Markets

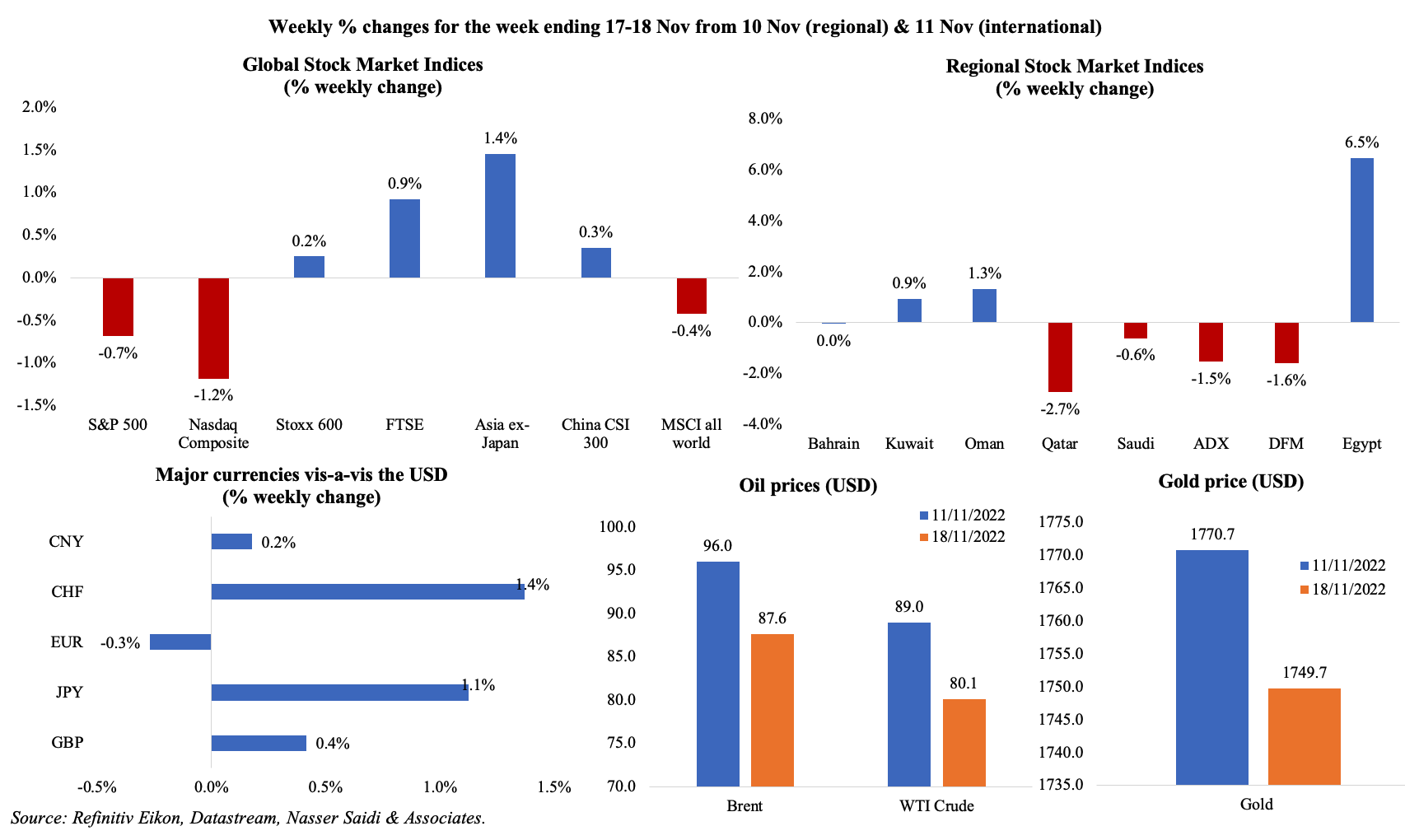

Mixed performance from global equity markets last week, with the US and MSCI world equities index posting losses. A BofA report disclosed that inflows into global equity funds touched the highest level in 35 weeks (in the week to last Wednesday). Regional markets were mostly down, on oil demand concerns following lockdowns in China and upcoming Fed hikes, with Qatar leading declines in the region, while Egypt gained by 6.5% (its 5th weekly gain). The euro suffered losses after policymakers’ statements that the ECB must raise rates high enough to restrict growth, while the GBP gained. Oil prices slipped by around 9% from the week before on rising concerns about demand for crude from China (WTI posted its biggest weekly loss since Mar) while gold price was down by 1.2%.

Global Developments

US/Americas:

- Industrial production edged lower by 0.1% mom in Oct, following a downwardly revised 0.1% gain in Sep; manufacturing of durable goods grew by 0.5% while auto production accelerated by 2%. Capacity utilisation slowed to 79.9% from 80.1% the month before.

- Producer price index rose by 0.2% mom and 8% yoy in Oct (Sep: 0.2% mom and 8.4% yoy), posting the smallest yoy increase since Jul 2021. Excluding food and energy, core PPI eased to 6.7% (Sep: 7.1%); in mom terms, core goods inflation dipped by 0.1%, the first decline since May 2020.

- Retail sales in the US grew by 1.3% mom in Oct after remaining unchanged the month before: this was the strongest rise in 8 months, thanks to sales at food services and drinking places (1.6%), food and beverage stores (1.4%) and non-store retailers (1.2%) among others.

- NY Empire State manufacturing index increased to 4.5 in Nov (Oct: -9.1) as shipments expanded, inventories grew, and employment rose. Philadelphia Fed manufacturing survey plunged to -19.4 in Nov (Oct: -8.7), the lowest reading since May 2020, as new orders and shipments indices remained negative and low respectively. Kansas Fed manufacturing activity improved to -10 in Nov (Oct: -22), remaining the 2nd lowest reading since May 2020.

- Housing starts declined by 4.2% mom to 1.425mn, with single-family housing starts tumbling by 6.1% to 855k units, the lowest level since May 2020. Building permits in the US fell by 2.4% mom to 1.526mn in Oct, the lowest since Aug 2020. Existing home sales plunged for the 9th consecutive month in Oct, down by 5.9% mom to 4.43mn, the lowest since Dec 2011. The 30-year fixed mortgage rate is averaging above 7%, the highest since 2002, putting off potential homebuyers.

- Initial jobless claims decreased by 4k to 222k in the week ended Nov 11th, with the 4-week average slightly up to 221k. Continuing jobless claims inched up by 13k to 1.507mn in the week ending Nov 4th.

Europe:

- GDP in the eurozone increased by 0.2% qoq and 2.1% yoy in Q3 (Q2: 0.8% qoq), with Latvia and Austria registering economic contractions over the last quarter.

- Inflation in the eurozone was revised down to 10.6% yoy in Oct, lower than the initial estimate of 10.7%, and still the highest on record. Core inflation stands at a record-high 5%.

- Industrial production in the eurozone increased by 0.9% mom and 4.9% yoy in Sep: this was the largest yoy increase since Aug 2021. In mom terms, output of non-durable consumer goods grew for a 3rd consecutive month (3.6% from Aug’s 1.4%), and capital goods were up for a 2nd straight month (1.5% from Aug’s 2.9%).

- ZEW indicator of economic sentiment in Germany improved to -36.7 in Nov (Oct: -59.2) while the current situation increased by 7.7 points to -64.5. Meanwhile, Eurozone’s ZEW economic sentiment indicator also declined significantly to -38.7 in Nov (Oct: -59.7).

- Wholesale price index in Germany slowed in Oct, rising by 17.4% yoy versus Sep’s 19.9%, with prices of raw materials and intermediate products the main drivers of the uptick; wholesale petroleum products prices surged by 41.5% yoy.

- Inflation in the UK jumped to a 41-year high of 11.1% in Oct (Sep: 10.1%) while core CPI remained unchanged at 6.5%. Inflation would have climbed to 13.8% had the government not limited the price of household energy bills to GBP 2500 a year on average, according to the ONS. Prices of food and non-alcoholic beverages rose at the fastest pace since 1977. Producer price indices eased on both input and output sides: input prices stood at 19.2% (Sep: 20.8%), the slowest pace since Mar, while output prices grew by 14.8% (Sep: 16.3%), the lowest since Apr. UK retail price index grew by 2.5% mom and 14.2% yoy in Oct, faster than Sep’s 0.7% mom and 12.6% yoy gain; in yoy terms, the most since Dec 1980.

- UK’s finance minister unveiled a GBP 55bn (USD 66bn) fiscal plan including GBP 30bn of spending cuts and GBP 25bn of tax rises. The Office for Budget Responsibility projected that the economy would contract by 1.4% in 2023 and would not reach pre-pandemic levels until late 2024. Real household disposable income is projected to fall by 4.3% in 2022-23, the largest single-year decline since the Office for National Statistics began recording in 1956-57.

- Retail sales in the UK rebounded by 0.6% mom in Oct (Sep: -1.5%). Sales volumes were down by 2.4% in the 3 months to Oct, as households adjusted to the rising inflation. Quantity of goods sold in Oct was 0.6% below Fed 2020 levels, though spending was 14.2% more.

- Unemployment rate in the UK inched up to 3.6% in the 3 months to Sep (previous: 3.5%). Employment fell by 52k and the employment rate was 75.5%, largely unchanged on the previous quarter. Average earnings excluding bonus grew by 5.7% in the same period (previous: 5.5%). After taking inflation into account, average pay including (excluding) bonuses fell by 2.6% yoy (2.7%) in Jul-Sep.

Asia Pacific:

- Industrial production in China grew by 5% yoy in Oct, slower than the 6.3% in the previous month, as output growth in both mining and manufacturing slowed. Fixed asset investment grew by 5.8% in Jan-Oct (Jan-Sep: 5.9%). Retail sales fell by 0.5% yoy in Oct, the first decline since May and down from Sep’s 2.5% growth; online sales of physical goods surged by 22% yoy in Oct, accounting for more than 1/4th of overall retail sales.

- FDI inflow into China grew by 14.4% yoy in Jan-Oct to CNY 1.09trn, lower than the 15.6% posted in Jan-Sep. Overall FDI inflow is inching close to 2021’s record-high CNY 1.15trn.

- GDP in Japan unexpectedly shrank by 0.3% qoq and an annualised 1.2% in Q3, as private consumption slowed (0.3% in Q3 vs 1.2% gain in Q2) and real compensation of employees falling by 1.6% (Q2: 1.2% drop).

- Inflation in Japan increased to 3.7% yoy in Oct (Sep: 3%), the highest reding since Jan 1991, while core CPI rose to 3.6% (the fastest pace since Feb 1982) exceeding the BoJ target for the 7th consecutive month. Excluding fresh food and fuel, CPI inched up to 2.5% from 1.8% the month before.

- Industrial production in Japan fell by 1.7% mom in Sep, following a 3.4% growth in Aug, as output of motor vehicles and chemicals fell by 12.4% and 6.3% respectively. In yoy terms, IP grew by 9.6%, from Aug’s 5.8% gain. Machinery orders fell by 4.6% mom in Sep (Aug: -5.8%), amid economic uncertainty and high import costs from a weak yen.

- Exports from Japan grew for the 20th straight month in Oct, rising by 25.3% yoy, and imports were up by 53.5%, causing trade deficit to widen to JPY 2.16trn (a record for Oct). Exports to China, Japan’s largest trading partner, grew by 7.7% in Oct, led by cars and audio equipment (though slower than Sep’s 17.7% gain).

- Wholesale price inflation in India eased to 8.3% in Oct (Sep: 10.7%), the lowest reading since Mar 2021. Consumer price inflation also inched lower to 6.8% in Oct (Sep: 7.4%), thanks to a softer increase in food prices (7% vs Sep’s 8.6%) and a strong base effect.

- According to the Reserve Bank of India, growth is expected to stay between 6.1% and 6.3% in Jul-Sep, resulting in an overall growth of about 7% in 2022-23.

- India’s foreign exchange reserves increased to USD 544.72bn in the week through Nov. 11, posting the biggest weekly jump in more than a year.

Bottom line: Though an agreement was reached at COP27 to set up a fund to cover “loss and damage” that the “particularly vulnerable” countries are suffering from due to climate change, nations failed to agree on phasing out fossil fuels or take a stronger stance on how to cut GHG emissions faster (despite threats from the EU to walkout of the talks). The US Black Friday sales data will be watched carefully, especially given the stronger than expected Oct retail sales number (in the backdrop of rising prices and interest rates). Meanwhile, weak economic activity is the likely common theme across this week’s release of preliminary PMI numbers for Nov.

Regional Developments

- Al Arabiya TV reported the OPEC Secretary’s statement that the organisation is ready to intervene for the benefit of oil markets.

- Bahrain’s domestic origin exports increased by 9% yoy to BHD 400mn in Oct 2022, with the top 10 nations accounting for more than three-quarters of the total value. The value of re-exports touched BHD 83mn (+44%) while imports stood at BHD 500mn (+11%).

- Employment levels in Bahrain rose in Q2: foreign workers grew by 5.5% yoy to 563,332 while employment among Bahrainis ticked up by 3.6% to 161,430. Construction (30.2%), wholesale and retail trade (18.5%) and accommodation and food services (13.7%) sectors accounted for the highest number of work permits.

- Egypt’s trade deficit widened to USD 4.18bn in Aug as both exports and imports dropped by 7.6% (to USD 3.33bn) and 3.2% (to USD 7.51bn) respectively. Exports of oil products and crude oil exports plunged by 19.8% and 49.7% yoy, while LNG exports surged by 179.1%.

- Unemployment in Egypt inched up to 7.4% in Q3 while the total labour force inched up by 0.9% qoq to 30.264mn.

- Remittances into Egypt fell by 2.34% yoy to USD 20.9bn in Jan-Aug, according to the central bank. In Aug, remittances shrank to USD 2.2bn (Jul: USD 2.4bn).

- Egypt’s Suez Canal Economic Zone signed a USD 500mn contract to establish a second container handling terminalin East Port Said.

- Egypt signed 8 framework agreements to develop green hydrogen and ammonia projects, with an aim to become a hub for hydrogen production and corner 5% of market share by 2040.

- The IMF and Jordan reached a preliminary agreement to boost assistance to around USD 2bn over the 2020-24 period. The nation has met most of its fiscal and monetary targets since the IMF programme began in 2020, including closing tax loopholes and widening the tax base. Jordan aims to reduce fiscal deficit to 2.9% of GDP by 2023 and reduce public debt to 80% of GDP by 2027.

- Moody’s affirmed Jordan’s B1 rating and changed the outlook to positive from stable, citing the government’s “strong commitment” to reforms and effective implementation.

- Kuwait attracted investments to the tune of KWD 106.1bn (USD 322mn) in 2021-22, disclosed the Kuwait Direct Investment Promotion Authority.

- Oman will launch the National Programme for Financial Sustainability and Development of the Financial Sector from Jan 2023 for a 3-year period, to support financial sector development and become a basic enabler for the growth of investments.

- Oman’s Sultan endorsed that vehicle fuel prices will be fixed in accordance with Oct 2021 rates, as a maximum ceiling, until end-2023.

- Bloomberg reported that Oman Investment Authority increased its assets to USD 41.5bn thanks to expanding its holdings in real estate, technology, and logistics sectors. Most of the investments are in Oman (61.5% of its portfolio) while North America, Western Europe and Asia Pacific account for 17%, 9.3% and 4.7% respectively.

- A report from ForwardKeys indicates that Oman can expect a 93% spike in international arrivals from European nations and a 156%+ surge from regional markets in Nov-Dec.

- GCC retail sector is estimated to grow by 15.7% yoy in 2022, with revenues touching USD 296.8bn, according to Alpen Capital. The sector is estimated to grow at a CAGR of 5.7% to reach USD 370bn by 2026. Saudi Arabia and UAE will spearhead regional sales, together accounting for 78.5% of total sales by 2026.

- Saudi Arabia and UAE were ranked 3rd and 4th in the World Bank’s GovTech Maturity Index for 2022. The data shows that 154 out of a total 198 countries (78%) have launched digital government or GovTech initiatives and 147 nations (74%) have relevant strategies to address country-specific digital transformation challenges. More: https://www.worldbank.org/en/programs/govtech/gtmi

Saudi Arabia Focus

- Inflation in Saudi Arabia slowed to 3% yoy in Oct (Sep: 3.1%, a 15-month high). An increase in food, transport and housing rents (up by 4.35%, 4.38% and 3.7% yoy respectively) was balanced by a fall in costs of clothing (-1/3% yoy) as well as ease in recreation, education and restaurant/ hotels prices.

- Wholesale price inflation in Saudi Arabia eased for the 7th straight month in Oct, rising to 4.6%, the lowest reading since Jun 2020. Prices have dropped significantly compared to the double-digit increases seen during Apr 2021 to May 2022.

- Saudi Arabia’s FDI inflows stood at SAR 7.9bn (USD 2.1bn) in Q2 2022, up by 6.6% qoq but lower by 85% yoy. The decline was due to asurge in FDI in Q2 2021 (thanks to the one-off Saudi Aramco deal). If the Aramco deal is excluded, FDI grew by 46.5% yoy in Q2 2022.

- PIF increased its stakes in Meta and Alphabet in Q3 2022, according to its latest 13F filings.

- The Saudi-Korea Investment Forum saw 26 investment agreements & MoU’s signed with a combined value of SAR 112.7bn (USD 30bn).

- Aramco plans to invest in a USD 7bn project to produce petrochemicals from crude oil at South Korean S-Oil Corp’s refining complex in the port city of Ulsan. Construction of the complex will begin in 2023 and end by 2026; the complex will produce up to 3.2mn tonnes per year of petrochemicals.

- Strengthening ties with Asia: Saudi Arabia signed a MoU with Indonesia to cooperate in the energy fields covering oil and gas, electricity and renewable energy. Five agreements were signed with Thailand to increase trade, investment, tourism and cooperation in energy as the countries agree to expand diplomatic relations (restored this year after 3 decades).

- Saudi Arabia’s crude oil exports rose for a fourth consecutive month in Sep: up 1.6% yoy to 7.721mn barrels per day, the highest since Apr 2020. Crude production however edged lower to 11.041mn bpd in Sep (Aug: 11.051mn bpd).

- Demand for office space in Riyadh continues to rise: occupancy levels at Grade A offices have increased by 4% yoy to 98%, according to Knight Frank. The average lease rates for prime office space in Riyadh grew by 18% yoy to approximately SR1,775 (USD 472) per sqm.

- Occupancy levels at Riyadh’s hotels rose to 72.3% in Oct, according to STR; with average daily rates of SAR 771.25 (USD 205), revenue per available room touched SAR 557.28, the highest since May 2011.

UAE Focus![]()

- Abu Dhabi has over 11 companies “being either advised or in final stages for application approval for the listing on Abu Dhabi stock market”, revealed the Abu Dhabi DED’s Chairman in a Bloomberg interview.

- Dubai school operator Taleem Holdings priced the IPO at AED 3 (USD 0.8168) a share: the offer was oversubscribed 18-times.

- UAE banking sector assets grew almost 12-fold to USD 900bn in 2022 from USD 75bn in 2000, and revenues are expected to jump to USD 25bn by 2030 according to the Chairman of UAE Banks Federation. He also underscored the role of digital transformation: “leading banks now provide 90% of their services via smartphone, and more than 50% of new bank accounts are opened through digital channels”.

- In the backdrop of rising prices, the UAE ministry of economy announced a new pricing policy for 9 basic consumer products including cooking oils, eggs, dairy, rice, sugar, poultry, legumes, bread and wheat.

- Abu Dhabi Department of Economic Development launched a “smart manufacturing” index to help private sector firms adopt smart manufacturing technologies: the index will allow for assessing capabilities, identifying gaps and recommending steps to improve competitiveness and productivity.

- Mubadala acquired a stake in Singapore-based AirCarbon Exchange, reported Reuters: the firm is partnered to establish the first regulated carbon trading exchange in Abu Dhabi.

- Abu Dhabi Global Markets (ADGM) launched Abu Dhabi Crypto Hub, a virtual platform that allows users access to information and connect with existing virtual asset firms at the ADGM. Virtual asset trading platforms Hayvn and Kraken have regulatory licenses from the ADGM, while Binance was granted approval last week.

- UAE firms with 50+ employees are mandated to have Emiratis as 2% of skilled staff by end-2022; this must be raised by 2% every year, with an aim to reach 10% by 2026.

Media Review

Deglobalization Is a Climate Threat

A new UN fund for “loss and damage” emerges from COP27

FTX businesses owe more than $3bn to largest creditors

https://www.ft.com/content/5d826ca9-389e-41ec-a38b-da43211da974

Aging is the Real Population Bomb

China is rapidly rolling out its new digital currency

Powered by: