Markets

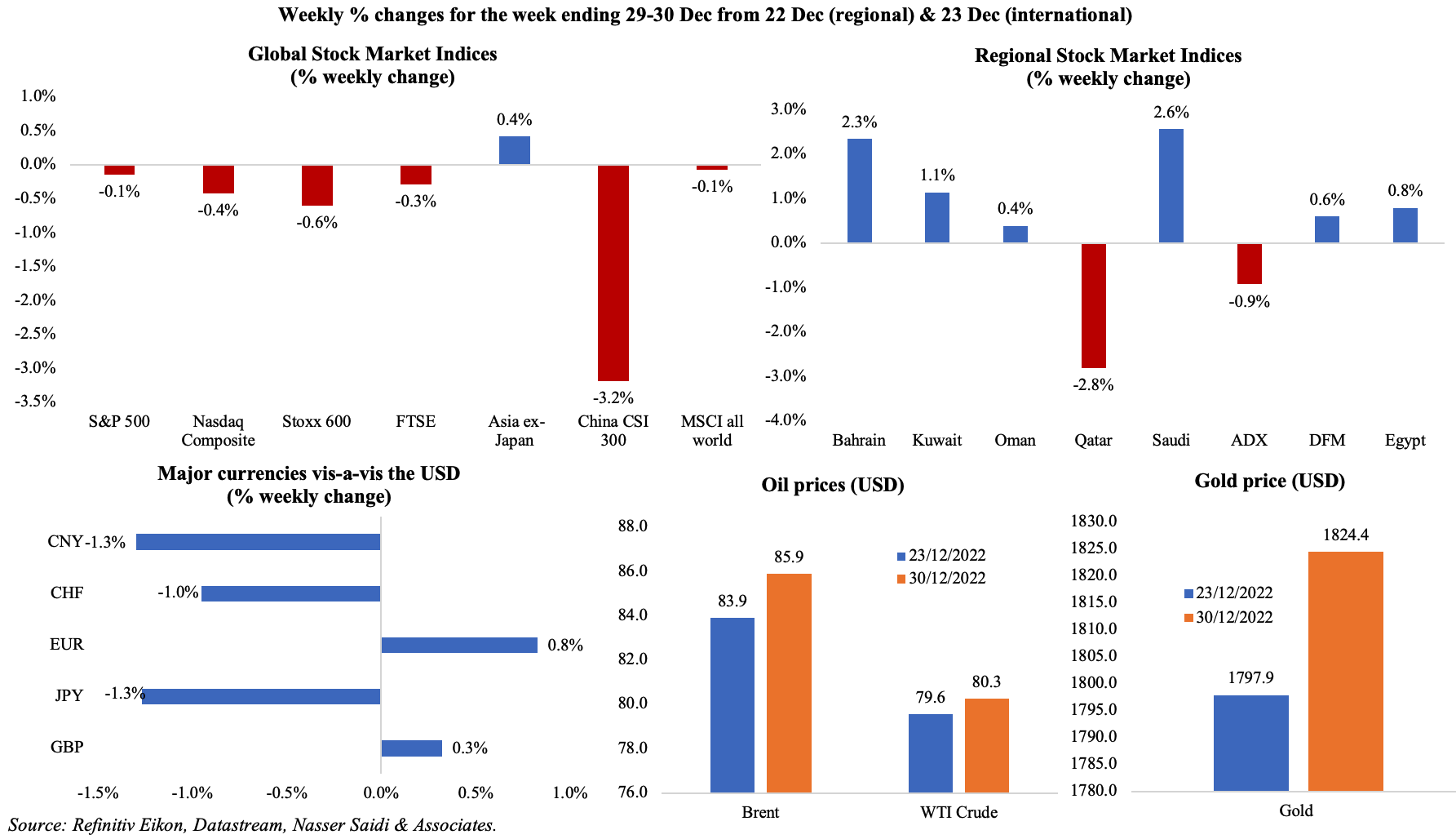

Capital markets had a horrendous year in 2022, the worst since the GFC in 2008, with global stocks and bonds losing more than USD 30trn last year, with the MSCI All-World Index losing about 1/5-th of its value, posting the biggest decline since 2008; US equity markets posted the first annual loss since 2018 (and the largest drop since 2008). The Russia-Ukraine War, surging inflation rates not seen in 40 years, peaking food and energy prices, change in monetary regimes with rising interest rates and the growing US trade and tech war on China all contributed to a dismal 2022 for markets and heralding near global recession in 2023. With Covid19 cases surging in China, CSI300 declined the most among major markets in the last week of 2022. Among regional markets, Saudi gained the most in the last week of 2022; the best performer in 2022 among regional markets was Egypt, while Qatar shed the most (-8.1%), recording the first yearly loss since 2017. A strong dollar was the highlight of 2022, with the currency posting its biggest annual increase since 2015; GBP had its worst performance since 2016 while the yen had its worst year since 2013 (thanks to BoJ’s dovish stance). Oil posted its second consecutive annual gain: in Mar, Brent had touched USD 139.13 a barrel, the highest since 2008. Though gold price gained in the last week of 2022, it posted an annual drop.

Global Developments

US/Americas:

- The Dallas Fed manufacturing business index plunged to -18 in Dec (Nov: -14.4), as new orders remained negative for the 7th consecutive month. Meanwhile, the production index inched up 9 points to 9.7 and employment index was up 8 points to 14.

- Richmond Fed manufacturing index edged up to 1 in Dec (Nov: -9), the first positive reading since Apr, as shipments and employment turned positive (5 and 3 respectively) and new orders improved (to -4 from -14). Expectations for next 6 months are still pessimistic, with the index falling to -20 in Dec.

- Chicago PMI remained in contraction territory in Dec, though rising to 44.9 points (from Nov’s 30-month low of 37.2). New orders fell at a slower pace while employment declined at a faster pace

- US goods trade deficit narrowed by 15.6% to USD 83.3bn in Nov – the smallest deficit since Dec 2020. Exports declined by 3.1% to USD 168.9bn while imports shrank by 7.6% to USD 252.2bn (the lowest level of imports in more than a year, led by consumer goods).

- S&P Case Shiller house price index cooled to a 8.6% yoy gain in Oct (Sep: 10.4%), the lowest reading since Nov 2020. Mortgage rates (at around 6.3% in Dec) continue to weigh on the housing sector, remaining nearly twice the level compared to a year ago at this time.

- Pending home sales index fell by 4% mom to 73.9 in Nov, the lowest level since Apr 2020. In yoy terms, it plunged by 37.8%, 18th straight month of decline and largest since Nov 2021.

- Initial jobless claims inched up by 9k to 225k in the week ended Dec 23rd, with the 4-week average little changed at 221k. Continuing jobless claims rose by 41k to 1.71mn in the week ended Dec 18th, the highest since Feb and slightly lower than pre-pandemic filings of 1.8mn.

Europe:

- The broad monetary aggregate M3 in the euro area eased to 4.8% in Nov, from 5.1% in Oct, averaging 5.4% in the Sep-Nov period. Additionally, credit to residents grew by 4.6% in Nov, slower than Oct’s 5% gain.

- Inflation in Spain slowed in Dec to 5.8% from 6.8% the previous month. However, core inflation accelerated to 6.9%(Nov: 6.3%) – the highest since records began in 2003.

Asia Pacific:

- China’s manufacturing PMI inched lower to 47 in Dec (Nov: 48), after Covid19 infections spread, following easing of restrictions in early-Dec: the production sub-index slipped to 44.6 (Nov: 47.8), new orders slowed by 2.5 points to 43.9 and exports sales fell to 44.2 (from 46.7).

- Non-manufacturing sector PMI in China plunged to 41.6 in Dec (Nov: 46.7), posting the steepest fall since Feb 2020. The new orders sub-index was down by 3.2 points to 39.1 and sub-indices for business activities in retail, road transport, accommodation and catering staying below 35 while the construction sector index expanded (to 52).

- Industrial production in Japan fell for the 3rd straight month in Nov, down by 0.1% mom (Oct: -3.2%), given weak domestic and foreign demand. Production of general-purpose and business-oriented machinery posted the largest decline (-7.9% mom), followed by machinery sector (-5.7%). The Ministry of Economy, Trade and Industry downgraded its assessment of industrial production, saying that it has weakened.

- Japan’s unemployment rate fell to 2.5% in Nov (Oct: 2.6%), with the jobs to applicants’ ratio unchanged at 1.34 – the highest level since Mar 2020.

- Retail trade in Japan increased for the 9th month running, with sales up by 2.6% yoy in Nov, it was much lower than the gains reported in Oct and Sep (of 4.4% and 4.8% respectively). The gain was supported by the removal of border controls (visitor arrivals to Japan jumped to nearly 1mn in Nov) and domestic travel subsidy.

- India’s current account deficit widened to USD 36.4bn or 4.4% of GDP in Jul-Sep, thanks to widening trade deficit (to USD 83.5bn from USD 63bn in the previous quarter). Private transfer receipts, which includes remittances, surged by 29.7% to USD 27.4bn.

- India’s core infrastructure output increased by 5.4% yoy in Nov (Oct: 0.9%), with upticks in output growth for electricity (12.1%), steel (10.8%) and cement (28.6%) among others.

- South Korea’s industrial production rebounded in Nov, rising by 0.4% mom after 5 months of declines, supported by gains in auto production (+9%) and general machinery (6.4%). In yoy terms, IP contracted by 3.7% – the biggest decline since the start of the pandemic. Semi-conductor sector plunged by 15% yoy (the most since 2009) and 11% mom.

- Inflation in Korea remained steady at 5% yoy in Dec; in mom terms, CPI was up 0.2% versus Nov’s 0.1% decline. Core inflation rose to 4.1% yoy in Dec (Nov: 4.3%) – the decline in annual core rate was the first since Nov 2021.

Bottom line: The scrapping of China’s zero-Covid policy has sent domestic cases surging and the upcoming Chinese New Year festivities could result in another jump given domestic travel plans. Many countries are now re-imposing testing requirements on travellers from China (and surrounding regions) including US, India and many European nations. This brings into question how fast China’s economic recovery would be? Though a post-pandemic bounce is expected, latest PMI data suggests that businesses are likely to face a dip in the first few months of 2023 (factories were forced to shut or reduce production as workers fell sick) before registering any gains. Government has promised to boost the economy through increased infrastructure spending, monetary easing, support to internet platforms through regulatory easing and general boosting of the private sector, while pent up consumer spending is likely to rapidly grow. This year, the global economy is expected to slow (the IMF expects that recession will hit one-third of the world this year) as policymakers continue to deal with lowering inflation. While climate change and geopolitical risks loom large, more concerning for the near term is the risk of potential debt crisis in emerging markets (amid higher rates and a continuing strong dollar).

Regional Developments

- Bahrain’s GDP grew by 4.2% yoy in Q3, with the non-oil sector growth accelerating by 4.9%. In Jan-Sep, real GDP and non-oil sector growth rose by 5.5% and 7.2% yoy respectively.

- Domestic-origin exports from Bahrain declined by 14% yoy to BHD 350mn (USD 923mn) in Nov 2022. Saudi Arabia, US and UAE were the top three recipients of the exports. Re-exports grew by 30% to BHD 64mn while imports to Bahrain declined by 3% to BHD 440mn. A trade deficit of BHD 26mn was posted in Nov, versus a surplus of BHD 2mn a year ago.

- Bahrain’s Economic Development Board (EDB) attracted over USD 1.1bn of direct investment in 2022 (exceeding the USD 1bn target set early in the year). The investments are from 88 firms and will likely generate more than 6300 jobs over the next 3 year.

- Egypt aims to achieve GDP growth of 5.5% in the fiscal year 2023-24, disclosed the finance minister. However, he also noted that budget deficit will be narrowed to 5% in the medium term, suggesting fiscal tightening.

- Egypt removed a key restriction on imports – to use letters of credit, introduced in Feb to ease a dollar shortage – and will now allow direct payment. Also, list of economic activities that the government would leave to the private sector was approved. Both these changes were required to secure funding from the IMF.

- Egypt launched a new international tender for oil and gas exploration in the Mediterranean Sea and Nile Delta. According to data from the ministry of petroleum and mineral resources, exports of natural gas accelerated by 14.28% yoy to 8mn tons in the current year while gas export revenues surged by 171% to USD 8.4bn in 2022.

- Saudi Arabia is the second largest investor in Egypt, with investments amounting to USD 6.1bn in 6,017 projects. Bilateral trade touched USD 4.572bn in 2021, up 41.3% yoy.

- Inflation rate in Lebanon increased to 189.4% yoy in Jan-Nov 2022, staying above 100% for the 29th straight month in Nov.

- Oman approved its 2023 budget: with revenues at OMR 10.05bn (-5% yoy) and expenditures at OMR 11.35bn (-6.4% yoy), the nation is expected to post a deficit of OMR 1.3bn (or 3% of GDP) and compares to a surplus of OMR 1.146bn in 2022. The budget is based on an oil price of USD 55 per barrel.

- Oman plans to set up an Integrated Gas Company to manage all its natural gas assets: the new entity by the finance ministry will enable the exclusion of gas purchase and transport costs from the state budget. Gas revenue had increased by 80% yoy to OMR 3.05bn in Jan-Oct 2022.

- Bilateral trade between the UK and Oman increased by 9.2% yoy to GBP 1.1bn (OMR 501mn) in the 1 year to end-Jun 2022. UK’s exports to Oman accounted for the largest share: it grew by 16.8% yoy to GBP 895mn.

- Japanese electricity generator JERA, Japan’s biggest importer of LNG, as well as trading houses Mitsui & Co and Itochu Corp signed agreements with Oman LNG for a total of 2.35mn tonnes per year starting in 2025. Last year, Japan imported 1.9mn tonnes of LNG from Oman, accounting for 2.6% of its total imports.

- Oman’s state energy company OQ signed an agreement to develop a petrochemicals complex in the Duqm economic zone with Kuwait Petroleum International and SABIC.

- International visitors into Qatar rose to 600k in Nov, according to Qatar Tourism, with the largest share from Saudi Arabia (16%), India (8%), US (7%), UK (6%) and Mexico (5%). Ticket sales for the World Cup also exceeded that for Russia in 2018.

- QatarEnergy and Japan’s Qatar Petroleum Development Company signed a new agreement for the continued development and production of the Al-Karkara and A-Structures oil fields in Qatar.

- Tunisia’s Ministry of Economy and Planning expects economic growth at 1.8% in 2023, from an estimated 2.5% in 2022. It plans to reduce fiscal deficit to 5.5% from a forecast of 7.7% in 2022, by raising tax revenue by 12.5% (partly from a new tax of half a percent on real estate assets worth over TND 3mn) and lowering subsidy spending by 26.4%.

- GCC was India’s largest trading partner bloc, with bilateral trade valued at over USD 154bn in fiscal year 2021-22, according to India’s Ministry of Commerce and Industry. GCC accounted for almost 35% of oil imports and made up 70% of gas imports in 2021-22.

- The UAE and Saudi Arabia together accounted for 76.4% of Japan’s oil imports in Nov, with shares of 41.5% and 36.3% respectively. Overall, oil from Arab nations into Japan met 95.4% of its oil needs in Nov.

- UAE’s manufacturing industry exports accounted for 43.9% of overall Arab manufacture exports in 2021, largely due to re-exports growth, according to Arab Monetary Fund. Overall Arab manufacturing exports grew by 33.2% yoy to USD 325bn in 2021.

Saudi Arabia Focus

- Saudi Arabia’s central bank assets increased by SAR 20.44bn (USD 5.4bn) to touch SAR 1.9trn in Nov. Separately, SAMA announced that Basel III reforms will come into force from Jan 1st, 2023.

- Unemployment in Saudi Arabia inched up to 9.9% in Q3 (Q2: 9.7%), with unemployment among Saudi females up to 20.5% (up 1.2 ppts from Q2) while labour participation rate of Saudis increased to 52.5%.

- A budget of SAR 1bn (USD 267mn) has been allocated for the National Intellectual Property Strategy: 12 initiatives will include 54 projects, that will be implemented by 37 governmental and private agencies. The nation aims to be in the top 20 countries in the field of IP protection in 5 years and within top 10 on the Global Competitiveness Index by 2030.

- Saudi Arabia issued 38 new mining licenses in Nov (Oct: 21), bringing the total mining exploration licenses to 2201.

- The number of SMEs in Saudi Arabia grew by 9.3% yoy to 978,445 firms in Q3. These firms received around SAR 221bn worth of credit facilities from financial institutions as of end-Q2 2022. It was also reported that venture capital funding surged by 93% yoy to total SAR 3.1bn in Jan-Sep 2022.

- Operating revenue of businesses in Saudi Arabia reached SAR 4.081trn in 2021, with manufacturing, mining and quarrying and wholesale and retail activities accounting for the largest shares – of 27%, 22% and 18% respectively. Separately, operating revenues of SMEs grew by 25% yoy to about SAR 1.2trn while spending surged by 33% to SAR 659.5bn.

- Saudi Arabia and Japan signed 15 investment agreements across metals, marine, petrochemicals, and automotive sectors among others during the Saudi Japan Investment Forum. Saudi Arabia has targeted USD 3.3trn worth of investments with Japan by 2030, according to the Saudi Minister of Investment. The two nations also signed a clean energy cooperation agreement covering the fields of the circular carbon economy, carbon recycling, clean hydrogen and fuel ammonia.

- Saudi Ports Authority is building a SAR 100mn (USD 27mn) logistics park at Damman port: when it is completed, the unit will have a handling capacity of 300,000 TEUs and support inland freight transportation.

UAE Focus![]()

- Three new laws come into force in Jan 2023: the unemployment insurance scheme for both private sector and federal government departments (with subscription fee dependent on the employee’s basic salary); the Emiratisation rule (firms with 50+ employees need to achieve an Emiratisation rate of 2% for skilled jobs); and the UAE’s new family business law will come into effect in Jan.

- Sharjah’s Ruler approved the AED 32.2bn (USD 8.76bn) budget for 2023, with spending 12% lower than last year and giving priority to infrastructure and capital projects (35% of the budget) and economic development (34%). Operating expenses represented 30% of the 2023 budget, a decline of 4% from the previous year.

- The CEPA agreement between UAE and Israel is expected to generate an annual USD 10bn in bilateral economic activity by 2026 (2 years ahead of projections). Non-oil trade between UAE and Israel grew by 114% yoy to USD 2bn in Jan-Sep 2022.

- Fuel price in the UAE has been reduced for Jan 2023 by 16% – 17% mom depending on the grade of petrol (to AED 2.59 for E-plus 91 to AED 2.78 for higher grade Super 98).

- Starting 1st Jan 2023, Dubai suspended the 30% municipality tax on all alcoholic beverages (this has been described as on a 1-year trial basis) and also announced that the personal liquor license fee has been scrapped.

- Dubai welcomed 12.82mn overnight international travellers in Jan-Nov 2022, reaching more than 85% of pre-Covid levels of the same period in 2019; this compares also to the 6.02mn visitors reported in Jan-Nov 2021. India, Oman, Saudi Arabia, UK and Russia were the top five source markets.

- The Dubai International Airport announced that nearly 2mn flyers were expected in and out of the airport over the 8 days starting Dec 27th. Average daily traffic is expected to be around 245k (with over 257k flyers on 2nd Jan), making this one of the busiest since 2019.

- Clean energy production in Dubai reached 2027 MW, or about 14% of Dubai’s total power production capacity, according to Dubai Water and Electricity Authority (DEWA)’s CEO. It was also separately revealed that a new DEWA project (thermal energy storage and turbine inlet air chilling project) had contributed to the reduction of 44,000+ tonnes of carbon dioxide emissions annually, equivalent to planting two million trees.

- Off-plan resales are ticking up in Dubai, according to Property Monitor: as of Nov 2022, total resale transactions grew by 3.2% to 4,425, i.e. a market share of nearly half (43.4%). Overall year-to-date deals, at 87,426, accounted for 142.6% of the entire annual transaction volume last year.

Media Review

War, inflation and tumbling markets: the year in 11 charts

https://www.ft.com/content/9c075e41-1eda-4e53-8d0e-d4ed048c529d

More War Means More Inflation

What 2022 meant for the world

https://www.economist.com/leaders/2022/12/20/what-2022-meant-for-the-world

IMF’s Top 10 Blogs of 2022 Chronicle Onslaught of War, Inflation, Dollar Surge

Powered by: