Middle East PMIs. KSA Oil Exports, Monetary Stats, Unemployment. UAE Monetary Stats, Inflation, Tourism.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 6 Jan 2023: Starting 2023 with a Macroeconomic Update

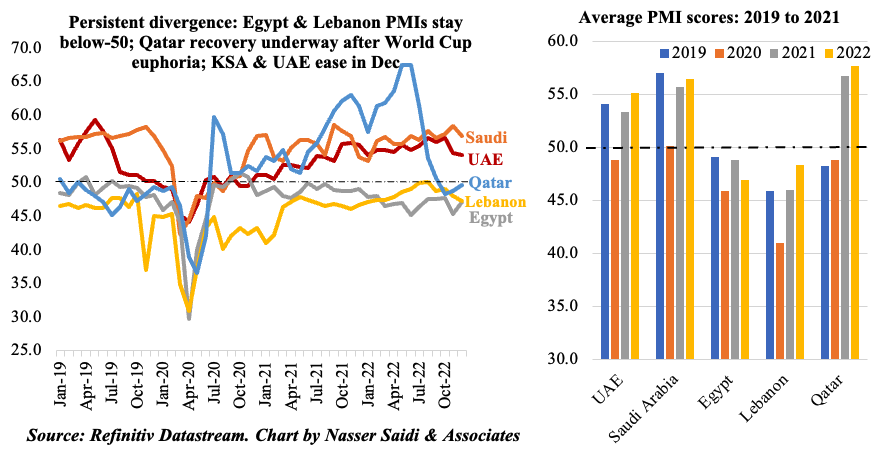

1. A mixed bag of Middle East PMIs in 2022

- Divergence in non-oil sector activity in the Middle East was the main story in 2022: on average, the GCC nations have stayed expansionary in 2022 alongside contractions in Egypt and Lebanon. Both UAE and Qatar have posted a higher average in 2022 compared to pre-Covid while in Saudi Arabia, it was slightly lower.

- Saudi Arabia and the UAE have been spearheading non-oil sector recovery in the region. Both ended Dec on a lower note, but in expansionary territory. Qatar had seen months of optimistic readings prior to the World Cup before it fell under-50 in the months preceding the event (as a result of pause in new work leading up to the mega-event). Qatar in Dec recorded expansion across all sectors of activity – wholesale, retail and service providers – and the 12-month outlook for business activity strengthening further to the highest since Jul 2020.

- Egypt and Lebanon continue to show readings below-50: the former has access to funding from the IMF while the ongoing economic-political turmoil in the latter has meant uncertainty regarding stabilization and an agreement with the IMF.

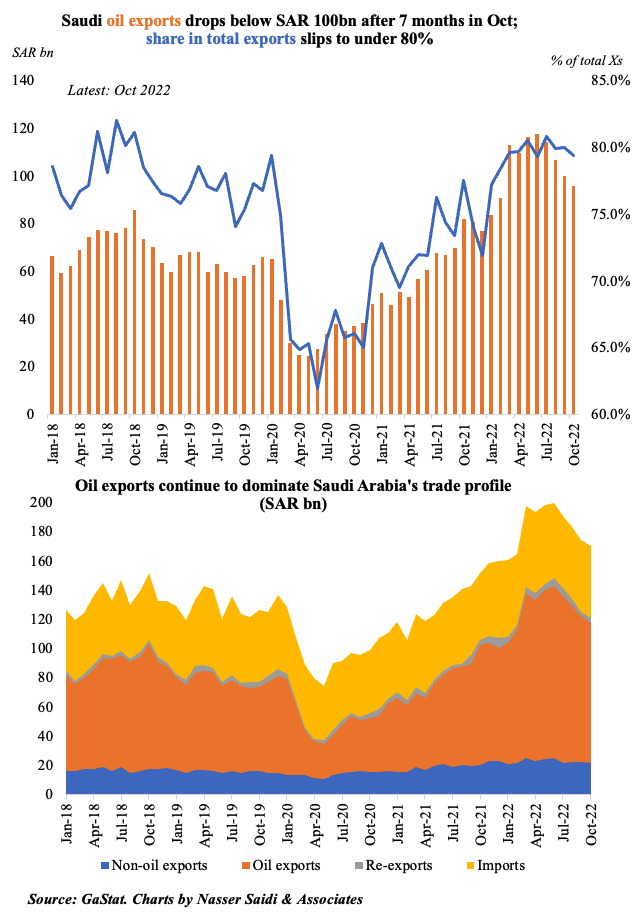

2. Irrespective of non-oil sector activity, oil sector continues to shine in Saudi Arabia

- Saudi Arabia’s oil exports declined to below SAR 100bn in Oct, after 7 consecutive months. Non-oil exports (including re-exports grew by 4.4% to SAR 24.9bn.

- JODI data indicated that Saudi Arabia’s crude exports grew 52,000 barrels per day (bpd) to 7.77mn bpd in Oct, a 30-month high.

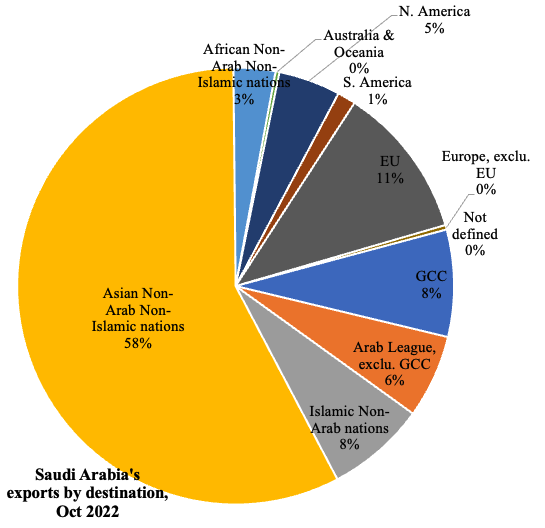

- Exports with major Asian nations increased in Nov – China by 15.7% yoy, South Korea (20.4%), India (11.3%) and Japan (8.7%) – while exports with the US was flat.

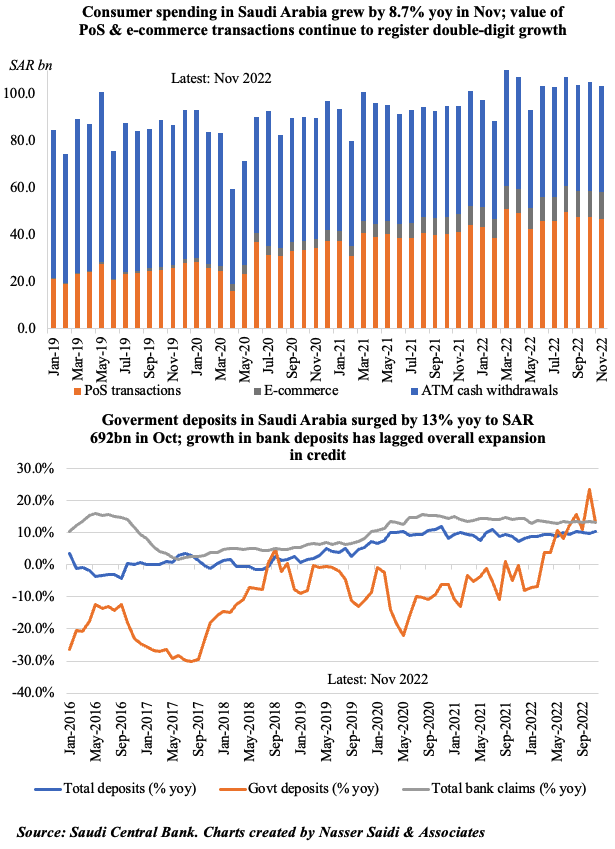

3. Banks in Saudi Arabia are lending at a faster pace compared to deposit growth

- Consumer spending in Saudi Arabia grew by 8.7% yoy in Nov, with e-commerce and point-of-sale transactions driving growth. Supported by the rush of World Cup visitors, ‘hotels’ posted the largest yearly rise in PoS transactions in Nov.

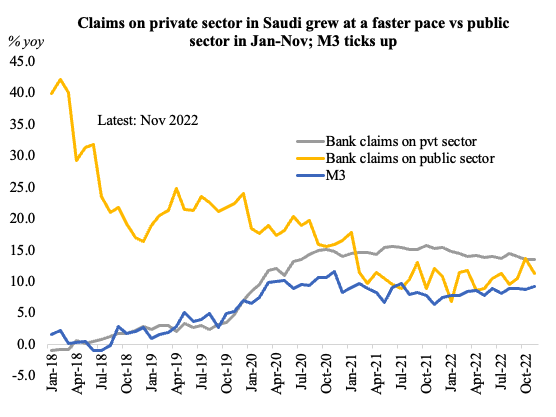

- Government deposits increased by 13% yoy to SAR 692bn in Nov while overall deposit growth stood at 9.6% in Nov. Lending has been rising in 2022: an average gain of around 13% yoy every month. Meanwhile the broad measure of money supply (M3) rose by 9.3% yoy and by 0.6% mom.

- Claims to the private sector inched up faster in Jan-Nov, compared to claims on the public sector.

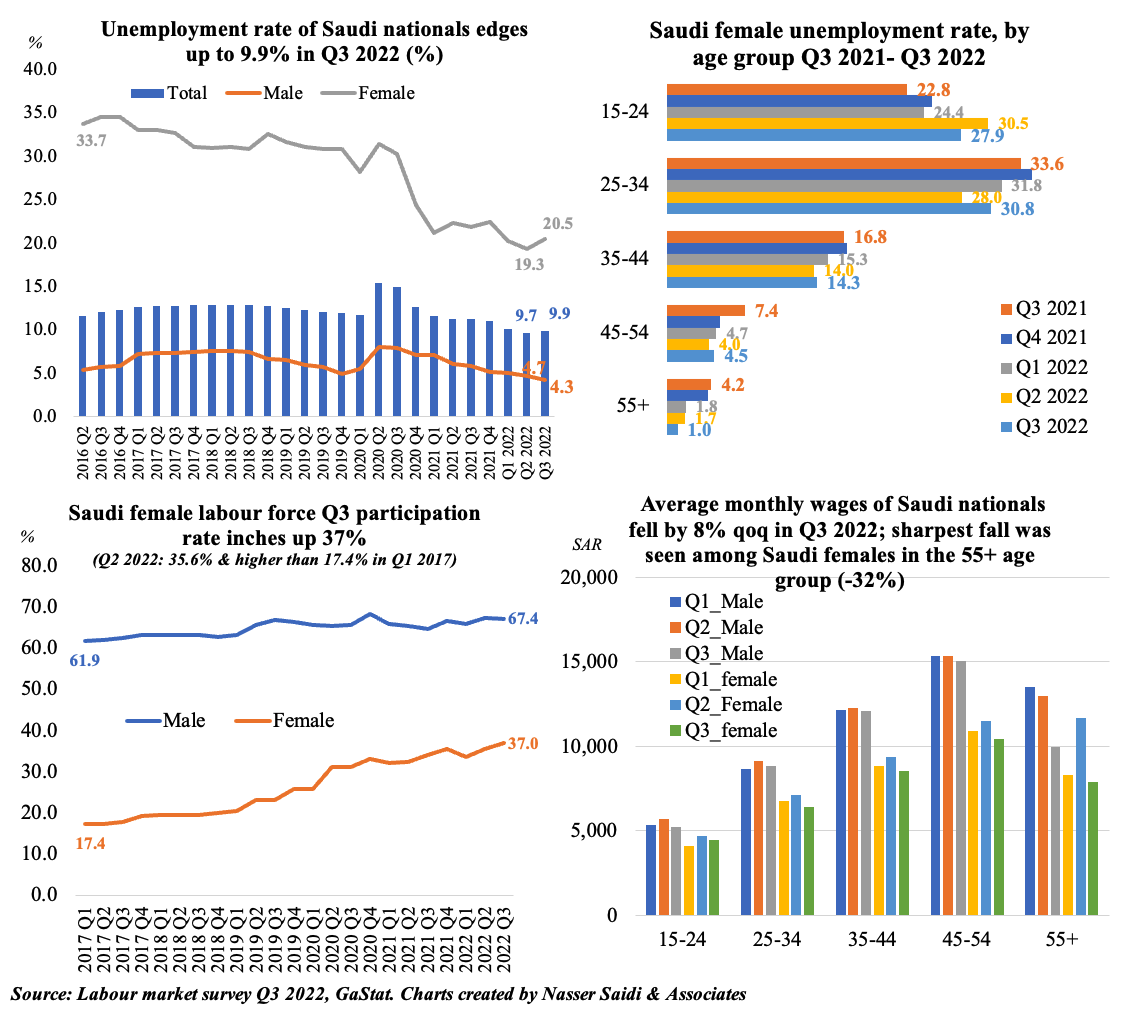

4. Unemployment among Saudi citizens inched up to 9.9% in Q3 2022

- Unemployment rate among Saudi women saw a slight increase to 20.5% in Q3. It was 30.8% in the 25-34 age group.

- Saudi female workforce participation rates continue to rise (37% in Q3 2022 vs 17.8% in Q3 2017).

- Evidence of a wage gap between Saudi men and women; overall wages dipped among Saudi citizens in Q3.

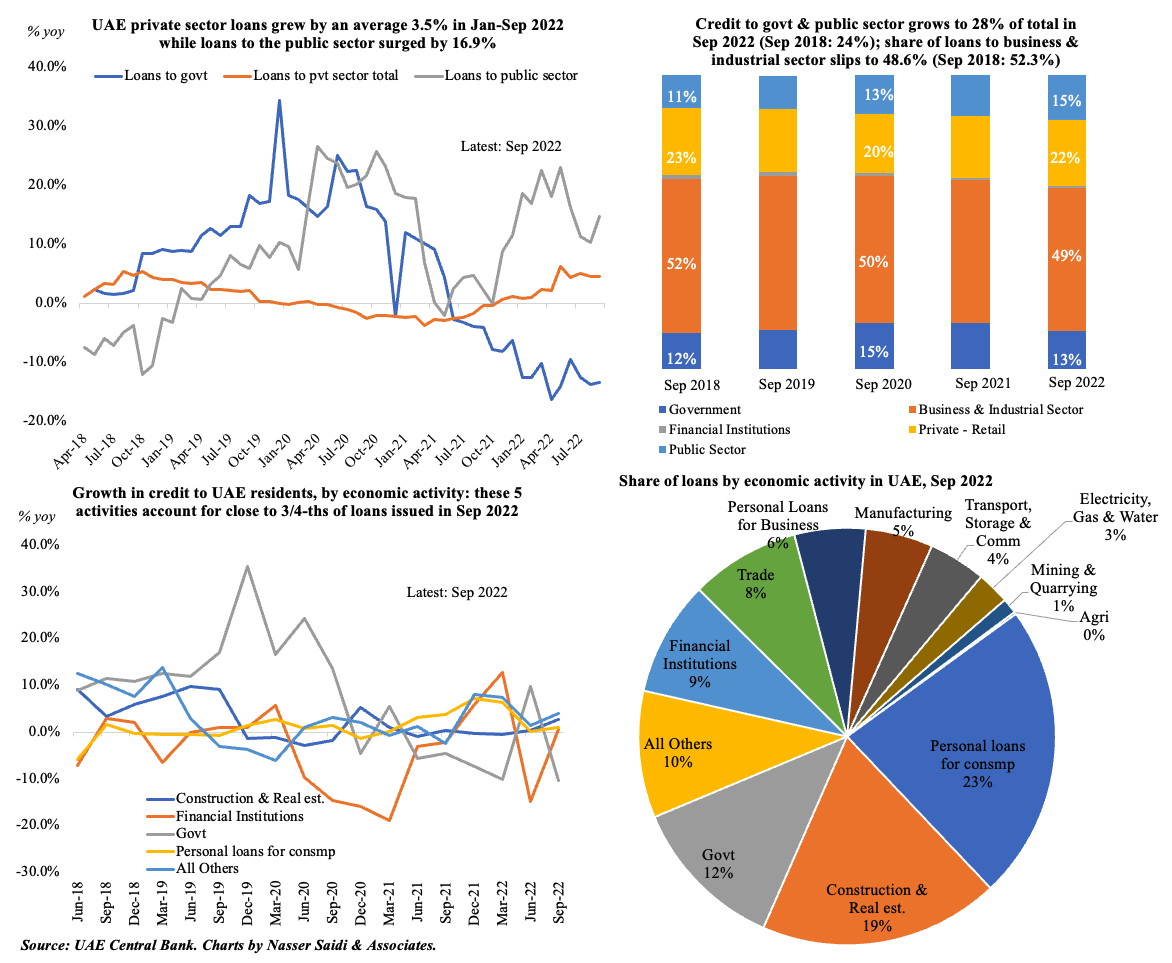

5. Deposit growth outpaces credit in the UAE; public sector loan growth in double-digits in 2022; loan growth to the construction sector leads in Sep 2022

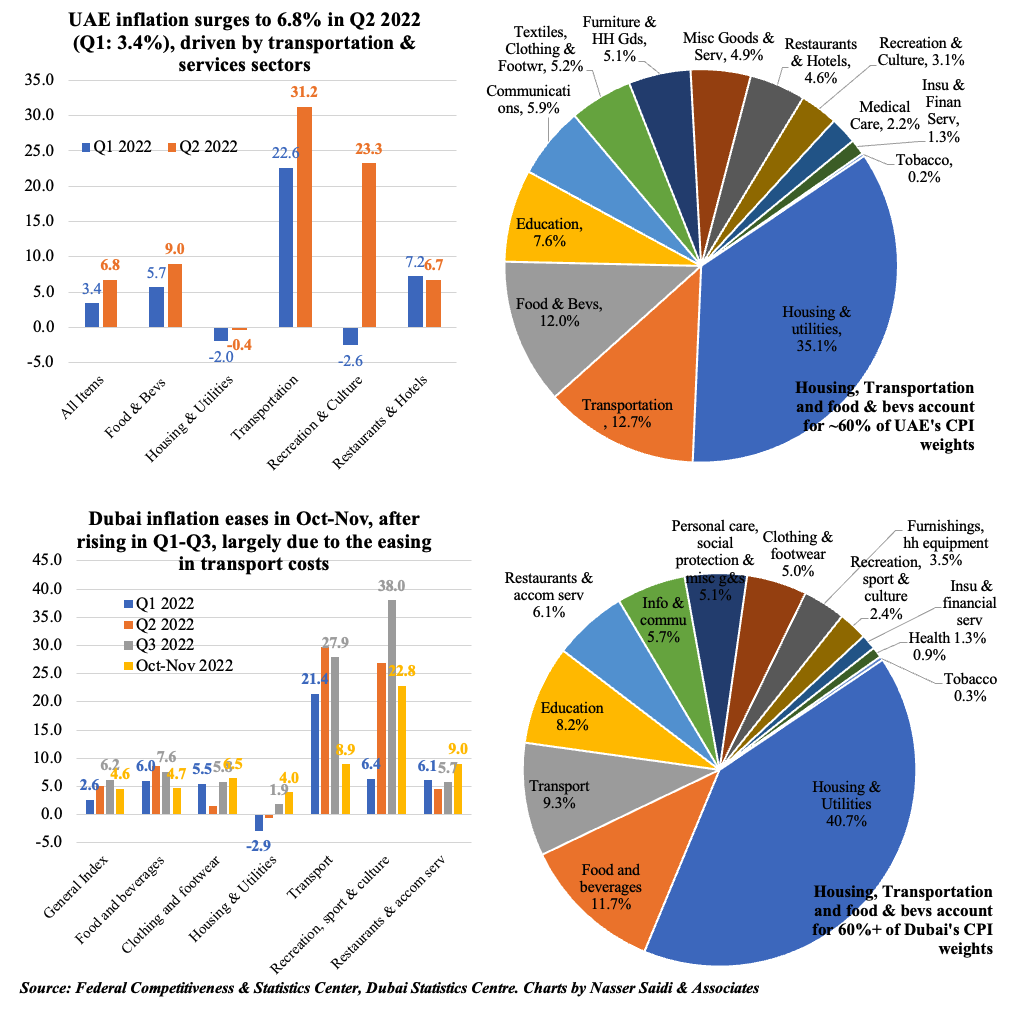

6. UAE inflation rose to 6.8% in Q2 2022

- UAE inflation rose to 6.8% in Q2 2022, as costs of transportation and services related sectors increased. Housing (which has the largest weightage of 35%) declined in Q1 & Q2, but at a slower pace in Q2.

- In contrast, Dubai inflation ticked up during the period Q1-Q3 2022, with Jul recording a peak 7.1% reading. A decline in petrol prices resulted in lowering of transportation costs. However, costs of services related sectors rising (recreation & restaurants/ accommodation at 20% & 9.8% respectively in Nov).

- Housing costs have been rising in Dubai, and is reflected in the index, but declined in Dubai in Q3.

- Muted effect from imported inflation given the peg to the strong $ in 2022

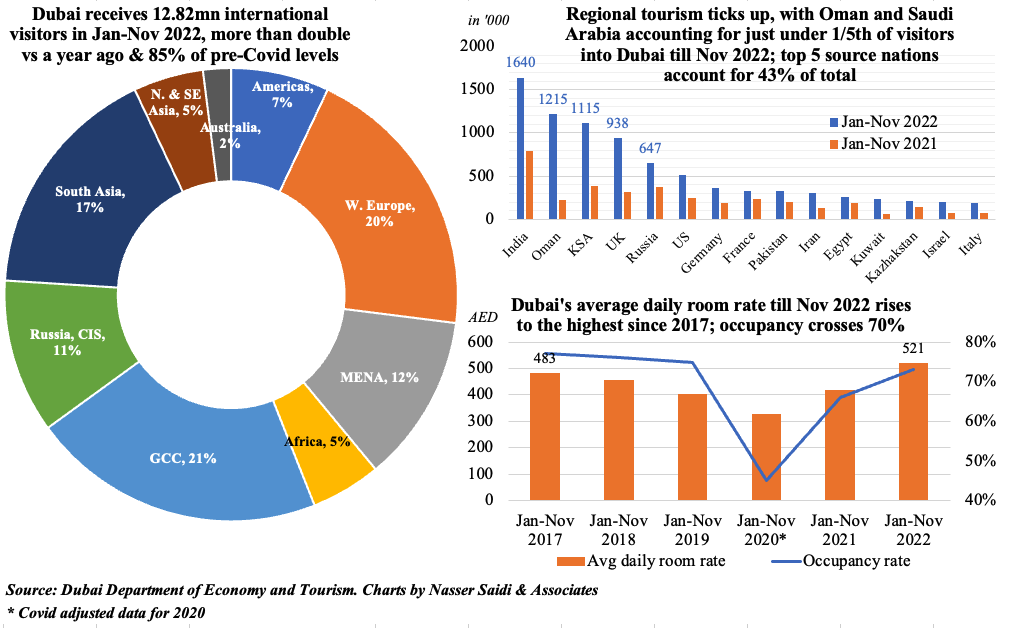

7. Dubai welcomes 12.8mn international visitors in Jan-Nov 2022: 85% of pre-Covid levels

In Nov, Dubai received 1.42mn visitors, supported also by the Qatar World Cup: interestingly, this was close to the visitors’ target for Qatar World Cup (estimated at 1.5mn visitors). Occupancy rates in Dubai in Nov (76.2%) surpassed Qatar (56%)!