Markets

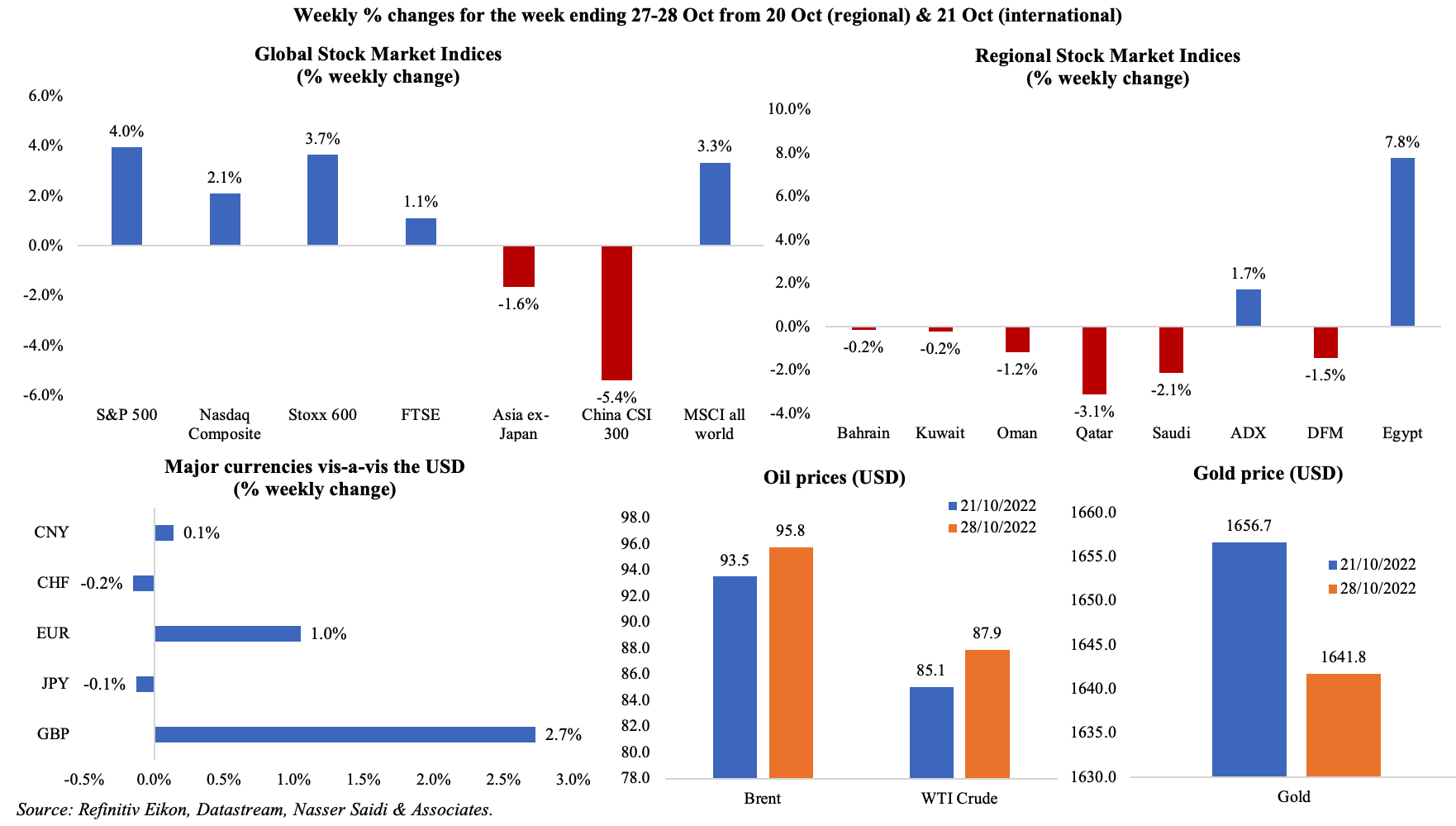

Global equity markets (other than in Asia & China) ended the week with gains as expectations grew that central banks’ might slowdown rate hikes (despite of weak earnings announcements from major tech companies). The fall in Chinese markets, given lower industrial profit numbers as well as new Covid19 outbreaks and related lockdowns, was reflected in Asian markets as well. Regional markets were mostly down, reflecting the movements in oil prices; Egypt gained on central bank reforms and the IMF deal, while Abu Dhabi index was inching closer to a record high. The dollar was strong vis-à-vis major currencies; while the euro was below parity with the dollar; the Rishi SunakUK government seems to have calmed markets resulting in gains for the pound. Oil prices inched up during the week though news of further widening of China’s Covid19 restrictions led to a slight decline on Fri. Gold price inched lower.

Global Developments

US/Americas:

- GDP rebounded in Q3, rising by an annualised 2.6% and reversing Q2’s 0.6% decline. In yoy terms GDP grew by 4.1% (Q2: 9.1%). The expansion in Q3 was supported by the narrower trade deficit amid a softening of consumer demand (+1.4%).

- US PCE price index rose by 0.3% mom and 6.2% yoy in Sep, similar to Aug. Core PCE inched up by 0.5% mom and 5.1% yoy (Aug: 0.5% mom and 4.9% yoy). Personal income increased by 0.4% mom in Sep while spending grew at a faster pace of 0.6%.

- Durable goods orders increased by a weaker-than-expected 0.4% mom in Sep (Aug: 0.2%), while excluding transportation, orders fell by 0.5%. Non-defence capital goods orders excluding aircraft, a proxy for business spending, fell by 0.7% (Aug: 0.8%).

- Goods trade deficit widened to USD 92.2bn in Sep (prev: USD 87.6bn): exports weakened (-1.5% to USD 177.6bn), dragged down by a 14% plunge in food exports and a strong USD. Goods imports inched up (by 0.8% to USD 269.8bn, supported by capital goods’ 4.4% rise).

- Chicago Fed national activity index remained unchanged at 0.1 in Sep. Richmond Fed manufacturing index fell to -10 in Oct (Sep: 0), the lowest since May 2022. Indices for shipments and new orders fell to -3 and -22 in Oct (Sep: 14 and -11 respectively).

- Michigan consumer sentiment index inched up to 59.9 in Oct, from a preliminary reading of 59.8, as the current conditions subindex was revised higher to 65.6 (from 65.3).

- S&P manufacturing PMI edged down below-50 in Oct for the first time since Jun 2020, clocking in at 49.9 (Sep: 52). New orders shrank and export demand declined at the quickest pace since May 2020. Services PMI slipped further to 46.6 in Oct (Sep: 49.3), given weak demand amid higher interest rates and rising inflation.

- S&P Case Shiller home prices increased by 13.1% yoy in Aug, but easing from the 15.6% hike in Jul. The monthly difference of 2.6% is the largest in the index history.

- Pending home sales fell by 10.2% mom and is at its lowest level since June 2010 excluding Apr 2020. The 30-year fixed mortgage rate averaged 6.94%, the highest in 20 years.

- Initial jobless claims rose by 3k to 217k in the week ended Oct 21st, with the 4-week average inching up to 219k. Continuing jobless claims meanwhile increased by 55k to 1.438mn in the week ending Oct 14th.

Europe:

- ECB raised interest rate by 75bps to 2%, while also scaling back support for banks. The ECB also signalled more hikes to come.

- German GDP grew by 0.3% qoq and 1.2% yoy in Q3 (Q2: 0.1% qoq and 1.6% yoy), thanks to private consumer spending.

- Inflation in Germany (HICP) jumped to a new record high of 11.6% in Oct (Sep: 10.9%); energy inflation eased slightly, down to 43.0% (still very high) from 43.9%.

- German Ifo business climate dropped to 84.3 in Oct (Sep: 84.4). Current assessment slipped to 94.1 (from 94.5) while expectations improved to 75.6 (75.3).

- Preliminary manufacturing PMI in Germany fell to 45.7 in Oct (Sep: 47.8), staying below 50 for the 5th consecutive month, being pulled lower due to higher energy costs amid weaker demand. Services PMI edged down to 44.9 from 45 in Sep: new business declined the most in over two years, while the pace of job creation fell to the lowest seen since Sep 2020.

- Eurozone’s manufacturing PMI fell to 46.6 in Oct (Sep: 48.4), with production slipping to a 29-month low and new orders falling the most since Apr 2009 (excluding the start of the pandemic). Services PMI also inched down, to 48.2 from 48.8 the month before: this was the lowest reading since May 2013 (excluding the pandemic lockdown months).

- The GfK consumer confidence survey in Germany showed an improvement to -41.9 in Nov (Oct: -42.8) but remaining in contractionary territory: the propensity to buy index ticked up to -17.5 from -19.5, while the income index rose to -60.5 from -67.7.

- Business climate in the eurozone slipped to 0.76 in Oct (Sep: 0.82), the lowest since Mar 2021. Consumer confidence in the euro area improved to -27.6 in Oct from Sep’s record low of -28.8.

- Rishi Sunak became UK’s 3rd PM in 2 months, and reappointed Hunt as his finance minister. He is expected to deliver the first economic plan on Nov 17th, after asking for more time to make the “right decisions”. Hence, BoE will hence make its monetary policy call and publish forecasts this week without (publicly) knowing details of the government’s fiscal plans.

- Manufacturing PMI in the UK slipped to 45.8 in Oct (Sep: 48.4), as production fell sharply, and manufacturers reported new job shedding for the first time since Dec 2020. Meanwhile services PMI moved into contractionary territory (47.5 from 50), the first since Feb 2021.

Asia Pacific:

- China’s exports increased by 5.7% yoy in Sep (Aug:7.1%), and imports were up by 0.3% (unchanged from Aug),resulting in the trade surplus widening to USD 84.7bn (Aug: USD 79.39bn). Trade surplus with the US narrowed to USD 36.1bn as imports from the US declined by 4.6% (to USD 14.7bn) while exports fell by a larger 11.6% (to USD 50.8bn).

- FDI into China grew by 15.6% yoy to more than CNY 1trn in Jan-Sep 2022. FDI into high-tech manufacturing and high-tech services grew by 48.6% and 27.9% respectively.

- The Bank of Japan kept interest rates unchanged, remaining dovish in sharp contrast to the rest of the world, reiterating that the recent cost-push inflation will likely prove temporary. The BoJ revised their core CPI forecast to 2.9% (from 2.3% previously).

- Japan’s manufacturing PMI edged down by 0.1 to 50.7 in Oct, with output and overall new orders declining for a 4th consecutive month, and new export orders posting a much faster drop. Services PMI meanwhile improved to 53 from 52.2 the previous month, as the nation opened up to tourists and output growth ticked up.

- The leading economic index for Japan was revised upwards to 101.3 in Aug, the highest since Apr (from the preliminary reading of 100.9 and Jul’s 98.9). Coincident index moved up by 0.1 points from the preliminary estimate to 101.8, the highest reading since May 2019.

- Japan industrial production grew by 3.4% mom and 5.8% yoy in Aug: this was the 3rd consecutive month-on-month increase and the first yoy increase in 6 months.

- Japan’s jobless rate increased to 2.6% in Sep; the jobs to applicants ratio inched up to 1.34 in Sep (Aug: 1.32), the highest reading since Mar 2020.

- Inflation in Tokyo increased to 3.5% yoy in Oct (Sep: 2.8%). Core CPI moved up to 3.4% from 2.8% the month before – exceeding the central bank’s target for the 5th consecutive month. Excluding both food and energy, prices grew by 2.2% (Sep: 1.7%).

- South Korea’s preliminary Q3 GDP grew by 0.3% qoq and 3.1% yoy (Q2: 0.7% qoq): this was the slowest quarterly growth in a year. Q3 growth was led by increase in consumer spending (+1.9%) and investment in facilities (5%).

- Inflation in Singapore stayed unchanged at 7.5% in Sep; core inflation inched up to 5.3% (Aug: 5.1%), the highest since Nov 2008, driven by increase in costs of food (6.9%), services (4%) as well as retail and other goods (3.1%) among others.

- Industrial production in Singapore expanded for the 12th straight month, up by 0.9% yoy in Sep (Aug: 0.4%). Output of transport engineering (38% yoy) and general manufacturing (23.3%) supported the uptick while biomedical manufacturing and electronics dropped (-3.5% and -7% respectively).

Bottom line: This is a heavy central bank meeting week: the Fed, Bank of England as well as central banks of Australia and Norway. After the Bank of Canada’s slower 50bps hike last week (short of the 75bps calls), all eyes are on whether the Fed will deliver a similar “surprise”. Given that the Fed’s preferred PCE index still running almost thrice as high as the target, we expect a 75bps hike is on the cards this week. The Bank of England, also expected to tighten by 75bps, has a tougher job at hand: it will have to make a call on economic forecasts with no clear visibility (publicly at least) on the new government’s fiscal plans (though the PM has indicated that tax hikes are on the cards).

Regional Developments

- The IMF, in its latest Regional Economic Outlook, projects GDP in the MENA region to grow by 5% in 2022 (2021: 4.1%) and ease to 3.6% in 2023. Inflation forecasts have been revised upwards to 12.1% and 11.2% this year and next respectively. Overall, oil exporters are projected to accrue a cumulative oil windfall of about USD 1trn over 2022−26; GCC nations are expected to save a substantial share of their oil revenues (improving non-oil fiscal balances).

- Bahrain’s finance minister stated at the Saudi FII conference that the GCC need to build production and export capabilities to transform their economies as currently non-oil GDP is dependent on consumption and imports.

- The CEO of Bahrain’s Economic Development Board expects non-oil GDP to grow by 5% this year. He also revealed that Bahrain received USD 921mn in FDI from 66 companies in H1 2022 and that USD 30bn worth of priority projects have been started to support economic recovery.

- FDI into Bahrain from Saudi Arabia stood at USD 9.8bn in 2021, accounting for 29% of total inward FDI stock; financial services sector constituted the major share (68%) followed by the industrial sector (19%).

- The IMF agreed a USD 3bn Extended Fund Facility with Egypt over 46 months, with a “commitment to durable exchange rate flexibility”. This will result in a larger multi-year financing package including an additional USD 1bn from the IMF’s Resilience and Sustainability Facility as well as USD 5bn from partner countries for development. The announcement followed the central bank of Egypt raising interest rates by 200bps and switching to a more flexible exchange rate system. The overnight deposit rate, overnight lending rate, and rate of the main operation was raised to 13.25%, 14.25%, and 13.75% respectively.

- Egypt announced a 15% increase in minimum monthly wage to EGP 3000 (from 2700), the fourth hike since 2014. Also announced was the disbursement of a EGP 100-300 (USD 4.42-13.25) bonus to food subsidy cards (used by ~10.5mn families) for six more months.

- Non-oil bilateral trade between Egypt and UAE exceeded AED 14.1bn (USD 3.8bn) in Jan-May 2022, up 6% yoy. In 2021, overall non-oil foreign trade grew by 7.6% to AED 27.8bn.

- Egypt’s PM disclosed that UAE’s FDI in Egypt rose to USD 4.6bn in the first nine months of the fiscal year 2021 – 2022, making the UAE a top FDI investor in the country.

- Energy and fuel subsidies (at KWD 2.04bn) account for more than half of total subsidies (KWD 4bn+) mentioned in Kuwait’s budget, reported the Al Rai daily. Educational support, social support and housing support account for the next largest components within subsidies.

- Population in Kuwait grew by 1.8% as of Jun 2022 from end-2021, according to a report by the National Bank of Kuwait: this is the first increase for both citizens and expats since 2019 (though for the latter it is much lower than pre-pandemic levels). Unemployment among citizens declined to about 5.2% – the lowest level since 2016.

- Inflation in Oman inched up to 2.4% yoy in Sep, driven by education (5.1%), food and non-alcoholic beverages (5%) and health (3.5%) among others.

- Qatar’s emir disclosed that initial indicators show GDP grew by 4.3% yoy in H1 2022; furthermore, budget surplus has surged to QAR 47.3bn thanks to higher energy prices.

- EY’s MENA IPO Eye Q3 report states that Saudi Arabia dominated listing activity in the quarter, with 5 IPOs, while the UAE registered the largest (Salik Company).

- Kearney’s Global Cities Report places Dubai in the top spot in the MENA region and 22nd globally (its highest ranking till date), thanks to business activity, human capital and political engagement. Abu Dhabi ranked number 9 in the global cities outlook, where Dubai is placed 11th.

Saudi Arabia Focus

- The Saudi energy minister has held meetings with various European counterparts to assure the stability of the international oil market and ensure availability of reliable energy supplies. In another instance, he stated that the use of emergency stocks to manipulate markets could be “painful” in coming months.

- Non-oil exports from Saudi Arabia grew by 16.6% yoy to SAR 27bn in Aug, while oil exports surged by 60.2% yoy to SAR 107bn.

- Saudi Arabia signed five investment agreements in aerospace, technology and finance on the sidelines of the Future Investment Initiative (FII), in a bid to increase FDI inflows and boost its position in global value chains. This includes agreements with Boston-based plane maker Boeing, local advanced metals maker Tasnee, US space training company Orbite, US biotech company Ginkgo Bioworks and Korea’s Taihan Cable and Solution among others.

- The Saudi minister of industry and mineral resources revealed at the FII that the nation intends to double industrial exports by 2030 and expects the number of factories will reach 36,000 by 2035.

- The Saudi PIF plans to invest USD 24bn in 6 Arab nations, setting up companies in Iraq, Jordan, Bahrain, Oman and Sudan in addition to Egypt (where the process has already begun). Investments will cover strategic sectors including infrastructure, mining, health and financial services among others.

- Saudi PIF’s assets under management grew by over 20% yoy to SAR 1.98trn in 2021, and profits touched SAR 85.7bn, according to its annual report. Saudi Arabia aims to ensure that at least 65% of its supply chain is domestic: it was also disclosed that PIF’s portfolio companies awarded SAR 140bn of contracts to local private sector firms. Separately, PIF was the second most active state investor, with 39 deals valued at USD 17.2bn during Jan-Oct, according to wealth fund tracker Global SWF.

- Tadawul’s CEO disclosed that non-Saudi firms would soon be able to obtain approval for dual listings on the market.

- The ministry of investment revealed that Saudi Arabia signed 53 deals in Q3 2022 across communications, energy and health industry.

- The Saudi central bank licensed a new payment technology company named Tiqmo to provide e-wallet services. This brings the total number of licensed payment companies to 22 in addition to 5 that were granted in-principle approval.

- The CEO of the Saudi EXIM Bank disclosed that the bank had provided SAR 20bn (USD 5.3bn) to support exports growth since it was established in 2020.

- Saudi Aramco launched a USD 1.5bn fund to support an inclusive global energy transition: the fund will target investments globally with a focus on areas including carbon capture and storage, greenhouse gas emissions, hydrogen, ammonia and synthetic fuels among others.

- Saudi Arabia’s mining ministry plans to auction five new mining exploration licenses with copper, zinc, lead and iron deposits for local and international investors in 2023.

- Saudia signed a deal with Germany’s Lilium to buy 100 innovative electric planes to connect Jeddah with other domestic tourist destinations.

- The value of real estate transactions in Saudi Arabia grew by 13% mom and 25% yoy to SAR 18.5bn in Sep; residential deals represented 55% of total real estate deals last month.

UAE Focus![]()

- The UAE government reported a total revenue of AED 305.6bn in H1 2022, according to the finance ministry. In 2021, state revenues totalled AED 463.9bn (+26% yoy) while expenditures ticked up by 1% to AED 402.4bn, thereby recording an overall surplus of AED 61.5bn. Current spending grew by 8% to AED 382.4bn.

- UAE’s finance ministry disclosed amendments to the VAT Law: from Jan 1st, registered persons who make taxable supplies are allowed to apply for an exception from VAT registration if all of their supplies are zero-rated or if they no longer make any supplies other than zero-rated supplies.

- The UAE central bank’s 6-week pilot of central bank digital currencies transactions (part of Project mBridge) saw commercial banks in four jurisdictions successfully use mBridge for 160 payment and foreign exchange transactions totalling more than AED 80mn.

- Dubai district cooling company Empower plans to sell a 10% stake and list on the DFM on Nov 16th. Dewa and EPI expect to sell 7% and 3% respectively of total issued share capital.

- Bayanat, which will begin trading on Monday, disclosed that it had received demand of AED 57.5bn for its IPO. G42 will continue to own 77% of the firm.

- ADIA reported that its 20-year and 30-year annualised rates of return were both 7.3% at end-2021, up from a 20-year rate of 6% and 30-year rate of 7.2% in 2020. Its long-term strategy portfolio shows an exposure to North America at a range of 45-60% and emerging markets at 10-20%. It has a total of 1520 employees, after a reduction in headcount last year.

- UAE and Cambodia have initiated CEPA negotiations, with an aim to boost non-oil bilateral trade to USD 1bn in the next 3-5 years. In Jan-Aug this year, bilateral trade was up by 40% yoy to USD 279mn and is estimated to cross USD 350mn by end-2022.

- Fitch Ratings affirmed Abu Dhabi’s long-term foreign-currency Issuer Default Rating (IDR) at “AA” with a stable outlook, citing high GDP per capita as well as strong fiscal and external metrics; though contingent liabilities are high compared to peers, it is deemed “manageable” given the emirate’s fiscal buffers.

- Sharjah disclosed a 12% increase in hotel guests in the emirate to 626k in H1 2022, with occupancy at 66% (+11% yoy), resulting in a 50% jump in hotel earnings up to AED 200mn+.

Media Review

IMF’s Regional Economic Outlook for the Middle East & Central Asia

Fed’s dilemma: how long to “keep at it” on inflation

https://www.ft.com/content/55a8b198-4f48-4eb4-b446-0e6166608e4a

The Case for Structural Financial Deglobalization

Saudi Arabia battles to win inward funds while investing abroad

IEA’s World Energy Outlook

https://www.iea.org/reports/world-energy-outlook-2022

Powered by: