Download a PDF copy of this week’s insight piece here.

Weekly Insights 4 Nov 2022: Saudi & UAE Non-Oil Sector Growth & Fiscal Consolidation

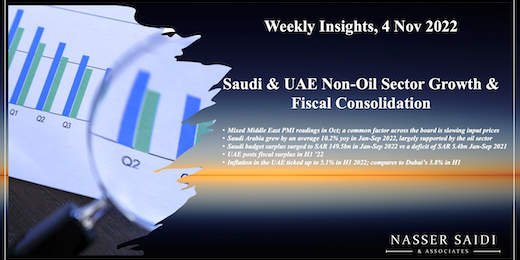

1. Mixed Middle East PMI readings in Oct; input prices are slowing across the board

- Saudi Arabia and UAE PMIs remain in expansionary territory, with the former posting its 2nd highest reading this year, thanks to an uptick in overall demand

- A point of contrast is that while Saudi new export orders rose at the sharpest rate in almost a year, UAE export orders grew the least since the start of 2022

- UAE PMI’s employment sub-index rose at the fastest pace since Jul 2016

- Qatar’s PMI slipped below-50, as new orders fell for the first time in 27 months; optimism however remains at a 12-month high thanks to the upcoming World Cup

- Even though Egypt and Lebanon readings remain below-50, it edged up in Oct. Egypt’s IMF deal should support improved sentiment in Nov

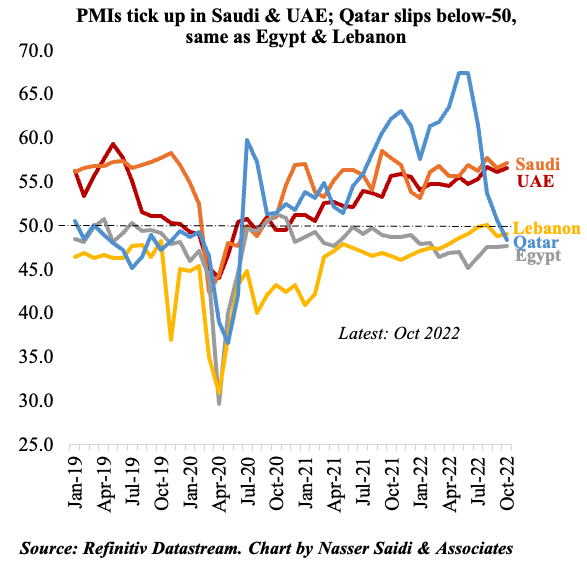

2. Saudi Arabia grew by an average 10.2% yoy in Jan-Sep 2022, largely supported by the oil sector

- Saudi Arabia’s flash GDP estimates for Q3 2022 placed overall growth at 8.6% yoy (slower than Q2’s 12.2%). Even though growth has slowed, it was still supported largely by the oil sector (14.5%) amid growth in non-oil (5.6%) and government (2.4%) sectors. In qoq terms, overall Q3 GDP was up by 2.6%, aided by oil (5.8%), government services (1.1%) and non-oil (0.2%) sector activity

- Consumer prices are ticking up: inflation rose to 3.1% yoy in Sep while food prices rose at a faster pace of 4.3%. Meanwhile, wholesale price inflation has fallen from its double-digit increases to under 5% in Sep 2022.

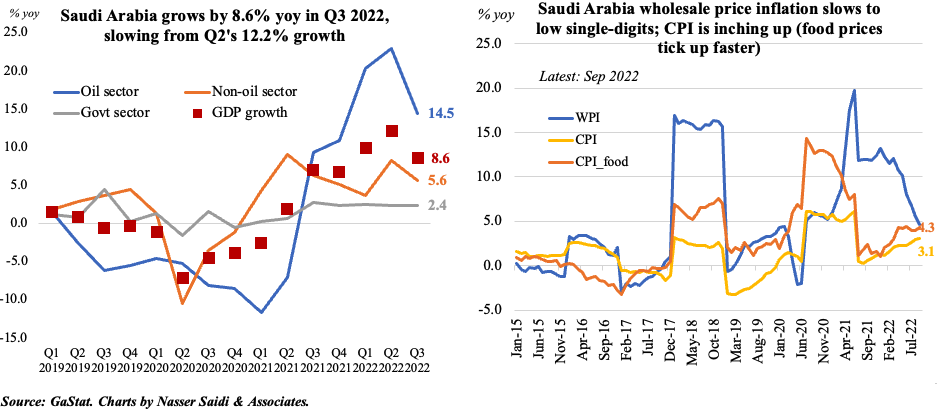

3. Saudi budget surplus surged to SAR 149.5bn in Jan-Sep 2022 vs a deficit of SAR 5.4bn in Jan-Sep 2021

- Sticking to fiscal consolidation plans: the surge in oil revenues in Saudi Arabia has not been accompanied by a similar rise in expenditures this year.

- Overall revenues grew by 5% yoy to SAR 950.2bn in the period Jan-Sep 2022.

- Taxes accounted for 79% of non-oil revenues this year, while oil revenues surged by 67% to SAR 663.1bn.

- In spite of the rise in revenues, spending rose by just 14%, allowing a surplus of SAR 149.5bn. Though compensation of employees grew by just 2.4%, it still accounted for nearly 50% of total expenditure. Capex jumped by 42.6% to SAE 91.3bn.

- In Q3 2022, overall revenues fell by 18.5% qoq as both oil and non-oil revenues slipped by 8.5% and 39% respectively. Taxes in Q3 fell by 46% qoq and 30% yoy.

- Overall expenditure fell by 2% qoq in Q3 2022, with declines recorded across grants and social benefits. But, capex ticked up by 12% qoq and 49% yoy to SAR 40.5bn.

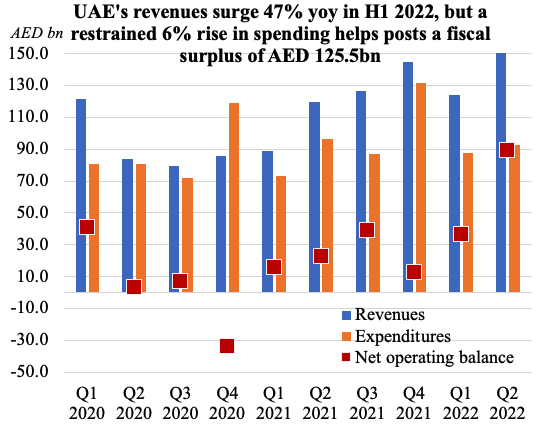

4. UAE posts fiscal surplus in H1 ‘22

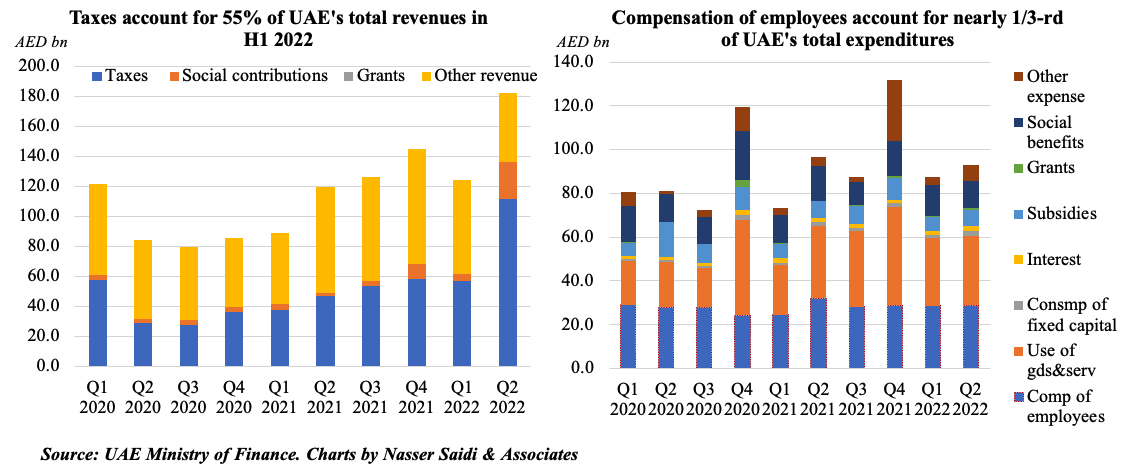

- Federal revenues grew by 47% yoy to AED 305.6bn in H1: This is the largest revenue recorded during a six-month period in the last four years

- Spending rose by 6% to AED 180.1bn in H1, resulting in a 3-fold increase in net operating balance to AED 125.5bn

- Tax revenues doubled to AED 167.9bn in H1 and accounted for 55% of total revenues. This is likely to tick up, once corporate tax is rolled out.

- Compensation of employees (32% of overall expenditure) edged up by 1% while subsidies declined slightly by 5% to AED 13.8bn

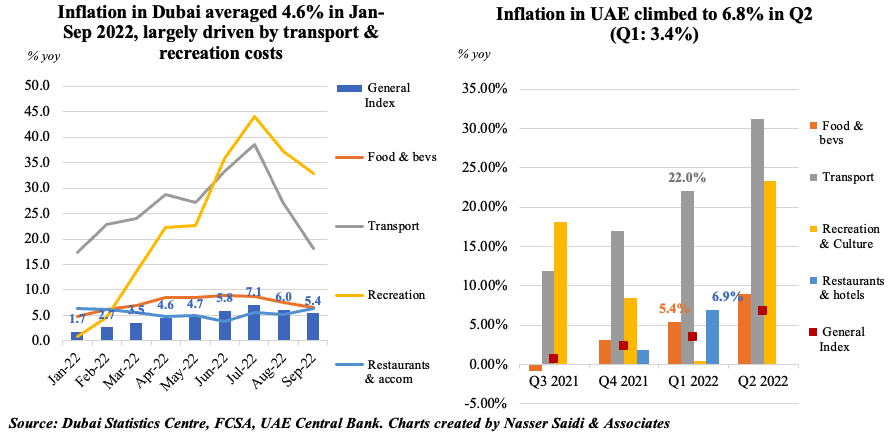

5. Inflation in the UAE ticked up to 5.1% in H1 2022; compares to Dubai’s 3.8% in H1

- Inflation in the UAE inched up to 6.8% in Q2 2022, double the 3.4% reading clocked in Q1, with the biggest increases registered in transportation (31.2% from 22% in Q1) and recreation (23.3% from 0.5% in Q1). Housing (with a weight of 35.1%) declined by 0.4% (lower than Q1’s 2% drop).

- Inflation rates in Dubai and UAE stood at 3.8% and 5.1% in H1. A few categories saw higher prices in Dubai: food (7.3% vs UAE’s 7.2%), clothing (3.5% vs 2%), recreation (16.6% vs 11.9%).

- The UAE central bank forecasts inflation at 5.3% in 2022. In its latest quarterly review, it also alluded to a significant increase in the 3m moving average of private sector wages in Aug, without providing a specific number.