Markets

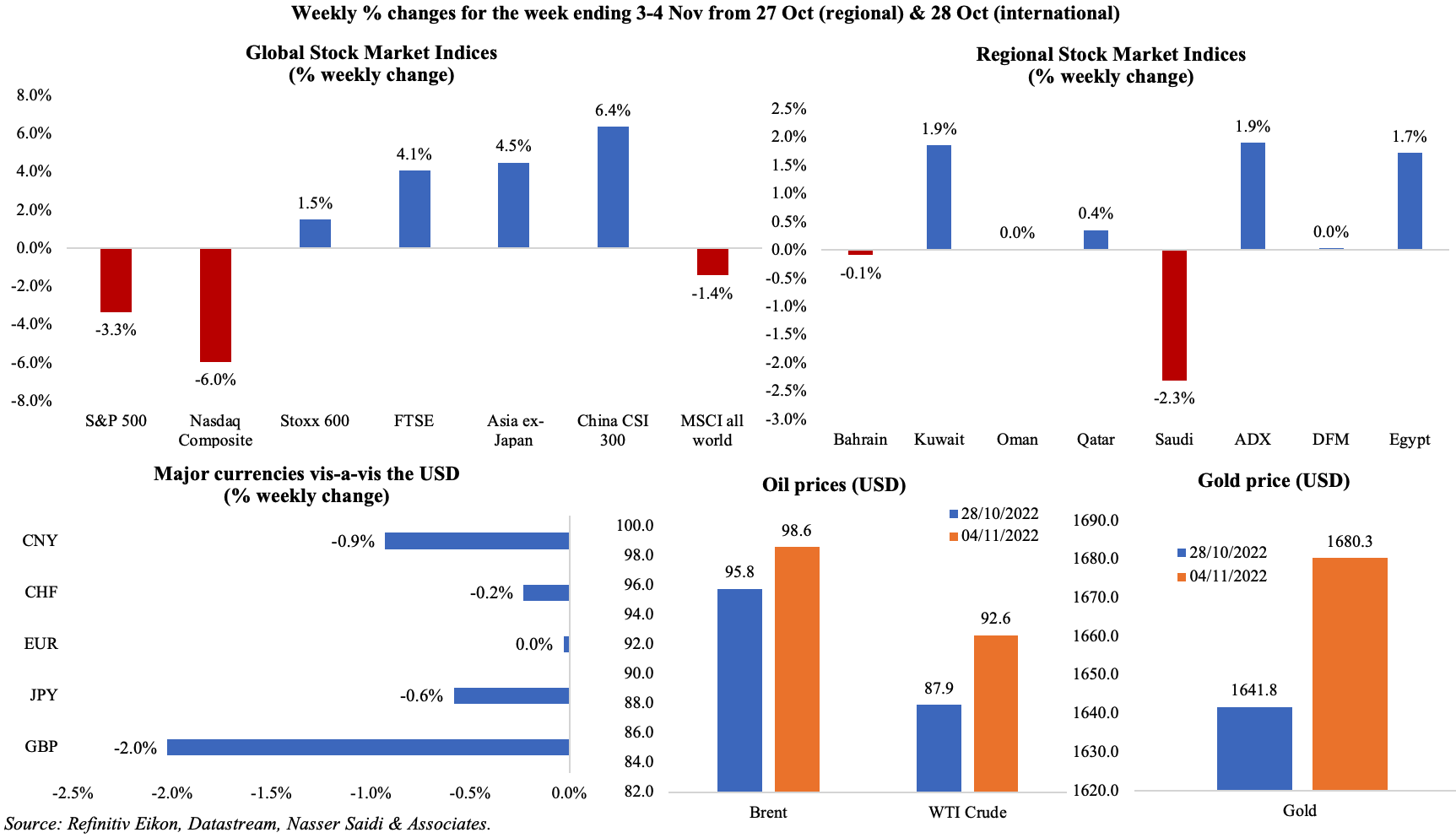

US equity markets declined while other major markets gained, including in China where expectations of a change in its zero-Covid policy led to a weekly gain. Regional markets presented a mixed picture, with many declining after the Fed hike and hawkish messaging and regional central banks following suit; Saudi Tadawul was down by 2.3% last week, posting its 3rd consecutive weekly decline while Abu Dhabi index touched an all-time high of 10,455 points. The pound recovered from record-lows vis-à-vis the dollar and also touched a low of GBP 0.878 to the euro. Oil prices increased (rising more than 5% on Friday) and so did the gold price.

Global Developments

US/Americas:

- The Fed, with its latest 75bps hike (4th in a row), lifted the benchmark to its highest since 2008 to a range of 3.75% to 4.00%. Powell commented that the Fed does not want to fail to tighten enough and loosen too soon. Hints were also dropped about smaller hikes (“that time is coming”) and there was a new reference to lags in the effects of monetary policy in the statement.

- Non-farm payrolls increased by 261k in Oct, much lower than Sep’s upwardly revised 315k gain. However, unemployment rate inched up to 3.7% in Oct (Sep: 3.5%). Average hourly earnings grew by 0.4% mom and labour force participation rate eased to 62.2% from 62.3%.

- Non-farm productivity rebounded by 0.3% in Q3 (Q2: -4.1%), adding pressure on labour costs, while unit labour costs grew by 3.5% vs the previous quarter’s 8.9% increase.

- Private sector jobs rose by 239k in Oct, much higher than the previous month’s 192k, accelerating thanks to gains in the leisure and hospitality sectors (+210k). JOLTS job openings unexpectedly increased to 10.717mn in Sep (Aug: 10.28mn). Despite the jump in vacancies, the number of workers voluntarily leaving jobs continued to edge lower to 4.1mn in Sep (Aug: 4.2mn). Overall, the labour market remains tight, with a very high 1.9 vacancy to unemployed ratio.

- Initial jobless claims slipped by 1k to 217k in the week ended Oct 28th, with the 4-week average down to 218.75k. Continuing jobless claims meanwhile grew by 47k to 1.485mn in the week ending Oct 21st.

- Factory orders rose by 0.3% mom and 13% yoy in Sep (Aug: 0.2%), thanks to a surge in orders for civilian aircraft (21.9%); many other orders declined including motor vehicle orders (0.1%), computers and electronic products (0.4%) as well as electrical equipment (1.2%).

- ISM manufacturing PMI inched slightly lower to 50.2 in Oct (Sep: 50.9), its lowest level in nearly two and a half years: new orders index remained below-50 though rising to 49.2 from 47.1 in Sep and employment index rose to 50 (Sep: 48.7) while prices paid eased for the 7th consecutive month (to 46.6 from 51.7).

- ISM services PMI eased to 54.4 in Oct (Sep: 56.7), recording the slowest growth since the contraction in May 2020, as new orders declined to 56.5 (from 60.6), new export orders plunged (47.7 from 65.1) and employment fell to 49.1 (Sep: 53). Prices paid increased to 70.7 from 68.7 the month before.

- S&P Global manufacturing PMI was revised upwards to 50.4 in Oct from the preliminary reading of 49.9, with production rising at a marginal rate and new export sales dropping sharply. Composite PMI also moved higher to 48.2 in Oct (preliminary: 47.3), the 4th consecutive month of decline, thanks to an increase in services PMI to 47.8 (prelim: 46.6).

- Chicago PMI edged lower to 45.2 in Oct (Sep: 45.7), the lowest reading since Jun 2020. Dallas Fed manufacturing business index fell to -19.4 in Oct (Sep: -17.2) as production declined (down 3 points to 6) and new orders slipped to -8.8 (5th consecutive negative reading).

- Goods and services trade deficit in the US widened to USD 73.3bn in Sep (Aug: USD 92.2bn). Exports of goods and services declined 1.1% to USD 258bn, while imports increased by 1.5%. Sep’s services exports, which includes visitors to the US, were the highest on record.

Europe:

- GDP in the eurozone grew by 0.2% qoq and 2.1% yoy growth in Q3, according to the Eurostat’s preliminary estimate, much slower than Q2 readings (0.8% qoq and 4.3% yoy). Growth accelerated slightly in Germany, but France, Italy and Spain reported sharp slowdowns.

- Harmonised index of consumer prices in the eurozone surged to a record-high 10.7% yoy in Oct (Sep: 9.9%), as energy costs surged to 41.9% (Sep: 40.7%) and food, alcohol and tobacco prices rose by 13.1% (Sep: 11.8%). Core CPI inched up to 5% in Oct (Sep: 4.8%).

- Manufacturing PMI in the eurozone slipped to 46.4 in Oct from a preliminary reading of 46.6, the biggest contraction since May 2020, as output and new orders fell at near record rates. Additionally, Germany’s manufacturing PMI also posted the largest decline since May 2020: the Oct reading eased to 45.1 from the preliminary reading of 45.7 in Sep.

- Exports from Germany unexpectedly declined by 0.5% mom and imports fell by a larger 2.3% in Sep, causing the trade surplus to widen to EUR 3.7bn. Imports with China saw a 5.4% mom increase while exports to China dropped by 2%.

- German factory orders fell by 4% mom and 10.8% yoy in Sep, much higher than the decline in Aug (-2% mom and -3.8% yoy). Foreign orders fell by 7% while domestic orders grew by 0.5%. New orders for capital goods plunged by 6% and intermediate goods fell by 3.4% while consumer goods orders grew by 7.2%.

- Retail sales in Germany rebounded by 0.9% mom in Sep, after a 1.4% drop the month before, as food and clothing sales grew by 2.4% and 9.9% respectively. Sales at petrol stations fell 15.7%, the biggest drop since the series began in 1994.

- Unemployment rate in the eurozone eased to 6.6% in Sep (Aug: 6.7%) as the number of unemployed fell by 66k to 10.99mn. Youth unemployment rate rose to 14.6% (Aug: 14.4%).

- Unemployment rate in Germany remained unchanged at 5.5% in Oct while the number of persons unemployed rose by 8k to 2.518mn, the highest in 14 months.

- The Bank of England hiked interest rates by 75bps to 3%, with all members voting to hike (though one vote was for a 25bps hike and another for a 0.5% rise), while also warning of the longest recession in 100 years (from this summer till mid-2024). The Bank expects inflation to peak by end-2022 and expects inflation to rise to 6.5% from 3.5% currently.

- UK’s manufacturing PMI increased to 46.2 in Oct (prelim: 45.8 and Sep’s 48.4), as new orders dropped the most in 2.5 years on weaker demand and employment declining for the first time since Dec 2020. Services PMI inched up to 48.8 in Oct (Sep: 47.5), resulting in the composite PMI rising to 48.2 from 47.2.

Asia Pacific:

- China’s NBS manufacturing PMI slipped unexpectedly to 49.2 in Oct (Sep: 50.1), the lowest since Jul: output, new orders and export sales were below the 50-mark. Non-manufacturing PMI declined to below-50 for the first time since May, clocking in a reading of 48.7 (down from Sep’s 50.6): new orders fell to 42.8 (Sep: 43.1), as did foreign sales (to 45) and employment dropped to 46.1.

- Caixin manufacturing PMI in China inched up to 49.2 in Oct, better than Sep’s 48.1 reading but still below-50: output and new orders fell at softer paces and employment shrank for the 6th consecutive month. Caixin services PMI dropped to 48.4 in Oct (Sep: 49.3), the lowest since May as Covid19 restrictions affected demand.

- Japan’s PMI stood at 50.7 in Oct, unchanged from the preliminary reading and a tad lower than Sep’s 50.8, with both output and new orders declining for the 4th straight month.

- Industrial production in Japan declined by 1.6% mom in Sep, the first drop since May and after posting a gain of 3.4% in Aug. In yoy terms, IP rose by 9.8% (Aug: 5.8%).

- Retail sales in Japan rose by 1.1% mom and 4.5% yoy in Sep, rising for the 7th consecutive month, thanks to improvements in consumption.

- Retail sales in Singapore grew by 3.3% mom and 11.2% yoy in Sep: this was the 6th straight month of double-digit yoy rises.

Bottom line: Climate change is on every newspaper headline with COP27 underway in Egypt; also on the cards this week are the US mid-term elections (where usually the incumbent party suffers) and inflation numbers (critical for upcoming Fed hikes). The key takeaway from last week’s central bank meetings was that more hikes are underway though the size could be reduced, depending on any visible impact on headline numbers. In contrast to the Fed & BoE’s 75bps hike, the Australian central bank raised rates by a much smaller 25bps (despite revising its inflation estimates upwards). Last but not the least, China’s health commission disclosed over the weekend that it would continue with its “dynamic-clearing” Covid19 strategy despite the evidence of a clear, negative, impact on economic activity.

Regional Developments

- The World Bank’s “Gulf Economic Update” forecasts GCC nations to grow by 6.9% yoy in 2022 and moderate to 3.7% and 2.4% respectively in 2023 and 2024. The report, which has a focus on green growth opportunities, expects that “a green growth strategy could see the GCC GDP grow to over US$13 trillion by 2050”. Access the report: https://www.worldbank.org/en/country/gcc/publication/gulf-economic-update-october-2022

- Bahrain attracted BHD 27.5mn (USD 72.7mn) in FDI into the financial services sector in Q1-Q3 2022, according to the Economic Development Board; this investment is expected to generate up to 840 jobs over the next 3 years.

- Egypt’s PMI stayed in contractionary territory for the 23rd straight month in Oct, though rising to 47.7 from Sep’s 47.6. Employment declined as weak sales led to layoffs and business optimism plunged to the lowest in more than a decade.

- The Sovereign Fund of Egypt added assets of EGP 15-16bn (USD 621-660mn), according to the CEO, who stated that the aim is to double it by next year. He disclosed that the financing sources ranged from a cash increase to in-kind increases (i.e. assets transferred to the fund).

- The Egyptian New and Renewable Energy Authority and the Egyptian Electricity Transmission Company have signed an MoU with ACWA Power to build a 10 gigawatt wind energy project in Egypt.

- Kuwait’s parliament approved the 2022-23 budget: based on an oil price of USD 80, revenues are expected to touch KWD 23.4bn, an 8-year high and up 114.1% from a year ago. Spending is to rise to a record high of KWD 23.5bn, driven by an increase in salaries and subsidies, resulting in a deficit (for the 8th straight year) of KWD 124mn. The budget assumes no transfers to the Future Generation Fund for 2022-23, but should there be a surplus, the General Reserve Fund would be replenished.

- PMI in Lebanon inched up slightly to 49.1 in Oct, though still in contractionary territory.

- Lebanon will not re-peg the dollar from LBP 1507 to LBP 15,000, reported Reuters, stating that political disagreements and a potential public backlash were hampering such a move. The dissension makes it unlikely that Lebanon will satisfy the requirements of an IMF agreement.

- The Electricite du Liban raised the cost of electricity for first time since the 1990s with a spokesperson stating this would lead to an eventual rise in power supply. Power will be priced at USD 0.10 per kilowatt-hour for the first 100 kWh, and USD 0.27 per kWh above that, but still resulting in continuing deficits and a drain on the government budget.

- Qatar’s PMI slipped below-50 to 48.4 in Oct (Sep: 50.7), as new orders fell for the first time in 27 months; optimism however remains at a 12-month high thanks to the upcoming World Cup.

- Qatar’s central bank doubled the ceiling on QMR deposits, to be applied immediately. QMR is a monetary instrument using which local banks are allowed to deposit with and borrow from the central bank overnight funds.

- FT reported that the Qatar Investment Authority plans to raise its stake in Credit Suisse Group; the Saudi National Bank is also expected to take part in Credit Suisse’s capital raising. The deal will lead to a quarter of the firm’s stock being held by Middle Eastern investors.

- Both Moody’s and S&P have upgraded Qatar’s credit rating. Moody’s upped credit outlook to positive (from stable) citing higher energy prices support for medium-term debt profile. S&P raised its rating to “AA” from “AA-” citing improvements in fiscal position.

- Qatar’s hospitality market is estimated to grow by 89% to over 56k hotel keys by 2025, according to Knight Frank. The planned delivery is expected to cost around USD 7bn.

- The Fed’s 75bps hike was mirrored by most GCC central banks: Bahrain raised its main rate by 75bps, Oman raised its repo rate to 4.5%, Qatar hiked deposit and repo rates by 75bps (to 4.5% and 4.75%) and lending rate by 50bps to 5%, Saudi hiked repo and repo rates to 4.5% and 4% respectively and UAE’s base rate rose to 3.9%.

- FDI inflows to the MENA and Pakistan region are set to reach USD 56bn in 2022, and rise further to USD 66bn in 2023, according to the IIF.

Saudi Arabia Focus

- Saudi Arabia GDP grew by an average 10.2% yoy in Jan-Sep 2022, largely supported by the oil sector. Flash GDP estimates place overall growth at 8.6% yoyin Q3 (slower than Q2’s 12.2%). Even though growth has slowed, it was still supported largely by the oil sector (14.5%) amid growth in non-oil (5.6%) and government (2.4%) sectors. In qoq terms, overall Q3 GDP was up by 2.6%, aided by oil (5.8%), government services (1.1%) and non-oil (0.2%) sector activity.

- Saudi PMI expanded to 57.2 in Oct (Sep: 56.6), higher than the series average of 56.8, as demand strengthened. Output rose to 61.3 last month (Sep: 59.5), new export orders roseat the sharpest rate in almost a year and employment stayed above-50 for the 7th consecutive month.

- Budget surplus in Saudi Arabia surged to SAR 149.5bn in Jan-Sep 2022 versus a deficit of SAR 5.4bn in Jan-Sep 2021. In Q3 2022,overall revenues fell by 18.5% qoq as both oil and non-oil revenues slipped by 8.5% and 39% respectively. Taxes in Q3 fell by 46% qoq and 30% yoy. Overall expenditure fell by 2% qoq in Q3 2022, with declines recorded across grants and social benefits. But capex ticked up by 12% qoq and 49% yoy to SAR 40.5bn.

- The CMA revealed that it had approved a concurrent and dual listing of Americana Group in both Saudi Arabia and the UAE. Americana received approval to sell 30% of its shares.

- The PIF-backed utility firm Marafiq (The Power and Utility Co. for Jubail and Yanbu) attracted total orders of SAR 6.37bn, making its retail offering 632% oversubscribed. Its institutional offering (which closed earlier) was 59 times covered.

- From Jan 2018 till H1 2022, Saudi CMA approved capital increase requests from 116 firms amounting to a total of SAR 100bn (USD 26.6bn).

- Saudi Arabia is planning to issue mining exploration licenses: 5 this year and another 10 opportunities next year, disclosed the mining minister. So far, more than 145 licenses have been issued and mining revenue has increased by 27% yoy. Separately, Saudi is considering whether to create a new metals and mining stock exchange index.

- Industrial sector investments in Saudi Arabia inched up by 0.17% mom to SAR 1.73trn (USD 460.3bn) in Aug, while the number of existing factories were up by 0.21% to 10,707. Separately, about 115 licenses were issued for non-oil industrial projects in Aug (+20% mom), worth an accumulated SAR 4.1bn.

- Value of contracts awarded in Saudi Arabia touched SAR 94.5bn (USD 25.15bn) in H1 2022, up 88% yoy. Transportation sector contracts touched 14 in Q2 with a value of SAR 22.3bn, the highest quarterly amount since Q3 2013.

- Thanks to mega projects’ construction, local cement sales in Saudi Arabia rose to 1.45mn tons in Q3 (Q2: 1.43mn tons).

- Saudi ports container throughput volumes grew by 10.5% yoy to 1,981,271 TEUs in Q3 2022.

- Saudi Arabia’s air traffic grew by 43% yoy to 497k flights in 2021; about 49mn passengers were transported last year, up 30% yoy.

UAE Focus![]()

- UAE’s PMI inched up to 56.6 in Oct (Sep: 56.1), the fastest since Jun 2019, supported by strong growth in demand. The output sub-index rose to 62.8 (Sep: 61.7) while the employment sub-index expanded at its fastest pace since Jul 2016. However, export orders posted the slowest increase since the start of 2022.

- Inflation in the UAE inched up to 6.8% in Q2 2022, double the 3.4% reading clocked in Q1, with the biggest increases registered in transportation (31.2% from 22% in Q1) and recreation (23.3% from 0.5% in Q1). Housing (with a weight of 35.1%) declined by 0.4% (lower than Q1’s 2% drop). The UAE central bank forecasts inflation at 5.3% in 2022. In its latest quarterly review, it also alluded to a significant increase in the 3m moving average of private sector wages in Aug, without providing a specific number.

- Dubai’s Empower raised its IPO stake to 20%, after it was increased earlier to 15% citing strong investor demand. DEWA and Emirates Power Investment, the selling shareholders, will sell 2bn shares and the price for the IPO has been set between AED 1.31-1.33 per share.

- Private school operator in Dubai, Taaleem, plans to raise AED 750mn from its IPO to expand its school network. 10% of shares will be offered to retail investors and another 88% to professional investors.

- Petrol prices in the UAE were raised by close to 10% mom in Nov to between AED 3.20 to 3.32 depending on the grade of petrol: it is cheaper than Jul’s peak of more than AED 4.5.

- ADNOC signed agreements worth AED 35bn (USD 9.5bn) with 25 companies to boost local manufacturing of products required for UAE’s energy industry.

- The US and UAE signed an MoU to spend USD 100bn on clean energy projects, with an aim to add 100 GW globally by 2035.

- Data from the Department of Economy and Tourism showed FDI projects in Dubai rose by 80.2% yoy to 492 in H1 2022. Total FDI inflows grew by 14.6% yoy to AED 13.72bn and created 15,164 jobs (+33.5%). Sectors that attracted most FDI this year were Speciality Trade Contractors (28%), Non-Residential Building Construction (12%), Accommodation and Food Services (12%), Data Processing, Hosting and Related Services (6%), and Electric Power Generation (4%).

Media Review

The Age of Megathreats

WTO’s World Trade Report 2022: Climate change and international trade

https://www.wto.org/english/res_e/publications_e/wtr22_e.htm

How the GCC countries have fared on their net-zero commitments so far

https://www.arabnews.com/node/2194376/business-economy

The world is missing its lofty climate targets. Time for some realism

Powered by: