudi had welcomed 7mn Umrah visitors of whom 4mn who were on Umrah visas.

- Saudi Arabia and Costa Rica signed two agreements to boost economic cooperation, establish a joint business council with an aim to improve trade and investment flows. Bilateral trade had surged by 59% yoy to SAR 355mn in 2021.

- Saudi property developer Dar Global is planning to list on London Stock Exchange’s main market at a valuation of about USD 600mn. The listing was approved by Britain’s Financial Conduct Authority.

- The Saudi Authority for Industrial Cities and Technology Zones (MODON) disclosed that it had signed agreements worth SAR 1.69bn (USD 285mn) in 2022 to support localization of the food and beverage industry.

UAE Focus![]()

- Abu Dhabi’s ADNOC set a price range of AED 2.25-2.43 per share for its gas unit, giving it an equity valuation of USD 47-50.8bn. ADNOC is selling about 3bn shares in its gas business, roughly 4% of its issued share capital.

- UAE signed defence deals totalling AED 23.34bn (USD 6.36bn) over 5 days of the International Defence Exhibition (IDEX) held in Abu Dhabi last week.

- UAE’s non-oil trade with Azerbaijan increased 3-fold over the past 5 years to AED 3.6bn in 2022. Breakdown of trade was AED 32.6mn in imports, AED 351.9mn in exports, and AED 3.5bn in re-exports.

- India’s Ambassador to the UAE revealed that India and UAE are exploring the possibility of a virtual trade corridor to enable clearances online to fast-track shipments.

- UAE and Spain held talks to improve economic cooperation between the two nations: bilateral non-oil exports crossed USD 2.6bn in 2022 and Spain was the 3rd largest European trade partners, receiving 8% of UAE’s non-oil exports to the EU.

- The DIFC’s governor revealed that there are about 60 hedge fund firms, with more than USD 1trn in assets under management, waiting to be licensed.

- Bloomberg reported that ADIA was among those considering a bid for a 34% stake in Associated British Ports (valued at GBP 2bn or more). The stake is being sold by the Canada Pension Plan Investment Board.

- The Abu Dhabi Department of Economic Development disclosed that it had issued 25,593 new economic licenses last year while also renewing 73,212 licenses.

- Dubai International Airport posted a 127% surge in annual passenger traffic in 2022, to 66.1mn; of these, 40% were transfers to other destinations. Separately, aviation consultancy OAG disclosed that Dubai was the busiest international airport in Feb: it logged 4.2mn seats (though down 9% mom), and compares to Heathrow in second, with 2.29mn seats (-7%).

- Dubai will waive the 10% fee levied on ticket sales at paid events across the emirate. However, the government will continue to levy the fees for the annual subscription to its e-permit and e-ticketing system.

- The Dubai Can initiative reduced the use of an equivalent of more than 7mn 500-ml single-use plastic water bottles in a year.

Media Review

How the dollar, energy and food prices swirled after a year of war

https://www.reuters.com/markets/one-year-war-europe-how-dollar-energy-food-prices-swirled-2023-02-24/

Big Asian economies take on the forces of international capital—and win

https://www.economist.com/finance-and-economics/2023/02/23/big-asian-economies-take-on-the-forces-of-international-capital-and-win

Technology Behind Crypto Can Also Improve Payments, Providing a Public Good

https://www.imf.org/en/Blogs/Articles/2023/02/23/technology-behind-crypto-can-also-improve-payments-providing-a-public-good

Metaverse creator Neal Stephenson on the future of virtual reality

https://www.ft.com/content/0ecab009-6543-4386-b936-0eecc9293d2e

Powered by: