Markets

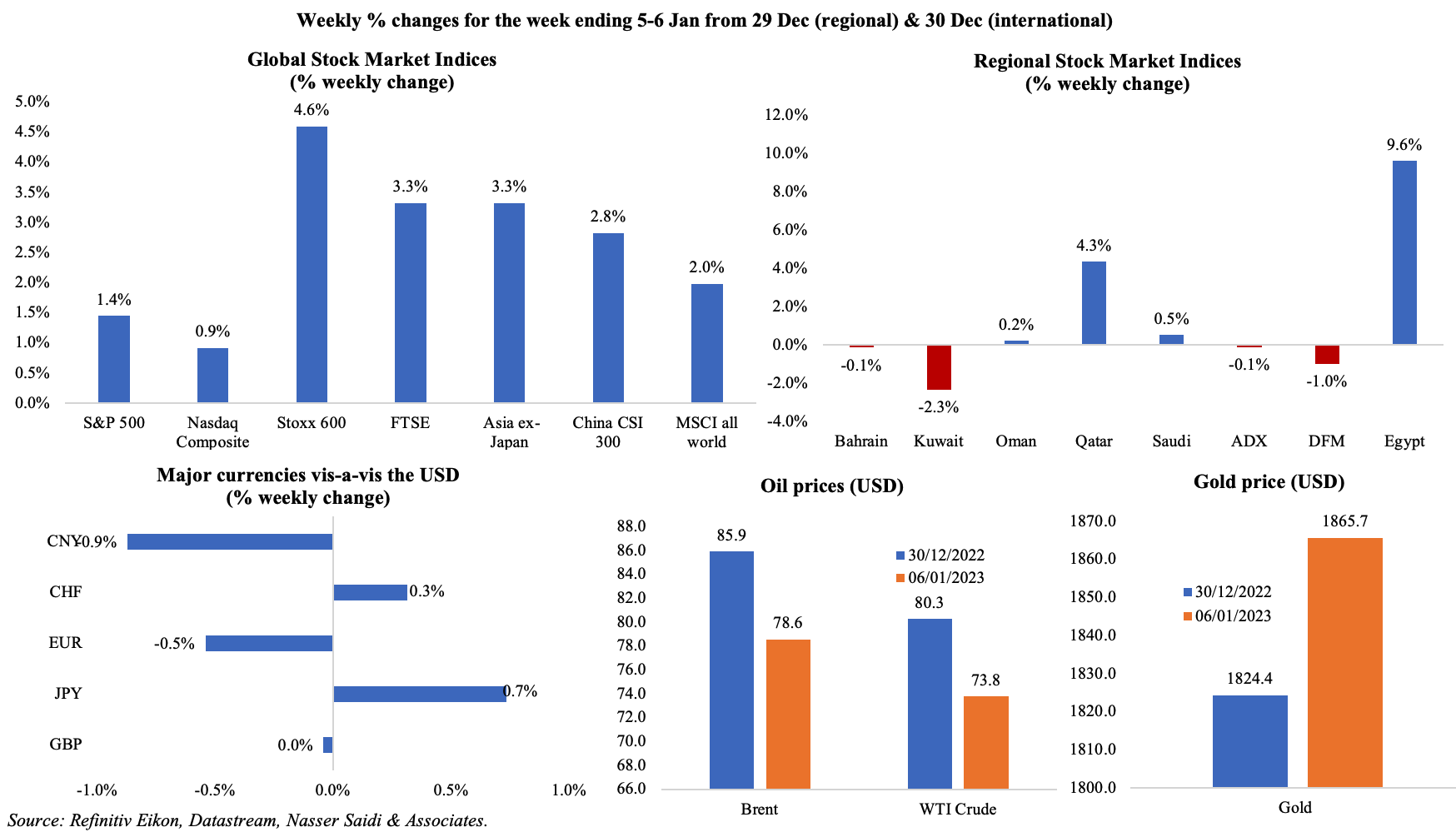

Equity markets rallied last week after a disappointing end to 2023, after indications of easing inflation (in the eurozone) and slowing wage growth (in the US, even though remaining strong). Among regional markets, Qatar and Egypt had a strong week (with the latter touching the highest level since Aug 2018) while UAE markets ended in the red. The yen climbed to a 7-month high on hopes of a shift in BoJ’s policy, the Chinese yuan touched a 4.5 month high on Thursday while the dollar weakened after the non-farm payrolls and US service sector contraction reports. The latter supported the increase in gold price, though oil prices declined (by more than 8% from a week ago) on worries that a potential recession would weaken demand significantly.

Global Developments

US/Americas:

- Non-farm payrolls increased by 223k in Dec (Nov: 256k), led by leisure and hospitality jobs, while the unemployment rate inched lower to a pre-pandemic low of 3.5% from 3.6% the month before. Average hourly earnings weakened in Dec, rising by 4.6% (compared to Nov’s 4.8% gain). Labour force participation rate inched up to 62.3%.

- Private payrolls increased by 235k in Dec (Nov: 127k), according to ADP, with service providers adding 213k jobs (led by leisure and hospitality).

- JOLTS job openings fell by 54k to 10.458mn in Nov, slightly lower than Oct’s 10.512mn. There were 1.74 jobs for every unemployed person and job openings rate was unchanged at 6.4% (though it was 0.9ppts below its peak in Mar 2022).

- Initial jobless claims inched up by 19k to 204k in the week ended Dec 31st, the lowest level since end-Sep, with the 4-week average inched lower by 6,750 to 213.75k. Continuing jobless claims dropped by 24k to 1.717mn in the week ended Dec 24th.

- FOMC minutes indicated that inflation was still a key focus point: most Fed officials see the federal funds rate peaking between 5% and 5.25% as an emphasis was placed on seeing “substantially more evidence” of easing price pressures.

- Factory orders dropped by 1.8% mom in Nov (Oct: 0.4%), driven by a decline in civilian aircraft and transport equipment orders (-36.4% and -6.3% respectively) while motor vehicle orders rose by 0.6%.

- Goods and services trade deficit in the US narrowed to USD 61.5bn in Nov, the lowest level since Sep 2020. Imports fell by 6.4% to an 11-month low of USD 313.4bn (dragged down by pharmaceutical preparations, auto vehicles and parts) while exports weakened by 2%. Average goods and services deficit fell USD 1.4bn to USD 71.2bn in Sep-Nov 2022.

- ISM Manufacturing PMI slipped to 48.4 in Dec (Nov: 49) as new orders fell to 45.2 (the lowest since May 2020, and from 47.2) amid a rebound in employment (51.4 from 48.4) and prices paid tumbling to 39.4 (the lowest level since Feb 2016, and from Nov’s 43).

- ISM’s non-manufacturing PMI slumped to 49.6 in Dec (Nov: 56.5), contracting for the first time since May 2020 and the weakest reading since late 2009, thanks to weaker demand and a fall in new orders (to 45.2 from 56) amid decline in employment (49.8 from 51.5). Separately, prices paid for inputs slipped to 67.6, the lowest since Jan 2021.

- S&P Global manufacturing PMI in the US stood at 46.2 in Dec, down 1.5 points from Nov, recording the biggest contraction since May 2020, as output and new orders contracted given weak demand (due to rising economic uncertainty).

Europe:

- Inflation in the eurozone eased to 9.2% in Dec (Nov: 10.1%): it ranged from 20.7% in Latvia to 5.6% in Spain. However, core inflation inched up to a new high of 5.2% from Nov’s 5.1% as costs of services and non-energy industrial goods edged higher.

- Producer price index in the euro zone fell by 0.9% mom in Nov, as energy costs eased alongside a 0.4% monthly fall in prices of intermediate goods.

- Inflation (harmonised index of consumer prices) in Germany declined to 9.6% in Dec (Nov: 11.3%), the lowest reading in 4 months. Energy inflation slowed to 24.4% in Dec (Nov: 38.7%) while services inflation rose to 3.9% (Nov: 3.6%).

- Manufacturing PMI in the eurozone inched up to 47.8 in Dec (Nov: 47.1) with manufacturing output falling the least since Jun while the employment growth slowed to a 22-month low. Composite PMI inched up to 49.3 (Nov: 48.8) thanks to the uptick in services PMI (0.7 points to 49.8).

- Germany’s manufacturing PMI slipped to 47.1 in Dec from the preliminary estimate of 47.4 (but higher than Nov’s 46.2), the 6th straight month of sub-50 readings; new orders were down for the ninth month in a row. Services PMI inched up to 49.2 (from 46.1) and so did composite PMI (49 from 46.3).

- Exports from Germany unexpectedly fell by 0.3% mom in Nov (Oct: 0.8%) on weak global demand and imports posted a larger drop of 3.3%. Exports to the US was down 1.5% while that to the EU states fell by 0.4%. Trade surplus widened to EUR 10.8bn (Oct: EUR 6.8bn).

- Germany factory orders declined by 5.3% mom in Nov (Oct: +0.6%), as foreign orders plunged (-10.3% from the Euro Area and -6.8% from other countries) amid a 1.1% fall in domestic demand. In yoy terms, factory orders shrank by 11%.

- Germany retail sales rebounded in Nov, rising by 1.1% (Oct: -2.8%), thanks to an uptick in non-food sales (+2.1%). Though sales tumbled in yoy terms – 5.9% yoy in Nov – it was 2.2% higher compared to pre-Covid.

- Eurozone retail sales increased by 0.8% mom in Nov, reversing Oct’s 1.5% decline: sales of non-food items and automotive fuel rose by 1.6% and 1% respectively while sale of food, drinks and tobacco slipped by 0.9%. In yoy, sales declined by 2.8%, from Oct’s 2.6% drop.

- German unemployment rate eased to 5.5% in Dec, with the number of unemployed declining unexpectedly by 13k to 2.52mn.

- UK manufacturing PMI improved to 45.3 in Dec from the preliminary estimate of 44.7 (though lower than Nov’s 46.5 reading): this was a 31-month low and one of the weakest since mid-2009 (excluding the lockdown reading). One silver lining was that input costs ticked up by the least since Nov 2020.

- Economic sentiment indicator in the euro area improved to 95.8 in Dec (Nov: 94), though it was still below the long-run average. Business climate remained unchanged at 0.54 in Dec, its lowest level since Mar 2021. Consumer confidence inched up for a 3rd consecutive month, rising to -22.2 in Dec (Nov: -23.9), the highest level since May.

Asia Pacific:

- China’s Caixin manufacturing PMI edged down further to 49 in Dec (Nov: 49.4), the lowest since Sep, as infections surged curbing production and demand.

- Caixin services PMI improved to 48 in Dec (Nov: 46.7), as both new orders and output shrank at softer rates though employment continued to decline. Future outlook increased to a 17-month high.

- Japan’s manufacturing PMI slipped to 48.9 in Dec (Nov: 49), the weakest since Oct 2022, as both output and new orders contracted for a 6th straight month while input price inflation cooled to a 15-month low.

- India’s manufacturing PMI jumped to 57.8 in Dec (Nov: 55.7), the highest reading since Oct 2020 and averaged 56.3 in the Oct-Dec quarter. Output growth touched a 13-month high and new orders rose the most since Feb 2021 while cost pressures were muted.

- Singapore’s GDP grew by 0.2% qoq and 2.2% yoy in Q4, bringing full year growth to 3.8% (higher than the official forecast of around 3.5% but slower than 2021’s 7.6% growth).

- Manufacturing PMI in Singapore stayed below-50 in Dec, with a reading of 49.7 (Nov: 49.8) as sub-indices of new orders, new exports, factory output, and inventory declined faster.

- Retail sales in Singapore grew by 6.2% yoy in Nov (Oct: 10.3%), following seven consecutive months of double-digit growth. Sales moderated across multiple categories including food & alcohol (rising 57.6%, down from Oct’s 61.3%),wearing apparel (34.1% from 53.7%) and recreational goods (16.2% from 23.5%) among others.

Bottom line: Global manufacturing PMIs ended 2023 on a weak note: readings indicate the weakest quarter since 2009 (excluding initial lockdown months) though the cooling of inflationary pressures offers some respite. In this context, US and Tokyo inflation numbers will be key to watch this week, after data from the eurozone showed a decline from earlier highs. Any easing will trigger chatter about potential monetary policy easing later in 2023. Meanwhile, even as China reopened its doors after 3 years of isolation, concerns related to demand and supply chain disruptions remain – as the economy battles a Covid19 surge amid concerns related to vaccination rates and effectiveness.

Regional Developments

- The Egyptian pound plummeted last week, to just over USD 26.3 for USD 1 from around 24.7, recording its largest single-day slide since the IMF deal was agreed to in mid-Dec. The EGP weakened by over 40% since the beginning of 2022.

- Microfinance offered by Egypt’s banks and financial institutions increased to EGP 64.6bn for 4.5 million beneficiaries in Jun 2022, compared to EGP 6.4bn in Dec 2016.

- Egypt’s digital services exports touched USD 4.9bn in 2022, according to the ministry of communications ⁢ the sector contributed 5% to GDP.

- PMI in Lebanon fell to an 11-month low of 47.3 in Dec (Nov: 48.1), as new orders and output declined amid a sharp decline in purchasing power, weak domestic turmoil and ongoing political uncertainty.

- Oman’s ministry of economy forecasts GDP to grow by 5.5% in 2023 (2022: 5%), thanks to an increase in oil and gas production.

- Oil production in Oman increased by 10% yoy to 355.47mn barrels per day during Jan-Nov 2022; oil exports rose by 12.7% to 293.94mn barrels. Oil exports to China, the biggest buyer of Oman’s crude, accounted for over 80% of the nation’s total oil exports during the period.

- Oman’s non-oil exports grew by 50.1% to OMR 5.619bn in the period Jan-Sep 2022; non-oil exports to US, India and Saudi Arabia surged by 84% (to OMR 689.2mn), 81% (to OMR 576.6mn) and 49.4%) to OMR 616.8mn) respectively.

- Qatar PMI increased to 49.6 in Dec (Nov: 48.8), as the FIFA World Cup boosted business activity across wholesale, retail and service providers. Non-oil output rose for the 13th consecutive month and the 12-month outlook strengthened to the highest since Jul 2020.

- Qatari IT services firm MEEZA (partly-owned by Ooredoo) will use book building to carry out an IPO, the first in the country to use the international practices (regulations for which were introduced in Feb 2021).

- QatarEnergy and Chevron Phillips agreed to invest in the USD 6bn Ras Laffan Petrochemicals Complex – the largest of its kind in the Middle East. When it begins production in 2026, the complex is expected to have a capacity of 2.1mn tonnes of ethylene per year, and local polymer production is expected to rise to 4mn tonnes per annum (from 2.6mn currently).

- Qatar announced that it would require all travellers inbound from China to provide a negative Covid19 test resultwithin 48 hours of departure, irrespective of vaccination status.

- UAE’s foreign minister met with the Syrian President last week, with discussions centering around developments in Syria and the wider Middle East.

- Middle East sovereign wealth funds more than doubled their investments in Western economies, including US and Europe, to USD 51.6bn in 2022 (2021: USD 21.8bn), according to the Global SWF report.

- MENA startups secured USD 125mn in funding in Dec across 38 deals, according to Wamda: funding was down by 40% yoy and 72% mom. Overall investment grew by 13% to USD 3.6bn in 2022 across 628 deals.

Saudi Arabia Focus

- Saudi Arabia’s non-oil sector PMI edged down to 56.9 in Dec (Nov: 58.5), as the output (to 61, from 64.6) and new orders components slowed. Job creation was the fastest since Jan 2018 – the employment sub-index rising to 52 from Nov’s 50.6 – while prices charged rose at the fastest pace in 9 months.

- The new companies law in Saudi Arabia will come into force on Jan 19th.The law makes exceptions for companies dealing with those outside the Kingdom: this includes cases where no other offer is technically acceptable or if the offer submitted by a foreign firm with no regional HQ in Saudi is the best offer (and their offer is less than 25% of the 2nd-best offer).

- Industrial licenses issued in Saudi Arabia grew by 5.1% mom to 82 in Nov, with small enterprises acquiring 85.3% of the new licenses. Projects worth SAR 7.2bn (USD 1.9bn) were approved in the month. The total number of existing factories reached 10,742 with investments amounting to SAR 1.4trn.

- Saudi Arabia’s PIF is 6th in the list of top sovereign wealth funds (SWFs) in the world, according to SWF Institute. From the region, Abu Dhabi and Kuwait Investment Authorities are ahead of PIF, with assets worth USD 790bn and USD 750bn respectively.

- The Saudi Central Bank launched a new lab to test open banking services: the first phase of open banking will focus on the account information service and the next payment initiation service. Implementation of open banking is one of the initiatives in Saudi’s Fintech Strategy.

- Saudi Arabia lowered the Feb official selling prices (OSP) for Arab light crude it sells to Asia to USD 1.80 a barrel versus the Oman/Dubai average: this is the lowest since Nov 2021 and is USD 1.45 a barrel less than the Jan OSP.

- Aramco awarded a contract to develop a seawater desalination plant valued at SAR 2.6bn (USD 693mn). The power capacity of the plant (which has a design capacity of 80,000 cubic meters a day) is estimated to be 270-320 megawatts by 2023.

- A new bylaw of private tourism hospitality was approved in Saudi Arabia: this allows citizens to rent residential units to tourists for a fee (allowing for Airbnb style businesses). This allows a maximum of 3 permits issued per property and these permits can last 1-3 years.

- Saudi airline flynas recorded a 91% surge in passenger growth to 8.7mn in 2022. The airline saw a 45% rise in the number of flights operated and a 46% growth in seating capacity.

- Ports in Saudi Arabia reported a 13% increase in the volume of cargo handled to 237mn tons in 2022. Dammam’s King Abdulaziz Port container throughput hit 2m TEUs in 2022 – the highest across the country.

- The rate of Saudization in capital market institutions reached 77% in Q3 2022, according to data from the Capital Market Authority. Total number of employees stood at 5100 at end-Q3, with about 21% of them female.

UAE Focus![]()

- PMI in the UAE slipped to 54.2 in Dec (Nov: 54.4), as output and new business growth dropped to 15-month lows of 58.8 and 55.5 respectively and employment posted the slowest growth rate in 8 months.

- Dubai announced a AED 32trn (USD 8.7trn) economic plan for the next decade, referred to as D33, involving around 100 transformative projects. The aim is that by 2033, foreign trade will double to AED 25.6trn (from AED 14.2trn in the past decade), FDI will cross AED 650mn, private sector investments will hit AED 1trn (from AED 790bn in last 10 years) and domestic demand will rise to AED 3trn (from AED 2.2trn in the last 10 years) among others.

- Population in Dubai increased by 2.1% yoy to cross 3.55mn at end-2022. The data also showed that population increased by 4% after 2020. Dubai’s GDP grew by 4.6% yoy to AED 307.5bn in Jan-Sep 2022.

- Bilateral trade between UAE and Pakistan touched USD 10.6bn in 2023, the “highest volume Pakistan had in the MENA region”, according to Pakistan’s Ambassador to the UAE.

- The MOHRE will apply “financial contributions” to firms that fail to meet Emiratisation targets: the fine will amount to AED 72000 a year, to be paid in a single instalment. Firms must double Emiratisation rate to 4% by end-2023 to avoid imposition of financial contributions by beginning of 2023. The value of monthly fines will increase progressively at a rate of AED 1000 annually until 2026 (when Emiratisation target is set to reach 10%).

- ADNOC has allocated AED 55mn (USD 15bn) to reduce its global emissions: the strategy also includes first-of-its-kind capture carbon and storage project.

- Sports events added AED 9bn to Dubai’s GDP or 2.3% of total GDP, according to a report from the Dubai Sports Council. In 2022, various championships/ events held in the emirate attracted more than 31k athletes and 713k spectators (mostly from overseas).

- Traveller arrivals into Dubai surged by 89% yoy to 23.7mn in 2022, with over 21mn arriving through airports, according to Dubai Media Office. It was also disclosed that on New Year’s Eve alone, there were more than 107k arrivals.

- Dubai Duty Free annual sales surged by 78% yoy to AED 6.4bn in 2022: there were over 17.3mn sales transactions registered last year, or 46k+ transactions per day.

Media Review

The new Gulf sovereign wealth fund boom

https://www.ft.com/content/33a985a5-6955-4f44-869f-82e82e620581

First Abu Dhabi Bank says it had considered making offer for StanChart

What the great reopening means for China—and the world

The Looming Financial Contagion

How Economies and Financial Systems Can Better Gauge Climate Risks

Powered by: