Markets

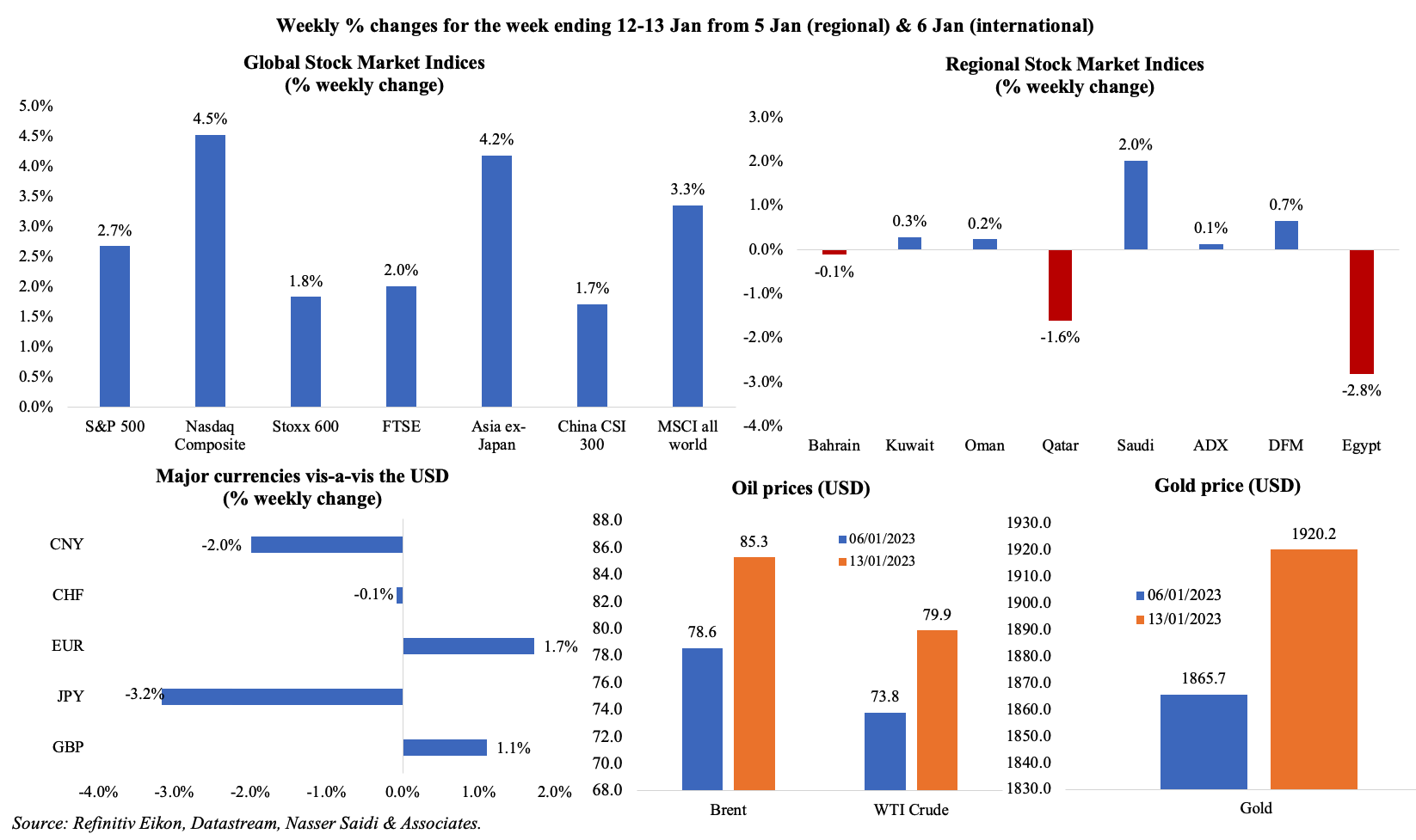

Equity markets recovered last week as earnings season started, with US stocks posting the largest weekly gain in 2 months alongside gains in Europe (STOXX closed at its highest level since Apr, on lower energy prices and expectations of a slowdown, rather than a full-blown recession) and in Asia. Most regional markets closed higher, in line with global equity markets and oil prices. The USD slipped to a 7-month low last week and to its lowest level vis-à-vis the yen since late-May given higher expectations that the BoJ may tweak or abandon its yield curve control policy at the meeting this week. Oil prices increased by more than 8% from the week ago, the biggest weekly gain since Oct, on expectations of higher demand from China; gold price also rose.

Global Developments

US/Americas:

- Inflation in the US eased to 6.5% yoy in Dec (Nov: 7.1%), posting the smallest gain since Oct 2021, while core inflation declined to 5.7% (Nov: 6%). In mom terms, inflation dipped by 0.1%, falling for the first time since May 2020; gasoline prices slipped by 9.4% while food prices edged up by 0.3% (the smallest increase in nearly 2 years).

- The US government’s budget deficit narrowed to USD 85bn in Dec (Nov: USD 249bn), bringing the Oct-Dec deficit to USD 421.41bn, up 12% yoy. Compared to Dec 2021, the deficit in Dec 2022 was four times higher, as spending increased amid a decline in revenues.

- NFIB business optimism index fell to a 6-month low of 89.8 in Dec (Nov: 91.9), with 32% of owners reporting inflation as the single most important business problem and expectations for better business conditions over the next 6 months worsening by 8 points to -51%.

- Michigan consumer sentiment index increased to 64.6 in Jan (Dec: 59.7), clocking in the highest reading since Apr, thanks to improvements in both current conditions (68.6 from Dec’s 59.4) and expectations (up by 2.1 points to 62). The five-year consumer inflation expectation inched up to 3% (Dec: 2.9%).

- Initial jobless claims unexpectedly slipped by 1k to 205k in the week ended Jan 7th, the lowest level since end-Sep, with the 4-week average inched lower by 1,750 to 212.5k. This is despite the layoffs in the tech sector, as well as lower headcounts in sectors affected by the interest rate hikes (including real estate). Continuing jobless claims dropped by 63k to 1.634mn in the week ended Dec 31st, below pre-pandemic levels.

- The US Treasury Secretary warned last week that the nation was on track to reach the debt limit by this Thursday. The ceiling was last raised in Dec 2021 by USD 2.5trn to a total of USD 31.4trn. The US had hit its debt ceiling in 2011, then leading to a downgrade in its credit rating and a drop in stock prices.

Europe:

- Industrial production in Germany rebounded by 0.2% mom in Nov (Oct: -0.4%), supported by gains in intermediate and capital goods (+1.2% and 0.7% respectively). In yoy terms, IP declined by 0.4%.

- Industrial production in euro area grew by 2% yoy in Nov, slowing from Oct’s 3.4% gain. In mom terms, IP grew by 1% (Oct: -1.9%), thanks to upticks across most sectors – capital (+1%), intermediate (+0.8%) and durable goods (+0.4%).Differences were stark across EU: France growing by 2.1% while Italy and Spain posted drops (-0.3% and -0.7% respectively).

- Trade deficit in the euro area narrowed to EUR 11.7bn in Nov (Oct: EUR 26.96bn). Compared to a year ago, deficit widened from EUR 3.9bn, as exports rose at a slower pace (+17.2% yoy) than imports (20.2%). Meanwhile, trade gap in the EU reached EUR 418.4bn in the Jan-Nov 2022.

- Sentix investor confidence in the eurozone climbed to -17.5 in Jan (Dec: -21), the highest level since Jun 2022, as the expectations index improved to -15.8 (Dec: -22.0), the strongest reading since Feb 2022.

- Unemployment rate in the eurozone is at a record low of 6.5% in Nov: the unemployment rate dropped in Italy, France and Spain by 0.1ppt to 7.8%, 7% and 12.4% respectively versus unchanged at 3% in Germany.

- GDP in the UK inched up by 0.1% mom in the 3 months to Nov (prev: 0.5%), thanks to a boost in services sector output (+0.2%) and increased spending on video games. During the same period, industrial production fell by 0.2% and manufacturing by a worse 0.5% (driven by a drop in the volatile pharmaceuticals production).

- UK’s trade balance posted a deficit of GBP 1.8bn in Nov from a revised surplus GBP 1.5bn the month before. Exports fell 2.2% to a 4-month low of GBP 72.9bn, while imports were up by 2.3% to GBP 74.7bn.

- Like for like retail sales in the UK increased in Dec, up by 6.5%, from Nov’s 4.1%. Food and drink sales surged by 8% in the run up to Christmas, the first since restrictions were lifted. However, sales were up largely due to the increase in prices (vs. volume of goods bought).

Asia Pacific:

- China’s inflation inched up to 1.8% yoy in Dec (Nov: 1.6%), driven largely by the 4.8% increase in food prices while non-food inflation remained unchanged at 1.1%. Full-year inflation stood at 2% in 2022, lower than the government’s 3% target. Separately, producer prices declined 0.7% in Dec (Nov: -1.3%), posting the 3rd consecutive month of deflation, as domestic demand weakened.

- Exports from China declined by 9.9% yoy in Dec (Nov: -8.7%) alongside a 7.5% drop in imports, widening the trade surplus to USD 78bn (Nov: USD 69.84bn). For the full year, exports and imports grew by 7.7% and 1.1% respectively. India’s trade deficit with China crossed USD 100bn for the first time last year while China’s trade with Russia touched a record-high USD 190bn (CNY 1.28trn).

- Money supply in China grew by 11.8% yoy in Dec (Nov: 12.4%). New loans unexpectedly increased to CNY 1.4bn in Dec (Nov: CNY 1.2bn), thereby setting a record for new bank lending in 2022 (CNY 21.31trn). Growth of outstanding total social financing slowed to 9.6% in dec (Nov: 10%).

- Inflation in Tokyo increased to 4% yoy in Dec (Nov: 3.7%), for the first time since 1982. Core CPI (excluding fresh food) also rose to 4% from 3.6% the month before. Excluding both food and energy, prices were up by 2.7% (Nov: 2.4%). Prices have exceeded the BoJ’s 2% target for 7 months now. Separately, wholesale prices in Japan jumped a record 9.7% yoy in 2022, twice as fast as in 2021.

- Japan’s leading economic index declined to 97.6 in Nov (Oct: 98.6) while the coincident index eased to 99.1 in Nov, the lowest since May, and down from Oct’s 99.6 reading.

- Overall household spending in Japan fell by 1.2% yoy in Nov (reversing Oct’s 1.2% gain), declining for the first time in 3 months; households of two or more people spent an average JPY 285,947 in Nov.

- Current account balance in Japan surged to a surplus of JPY 1.8trn in Nov from a deficit of JPY 64.1bn the month before. This is the first surplus recorded in 8 months, thanks to a combination of a pause in yen’s weakening, lower oil prices and recovery in inbound tourism.

- Consumer price index in India eased to a one-year low of 5.72% in Dec (Nov: 5.88%). Led by lower food prices. However, core inflation at around 6% remains concerning, with health and education costs rising to 6.1% and 5.9% respectively.

- India’s industrial output rebounded by 7.1% yoy in Nov (Oct: -4%), resulting in the cumulative output growing by 5.5% in Apr-Nov (prev: 5.3%). Production grew for all six sub-sectors for the first time since Jun 2022; consumer durables and capital goods output grew by 5.1% and 20.7% respectively.

- Bank of Korea raised interest rates by 25bps to 3.5% at last week’s meeting, the 10th hike in the current tightening cycle which began in Aug 2021, while hinting that the rates will hold steady (leading to a plunge in bond yields).

Bottom line: Though headline inflation readings across the globe have been easing, the rising core inflation numbers along with higher inflation expectations remain concerning (in many cases driven by essentials like housing costs and/ or health and education) for policymakers in the backdrop of many central banks signalling a softer pace of hikes going forward, leading markets higher. This week’s BoJ meeting will be closely watched to see how the BoJ deals with its yield curve control policy; another key data point is the release of Q4 GDP numbers from China.

Regional Developments

- The World Bank’s latest Global Economic Prospects report forecasts growth in the MENA region to decline to 3.5% this year and 2.7% in 2024, following 5.7% growth in 2022. In the GCC, GDP is projected to grow by 3.7% and 2.4% in 2023 and 2024 respectively.

- Bahrain’s Crown Prince announced an additional month of financial support for low-income families alongside various measures to lessen the impact from inflation. This includes temporary suspension for three months of (a) industrial land fees for food storage facilities and (b) approvals and fees required by the Ministry of Industry and Commerce for supermarkets to run promotional campaigns alongside increased monitoring of market prices.

- Tamkeen invested BHD 98mn (USD 260.6mn) in funding support last year in Bahrain, supporting about 4100 firms (of which 48% were SMEs).

- An IMF staff report revealed that Egypt committed to slower investment in public projects (to reduce inflation and preserve foreign exchange), reversal of curbs on import financing, an increase in fuel product pieces, greater exchange rate flexibility as well as more efficient monetary policy while agreeing to the 46-month arrangement of the USD 3bn financial support package. The IMF disclosed that Egypt will need about USD 17bn in funding from global partners to close its financing gap.

- Annual urban consumer inflation in Egypt rose to 21.3% in Dec (Nov: 18.7%), the highest since end-2017, given the devaluation in Oct and restriction on imports. Core inflation rose to 24.4%.

- The Egyptian pound fell to a new low last Wednesday, falling more than 13% to below 32 to the USD. The EGP has plummeted by a cumulative 51% against the USD since March.

- In a bid to reduce spending amid pressure on the EGP, Egypt’s government has asked ministries to postpone any new national project reliant on foreign currency as well as seek approval from the finance ministry for any foreign currency spending. Ministries of health, interior, foreign and defence were exempted as well as agencies dealing with subsidised food products and energy.

- Eni and Chevron disclosed a new gas discovery in an Egyptian offshore field in the Eastern Mediterranean Sea; both firms hold a 45% stake each, while Egypt’s Tharwa Petroleum Company SAE holds a 10% interest.

- Oil exports from Iran surged to new highs – ranging between 1.1 to 1.2mn barrels per day- in Nov-Dec 2022, thanks to higher shipments to China and Venezuela, according to various firms that track supply. Iran’s oil ministry does not release such data though draft state budget is based on even higher shipments of 1.4mn bpd, according to the Fars news agency.

- The Wall Street Journal reported that Iran has doubled the price for additional shipments of oil to Syria (to a rate of more than USD 70 per barrel) and has also refused to deliver shipments on credit.

- Iraq’s oil production remained unchanged at 4.43mn barrels per day in Dec, in line with OPEC+ quota, according to SOMO data.

- Germany is in discussions with Iraq to import natural gas, disclosed the German Chancellor though no details were given on the volumes. Germany has already signed deals with Qatar and the US to import gas.

- Jordan received 4.6 million visitors in 2022, almost four times the level from 2020, resulting in receipts of USD 5.3bn. Petra alone welcomed 900k visitors last year, inching close to the record 1mn touched in 2019.

- Kuwait expects to ship 2.5mn tonnes of diesel to the EU in 2023, partly replacing the oil product imports from Russia. Sales of jet fuel also expected to double to 5 million tons.

- FDI inflows into Oman increased by 10.4% yoy to OMR 18.14 in Jan-Sep 2022. FDI into the manufacturing sector alone grew by 13.6% to OMR 1.72bn during the same period.

- Qatar’s central bank disclosed that foreign reserves and hard currency liquidity stood at QAR 230bn (USD 62.7bn) in Dec, recording their “highest growth during the last two years”.

- Qatar’s IT services firm MEEZA launched its IPO process yesterday (on Jan 15th) – this will be the first IPO in almost three months on Qatar Exchange. About 6 firms are likely to go public through IPOs in the next 6 months.

- Aftermath of hosting the World Cup: Qatar expects more than 50 cruise liners to dock before end-Apr, bringing in an estimated 200k cruise visitors to the country.

- Energy ministers of both Qatar and the UAE remarked (at a conference) that natural gas will be needed for a long time; even with increases in installed renewable energy, more investment would be needed to support supply security and affordable prices of natural gas.

- IATA revealed that Middle East carriers posted a 14.7% decline in cargo volumes in Nov 2022, marginally improving from Oct’s 15% drop. Global cargo volumes were down 13.7%.

- Investment banking fees in the MENA region grew by 5% yoy to USD 1.6bn in 2022, according to Refinitiv data. This contrasts the global picture where fees declined by 33%. Advisory fees earned from M&A transactions surged by 35% to USD 509.6mn. Additionally, 38% and 35% of all MENA fees were generated in Saudi Arabia and the UAE respectively.

Saudi Arabia Focus

- Saudi Arabia’s inflation inched up to 3.3% in Dec (Nov: 2.9%), driven by higher cost of housing (5.9% yoy and 0.9% mom). Price of food and beverages were up by 4.2% yoy though fell by 0.1% mom.

- The Diriyah Project was announced as the fifth giga-project under the PIF’s mandate in addition to the four others NEOM, Red Sea, Qiddiya and ROSHN.

- Saudi Arabia has signed 5 agreements worth more than SAR 43bn (USD 11.5bn) to setup projects in the industrial cities of Ras Al Khair and Yanbu. The projects include a factory for smelting and rolling aluminium and its alloys and building a “high-purity chemicals” unit among others.

- The Saudi Fund for Development will finance the purchase of oil derivatives worth USD 1bn to support Pakistan, disclosed the latter’s economic affairs division. This announcement followed a report that Saudi was planning to increase its investments in Pakistan to USD 10bn (from the USD 1bn announced last Aug).

- Saudi Arabia’s energy minister disclosed plans to use its national uranium resources to support its nuclear power industry (in a bid to diversify its energy mix).

- Saudi Arabia’s PIF and Ma’aden signed a joint-venture agreement to establish a new company that aims to invest in mining assets globally to secure strategic minerals for Saudi’s industrial development.

- The PIF raised its stake in Japan’s Nintendo Co to 6%, increasing its exposure to the video gaming industry, from the 5% earlier.

- The “2022 Saudi Arabia Venture Capital Report”, prepared by MAGNiTT, showed that it was the second-most funded market in the region – attracting 31% of total capital deployed last year. A record high of 104 investors participated in deals closed by Saudi startups in 2022, up 30% yoy while the number of exits doubled to 10.

- Contracts worth SAR 25.2bn (USD 6.7bn) were awarded in Saudi Arabia in Q3 2022, according to a US Saudi Business Council Report. The total value of awarded contracts surged by 67% yoy to SAR 119.7bn in Jan-Sep 2022. Oil and gas, transportation and real estate were the top 3 sectors.

UAE Focus![]()

- UAE foreign assets inched up by 0.4% mom to AED 426.03bn at end-Oct, thanks to the increase in bank balances and deposits with banks abroad (+2.2%), according to central bank data. Domestic credit to the public and private sectors inched up by 0.7% and 0.1% respectively while total bank deposits grew by 0.8% to AED 2.205trn.

- Dubai PMI rose to 55.2 in Dec (Nov: 54.9): though job creation slipped to the weakest since Sep, new work received by construction firms rose at the strongest rate in nearly two years.

- UAE agreed to loan USD 1bn to Pakistan, in addition to rolling over an existing USD 2bn loan, according to Pakistan’s information minister. This will provide a breather to the economy as forex reserves held by Pakistan’s central bank had fallen to just USD 4.3bn (because of external debt repayments), not enough for even 3 weeks of imports.

- The DIFC’s CEO stated that the contribution of DIFC-based financial firms to the financial services sector is estimated to have surpassed 13% of Dubai’s nominal GDP in 2021. Separately, the DFSA revealed that authorised firms in the DIFC increased by 11% yoy to 588 in 2022 while licensing and registration activity grew by 54%.

- The DMCC announced a 7% yoy increase in new member company registrations in 2022, attracting 3049 news firms. The DMCC Crypto Centre has over 500 members, making it the largest concentration of crypto and blockchain firms in the region.

- UAE and UK signed an MoU to boost cooperation in the energy sector covering peaceful nuclear energy, low-carbon hydrogen, and in clean and renewable energy.

- Abu Dhabi’s Masdar signed an MoU with four Dutch firms to develop a green hydrogen supply chaine. exploring the option of production in Abu Dhabi and exporting to Europe’s key sectors via the Netherlands.

- Masdar signed an agreement with Kyrgyzstan’s energy ministry to develop clean energy projects: it will start with a 200 MW solar PV plant scheduled to begin operations in 2026.

- UAE’s MOHRE issued fines of AED 400mn (USD 108.9mn) to firms failing to meet Emiratisation targets in 2022. Nearly 8900 firms achieved the targets set.

- In 2022, a total of 90,881 real estate transactions were registered in Dubai, exceeding 2009’s previous record high of 81,182 transactions, according to CBRE. Off-plan property sales surged by 92.5% while secondary sales posted an increase of 32.4%.

- The Dubai branch of ICBC, the largest global lender by assets, is planning to issue a benchmark-sized 3-year green bond, reported Reuters.

- STR’s preliminary Dec 2022 report shows that occupancy rate in Dubai hotels reached a high of 91% on New Year’s Eve, with the average daily rate (ADR) at AED 1765.51. Overall occupancy rate was 76.6% in Dec, with ADR of AED 892.24.

- The number of golden visas issued in all categories surged by 68.9% yoy to 79,617 in 2022, according to the GDFRA in Dubai.

- The UAE announced a ban on the import, production and circulation of single-use plastic shopping bags from Jan 2024, with a similar ban on plastic cups, plates and cutlery from Jan 2026.

Media Review

A better year for stock markets?

Dollars flow into Egypt currency market after depreciation: bankers

New COP28 president wants renewable energy generation to triple by 2030

https://www.ft.com/content/10e114ed-c426-45f7-8548-d9e0540811ff

Explainer: How does Japan’s yield curve control work?

https://www.reuters.com/markets/asia/how-does-japans-yield-curve-control-work-2023-01-16/

Powered by: