Middle East PMIs. Dubai tourism. Saudi industrial production, investment licenses. Kuwait 2023-24 budget.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 10 Feb 2023: Middle East’s non-oil sector PMIs – firms’ responses seem disconnected from macro evidence

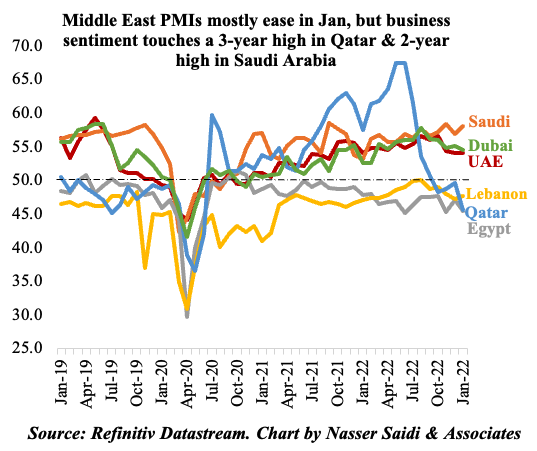

1. Middle East PMIs in Jan 2023: Saudi and Lebanon post increases (the latter remaining below-50) while others ease slightly

- Saudi Arabia’s PMI rose to 58.2 in Jan (highest in the Middle East), with output, new orders and new export orders all rising at a strong pace.

- On the other end of the spectrum was Egypt (at 45.5) where PMI declined to 45.5, as higher inflation and depreciation of the pound affected businesses. Also affected by economic uncertainty was Lebanon, where an unexpected rise in both output and new orders led to a slight uptick in Jan (47.7 from Dec’s 47.3).

- Qatar is in contraction for 4th straight month: at 45.7 in Jan, it is the lowest reading since Jun 2020, on account of a decline in activity and new orders following the World Cup boom.

- UAE PMI eased to a 12-month low of 54.1 in Jan: while output was unchanged, new exports orders declined to 47.5 – the lowest level since Jun 2021. Dubai slipped to an 11-month low.

- Outlook for the future is quite diverse: Business sentiment in Qatar and Saudi Arabia were at a 3- and 2-year high respectively while remaining quite pessimistic in Egypt and Lebanon (understandable, given ongoing economic issues). UAE (and Dubai) businesses, given its global market linkages, have a dim view about prospects: only 9% (and 11%) of panellists forecast growth over the next 12 months.

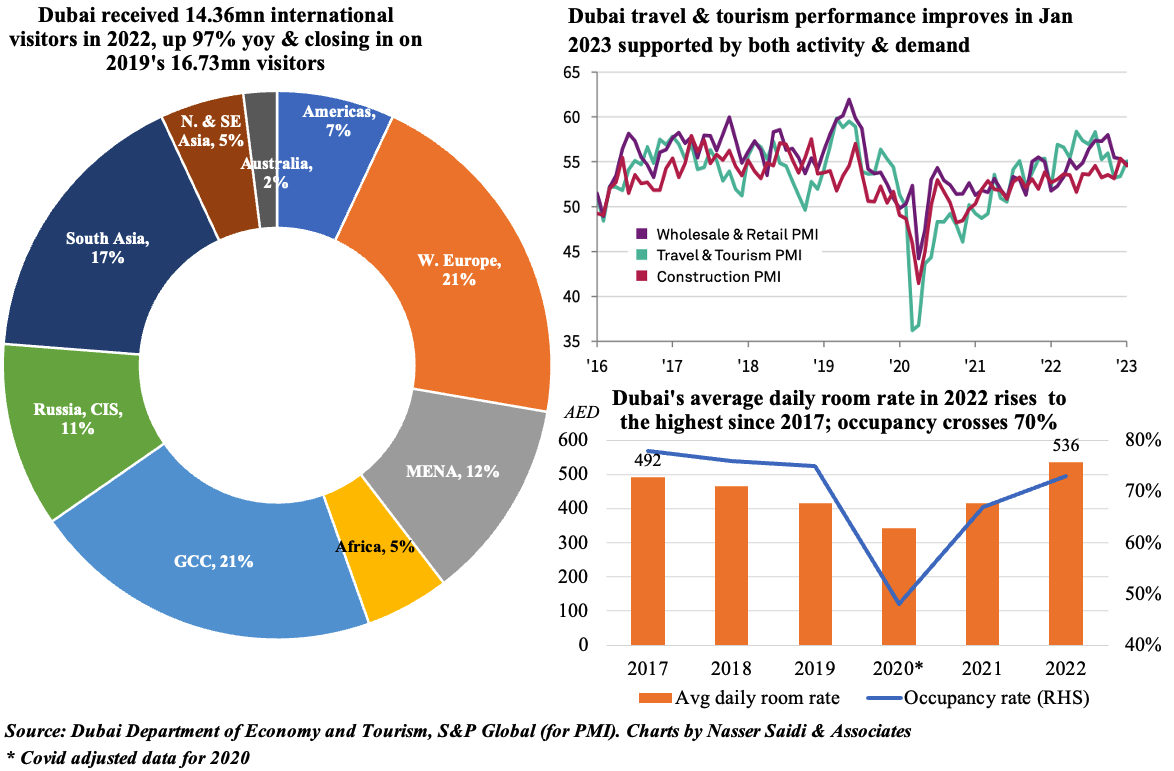

2. Dubai’s tourism sector continues to support non-oil sector activity: 14.36mn international visitors in 2022 (85% of pre-pandemic levels)

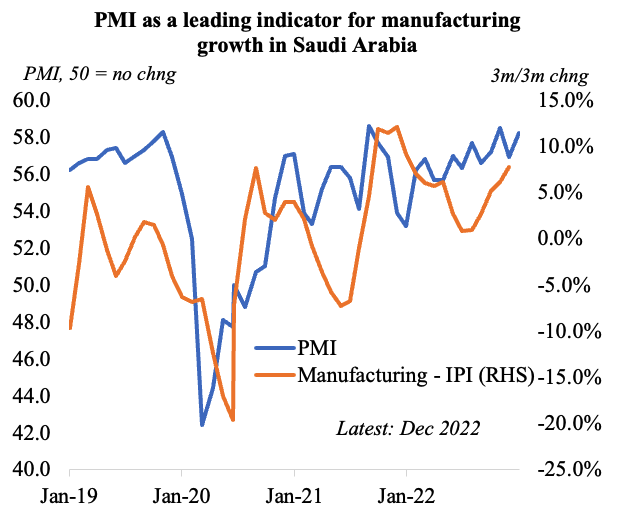

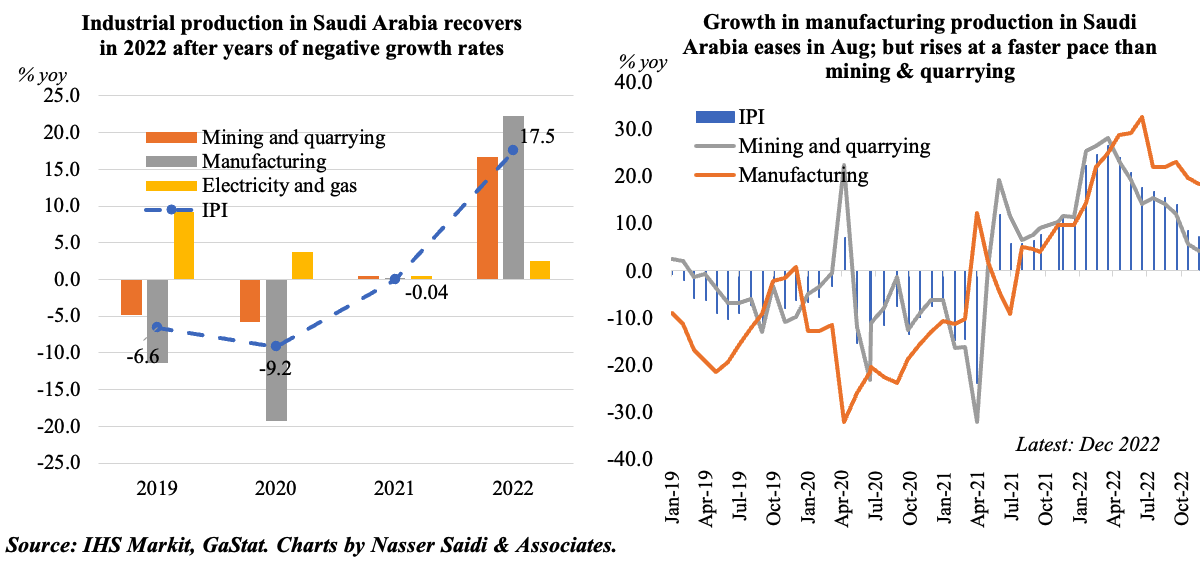

3. Industrial production in Saudi Arabia posts 17.5% yoy growth in 2022, after years of decline

- Overall industrial production (IP) grew by 17.5% yoy in 2022, supported by mining & quarrying (+16.7% yoy) and manufacturing (+22.3%).

- Manufacturing growth has been positive for 17 straight months, with double-digit growth for the past 11 months.

- IP has rebounded from pandemic-lows, with manufacturing a key sector of continuous growth. The 3m-rolling average displays this strength, and the uptick in output, new orders & new export orders within PMI (above average for 29-months expansion) bodes well for the IP index.

- Furthermore, industrial licenses issued reached 885 in Jan-Nov 2022 with investments of ~SAR 29.7bn and creating 40k+ job opportunities.

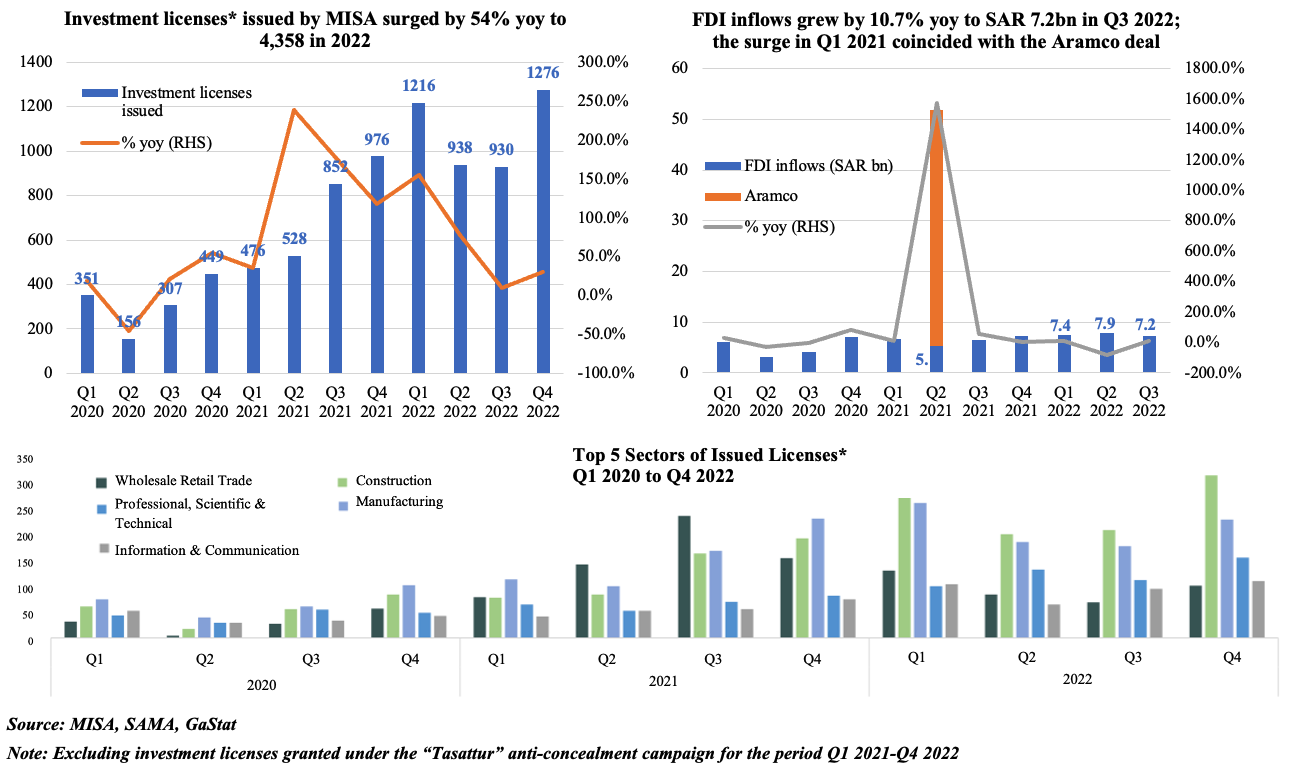

4. Saudi Arabia’s investment licenses surged in 2022: construction licenses had the lion’s share, not surprising given the mega/ gigaprojects in the pipeline; manufacturing continues to attract investments as well, thereby confirming strength in IP in the coming months

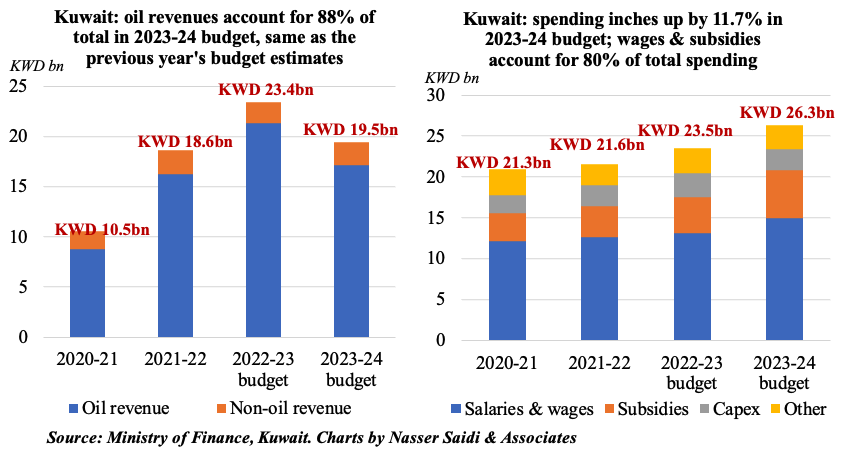

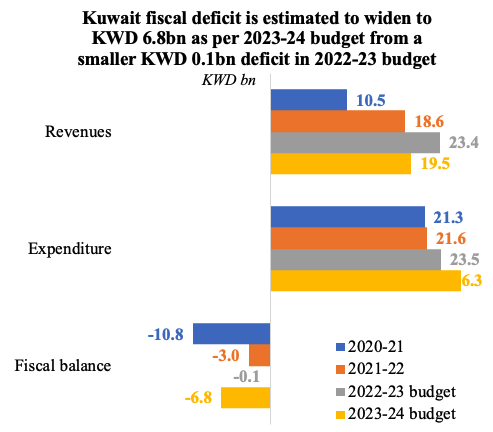

5. Kuwait unveiled its 2023-24 budget, with spending up 11.7% yoy

- Kuwait’s draft 2023-2024 budget projects total spending at a record-high KWD 26.5bn, driven by a 13.3% hike on salaries and a 34.2% rise in subsidies.

- Revenues are forecast to decline (-17% to KWD 19.5bn), owing to a 19.5% drop in oil revenue (based on oil price at USD 70 vs USD 80 in the 2022-23 budget).

- A deficit of KWD 6.8bn is estimated in 2023-24 (pre-inclusion of GRE’s earnings), in contrast to the surpluses achieved by other GCC nations. The budget breakeven is an estimated USD 92.9.

- Unlike other GCC nations, Kuwait is constrained by its lack of non-oil revenue proceeds and delays in passing its new debt law (that would allow the nation to tap international markets) among others.