Markets

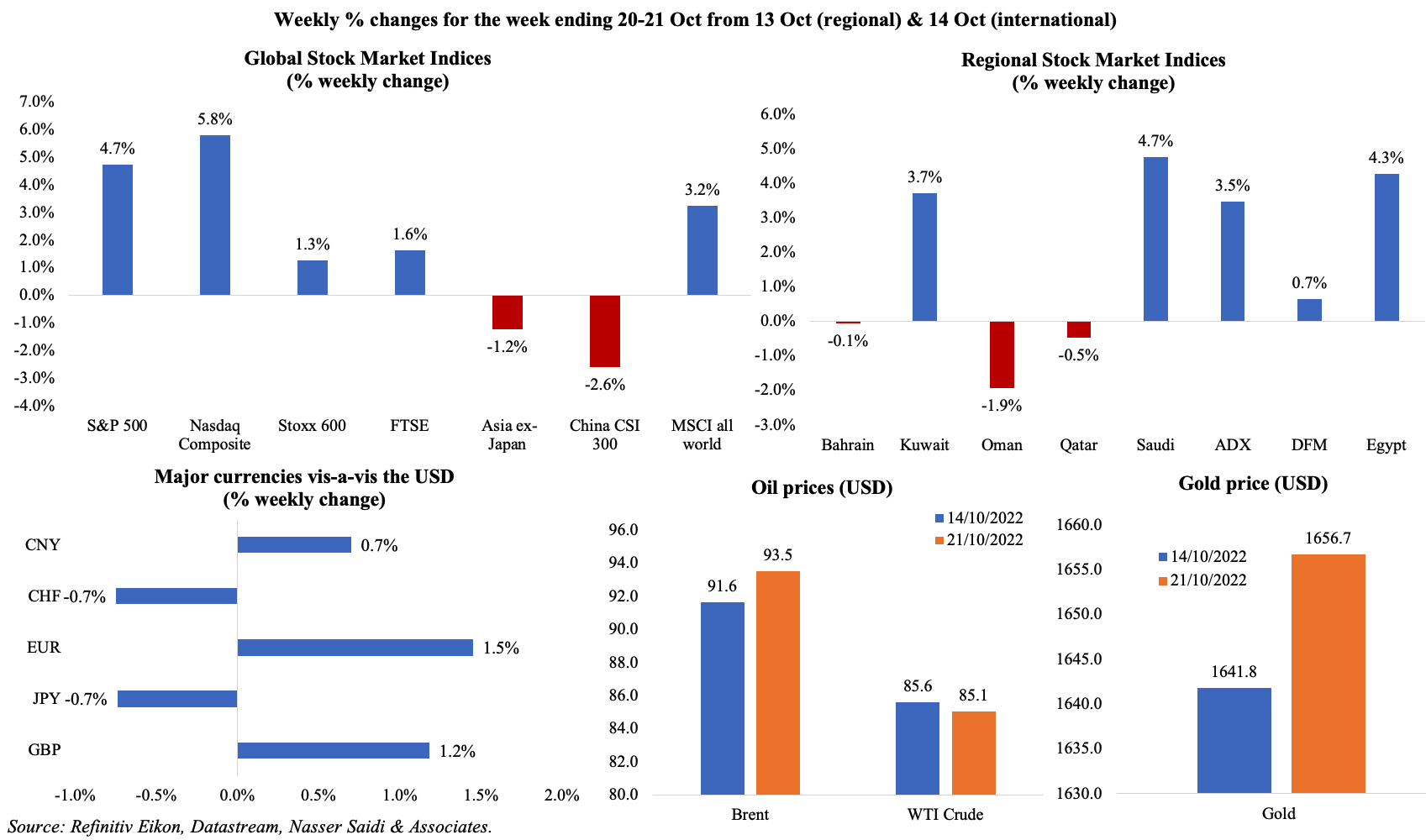

US equity markets posted the largest weekly gains since Jun, on news that the Fed might move opt for a less aggressive stance to counter inflation. European markets gained on the week, in spite of slipping after high inflation readings, expectations of central bank moves and recession concerns. Regional markets were mixed during the week on volatile oil movements and expectations of weaker demand from a potential recession: Saudi and Abu Dhabi markets ended the week with gains of 4.7% and 3.5% respectively. The yen touched the lowest level since 1990 (on Oct 20th, crossing the 150-mark against the dollar in intra-day trading) before the greenback tumbled vs the yen on Fri (a possible intervention from the BoJ). Brent oil price ended the week stronger (+2% from the week before) on hopes of a resurgence in Chinese demand, while gold price edged up by 0.9%.

Global Developments

US/Americas:

- Fed’s Beige book provided an overall gloomy outlook, noting “growing concerns about weakening demand” given higher interest rates; however, contrary to previous editions in the summer, firms’ “expectations were for price increases to generally moderate” near-term.

- Industrial production in the US rebounded by 0.4% mom in Sep (Aug: -0.1%); IP grew by 5.3% yoy, thanks to gains in both durable (6%) and non-durable goods (3.6%). Capacity utilisation edged up to 80.3% (Aug: 80.1%) and manufacturing output posted a 0.4% mom and 4.7% yoy gain (Aug: +0.4% mom and 3.5% yoy).

- NY Empire State Manufacturing Index plunged to -9.1 in Oct (Sep: -1.5), declining for the 3rd consecutive month. While new orders were unchanged at -3.7, the index was dragged down by a sharp 19.9 points drop in the shipments index to -0.3.

- Housing starts declined by 8.1% mom to a seasonally adjusted annual rate of 1.439mn, with new single-family home projects falling by 4.7% to an annual rate of 892k (the lowest level since May 2020). Building permits in the US increased by 1.4% mom to 1.564mn in Sep, but mainly due to gains in multi-unit projects.

- Existing home sales edged down by 1.5% to 4.71mn in Sep, the 8th straight month of decline and the lowest since May 2020. The 30-year fixed mortgage rate averaged 6.94% around mid-Oct, the highest since 2002: this, along with elevated prices are weakening the housing market.

- US budget deficit for the fiscal year 2022 (which ended in Sep) narrowed to USD 1.375trn, a reduction of USD 1.4trn from a year ago, as Covid19 related relief spending dissipated. Receipts meanwhile grew by 21% yoy to a record USD 4.896trn.

- Initial jobless claims fell by 12k to 214k in the week ended Oct 14th, with the 4-week average inching up to 212.25k. Continuing jobless claims meanwhile increased, by 21k to 1.385mn in the week ending Oct 7th.

- US authorised the release 15mn barrels of oil from its strategic reserve in a bid to rein in prices, and weeks before the mid-term elections (where rising gas prices is a major issue for voters). Over half of the Strategic Petroleum Reserves is still available, over 400mn barrels.

Europe:

- Inflation in the Eurozone increased by 1.2% mom in Sep, posting a 9.9% yoy reading – lower than the 10% estimate released earlier. Energy prices, food and services added 4.19, 2.47 and 1.8 ppts to the total yoy reading.

- EU consumer confidence index rose by 0.6 points to -29 in Oct; in the Euro area, sentiment gained a higher 1.2 points to -27.6.

- The ZEW Economic Sentiment Index for Germany improved to -59.2 in Oct (Sep: -61.9), though the current situation worsened, dropping further by 11.7 points to -72.2. The Economic Sentiment Index in the wider Eurozone gained one point to -59.7 in Oct and inflation expectations deteriorated (by 23.7 points to -35.8).

- Producer price index in Germany inched up by 2.3% mom in Sep (Aug: 7.9% mom); in yoy terms, the increase remained unchanged at 45.8% – the largest ever increase recorded. Excluding energy prices (which rose by 132.2% yoy), PPI increased by 14% yoy.

- Inflation in the UK returned to a 40-year high of 10.1% yoy in Sep (Aug: 9.9%), with the core CPI also inching up to a new 30-year high of 6.5% from 6.3% the month before. Food and non-alcoholic beverages (14.6%), transport (10.9%) and furniture and household goods prices (10.8%) drove the increase.

- Both input and output producer price indices in the UK eased in Sep, thanks to the decline in crude oil and petroleum products: input prices were up 20%, lower than Aug’s 20.9% increase, declining for the 3rd consecutive month; output prices declined to 15.9% (vs Aug’s 16.4%). Services producer prices rose by 6.6% yoy in Q3 (Q2: 5.4%) – the highest rate since records began in Q1 1999.

- The GfK consumer confidence index improved slightly, gaining 2 points to -47 in Oct, but remains close to the 50-year low recorded in Sep.

- Retail sales in the UK tumbled by 6.9% yoy in Sep. In mom terms, sales were down by 1.4% following a 1.7% drop in Aug and fell in all main sectors: food (-0.7%), non-food stores (-0.2%), non-store retailing (-0.4%) and fuel (-0.1%). Compared to Feb 2020, total retail sales were 1.3% lower.

- Moody’s lowered UK’s outlook to “negative” from “stable” over ongoing political turmoil, weaker growth prospects and high inflation.

Asia Pacific:

- GDP growth in China clocked in at 3.9% yoy in Q3 (Q2: 0.4%), falling way short of the previously announced target growth of around 5.5% for the full year 2022. Retail sales rose by 2.5% yoy in Sep while industrial production rose by 6.3%.

- China’s PBoC left interest rates unchanged at the latest meeting. Furthermore, the apex bank kept the rate on CNY 500bn (USD 69.6bn) worth of one-year medium-term lending facility loans to some financial institutions unchanged at 2.75%. (Later in the week, the PBoC governor was not named to the ruling party’s new Central Committee, making his departure from the PBoC more likely.)

- Inflation in Japan remained unchanged at 3% yoy in Sep. Excluding fresh food, prices rose to a new 8-year high of 3% from 2.8% the month before – this was the fastest gain since Sep 2014 and stays above the BoJ target for the 6th Excluding both food and energy, prices were up to 1.8% (Aug: 1.6%) – the fastest pace since Mar 2015.

- Exports from Japan increased by 28.9% yoy in Sep (Aug: 22%), with the strongest growth in autos and steel. Imports grew at a faster pace of 45.9% (Aug: 49.9%) to JPY 11trn, the largest on record, on rising fuel costs. Trade deficit narrowed to JPY 2.1trn in Sep. Exports to China grew by 17.1%, on demand for cars and chip-making equipment.

- Industrial production in Japan increased by 5.8% yoy, reversing the 2% drop recorded in Jul. In mom terms, IP grew by 3.4% in Aug (Jul: 0.8%), thanks to production machinery (6.2%), chemicals (4.4%) as well as iron, steel, and non-ferrous metals (3.6%).

Bottom line: This week sees the BoJ and ECB meetings: despite the weakening yen and inflation at an 8-year high, Japan’s central bank is widely expected to stay put while the ECB is likely to hike by 75bps (given inflation close to 10%). Even as the US-China tech Cold War gathers pace (check the Media Review section), China’s Xi was re-elected as leader for an unprecedented third term (with strategy placing an emphasis on national self-reliance in science and technology as well as an “increased internationalizing of the RMB”). Meanwhile in the UK, Sunak has become the frontrunner for the new PM after Boris pulled out of the race with continuing political uncertainty leading to volatility in the GBP.

Regional Developments

- National-origin exports from Bahrain grew by 6% yoy to BHD 1.24bn (USD 3.29bn) in Q3 2022. As previously, Saudi Arabia, US and UAE were the top nations receiving these goods and the top 10 nations accounted for 77% of the total value. Imports increased by 9% to BHD 1.47bn in Q3 – a list topped by China, Brazil and Australia.

- Bahrain and Israel signed an agriculture cooperation deal with a focus on “innovation in aquaculture, as part of global efforts to address food security”.

- Egypt plans to issue EGP 9.8bn worth Green Bonds during the current fiscal year (that ends in Jun 2023), according to the finance minister. The country also plans to raise external finances by 87% yoy to EGP 146.4bn in the new fiscal year 2022-2023.

- Following a meeting between the energy ministers of Egypt and Lebanon, the former reiterated the commitment and readiness to pump natural gas as soon as the gas exporting procedures were completed.

- Asharq reported that the Egypt – Saudi Arabia electricity interconnection project, worth USD 1.8bn, is expected to launch its trial by end-May 2025.

- The value of Kuwait’s exports touched KWD 312.1mn (USD 1bn) during Jan-Jul 2022. GCC accounted for ~60% of total exports followed by Arab nations (30%) and Europe (3.5%).

- According to central bank data, consumer spending in Kuwait increased by 28.5% yoy and 6.4% qoq to KWD 10.54bn by end-Jun. Additionally, inflation inched up to 4.15%, driven by foodstuff and education.

- Lebanon’s finance minister claimed that the burden of repaying depositors’ frozen funds should not fall only on the government. Till date, a bank restructuring plan outlining the recovery of such funds has not been finalised.

- MPs in Lebanon passed a revised version of the banking secrecy law, which still doesn’t meet all of IMF’s criteria. This new draft allows additional government institutions to ask for general information on a body of transactions, but does not lift banking secrecy as a whole.

- Lebanon’s Parliament failed to elect a President for the 4th time. The current President’s term ends on Oct 31st.

- Total banking deposits in Oman grew by 5.2% yoy to OMR 26.2bn at end-Aug, with private sector deposits up by 1.6% (to OMR 17.4bn). Credit disbursed to the private sector grew by 2.4% to OMR 23.9bn.

- ACWA Power aims to start commercial operation of the planned hydrogen project in Oman’s Dhofar region before 2029. The integrated green hydrogen and ammonia facility is estimated to be worth USD 7bn.

- As the Qatar World Cup inches closer, the FIFA President disclosed that ticket sales were approaching the 3mn mark, with more than 240,000 hospitality packages sold. About 2mn room nights have already been sold, according to the director general of the organising committee, with around 30k rooms being added to account for last-minute ticket sales.

- Qatar inaugurated its first solar power plant: operational since June and built at a cost of QAR 1.7bn (USD 467mn), the plant has some 1.8mn solar panels covering an area of more than 10sq km and aims to provide up to 10% of the country’s energy supply.

- Talks for a free trade agreement between GCC and India will begin in Nov, disclosed India’s senior trade ministry official, with an aim to have a deal in place by June 2023. It was also revealed that the country is in talks with the UAE about a INR-AED trade mechanism.

- Overall payments revenue in the GCC region is expected to grow at a compound annual growth rate of 9.3% from 2021 to 2031, according to a BCG report. Saudi CAGR is estimated at 11.2% (reaching a total of USD 28.3bn by 2031) while UAE’s CAGR is pencilled in at 7.7% (to USD 18.7bn).

- MENA equity and equity-related issuance surged to USD 15.3bn in Jan-Sep 2022, up by 166% yoy, according to Refinitiv.IPOs accounted for 86% of the activity: 29 offerings, the highest level since 2008, raising a combined USD 13.2bn (a first 9-month record). UAE was the most active in equity capital market activity, raising USD 9.56bn (more than half from DEWA IPO).

Saudi Arabia Focus

- While a disagreement related to the OPEC+ production cut decision continues with the US, Saudi Arabia has been seen strengthening cooperation with the oil-consuming emerging Asian nations: Saudi energy minister has been in conversations with his Chinese and Indian counterparts as well as the trade minister of Japan to strengthen energy cooperation. India, South Korea, Indonesia and Japan are on the cards for the Crown Prince’s upcoming trip to the region.

- Saudi Arabia launched a National Industrial Strategy: with more than 136 initiatives,the strategy expects to almost quadruple manufacturing GDP by 2035 (its contribution stands at around SAR 340bn now), add 3.7-times the total jobs compared to 2020 and result in more than 5-times jump in industrial exports to SAR 892bn, diversifying exports. Focusing on 12 sub-sectors (including food, medicine, medical equipment and marine industries), the strategy would see a surge in the number of industrial facilities to ~36,000 by 2035 (ytd in 2022: 10,640) and plans to attract SAR 1.3trn of additional investment into the sector. Access the Strategy document at: https://mim.gov.sa/mim/nis/files/NSD_AR.pdf

- Crude oil exports from Saudi Arabia rose by 3% mom to 7.6mn barrels per day (bpd) in Aug, according to data from JODI: this was the highest since Apr 2020 and increasing for the 3rd consecutive month.

- Bloomberg reported that Saudi Aramco is planning an IPO of its oil-trading unit, potentially eyeing a listing by end-2022 or early-2023.

- The Capital Market Authority in Saudi Arabia approved 3 IPOs: the Saudi cable producer Riyadh Cables Group on the main exchange while real estate developer Al Ramz Real Estate Co and Nofoth Food Products Co will list on Nomu.

- Saudi Arabia sold USD 5bn in conventional bond and Sukuk, in its first international bond sale in over a year: demand for this surpassed USD 26.5bn amid volatile markets.

- Saudi Arabia launched the Global Supply Chain Resilience Initiative to attract investments in supply chains: initial plans are to raise SAR 40bn. Last week, the Ministry of Industry and Mineral Resource launched an initiative aimed at developing local supply chains for around 9,000 industrial products; to further support the ecosystem, the ministry of transport and logistics separately disclosed it was working to inaugurate 59 logistic zones to bolster supply chains and logistic services.

- The Ministry of Economy and Planning launched a new leading indicator MEPX to track private sector performance: it tracks ten economic factors classified into four categories, consumers, firms, and the financial and trade sectors. The latest reading shows an expansionary growth pattern: https://twitter.com/MEPSaudi/status/photo/

- Bilateral trade between Saudi Arabia and Spain grew by more than USD 1bn between 2020 and 2021. In 2021, Saudi Arabia’s exports to Spain touched USD 3bn while Spanish imports to Saudi were valued at USD 2.34bn.

- Net income of Saudi finance companies plunged by 67.7% qoq to SAR 283mn (USD 75.2bn) in Q2 2022: this was the largest drop since the start of 2018.

- Saudi Arabia plans to automate 4,000 factories (roughly 30% of factories in the country) to improve production efficiency and compete in the 4th IR.

- The Saudi Human Resources Development Fund revealed that it had supported the employment of 277k Saudi citizens in the private sector this year till end-Q3. Total amount spent on support programs during the period stood at SAR 3.75bn.

- The Real Estate Price Index in Saudi Arabia grew by 1.5% yoy in Q3 2022: residential real estate prices increased by 2.5% (largely due to a 2.6% rise in land plot prices) amid declines in commercial and agricultural real estate prices.

UAE Focus![]()

- The UAE steadfastly stands by the OPEC+’s unanimous production cuts decision, according to the foreign ministry, while rejecting statements pushing a political angle. The UAE energy minister separately stated that the nation is committed to increasing its oil production capacity.

- Money supply (M2) in the UAE grew by 1.4% mom to AED 1.63trn at end-Aug. Domestic credit inched down by 0.4% mom due to declines across government (0.9%), GREs (1.2%) and the private sector (0.2%). Government sector deposits rose by 7.1% mom, driving overall increase in resident deposits by 2.8%.

- ADNOC is planning an IPO of its marine services and logistics unit, likely for next year, reported Reuters.

- Bayanat, a geospatial data products and services provider owned by G42, plans to raise AED 628.5mn (USD 171mn) from a listing on the Abu Dhabi Securities Exchange. Private equity firm Silver Lake and Abu Dhabi-listed IHC are to become cornerstone investors.

- In 2021, Dubai accounted for 86% of the total non-oil trade with UAE and India (or USD 38.4bn). According to DP World, Indian companies at the Jebel Ali Port and Free Zone were the second largest partners in terms of trade volume(4.4mn metric tonnes) and fourth for trade value (USD 6.5bn).

- Abu Dhabi’s Mubadala sold USD 1bn in bonds maturing in ten and a half years after drawing upwards of USD 4.2bn in orders.

- The UAE signed of industrial deals worth AED 260mn (USD 70.8mn) between major pharmaceutical and medical companies to manufacture medical equipment locally: this will include the setting up of factories and production lines in Abu Dhabi and Ras Al Khaimah.

- The full ownership of the Etihad Aviation Group has been transferred Abu Dhabi’s sovereign wealth fund ADQ in a bid to transform the emirate into a global aviation hub.

- The real estate firm JLL disclosed that average residential prices in Dubai grew by 9% yoy in Q3, while average rental rates saw a 25% yoy rise, thanks to stronger demand. Separately, Bloomberg reported that the emirate’s luxury property market is witnessing a boom, with about 70% of transactions cash-based.

- The Economist Impact’s Global Food Security Index 2022 ranked the UAE first in the MENA region, up from 3rd place in the previous edition. Globally, the country ranks 23rd, climbing 12 points from 2021.

Media Review

Xi’s congress report lays bare an aggressive and statist worldview

https://www.ft.com/content/8576916d-2cf5-483f-bfe4-2238080a5c70

The Great Chips War

https://www.ft.com/content/bbbdc7dc-0566-4a05-a7b3-27afd82580f3

Even super-tight policy is not bringing down prices

IMF: How Countries Should Respond to the Strong Dollar

https://www.imf.org/en/Blogs/Articles/2022/10/14/how-countries-should-respond-to-the-strong-dollar

How the markets broke ‘Trussonomics’

https://www.ft.com/content/156682c1-1fb9-42d1-aac3-de531e266d68

Abu Dhabi fund ADQ wields economic diplomacy to forge regional ties

Powered by: