UAE & Dubai PMIs. UAE monetary developments. MENA inflation, tourism, passenger traffic & cargo movements.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 20 Jan 2023: UAE/ Dubai economic recovery supported by non-oil sectors

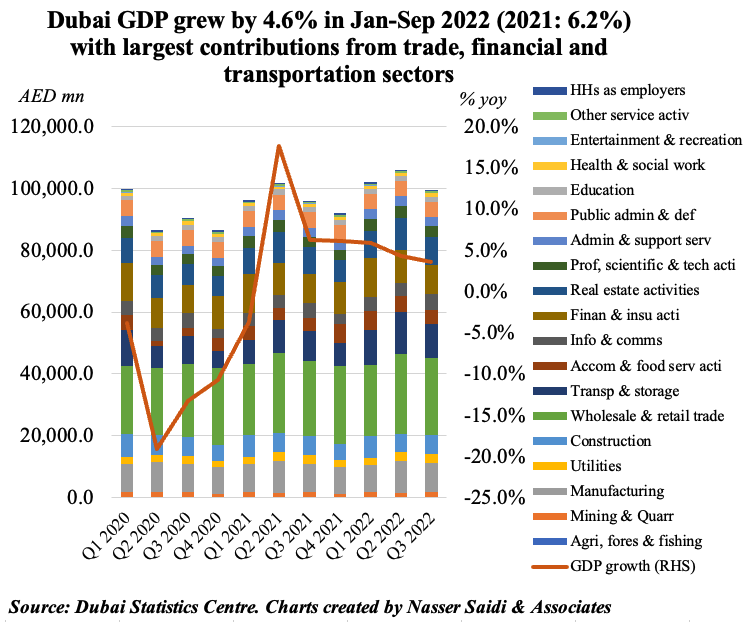

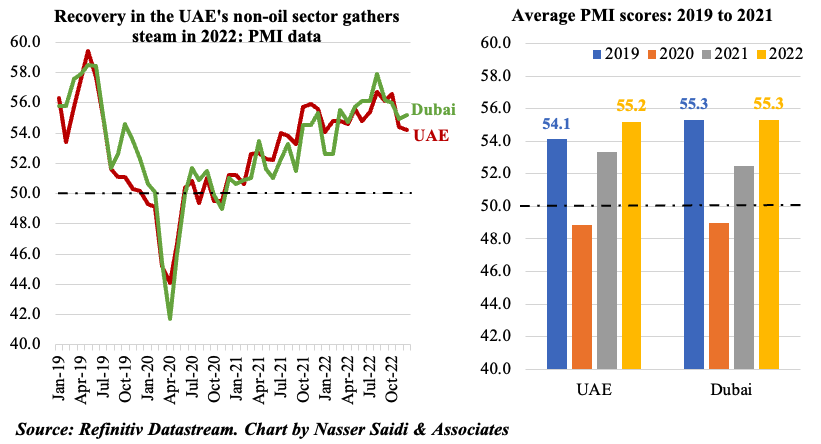

1. UAE & Dubai PMIs underscore pace of recovery

- The UAE and Dubai PMIs have been in expansionary territory since Dec 2020, contrasting with declining global business activity, where new orders were falling given weak demand conditions. Towards the end of 2022, most businesses also reported a reduction in input costs amid improved input availability. Earlier in the year, amid rising input prices (and transport costs), businesses had more often than not absorbed the additional costs to remain more competitive and support domestic demand.

- In Dubai’s case, the recovery was broad-based across all sectors – construction, wholesale & retail and travel & tourism (also evident from GDP growth in Jan-Sep 2022). The Qatar World Cup supported Dubai’s travel and tourism sector: share of passengers booking a return flight from the UAE to Qatar with only 0-1 nights of stay increased from 14% in Oct to 51% in Nov. Furthermore, new work received by construction firms rose at the strongest rate in nearly two years in Dec.

- Overall, though the UAE has benefitted from the rise in oil prices, its non-oil sectors ranging from real estate to travel & tourism and manufacturing have also been posting strong growth rates. Going forward, labour market reforms to improve mobility, push to accelerate trade via FTAs and a concerted push for manufacturing will support growth.

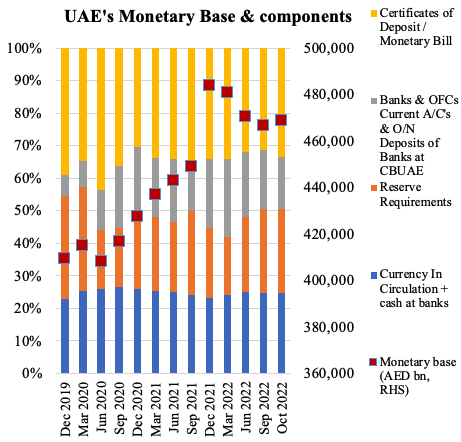

2. UAE Monetary Developments -Oct 2022

- Monetary aggregates M1 and M3 grew by 0.02% mom and 0.5% respectively in Oct 2022, with the latter gaining thanks to the 7% mom surge in government deposits. Government deposits have increased almost 1.5-times to AED 429.4bn as of Oct 2022 from end-Dec.

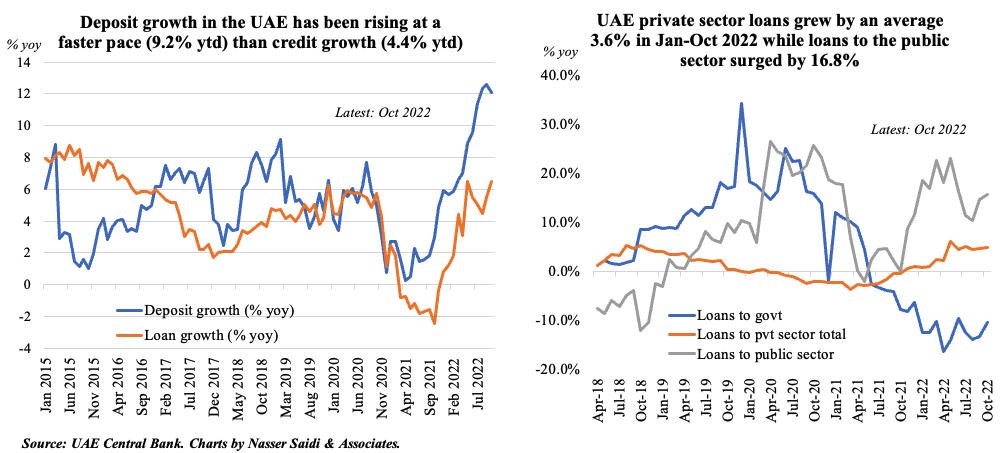

- Deposit growth outpaces credit in the UAE more than two-fold during the Jan-Oct 2022 period; in Oct 2022, growth in total bank deposits was supported by a 0.4% mom uptick in resident deposits and growth in non-resident deposits by 4.2%.

- Claims to the private sector inches up in 2022, rising by an average 3.6% in Jan-Oct, while public sector loan growth is in double-digits (average in Jan-Oct: 16.8%).

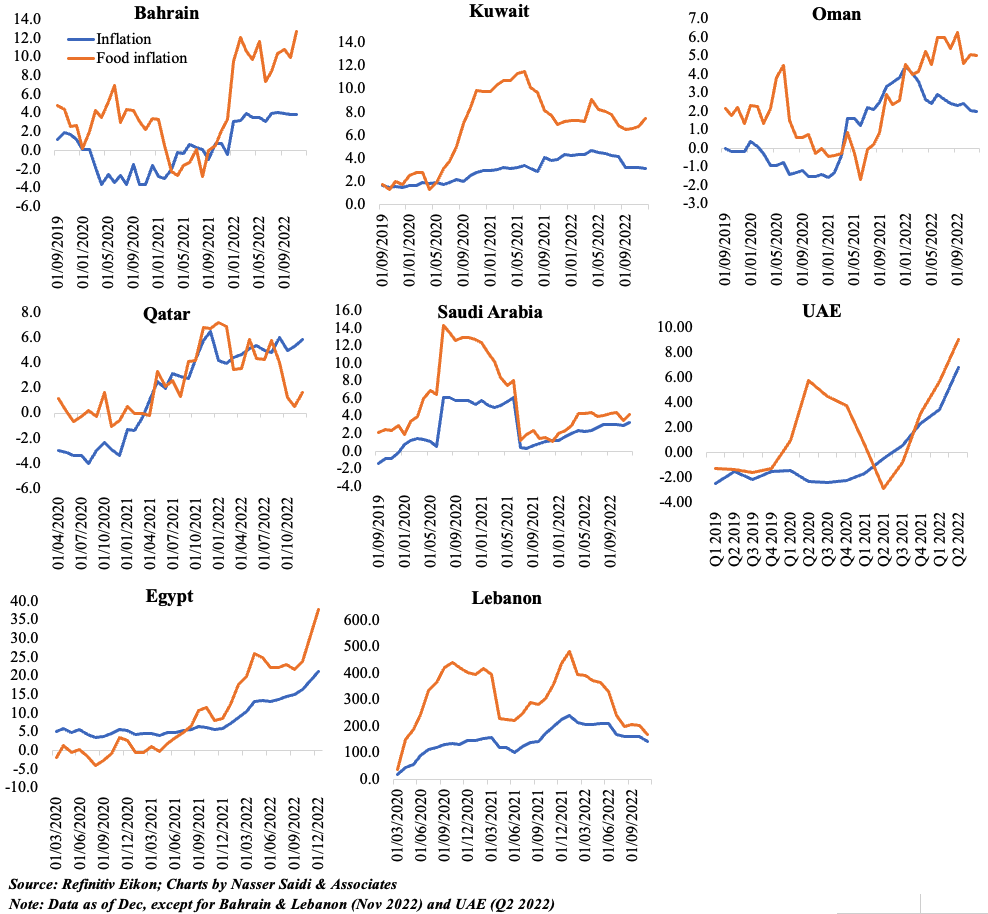

3. Inflation in MENA remains higher among oil importers. GCC inflation will moderate this year, thanks to dampened demand (from tighter monetary policy) & weaker growth. Keep an eye out for sticky upticks in service sector costs

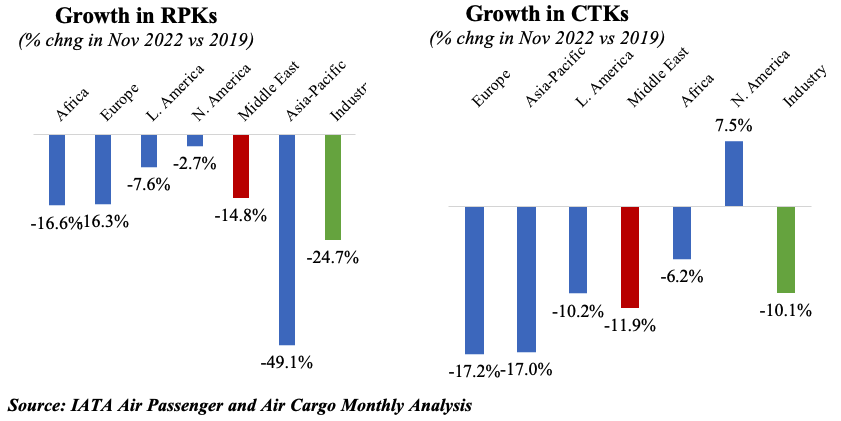

4. Passenger traffic is recovering thanks to re-opening of more routes & increase in global demand; cargo volumes are easing

- According to IATA data, passenger traffic measured in revenue passenger-kilometers (RPKs) globally grew by 41.3% yoy in Nov, with international traffic performing well (falling just 26.3% short of Nov 2019 levels) amid increased demand for air travel. Overall growth was reaching closer to pre-pandemic levels in both North America and Latam, while in the Middle East, the Nov reading was just 14.8% lower than Nov 2019.

- China’s reopening of borders is yet to be reflected in the passenger traffic data. But the outlook looks promising: average daily tickets sold for international flights grew by more than 85% for both outbound and inbound travellers soon after the announcements.

- Air cargo activity softened in Nov, with overall global air cargo tonne-kilometers (CTKs) lower by 10.1% yoy compared to Nov 2019 while in the Middle East it was down by 10.2%. The Middle East-Europe traffic fell by 16.3% yoy in Nov (Oct: -12.1%) while the Middle East-Asia segment remained largely unchanged (-15.5% yoy).

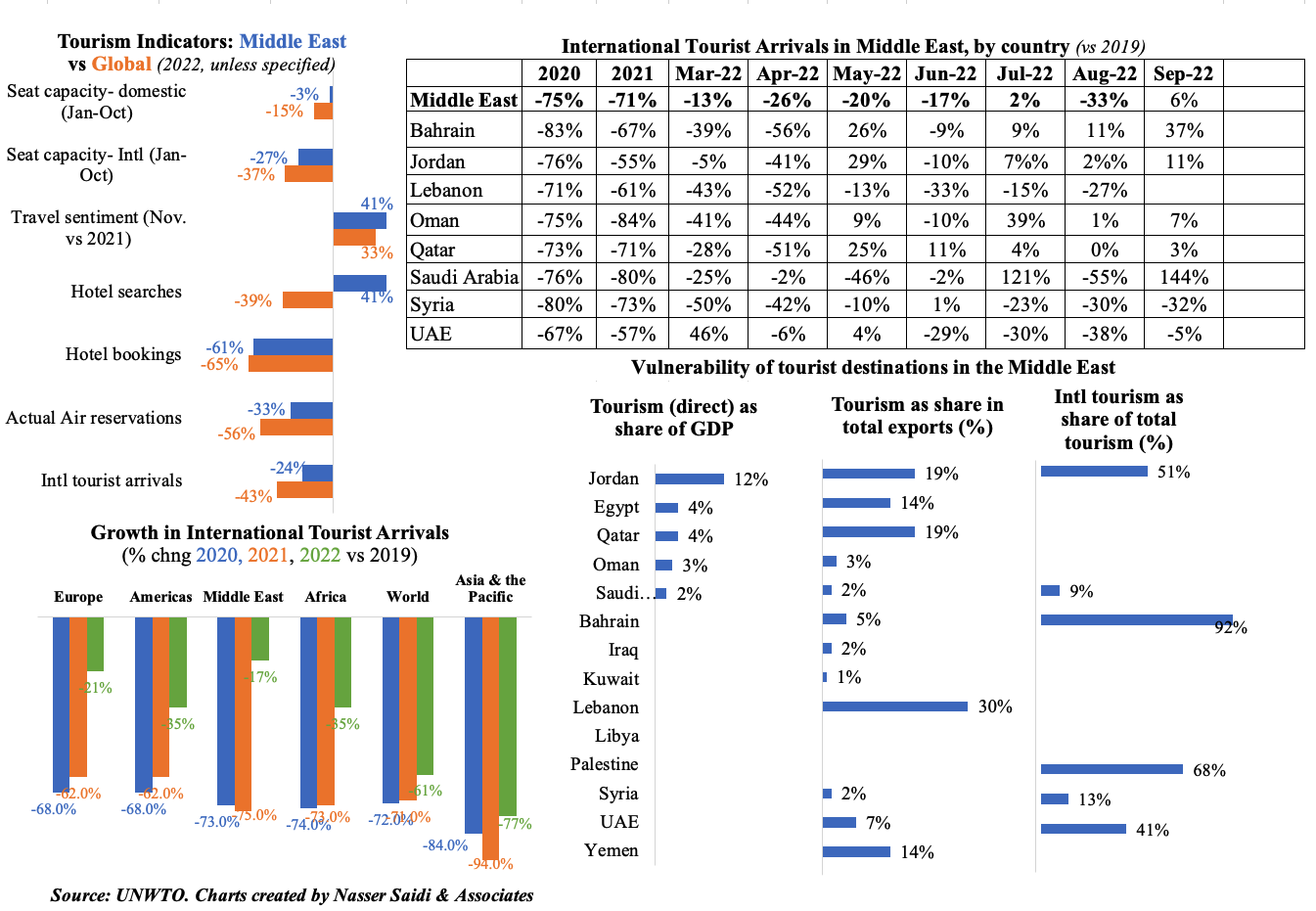

5. Tourism Recovery Evident in 2022; Middle East posts strongest post-Covid recovery in international tourist arrivals (-17% vs 2019). Direct contribution of tourism to GDP estimated at 3.8% in Middle East vs 2.2% globally