Download a PDF copy of this week’s insight piece here.

Weekly Insights 24 Feb 2023: Saudi Arabia’s non-oil exports ease & industrial investments rise amid higher prices

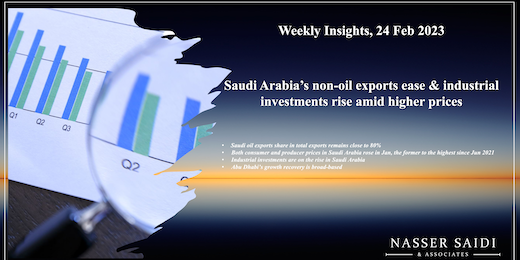

1. Saudi oil exports share in total exports remains close to 80%

- Total exports grew by 48.6% to SAR 1.54trn in 2022, of which non-oil exports share was 17.3% and re-exports accounted for 3.2%. Following 13 months of non-oil exports higher than SAR 20bn, Nov-Dec saw it drop below that mark.

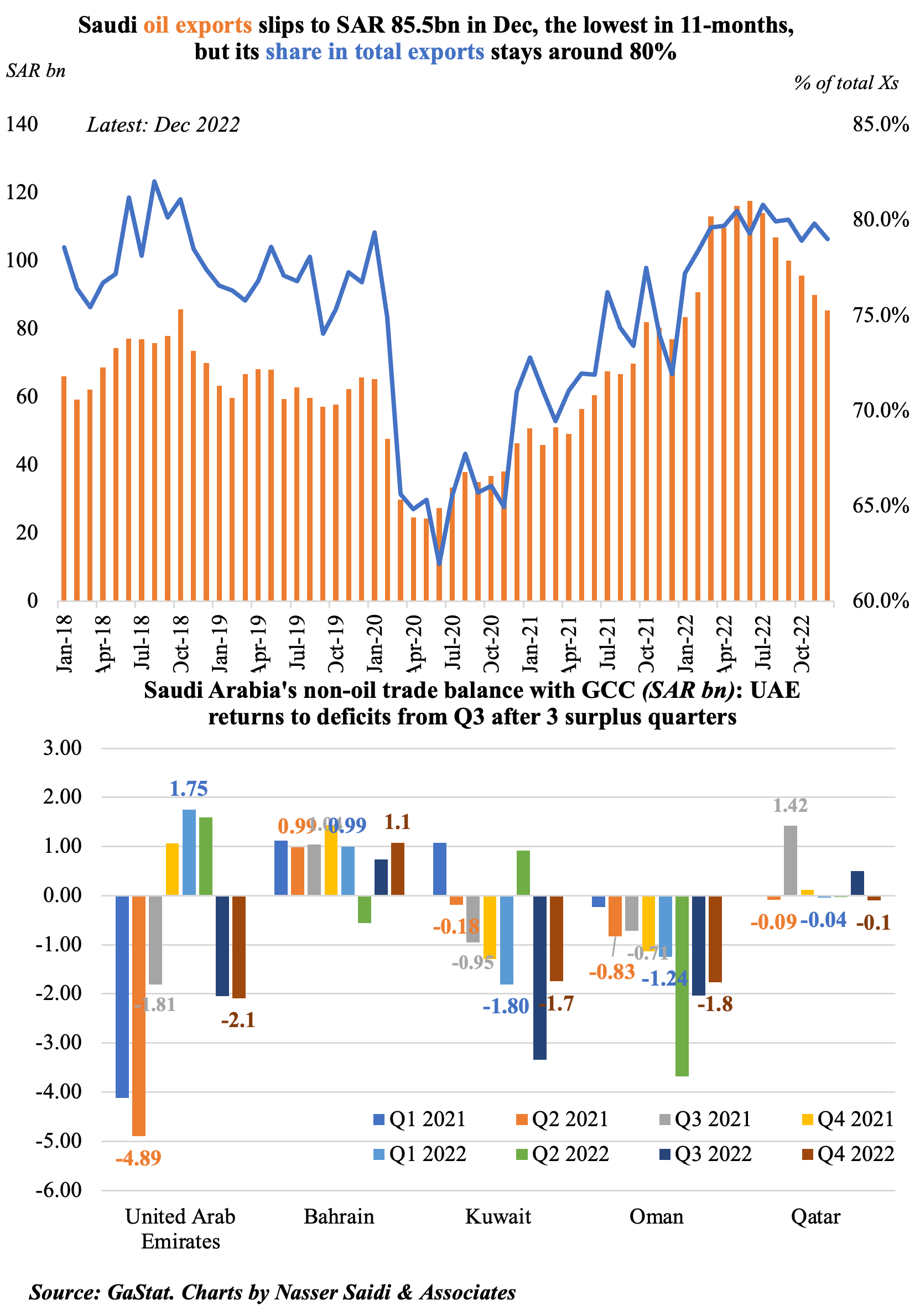

- Among export destinations, Asian non-Arab, non-Islamic nations account for the lion’s share in Dec 2022 (54%); China, Japan, India and South Korea were the largest export partners. For non-oil exports, UAE was the top partner in Dec 2022, followed by India, China and Turkey.

- Overall non-oil trade balance with GCC widened in 2022, due to Oman and Kuwait’s widening deficit; UAE’s deficit narrowed.

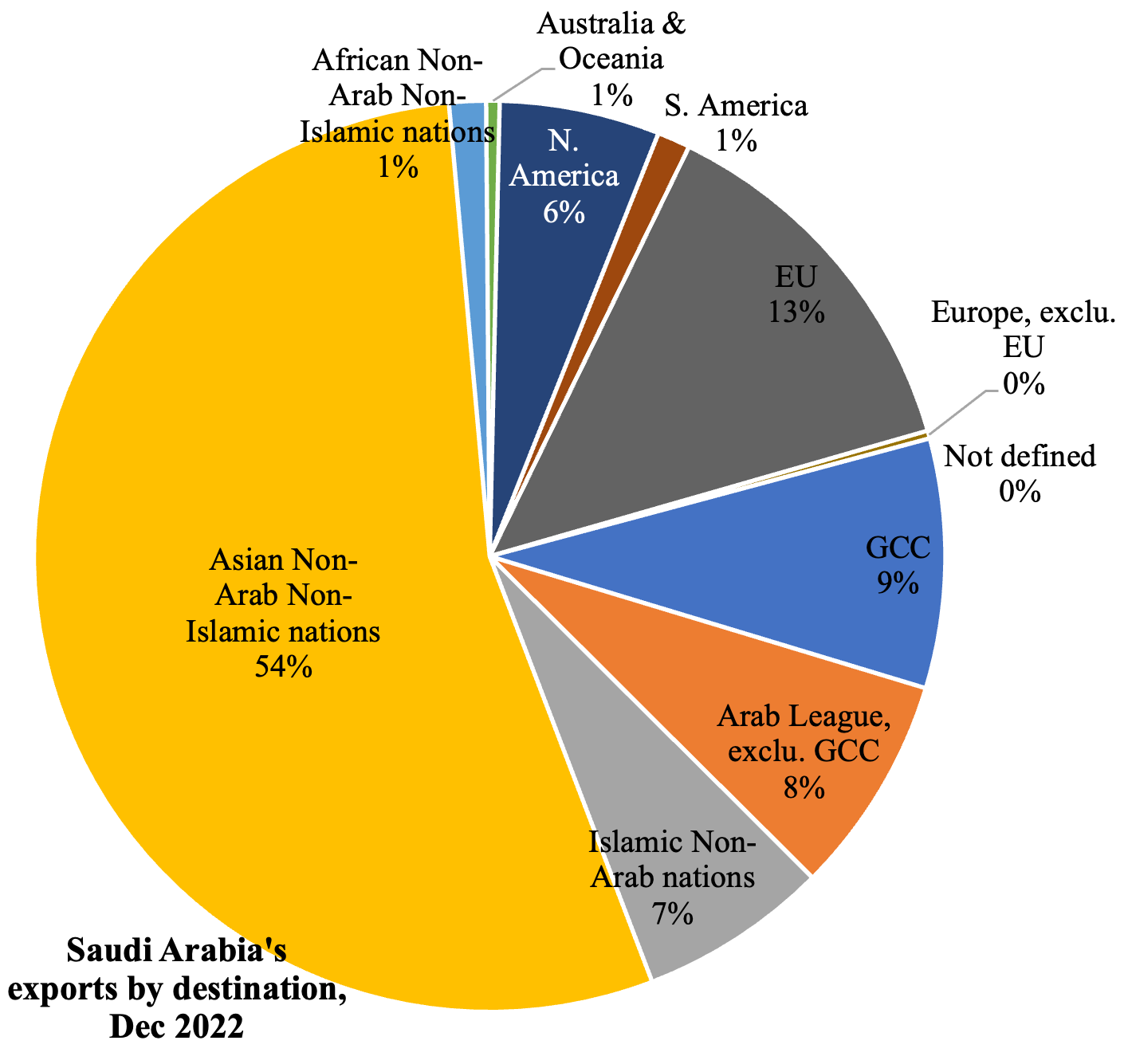

2. Both consumer and producer prices in Saudi Arabia rose in Jan, the former to the highest since Jun 2021

- Inflation in Saudi Arabia inched up to 3.4% yoy in Jan (Dec: 3.3%), highest since Jun 2021, largely owing to the uptick in housing & utilities costs (6.6%) and food & beverages (4.2%). Inflation is estimated to average 2.1% this year, as per the budget document.

- Within food, costs of milk products and eggs surged by 15.8% and meat & poultry prices were up 6.1%.

- Within housing and utilities, rentals for an apartment surged by 19.3% (housing and utilities makes up 25.5% of the consumer basket). There has been a rise in rentals and property prices in Saudi Arabia, partly driven by the supply shortage alongside the government’s drive to increase home ownership.

- The wholesale price index rose by 3.6% yoy in Jan(higher than Dec’s 30-month low of 3%), but below last year’s average. This was the first increase after 9 straight months of easing. Food products and other transportable goods except metal account for the largest upticks, at 7.58% and 4.2% respectively.

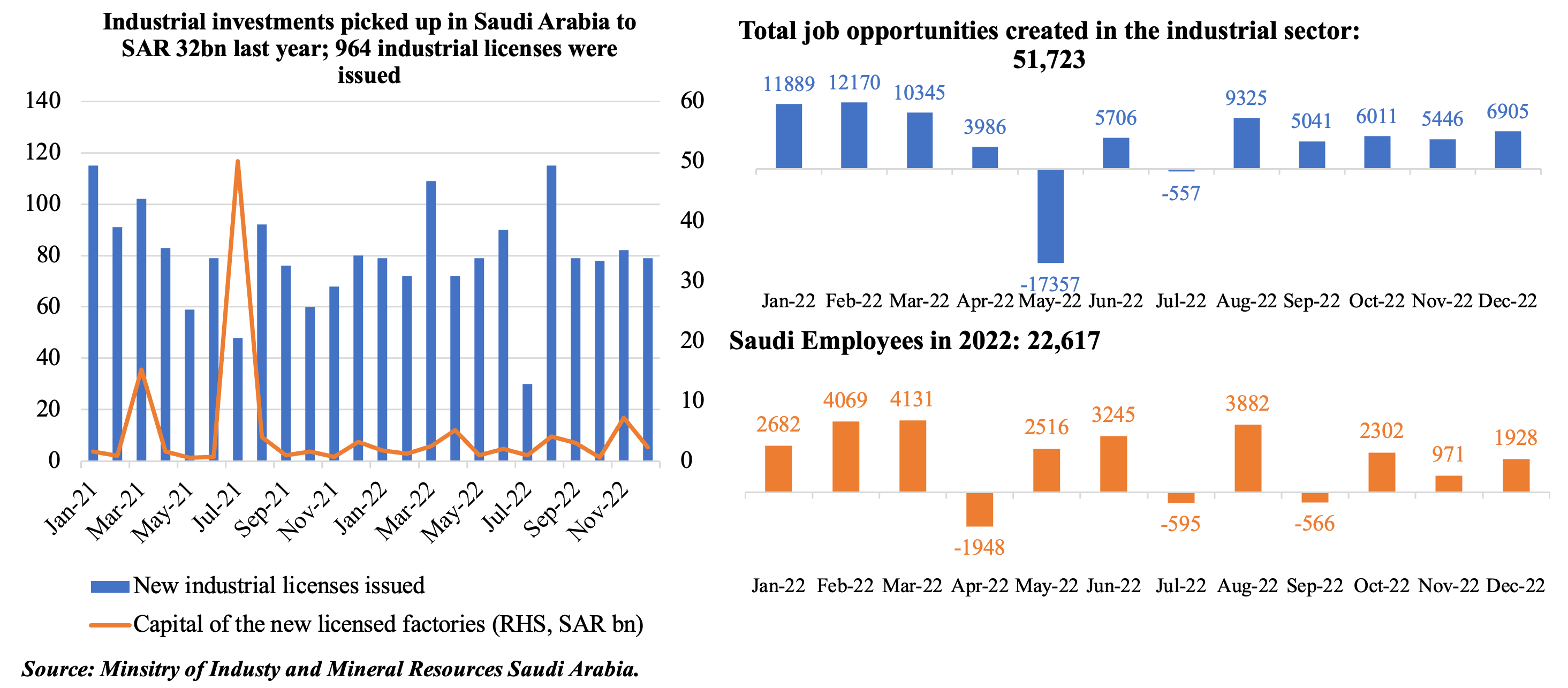

3. Industrial investments are on the rise in Saudi Arabia

- The Ministry of Industry and Mineral Resources disclosed that a total of 964 industrial licenses were issued in 2022, with the highest and lowest numbers issued in Aug and Jul respectively (115 and 30).

- During last year, 1023 factories initiated operations, with its investments amounting to SAR 28.79 bn.

- Industrial investments in Saudi Arabia totalled SAR 32bn in 2022 and 51,723 job opportunities were created during the year (of which about 43% were Saudi citizens).

- Saudi Arabia is one of the world’s fastest-growing countries in the industrial sector with an average growth rate of 7.5% per year, as stated in the Invest Saudi website. According to the Minister of Industry and Mineral Resources, there are 212 industrial investment opportunities (under the Invest Saudi platform); 82 out of the 163 investment opportunities are presented on the website, while the rest will be added later this year.

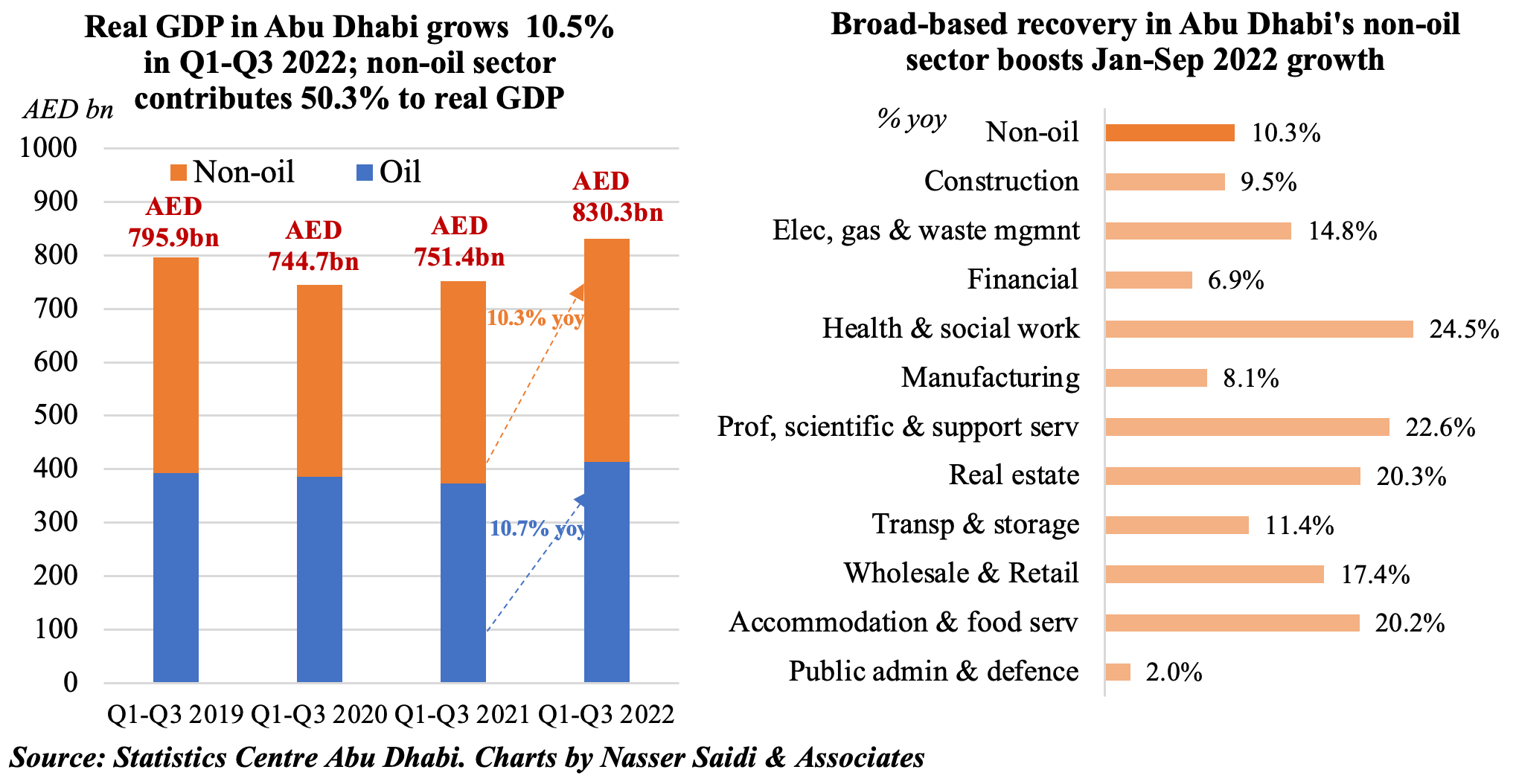

4. Abu Dhabi economy grew by 10.5% in Jan-Sep 2022, driven by both oil and non-oil sector activity (10.7% and 10.3% respectively)

- GDP in Abu Dhabi expanded by 10.5% yoy in Jan-Sep 2022, with the non-oil sector accounting for 50.2% of total GDP. Oil sector witnessed a significant acceleration: rising by 10.7% yoy to AED 830.4bn as of Sep 2022.

- Non-oil sector grew by 10.3% yoy in Jan-Sep, with the highest growth rates registered in health and social work (24.5%), professional, scientific and technical services (22.6%) as well as real estate (20.3%) and accommodation & food services (20.2%) while manufacturing was up by 8.1%. No sectors registered a decline in growth: it was least in arts & recreation (1.1%), public administration (2%) and agriculture (2.3%).

- In contrast, Dubai GDP grew by 4.6% yoy in Jan-Sep 2022, with growth was concentrated in a few sectors including accommodation & food services (28%), transportation (26.3%) and arts & recreation (18.1%); among the sectors posting negative rate of growth were mining& quarrying (-3.8%), construction (-3.1%) and public administration (-2.3%).

Powered by: