Markets

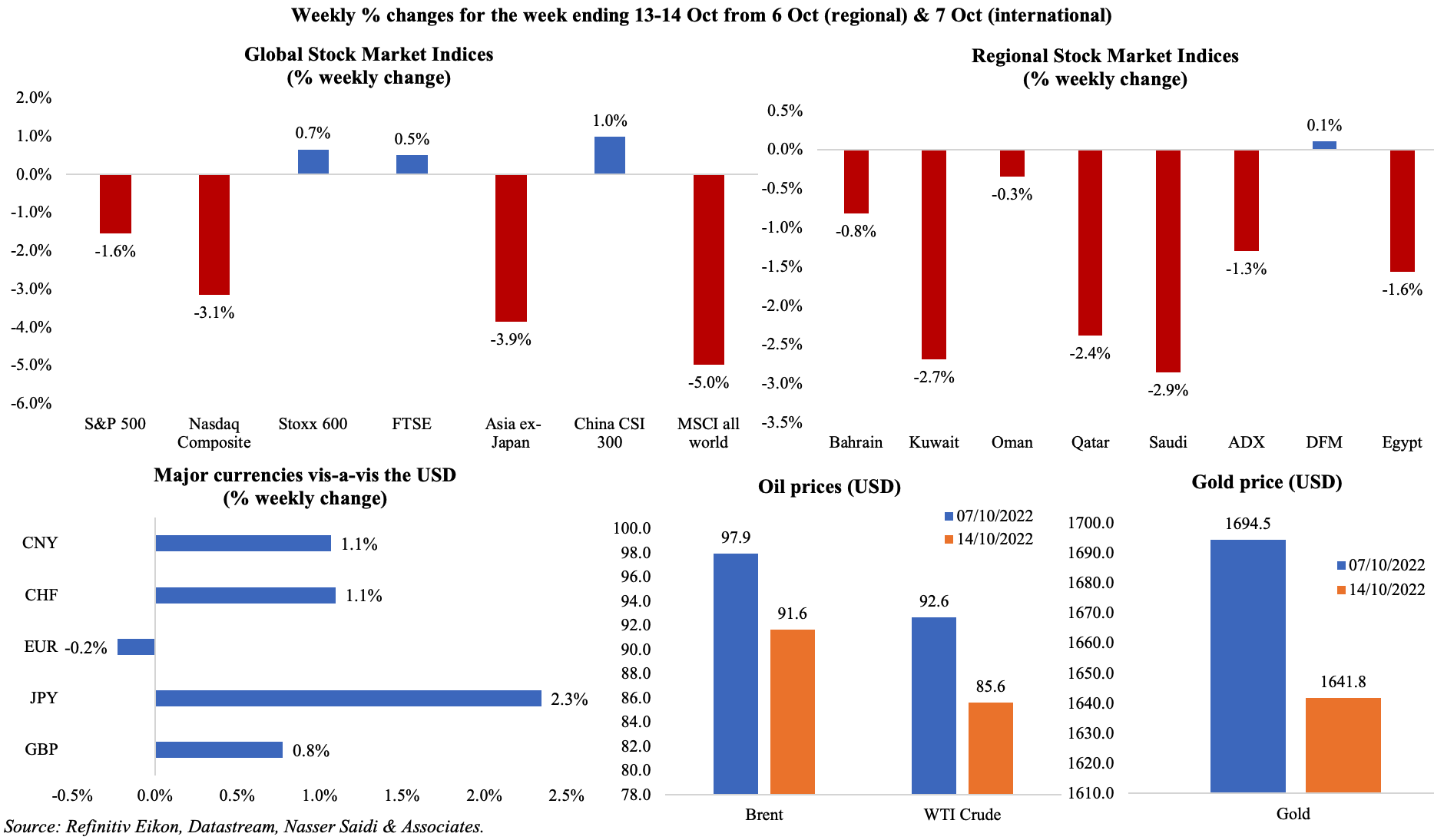

Equity markets were mostly down last week, including in the Middle East region, after the US inflation numbers (rising to a 40-year high) strengthened the case for higher interest rates and for a longer period. The dollar remained strong; the pound slipped against the dollar after UK’s finance chief was fired amidst uncertainty on the UK’s finances while the yen weakened to a new 32-year low. Oil prices fell on expectations of weak oil demand (estimated by OPEC & IEA) and recession worries while gold prices tumbled.

Global Developments

US/Americas:

- US inflation rose to a 40-year high of 8.2% yoy in Sep while in month-on-month terms it gained 0.1% in Aug and 0.4% in Sep. Excluding food and energy, prices were up by 0.6% mom and 6.6% yoy (the highest since 1982) vs 6.3% the month before. In mom terms, food prices rose by 0.8% and owners’ equivalent rent grew by 0.8% (largest gain since Jun 1990).

- Producer price index in the US rebounded by 0.4% mom in Sep, the first rise in 3 months (Aug: -0.2%); price of services posted a 0.4% monthly gain, accounting for 2/3-rds of the rise. Excluding food, energy and trade services, PPI advanced by 0.4% mom and 5.6% yoy in Sep.

- FOMC minutes indicate surprise at the persistence of the inflation readings, well above the long-run goal of 2%; it also emphasised that rates were likely to stay higher for longer.

- Retail sales in the US were flat in Sep (Aug: 0.4%) as inflation and rising rates affected consumer spending: gasoline, electronics and furniture store receipts were down by 1.4%, 0.8% and 0.7% respectively. In yoy terms, it slowed to a 5-month low of 8.2% yoy.

- Michigan consumer sentiment index edged up to a 6-month high of 59.8 in Oct (Sep: 58.6): current economic conditions sub-index increased to 65.3 from 59.7 while the expectations gauge fell to 56.2 from 58.

- Initial jobless claims increased by 9k to 228k in the week ended Oct 7th, with the 4-week average inching up to 211.5k. Continuing jobless claims also rose, by 5k to 1.368mn in the week ending Sep 30th.

Europe:

- Sentix investor confidence in the eurozone worsened to -38.3 in Oct (Sep: -31.8), the lowest level since Mar 2020. The current situation declined to -35.5 (Sep: -26.5), the lowest value since Aug 2020 and the expectations index touched -41, the lowest since Dec 2008.

- Industrial production in the eurozone rebounded by 1.5% mom in Aug (Jul: -2.3%): capital and durable consumer goods output grew by 2.8% and 0.9% mom. IP expanded by 2.5% yoy in Aug.

- GDP in the UK fell by 0.3% mom in Aug, declining from the 0.1% gain in Jul, with industrial and manufacturing production inching down by 1.8% and 1.6% respectively; construction sector was the only one of the three main sectors to post a growth (Aug: 0.4%).

- Last week, the UK’s PM fired the finance minister, and reversed GBP 20bn of tax cuts, part of the policy that had led to a plunge in pound and bond prices. Earlier this morning, the new chancellor reversed “almost all” of the mini-budget tax cuts, hence raising an extra GBP 32bn per year for the Treasury.

- UK claimant count climbed by 25.5k in Sep, a second monthly rise after Aug’s 1.1k. Unemployment rate edged downto 3.5% in the 3 months to Aug, a new low since 1974, and below the previous month’s 3.6% reading. Average earnings excluding bonus increased by 5.4% yoy during this period from 5.2% prior.

- UK’s total trade deficit widened to GBP 7.08bn in Aug (Jul: GBP 5.44bn): imports grew by 4.3% mom to a record-high GBP 75.3bn amid a 2.2% rise in exports to a record GBP 68.2bn.

- BRC like-for-like retail sales in the UK grew by 1.8% yoy in Sep (Aug: 0.5%); food sales grew by 4.2% and non-food retail sales declined by 1.1%.

Asia Pacific:

- China’s money supply increased by 12.1% yoy in Sep (Aug: 12.2%) while outstanding yuan loans grew by 11.2% (Aug: 10.9%). New loans surged in Sep, nearly doubling to CNY 2.5trn from the previous month’s CNY 1.25trn taking the total this year to CNY 18.08trn.

- Inflation in China rose to a 29-month high of 2.8% yoy in Sep from Aug’s 2.5% – the fastest pace of increase since Apr 2020. Producer price index grew to 0.9% yoy – the weakest since Jan 2021 – and easing from Aug’s 2.3% gain.

- Core machinery orders in Japan slumped by 5.8% mom in Aug (Jul: 5.3%), the biggest decline in 6 months, due to a 21.4% decline in non-manufacturing orders while orders from manufacturers grew by 10.2%.

- Reuters Tankan survey showed a drop in business confidence in Oct, on a weaker yen and higher costs. The manufacturer’s sentiment index dropped to 5 in Oct (Sep: 10) while the services sector outlook was more promising: +14 in Oct vs Sep’s +11 reading.

- Japan’s current account surplus narrowed to JPY 58.9bn in Aug (Jul: JPY 229bn) – the smallest on record for the month of Aug. While trade deficit widened to JPY 2.5trn on a BoP basis in Aug (Aug: JPY 1.2trn), the primary income balance posted a record JPY 3.327trn supported by a weaker yen.

- Bank of Korea hiked interest rate by 50 bps to 3% last week: the board decision was not unanimous, with 2 members opting for a milder 25bps hike. Inflation has been the main concern for policymakers amid the won’s 17% decline this year.

- India’s consumer price inflation inched up to 7.4% yoy in Sep (Aug: 7%), higher than the RBI’s upper target of 6%, thanks to the uptick in food prices (8.6% from 7.6% in Aug). Wholesale price index eased to 10.7% in Sep (Aug: 12.4%), the lowest since Sep 2021.

- Industrial output in India contracted by 0.8% yoy in Aug (Jul: 2.4%), as manufacturing output slipped by 0.7% (Jul: 3.2%). In this fiscal year (starting Apr), industrial output has risen by 7.7%.

- Singapore’s GDP grew by 1.5% qoq and 4.4% yoy in Q3, avoiding a technical recession after growth slipped by 0.2% qoq in Q2. The Ministry of Trade and Industry’s GDP forecast for the full year was lowered to a range of 3% to 4% from a target of 3%-5% previously.

- The Monetary Authority of Singapore (MAS) tightened policy as expected, re-centering the midpoint of its exchange rate policy band or the SGD NEER while keeping the slope and width of the band unchanged.

Bottom line: Even as the IMF revised global growth forecast down to 3.2% in 2022 and lower further to 2.7% next year, a cost-of-living “crisis” and the ever-present threat of another Covid19 outbreak has the world sitting on the cusp of a global economic recession. The IMF expects more than 1/3-rd of nations to experience a recession and given how interlinked nations are, we can anticipate a relatively gloomy 2023. Even as Egypt and the IMF inch closer to an agreement, all eyes are on the UK and its ongoing turmoil with the IMF warning of “disorderly asset re-pricings” and “financial market contagion”. This week also sees the release of China’s Q3 GDP data which should highlight the impact of weak consumer demand and business uncertainty given multiple lockdowns, with President Xi confirming that China would continue with its strict Covid restrictions presaging continued low growth.

Regional Developments

- The IMF, in its World Economic Outlook report, forecast the MENA region to grow by 5% yoy this year before slowing to 3.6% in 2023. Iraq is to be the fastest growing in the region this year, up by 9.3% yoy, followed by Kuwait (8.7%) and Saudi Arabia (7.6%). Inflation in MENA is expected to average 14.2% in 2022 and 2023, driven by high food and energy prices.

- Cashless transactions in Bahrain are ticking up: a recent report by the central bank shows digital payments rising by 24.6% yoy in Aug while ATM withdrawals fell by 9.8%.

- Bahrain’s Economic Development Board disclosed that the country attracted USD 98mn worth direct investments from 14 international firms in the ICT sector in Jan-Sep 2022: these investments are estimated to create over 770 jobs.

- Egypt’s staff-level agreement with the IMF has been finalised, according to the finance minister, who stated that an announcement would be made “very soon”. A related IMF statement disclosed that policies discussed included monetary and exchange rate policies that “would enable Egypt to gradually and sustainably rebuild foreign reserves,” public debt reduction, social safety net expansion, and increasing competitiveness among others.

- Inflation in Egypt surged to a 4-year high of 15% in Sep, driven by higher food and beverage prices (21.7%). Core inflation in Egypt is also rising, at 18% in Sep. Ongoing restrictions on imports & foreign exchange scarcity adds to costs; recent increases in gas prices (some 109%) for cement factories could see spillover effects

- Asharq reported that Egypt was still waiting for funds from the Qatar Investment Authority to the tune of over USD 5bn after no agreement was reached about “targeted shares in [Egypt’s] companies”.

- Amid dollar scarcity in Egypt, banks have tightened limits on foreign currency withdrawals from local accounts. No circular to this effect was issued by the central bank.

- Iraq parliament elected a new president, marking the end of the political deadlock since elections in Oct 2021. The President-nominated PM now has one month to form a government.

- The IIF forecast Kuwait to grow by 7% yoy this year, supported by a 10% rise in oil production. Nominal GDP is estimated to touch USD 170.6bn this year and current account is to post a surplus of USD 52.6bbn.

- Lebanon’s energy minister disclosed that once the maritime border deal is concluded with Israel, TotalEnergies would begin the gas exploration process.

- Syrian refugees will be sent back home from Lebanon by end of this week, revealed the President. The government estimates there are roughly 1.6mn refugees from Syria though the official UNHCR number is below 1mn.

- Oman posted a fiscal surplus of OMR 1.09bn in Jan-Aug 2022 vs a deficit of OMR 1.05bn the same period a year ago. Average oil price stood at USD 91 during this period, versus USD 56 a year ago. Net oil revenues grew by 38.8% yoy while gas revenues almost doubled to OMR 2.4bn.

- The central bank of Oman underscored that inflation is to be largely benign, especially as housing costs remain moderate and prices of utilities and energy are still “administered”.

- Oman has pledged to reach net-zero emissions by 2050: to meet this target, the Oman Sustainability Centre will be set up to supervise and follow up on zero carbon emission plans and programmes.

- Inflation in Qatar inched up to 6% in Sep, the highest since Dec 2021, driven by recreation and culture (35.6%), housing and utilities (10.7%) though food and beverages prices eased (4.06% vs 5.77%).

- QatarEnergy will begin drilling work in 2023 on the 2 oil wells discovered off the Namibian coast. It was not revealed when the oil finds would be brought into production.

- The World Cup is benefitting the MENA region: Forward Keys reported that flight bookings to Qatar from the UAE and nine other countries have risen tenfold compared with before the pandemic; from the UAE it is up 103 times vs pre-boycott 2016. The firm disclosed Dubai to be the biggest beneficiary of fans traveling to other destinations as well, capturing 65 percent of onward visits.

- Qatar Airways is planning to hire 10,000 persons to handle passengers flying into the country during the World Cup: the firm currently employs around 45k persons.

- Saudi Aramco will keep supplies to Asia steady for Nov, reported Reuters.

- Value of mergers & acquisitions transactions in the MENA region touched USD 69.7bn in Jan-Sep 2022, down by 17% yoy, according to Refinitiv’s investment banking analysis report. UAE, Saudi Arabia and Egypt were the most targeted nations for M&As; MENA outbound M&A jumped to a13-year high of USD 27.9bn in Jan-Sep.

- Philanthropy and charitable donations by GCC-based private individuals and families is estimated at USD 210bn and expected to grow, according to a report by the University of Cambridge.

Saudi Arabia Focus

- Saudi Arabia remains the fastest growing nation among all G20 nations, according to the IMF: it is expected to grow 7.6% this year and 3.7% in 2023.

- US and Saudi Arabia have been exchanging words on the OPEC+ supply cuts: while the US has called the decision “short-sighted” and promised “consequences”, the Saudi ministry holds its position that the decision was taken unanimously by all OPEC+ members, based on “economic considerations”, to curb volatility and to “maintaining balance of supply and demand”.

- Inflation in Saudi Arabia inched up to a 15-month high of 3.1% in Sep (Aug: 3%), thanks to an increase in both transport and food and beverage prices (both rising by 4.3%) alongside housing and utilities (3.2%). Separately, weekly PoS transactions data from the central bank shows a 15.8% decline in PoS transactions in the week ended Oct 8th, the steepest drop in 3 months, driven by a decline in food and beverages PoS.

- Saudi Arabia’s industrial production surged by 16.8% yoy in Aug, driven by increases across all three sub-sectors: mining and quarrying (15.5%), manufacturing (22%) and electricity and gas (11.3%). However, the 16.8% growth has been the slowest recorded since Jan 2022. Separately, the Ministry of Industry and Mineral Resources issued 52 new mining licenses in Aug 2022.

- SAMA disclosed that credit to microenterprises in Saudi Arabia surged by 62.2% yoy to SAR 18.1bn (USD 4.82bn), in line with government efforts to support the start-up sector; loans extended to SMEs grew by 25.4$ to SAR 63bn in Q2.

- Construction and building activities contributed 11.6% to Saudi non-oil economic activity in Q2, according to the vice minister at the ministry of municipal, rural affairs and housing. He also disclosed that the housing sector has created 40k direct and indirect jobs in the country and that real estate assets account for 15% of PIF’s total assets.

- Saudi Ports reported a 9.2% yoy in container throughput volumes to 657,420 twenty-foot equivalent units (TEUs) in Sep.

- Saudi Arabia’s health ministry is expected to green light 100 projects worth around SAR 48bn (USD 12.7bn) to be completed in cooperation with the private sector in the next 5 years. The aim is to raise private sector’s contribution to the healthcare system to 35% by 2030 from 25% currently.

- Al Eqtisadiah reported, citing Saudi Arabia’s ministry of commerce that a total of 281 licenses to export iron and cement has been issued since a ban on the exportation of the commodities was lifted 6 years ago. Till end-Sep 2022, 30 licenses were issued including 19 to export iron.

- The Saudi Minister of Human Resources and Social Development issued an order last week to Saudize all professions in the consulting sector: no further details or timing of the implementation were disclosed.

- Saudi Arabia and South Africa signed 11 agreements and MoU in the government and private sectors covering various fields like energy, water, green hydrogen, waste diversion, logistics and aerial survey services.

- Saudi Al Awali Real Estate Co. is planning to raise SAR 500mn (USD 133mn) by offering 20% of its shares on Nomu.

UAE Focus![]()

- UAE Cabinet approved a AED 252.3bn (USD 68.7bn) Federal budget for 2023-26; revenues were estimated at AED 255.7bn. In 2023, revenues are estimated to rise by 11% to AED 63.613bn while expenses are to increase by 3.9% to AED 63.066bn (social expenditures accounted for the largest proportion, 39.3%).

- An unemployment insurance scheme was rolled out by the UAE to support both local and expat population: the compensation stands at 60% of the employee’s salary with a maximum of AED 20k to be provided for no more than 3 months. Eligibility is linked to employees having been insured for at least 12 months, calculated from the date of subscription in the insurance system.

- Dubai PMI touched 56.2 in Sep, slightly lower than Aug’s 57.9, taking the Q3 reading to the strongest in nearly 3 years. Wholesale and retail businesses supported the growth in sales while the travel and tourism sector slowed down its lowest level since Jan. Input prices slipped to its lowest in less than a year while output prices continued to ease.

- The UAE launched an initiative to develop 1,000 technological projects and export AED 15bn worth of advanced Emirati tech products annually.

- The supermarket chain Lulu group is planning an IPO and has hired the investment bank Moelis & Co to advise it. The chain plans to list next year, according to sources.

- Non-oil trade of Dubai Airport Free Zone (DAFZ) rose by more than 36% yoy to over AED 162bn in 2021. The ‘machinery, equipment, and appliances’ and ‘precious stones, metals and jewellery’ sectors together accounted for an average of 94% of DAFZ’s overall trade.

- Prime residential market values in Dubai rose by 88.8% over the last 12 months, according to Knight Frank; it was also disclosed that 152 ultra-Prime sales were registered in Jan-Sep 2022 and of this 93 took place in Q3 alone. Separately, Dubai residential market transactions grew by 33.4% yoy in Sep driven by off-plan and secondary market sales.

- The emirates of Ras Al Khaimah and Sharjah have been connected to the UAE national rail project. The tracklaying work to link the two emirates to Ghuwaifat in the west of the country has been completed.

Media Review

IMF World Economic Outlook: Countering the Cost-of-living Crisis

https://www.imf.org/en/Publications/WEO/Issues/2022/10/11/world-economic-outlook-october-2022

Xi’s China Dream – its appeal and dangers

https://www.straitstimes.com/opinion/xis-china-dream-its-appeal-and-dangers

A collective will to tackle global challenges needs more tools

https://www.ft.com/content/94c007db-727a-4624-8f41-e7277f6352ea

Saudi wealth fund braves market tumult in green bonds debut, others unlikely to rush

https://www.reuters.com/world/middle-east/saudi-wealth-fund-braves-market-tumult-green-bonds-debut-others-unlikely-rush-2022-10-12/

Powered by: