Markets

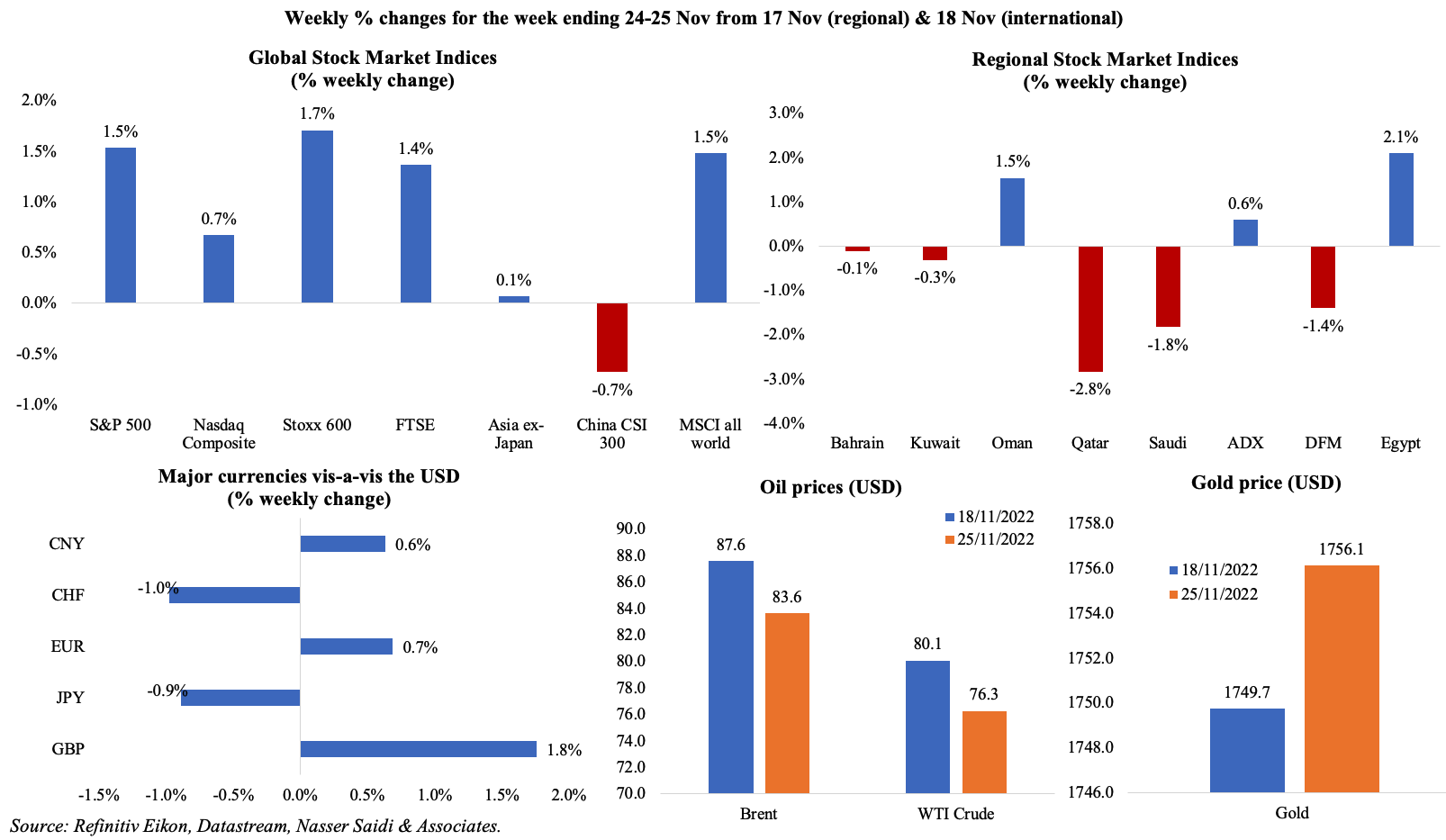

US equities had a good week and the dollar weakened given signs of a potential slowdown in Fed hikes (from the FOMC minutes); Europe’s Stoxx600 posted the 6th consecutive week of weekly gains while in China, equities are downbeat given that the zero-Covid policy is triggering protests and raising questions about growth. More losses than gains recorded across the Middle East last week on concerns about the decline in oil prices. Oil prices fell for the 3rd straight week, with the benchmarks hitting 10-month lows, on growing concerns about weak demand from China. Gold price gained on safe-haven demand.

Global Developments

US/Americas:

- The FOMC minutes indicate that Fed officials are expecting smaller rate hikes “soon”, though there were few signs of inflation abating, and given concerns that the rate increases could pose risks to financial stability and negatively affect the economy.

- Durable goods orders grew by 1% mom in Oct (from a downwardly revised Sep reading of a 0.3% gain), led by gains in transportation equipment and military aircraft. Non-defence capital goods orders excluding aircraft rebounded, rising by 0.7% following Oct’s 0.8% drop.

- S&P Global manufacturing PMI in the US declined to 47.6 in Nov (Oct: 50.4), posting the lowest reading since May 2020, with new orders remaining subdued while price pressures eased. Services PMI slipped to 46.1 (Oct: 47.8), with businesses highlighting weak demand amid moderation in input prices. Composite PMI slipped to 46.3 (Oct: 48.2), with composite new orders index down to 46.4 – the lowest since May 2020, and worst reading since 2009 excluding initial period of the pandemic.

- Richmond Fed manufacturing index improved to -9 in Nov (Oct: -10), thanks to an improvement in new orders (-14 in Nov from -22 in Oct) while employment showed a slight decline (to -1 from 0). Chicago Fed national activity index slipped to -0.05 in Oct (Sep: 0.17), the weakest headline number in 4 months.

- Michigan consumer sentiment index rose to 56.8 in Nov from a preliminary reading of 54.7 (but lower than Oct’s 59.9). Inflation expectations for 2023 eased to 4.9% from 5.1% in the preliminary estimate.

- US new home sales unexpectedly rebounded 7.5% mom to 632k in Oct (new home sales account for about 10% of home sales and are relatively more volatile). The median new house price grew by 15.4% yoy to USD 493k in Oct and there were 470k new homes on the market.

- Initial jobless claims increased by 17k to 240k in the week ended Nov 18th, the highest since mid-Aug, with the 4-week average slightly up to 222.75k. Continuing jobless claims inched up by 48k to 1.551mn in the week ending Nov 11th.

Europe:

- GDP in Germany grew by 0.4% qoq and 1.3% yoy in Q3, higher than the preliminary estimates, supported by consumer spending. Household final consumption expenditure grew by 1% qoq, while gross fixed capital formation in construction was down by 1.4% and in machinery and equipment up by 2.7%. GDP exceeded pre-pandemic levels (Q4 2019) for the first time in Q3 2022 (+0.3%).

- Germany’s GfK consumer confidence survey improved to -40.2 in Dec (Nov: -41.9), supported by a series of government energy relief measures. Additionally, a full gas storage in Germany allays fears of a supply crunch this winter.

- Ifo business climate in Germany increased to 86.3 in Nov (Oct: 84.5), with businesses hinting at a less severe recession than expected. However, the current assessment worsened to 93.1 (Oct: 94.2). Expectations rose to 80 from 75.9, though among energy intensive businesses, uncertainty was much higher compared to the month before.

- The flash composite output index in Germany remained below-50 for the 5th consecutive month in Nov, clocking in at 46.4 (Oct: 45.1). Manufacturing PMI in Germany increased to 46.7 in Nov (Oct: 45.1) while services PMI inched lower to 46.4 (Oct: 46.5). Firms reported easing price pressures, recording the weakest rise in input costs since May 2021.

- Eurozone’s manufacturing PMI improved slightly to 47.3 in Nov (Oct: 46.4) while services PMI remained unchanged at 48.6, resulting in an increase in composite PMI to 47.8 (below-50 for the 5th straight month). It was stated that overall sentiment was “gloomy” and “demand continued to fall at a steep rate”. While Germany reported the steepest downturns, France’s composite PMI fell below-50 for the first time since Feb 2021 as services output contracted for the first time since Mar 2021.

- Producer price index in Germany dropped by 4.2% mom in Oct (Sep: 2.3%). In yoy terms, it fell to 34.5% following record levels of 45.8% in Aug and Sep though energy remained the biggest contributor (85.6%); excluding energy, producer prices grew by 13.7%.

- Consumer confidence in the eurozone improved to -23.9 in Nov (Oct: -27.5); in the wider EU, sentiment rose by 2.8 points to -25.8.

- Manufacturing and services PMI in the UK remained steady at 46.2 and 48.8 in Nov. Composite PMI edged up to 48.3 (Oct: 48.2). UK posted the sharpest fall in new orders since Jan 2021 and the steepest fall in export sales among manufacturing firms since May 2020.

Asia Pacific:

- The PBoC left its benchmark lending rates unchanged for a 3rd consecutive month. However, it cut the reserve requirement ration by 25bps on Fri, releasing about CNY 500bn in long-term liquidity to support the economy (this follows a similar cut in Apr). Separately, the PBoC also outlined 16 support measures for the property sectorincluding extensions for loan repayment.

- Inflation in Tokyo inched up to 3.8% in Nov (Oct: 3.5%). Excluding food and energy, prices rose to 2.5% from 2.2% the month before. Core CPI (i.e. excluding fresh food) increased to 3.6% from 3.4% in Oct – this is the highest since Apr 1982, and was driven mostly by electricity bills and food prices.

- Japan’s leading economic index fell to 97.5 in Sep (Aug: 101.3), the lowest reading since Dec 2020 while the coincident index slipped to 101.4 in Sep (Aug: 101.8). Both were higher than the preliminary readings issued earlier this month (leading: 97.4, coincident: 101.1).

- Manufacturing PMI in Japan fell to 49.4 in Nov (Oct: 50.7), the first contraction since Jan 2021, given reductions in output and new orders reflecting weak demand amid rising inflation. Services PMI edged down to 50 (Oct: 53.2).

- Bank of Korea increased interest rates by 25bps to 3.25%: though the pace of the rate hike is slower (vs 50bps before), rates are now at the highest level since 2012.

- GDP in Singapore grew by 1.1% qoq and 4.1% yoy in Q3, slower than the advance estimates. According to the Ministry of Trade and Industry, GDP is estimated to rise by 0.5%-2.5% next year, down from about 3.5% this year.

- Singapore inflation eased to 6.7% yoy in Oct (Sep: 7.5%), thanks to smaller increases in the prices of energy and food commodities. Core inflation also slowed to 5.1% (Sep: 5.3%), its first easing in 8 months. The MAS, in its financial stability review, stated that “inflation is expected to remain elevated, underpinned by a strong labour market and continued pass-through from high imported inflation”.

- Industrial production in Singapore fell by 0.8% yoy in Oct, following a downwardly revised 1.6% gain in Sep. This was the first decline since Sep 2021, largely due to a plunge in the volatile biomedical manufacturing (-14.5% and pharmaceuticals, by -27.1%).

Bottom line: The FOMC minutes indicate a “slower” pace of hikes, but inflation remains high, weakening consumer demand (anecdotal evidence of thin lines in front of stores during Black Friday) and eating into corporate profits (affected also by the strong dollar and high borrowing costs). This week’s jobs data in the US will be of interest, especially in the backdrop of the recent tech layoffs; also to be released are eurozone inflation numbers, where recent flash PMI readings point towards falling output levels and potential recession (though price pressures seem to be easing for now). The evolving stories to watch for now are the ongoing protests in China related to Covid restrictions and lockdowns, as well as the oil price caps for Russia (EU sanctions to kick in on Dec 5th). These factors will also play into the OPEC+ decision this week: we expect them to hold the current output decision (i.e. status quo).

Regional Developments

- A Wall Street Journal report that OPEC+ was planning a boost in oil output at the Dec meeting resulted in various ministers denying such discussions (Saudi Arabia, Kuwait and Iraq among others). It was emphasised that output cuts would be maintained and that the main aim is to maintain balance and stability in the oil markets.

- Bahrain’s King approved the formation of a new Cabinet, with the Crown Prince reappointed as the PM.

- Bahrain revealed that it had secured BHD 110mn (USD 291mn) in direct investment in the tourism sector during Jan-Sep 2022. Within 3 years, the new firms are expected to create about 1090 jobs. Bahrain’s 4-year strategy includes welcoming 14.1mn tourists by 2026.

- Egypt’s external debt service payments amounted to USD 26.3bn in the fiscal year 2021-22, inclusive of interest of USD 4.57bn, according to the central bank. Total external debt grew by 12.9% yoy to USD 155.708bn as of Jun 2022, about 32.5% of GDP.

- Volume of Islamic banking in Egypt grew by 12.8% yoy to EGP 459bn as of end- Sep. Islamic banking accounts for just 5% of total banking.

- Trade between Egypt and COMESA nations increased by 33% yoy in 2021: exports to COMESA surged by 30.9% to USD 3.066bn while imports from COMESA grew at a faster pace of 37.8% to USD 1.319bn.

- Saudi Arabia’s ACWA Power aims to invest USD 10bn in Egypt by 2026: according to the CEO of ACWA Power, the group will invest about USD 1bn in 2023, while those investments will increase by USD 3bn each year from 2024 to 2026.

- Kuwait’s fiscal deficit narrowed to KWD 3bn in the 2021-22 fiscal year(ended Mar 2022). This is the first-time deficit narrowed since FY2018-19, and much lower than the deficit of KWD 12.1bn estimated in the budget. Revenues surged by 76.9% yoy to KWD 18.6bn in 2021-22, supported by oil revenues (which surged by 84.5% yoy to almost double the budget estimate). Expenditure, in contrast, inched up by just 1.5% yoy in 2021-22; salaries and wages accounted for 58.4% of the total, and subsidies another 17.65%.

- Lebanon’s central bank will use an exchange rate of LBP 15,000 per USD as of Feb 1st, according to the governor, leaving a very wide gap with the parallel market exchange rate which has crossed LBP 40,000 per dollar.

- An independent audit of physical gold reserves at Lebanon central bank has been completed, claimed a bank statement. Reuters reported that an audit copy was not provided to them nor the name of the “specialized and professional international auditing firm”.

- The World Bank, in its latest Lebanon Economic Monitor, revealed that GDP is estimated to contract by a further 5.4% this year (from a 7% drop in 2021) given delays in agreeing upon and implementing reform measures; it also stated that “an IMF programme remains elusive”. More: https://www.worldbank.org/en/country/lebanon/publication/lebanon-economic-monitor-fall-2022-time-for-an-equitable-banking-resolution

- Lebanon’s caretaker PM disclosed that the World Food Programme agreed to allocate USD 5.4bn in aid over the next three years, with the amount to be divided equally between the Lebanese and Syrian refugees (an estimated 1mn+ persons).

- Qatar and China agreed to a 27-year LNG deal: the sales and purchase agreement is for QatarEnergy to supply 4mn tonnes of LNG to China’s Sinopec. QatarEnergy’s chief revealed that negotiations were ongoing with other buyers in China and Europe, given the long-term security of supply.

- FIFA earned record revenues of USD 7.5bn via commercial deals related to the Qatar World Cup: the increase is largely owing to deals with state-backed firms including QatarEnergy (the main sponsor).

- Qatar is in talks to deliver up to USD 10bn in funding for Turkey via either a swap, Eurobond or other method: this would include up to USD 3bn by end of the year and there is already a swap deal in place which was tripled to USD 15bn in 2020.

- UNWTO disclosed that the Middle East witnessed a recovery in international passenger arrivals to 77% of pre-pandemic levels during the Jan-Sep period. Furthermore, international arrivals surpassed pre-pandemic levels by 3% in Sep alone.

Saudi Arabia Focus

- Saudi oil exports almost doubled to SAR 952bn in Jan-Sep 2022; non-oil exports grew by 24%. As of Sep 2022,almost half of Saudi exports went to Asian non-Arab non-Islamic nations, followed by the EU (13%) and the GCC (8%).

- Saudi Arabia is in discussions to deposit USD 5bn at Turkey’s central bank; a Turkish official stated that discussions are over a swap or deposit agreement to boost currency reserves.

- SAMA licensed a new payment fintech firm Tweeq to provide e-wallet services, bringing the total number of licensed payment firms to 23.

- Saudi Arabia plans to launch an index to measure investment funds’ performance given the recent surge in demand for such funds. According to SAMA data, total assets of such funds in the nation dropped by SAR 23.2bn (USD 6.2bn) in Q2 – the steepest fall since Q2 2006.

- Aramco’s base oil subsidiary Luberef received an approval for an IPO: it plans to offer investors 50.045mn of its shares, equivalent to 29.656% of its share capital. Aramco is also planning to list its energy trading business.

- Saudi’s PIF is planning an IPO of the oil and gas drilling firm ADES International next year, reported Reuters.

- SABIC and Aramco plan to undertake a joint project to convert crude into petrochemicals; this will have a capacity of 400k barrels of crude per day.

- Aramco signed 59 corporate procurement agreements worth a combined USD 11bn to secure its supply chains as well as support local manufacturing and create 5,000 jobs.

- The number of mining licences issued by Saudi Arabia declined by 50% mom to 26 in Sep (vs. Aug’s 52). As of Sep 2022, only 2,143 licenses have been validated: 1,342 for quarry building materials, 561 for exploration, 173 for mining and small mining exploration, 36 for reconnaissance and 31 mineral ores licenses.

- Saudi Arabia and Morocco signed an MoU to cooperate in tourism; Saudi invested USD 26.6mn in Morocco’s real estate, tourism, and agricultural sectors in 2020.

- The Saudi Tourism Development Fund allocated SAR 1bn (USD 266mn) to back 50 medium and small projects, revealed the minister of tourism.

- The number of residential transactions in Saudi Arabia declined by 15.5% yoy to 37,743 in Q3, while the transaction value dropped by 0.8% to SAR 25.6bn, according to a report by CBRE. The report also disclosed that average apartment prices grew by 7.8% yoy in Sep, with Riyadh witnessing a 13.1% increase.

- MEED’s Saudi giga projects report disclosed that about USD 569bn worth of contracts are likely to be awarded till 2025. This compares to contracts worth just USD 172bn awarded between 2016 and 2021.

UAE Focus![]()

- The UAE plans to double GDP to AED 3trn (USD 820bn) by 2031 (from AED 1.49trn currently) while the aim is to increase foreign trade and non-oil exports to AED 4trn and AED 800bn respectively.

- IMF, after completing the Article IV consultation,projected UAE’s growth at over 6% this year (2021: 3.8%), thanks to a strong rebound in domestic activity (tourism, construction and Expo related activity) and higher oil production.

- Real GDP in Abu Dhabi grew by 11.2% yoyto AED543bn in the first half of 2022, supported by both oil and non-oil sectors (which grew by 10.8% and 11.6% yoy respectively). Oil sector accounted for 49.7% of overall GDP in H1 2022. According to Statistics Centre Abu Dhabi, Abu Dhabi’s GDP grew by 11.7% yoy in Q2 2022, the highest quarterly value in 6 years.

- Abu Dhabi is close to unveiling a new economic strategy, disclosed the chairman of the Abu Dhabi DED. The focus will be on diversification, as well as developing innovation and digitisation.

- India’s ambassador to the UAE disclosed that the central banks of both nations are discussing rupee-dirham financed trade prospects, which will lower transaction cost in the backdrop of the CEPA signed earlier this year.

- DFM launched a new general index, with the new features including capping the threshold of a DFM index individual constituent at 10% of the index weightage (vs 20%) as well as adding new sectors tracked by institutional clients.

- UAE plans to attract AED 100bn in investments into the tourism sector, 40mn hotel guests and increase the contribution of the tourism sector to AED 450bn by 2031.

- Dubai Airports expect passenger traffic to increase by 1.5mn to 64.3mn this year after passengers tripled in Q3 (18.5mn from 6.7mn a year ago). More than 46.3mn passengers travelled through the airport year to date, up 168% yoy, but about 72% of traffic in the same period of 2019.

Media Review

UAE market goes into overdrive as economy improves

https://www.arabnews.com/node/2204701/business-economy

What does crypto look like after FTX?

https://www.ft.com/content/6874a389-0b9f-4b32-aba6-622f7137bbe4

Egypt not out of the woods after IMF rescue deal

https://www.reuters.com/markets/egypt-not-out-woods-after-imf-rescue-deal-2022-11-25/

Unrest breaks out across China, as frustration at lockdowns grows

Nomura warns seven emerging economies face currency crisis danger (including Egypt)

Powered by: