Markets

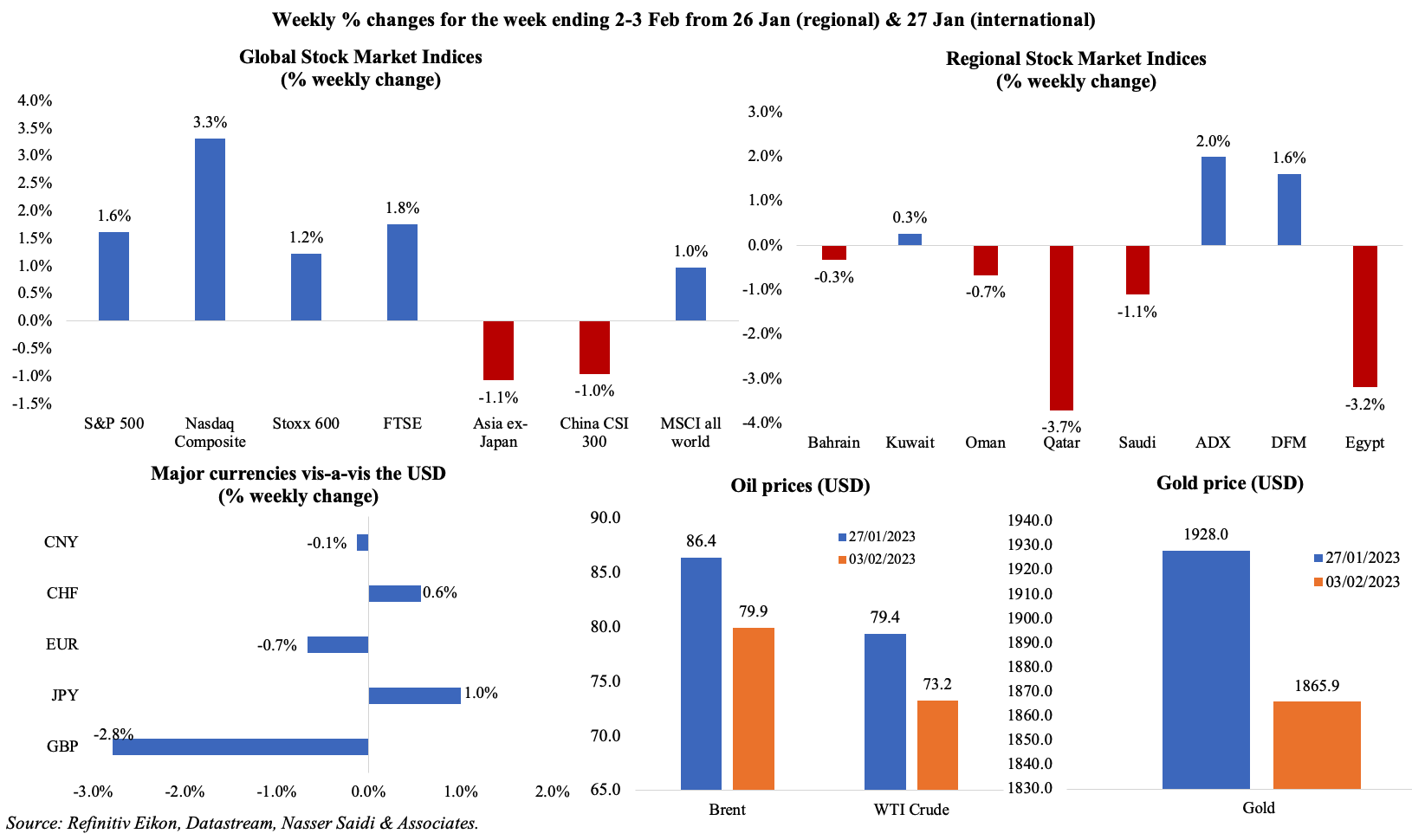

Equity markets were mostly up, on hopes that major central banks were closer to the end of the monetary policy tightening cycle; Asian markets declined (and could get worse this week on the deteriorating China-US relations) while the FTSE 100 index climbed to an all-time high on Friday. Regional markets were mixed: bourses dragged down on weak earnings while UAE markets performed better than the others. The dollar rose from its recent 9-month lows while both the Brent and WTI prices were down by nearly 8% last week.

Global Developments

US/Americas:

- The Fed raised policy rates by 25bps to 4.5-4.75%, the highest level since Sep 2007, but marking a return to slower pace of rate rises. During the press conference, it was highlighted that it is “very premature to declare victory”, while also ruling out pausing of rate hikes and confirming that QT would continue as the Fed reduces its portfolio.

- Non-farm payrolls increased by 517k in Jan (Dec: 260k), almost 3-times higher than expected, while unemployment rate inched lower to 3.4% in Jan (Dec: 3.5%), the lowest level since 1969. Labour force participation rate inched up to 62.4% and average hourly earnings increased by 4.4% (Dec: 4.9%).

- Non-farm productivity accelerated at a 3% annualised pace in Q4, higher than the upwardly revised Q3 gain of 1.4%. Unit labour costs increased by 1.1% in Q4, slower than the previous quarter’s 2% uptick.

- Initial jobless claims declined for the fifth consecutive week, falling by 3k to 183k in the week ended Jan 28th: this was the lowest in 9 months, and the 4-week average fell by 9,250 to 191.75k. Continuing jobless claims rose by 11k to 1.655mn in the week ended Jan 21st.

- The private sector added 106k jobs in Jan (Dec: 253k), with the growth attributed largely to the hospitality sector (95k jobs). Separately, it was reported that the number of job openings unexpectedly increased to 11.012mn in Dec (Nov: 10.44mn) – the highest reading since Jul – with the largest openings in accommodation and food services (409k). JOLTS revealed that there were 1.9 available jobs for every person looking for one.

- Factory orders rebounded by 1.8% mom in Dec (Nov: -1.9%), supported by the steep 16.9% rise in transportations orders. For the full year 2022, factory orders were up by 11.8%.

- S&P Case Shiller home prices dropped for the 5th consecutive month, rising by 6.8% yoy in Nov (Oct: 8.7%), the slowest growth since Sep 2020.

- Chicago PMI edged down to 44.3 in Jan (Dec: 44.9), the fifth consecutive month of contraction, with the employment subindex slipping to a 4-month low of 42. Separately, Dallas Fed manufacturing business index improved to -8.4 in Jan (Dec: -20) as the new orders index rose (to -4 from -11) while the production index fell from 9.1 to 0.2.

- S&P manufacturing PMI inched up to 46.9 in Jan (Dec: 46.2), largely due to a decline in new orders and output amid weak demand conditions. Both services and composite PMIs inched up to 46.8 respectively.

- ISM manufacturing PMI dropped to 47.4 in Jan (Dec: 48.4), as new orders plunged to 42.5 (Dec: 45.1), employment inched down to 50.6 (Dec: 50.8) while manufacturing prices paid increased to 44.5 (Dec: 39.4).

Europe:

- The ECB raised policy rate by 50bps to 2.5%, the highest level since 2008, also stating that rates will be hiked another 50bps next meeting and then it would “evaluate the subsequent path of its monetary policy”.

- GDP in the EU expanded by 0.1% qoq and 1.9% yoy in Q4 (Q3: 0.3% qoq); Ireland recorded the highest increase vs Q3 (3.5%), followed by Latvia (0.3%), Spain and Portugal (both 0.2%) while Lithuania posted the largest decline (-1.7%).

- Inflation in the EU inched lower for the third straight month, to 8.5% yoy in Jan (Dec: 9.2%) but remains higher than 4 times the ECB’s goal. Core inflation remained unchanged at an all-time high of 5.2%. However, inflation in Spain rose to 5.8% yoy in Jan, the first acceleration in annual pace in 6 months – indicating that inflation can re-accelerate again even after peaking.

- Producer prices in the EU rebounded in Dec, up by 1.2% mom and 25.2% yoy. Industrial producer prices in the energy sector surged by 49.6% yoy.

- Germany Q4 GDP unexpectedly shrank by 0.2% qoq in Q4 (Q3: 0.5%); in yoy terms, it was up by 1.1%, the weakest since the 2.1% contraction recorded in Q1 2021. Private consumption was the main reason for the decline in Q4 GDP.

- Exports from Germany declined by 6.3% mom in Dec and imports were down by 6.1%, taking the trade surplus lower to EUR 10bn from the previous month’s EUR 10.9bn. For the full year 2022, exports grew by 14.3% yoy and imports rose by a stronger 24.3%.

- Euro area’s consumer confidence stood at -20.9 in Jan, the highest since Feb 2022; consumer confidence in the EU also saw an improvement (+1.4 points to -22.2). Business climate in the euro area improved to a 3-month high of 0.69 in Jan (Dec: 0.57).

- After 6 straight months of declines, composite PMI in the EU inched up by 1.0 point to 50.3 in Jan, supported by services recovery, an uptick in employment and decline in input cost inflation. Services PMI rose to 50.8 in Jan (Dec: 49.8), in expansion for the first time since Jul 2022 while manufacturing PMI stayed below-50 at 48.8 (a 5-month high).

- Germany’s manufacturing PMI edged up to 47.3 in Jan (Dec: 47.1), remaining below-50 as a result of decline in new orders and export orders. Thanks to services PMI moving to expansionary territory (a 7-month high of 50.7 from Dec’s 49.2) after 6 months of sub-50 readings, the composite PMI improved to 49.9 (Dec: 49).

- Retail sales in Germany declined by 6.4% yoy and 5.3% mom in Dec (Nov: -5.9% yoy and 1.9% mom). The mom decline was the most since Jul 2021. In 2022, retail sales fell by 0,6%, driven by a 4.1% drop in H2.

- Unemployment rate in Germany held steady at 5.5% in Dec. The number of unemployed fell unexpectedly by 15k in Dec to 2.51mn (Nov: -13k).

- The Bank of England (BoE) increased policy rate by 50bps to 4%, up from the historical low of 0.1% in late 2021 and highest since 2008. The BoE forecast a 0.5% decline in output this year compared with the 1.5% contraction predicted in Nov.

- UK’s manufacturing PMI rose to 47 in Jan (from Dec’s 31-month low of 45.3) while the services PMI declined sharply to a 24-month low of 48.7.

Asia Pacific:

- China NBS manufacturing PMI improved to 50.1 in Jan (Dec: 47), as new orders rebounded (50.9 from 43.9) while export sales fell at a slower pace (46.1 from 44.2). Meanwhile, non-manufacturing PMI jumped to 54.4 from 41.6 in Dec, supported by a surge in spending for the Lunar New Year holidays as Covid related restrictions were removed.

- Caixin manufacturing PMI in China inched up to 49.2 in Jan (Dec: 49), with output falling the least in 5 months though foreign demand fell for the 6th month running and employment fell for the 10th straight month. Caixin services PMI expanded for the first time in 5 months, moving up to 52.9 in Jan (Dec: 48).

- Japan manufacturing PMI stayed at 48.9 in Jan, unchanged from Dec’s reading, with output and new orders remaining weak while employment growth improved and prices charged inflation cooled to its lowest for 16 months.

- Japan’s unemployment rate stayed unchanged at 2.5% in Dec, the lowest since Feb 2020. The jobs to applicant ratio was also same at 1.35, the highest level since Mar 2020.

- Industrial production in Japan declined by 2.8% yoy and 1.1% mom in Dec (Nov: -0.9% yoy and +0.2% mom). In mom terms, the general purpose and business-oriented machinery industry fell the most (-6% from Nov’s 8% drop).

- Retail trade in Japan rebounded by 1.1% mom in Dec (Nov: -1.3%); in yoy terms, sales grew for the 10th straight month, up by 3.8% (Nov: 2.5%) as domestic consumption improved.

- Unemployment rate in Singapore stood at 2% yoy in Q4 (Q3: 2.1%), the lowest reading since Q1 2016. For the full year, jobless rate fell to 2.1% (2021: 2.7%).

- Retail sales in Singapore grew by 1.3% mom and 7.4% yoy in Dec, thanks to stronger demand during the festive season and rush to spend on big-ticket items ahead of the GST hike in Jan.

Bottom line: Global composite PMI remained in contractionary territory in the start of Jan (49.8, though rising from Dec’s 48.2) though business services and consumer goods sectors registered expansions. Developing nations were performing better, especially in Asia where both China and Japan returned to expansions. Separately, China has been showing signs of increased mobility – passenger trips during the holiday travel rush reached 892 million from Jan 7th to 29th, up 56% from 2022 – which could lead up to increased domestic demand and consumption. As markets try to understand whether the rate hiking cycle is inching closer to a pause, the UN disclosed that global food prices (one of the initial factors leading to higher prices) continued to decline for the 10th consecutive month.

Regional Developments

- The IMF, in its latest World Economic Outlook update, projects MENA’s economic growth to slow to 3.2% in 2023 (2022: 5.4%). Saudi Arabia is forecast to grow by just 2.6% this year from 8.7% in 2022, largely due to an expected decline in oil production.

- Most GCC central banks followed the Fed’s 25bps rate hike given the peg to the US dollar. Qatar central bank however left rates unchanged, keeping the deposit, lending and repo rates at 5%, 5.5% and 5.25% respectively.

- The OPEC+ panel left production cuts agreed in 2023 unchanged at the latest meeting, pinning hopes on higher demand from a reopened China and uncertain supply from Russia.

- Egypt’s central bank unexpectedly left interest rates unchanged, stating that the 800bps hikes over last year will be sufficient to bring inflation (currently at 21.3%) under control. Separately, the IMF estimates GDP to grow by 4% in the fiscal year 2022-23 and 5.3% in 2023-24.

- PMI in Egypt declined to 45.5 in Jan (Dec: 47.2) as higher inflation and depreciation of the pound affected businesses. New orders and output fell to 42.6 and 42.3 (Dec: 45.5 and 44.8 respectively) while the sub-index for overall input prices climbed to 72.3 (the largest rise since Feb 2017 and compares to Dec’s 65) and for purchase price sub-index rose to 72.7 (Dec: 64.3).

- A detailed plan of Egypt’s state stake sales will be provided this week, according to the PM last week. The offerings of at least 20 state-owned firms, to be made over 12 months, will be a mix of sale to strategic investors and listings on the stock exchange.

- Egypt’s net foreign assets increased to negative 494.3bn in Dec (Nov: – EGP 541.5bn). It stood at a positive EGP 248bn in Sep, before the decline started. Money supply (M2) grew by 27.1% yoy in Dec to EGP 7.4trn.

- Kuwait’s cabinet submitted a draft 2023-2024 budget, the largest in history with total spending of KWD 26.5bn (+11.7% yoy) and projecting a deficit of KWD 5bn (USD 16.4bn) from the estimated USD 10.3bn this year, in contrast to the surpluses achieved by other GCC members. Revenues are estimated to drop by 16.9% to USD 63.8bn, with oil revenues down by 19.5% (based on oil price at USD 70).

- Kuwait airways plans to expand its network, launching 20 new destinations this year.

- Lebanon devalued its official exchange rate by 90%, with the new official rate fixed at LBP 15,000 per dollar (from LBP 1507.5 previously), but remaining some 75% below the informal market rate.

- PMI in Lebanon inched up to 47.7 in Jan (Dec: 47.3), rising for the first time since Oct 2022, driven by an unexpected rise in both output and new orders. Overall outlook remains pessimistic given the political and economic uncertainty alongside the devaluation of LBP.

- A senior French official disclosed that the regional plan to export power from Egypt to Lebanon via Syria is being held up as Egypt waits for assurances that US sanctions will be waived.

- Oman and Saudi Arabia signed 13 MoUs on the sidelines of the Saudi-Oman Investment Forum, covering various sector including biochemicals, energy, mining, financial investment, logistics, maritime transport, and IT among others. An MoU was also signed to support cooperation and enhance development of SEZs and free zones in the 2 nations.

- Qatar PMI inched lower to 45.7 in Jan (Dec: 49.6), the lowest reading since Jun 2020, on account of a decline in activity and new orders following the World Cup. Input cost inflation rose to a 7-month high while employment increased to the highest in 6 months. However, business sentiment improved to a 3-year high of 74.9.

- Saudi Arabia remained the largest projects market in the GCC last year, awarding contracts worth USD 54.2bn, according to report from Kamco Invest. However overall value of contracts in the GCC declined by 18.7% to USD 93.6bn last year.

- The MENA region saw a record-high 51 IPOs in 2022 (+143% yoy), with its combined proceeds at USD 22bn (+179%), according to EY. In the last quarter alone, there were 20 IPOs raising USD 7.3bn; Q2 was the strongest, with USD 9.2bn raised from 9 IPOs.

Saudi Arabia Focus

- PMI in Saudi Arabia rose to 58.2 in Jan (Dec: 56.9), just a tad lower than the Nov’s reading of 58.5 (the highest since Sep 2021): output, new orders and new export orders all increased at a strong pace. Sentiment hit the highest since Jan 2021 while job creation slowed from Dec’s near 5-year high.

- Saudi Arabia’s GDP grew by 5.4% in Q4 2022 according to preliminary estimates (easing from 8.8% in Q3), supported by a 6.2% increase in non-oil sector activity alongside a 6.1% uptick in oil sector growth. This brings the full year growth to 8.7%, largely due to boost from the oil sector (15.4% yoy) while non-oil sector activity increased by 5.4%.

- Saudi energy minister stated that sanctions and underinvestment in the energy sector could lead to a shortage in supply. He also stated that he remains cautious on any increase in production.

- Saudi Arabia appointed a new central bank governor; the previous governor has now become an adviser at the royal court.

- Saudi Arabia will invest up to SAR 1trn (USD 266.4bn) to generate “cleaner energy”; this investment will also add “transport lines and distribution networks” to enable exports.

- Saudi Arabia’s Ministry of Industry and Mineral Resources issued the first industrial license to NEOM Green Hydrogen Co. at OXAGON: the plant is expected to produce up to 1.2 million tons of green ammonia annually and begin green hydrogen production using 100% renewables in 2026.

- Saudi Aramco reduced material and logistics supply chain emissions by 23% since 2015, revealed the Chairman. It was disclosed that the firm has a local supply chain comprising an estimated 1,000 local manufacturers and more than 2,000 service providers.

- The Public Investment Fund and Aerofarms have signed a deal to establish “indoor vertical farms” in Saudi Arabia and across the MENA region.

- Tourism spending in Saudi Arabia surged by 93% yoy to SAR 185bn (USD 49bn) in 2022, with direct jobs at 880k (+15%) and its direct contribution to GDP at 3.2% (target is 10% by 2030).

UAE Focus![]()

- UAE PMI eased to a 12-month low of 54.1 in Jan (Dec: 54.2): while the output sub-index was unchanged at 58.8 and new orders rose to a 3-month high of 56, new exports orders declined to 47.5 – the lowest level since Jun 2021. Future prospects remain dim with only 9% of respondents forecasting growth over the coming year.

- Reuters reported that Indian refiners had begun paying for Russian oil purchased via Dubai-based traders in AED (dirhams) instead of USD. The State Bank of India is now clearing UAE dirham payments, enabling this alternative method of payment.

- Dubai welcomed 14.36 million international visitors in 2022, up 97% yoy and compares to the 16.73mn recorded in 2019. Visitors from the GCC accounted for 21% of overall arrivals while South Asia and MENA contributed 17% and 12% respectively. Average hotel occupancy stood at 73% for the year (up from 67% in 2021 although lower than 2019’s 75%).

- The UAE’s national digital economy is expected to surge to USD 140bn by 2031 from USD 38bn currently, according to a report by the Dubai Chamber of Digital Economy; this will allow for the sector’s contribution to GDP to rise to over 20% from 9.7% now. The emirate plans to attract over 300 digital start-ups and 100 tech experts by 2024.

- Energy demand in Dubai grew by 5.5% yoy to 53,180 GWh in 2022, according to the CEO of DEWA. The company reported a reduced line loss of 2.2% and a world-record low electricity Customer Minutes Lost of 1.19 minutes per customer.

- The UAE, France and India established a tripartite cooperation initiative in several areas including energy and climate change and drew a road map to implement it.

- Abu Dhabi’s Borouge reported a 17% decline in Q4 profits and announced a USD 400mn cost savings drive.

- Dubai residents can now pay housing rents using direct debits as opposed to the practice of handing over post-dated cheques during the start or renewal of a tenancy contract.

Media Review

A bipolar currency regime will replace the dollar’s exorbitant privilege: Roubini

https://www.ft.com/content/e03d277a-e697-4220-a0ca-1f8a3dbecb75

Why the US Fed should raise rates by 0.5 of a percentage point:El-Erian

Iraqi PM says banking reforms reveal fraudulent dollar transactions

https://www.arabnews.com/node/2242586/middle-east

Distressed debt funds eye Gulf region opportunities

https://www.reuters.com/markets/distressed-debt-funds-eye-gulf-region-opportunities-2023-01-31/

Dr. Nasser Saidi’s comments on China-GCC relations

Powered by: