Markets

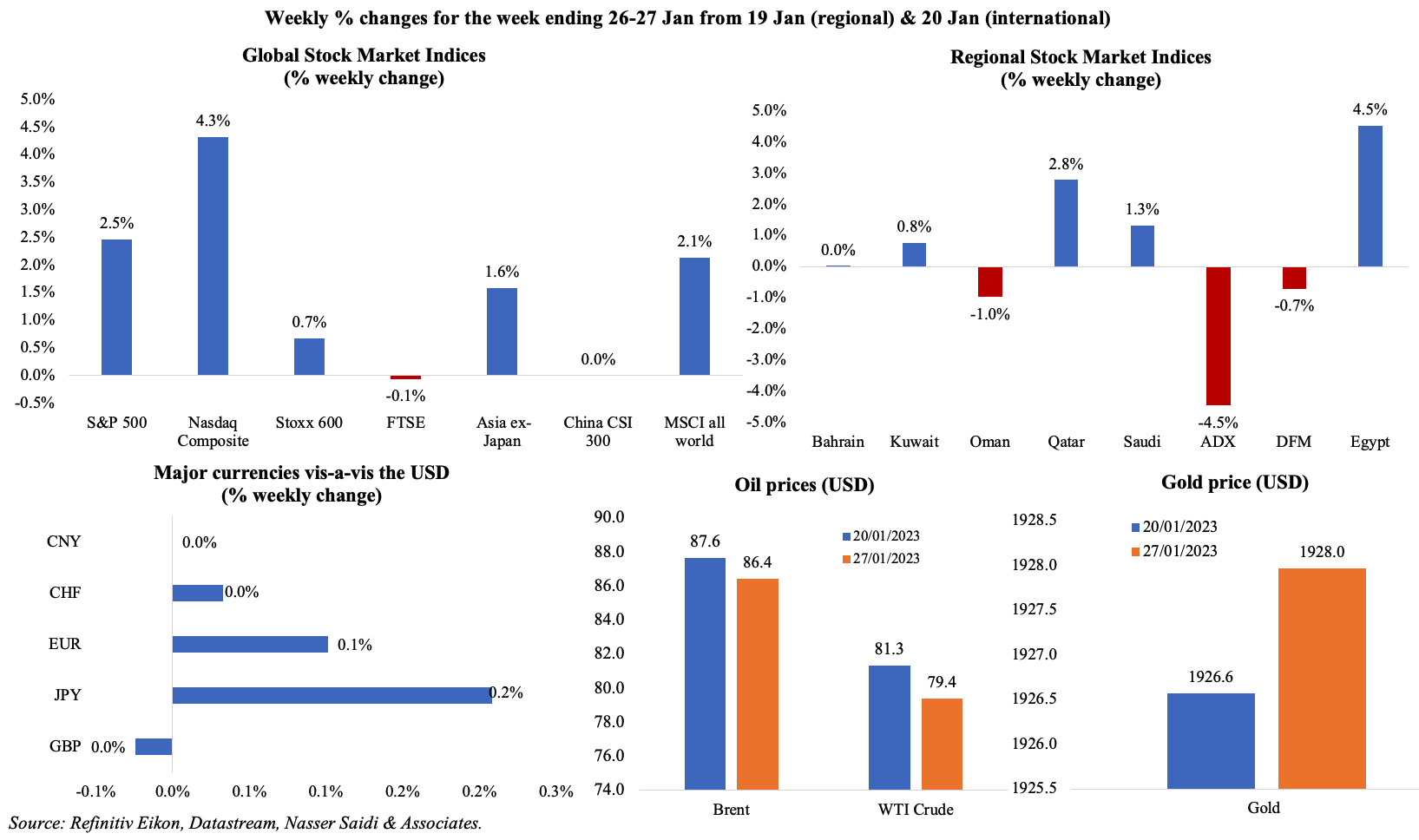

Global equity markets had an uplifting week: MSCI’s broadest Asia-Pacific index (outside Japan) touched an almost 9-month high (in spite of the rout in shares of Adani Enterprises) buoyed by China opening up, though mainland China markets were closed for the Chinese New Year holidays. Earnings played a heavy role in regional equity markets performance, especially in Abu Dhabi where the index fell to a 3-month low. The dollar edged up from an 8-month low, oil prices settled lower and gold price gained last week.

Global Developments

US/Americas:

- GDP grew by 2.9% annualised rate in Q4 (Q3: 3.2%), pulled down by residential fixed investment (-26.7%), weaker exports (-1.3%) and consumer spending (+2.1% from 2.3%) while private investment and government spending supported.

- Personal income grew by 0.2% mom in Dec – the smallest gain in 8 months – while spending fell for the second consecutive month (-0.2%). The savings rate rose to a 7-month high of 3.4% from 2.9% in Nov. The personal consumption expenditures (PCE) price index increased 5.0% in Dec, the smallest gain since Sep 2021, slower than Nov’s 5.5% gain. Core PCE rose to 4.4%, the smallest rise since Oct 2021 and slower than Nov’s 4.7%.

- Goods trade deficit in the US widened to USD 90.3bn in Dec from a near 2-year low of USD 82.9bn in Nov: exports were down by 1.6%, dragged down by sales of industrial supplies (-5.1%) while imports were up by 1.9%, supported by purchases of vehicles (+9.4%).

- Durable goods orders rebounded by 5.6% mom in Dec (Nov: -1.7%), driven by transportation equipment (specifically, demand for Boeing passenger planes). Non-defence capital goods orders fell by 0.2% mom in Dec after a flat reading the month before.

- Richmond Fed manufacturing index plummeted to -11 in Jan (Dec: 1), the lowest reading since May 2020 with all components declining (new orders fell to -24 from -4 a month ago).

- Chicago Fed National Activity index improved to -0.49 in Dec (Nov: -0.51), with the sales, orders, and inventories category and employment indicators supporting the slight uptick.

- S&P Global preliminary composite PMI in the US remained below-50 for the third consecutive month in Jan, though edging up to 46.6 from Dec’s 45: new orders contracted for the 4th consecutive month, while input prices increased after 7 months of moderating.

- New home sales rose for a 3rd consecutive month, up by 2.3% mom to 616k in Dec. While the median new house price rose by 7.8% yoy to USD 442,100 in Dec, the 30-year fixed mortgage rate declined to an average 6.15% mid-Jan. Pending home sales rebounded in Dec, rising by 2.5% mom – the first monthly gain since May.

- Michigan consumer sentiment index inched up to 64.9 in Jan (Dec: 59.7), the highest since Apr. The survey’s 1-year inflation expectations fell to a 21-month low of 3.9% in Jan while the 5-year outlook lowered to 2.9%.

- Initial jobless claims declined for the fourth consecutive week, lower by 6k to 186k in the week ended Jan 21st: this was the lowest reading since Apr 2022, and the 4-week average fell by 9,250 to 197.5k. Continuing jobless claims rose by 20k to 1.675mn in the week ended Jan 14th.

Europe:

- After 6 straight months of declines, the flash composite PMI in the EU inched up by 0.9-point to 50.2 in Jan, with an uptick in employment and decline in input cost inflation. Services PMI rose to 50.7 in Jan (Dec: 49.8) while manufacturing PMI stayed below-50 at 48.8 (a 7-month high).

- Germany’s preliminary manufacturing PMI edged down to 47 in Jan (Dec: 47.1). Thanks to services PMI moving to expansionary territory (50.4 from Dec’s 49.2) after 6 months of sub-50 readings, the composite PMI improved to 49.7 (Dec: 49).

- Sentiment improved in Germany with the Ifo expectations rising to 86.4 in Jan (Dec: 83.2), as did business climate (to 90.2 from 88.6). However, the current assessment edged down to 94.1 in Jan (Dec: 94.4).

- Consumer confidence in the euro area eased to -20.9 in Jan (Dec: -22.2): this was the highest reading since Feb 2022, on hopes of lower energy prices. In the EU, sentiment increased by 1.4 points to -22.4.

- UK’s preliminary manufacturing PMI rose to 46.7 in Jan (Dec: 45.3) while the services PMI declined sharply to a 24-month low of 48.

- Core output producer price index in the UK eased to 12.4% yoy in Dec (Nov: 13%), the lowest rate since Mar 2022.

Asia Pacific:

- Core inflation in Tokyo increased to 4.3% in Jan (Dec: 3.9%), posting the fastest pace of increase since May 1981 and staying above the BoJ’s target for the 8th consecutive month. Excluding both food and energy, core prices eased to 1.7% (Dec: 2.7%). Headline inflation rose to 4.4% from 3.9% the month before.

- Japan preliminary manufacturing PMI stayed at 48.9 in Jan, unchanged from Dec’s reading, with output and new orders remaining weak while employment growth improved.

- Leading economic index in Japan slipped to 97.4 in Nov, down by 0.2 points from the preliminary reading and Oct’s 98.6: this was the lowest reading since Dec 2020. The coincident index stood at 99.3 (prelim: 99.1 and Oct: 99.6).

- Preliminary GDP in Korea shrank by 0.4% qoq in Q4, posting the first contraction since Q2 2020, largely due to the drop in exports (-5.8%) and private consumption (-0.4%). In yoy terms, growth slowed to 1.4% from the previous quarter’s 3.1%.

- Inflation in Singapore eased to 6.5% in Dec (Nov:6.7%) though prices of food and recreation increased by 7.5% each (from Nov’s 7.3% and 5.8% respectively). Core inflation stood unchanged at 5.1%. For the full year 2022, prices were up by 6.1% yoy.

- Industrial production in Singapore rebounded in Dec, rising by 3.2% mom after Nov’s 1.6% dip. Excluding the volatile biomedical manufacturing, IP expanded by 6.8% mom and 0.3% yoy in Dec.

Bottom line: The Fed, ECB and BoE policy meetings are on the cards this week, with all expected to raise rates; even though inflation has eased, it remains at multi-year highs. Last week’s flash PMI data signalled reduced risks of recession, raising hopes that this week’s global data are likely to show some encouraging signs as well (potentially an uptick in new orders, improvement in business outlook, rising employment numbers and falling input prices). China’s service sector is likely to show a slight expansion given the reversal of zero-Covid policies, though manufacturing performance may still be muted. Earnings season is well under way and this week sees big tech firms like Alphabet, Amazon, Apple, Meta and others releasing Q4 results – will be interesting to read their perspective on growth/ profits and compare/ contrast to the IMF’s global growth outlook (to be released tomorrow morning).

Regional Developments

- Exports of Bahrain-origin products grew by 24% yoy to BHD 4.97bn (USD 13.18bn) in 2022. Saudi Arabia, the US and the UAE were the top three recipient nations. Imports meanwhile grew by 10% to BHD 5.84bn (China, Brazil and Australia were top partners), leading to a trade deficit of BHD 155mn (much smaller than 2021’s BHD 643mn).

- It was disclosed to the Cabinet that unemployment in Bahrain declined to 5.4% in Dec 2022 from 7.7% in 2021.

- Bahrain’s crown prince spoke with Qatar’s emir via telephone last week, a sign of improving ties between the two nations. There had been no prior bilateral discussions between the two nations since the embargo was lifted in Jan 2021.

- Suez Canal reported a record-high annual revenue of USD 8bn last year, up 25% yoy: tolls were hiked thrice last year. An average 68 ships crossed the waterway daily in 2021, carrying 1.41bn tons of cargo (also another record high).

- Qatar is in talks to acquire a stake in the USD 27bn cluster of energy projects in Iraq from Total Energies, reported Reuters.

- The Central Bank of Kuwait raised the discount rate by 50bps to 4% from 26th

- Oil revenue in Kuwait is expected to exceed KWD 25bn in the 2022-23 fiscal year, reported Al-Qabas daily; it had crossed KWD 20bn in Q1-Q3 of the year, with average selling price of a Kuwaiti oil barrel at USD 101.8 during the period.

- Less than four months after being sworn in, the Kuwaiti government’s resignation was accepted in an Emiri decree, with the PM and his cabinet assigned as a caretaker government.

- Protests were rife in Lebanon given the record low value of the lira of LBP/$ 60,000: petrol prices surged last week to more than LBP 1mn for a 20-litre tank.

- The US will provide USD 72mn as cash stipends to Lebanon’s security forces through the UN as a temporary measure given that the currency meltdown. About USD 100 will be disbursed in cash monthly for 6 months to members of the Lebanese Armed Forces and the Internal Security Forces.

- Lebanon’s energy ministry disclosed that Qatar Energy, Total Energies and Eni will form a three-way consortium to explore oil and gas in two maritime blocks off the coast.

- Qatar Investment Authority increased its stake in Credit Suisse to just under 7%, making it the second largest shareholder after Saudi National Bank.

- According to the EY MENA Climate Change Readiness Index report, carbon dioxide emissions per capita fell by the most in UAE and Oman in the period 2015-2020 – by 35% and 16% respectively.

- PwC’s CEO Survey shows that almost 61% of Middle East CEO’s expect growth in the region to improve this year and remain more optimistic about their firm’s revenue growth this year (63%) and in the next 3 years (71%).

Saudi Arabia Focus

- Saudi Arabia expects its financing needs to be around SAR 45bn (USD 12bn) in 2023, after raising SAR 48bn last year in pre-funding transactions. Sovereign debt rose by about SAR 52bn to SAR 990bn in 2022 or 25% of GDP (2021: 30% of GDP). The 2023 budget statement estimates sovereign debt to fall slightly to SAR 951bn in 2023.

- Oil exports from Saudi Arabia grew by 11.8% yoy to SAR 90bn in Nov, the lowest since Jan 2022, and accounting for around 80% of total exports. Non-oil exports and re-exports were 16.7% and 3.5% of total exports (which stood at SAR 112.8bn) respectively.

- The Saudi Central Bank (SAMA) is currently studying the economic impact, market readiness, and potentially effective and swift applications for payment solutions using digital currency, reported the Saudi Press Agency. It also mentioned that the apex bank is testing the central bank digital currency in cooperation with other financial institutions and FinTech firms.

- SAMA issued licenses to two fintech firms specialized in debt-based crowdfunding: one firm is Tameed which is the only purchase order financing platform in Saudi Arabia.

- The Saudi Entertainment Ventures (Seven) started the construction of its SAR 1bn (USD 266mn) entertainment complex in Tabuk. Seven is investing more than SAR 50bn to build 21 entertainment destinations.

- Privatisation of four regional airports in Saudi Arabia is on the cards, with preparations underway already, revealed the minister of transport and logistics. He also stated that there are 22 investment opportunities in the transport sector currently.

- Saudi Arabia attracted more than 18mn inbound visitors in Jan-Sep 2022, higher than UAE (14.8mn) and Morocco (11mn), according to UNWTO. Tourism spending touched USD 7.2bn in H1 2022, according to Saudi ministry of investment.

UAE Focus![]()

- UAE has 11 IPOs estimated to be worth USD 2.2bn in the pipeline, disclosed the deputy CEO of the Securities and Commodities Authority: this includes 4 free zone firms and 2 SPACs.

- Gross assets of UAE banks inched up by 0.7% mom to AED 3.639trn (USD 900bn) at end-Nov. Deposit growth outpaced credit growth, avisible pattern since the start of 2021. Within credit, lending to the public sector (GREs) were up by 2% mom while that to the private sector nudged up by 0.6%.

- UAE banks’ investments roseto a high of AED 511.1bn in Nov 2022, up 3.5% mom and 7.7% yoy; debt securities are the largest component (49.1%), followed by held to maturity securities (39.3%).

- Bilateral trade between UAE and Israel more than doubled to USD 2.56bn in 2022, allowing UAE to join the top 20 trading partners of Israel, disclosed Israel’s ambassador to the UAE.

- UAE hopes to reach 14 gigawatts of renewable energy by 2030, from 9.2GW currently, according to the climate minister. By 2050, UAE aims for 50% its energy supply to come from clean and renewable energy.

- Hotel revenues in Abu Dhabi surged by 23% yoy to AED 5.4bn in 2022; a total of 4.1mn hotel visitors stayed in the capital’s hotels last year, up 24%.

- Dubai Gold and Commodities Exchange (DGCX), the largest and most diversified derivatives exchange in the Middle East, reported a total of 8.239 contracts (+16% yoy) with a value of USD 162.01bn (8.24%) in 2022.

Media Review

Unrest What China’s reopening means for markets

https://www.ft.com/content/89e8e569-7f5f-40a4-bf2a-4fd651663895

How Not to Fight Inflation

https://www.project-syndicate.org/commentary/us-inflation-fed-interest-rates-high-costs-dubious-benefits-by-joseph-e-stiglitz-2023-01

Dubai hopes to seize private sector listings, boost access to stock exchange

https://www.reuters.com/world/middle-east/dubai-hopes-seize-private-sector-listings-boost-access-stock-exchange-2023-01-24/

Adani sell-off hits $68bn

https://www.bloomberg.com/news/articles/2023-01-30/most-adani-stocks-drop-as-rebuttal-draws-hindenburg-response

Powered by: