Markets

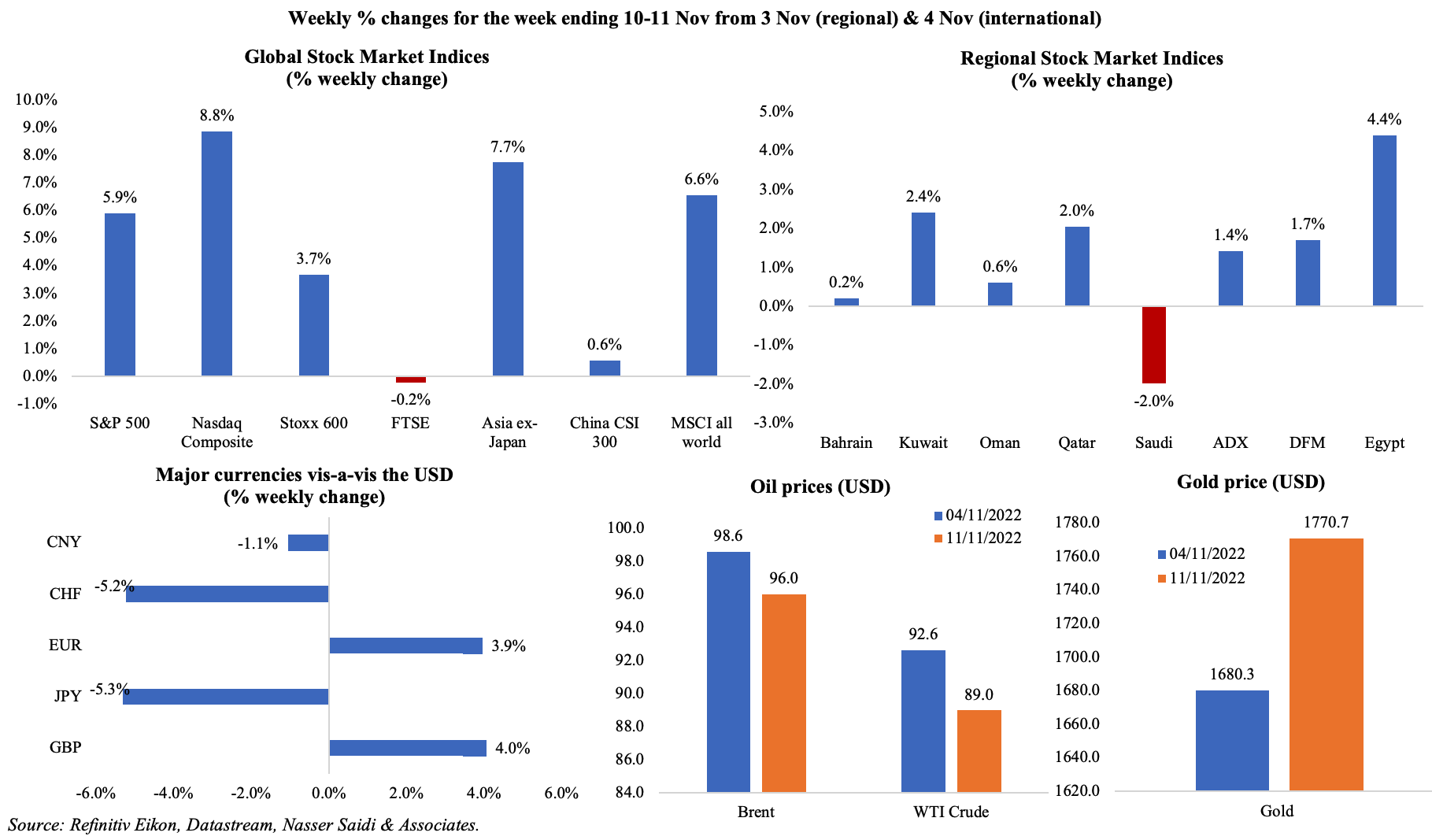

Most equity markets gained last week, after US inflation eased (raising expectations for a lower Fed hike come Dec) and given China’s decision to scrap Covid flight bans and relax quarantine requirements for international inbound travellers. Asian shares rose to a 7-week high while signs of a potentially lengthy recession in UK pulled the FTSE down. Regional markets were mostly up except for Saudi Arabia which posted a 3rd weekly loss. Currency markets saw the dollar post its biggest 2-day drop in 2 years. Oil price declined in week-on-week terms on worries about Chinese demand and rising US oil inventories though it saw gains towards end of the week (on news from the US and China). Gold price rose to a near 3-month high. The FTX drama and related turmoil resulted in bitcoin dropping to a 2-year low.

Global Developments

US/Americas:

- Inflation in the US eased to 7.7% yoy in Oct (Sep: 8.2%), its lowest level since Jan, spiking expectations of a lower hike by the Fed in Dec. While vehicle prices, medical care costs and airline fares declined, rents rose (+6.9% yoy, contributing to half the overall monthly inflation uptick). Core inflation also slipped to 6.3% from the previous month’s 6.6%.

- US monthly budget deficit declined by 47% yoy to USD 88bn in Oct: this is the first month of the government’s 2023 fiscal year. Spending dropped by 9% to USD 406bn while revenues were up by 12% to USD 319bn.

- Michigan consumer sentiment index fell to 54.7 in Nov (Oct: 59.9), the lowest since Jul as the current conditions index declined to 57.8 (Oct: 65.6) while expectations tumbled to 52.7 (from 56.2). UoM’s 5-year consumer inflation expectations rose to 3% in Nov (Oct: 2.9%).

- Initial jobless claims climbed by 7k to 225k in the week ended Nov 4th, with the 4-week average down to 218.75k. Continuing jobless claims also increased by 5k to 1.493mn in the week ending Oct 28th.

Europe:

- Industrial production in Germany rebounded by 0.6% mom in Sep (Aug: -1.2%), thanks to increased production in both consumer and capital goods – by 1.4% and 1.1% respectively.

- European Commission predicts a sharp contraction in Germany’s output: the nation is forecast to post a 0.6% yoy decline in real GDP in 2023. Overall growth in the EU is estimated to fall by 0.3% in 2023 while inflation is projected at 7% (2022 estimated: 9.3%).

- Sentix investor confidence in the eurozone improved slightly to -30.9 in Nov (Oct: -38.3). The current situation index increased to -29.5 (Oct: -35.5) while expectations rose to -32.3 (Oct: -41).

- Retail sales in the eurozone inched up by 0.4% mom in Sep, after being flat in Aug. Sales of non-food products grew by 1.0% (Aug: 0.2%) and online trade was up by 2.6% (Aug: -4.1%) while fuel sales were down by 0.6%. In yoy terms, retail sales declined by 0.6%.

- UK GDP fell by 0.2% qoq in Q3 while in yoy terms, GDP was up by 2.4% yoy (GDP shrank by 0.6% in Sep, and by 0.1% in Aug). Industrial production grew by 0.2% mom in Sep while manufacturing was flat. Business investment dropped by 0.5% in Q3, also remaining 8.4% below its pre-pandemic levels.

- BRC like-for-like retail sales in the UK grew by 1.2% yoy in Oct, slowing from Sep’s 1.8%. Spending on food in the three months to Oct rose by 5.1% yoy while non-food spending dropped by 1.2%.

Asia Pacific:

- China eased Covid quarantine requirements for international travellers and close contacts to 5 days instead of the previous 7 days, while maintaining three further days of home isolation.

- Exports from China unexpectedly fell by 0.3% yoy in Oct (the first time since May 2020) and imports shrank by a larger 0.7% (weakest since Aug 2020), widening the trade surplus to USD 85.1bn. Exports to the US and EU fell by 12.6% and 9% yoy respectively.

- Inflation in China eased to 2.1% yoy in Oct, from Sep’s 29-month high of 2.8%, driven by a decline in food prices (7% from Sep’s 8.8%). Core inflation rose to 0.6%, unchanged from Sep. Producer price index fell -1.3% in Oct (Sep: 0.9%), dropping for the first time since Dec 2020, likely a result of declining domestic demand and impact of Covid19 restrictions on production.

- Money supply (M2) in China grew by 11.8% yoy in Oct (Sep: 11.2%). New loans tumbled to CNY 615.2bn, almost one-fourth of Sep’s CNY 2.47trn. Household loans contracted by CNY18bn while corporate loans fell to CNY 462.2bn (Sep: CNY 1.92trn). Growth of outstanding total social financing (TSF) slowed to 10.3% in Oct (Sep: 10.6%).

- Leading economic index in Japan declined to 97.4 in Sep (Aug: 101.3), the lowest since Dec 2020, while the coincident index slipped by 0.7 points to 101.1.

- Current account surplus in Japan widened to JPY 909.3bn in Sep (Aug: JPY 694.2bn). In Apr-Sep, current account surplus more than halved in yoy terms to JPY 4.85trn, the biggest fall since H2 of fiscal 2008.

- Overall household spending in Japan grew by 2.3% yoy in Sep (Aug: 5.1%); in mom terms, spending was up by 1.8%, following two straight months of contraction. Real wages fell by 1.3% yoy in Sep while nominal wages rose by 2.1%, the biggest increase since Jun 2018.

- Industrial output in India rebounded by 3.1% yoy in Aug (Jul: -0.7%), supported by the 1.8% rise in manufacturing (Jul: -0.5%).

Bottom line: The crypto fiasco continues to dominate the news, sparking discussions about transparency (especially about crypto exchanges’ proof of reserves) and more generally regulation/ supervision of crypto firms. This week, markets await UK’s fiscal plan which is expected to include tax rises and spending cuts (in the backdrop of last week’s GDP numbers, it looks like a long recession for the country alongside high inflation). China’s easing restrictions for inbound travelers can be seen as a welcome sign, but with domestic cases at 6-month highs, it begs the question how long the macro picture will remain dismal: already seen evidence of lockdown-hit dwindling domestic demand and production levels. Meanwhile, at the COP 27 conference, financing concerns are coming to the forefront (especially from developing nations) and the big question remains how much progress will be made with respect to the implementation of deals/ pledges made in past years.

Regional Developments

- Bahrain announced two natural gas discoveries in the Al-Joubah and Al-Jawf reservoirs: estimated reserves were not disclosed in the official statement.

- In Bahrain’s general elections on Saturday, voter turnout was more than 70% according to the authorities. The number of women candidates stood at 94, double that of the 2018 elections.

- Inflation in Egypt surged to a 4-year high of 16.2% yoy in Oct (Sep: 15%), driven by higher food prices and school fees among others. Core inflation also increased to 19% from the previous month’s 18%.

- Qatar Investment Authority deposited USD 1bn in the central bank of Egypt as part of its plan to buy stakes in Egyptian firms ahead of “due diligence” and “finalising the deal”, reported Bloomberg.

- Egypt signed partnerships to support the implementation of climate projects with investments worth USD 15bn, including one energy project worth USD 10bn. Other 8 projects cover food security, agriculture, irrigation, and water projects.

- UAE and Egypt signed an agreement to develop one of the world’s largest onshore wind projects in Egypt: Egypt will save an estimated USD 5bn in annual natural gas costs with this project.

- Egypt aims to attract 30mn tourists annually, stated the tourism minister in an interview with CNN.

- Fitch revised Egypt’s outlook to negative from stable citing a deterioration in external liquidity position and reduced prospects for access to bond markets.

- Iraq’s oil ministry in a statement reiterated that it respects the OPEC+ agreement and wants to raise the “value or revenue” of a barrel, as beneficial to both producers and consumers.

- Kuwait committed to becoming carbon neutral in the oil and gas sector by 2050, and at the country level by 2060, disclosed the foreign minister on the sidelines of COP27.

- New CEOs were appointed for Kuwait’s state oil companies: Kuwait Oil company, Kuwait National Petroleum Company and Kuwait Integrated Petroleum Industries Co among others.

- Blurring the distinction between the executive and legislative powers, Lebanon’s caretaker PM stated that the country could still finalise an IMF deal in the absence of a president and fully empowered government: “if parliament approves it, it can go into effect”.

- The US pledged USD 72mn in humanitarian assistance to Lebanon, in addition to the USD 260mn already provided in development assistance, allowing 660k new beneficiaries to be added to those receiving support from the US Agency for International Development.

- Oman posted a budget surplus of OMR 1.123bn (USD 2.9bn) at end-Sep, thanks to a rise in revenues (43.4% yoy to OMR 10.567bn) while spending grew by 12.5% to OMR 9.4bn.

- Oman’s energy minister expects oil prices to decline from the range of USD 90 per barrel after winter as the prices are not “sustainable comfortably”. Oman’s production capacity is currently at 1.2mn bpd.

Saudi Arabia Focus

- Saudi Arabia’s crown prince committed USD 2.5bn to the Middle East Green Initiative launched last year. He also stated that the PIF would aim for net-zero emissions by 2050.

- Industrial production in Saudi Arabia grew by 15.7% yoy in Sep (Aug: 16.8%), supported by manufacturing (22%) and mining and quarrying (14.2%). Headline IP growth was the slowest since Jan 2022. In month-on-month terms, IP fell by 0.4% with all sectors posting declines.

- The number of fintech companies in Saudi Arabia grew by 79% to 147, according to Fintech Saudi (in 2018, this number stood at just 10). About 114 fintech firms have its headquarters in Riyadh. Funding grew by 11% yoy to SAR 1.508bn (USD 402mn) from Sep 2021-Aug 2022. Of fintech firms active in Saudi Arabia, 87% are based in the country, 6% in the UAE, 2% in Kuwait, while UK, India, Jordan, US and Bahrain all account for 1% each.

- During a Bloomberg TV interview, Saudi Arabia’s energy minister stated that OPEC+ will be “cautious” on oil production given ongoing global “uncertainties”.

- Reuters reported that multiple Chinese refiners have requested Aramco to reduce Dec-loading crude oil volumes by about half the previous month’s level. This could be due to the reduced demand and buying of Russian crude at discounted rates.

- Reuters reported that PIF was working with Lazard on a potential IPO of Masar, a USD 27bn mega project in the holy city of Mecca. While the IPO plan was scheduled for next year, it would be moved as the size or value is yet to be finalised.

- Saudi PIF sold a 10% stake in the stock exchange operator Tadawul Group (12mn shares) raising SAR 2.3bn (USD 612mn) via a secondary share offering. PIF still owns a 60% stake.

- On the sidelines of the Saudi Green Initiative event taking place in Egypt during the COP27, it was announced that Saudi Arabia would host the MENA climate week in 2023 – taking place in the run-up to COP28 in the UAE. Furthermore, a circular carbon economy knowledge hub would be launched in Riyadh starting Jan 1, 2023.

- More clarity about the Saudi Green Initiative targets: the Saudi energy minister disclosed that plans are being finalised to develop 10 more renewable energy projects and to connect an additional 840 MW of solar PV power to the grid. He also disclosed that a greenhouse gas crediting and offsetting scheme would be initiated at the beginning of 2023. Pilot projects for carbon capture and utilisation were also announced involving King Abdullah University of Science and Technology, the NEOM smart city, the Saudi Electricity Company, Alsafwa Cement Company, Ma’aden and Gulf Cryo.

- Aramco signed a joint development agreement with SLB and Linde to establish a carbon capture and storage hub: this will potentially be able to safely store up to 9mn tonnes of carbon dioxide a year by 2027 and aims to store 44mn tons a year by 2035. Aramco looks set to contribute around 6mn tonnes.

- Saudi Arabia presented 66 initiatives as part of its environmental plan covering 4 main pillars – the circular carbon economy, raising vegetation cover and reducing degraded lands, protecting wildlife habitats and biodiversity and promoting sustainability.

- Saudi ports reported a 15.33% yoy increase in container throughput volumes to a total of 694,517 twenty-foot equivalent units in Oct 2022.

- MEED reported that NEOM is in negotiations with various entities for its USD 20bn brine chemicals complex within OXAGON. The complex aims to build industries and plants that convert brine (the main waste output of desalination) into industrial materials that can be used locally or exported internationally.

UAE Focus![]()

- At the COP27 conference, UAE’s President stated the nation is a “responsible supplier of energy”, also investing in renewable energy, and that oil and gas in UAE is among the least carbon intensive globally.

- Dubai PMI edged down slightly to 56 in Oct (Sep: 56.2), with the output sub-index showing a slight decline. Posting its 23rd consecutive month of expansionary reading, sector-wise numbers show that wholesale & retail grew at the sharpest rate since Jul 2019, potentially a result of the level of discounting on offer (it was the quickest in more than 2 years, given easing cost pressures). Meanwhile, the rate of job creation rose to the highest since Nov 2019.

- UAE launched its Tourism Strategy 2031 with an aim to raise the sector’s contribution to GDP to touch AED 450bn in 2031, attract AED 100bn as additional tourism investments and attract 40mn hotel guests.

- DP World revealed its plans to invest around USD 500mn to reduce carbon dioxide in its operations by 700,000 tonnes over the next 5 years.

- The Abu Dhabi Global Market (ADGM) is set to begin a voluntary carbon-offset exchange “in a matter of weeks”, to be operated by Singapore-based digital exchange AirCarbon. ADGM is also liaising with UAE authorities on clearer requirements for ESG funding tools.

- Thanks to travel demand recovery and easing of pandemic restrictions, Emirates airlines reported a record profit of AED 4bn in H1 of the 2022-23 financial year. Revenues surged by 131% to AED 50.1bn in H1 and the firm has increased employees by 10% (to 93,893).

- Majid Al Futtaim’s Q3 2022 State of the UAE Retail Economy report indicates that overall consumer spending in the UAE grew by 20% yoy in the period till Sep 2022, with retail growing by 15% and non-retail by 29%. Fashion spending surpassed all others, growing by 23% yoy and up 25% on 2019. E-commerce sales accounted for 11% of total retail sales.

- Dubai real estate market continues to flourish in Oct: the residential sector reported a 72.5% yoy increase to 8,269 transactions, driven by a 133.5% surge in off-plan market sales. Year-to-date, total transactions stands at 71,412 – the highest total since 2009.

- Real estate firm Nakheel disclosed having secured AED 17bn in financing (AED 11bn in refinancing and additional funds of AED 6bn via a syndicate from Emirates NBD, Mashreq bank and Dubai Islamic Bank) for new waterfront projects including another man-made island named Dubai Islands and revisit plans for the Palm Jebel Ali (inactive since 2009).

- Hotel and casino operator Wynn Resorts will open a casino at its luxury resort being built in Ras Al Khaimah. It was disclosed during an earnings call that the casino would be completed in 2026.

- Brazilian soccer league LIBRA chose Mubadala Capital as a new investor (over two US-based equity firms), with the latter owning 20% of the league’s commercial rights for USD 971mn (value and stake size were reported by Brazilian newspaper O Globo).

Media Review

Don’t Let Geopolitics Kill the World Economy

How crypto giant FTX went from $16bn to bankruptcy in a week after fundraising trips to Saudi and UAE

Crypto exchanges race to soothe clients’ nerves after FTX collapse

https://www.ft.com/content/ad84e038-37b5-4612-a8d6-c9bf8363f456

Analysis of draft texts at COP27 by the Carbon Brief

World hoped to crucify top oil supplier, Saudi says

Powered by: