Download a PDF copy of this week’s insight piece here.

Weekly Insights 25 Nov 2022: Oil price boosts fiscal stance, exports, T-bill investments & GDP in the GCC

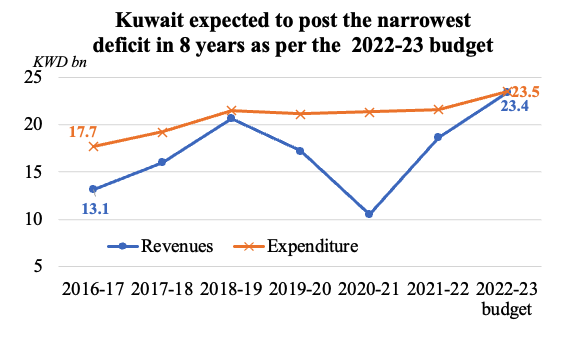

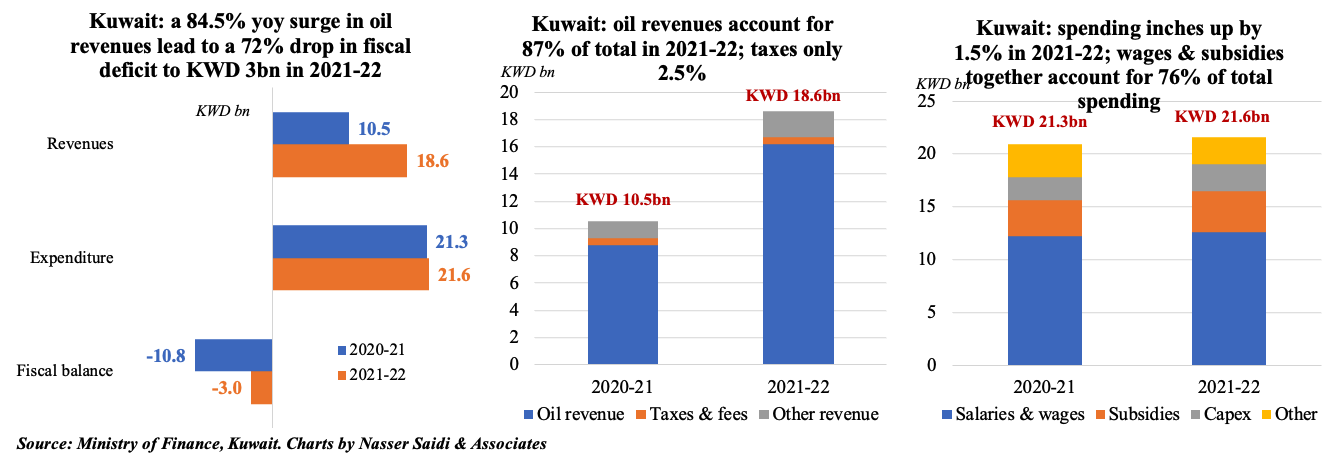

1. Kuwait’s fiscal deficit narrows in fiscal year 2021-22

- Kuwait’s fiscal deficit narrowed to KWD 3bn in the 2021-22 fiscal year (ended Mar 2022). This is the first-time deficit narrowed since FY2018-19, and much lower than the deficit of KWD 12.1bn estimated in the budget. In the 2022-23 budget, deficit is forecast to further decline to USD 0.1bn.

- Revenues surged by 76.9% yoy to KWD 18.6bn in 2021-22, supported by oil revenues – which surged by 84.5% yoy to almost double the budget estimate. Taxes accounted for just 2.5% of total revenues.

- Expenditure, in contrast, inched up by just 1.5% yoy in 2021-22. Salaries and wages accounted for 58.4% of the total, and subsidies another 17.65%.

- In FY 2022-23, oil production is forecast to rise to 2.73mn barrels per day (from 2.43mn bpd) and average oil price to jump to USD 80 (from USD 45).

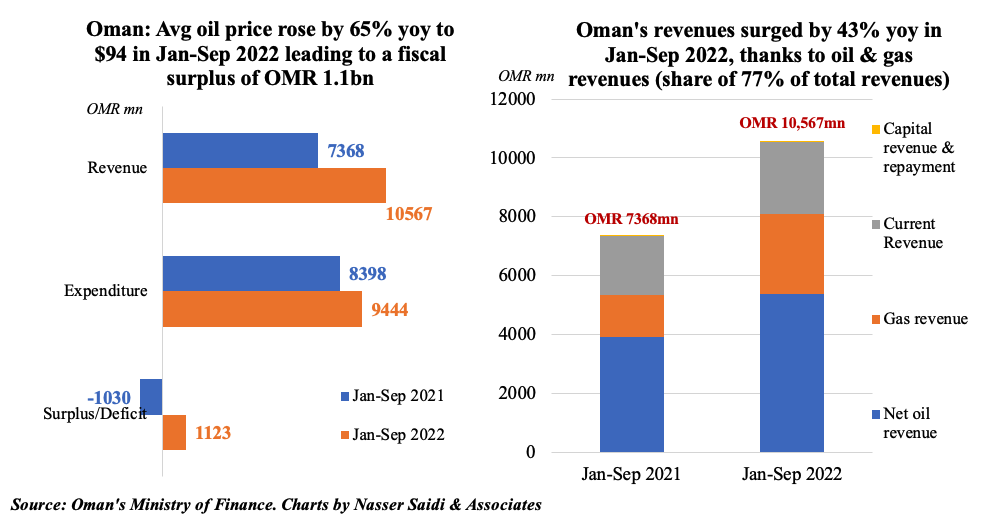

2. Oman’s fiscal surplus stood at OMR 1.123bn in Sep 2022

- With revenues rising by 43.4% yoy and expenditures by a lower 12.5%, fiscal balance in Oman moved to a surplus of OMR 1.123bn in the period Jan-Sep 2022 (from a deficit of OMR 1.03bn a year ago).

- Revenues, as expected, grew thanks to a jump in net oil revenues (+37% to OMR 5.36bn) and gas revenues (92.8% to OMR 2.7bn): together oil and gas revenues accounted for 76.7% of total revenues. Average oil price has increased to USD 94 (from USD 57 a year ago) in Jan-Sep, and average daily oil production was up to 1.056mn barrels per day (from 957k bpd a year ago).

- Expenditures stood at OMR 9.4bn as of Sep 2022, reaching 78% of 2022 budget estimate. An amount of OMR 150mn was allocated for future debt obligations budget-item.

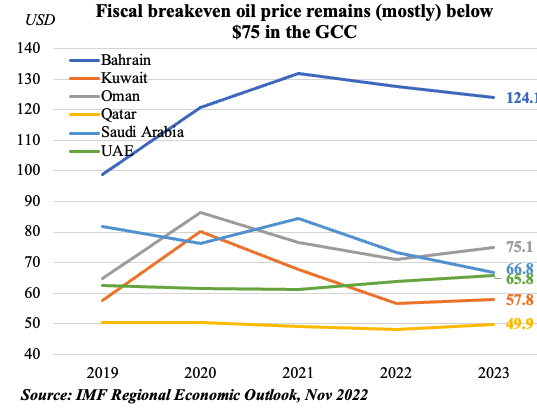

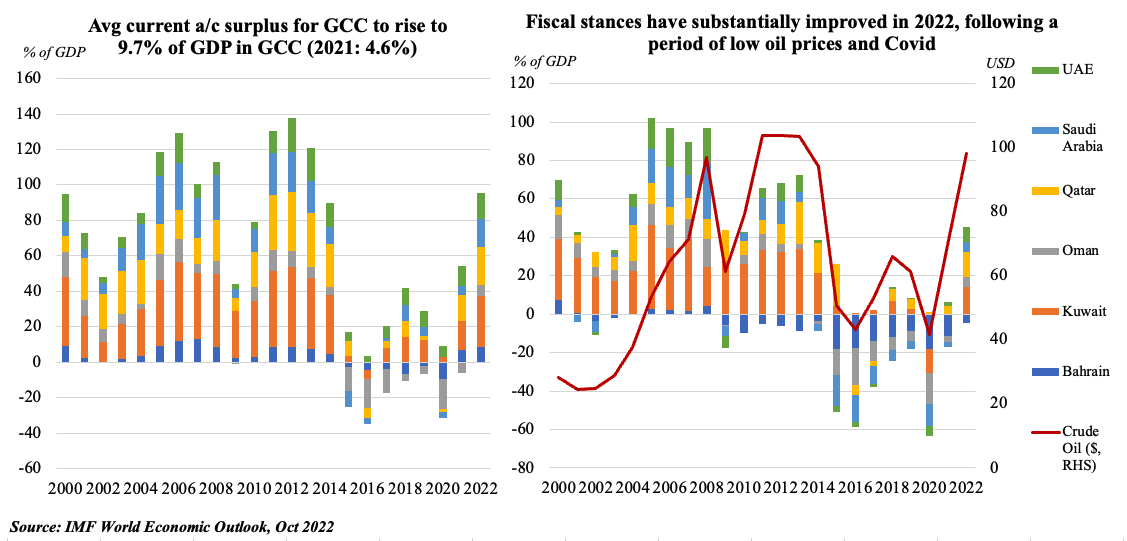

3. GCC’s fiscal prudence

- Fiscal stances have improved in 2022, following a long period characterized by low oil prices and then the Covid19 pandemic.

- As the GCC nations narrow fiscal deficits or move into surpluses, one common factor is that of limited spending (in contrast to pro-cyclical spending) and saving (about 33%) oil revenues for future use.

- Current account surpluses are rising: instead of petro-dollars flowing mostly to the US (Treasuries, equity markets etc), funds are being re-routed into the domestic/ regional economies (providing aid to low- and middle-income nations).

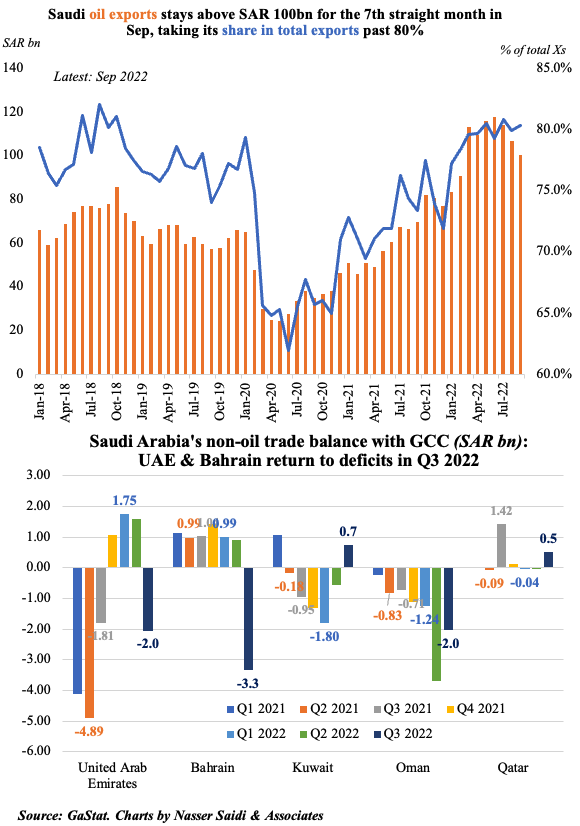

4. Saudi oil exports almost doubles to SAR 952bn in Jan-Sep 2022; non-oil exports grow by 24%

- Oil exports value surpassed SAR 100bn for the 7th consecutive month in Sep, and continued to drive overall exports and foreign trade. Non-oil exports are also rising, thanks to an uptick in chemical products & plastics (accounting for > 2/3rd of total exports in Sep).

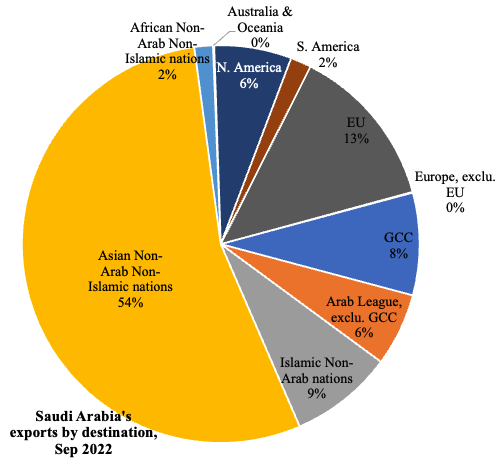

- As of Sep 2022, almost half of Saudi exports went to Asian non-Arab non-Islamic nations, followed by the EU (13%) and the GCC (8%). Among GCC, both UAE and Bahrain returned register trade deficits with Saudi in Q3 2022.

5. Holdings of US Treasuries in the GCC grew by 3.2% from end-Dec 2021 to Sep 2022

- Saudi Arabia is the 16th largest investor in US Treasury bonds globally as of Sep 2022 (USD 120.997bn).

- While this pales in comparison to the top of the list Japan (USD 1.120trn) and China (USD 933.6bn), it is still highest among the GCC.

- GCC nations, excluding the UAE, have increased their holding compared to end-2021. Fiscal buffers and reserves increasing has led to increased Treasury-bill investments. Max increase was from Qatar: +71.6% ytd to USD 9.7bn. Overall, GCC holdings of US Treasuries grew by 3.2%to USD 237.4bn as of Sep.

- A strong dollar, and recent global central banks’ decisions to aggressively raise rates to combat inflation contributed to selling of Treasuries by many nations. Foreign holdings of Treasuries dropped to their lowest level in Sep 2022 since May 2021.

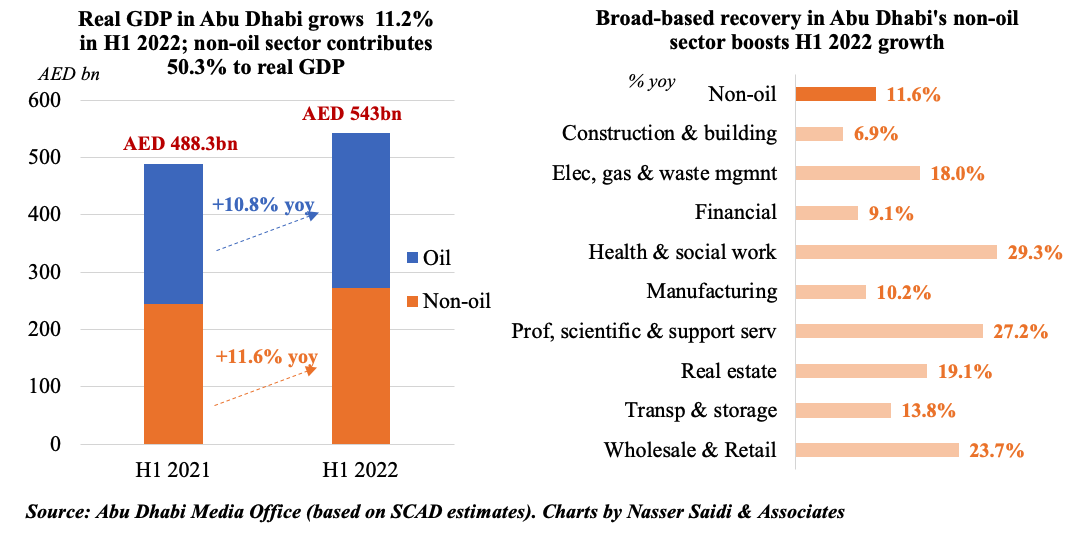

5. Abu Dhabi GDP grew by 11.2% yoy in H1 2022

- Real GDP in Abu Dhabi grew by 11.2% yoy to AED543bn in the first half of 2022, supported by both oil and non-oil sectors (which grew by 10.8% and 11.6% yoy respectively). Oil sector accounted for 49.7% of overall GDP in H1 2022.

- According to Statistics Centre Abu Dhabi, Abu Dhabi’s GDP grew by 11.7% yoy in Q2 2022, the highest quarterly value in 6 years.

- Among non-oil sector activity (the share of which stood at 50.3%), the highest growth rates were seen in health and social work (29.3% yoy), professional, scientific and support services (27.2%) and the wholesale and retail sector (23.7%). The recovery was broad-based with manufacturing ticking up by 10.2% and financial sector by 9.1%.

- IMF, in its completion of the Article IV consultation, projected UAE’s growth at over 6%, thanks to a strong rebound in domestic activity and higher oil prices.