Download a PDF copy of this week’s insight piece here.

Weekly Insights 9 Dec 2022: Non-oil sector recovery & fiscal consolidation in the GCC

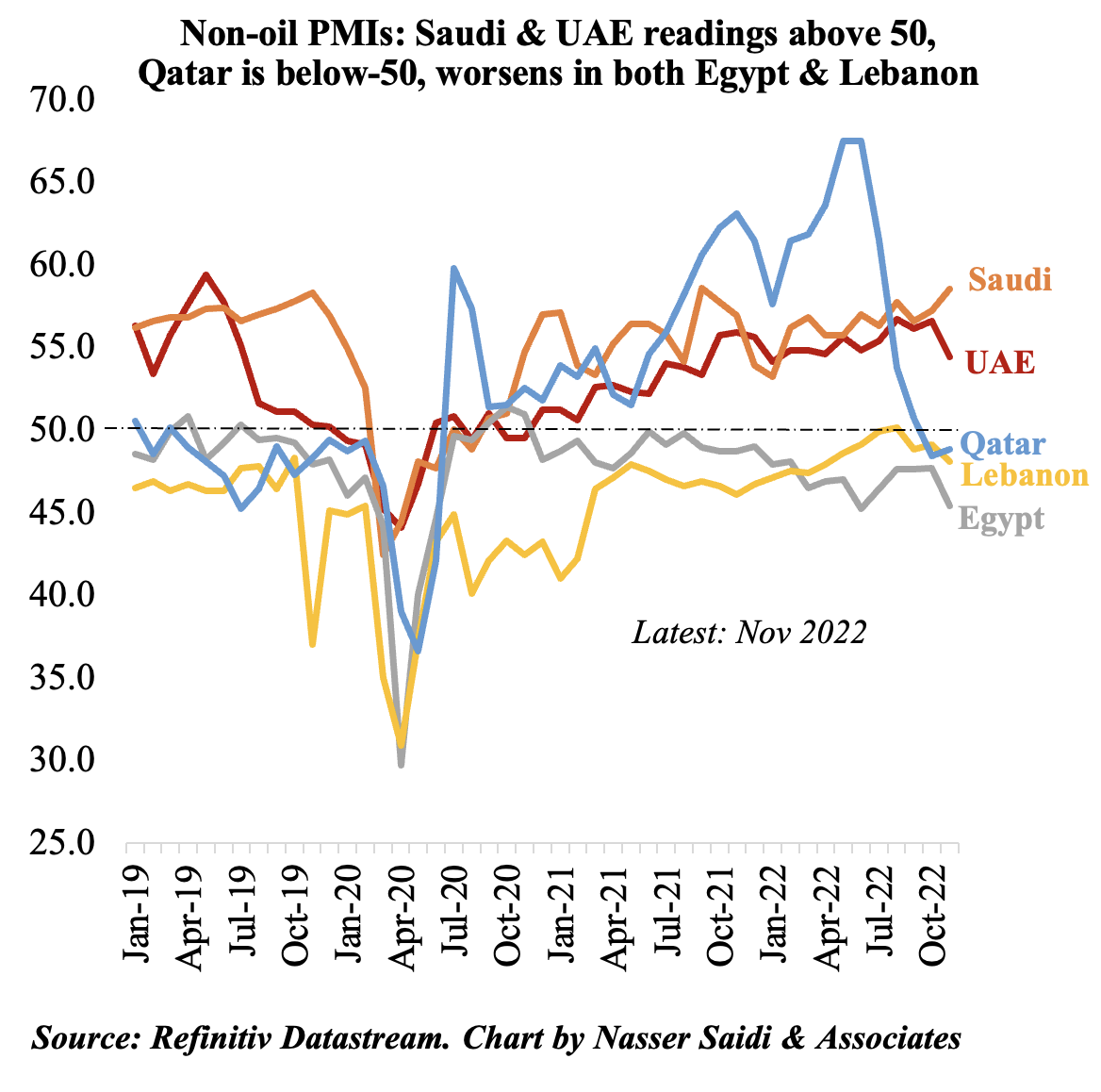

1. Middle East’s Divergent PMIs

- Divergence in non-oil sector activity: Saudi Arabia and the UAE continue to record expansionary readings while in Egypt and Lebanon, the situation worsened.

- Saudi PMI was supported by an improvement in new orders growth, output sub-index and new export businesses. UAE PMI slipped slightly in Nov, with new orders and output rising at weaker paces.

- Qatar poses an interesting study: while PMI inched up in Nov, it remained below-50. There were signs of increased activity across wholesale, retail and service providers during the World Cup month, while sales prices increased to an all-time high given rising demand. Businesses are adjusting to a post-World Cup scenario.

- In both Egypt and Lebanon, new orders and output fell sharply, dragging down overall PMI. Egypt, a victim of the sharp devaluation exercise, has seen a significant increase in input costs. In Lebanon, the political and economic uncertainty adds to the already rising prices and exchange rate depreciation.

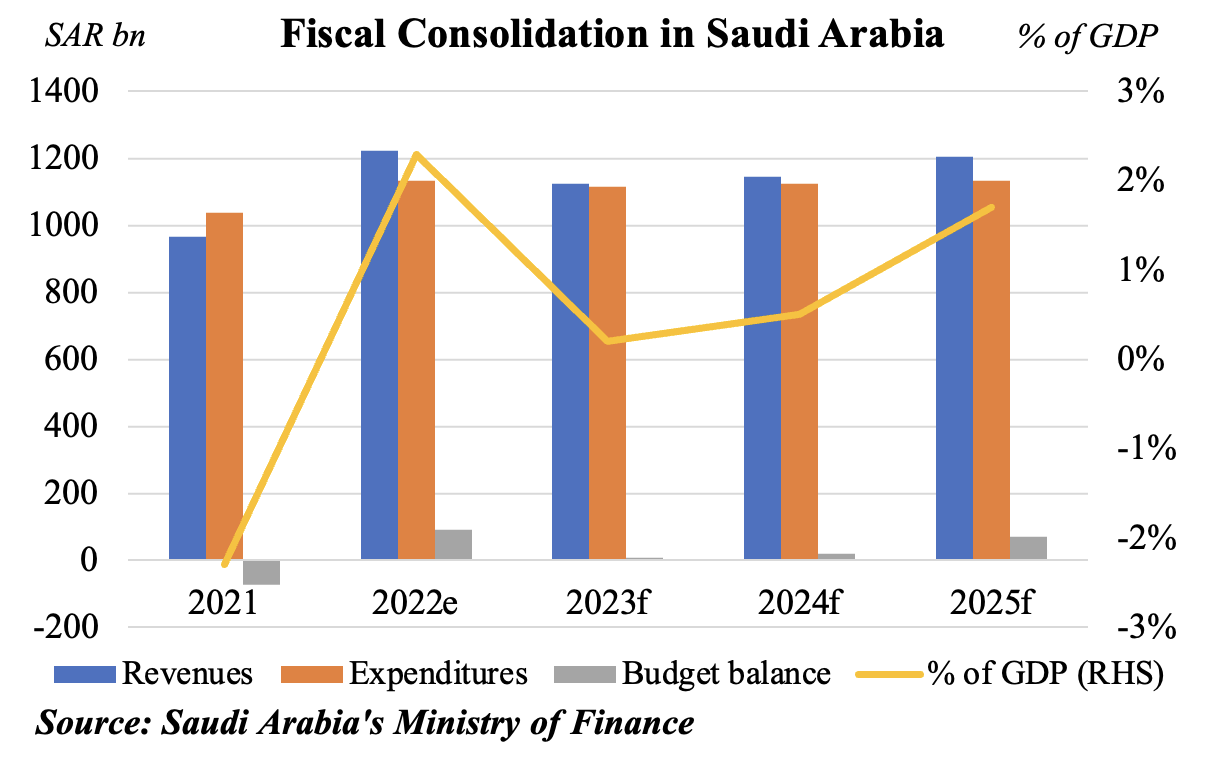

2. Fiscal Consolidation Remains Name Of The Game In Saudi Arabia’s Budget For 2023

- Saudi Arabia’s fiscal balance has moved into a surplus this year (roughly 2.3% of GDP), thanks to the increase in both oil and non-oil revenues.

- In 2023, revenues are estimated to drop by 8% yoy and spending by a smaller 2%, thereby reducing the budget surplus by a tenth to SAR 9bn (or roughly 0.2% of GDP)

- Diversification efforts will support non-oil revenue generation in Saudi Arabia. Spending is expected to remain contained, reaching SAR 1134 by 2025. Various financing tools have been mentioned in the Ministry’s report (including bonds, sukuk and loans), to support the rollout of strategic & developmental projects.

- In contrast to previous years of oil windfalls and procyclical policies, it is noteworthy to see that a significant portion of oil revenues are being saved (as denoted by the improvement in overall primary fiscal balances and revenue projections). The IMF estimates that ~40% of the windfall oil revenues are being saved in the GCC on average. Fiscal vulnerabilities have also been significantly reduced, as evidenced by the lower breakeven oil prices.

- A few additional policy steps can further support fiscal consolidation, including: (a) phase out fuel/ electricity subsidies; (b) rein in public sector wage bills, by encouraging/ offering incentives for job creation in the private sector; and (c) diversifying non-oil revenue sources among others.

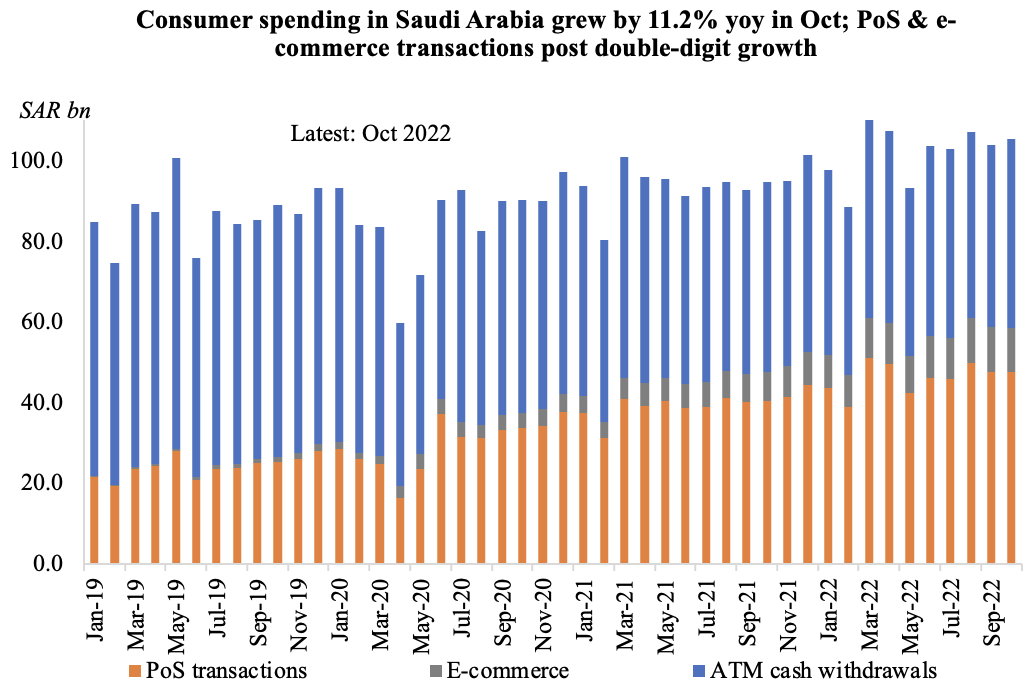

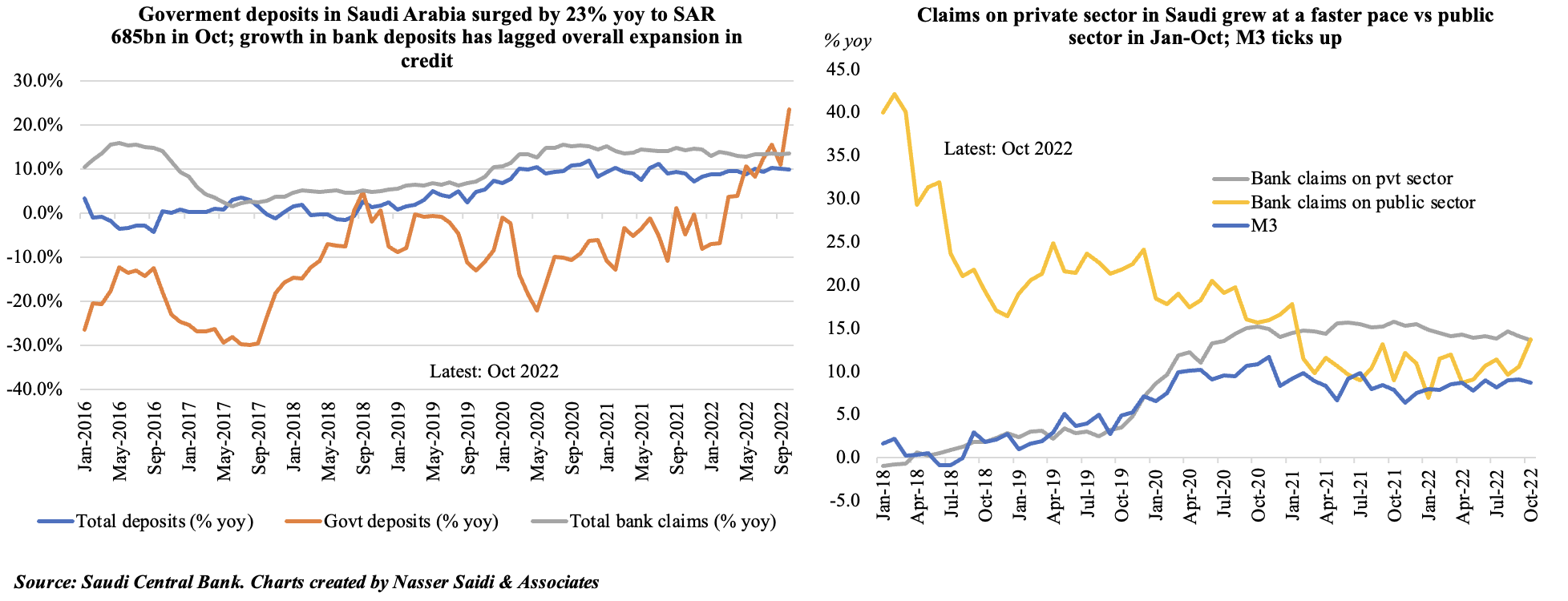

3. Lending continues to outpace deposit growth in Saudi Arabia

- Oil windfall gains haven’t translated fully into an increase in government deposits in Saudi Arabia: though government deposits surged by 23% yoy to SAR 685bn in Oct, this has been accompanied by a consistent increase in lending (an average gain of around 13% yoy every month this year).

- The construction pipeline, given mega and giga-projects, is driving lending growth. But, ideally, these should be financed by tapping the capital markets.

- Claims on the private sector is rising, and at a faster pace. Saudi banks’ residential new mortgages finance for individuals remains volatile.

- Consumer spending in Saudi Arabia has been rising, with e-commerce and point-of-sale transactions driving the growth.

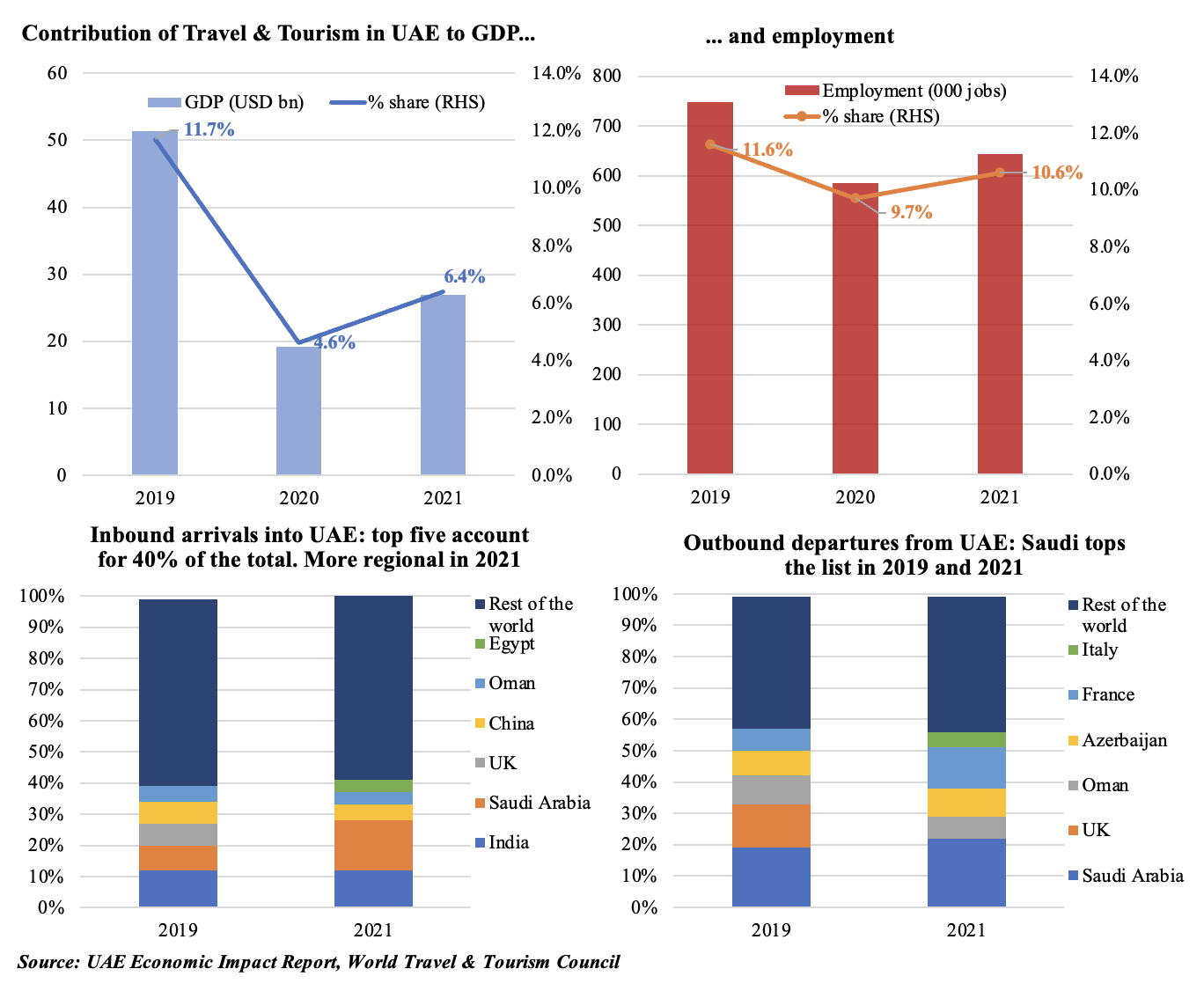

4. Travel & Tourism reaching pre-pandemic levels in UAE

Dubai tops the list of highest visitor spending among city destinations: $ 29.4bn in 2022

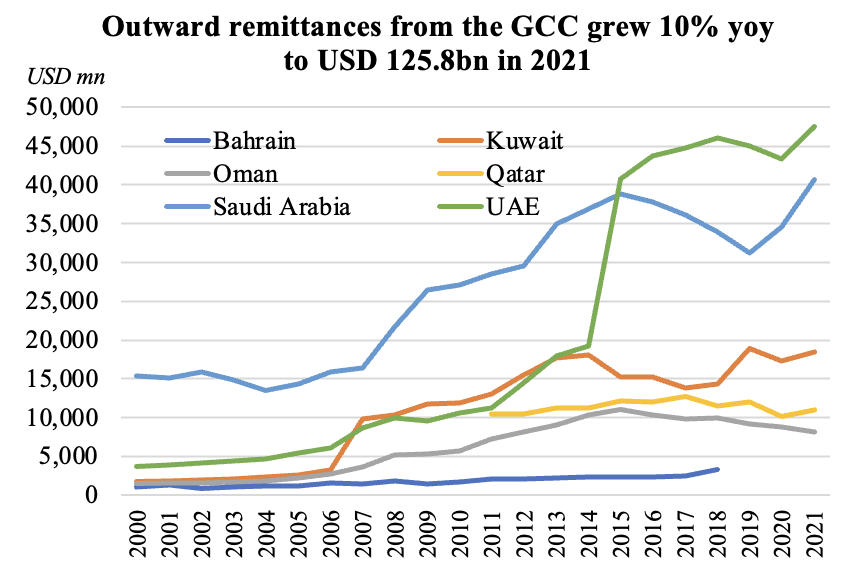

5. Remittances into the Middle East estimated to slow in 2022, after receiving USD 62bn in 2021 (+10.5% yoy)

- Remittances inflows into MENA is estimated to weaken this year, rising by just 2.5% versus 2021’s 10.5% gain

- Rising inflation and exchange rate depreciation in labour-exporting (oil-importing) nations underscore the need for increased remittances to support household consumption. While remittances from the GCC are likely to be steady, high inflation rates in Europe/ US are eating into real wages, thereby negatively impacting amounts remitted.

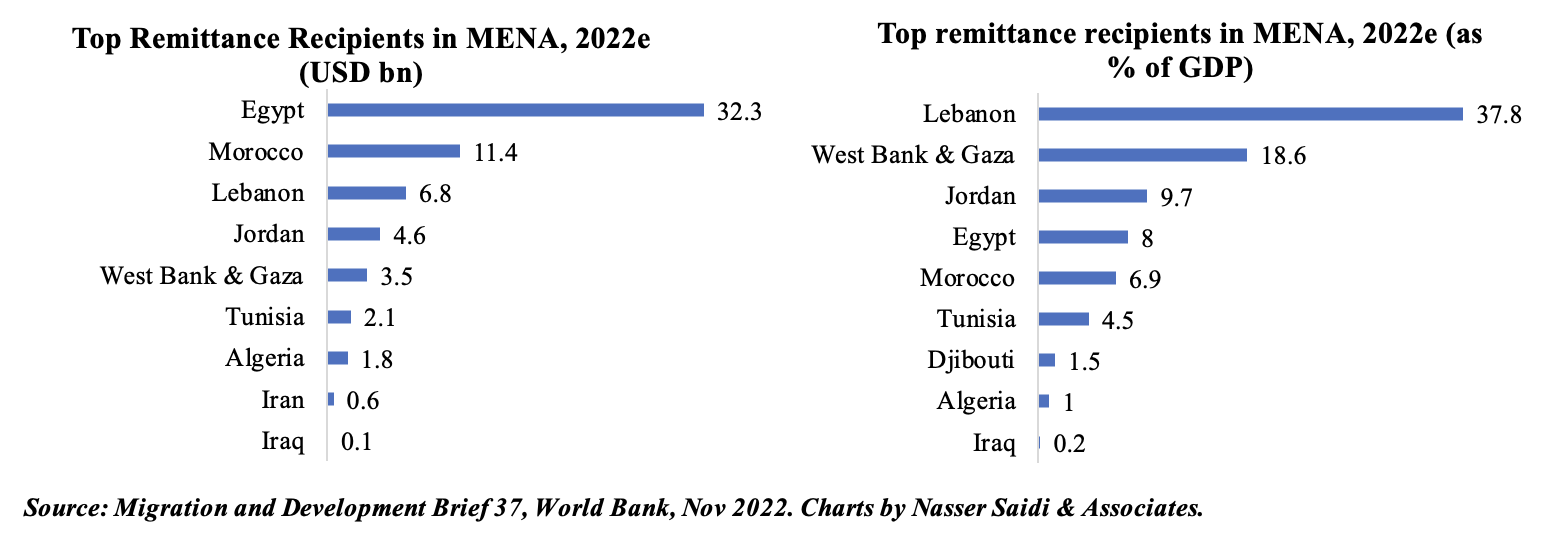

- Egypt, Morocco and Lebanon are the top recipients of remittances in MENA, together receiving an estimated USD 50bn this year. In terms of GDP, Lebanon and West Bank are the most dependent on remittances: 37.8% and 18.6% of GDP respectively this year.

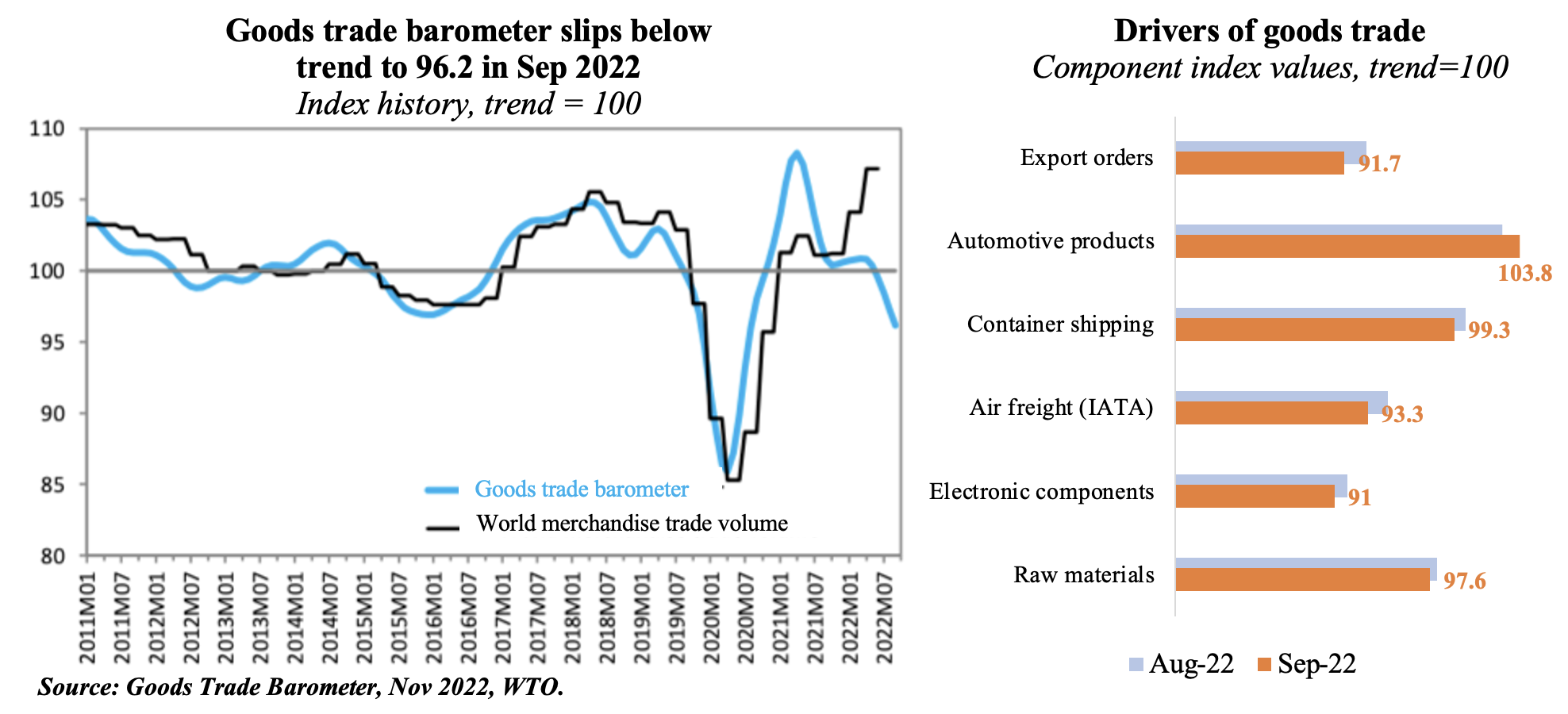

6. Trade growth drops below-trend, on weakened demand: harbinger of global recession?

- The WTO expects global growth to decline in H2 2022 and remain subdued in 2023: this is evident in the latest Goods Trade Barometer report. As can be seen from the chart on the left, there is a divergence in the readings of trade volumes index and the barometer index, likely due to delayed shipments and supply chain disruptions

- Global PMI indicators have been showing a significant decline in activity in the recent months, especially with respect to export orders, which drag down overall growth. Asian nations, especially China, has seen weakening demand which in turn is reflected in import growth. The easing of China’s Covid19 restrictions will support trade recovery in the coming months

- Among the drivers of growth tracked by the WTO, only automotive products seem to be performing above trend: this has been supported by “stronger vehicle sales in the United States and increased exports from Japan”.

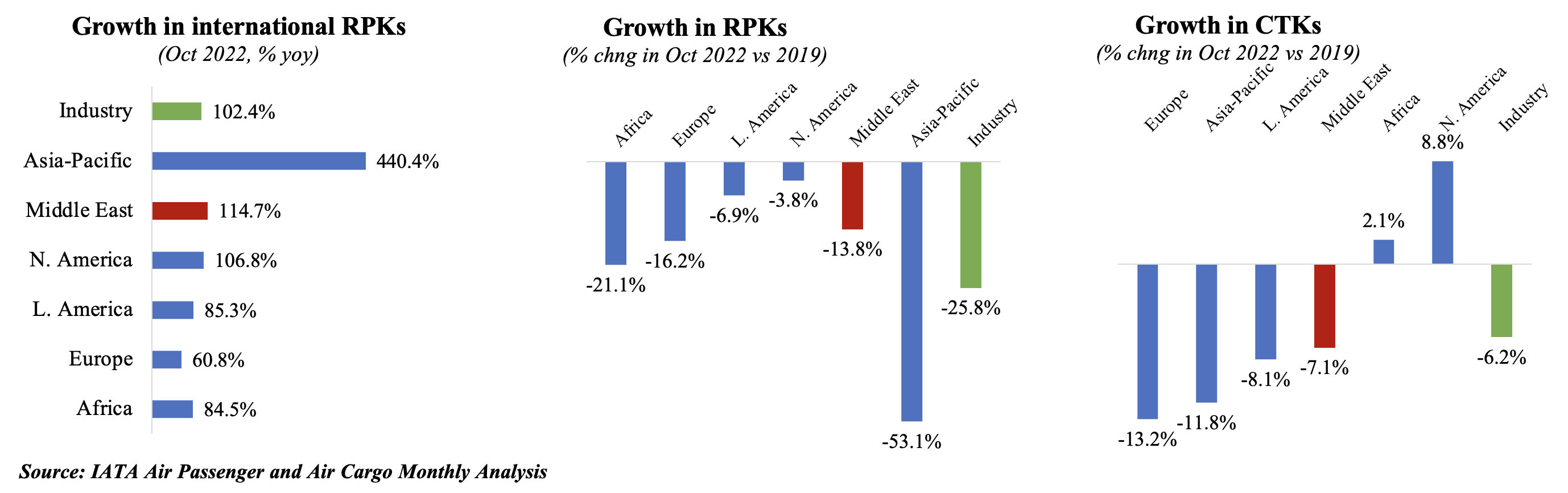

7. Steady “recovery” in Middle East’s passenger & cargo traffic

- IATA forecasts a 4% yoy growth in passenger demand in Middle East this year, outpacing capacity growth of 21.2%.

- The latest data indicates a 7% yoy surge in international air passenger traffic in the Middle East in Oct (vs an industry reading of 102.4%): this brings passenger traffic and seat capacity to at 15.1% and 20.3% below pre-COVID levels respectively. The World Cup matches in Nov-Dec is likely to result in increased capacity towards end of the year.

- Middle Eastern carriers witnessed a 15% yoy fall in air cargo volumes in Oct, and down by 7.1% versus Oct 2019 (pre-pandemic). Within this, the Middle East-Europe cargo traffic posted an improvement (-4.0% in Oct vs Sep’s 6.2% drop), as did Middle East-Asia (-4.3% yoy vs -4.8% yoy in Sep).

- Going forward, the gradual opening up of China will work to the benefit of the region: not only are Chinese visitors among the top arrivals (and spenders) in the region, but the nation also remains one of the largest trading partners (supporting cargo).