Download a PDF copy of this week’s insight piece here.

Weekly Insights 18 Nov 2022: Will easing inflation in the Middle East raise demand & improve activity?

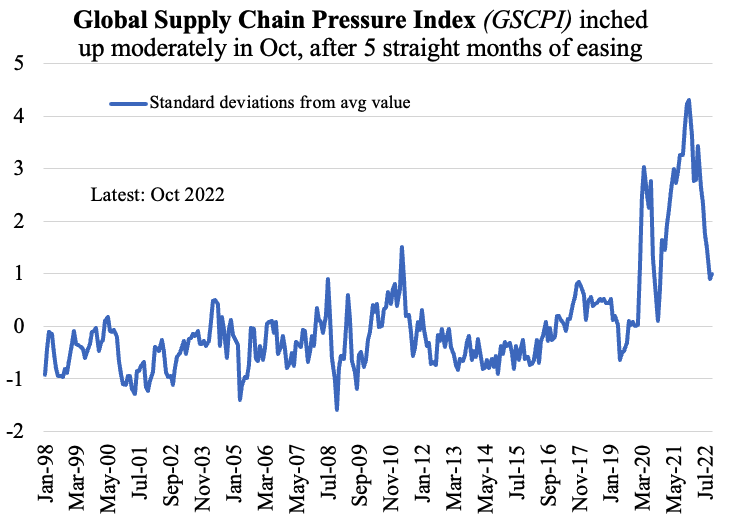

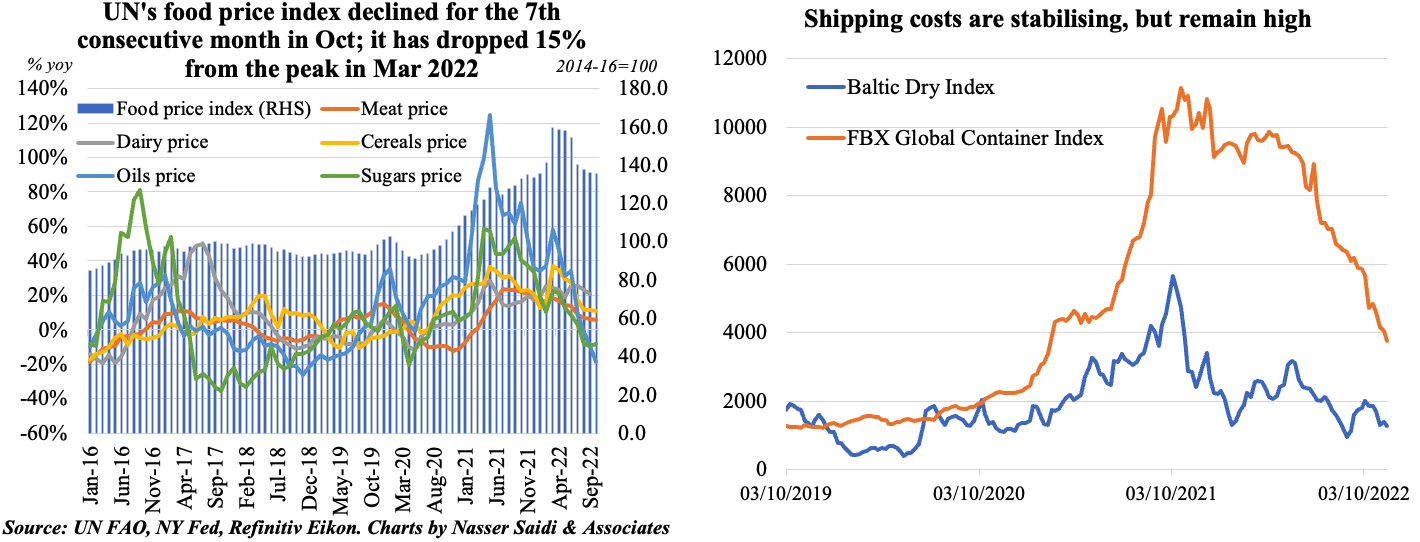

1. Signs of encouragement for inflation globally?

- The Fed’s GSCPI readings have eased, as shipping costs stabilize, and supply disruptions improve amid a reduction in demand for goods

- UN’s food price index appears to have peaked: it has dropped 15% from its peak in Mar 2022, but in Oct 2022 remained 2% higher vs a year ago

- Food import costs globally are projected to reach an all-time high of ~USD 2trn this year, up 10% yoy (Source: FAO), raising concerns of food security and fiscal burden (especially nations that are dependent on imported food and facing currency depreciation)

- Costs of services are still high, feeding overall inflation

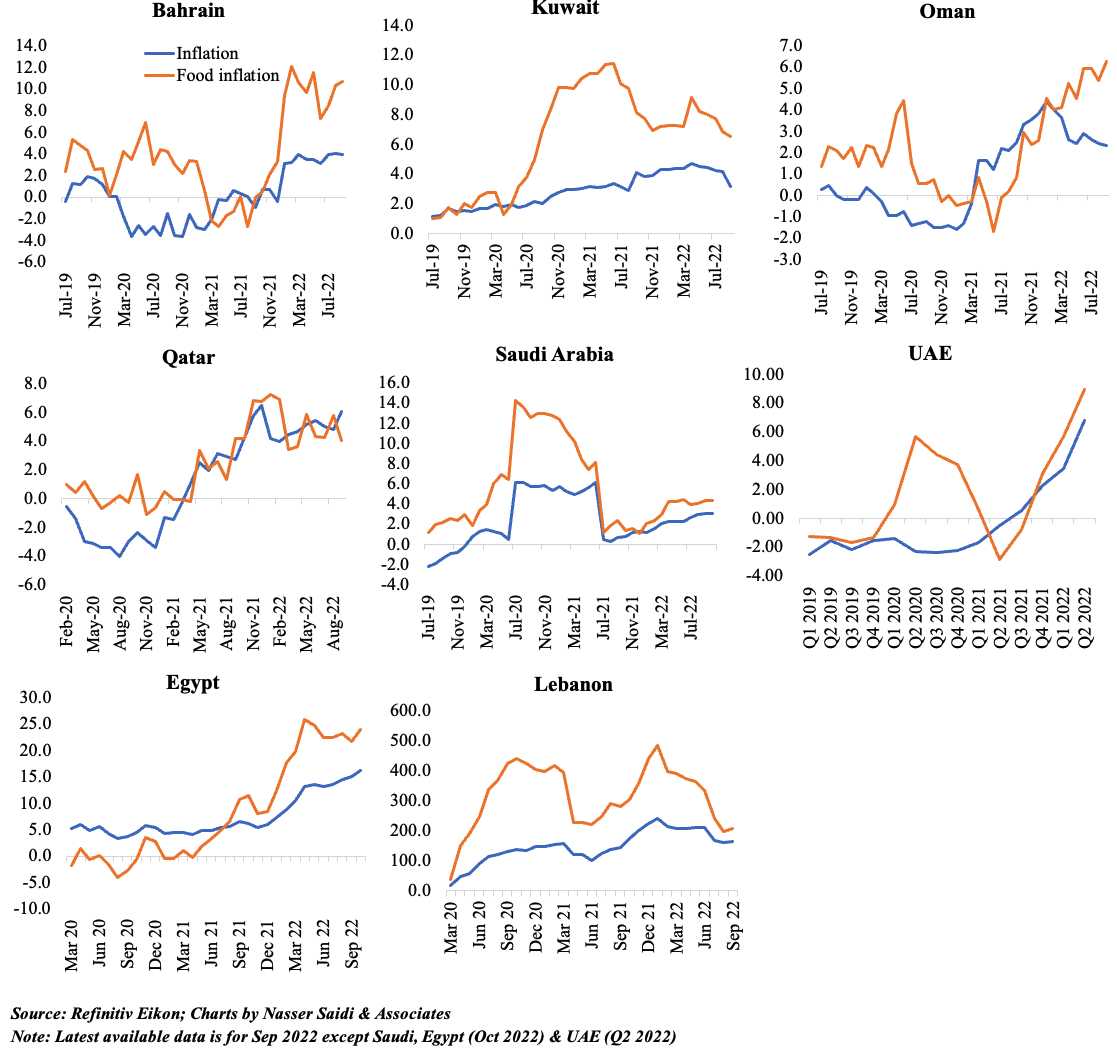

2. Inflation in the Middle East ease in many nations, but food prices remain high

- Food prices have been rising in the ME, often at a faster pace than headline inflation. However, broader inflationary pressures have stemmed from non-traded, higher services prices (recreation, restaurants, hotels etc.) as well as transport costs and housing

- In Egypt, inflation quickened to a 4-year high of 16.2% even before accounting for the adoption of a flexible exchange rate; higher rates likely in coming months,

- Ongoing financial support from the GCC will benefit Egypt.

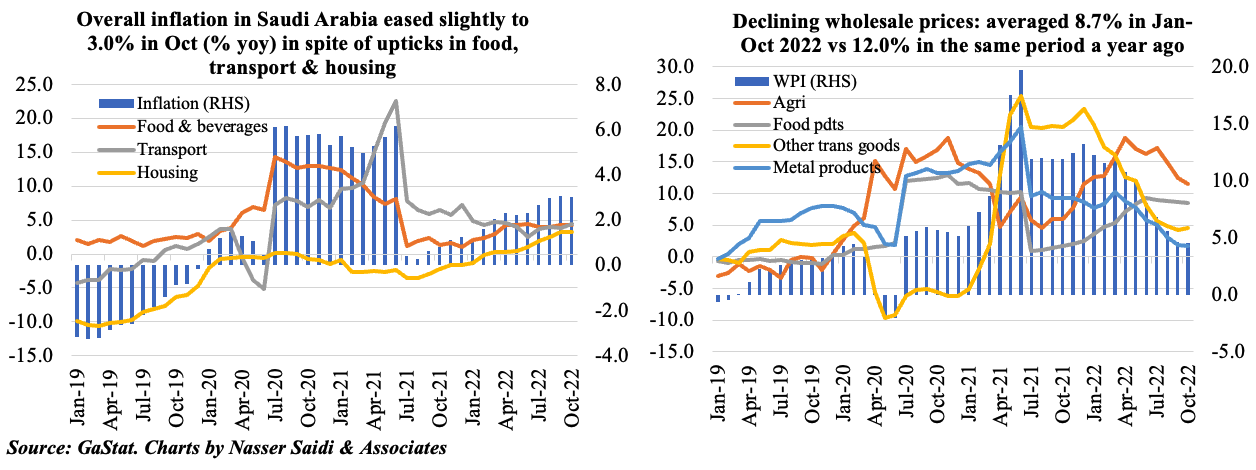

3. Inflation in Saudi Arabia eased in Oct: both consumer and wholesale prices

- Consumer price inflation in Saudi Arabia eased to 3% in Oct, from Sep’s 15-month high reading of 3.1%. An increase in food, transport and housing costs (up by 4.35%, 4.38% and 3.3% yoy respectively) was balanced by a fall in costs of clothing (-1/3% yoy) as well as ease in recreation, education and restaurant/ hotels prices.

- Wholesale prices eased for the 7th straight month in Oct: prices were up by 4.6% (vs Sep’s 4.61% gain), the lowest reading since Jun 2020. Prices have dropped significantly compared to the double-digit increases seen during Apr 2021 to May 2022.

- This confirms the majority response of easing input prices from the Oct PMI results. Softening prices have resulted in a strengthening of demand (including export orders), supporting expansion in the non-oil private sector.

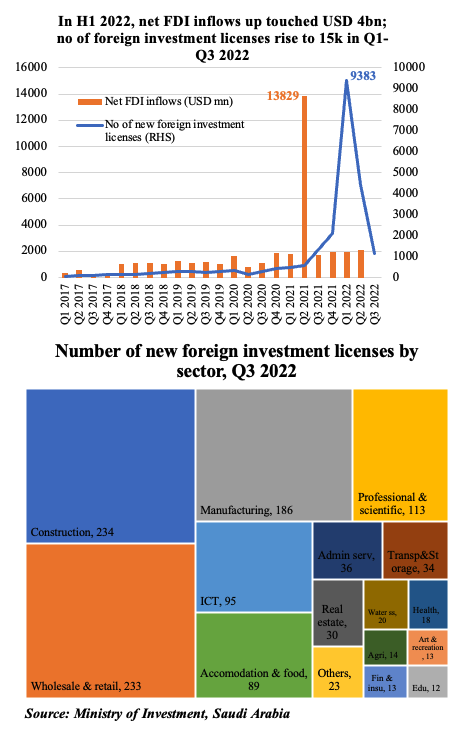

4. Saudi Arabia’s FDI flows stood at USD 2.1bn in Q2 2022

- In Q2 2022, Saudi Arabia’s FDI inflows stood at USD 2.1bn: this was up 6.6% qoq but lower by 85% in year-on-year terms. The yoy decline was a result of the surge in FDI due to the one-off Saudi Aramco deal in Q2 2021. If that is excluded, FDI grew by 46.5% yoy in Q2 2022.

- The number of investment licenses issued surged in 2022 (till Q3) by 527.4% to 15k.

- Together, construction, wholesale and retail, manufacturing and professional activities accounted for close to 2/3-rd of the new licenses issued in Q3 2022.

- The Economic and Investment Monitor revealed that 203 deals were closed in 2022 (till Q3), up 133.3% yoy; entrepreneurship & innovation sector reeled in the most deals (47 out of 53 in Q3 2022).

- The appetite for investment was also evident from the recent Saudi-Korea Investment Forum, which saw 26 investment agreements & MoU’s signed with a combined value of SAR 112.7bn (USD 30bn).

- Worthwhile bearing in mind that Saudi Arabia launched, last year, the National Investment Strategy – which aims to attract SAR 388bn in FDI annually, creating jobs and increasing investments contribution to GDP to 30% by 2030 (2019: 22%).

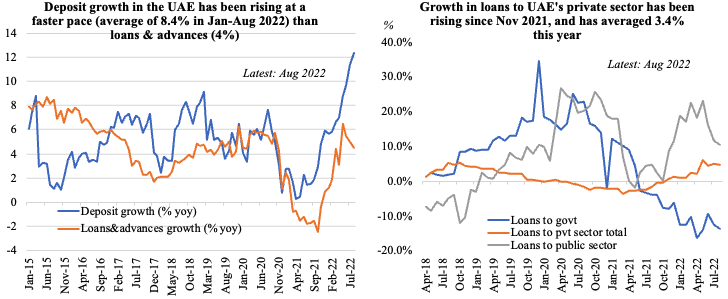

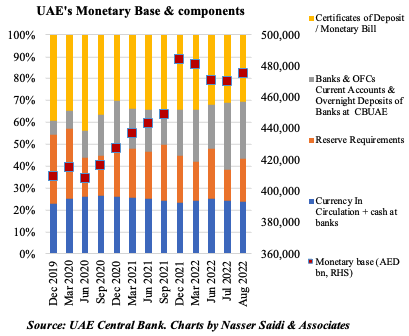

5. UAE Banking Indicators Aug 2022

- Deposit growth in the UAE outpaced loans & advances in 2022: an average of 8.4% and 4% respectively in Jan-Aug this year.

- In Aug alone, domestic credit declined by 0.4% mom & credit to the private sector fell by 0.2%; the only segment that witnessed an uptick was retail customers (a modest 0.97% gain).

- Monetary aggregates M2 & M3 grew in Aug; currency in circulation outside banks dipped by 1.23% mom in Aug. Monetary base inched up by 1.0% to AED 475.5bn.