Markets

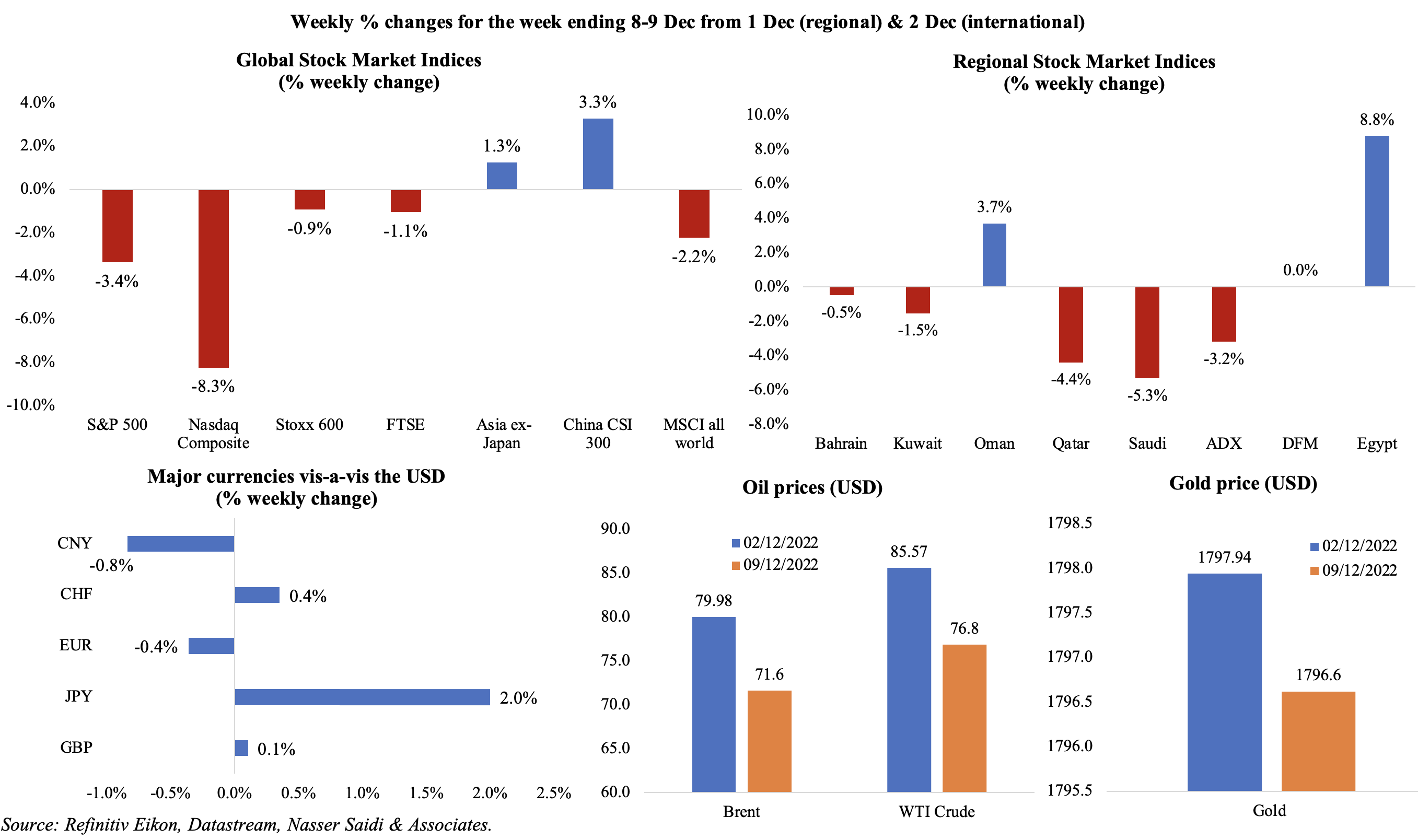

Equity markets were mostly down, haunted by recession worries: Stoxx600 ended in the red after a 7-week rally. Asia and Chinese equity markets received a boost from China’s policy to ease Covid restrictions. Regional markets had a rough week, in line with oil price fluctuations: Saudi Tadawul touched a 19-month low on Wednesday before recovering slightly while Egypt remained the best performer. Oil prices fell by 10%, with the WTI posting its largest weekly decline since Apr, also touching a new 2022 low of USD 71.02.

Global Developments

US/Americas:

- Factory orders in the US accelerated by 1% mom in Oct, faster than the previous month’s 0.3% gain, driven largely by the increase in bookings for transportation equipment (+2.2%) while motor vehicle orders rebounded by 1.7%.

- Non-farm productivity in the US rebounded in Q3, rising at a 0.8% annualised rate, higher than the 0.3% pace reported earlier. unit labour costs increased at a 2.4% rate (down from a previous estimate of 3.5%).

- ISM services PMI in the US increased to an 11-month high of 56.5 in Nov (Oct: 54.4), thanks to improvements in the employment index (51.5 from 49.1) and prices paid slowed (to 70 from 70.7). Additionally, new orders inched slightly down to 56 (from 56.5) as exports tumbled to the lowest level since Apr 2020.

- S&P Global composite and services PMI in the US stayed below-50 in Nov, both rising by just 0.1 points from the preliminary estimates to 46.4 and 46.2 respectively. Among prices, cost burdens inflation eased to the lowest since end-2020.

- Producer price index in the US rose to 7.4% yoy in Nov, the slowest pace since May 2021. Excluding food and energy, PPI was up by 0.4% mom and 6.2% yoy.

- Michigan consumer sentiment index rose to 59.1 in Dec, rising from Nov’s 56.8 reading. The UoM 5-year consumer inflation expectation eased in Dec, falling to 4.6%, 0.3 ppts below a month ago.

- Trade deficit in the US widened by 5.4% to USD 78.2bn in Oct, as exports fell by 0.7% to USD 256.6bn alongside a 0.6% uptick in imports. Interestingly, capital goods exports were the highest on record and exports of services rose to an all-time high of USD 80.6bn.

- Initial jobless claims inched up by 4k to 230k in the week ended Dec 2nd, with the 4-week average rising to 230k, the most since Sep. Continuing jobless claims rose by 62k to 1.671mn in the week ending Nov 25th, the highest since Feb.

Europe:

- Eurozone’s Q3 GDP grew by 0.3% qoq and 2.3% yoy, higher than previous estimates; household spending and gross fixed capital formation added 0.4 and 0.8 ppts to growth. The strongest growth was recorded in Ireland (2.3%) while Malta and Cyprus both grew by 1.3% and the steepest declines were in Estonia, Latvia and Slovenia. Employment accelerated by 0.3% qoq in Q3, the same pace as in Q2 2022.

- Factory orders in Germany unexpectedly rebounded by 0.8% mom in Oct, following Sep’s upwardly revised 2.9% drop. Domestic orders fell by 1.9% while export orders rose by 2.5% and by sector, orders for capital and intermediate goods rose (by 3.2% and 1.4% respectively) while consumer goods orders fell by 6.3%.

- Industrial production in Germany declined slightly in Oct, down by 0.1% mom following an upwardly revised 1.1% gain in Sep.

- Composite PMI in Germany stayed below-50 for the 5th month in a row in Nov with the final reading at 46.3 (lower than the preliminary estimate of 46.4 but better than Oct’s 45.1). the decline was reflected across both manufacturing (46.2) and services (46.1).

- Eurozone’s composite PMI stood at 47.8 in Nov: manufacturing PMI showed signs of improvement (rising to 47.1 from 46.4) but services PMI indicated a slight decline (48.5 from 48.6). The rate of job creation in the services sector was the weakest in just over 1.5 years.

- Retail sales in the eurozone fell by 1.8% mom and 2.7% yoy in Oct, in a sign of weak consumer demand. Sales of non-food products fell the most in month-on-month terms (-2.1%) while food, drinks and tobacco sales fell the most in year-on-year terms (-3.9%).

- Sentix investor confidence improved to a 6-month high of -21 in Dec (Nov: -30.9). The expectations index surged to -22.0 (from -32.3), the highest reading since Mar, while the current assessment measure rose to -20.0 (from -29.5).

- UK composite PMI edged down to 48.2 in Nov (Oct: 48.3), in recession mode, while the services PMI remained in downturn, matching Oct’s 48. 8 reading, also the lowest since Jan 2021.

Asia Pacific:

- China’s trade weakened in Nov: exports shrank by 8.7% and imports plunged by 10.6%, both reflecting the sharp slowdown and bringing the trade surplus down to USD 69.84bn (Oct: USD 85.15bn).

- Both consumer inflation and producer prices fell in China: CPI rose at the slowest pace in 8 months in Nov (1.6% yoy from Oct’s 2.1%) while PPI fell by 1.3% yoy (slower than Oct’s 1.4% fall).

- Caixin services PMI in China slipped to a 6-month low of 46.7 in Nov (Oct: 48.4), with firms reporting the strongest declines in output and new work for six months. Additionally, Nov also saw the quickest rate of job losses since the survey began in Nov 2005 and the 1-year outlook fell to an 8-month low.

- Japan’s GDP shrank by an annualised rate of 0.8% in Q3, from the 1.2% previously reported, thanks to an improvement in domestic demand (+0.42%) while capital spending remained unchanged (+1.5%).

- The leading economic index in Japan rose to 99 in Oct from the 20-month low of 98.2 recorded in Sep. Coincident index meanwhile weakened to 99.9 (Sep: 100.8).

- Japan composite PMI moved down to 48.9 in Nov (Oct: 51.8), dragged down by declines in output and new orders at manufacturing firms while business activity among services sector improved. Easing of Covid19 restrictions is supporting demand and raising confidence of a market recovery thanks to rise in tourism volumes, as services PMI clocked in at 50.3 in Nov.

- Japan’s current account moved into a deficit of JPY 64.1bn (USD 469.25mn) in Oct, for the first time in nine months, as the costs of oil imports surged (with the yen’s weakness also contributing). Primary income, which reflects returns on investments made overseas, logged a surplus of JPY 2.83trn, up JPY 451.5bn from a year earlier.

- Overall household spending in Japan grew for the 5th straight month in Oct, rising by a real 1.2% yoy to an average JPY 298,006 for households of two or more people. However, real wages fell by 2.6% yoy, declining for the 7th consecutive month.

- The Reserve Bank of India hiked the repo rate by 35bps, bringing the interest rates to 6.25%; this follows a 50bps hike in Sep.

- Singapore retail sales grew by 0.1% mom and 10.4% yoy in Oct, with online retail sales accounting for about 14.5% of total sales. Excluding motor vehicles, retail sales expanded by 0.8% mom and 14.3% yoy on a seasonally adjusted basis.

Bottom line: While recent PMIs paint a low growth scenario given weakened demand and waning export orders, the easing of Covid requirements in China offers hope for a potential recovery in 2023. However, last week’s China exports data indicate a broader weak global demand/ sentiment rather than just anaemic domestic demand. The central bank meetings this week –the US Fed, the ECB, Bank of England, to Switzerland and Norway – are likely to see a slower pace of rate hikes, setting the tone for the coming year (i.e. supportive of economic growth amid price pressures). The press conferences will be keenly watched for signals for how high rates can go next year and when will they peak.

Regional Developments

- Egypt’s PMI declined to 45.4 in Nov (Oct: 47.7), the second lowest since Jun 2020, as output and new orders fell sharply. A sharp depreciation of the EGP led to rising input costs, with purchase price inflation touching a 52-month high of 72.4 in Nov.

- Inflation in Egypt surged to a 5-year high of 18.7% yoy in Nov (Oct: 16.2%).

- Egypt expects to receive approval of a new USD 3bn Extended Fund Facility package from the IMF next week. The Egyptian pound was selling on the black market for EGP 32-33 (on Fri) versus the official rate of about EGP 24.6 to the dollar, ahead of this meeting.

- The Deputy PM of Egypt disclosed that the nation plans to issue its first ever Panda bonds, likely around USD 500mn, by end of this fiscal year.

- Iraq’s oil output stood at 4.43mn barrels per day of crude in Nov, down by 221k bpd. The country also reduced domestic consumption by 92k bpd and exports by 63k bpd amid a decline in stock levels.

- The central bank of Kuwait raised its discount rate by 50bps to 3.50% effective Dec. 7.

- Lebanon’s PMI fell to a 7-month low of 48.1 in Nov, largely due to an accelerated fall in new orders amid declines across output and weak client purchasing power.

- Lebanon has begun the hiring process for a power sector regulatory body, a pre-condition put forth by the World Bank before releasing funds for the nation’s regional gas import deals.

- An extension has been announced by Lebanon’s energy ministry for applications to explore for hydrocarbons in eight offshore blocks. The new deadline is June 30, 2023.

- Fiscal surplus in Oman increased to OMR 1.208mn in Jan-Oct, compared to a deficit of OMR 1.007mn during the same period a year ago. Revenues increased by 42.3% to OMR 11.862bn till end-Oct while spending rose by just 14%.

- Ongoing food security projects in Oman (either in development or operation) stand at around 100, with a total investment of OMR 1.3bn, according to the minister of agriculture, fisheries and water resources.

- Oman’s state energy company OQ is exploring the feasibility of producing green ammonia and green methanol at the Duqm and Salalah ports as well as producing blue ammonia in Sur.

- PMI in Qatar inched up to 48.8 in Nov (Oct: 48.4); with the World Cup being hosted in the country, there were signs of activity across wholesale, retail and service providers while sales prices increased to an all-time high given rising demand.

- The first 17 days of the Qatar World Cup saw just over 765k visitors, more than half of whom have already left the country; this falls short of the 1.2mn expected during the month-long event. The peak period for international visitors was expected to be Nov 24-28 when 32 teams were playing 4 matches every day.

- Non-ticketed fans will be allowed to enter Qatar to attend the World Cup; all GCC residents have also been permitted to enter without a Hayya card.

- VISA disclosed that the highest volume of in-stadium payment transactions at the group stage of the World Cup was recorded in Saudi Arabia match against Mexico. Spending by value at Qatar 2022 during the group stages was already at 89% of the total in Russia 2018. The average in-stadium spend during the group stage was USD 23 and the 3 spend categories were merchandise (47%), food and beverages (36%) and ticketing (11%).

- The Syrian pound touched a new record low against the dollar (more than 6000 Syrian pounds to the dollar) in the black market, in the backdrop of chronic fuel shortages.

- The contribution of the metaverse to GCC nations is expected to touch around USD 15bn by 2030, according to a PwC report. Saudi Arabia and the UAE would account for the largest share, of USD 7.6bn and 3.1bn respectively.

- There are over 170k hotel rooms under active development in the GCC, roughly equivalent to 40% of existing hotel room inventory, according to research commissioned by Arabian Travel Market. Saudi Arabia and UAE will remain the largest markets, with total estimated room inventory of over 218k and 251k respectively by 2030.

Saudi Arabia Focus

- GDP in Saudi Arabia grew by 8.8% yoy and 2.1% qoq in Q3, supported by both oil and non-oil sector growth (14.2% yoy and 6% respectively). Within the non-oil sector, manufacturing (excluding refining) posted the strongest gains.

- Saudi Arabia’s finance minister disclosed that nominal GDP is expected to rise to a record-high SAR 3.97trn (USD 1.05trn) this year and rise further to SAR 3.9-4trn in 2023.

- Saudi Arabia’s PMI increased to 58.8 in Nov (Oct: 57.2), expanding at the fastest rate in 7 years, supported by an improvement in new order growth (a 14-month high of 65.7), an acceleration in output sub-index (to 64.6 from Oct’s 61.3) and new export business posting the fastest increase since Nov 2015. However, price pressures increased with average input costs and prices charged rising to the highest since Jul.

- Saudi Arabia and China signed 35 investment deals worth more than USD 30bn during the Chinese President’s visit: this covers multiple sectors including transportation, logistics, manufacturing, clean energy, technology and cloud services among others. One major deal was with Huawei on cloud computing and building high-tech complexes in Saudi cities. The Chinese president also called for oil trade in the yuan: supporting the internationalisation of the renminbi and weakening the dollar trade. (Time to re-read an article written in 2018 recommending that the GCC adopt the PetroYuan: https://nassersaidi.com/2018/01/11/why-the-gcc-should-adopt-the-petroyuan-article-in-the-national-9-jan-2018/)

- The Budget 2023 document showed that budget surplus for 2022 touched an estimated SAR 102bn (USD 27.13bn) or 2.6% of GDP. In 2023, a SAR 1.114trn budget was approved, with a surplus of SAR 16bn (or 0.4% of GDP). The central bank governor stated that central bank will continue to manage forex reserves based on “balanced investment policies”. The Saudi minister stated that “difficult decisions” taken before were unlikely to be revised given the surpluses this year and next and called for not changing policies “in haste”. He also stated that the surplus would be distributed in Q1 2023, most of it to increase the reserves, and some to the National Development Fund and “maybe” to the sovereign wealth fund.

- Saudi Arabia’s finance minister revealed that the country would deposit USD 5bn at Turkey’s central bank “within days”.

- The number of SMEs in Saudi Arabia grew by 9.3% to 97,8445 in Q3 2022, with venture capital funding surging 93% yoy to SAR 3.1bn (USD 820mn). Q3 also saw a surge in fintech investments, with 22 deals (+266% yoy).

- Saudi Arabia unveiled a “Stimulating Local Industry” initiative with an aim to increase the share of local content, raise operational efficiency and enable technology transfer. The program will finance up to 75% of the project cost and support with financial incentives.

- The Saudi Space Accelerator Program seeks to develop the national space sector (including infrastructure, supporting businesses that provide innovative space solutions etc).

- Saudi Arabia revealed NEOM’s first luxury island development, Sindalah, last week: it is expected to have an 86-berth marina, host 413 ultra-premium hotel rooms and 333 top-end serviced apartments.

- Riyadh and Jeddah were among the world’s most improved cities on the global urban mobility readiness index. Riyadh moved up 5 places to 49 and Jeddah up to 51 (from 58).

- Saudi Arabia will host the 2027 Asian Cup, according to the Asian Football Confederation, after India withdrew its bid.

UAE Focus![]()

- The UAE issued the Federal Decree Law No 47 of 2022 on Taxation of Corporations and Businesses: a standard rate of 9% will be levied on companies’ taxable profits exceeding AED 375,000 (USD 102,000). The tax will be charged on earnings for financial years starting on or after June 1, 2023.

- UAE is expected to grow by 6.5% this year and more than 7% next year, according to the economy minister.

- PMI in the UAE inched lower to 54.4 in Nov (Oct: 56.6), posting its slowest pace since Jan. The output and employment sub-indices fell to 59.9 and 51.5 respectively (from 62.8 and 52 in Oct).

- Non-oil foreign trade in the UAE grew by 18.9% to AED 1.637trn in Jan-Sep 2022. Overall trade volume is expected to touch AED 2.2trn by end-2022.

- Dubai approved the 2023-25 budget with a total spending of AED 205bn. In 2023, Dubai expects revenue of AED 69bn and spending at AED 67.5bn.

- UAE and Ukraine will initiate negotiations on a bilateral trade deal, with an aim to conclude it by mid-2023: it would be the first such deal for the UAE with a European nation. Bilateral non-oil trade had grown by 29% yoy to just over USD 900mn in 2021.

- UAE’s Taqa, Mubadala and ADNOC have become stakeholders in Abu Dhabi’s Masdar (flagship clean energy company), holding 43%, 33% and 24% respectively. Masdar has an ambitious target of at least 100GW renewable energy capacity and production of up to 1mn tons of green hydrogen by 2030, amid plans to grow its renewable energy portfolio to more than 200GW.

- ADNOC and Malaysia’s Petronas signed an unconventional oil resources deal, with the latter retaining a 100% stake in the operating rights of the concession to explore and appraise resources in Abu Dhabi’s Al Dhafra region.

- FinTech firms based in the Dubai International Financial Centre (DIFC) secured more than AED 2bn (USD 559mn) in funding during Jan-Sep 2022, according to DIFC FinTech Hive’s 2022 report. Overall funding for MENA fintech firms nearly doubled to USD 998mn in 2021.

- The UAE’s Ministry of Human Resources and Emiratisation, using an automated system to complete employment contracts, were able to reduce processing time to 30 minutes from 2 days before. About 35k contracts were completed in 2 days since the system launched.

- Ajman’s Department of Economic Development revealed that there was a 24% increase in the issuance of new licenses till Nov this year. The number of new industrial licences increased by 22% or 155 licences during the same period.

- DP World opened a 6,000-square-meter high-end warehouse offering new storage solutions at Dubai’s Jebel Ali Free Zone; the facility has a monthly capacity of 6000 TEUs.

- The World Travel and Tourism Council’s Cities Economic Impact Report places Dubai at the top of the world with respect to highest visitor spending among city destinations: international visitor spending is estimated to reach USD 29.4bn in 2022. The report also finds that only of the 82 city destinations analysed will exceed pre-pandemic performance this year.

Media Review

All Pain & No Gain from Higher Interest Rates

Gulf Arab states draw closer to China as Xi visits Riyadh

https://www.ft.com/content/ed8734cd-1866-4b28-82c8-367ad6a85b21

Global Food Prices to Remain Elevated Amid War, Costly Energy, La Niña

Could an A.I. Chatbot Rewrite My Novel?

https://www.newyorker.com/news/our-columnists/could-an-ai-chatbot-rewrite-my-novel

Powered by: